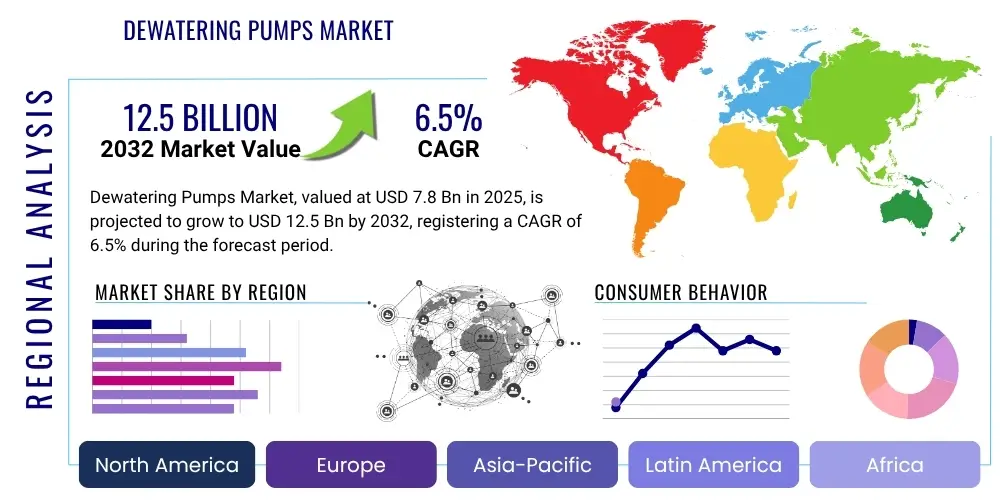

Dewatering Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429381 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Dewatering Pumps Market Size

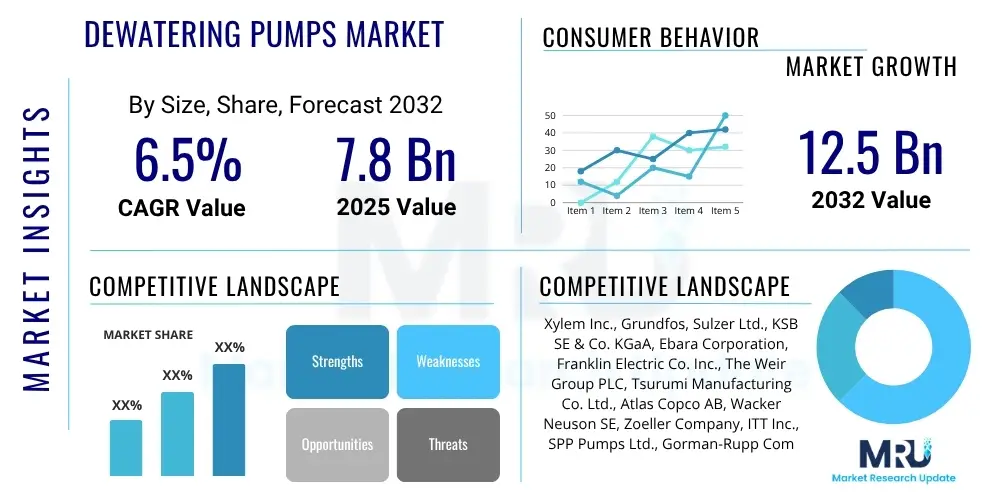

The Dewatering Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at $7.8 Billion in 2025 and is projected to reach $12.5 Billion by the end of the forecast period in 2032.

Dewatering Pumps Market introduction

The dewatering pumps market encompasses a vital segment within the global industrial equipment landscape, serving critical functions across numerous sectors by efficiently removing unwanted water or liquid from various environments. These specialized pumps are engineered to handle water mixed with solids, sludge, or abrasive materials, ensuring operational continuity, structural integrity, and safety on worksites. Their robust design and diverse operational mechanisms make them indispensable tools in challenging conditions where effective water management is paramount.

Dewatering pumps, fundamentally, are devices designed to extract water, often mixed with debris, sediment, or other contaminants, from an enclosed or saturated area. This includes product types such as submersible pumps, known for their ability to be fully immersed in the liquid, and non-submersible pumps like centrifugal, diaphragm, trash, and slurry pumps, each tailored for specific operational requirements, such as handling high volumes, viscous fluids, or highly abrasive slurries. Key benefits derived from their deployment include preventing structural damage to foundations and excavations, ensuring worker safety by maintaining dry and stable working conditions, and significantly reducing project downtime caused by waterlogging. The ability of these pumps to effectively manage groundwater and surface water runoff is crucial for adherence to environmental regulations and project timelines.

Major applications for dewatering pumps span a broad spectrum of industries, predominantly driven by global infrastructure development, increasing mining activities, and the growing need for municipal water management solutions. Construction sites frequently utilize these pumps for trench dewatering, foundation excavation, and tunnel projects, while the mining sector relies on them for managing pit water, tailing ponds, and underground mine operations. Furthermore, agricultural irrigation, disaster relief efforts, industrial processing, and marine applications constitute significant demand areas. The overarching driving factors for market growth include accelerated urbanization leading to extensive construction projects, the continuous expansion of the global mining industry, escalating occurrences of extreme weather events necessitating rapid flood control and water removal, and increasingly stringent environmental regulations promoting responsible water discharge and management.

Dewatering Pumps Market Executive Summary

The global dewatering pumps market is experiencing robust expansion, primarily fueled by a surge in construction activities, sustained growth in the mining sector, and the increasing frequency of climate-induced flooding events. Business trends indicate a strong move towards enhanced efficiency, greater automation, and the integration of smart technologies into pump designs, allowing for remote monitoring, predictive maintenance, and optimized energy consumption. Manufacturers are focusing on developing more durable, energy-efficient, and portable pump solutions to meet the diverse and evolving demands of end-users. Strategic partnerships and acquisitions are also becoming more prevalent as companies seek to expand their product portfolios and geographical reach, consolidating market positions and fostering innovation.

Regionally, Asia Pacific continues to dominate the market, driven by massive infrastructure projects, rapid urbanization, and significant mining operations in countries such as China, India, and Australia. North America and Europe represent mature markets characterized by stringent environmental regulations and a focus on technologically advanced, high-efficiency dewatering solutions, with consistent demand from municipal and industrial sectors. Latin America and the Middle East and Africa regions are emerging as high-growth markets, spurred by investments in infrastructure development, resource extraction, and expanding industrial bases. These regions present substantial opportunities for market players, especially those offering cost-effective and robust solutions tailored to local operational challenges.

Segment-wise, submersible dewatering pumps are anticipated to maintain their leadership position due to their versatility, ease of deployment, and effectiveness in various applications, particularly in construction and mining. The construction and mining industries remain the largest end-user segments, with increasing investments in commercial, residential, and industrial infrastructure projects globally. The growing adoption of diesel-powered pumps for remote and off-grid operations, alongside the rising preference for electric and hydraulic pumps for their efficiency and environmental benefits in specific contexts, also highlights diverse trends. Furthermore, the rental market for dewatering pumps is growing significantly, offering flexibility and cost-effectiveness for short-term projects or specialized needs, contributing to overall market dynamism and accessibility.

AI Impact Analysis on Dewatering Pumps Market

Users are increasingly seeking to understand how Artificial Intelligence (AI) can revolutionize the dewatering pumps market, with common questions revolving around improved operational efficiency, the implementation of predictive maintenance, possibilities for autonomous pump operation, and the overall cost implications of AI integration. There is significant interest in how AI can enhance safety protocols, optimize energy consumption, and provide advanced data analytics for better decision-making in challenging environments. End-users are also exploring the extent to which AI technologies can lead to more reliable pump performance, reduce unexpected downtimes, and streamline water management processes, while also considering the potential impact on existing workforce skills and future job roles within the industry.

- Predictive maintenance capabilities through AI algorithms analyze operational data, forecasting potential failures and enabling proactive repairs, significantly reducing downtime and maintenance costs.

- Optimized pump performance facilitated by AI ensures pumps operate at peak efficiency, adjusting parameters dynamically based on real-time environmental conditions and workload demands, thereby minimizing energy consumption.

- Remote monitoring and control systems powered by AI allow operators to supervise and manage dewatering operations from distant locations, enhancing safety, responsiveness, and operational flexibility.

- Autonomous operation is emerging through AI-driven systems that can automatically detect water levels, activate/deactivate pumps, and adjust flow rates without direct human intervention, particularly beneficial in hazardous or remote sites.

- Enhanced safety protocols are achieved by AI analyzing operational data to identify hazardous conditions or anomalies, alerting personnel, and potentially automating shutdown procedures to prevent accidents.

- Improved energy efficiency stems from AI optimizing pump cycles and motor speeds, reducing unnecessary power consumption and aligning operation with actual dewatering requirements.

- Advanced data analytics provided by AI processes vast amounts of sensor data, offering insights into operational trends, environmental impacts, and long-term performance optimization strategies.

- Supply chain optimization benefits from AI's ability to forecast demand for spare parts and new equipment, leading to more efficient inventory management and reduced lead times.

DRO & Impact Forces Of Dewatering Pumps Market

The dewatering pumps market is significantly influenced by a confluence of driving forces, inherent restraints, and emerging opportunities, all shaped by broader impact forces. Key drivers include the global push for infrastructure development, particularly in rapidly urbanizing regions, which necessitates extensive dewatering for construction foundations, tunnels, and underground utilities. The continuous expansion of the mining industry, both open-pit and underground, represents another critical driver, as efficient water removal is essential for operational safety and productivity. Furthermore, the increasing frequency and intensity of extreme weather events, such as heavy rainfall and flooding, escalate the demand for dewatering pumps in emergency response and disaster management, creating a consistent market pull.

However, the market also faces notable restraints. High initial capital investment for advanced dewatering systems can be a barrier for smaller contractors or projects with limited budgets. The ongoing maintenance costs associated with operating robust pump systems in harsh environments, including wear and tear from abrasive materials, also pose a challenge. Environmental regulations regarding water discharge quality and disposal of contaminated water are becoming increasingly stringent, requiring additional filtration and treatment solutions, which can add to operational complexities and expenses. Moreover, the energy consumption of large dewatering pump fleets can be substantial, leading to higher operational costs and environmental concerns, prompting a demand for more energy-efficient models.

Opportunities within the market primarily revolve around technological advancements and untapped regions. The development of smart dewatering solutions integrating IoT, AI, and advanced sensor technologies offers significant potential for optimized performance, remote monitoring, and predictive maintenance, attracting premium market segments. The integration of renewable energy sources, such as solar power, for dewatering operations in remote areas presents a sustainable and cost-effective alternative to conventional power sources. Emerging economies in Asia Pacific, Latin America, and Africa, with their rapid industrialization and infrastructure growth, represent substantial growth avenues. Additionally, the increasing trend towards equipment rental, rather than outright purchase, provides manufacturers with an opportunity to serve a broader customer base and generate recurring revenue, ensuring equipment accessibility for diverse project scales and durations. These dynamics collectively shape the strategic landscape for market participants.

Segmentation Analysis

The dewatering pumps market is comprehensively segmented to provide granular insights into market dynamics, enabling a detailed understanding of consumer preferences, technological trends, and application-specific demands. This segmentation allows for precise market sizing and forecasting, identifying key growth areas and competitive landscapes across various product types, operational modes, power sources, applications, and end-user industries. The categorization reflects the diverse technical specifications and functional requirements inherent in dewatering operations across different sectors, from large-scale industrial projects to localized municipal needs.

- By Type

- Submersible Pumps: Fully immersed in water, ideal for deep excavations and continuous operation.

- Non-Submersible Pumps: Operated above water level, includes various designs for specific applications.

- Centrifugal Pumps: High flow rates, versatile for general dewatering.

- Diaphragm Pumps: Excellent for pumping viscous liquids or those with high solid content.

- Trash Pumps: Designed to handle significant solids and debris without clogging.

- Slurry Pumps: Specifically engineered for highly abrasive and dense slurries.

- By Operation

- Automatic: Equipped with sensors and controls for self-regulation, enhancing efficiency and reducing manual intervention.

- Manual: Requires direct human control for activation and deactivation, common in smaller or less complex operations.

- By Power Source

- Electric Pumps: Powered by electricity, widely used due to accessibility and lower emissions.

- Diesel Pumps: Preferred for remote locations lacking electrical infrastructure, offering high power and portability.

- Hydraulic Pumps: Driven by hydraulic power, suitable for heavy-duty applications and hazardous environments.

- Solar Pumps: Emerging as a sustainable option for off-grid and environmentally conscious projects.

- By Application

- Construction: Trench dewatering, foundation work, tunnel projects.

- Mining: Pit dewatering, tailings management, underground operations.

- Municipal: Wastewater treatment, flood control, drainage systems.

- Industrial: Process water management, wastewater discharge, chemical processing.

- Agriculture: Irrigation, drainage for fields, pond management.

- Marine: Bilge pumping, dock maintenance, salvage operations.

- Emergency Services: Flood relief, disaster recovery.

- By End-User

- Residential: Smaller scale dewatering for homes, basements, septic tanks.

- Commercial: Building complexes, commercial landscapes, smaller construction sites.

- Industrial: Large factories, power plants, manufacturing facilities.

Value Chain Analysis For Dewatering Pumps Market

The value chain for the dewatering pumps market begins with the upstream activities involving raw material procurement and component manufacturing. This stage includes sourcing specialized metals such as cast iron, stainless steel, and various alloys for pump casings, impellers, and shafts, along with rubber and polymer components for seals and hoses. Key components like motors, engines, sensors, and control systems are often sourced from specialized suppliers, emphasizing quality and performance given the demanding operational environments of dewatering pumps. Efficient procurement and quality control at this initial stage are crucial for the overall reliability and longevity of the final product.

Moving downstream, the value chain encompasses the manufacturing and assembly of the dewatering pumps, where various components are integrated into a complete pump unit. This involves precision engineering, quality assurance, and often customization based on specific application requirements or client specifications. Following manufacturing, the distribution channel plays a critical role in bringing the pumps to the end-users. This typically involves a multi-faceted approach, combining direct sales channels, where manufacturers sell directly to large industrial clients or government agencies, with indirect channels through an extensive network of distributors, dealers, and rental companies. These intermediaries provide local market access, technical support, and after-sales service, which are vital for customer satisfaction and market penetration.

The final stages of the value chain involve sales, installation, operation, and crucially, after-sales services including maintenance, repairs, and spare parts supply. The effectiveness of the distribution network, whether direct or indirect, significantly impacts market reach and customer engagement. Indirect channels, particularly through equipment rental fleets, have gained prominence, offering flexibility to end-users who may not require permanent ownership. After-sales support is a competitive differentiator, ensuring the pumps perform reliably throughout their lifecycle and providing essential technical assistance, which in turn builds customer loyalty and repeat business. This comprehensive chain ensures the efficient flow of products and services from raw material to end-user operation.

Dewatering Pumps Market Potential Customers

The dewatering pumps market serves a diverse array of end-users and buyers whose operations are critically dependent on effective water management. These potential customers span multiple sectors, each with unique requirements regarding pump capacity, durability, and operational features. Foremost among these are construction companies involved in large-scale infrastructure projects, commercial building developments, and residential construction, where managing groundwater and surface water in excavations and foundations is non-negotiable for project safety and progress. Their demand is driven by project timelines and the need to prevent costly water-related delays and structural damage.

Another significant segment of potential customers comprises mining operators, encompassing both surface and underground mines, which require robust pumps to manage pit water, process water, and mine tailings. The abrasive nature of mining environments necessitates pumps built for extreme durability and high performance in handling slurries and solid-laden water. Municipalities and public works departments also represent substantial buyers, utilizing dewatering pumps for flood control, wastewater treatment plants, storm drainage systems, and maintaining urban infrastructure, particularly in regions prone to heavy rainfall or flooding. Their procurement decisions are often influenced by public safety mandates, environmental compliance, and long-term operational efficiency.

Furthermore, industrial facilities, including power generation plants, manufacturing units, and chemical processing sites, constitute important end-users for managing industrial wastewater, process fluids, and preventing localized flooding. Agricultural enterprises use dewatering pumps for irrigation, field drainage, and managing water levels in ponds. Marine and offshore industries, as well as emergency response and disaster relief organizations, also frequently purchase or rent dewatering pumps for critical applications such as bilge pumping, salvage operations, and rapid water removal in flood-affected areas. The rental sector itself acts as a major buyer, acquiring fleets of pumps to lease to a wide spectrum of temporary or project-specific customers, offering flexible solutions across various industries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $7.8 Billion |

| Market Forecast in 2032 | $12.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Xylem Inc., Grundfos, Sulzer Ltd., KSB SE & Co. KGaA, Ebara Corporation, Franklin Electric Co. Inc., The Weir Group PLC, Tsurumi Manufacturing Co. Ltd., Atlas Copco AB, Wacker Neuson SE, Zoeller Company, ITT Inc., SPP Pumps Ltd., Gorman-Rupp Company, Toyo Denki Seizo K.K., Wastecorp Pumps, HCP Pump Manufacturer Co. Ltd., Dragflow SRL, BJM Pumps, Pioneer Pump Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dewatering Pumps Market Key Technology Landscape

The dewatering pumps market is undergoing significant technological evolution, driven by the demand for increased efficiency, reduced operational costs, and enhanced environmental performance. A primary area of innovation lies in the integration of Internet of Things (IoT) sensors and smart monitoring systems. These technologies enable real-time data collection on pump performance parameters such as flow rates, pressure, vibration, temperature, and energy consumption. This data is crucial for predictive maintenance, allowing operators to identify potential issues before they lead to catastrophic failures, thereby minimizing downtime and extending the lifespan of the equipment. Remote access and control capabilities via cloud-based platforms are also becoming standard, offering unparalleled operational flexibility and responsiveness, particularly for large-scale or geographically dispersed projects.

Another pivotal technological advancement involves the widespread adoption of variable frequency drives (VFDs) and energy-efficient motor technologies. VFDs allow for precise control over pump speed and flow, enabling pumps to operate at optimal levels based on actual demand rather than constantly running at full capacity. This significantly reduces energy consumption and operational costs, aligning with global sustainability initiatives and stricter energy efficiency regulations. Furthermore, the development of advanced materials for pump components, such as wear-resistant alloys and specialized coatings, is enhancing the durability and lifespan of pumps, especially when handling abrasive fluids or corrosive environments, which is a common challenge in mining and industrial dewatering applications.

Beyond hardware enhancements, telematics and advanced control systems are transforming how dewatering operations are managed. These systems provide comprehensive data analytics, allowing for optimization of pump sequencing, energy usage, and overall system performance. The integration of GPS tracking and geofencing capabilities further improves asset management for rental companies and large contractors. Furthermore, the market is seeing increased focus on quieter, more compact, and portable designs, especially for urban construction sites or emergency response, where noise pollution and rapid deployment are key considerations. Innovations in wastewater treatment and filtration technologies, often integrated with dewatering systems, are also becoming critical to meet evolving environmental discharge standards, highlighting a holistic approach to water management.

Regional Highlights

- North America: A mature market characterized by robust demand from municipal wastewater management, civil engineering, and mining sectors. Strict environmental regulations and a focus on technologically advanced, energy-efficient solutions drive market trends. The United States and Canada are key contributors due to extensive infrastructure maintenance and mining activities, alongside increased spending on flood control measures.

- Europe: Exhibits steady growth, propelled by infrastructure refurbishment projects, industrial applications, and a strong emphasis on sustainable water management practices. Countries like Germany, the UK, and France are significant markets, investing in advanced dewatering systems that comply with stringent environmental and energy efficiency directives. The rental market is particularly strong in this region.

- Asia Pacific (APAC): The largest and fastest-growing market, primarily fueled by rapid urbanization, massive infrastructure development projects (roads, railways, smart cities), and extensive mining operations in China, India, and Australia. The region's increasing industrialization and agricultural output also contribute significantly to the demand for dewatering pumps. Developing countries in Southeast Asia are experiencing substantial growth.

- Latin America: An emerging market with considerable potential, driven by expanding mining activities, particularly in countries like Brazil, Chile, and Peru, and ongoing infrastructure investments. Economic stability and foreign direct investments are key factors shaping market growth, although market penetration of advanced technologies might be slower compared to developed regions.

- Middle East and Africa (MEA): This region is witnessing growth spurred by significant investments in oil and gas infrastructure, construction projects (e.g., smart cities in Saudi Arabia and UAE), and increasing demand for water management in arid regions. South Africa, with its substantial mining industry, is a primary market player. Challenges include harsh operating conditions and the need for robust, reliable equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dewatering Pumps Market.- Xylem Inc.

- Grundfos

- Sulzer Ltd.

- KSB SE & Co. KGaA

- Ebara Corporation

- Franklin Electric Co. Inc.

- The Weir Group PLC

- Tsurumi Manufacturing Co. Ltd.

- Atlas Copco AB

- Wacker Neuson SE

- Zoeller Company

- ITT Inc.

- SPP Pumps Ltd.

- Gorman-Rupp Company

- Toyo Denki Seizo K.K.

- Wastecorp Pumps

- HCP Pump Manufacturer Co. Ltd.

- Dragflow SRL

- BJM Pumps

- Pioneer Pump Inc.

Frequently Asked Questions

What is a dewatering pump primarily used for?

A dewatering pump is primarily used to remove unwanted water or other liquids from a specific area, such as construction sites, mines, basements, or flooded areas, to enable safe and efficient operations or prevent damage.

What are the main types of dewatering pumps available?

The main types include submersible pumps, which operate fully immersed in water, and non-submersible pumps, such as centrifugal, diaphragm, trash, and slurry pumps, each designed for different fluid characteristics and operational needs.

How does the dewatering pumps market benefit from infrastructure development?

Infrastructure development, including roads, bridges, and buildings, drives demand for dewatering pumps by requiring extensive water removal from excavations, foundations, and tunnels to ensure stable and dry working conditions and project progression.

What role does AI play in modern dewatering pump technology?

AI enhances modern dewatering pumps through predictive maintenance, optimizing performance and energy efficiency, enabling remote monitoring and control, and even facilitating autonomous operation, leading to reduced downtime and operational costs.

Which region currently leads the global dewatering pumps market?

The Asia Pacific region currently leads the global dewatering pumps market, driven by rapid urbanization, significant infrastructure projects, and expansive mining operations, particularly in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager