Die-Cutting Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429335 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Die-Cutting Machine Market Size

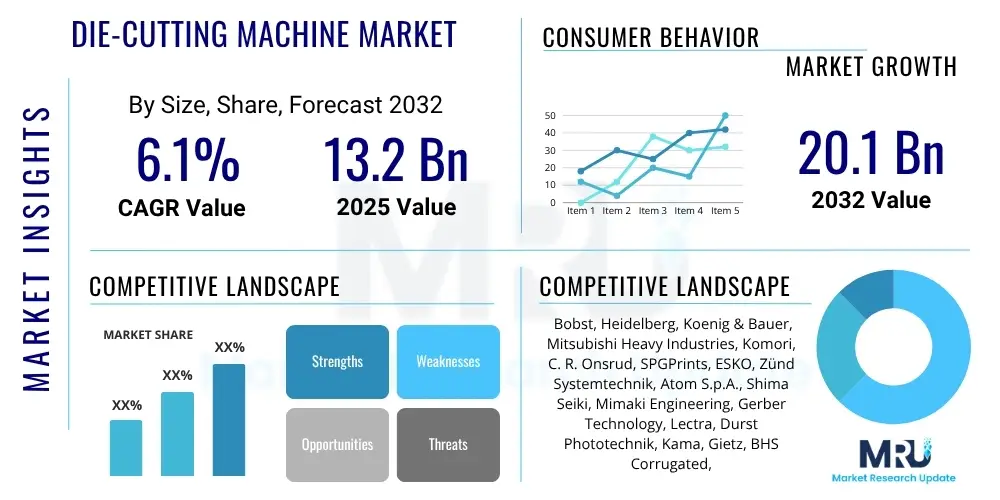

The Die-Cutting Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2025 and 2032. The market is estimated at USD 13.2 billion in 2025 and is projected to reach USD 20.1 billion by the end of the forecast period in 2032.

Die-Cutting Machine Market introduction

The Die-Cutting Machine Market encompasses a broad range of industrial equipment designed for precise cutting, creasing, and embossing of various materials such as paper, cardboard, textiles, leather, plastics, and composites. These machines are integral to manufacturing processes across numerous industries, enabling the creation of intricate shapes and designs with high accuracy and repeatability. Product offerings include manual, semi-automatic, and fully automatic systems, catering to diverse production scales and operational complexities. Major applications span packaging production, where die-cut blanks form cartons and boxes; textile manufacturing for apparel and upholstery components; automotive industries for gaskets and interior trims; and electronics for insulation and circuit board components. The primary benefits of employing die-cutting machines include enhanced production efficiency, significant waste reduction through optimized material usage, superior product consistency, and the capability to produce complex geometries that would be difficult or impossible with traditional cutting methods. Key driving factors propelling market growth include the escalating demand for customized and visually appealing packaging solutions, the rapid expansion of e-commerce necessitating robust packaging, continuous advancements in automation and precision technology, and the increasing adoption of specialized materials across various end-user sectors. Furthermore, the global trend towards mass customization and the need for high-volume, low-cost production are further solidifying the indispensable role of die-cutting technology in modern manufacturing.

Die-Cutting Machine Market Executive Summary

The Die-Cutting Machine Market is experiencing robust growth, driven by dynamic shifts in business trends, regional development, and segment-specific advancements. Business trends indicate a strong move towards automation and integration of smart technologies to enhance operational efficiency and reduce labor costs. Manufacturers are increasingly investing in high-speed, precision die-cutting solutions that can handle a wider array of materials and complex designs, directly responding to consumer demand for customized and high-quality products. The market is also seeing a consolidation among key players, alongside strategic partnerships aimed at expanding technological capabilities and market reach. Regional trends highlight the Asia Pacific as a dominant and rapidly expanding market, fueled by burgeoning manufacturing sectors, particularly in packaging, automotive, and electronics, with significant investments in industrial infrastructure and burgeoning consumer markets. North America and Europe continue to be mature markets characterized by technological innovation, demand for sustainable solutions, and a focus on advanced automation. Segment trends reveal a growing preference for automatic die-cutting machines due to their superior speed, accuracy, and reduced manual intervention. The packaging industry remains the largest application segment, with significant growth also observed in textile and automotive sectors. Furthermore, the increasing adoption of digital die-cutting technologies, offering flexibility and shorter lead times for small batches and personalized items, is reshaping market dynamics and creating new opportunities for market participants across the globe.

AI Impact Analysis on Die-Cutting Machine Market

User questions regarding AI's impact on the Die-Cutting Machine Market frequently center on automation, predictive maintenance, and design optimization. There is a keen interest in how AI can enhance the precision and speed of operations, automate complex setup processes, and anticipate machine failures before they occur, thereby reducing downtime and operational costs. Users also explore AI's role in optimizing material usage, improving design iteration cycles, and integrating seamlessly with existing production lines to achieve smart factory environments. Key themes revolve around the potential for increased efficiency, cost savings, greater flexibility in production, and the ability to handle highly customized jobs with minimal human intervention. Expectations are high for AI to transform die-cutting from a largely mechanical process into an intelligent, adaptive manufacturing step, ultimately leading to higher quality products and more sustainable production practices. Users are also concerned about the initial investment required for AI integration, the complexity of data management, and the need for skilled personnel to operate and maintain these advanced systems, highlighting a balance between anticipated benefits and implementation challenges.

- AI-driven machine vision systems enhance cutting accuracy and quality control by detecting material flaws and ensuring precise alignment.

- Predictive maintenance algorithms leverage sensor data to forecast equipment failures, minimizing unexpected downtime and extending machine lifespan.

- AI-powered design optimization tools automate the creation of cutting paths, significantly reducing material waste and optimizing production efficiency.

- Integration of AI in automation enables adaptive adjustments to cutting parameters based on material properties, improving process consistency.

- Smart factory integration facilitates seamless communication between die-cutting machines and other production systems, optimizing overall workflow.

- Enhanced customization capabilities through AI allow for rapid adaptation to changing design requirements and personalized product demands.

- AI assists in complex job scheduling and resource allocation, improving throughput and operational planning in manufacturing facilities.

DRO & Impact Forces Of Die-Cutting Machine Market

The Die-Cutting Machine Market is shaped by a complex interplay of drivers, restraints, and opportunities, all influenced by various impact forces. The primary drivers include the burgeoning demand for packaging across industries, especially from e-commerce growth, which necessitates high-speed and precise cutting solutions. Technological advancements in automation, software integration, and machine precision are further propelling market expansion. Simultaneously, the market faces restraints such as the high initial capital investment required for advanced machinery, coupled with ongoing maintenance costs and the need for specialized technical expertise. Opportunities abound in the development of sustainable die-cutting solutions, the integration of AI and IoT for smart manufacturing, and expansion into emerging markets with growing industrial bases. These market dynamics are significantly influenced by impact forces such as rapid technological innovation, global economic fluctuations affecting investment decisions, stringent environmental regulations pushing for eco-friendly practices, and the evolving competitive landscape requiring continuous product differentiation.

The increasing complexity of product designs and the demand for shorter product lifecycles are pushing manufacturers to adopt more versatile and efficient die-cutting solutions. This drives innovation in areas like digital die-cutting, which offers unparalleled flexibility for prototyping and short-run production. The push for sustainability also acts as a powerful driver, as companies seek machines that can optimize material usage, reduce waste, and handle recyclable or biodegradable materials effectively. However, the high cost of sophisticated die-cutting equipment can be a significant barrier for small and medium-sized enterprises (SMEs), particularly in developing regions. The operational complexities involved in maintaining and troubleshooting these advanced machines also add to the challenge, requiring substantial investment in training and skilled labor, which can be scarce. Furthermore, intense competition from alternative cutting technologies, such as laser cutting for certain applications, necessitates continuous innovation and differentiation within the die-cutting sector.

Opportunities for market growth are particularly strong in the integration of Industry 4.0 technologies. The convergence of AI, IoT, and advanced robotics can revolutionize die-cutting by enabling fully autonomous operations, predictive analytics for maintenance, and real-time quality control. Emerging markets, characterized by rapid industrialization and growing consumer bases, present untapped potential for market expansion, provided manufacturers can offer cost-effective and robust solutions. The increasing demand for specialized applications in sectors like medical devices, aerospace, and advanced textiles also offers niche growth avenues for highly precise and customized die-cutting machinery. The impact forces of globalization mean that market players must contend with diverse regulatory environments and competitive pressures, while economic stability and trade policies can significantly affect supply chains and market access. Therefore, strategic adaptation to these forces is crucial for sustainable growth and competitive advantage in the Die-Cutting Machine Market.

- Drivers: Growing packaging industry, increasing demand for customized products, technological advancements in automation and precision, expansion of e-commerce.

- Restraints: High initial investment cost, complex maintenance requirements, competition from alternative cutting technologies, need for skilled labor.

- Opportunities: Integration of AI and IoT for smart manufacturing, development of sustainable die-cutting solutions, expansion into emerging economies, niche applications in medical and electronics.

- Impact Forces: Technological innovation, economic stability, environmental regulations, global trade policies, evolving consumer preferences.

Segmentation Analysis

The Die-Cutting Machine Market is comprehensively segmented by Type, Application, End-User, and Operating Speed, providing a detailed view of its diverse landscape and operational dynamics. Each segment reflects unique demand characteristics and technological preferences across various industrial ecosystems. By understanding these segmentations, stakeholders can better identify market niches, tailor product development, and formulate targeted marketing strategies to capitalize on specific growth opportunities. The segmentation analysis reveals distinct trends in automation adoption, material processing capabilities, and industry-specific requirements, highlighting the versatility and adaptability of die-cutting technology to meet evolving market needs. This granular perspective is critical for both new entrants and established players seeking to innovate and expand their footprint in a competitive market environment.

The segmentation by Type differentiates between manual, semi-automatic, and automatic machines, each serving different levels of production volume and automation requirements. Automatic machines, characterized by higher speeds and precision with minimal human intervention, are gaining significant traction due to increasing labor costs and the drive for efficiency. The Application segment illustrates the wide utility of die-cutting machines across crucial sectors such as packaging, textiles, automotive, electronics, and footwear, with packaging consistently holding the largest share due to global consumption trends. The End-User segmentation categorizes buyers into Printing & Packaging Companies, Textile Manufacturers, Automotive Component Manufacturers, and Electronics Manufacturers, indicating concentrated demand from specific industrial sectors that rely heavily on precise component fabrication. Finally, segmentation by Operating Speed (low, medium, high) reflects the varied production demands, from custom small-batch runs to high-volume mass production, showcasing the adaptability of available machine technologies.

- By Type:

- Manual Die-Cutting Machines

- Semi-Automatic Die-Cutting Machines

- Automatic Die-Cutting Machines

- By Application:

- Packaging

- Textile

- Automotive

- Electronics

- Footwear

- Medical

- Others

- By End-User:

- Printing & Packaging Companies

- Textile Manufacturers

- Automotive Component Manufacturers

- Electronics Manufacturers

- Others

- By Operating Speed:

- Low Speed

- Medium Speed

- High Speed

Value Chain Analysis For Die-Cutting Machine Market

The value chain for the Die-Cutting Machine Market encompasses a series of interconnected activities, beginning with the upstream suppliers of raw materials and components, extending through the manufacturing and assembly processes, and culminating in the downstream distribution channels and end-user consumption. Upstream analysis focuses on the procurement of specialized steels, electronic components, automation software, and precision engineering parts that are crucial for machine construction. Key suppliers include metal fabricators, electronics manufacturers, and software developers whose innovations directly impact the quality and performance of the final die-cutting equipment. The efficiency and reliability of these upstream providers are paramount for maintaining consistent production quality and managing costs for die-cutting machine manufacturers.

Downstream analysis involves understanding how die-cutting machines reach their end-users. This segment includes various distribution channels, which can be broadly categorized as direct and indirect. Direct distribution often involves manufacturers selling directly to large industrial clients or through their own dedicated sales forces and service networks, allowing for greater control over customer relationships and bespoke solutions. Indirect distribution, on the other hand, relies on a network of distributors, agents, and resellers who provide market access, localized support, and integration services, particularly for smaller enterprises or across diverse geographical regions. Both channels play a critical role in market penetration and customer reach, with the choice often depending on the manufacturer's strategic objectives, market characteristics, and the scale of the target clientele. The effectiveness of these channels significantly influences market accessibility, customer satisfaction, and after-sales support.

The distribution network also impacts the overall cost and delivery efficiency of die-cutting machines. Direct channels typically offer closer customer interaction and quicker feedback loops, fostering product innovation and customization. However, they require substantial investment in sales and service infrastructure. Indirect channels, while potentially adding a layer of cost, can provide extensive market coverage and leverage existing logistical networks, making them an efficient choice for reaching a broader customer base without significant capital expenditure from the manufacturer. Moreover, the value chain extends to post-sales services, including installation, maintenance, spare parts supply, and technical support, which are critical for ensuring optimal machine performance and customer loyalty throughout the equipment's lifecycle. Enhancing efficiency across the entire value chain, from raw material sourcing to after-sales service, is essential for manufacturers to maintain competitiveness and deliver maximum value to their end-users in the dynamic Die-Cutting Machine Market.

Die-Cutting Machine Market Potential Customers

The potential customers for Die-Cutting Machines represent a diverse and extensive range of industries, all requiring precise and efficient material shaping for their products. These end-users or buyers are predominantly manufacturing entities that integrate die-cutting processes into their production lines to create components, packaging, or finished goods from various substrates. The primary appeal for these customers lies in the machines' ability to deliver high accuracy, repeatability, speed, and the capacity to handle intricate designs across different material types. Understanding the specific needs and production scales of these diverse customer segments is crucial for machine manufacturers to tailor their product offerings, sales strategies, and service provisions effectively. This broad customer base ensures sustained demand for die-cutting technology, driven by continuous innovation in product design and manufacturing processes across global industries.

Key segments of potential customers include packaging companies that utilize die-cutting machines to produce boxes, cartons, labels, and specialized protective packaging for a vast array of consumer and industrial products. Textile manufacturers are another significant customer group, employing these machines for cutting fabrics, leather, and technical textiles for apparel, upholstery, automotive interiors, and industrial applications. In the automotive sector, die-cutting machines are indispensable for fabricating gaskets, insulation, interior trim components, and specialized adhesive parts with high precision. Electronics manufacturers rely on them for cutting films, foils, and insulating materials used in circuit boards, displays, and other electronic components. Furthermore, the footwear industry uses die-cutting extensively for leather and synthetic materials in shoe production, while the medical device sector employs precision die-cut components for diagnostics, bandages, and other specialized applications.

The growing demand for customization and shorter production runs also expands the customer base to include smaller businesses and custom manufacturers who benefit from the flexibility of digital die-cutting solutions. This includes print shops offering custom packaging, artisanal workshops working with textiles or leather, and specialized prototyping firms. Companies focused on sustainability are also key potential customers, as they seek machines that optimize material usage and minimize waste, aligning with environmental goals. Ultimately, any business involved in the mass production or precise fabrication of shapes from sheet or roll materials, where efficiency, accuracy, and cost-effectiveness are paramount, represents a potential customer for die-cutting machine manufacturers, indicating a robust and continually expanding market landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 13.2 Billion |

| Market Forecast in 2032 | USD 20.1 Billion |

| Growth Rate | 6.1% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bobst, Heidelberg, Koenig & Bauer, Mitsubishi Heavy Industries, Komori, C. R. Onsrud, SPGPrints, ESKO, Zünd Systemtechnik, Atom S.p.A., Shima Seiki, Mimaki Engineering, Gerber Technology, Lectra, Durst Phototechnik, Kama, Gietz, BHS Corrugated, Baysek, Young Shin |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Die-Cutting Machine Market Key Technology Landscape

The Die-Cutting Machine Market is characterized by a dynamic and evolving technological landscape, with innovations continuously enhancing efficiency, precision, and versatility. Core technologies include advancements in cutting mechanisms such as rotary, flatbed, and digital die-cutting, each offering distinct advantages for different production needs and material types. Rotary die-cutting is prized for high-speed, continuous production, commonly seen in packaging and labeling. Flatbed die-cutting provides higher pressure and accuracy for thicker materials and intricate designs, while digital die-cutting (knife cutting, laser cutting) offers unparalleled flexibility for short runs, prototyping, and complex geometries without the need for physical dies. This technological diversity enables manufacturers to address a broad spectrum of applications, from mass-produced consumer goods to highly specialized industrial components, ensuring that the market remains responsive to evolving industrial demands and material science advancements.

Further technological advancements revolve around automation and integration with Industry 4.0 paradigms. Advanced automation features, including robotic loading and unloading systems, automatic registration, and quick changeover capabilities, are becoming standard, significantly reducing manual labor and increasing throughput. The integration of sophisticated sensor technology and real-time monitoring systems allows for enhanced quality control, detecting imperfections and ensuring consistent cutting parameters throughout production runs. Software advancements play a crucial role, with CAD/CAM software enabling precise design translation and optimization of cutting paths to minimize material waste. Furthermore, human-machine interface (HMI) systems are becoming more intuitive, simplifying machine operation, setup, and troubleshooting, thereby improving overall operational efficiency and reducing the learning curve for operators.

The emergence of AI and IoT is poised to revolutionize the die-cutting landscape by enabling predictive maintenance, self-optimization, and seamless connectivity within smart factory ecosystems. AI algorithms can analyze performance data to predict potential machine failures, schedule maintenance proactively, and optimize cutting parameters in real time based on material characteristics and environmental conditions. IoT integration facilitates data exchange between machines and centralized control systems, enabling comprehensive production monitoring and supply chain management. The development of more sustainable and energy-efficient die-cutting technologies, including those capable of processing eco-friendly materials and reducing energy consumption, is also a significant trend. These technological shifts underscore a broader industry movement towards smarter, more sustainable, and highly adaptable manufacturing processes, driving continuous innovation in die-cutting machinery to meet future industrial challenges and opportunities.

Regional Highlights

- North America: A mature market characterized by demand for advanced automation, high-precision machinery, and increasing adoption of digital die-cutting for customized packaging and specialized industrial applications. The region benefits from robust manufacturing sectors and significant investment in R&D.

- Europe: Driven by stringent quality standards, emphasis on sustainable manufacturing, and a strong automotive and textile industry. Western European countries lead in adopting high-end automated solutions, while Eastern Europe shows growth in mid-range segment due to industrial expansion.

- Asia Pacific (APAC): The largest and fastest-growing market, fueled by rapid industrialization, expanding manufacturing bases (especially in China, India, Japan, and South Korea), and booming e-commerce necessitating extensive packaging solutions. Significant investments in infrastructure and lower labor costs contribute to its dominance.

- Latin America: An emerging market with growing industrialization and increasing foreign direct investment. Demand is rising for cost-effective and semi-automatic die-cutting machines, particularly in the packaging and textile sectors, as regional economies develop.

- Middle East and Africa (MEA): Shows steady growth driven by diversification efforts from oil-dependent economies into manufacturing, especially packaging and construction. Investment in industrial infrastructure and local production capabilities are key growth factors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Die-Cutting Machine Market.- Bobst

- Heidelberg

- Koenig & Bauer

- Mitsubishi Heavy Industries

- Komori

- C. R. Onsrud

- SPGPrints

- ESKO

- Zünd Systemtechnik

- Atom S.p.A.

- Shima Seiki

- Mimaki Engineering

- Gerber Technology

- Lectra

- Durst Phototechnik

- Kama

- Gietz

- BHS Corrugated

- Baysek

- Young Shin

Frequently Asked Questions

What is a die-cutting machine and its primary function?

A die-cutting machine is an industrial device used to cut, crease, or emboss materials like paper, cardboard, plastic, and textiles into specific shapes and designs, primarily for packaging, textile, and automotive applications.

Which industries are the major end-users of die-cutting machines?

The major end-users include the packaging industry, textile and apparel manufacturers, automotive component producers, electronics manufacturers, and companies in the footwear and medical sectors.

How is AI impacting the Die-Cutting Machine Market?

AI is enhancing precision, enabling predictive maintenance, optimizing material usage, automating design processes, and improving overall operational efficiency by integrating with smart factory ecosystems.

What are the key drivers for the Die-Cutting Machine Market growth?

Key drivers include the expanding packaging industry, increasing demand for customized products, advancements in automation technology, and the rapid growth of the e-commerce sector globally.

What are the main types of die-cutting machines available in the market?

The main types include manual, semi-automatic, and automatic die-cutting machines, along with specialized technologies like rotary, flatbed, and digital die-cutting systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager