Dietary Supplement Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430420 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Dietary Supplement Packaging Market Size

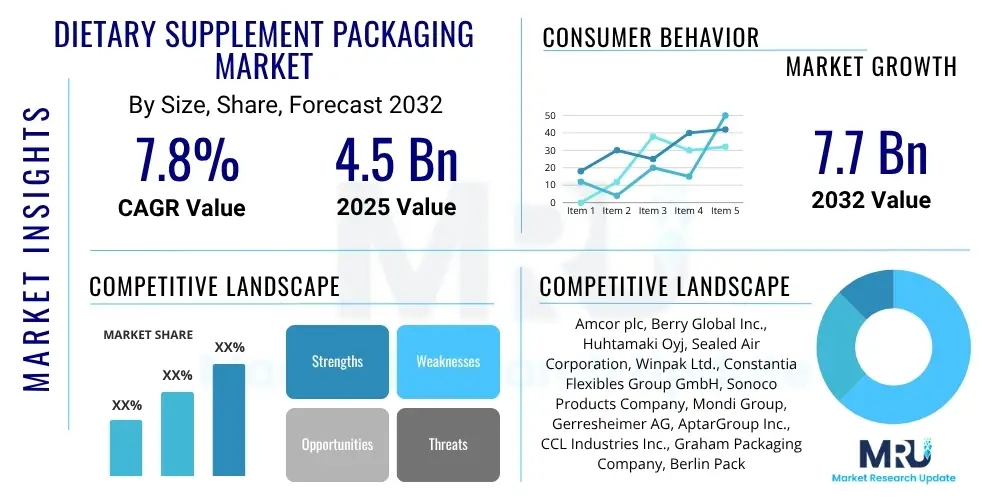

The Dietary Supplement Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 4.5 billion in 2025 and is projected to reach USD 7.7 billion by the end of the forecast period in 2032.

Dietary Supplement Packaging Market introduction

The dietary supplement packaging market encompasses a comprehensive range of specialized solutions engineered to encase, protect, preserve, and effectively present various nutritional products. This includes an extensive spectrum of items such as vitamins, essential minerals, complex herbal supplements, performance-enhancing sports nutrition formulations, and sophisticated weight management aids. The sustained expansion of this market is propelled by a globally escalating consumer consciousness regarding proactive health management and overall wellness. Concurrently, an expanding aging demographic, alongside the rising global incidence of chronic diseases, collectively fuels an unprecedented demand for dietary supplements, consequently amplifying the need for innovative and secure packaging solutions across diverse product categories.

Packaging solutions employed within this dynamic sector are remarkably varied, spanning traditional rigid formats like robust plastic bottles (HDPE, PET), glass jars, and metal cans, to increasingly popular flexible options such as barrier-rich pouches, convenient stick packs, and protective blister packs. Each packaging type is precisely chosen and engineered to cater to the distinct physical properties and preservation requirements of different product forms, including solid pills, granular powders, viscous liquids, and enjoyable gummies. Product descriptions within this market segment critically emphasize cutting-edge material science, superior barrier properties against moisture, oxygen, and light, ergonomic design for ease of use, and compelling aesthetic appeal. Major applications extend across traditional retail, the exponentially growing e-commerce sphere, and direct-to-consumer (DTC) sales models, each demanding highly durable, tamper-evident, and visually engaging packaging.

The tangible benefits derived from advanced dietary supplement packaging are multifaceted, significantly contributing to market value and consumer satisfaction. These benefits include demonstrably extended product shelf life, robust prevention of contamination, precise dosage control, and a markedly enhanced overall consumer experience through user-friendly designs and clear labeling. Such attributes directly underpin brand reputation and contribute substantially to market expansion. Moreover, a paramount aspect driving innovation and material selection is strict adherence to stringent regulatory standards (e.g., FDA, EFSA). The overarching trend towards sustainable packaging materials, including recycled plastics, bioplastics, and responsibly sourced glass, further accentuates market dynamics, addressing urgent environmental concerns and aligning with evolving consumer values. This intricate interplay of functional efficacy, regulatory compliance, and environmental stewardship defines the modern dietary supplement packaging landscape.

Dietary Supplement Packaging Market Executive Summary

The global dietary supplement packaging market is experiencing robust growth, primarily propelled by evolving consumer health paradigms and groundbreaking advancements in packaging science. Business trends indicate a pronounced pivot towards adopting sustainable and environmentally conscious packaging materials, with brands investing in recyclable, biodegradable, and post-consumer recycled (PCR) content solutions. This effort is driven by stringent environmental regulations and heightened ecological expectations from consumers. The rise of e-commerce has fundamentally reshaped packaging design, necessitating solutions that offer superior protection during transit while simultaneously delivering an exceptional unboxing experience. An intensified focus on integrating advanced child-resistant features and robust tamper-evident designs is also critical for augmenting consumer safety and preserving product integrity across the supply chain.

From a regional perspective, North America and Europe consistently maintain their positions as dominant and mature markets, characterized by well-established cultures of health consciousness, robust regulatory frameworks, and the substantial presence of global packaging industry leaders. They actively drive advancements in material science and novel packaging formats. Simultaneously, the Asia Pacific (APAC) region is rapidly ascending as the most significant growth engine, underpinned by a burgeoning middle class, significant increases in disposable incomes, and rapidly expanding awareness of preventive healthcare across key economies like China, India, and Japan. The APAC region is experiencing substantial investments in advanced manufacturing capabilities and a swift adoption of international packaging standards, often complemented by unique localized demands. Latin America and the Middle East and Africa (MEA) also demonstrate promising growth, albeit from a smaller market base, as health awareness permeates new demographics and distribution infrastructure continues to mature.

In terms of market segmentation, plastic packaging, particularly utilizing high-density polyethylene (HDPE) and polyethylene terephthalate (PET) in bottle and jar formats, continues to represent the largest and most widely adopted segment due to its versatility, cost-effectiveness, and excellent barrier properties. However, the market is witnessing a notable shift towards innovative flexible packaging options, including multi-layer pouches and highly convenient stick packs, offering enhanced portability, reduced material usage, and superior product protection for on-the-go lifestyles. Glass packaging maintains a significant niche for premium-tier products where perception of purity and superior recyclability is a key brand differentiator. Moreover, strong growth is observed in specialized packaging solutions tailored for emerging product forms like palatable gummies, viscous liquid supplements, and delicate softgels, each necessitating bespoke barrier and dispensing mechanisms. This diversification in product offerings is broadening the scope of material applications and fostering significant innovation opportunities across the entire packaging value chain.

AI Impact Analysis on Dietary Supplement Packaging Market

User inquiries concerning the transformative impact of Artificial Intelligence (AI) on the dietary supplement packaging market frequently coalesce around several core thematic areas: the potential for vastly improved operational efficiency, the capability for highly personalized consumer experiences, stringent advancements in quality control protocols, and comprehensive optimization of intricate supply chain networks. Stakeholders are particularly keen on understanding how AI can facilitate highly tailored packaging designs, precisely catering to specific demographic segments or individual health conditions, thereby enhancing product relevance. Significant interest also lies in AI's profound role in dramatically accelerating manufacturing speeds, minimizing material waste through predictive modeling, and accurately forecasting dynamic market trends to enable demand-driven production. Furthermore, questions arise regarding AI's advanced capabilities in ensuring unwavering regulatory compliance through sophisticated automated verification processes and its innovative application in developing intelligent packaging solutions that can monitor product integrity in real-time or deliver highly interactive experiences. The overarching expectation is that AI integration will invariably lead to more responsive, economically efficient, and profoundly consumer-centric packaging paradigms.

The integration of AI into the dietary supplement packaging lifecycle promises a paradigm shift. AI algorithms are not merely tools but strategic assets that can analyze vast datasets, learning from consumer behaviors, production metrics, and environmental variables to make informed decisions. This capability extends beyond basic automation, allowing for sophisticated pattern recognition that can preempt potential issues, such as material fatigue or shelf-life limitations. For instance, AI can optimize packaging line layouts for maximum throughput, predict maintenance needs for machinery, and even simulate various packaging designs under different stress conditions to ensure optimal protection. The continuous feedback loop enabled by AI, from consumer interaction data to manufacturing output, creates an agile system capable of rapid iteration and improvement in packaging functionality and aesthetics. This level of insight and control is unprecedented, offering a competitive edge to strategic adopters.

- AI-driven predictive analytics optimize inventory management for packaging materials, reducing waste and overstocking.

- Automated quality control systems powered by AI detect defects in packaging lines with higher accuracy and speed, ensuring product safety.

- AI algorithms assist in personalized packaging design, analyzing consumer data to suggest optimal formats, sizes, and aesthetic elements for targeted demographics.

- Robotics integrated with AI enhance packaging line efficiency, improving speed, precision, and flexibility in handling diverse supplement products.

- AI contributes to smart packaging solutions by embedding sensors and RFID tags for real-time tracking, temperature monitoring, and anti-counterfeiting measures.

- Machine learning models can forecast consumer demand for specific supplement packaging types, enabling proactive adjustments in production schedules.

- AI-powered tools streamline regulatory compliance by automating checks for labeling accuracy, material suitability, and adherence to industry standards.

- Generative AI explores novel sustainable packaging designs, optimizing material usage and recyclability based on performance criteria.

- Enhanced supply chain visibility and efficiency through AI-driven logistics management, reducing transit damage and improving delivery times.

- AI-enabled customer feedback analysis informs packaging improvements, leading to more ergonomic and user-friendly designs.

DRO & Impact Forces Of Dietary Supplement Packaging Market

The dietary supplement packaging market is dynamically shaped by a powerful interplay of propelling drivers, significant restraining factors, and burgeoning opportunities that collectively dictate its developmental trajectory. Among the foremost drivers is the rapidly escalating global consumer interest in proactive preventive healthcare, holistic personal wellness, and sustained healthy living, which has translated into a consistent surge in the consumption of various dietary supplements worldwide. Furthermore, the persistently expanding global aging population, increasingly reliant on supplements for managing age-related health conditions, acts as a profound catalyst, intensifying demand for secure, convenient, and senior-friendly packaging solutions. Concurrently, the unprecedented expansion of e-commerce platforms mandates the creation of robust, protective, and aesthetically compelling packaging designs capable of withstanding transit and captivating online shoppers. The relentless pace of innovation in advanced packaging materials, including groundbreaking sustainable and superior high-barrier options, serves as an additional, crucial growth accelerator, adeptly meeting evolving consumer expectations and stringent regulatory mandates.

Despite its robust growth, the market contends with several notable restraints. Stringent and increasingly complex regulatory frameworks across different geographical regions present substantial compliance challenges for manufacturers, demanding continuous adaptation in material selection, precise labeling, and safety features. The inherent volatility in raw material prices, particularly for petrochemical-derived plastics and specialized resins, can exert considerable pressure on production costs and erode profit margins. Moreover, a heightened global public awareness coupled with growing environmental concerns pertaining to plastic waste generation is compelling companies to pivot towards more sustainable, yet frequently costlier, packaging alternatives, creating a dilemma between affordability and ecological responsibility. The persistent threat posed by counterfeit products also remains a significant impediment, undermining consumer trust and brand value, necessitating substantial investments in advanced anti-tampering and authentication technologies.

Opportunities within the dietary supplement packaging market are exceptionally abundant, particularly within the burgeoning segment of sustainable packaging solutions. This includes the accelerated development and adoption of advanced biodegradable plastics, innovative plant-based materials, and the widespread implementation of refillable and reusable container systems, all of which resonate powerfully with eco-conscious consumers and concurrently open up lucrative new market segments. The strategic integration of cutting-edge smart packaging technologies, such as Near Field Communication (NFC) tags or interactive QR codes, offers unprecedented avenues for conveying comprehensive product information, facilitating precise dosage reminders, and enabling robust authenticity verification, significantly enhancing consumer engagement and trust. Furthermore, the rapid economic development in emerging markets, characterized by their expanding middle classes and increasing healthcare expenditures, presents substantial untapped growth potential. Beyond these, the growing demand for highly customized packaging tailored to specific demographic needs, like child-resistant features or elderly-friendly designs, alongside aesthetically premium packaging, collectively represents fertile ground for significant market expansion and differentiation.

Segmentation Analysis

The dietary supplement packaging market is meticulously segmented to comprehensively reflect the multifaceted requirements of diverse products and an expansive consumer base, thereby facilitating an in-depth analysis of dynamic market forces across various critical categories. These fundamental segments primarily delineate packaging solutions based on their core material composition, the physical form of the product they contain, the specific type of packaging format employed, and the ultimate end-user application. This intricate segmentation empowers packaging manufacturers to precisely tailor their product offerings, ensuring optimal suitability for distinct client needs, and concurrently enables all stakeholders to gain profound insights into specific growth pockets, emerging trends, and the competitive landscapes. The detailed segmentation highlights consumer and industry preferences for particular packaging characteristics, including superior barrier properties, paramount ease of use, demonstrable sustainability credentials, and compelling aesthetic appeal, all of which are critical factors influencing purchasing decisions and market share.

- By Material Type: This segment analyzes the primary raw materials used in the construction of packaging solutions, each offering distinct properties and cost structures.

- Plastics: Dominant, chosen for versatility, light weight, and excellent barrier properties.

- HDPE (High-Density Polyethylene): Widely used for opaque bottles due to excellent moisture barrier.

- PET (Polyethylene Terephthalate): Favored for transparent bottles, offering good oxygen barrier and clarity.

- PP (Polypropylene): Known for high heat resistance and versatility, used in caps, containers.

- PVC (Polyvinyl Chloride): Used in blister packs for clarity and barrier, but declining due to environmental concerns.

- Others: Includes LDPE for flexible applications and specialized blends.

- Glass: Primarily used for premium or liquid supplements due to inertness, recyclability, perceived purity.

- Metal (Aluminum): Utilized for cans, bottles, offering superior barrier protection against light, moisture, and oxygen.

- Paper and Paperboard: Used for secondary packaging, cartons, and some primary packaging for dry products, chosen for sustainability and printability.

- Plastics: Dominant, chosen for versatility, light weight, and excellent barrier properties.

- By Product Form: Packaging solutions are often customized to the physical state of the dietary supplement.

- Powders: Typically packaged in jars, stand-up pouches, or flexible sachets, requiring good moisture barriers.

- Tablets/Capsules: Dominantly found in bottles, blister packs, necessitating protection from humidity and impact.

- Liquids: Requires secure, leak-proof bottles, often glass or PET, with precise dispensing mechanisms.

- Gummies: Packaged in jars or pouches, requiring robust sealing to prevent stickiness, often with child-resistant closures.

- Softgels: Similar to capsules, typically in bottles or blister packs, needing protection from heat and moisture.

- Other Product Forms: Includes bars, gels, effervescent tablets, sprays, demanding specialized packaging.

- By Packaging Type: Refers to the physical format of the packaging.

- Bottles and Jars: Traditional, widely used for tablets, capsules, powders, and liquids, offering robustness and resealability.

- Pouches and Stick Packs: Flexible, lightweight, convenient for single servings, powders, and gummies, growing due to portability.

- Blister Packs: Ideal for precise dosing and preventing cross-contamination for tablets and capsules.

- Cartons: Primarily used as secondary packaging, providing branding space and additional protection.

- Cans: Metal cans offer superior barrier protection for certain powders or specialty supplements.

- Others: Includes tubes, droppers, and specialized dispensing systems.

- By End User: Identifies the primary industries purchasing dietary supplement packaging.

- Nutraceutical Companies: The largest consumer, producing a wide array of health supplements.

- Pharmaceutical Companies: For over-the-counter vitamins and mineral supplements.

- Food and Beverage Companies: For fortified food products and functional beverages.

- Other End Users: Includes cosmetic companies and specialized health brands.

- By Application: Categorizes packaging based on the type of supplement it contains.

- Vitamins and Minerals: High volume, requiring standard protection.

- Herbal Supplements: Often requires enhanced barrier properties due to sensitivity of natural ingredients.

- Sports Nutrition: Demands robust, often larger formats like tubs, or convenient single-serve pouches.

- Weight Management: Similar to sports nutrition, with a focus on convenience and portion control.

- Probiotics: Highly sensitive, requiring superior moisture and oxygen barrier packaging, often with active desiccant technology.

- Other Applications: Includes omega-3 fatty acids, specialty blends, and children's supplements.

Value Chain Analysis For Dietary Supplement Packaging Market

The value chain for the dietary supplement packaging market is an intricate ecosystem, commencing with robust upstream activities predominantly centered on the meticulous procurement and initial processing of raw materials. This foundational stage involves a diverse array of essential suppliers, including major producers of various plastic resins (HDPE, PET, PP), specialized glass manufacturers, reputable metal suppliers primarily for aluminum, and sustainable pulp and paper producers. These critical raw materials subsequently undergo sophisticated primary processing to be transformed into intermediary forms such as polymer sheets or granular pellets, which are then utilized by specialized packaging component manufacturers. The intrinsic quality, consistent availability, and cost-effectiveness of these foundational materials profoundly influence downstream production processes and the final packaged product's attributes. Cultivating strong supplier relationships, coupled with highly efficient procurement strategies, remains absolutely critical for maintaining competitive pricing structures and ensuring a reliable supply of high-grade raw materials.

The core of the value chain is encapsulated in the midstream activities, which involve the highly specialized conversion of processed raw materials into an expansive array of distinct packaging formats, including bottles, jars, pouches, complex blister packs, and folding cartons. This pivotal segment is characterized by the application of advanced manufacturing technologies, encompassing precision injection molding, sophisticated blow molding, efficient thermoforming, and state-of-the-art printing and labeling processes. Packaging converters often demonstrate deep specialization in particular material types or packaging formats, leveraging their expertise and proprietary technologies to engineer bespoke solutions. These custom solutions meticulously meet client specifications across critical parameters such as innovative structural design, superior barrier properties, robust child-resistant functionalities, and compelling sustainability credentials. Significant investment in ongoing research and development for pioneering packaging solutions, including active and intelligent packaging features, also predominantly occurs at this midstream juncture. Throughout this intensive manufacturing phase, unwavering quality control protocols and rigorous adherence to stringent food safety and pharmaceutical-grade standards are paramount.

Downstream analysis meticulously scrutinizes the complex network of distribution channels and the ultimate consumption patterns of packaged dietary supplements. Direct distribution pathways typically involve large-scale packaging manufacturers supplying their products directly to major multinational nutraceutical and pharmaceutical companies. Conversely, indirect channels encompass a vast ecosystem of specialized distributors, wholesalers, and third-party logistics (3PL) providers who expertly manage the storage, transportation, and final delivery of packaged goods to smaller, emerging brands, traditional retail outlets, and e-commerce fulfillment centers. The unprecedented proliferation of e-commerce has fundamentally reshaped distribution paradigms, creating an imperative for packaging solutions that are not only cost-effective and robust enough to endure the rigors of parcel shipping but also meticulously designed to offer an engaging unboxing experience. The ultimate stage of the value chain culminates with the end-users, where the packaging's inherent functionality, intuitive ease of use, and compelling aesthetic appeal directly influence consumer satisfaction, foster repeat purchases, and significantly reinforce brand loyalty. Both direct and indirect distribution mechanisms play unequivocally crucial roles in ensuring widespread market penetration and product availability.

Dietary Supplement Packaging Market Potential Customers

The primary potential customers and discerning end-users of dietary supplement packaging represent a remarkably diverse and expansive ecosystem, spanning from colossal multinational pharmaceutical and nutraceutical conglomerates to agile small and medium-sized enterprises (SMEs) that specialize in organic, niche, or personalized health products. These varied entities collectively demand packaging solutions that fundamentally serve a dual purpose: not only to robustly protect their sensitive products from environmental degradation stemming from moisture, oxygen, UV light, and temperature fluctuations, but also to meticulously ensure strict compliance with an increasingly complex web of stringent regulatory labeling and paramount safety standards globally. Their intricate purchasing decisions are significantly influenced by a multitude of critical factors, including the cost-effectiveness of materials, verifiable sustainability credentials, extensive design flexibility for compelling branding, and the indispensable ability to seamlessly incorporate advanced safety features such as child resistance or tamper evidence. A brand's reputation and the invaluable trust it garners are often inextricably linked to the perceived quality and demonstrable safety of its chosen packaging.

Beyond the deeply entrenched traditional nutraceutical and pharmaceutical sectors, the rapidly expanding and highly dynamic market for sports nutrition products and innovative functional foods now constitutes a profoundly significant and growing customer base for packaging suppliers. Manufacturers operating within these fast-paced segments actively seek packaging solutions that strategically offer a compelling trifecta of convenience, enhanced portability, and aesthetically striking designs, all meticulously crafted to powerfully appeal to an active, health-conscious, and performance-driven consumer demographic. For instance, the demand for single-serve pouches, flexible sachets, and convenient stick packs is exceptionally high for protein powders and energy gels, due to their unparalleled ease of use. Conversely, robust, larger-format bottles and tubs are consistently preferred for bulk protein shakes and recovery drinks, requiring secure and often resealable closures. These discerning customers prioritize packaging that seamlessly integrates with an active lifestyle, rigorously maintains product efficacy, and provides clear, informative branding to powerfully resonate with their specific target demographics.

Moreover, the unprecedented proliferation and continuous expansion of the e-commerce channel have fundamentally engendered a distinct and rapidly evolving category of potential customers, each presenting unique and specific packaging demands. Online retailers and direct-to-consumer (DTC) brands urgently require packaging that is not only inherently cost-effective for efficient shipping and logistics but also exceptionally robust and structurally resilient enough to effectively prevent any form of damage during transit. The concept of the 'unboxing experience' has transcended mere functionality to become a critical and integral element of the brand journey, leading to a palpable surge in demand for packaging that is simultaneously aesthetically pleasing, demonstrably sustainable, and frequently customizable to reinforce distinctive brand identity and actively encourage organic social media sharing. These modern customers often seek comprehensive packaging partners capable of providing fully integrated, end-to-end solutions, ensuring absolute consistency, operational efficiency, and a seamlessly integrated brand presentation across all their digital sales channels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.5 billion |

| Market Forecast in 2032 | USD 7.7 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, Berry Global Inc., Huhtamaki Oyj, Sealed Air Corporation, Winpak Ltd., Constantia Flexibles Group GmbH, Sonoco Products Company, Mondi Group, Gerresheimer AG, AptarGroup Inc., CCL Industries Inc., Graham Packaging Company, Berlin Packaging, Wihuri Group, UFlex Ltd., SGD Pharma, WestRock Company, DS Smith Plc, Ardagh Group S.A., Crown Holdings Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dietary Supplement Packaging Market Key Technology Landscape

The dietary supplement packaging market is undergoing profound technological innovation and rapid transformation, driven by an escalating convergence of critical demands. These include the imperative for vastly enhanced product protection, a powerful industry-wide pivot towards sustainability, an unyielding focus on maximizing consumer convenience, and rigorous adherence to increasingly complex regulatory compliance mandates. At the forefront of these advancements are sophisticated barrier technologies, which are fundamentally crucial for preserving the integrity and efficacy of sensitive supplement formulations. These technologies strategically employ multi-layer film constructions, active oxygen scavengers, and advanced moisture absorbers to substantially extend the shelf life and steadfastly maintain the potency of highly delicate ingredients like probiotics and vitamins. Such innovations are specifically engineered to prevent product degradation caused by pervasive environmental factors like damaging light exposure, atmospheric oxygen infiltration, and detrimental humidity fluctuations, thereby ensuring the utmost stability and bio-efficacy of supplements. Furthermore, continuous R&D yields specialized coatings and innovative material blends, specifically formulated to significantly improve mechanical strength and chemical inertness, robustly safeguarding products during shipping and handling.

Another profoundly pivotal area witnessing groundbreaking technological advancement is the comprehensive realm of sustainable packaging solutions. This critical trend encompasses the widespread and rapidly increasing adoption of Post-Consumer Recycled (PCR) plastics, which divert waste from landfills and reduce reliance on virgin materials. Concurrently, there is a significant movement towards bioplastics, derived from rapidly renewable organic resources such as corn starch or sugarcane. Additionally, the market is actively exploring and integrating compostable and industrially biodegradable materials that return nutrients to the earth. Innovations in advanced lightweighting techniques for both rigid plastic and glass packaging components are strategically aimed at substantially reducing overall material usage and diminishing the carbon footprint associated with transportation logistics. Intensive research into developing mono-material packaging, which significantly simplifies and enhances the efficiency of recycling processes, alongside the design and implementation of sophisticated refillable and reusable packaging systems, are rapidly gaining substantial traction. These initiatives align directly with global imperatives to transition towards a truly circular economy model and effectively address mounting environmental concerns.

Moreover, the integration of advanced smart packaging technologies is increasingly becoming a strategic imperative within the dynamic dietary supplement sector, designed to fundamentally enhance both consumer engagement and product integrity. This forward-thinking approach includes the strategic incorporation of interactive QR codes and sophisticated Near Field Communication (NFC) tags, which provide unprecedented avenues for delivering detailed product information, verifying authenticity, offering personalized dosage reminders, and creating highly interactive brand experiences. The deployment of robust anti-counterfeiting measures, such as intricate holograms, covert invisible inks, and unique serialized codes, is absolutely vital for diligently protecting established brands from illicit imitation and unequivocally ensuring consumer safety. Furthermore, advancements in high-definition digital and flexographic printing technologies enable the creation of exceptionally high-quality, vibrantly appealing graphics, intricate textural finishes, and premium tactile elements on packaging surfaces. These aesthetic enhancements are indispensable for achieving distinct brand differentiation and powerfully attracting discerning consumer attention on crowded retail shelves and competitive online platforms, contributing to overall market competitiveness and innovation.

Regional Highlights

- North America: This region stands as a highly mature and dominant market for dietary supplement packaging, characterized by high consumer health consciousness, a robust regulatory environment, and the significant operational presence of numerous leading global market players. The United States and Canada are at the forefront of adopting cutting-edge innovative packaging solutions, particularly those incorporating advanced sustainable materials and sophisticated child-resistant closure mechanisms, driven by evolving consumer demand for safety and environmental responsibility, alongside stringent regulatory pressures. The region represents a colossal consumer base for vitamins, essential minerals, and specialized sports nutrition products, necessitating diverse and high-performance packaging solutions. Its strong e-commerce infrastructure also fuels demand for protective and aesthetically pleasing shipping packaging, driving innovation for direct-to-consumer models.

- Europe: The European dietary supplement packaging market exhibits robust and consistent growth, fundamentally underpinned by a rapidly aging population, increasing public awareness of preventive healthcare, and the pervasive influence of stringent packaging waste directives, such as the EU Packaging and Packaging Waste Directive. Key countries like Germany, the United Kingdom, and France, are actively leading the charge in the widespread adoption of eco-friendly packaging materials, including advanced bioplastics and extensive use of recycled content, alongside the sophisticated integration of anti-counterfeiting technologies. This regional market is also characterized by a strong emphasis on clean label packaging, transparency, and traceability, compelling manufacturers to invest in solutions that clearly communicate product origins and ingredient integrity.

- Asia Pacific (APAC): The Asia Pacific region is unequivocally recognized as the fastest-growing and most dynamic market for dietary supplement packaging globally. This extraordinary growth is powered by rapidly rising disposable incomes, accelerated urbanization trends, and the emergence of a colossal middle class across economic powerhouses such as China, India, Japan, and Australia. The escalating awareness of health and wellness benefits, synergistically coupled with the exponential expansion of e-commerce platforms, is dramatically driving an unprecedented demand for diverse and innovative packaging formats, ranging from traditional herbal remedies to state-of-the-art modern supplements. The region is witnessing substantial investments in advanced packaging manufacturing capabilities, alongside a swift adoption of international quality and safety standards, often requiring nuanced localization.

- Latin America: This region is demonstrating promising and consistent growth within the dietary supplement packaging sector, primarily influenced by a steadily rising health awareness among its populations and increasing strategic investments in improving healthcare infrastructure. Brazil and Mexico stand out as particularly pivotal markets, exhibiting a burgeoning demand for both fundamental nutritional supplements and specialized sports nutrition products. The region's packaging market is characterized by a strong emphasis on cost-effectiveness, given economic sensitivities, while simultaneously striving for full compliance with increasingly stringent national and international regulatory standards. There is a noticeable trend towards adopting more advanced packaging solutions that offer extended shelf life and greater convenience, mirroring global trends but often with a focus on local sourcing and production.

- Middle East and Africa (MEA): As an emerging market with substantial untapped potential, the MEA region's dietary supplement packaging growth is driven by rising health expenditures, an increasing prevalence of lifestyle diseases, and a growing interest in wellness products. The United Arab Emirates (UAE) and Saudi Arabia are leading the adoption of international packaging standards and increasingly demanding premium packaging solutions for supplements, catering to a sophisticated and affluent consumer segment. Despite being in relatively early stages of broad market development, the market shows rapid progression in terms of adopting modern packaging technologies, materials, and designs. Challenges include varying regulatory environments, supply chain complexities, and the need for packaging solutions that can withstand harsh climatic conditions, ensuring product integrity and safety.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dietary Supplement Packaging Market.- Amcor plc

- Berry Global Inc.

- Huhtamaki Oyj

- Sealed Air Corporation

- Winpak Ltd.

- Constantia Flexibles Group GmbH

- Sonoco Products Company

- Mondi Group

- Gerresheimer AG

- AptarGroup Inc.

- CCL Industries Inc.

- Graham Packaging Company

- Berlin Packaging

- Wihuri Group

- UFlex Ltd.

- SGD Pharma

- WestRock Company

- DS Smith Plc

- Ardagh Group S.A.

- Crown Holdings Inc.

Frequently Asked Questions

What are the primary drivers of growth in the dietary supplement packaging market?

The primary drivers propelling growth in the dietary supplement packaging market are increasing global consumer health consciousness, a steadily growing aging population necessitating health support, the significant expansion of e-commerce platforms for supplement sales, and continuous innovations in packaging materials focusing on both sustainability and superior product protection.

Which packaging materials are most commonly used for dietary supplements?

Plastics, particularly high-density polyethylene (HDPE) and polyethylene terephthalate (PET), remain the most commonly utilized materials due to their exceptional versatility, lightweight nature, and effective barrier properties. Glass packaging is frequently chosen for premium or liquid supplements for its inertness and recyclability, while flexible packaging formats such as pouches and stick packs are rapidly gaining popularity for convenience and portability.

How do sustainability trends impact dietary supplement packaging?

Sustainability trends profoundly impact the dietary supplement packaging market by driving an accelerating demand for environmentally responsible solutions. This includes the widespread adoption of Post-Consumer Recycled (PCR) plastics, innovative bioplastics, and easily recyclable mono-materials. Companies are increasingly investing in packaging that is recyclable, reusable, and compostable, aligning with evolving consumer preferences and stringent global environmental regulations.

What role does AI play in the future of dietary supplement packaging?

Artificial Intelligence (AI) is poised to revolutionize the dietary supplement packaging market by enabling optimized inventory management, automated and highly accurate quality control systems, personalized packaging design tailored to consumer data, and significantly enhanced manufacturing efficiency. Furthermore, AI contributes to the development of smart packaging features for real-time tracking, product authentication, and anti-counterfeiting measures, leading to more responsive and consumer-centric solutions.

What are the main challenges faced by manufacturers in this market?

Key challenges for manufacturers in the dietary supplement packaging market include navigating complex regulatory landscapes across different regions, managing the volatility of raw material prices, addressing mounting environmental concerns related to plastic waste, and effectively combating the persistent threat of counterfeit products that undermine brand integrity. Additionally, the high initial investment required for advanced packaging technologies can also pose a barrier.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager