Digital Evidence Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428201 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Digital Evidence Management Market Size

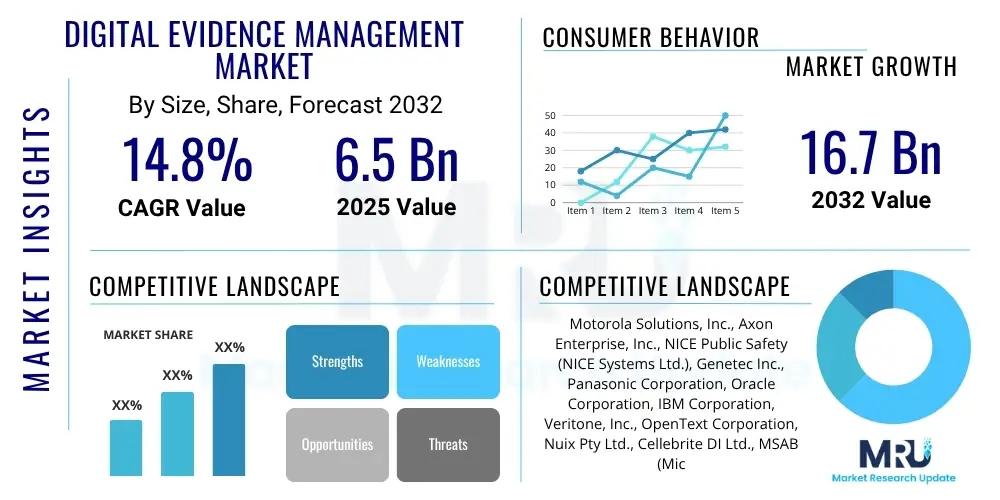

The Digital Evidence Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2025 and 2032. The market is estimated at USD 6.5 Billion in 2025 and is projected to reach USD 16.7 Billion by the end of the forecast period in 2032.

Digital Evidence Management Market introduction

The Digital Evidence Management (DEM) market encompasses a suite of solutions and services designed to securely collect, store, manage, analyze, and present digital evidence throughout its lifecycle. This critical domain addresses the ever-growing volume of digital data generated from various sources, including body-worn cameras, CCTV, mobile devices, social media, and cloud platforms. As digital transformation accelerates across all sectors and cybercrime incidents become more sophisticated, the integrity and accessibility of digital evidence are paramount for legal proceedings, investigations, and regulatory compliance. DEM solutions provide a structured framework to handle this complex data, ensuring its authenticity, chain of custody, and admissibility in court.

Products within the DEM market typically include software platforms for ingestion, indexing, and redaction, secure cloud or on-premise storage infrastructure, and analytics tools powered by artificial intelligence and machine learning. Major applications span law enforcement agencies, legal firms, government intelligence bodies, and corporate security departments, all of whom require robust systems to manage evidence for internal investigations, criminal cases, and compliance audits. The primary benefit of adopting DEM solutions is the significant enhancement of operational efficiency, reduction of manual errors, and strengthening of evidential integrity, which collectively contribute to more effective and equitable justice systems.

Key driving factors fueling the expansion of the DEM market include the exponential growth in the generation of digital data, the increasing adoption of digital technologies by law enforcement and legal entities, and the heightened regulatory scrutiny surrounding data privacy and evidence handling. Furthermore, the persistent threat of cyberattacks and the need for irrefutable evidence in an increasingly digital world compel organizations to invest in advanced DEM systems. These factors collectively underscore the indispensability of sophisticated digital evidence management for modern societal and organizational security.

Digital Evidence Management Market Executive Summary

The Digital Evidence Management (DEM) market is experiencing robust growth driven by accelerating digital transformation, the proliferation of data sources, and stringent regulatory demands. Key business trends indicate a strong shift towards cloud-based DEM solutions, offering enhanced scalability, accessibility, and cost-efficiency compared to traditional on-premise systems. Furthermore, the integration of advanced analytics, artificial intelligence (AI), and machine learning (ML) capabilities is revolutionizing how evidence is processed and analyzed, moving beyond mere storage to predictive insights and automated redaction. Strategic partnerships and mergers among technology providers are also shaping the competitive landscape, aiming to offer integrated, end-to-end solutions that address the complex needs of diverse end-users.

Regionally, North America continues to dominate the DEM market due to early adoption of advanced technologies, substantial investments in public safety infrastructure, and the presence of numerous key market players. Europe follows closely, propelled by strict data protection regulations such as GDPR, which necessitate sophisticated evidence management practices for compliance. The Asia Pacific region is emerging as a significant growth hub, fueled by rapid digitalization, increasing internet penetration, and a rising awareness of cybersecurity, leading to increased government spending on digital forensics and evidence management systems. Latin America and the Middle East & Africa regions are also showing promising growth, albeit from a smaller base, driven by modernizing legal frameworks and growing investments in national security.

Segmentation trends highlight the increasing preference for software components within DEM solutions, particularly those offering comprehensive features for data ingestion, processing, and analysis. Cloud deployment models are gaining significant traction across all end-user segments, from law enforcement to corporate enterprises, due to their flexibility and lower upfront capital expenditure. Among end-users, law enforcement agencies remain the largest segment, but corporate enterprises and the legal sector are rapidly increasing their adoption of DEM solutions to manage internal investigations, intellectual property disputes, and compliance documentation. The market is also seeing a diversification of offerings to cater to specific types of evidence, such as video, audio, and social media data, reflecting the evolving nature of digital crime and investigations.

AI Impact Analysis on Digital Evidence Management Market

Common user questions related to the impact of AI on the Digital Evidence Management (DEM) Market frequently revolve around the automation capabilities, accuracy enhancements, and ethical implications of integrating AI technologies. Users often inquire about how AI can streamline the time-consuming processes of evidence review, transcription, and redaction, seeking to understand the extent of efficiency gains. Concerns are also raised regarding the potential for AI algorithms to introduce biases, compromise data privacy, or diminish the role of human judgment in critical investigations. Furthermore, there is a strong interest in AI's capacity for advanced pattern recognition, predictive analytics, and its potential to uncover hidden connections within vast datasets, alongside questions about the future landscape of DEM as AI capabilities mature and become more pervasive in forensic workflows.

- Automation of data processing: AI algorithms significantly accelerate the classification, indexing, and tagging of digital evidence, reducing manual labor and processing backlogs.

- Enhanced search and retrieval: AI-powered natural language processing (NLP) and computer vision enable more precise and rapid searching across diverse evidence types, including unstructured data.

- Predictive analytics and pattern recognition: AI identifies trends, anomalies, and correlations within large datasets, offering investigators deeper insights and potential leads that human analysis might miss.

- Automated redaction: AI tools can automatically identify and redact sensitive personal information from video, audio, and text evidence, ensuring compliance with privacy regulations like GDPR.

- Improved data integrity verification: AI can monitor and flag potential tampering or inconsistencies in the chain of custody, bolstering the reliability and admissibility of evidence.

- Facial recognition and object detection: AI assists in identifying individuals, objects, and activities in video evidence, providing critical support for identification and tracking in investigations.

- Transcription and translation services: AI-driven speech-to-text and translation capabilities expedite the processing of audio and multi-language evidence, making it more accessible and reviewable.

DRO & Impact Forces Of Digital Evidence Management Market

The Digital Evidence Management (DEM) market is shaped by a dynamic interplay of drivers, restraints, opportunities, and broader impact forces. A primary driver is the exponential growth in digital data volume, originating from ubiquitous connected devices, social media platforms, and IoT ecosystems. This data deluge necessitates robust systems for its capture, preservation, and analysis, especially as digital evidence becomes increasingly central to legal and investigative processes. Concurrently, the escalating sophistication and frequency of cybercrime, coupled with a heightened focus on national security, compel government agencies and private enterprises alike to invest in advanced DEM solutions. Regulatory frameworks, such as GDPR and CCPA, which mandate stringent data handling and privacy compliance, further drive demand, pushing organizations to adopt compliant and secure evidence management practices to avoid severe penalties. The overarching trend of digital transformation across industries, aimed at enhancing operational efficiency and accountability, also fuels the adoption of integrated DEM platforms.

However, significant restraints temper the market's growth trajectory. The high initial implementation costs associated with acquiring, configuring, and integrating sophisticated DEM systems can be prohibitive for smaller organizations or those with limited IT budgets. Data privacy concerns and the ethical dilemmas surrounding the collection and use of digital evidence, particularly with emerging technologies like facial recognition, pose considerable challenges, requiring careful navigation of public trust and legal boundaries. Furthermore, the interoperability issues arising from disparate legacy systems and diverse data formats can complicate seamless integration and data exchange, creating bottlenecks in evidence workflows. A persistent shortage of skilled personnel proficient in digital forensics and DEM technologies also restricts adoption and effective utilization of these advanced systems, requiring continuous investment in training and expertise development.

Despite these challenges, the DEM market presents substantial opportunities for innovation and expansion. The burgeoning trend of cloud-based DEM solutions offers scalability, flexibility, and reduced infrastructure overheads, making advanced capabilities accessible to a wider range of users and potentially lowering the barrier to entry. The increasing integration of advanced AI and Machine Learning (ML) technologies is poised to revolutionize evidence analysis, automation, and predictive capabilities, unlocking new efficiencies and insights. Moreover, the application of blockchain technology for maintaining the immutable integrity of the chain of custody for digital evidence offers a promising avenue for enhanced trustworthiness. Geographic expansion into emerging markets, particularly in Asia Pacific and Latin America, driven by growing digital infrastructure and increasing awareness of cyber threats, represents significant untapped potential for vendors.

Segmentation Analysis

The Digital Evidence Management (DEM) market is extensively segmented to reflect the diverse needs and operational models of various stakeholders, allowing for tailored solutions that address specific functional requirements and deployment preferences. These segmentations provide a comprehensive view of the market landscape, highlighting key growth areas and differentiating technological approaches. The primary segmentation categories include components, deployment models, end-users, and types of evidence management, each contributing to a nuanced understanding of market dynamics and competitive positioning.

- By Component:

- Software: Core platforms for ingestion, processing, analysis, redaction, and reporting.

- Hardware: Storage devices, servers, specialized forensic workstations, capture devices (e.g., body cameras).

- Services: Professional services (consulting, implementation, training, integration), Managed services (hosting, maintenance, support).

- By Deployment:

- On-Premises: Solutions hosted and managed within an organization's internal infrastructure.

- Cloud-Based: Solutions hosted and delivered via cloud service providers (Public Cloud, Private Cloud, Hybrid Cloud).

- By End-User:

- Law Enforcement Agencies: Police departments, federal agencies (FBI, DEA), investigative units.

- Legal Sector: Law firms (corporate, criminal, civil litigation), public prosecutors.

- Corporate Enterprises: Security departments, compliance teams, HR for internal investigations.

- Government & Public Sector: Intelligence agencies, border control, defense departments.

- Healthcare: Regulatory compliance, patient data security, internal fraud investigations.

- BFSI (Banking, Financial Services, and Insurance): Fraud detection, compliance, risk management.

- By Type of Evidence Management:

- Evidence Collection: Tools for acquiring data from various sources (mobile, cloud, social media).

- Evidence Storage: Secure long-term and short-term storage solutions.

- Evidence Processing: Tools for data extraction, indexing, and normalization.

- Evidence Analysis: Analytics platforms, AI/ML tools for pattern recognition, insights.

- Evidence Presentation: Tools for creating reports, visualizations, and courtroom presentations.

Value Chain Analysis For Digital Evidence Management Market

The value chain of the Digital Evidence Management (DEM) market is intricate, involving several stages from fundamental technology provision to the ultimate delivery and support of comprehensive solutions to end-users. At the upstream stage, the market is heavily reliant on core technology providers who supply the foundational components necessary for DEM systems. This includes developers of advanced artificial intelligence and machine learning algorithms for data analysis and automation, cloud infrastructure providers (such as AWS, Microsoft Azure, Google Cloud) offering scalable storage and computing resources, and manufacturers of specialized hardware like high-capacity storage servers, forensic workstations, and data capture devices (e.g., body-worn cameras, dash cameras, mobile forensic kits). These upstream players form the bedrock upon which integrated DEM solutions are built, providing the necessary technological capabilities and infrastructure.

Moving downstream, the value chain involves software developers who create the DEM platforms, system integrators responsible for customizing and deploying these solutions into existing organizational IT infrastructures, and value-added resellers (VARs) who bundle DEM offerings with other related services to provide complete packages to clients. These downstream participants are crucial for tailoring generic solutions to meet the specific, often complex, requirements of various end-user segments like law enforcement or legal firms. Their expertise in integration, customization, and client-specific solutions adds significant value by ensuring that the DEM systems are not only functional but also seamlessly integrated and optimized for the operational workflows of the end-users. The effective collaboration between these entities ensures that cutting-edge technologies are transformed into practical and deployable solutions.

The distribution channel for Digital Evidence Management solutions is multifaceted, encompassing both direct and indirect sales approaches. Direct sales involve DEM solution providers engaging directly with large government agencies, federal law enforcement bodies, or major corporate clients, often through dedicated sales teams and complex tender processes. This direct approach allows for highly customized solutions and direct client relationships. Indirect channels include partnerships with system integrators, managed service providers (MSPs), and value-added resellers (VARs) who have established relationships with a broader client base and can offer localized support and expertise. Additionally, some DEM software components might be available through online marketplaces or cloud service provider marketplaces, enabling easier access for smaller organizations. The choice of distribution channel often depends on the scale of the client, the complexity of the solution, and the geographical reach desired by the DEM vendor, ensuring a wide market penetration and tailored service delivery.

Digital Evidence Management Market Potential Customers

The Digital Evidence Management (DEM) market serves a broad and diverse range of potential customers, all of whom share a critical need to securely and efficiently manage digital evidence for investigative, legal, and compliance purposes. Foremost among these are law enforcement agencies, including local police departments, state bureaus of investigation, and federal organizations such as the FBI, DEA, and Homeland Security. These entities rely heavily on DEM solutions to handle vast quantities of video from body-worn and dash cameras, audio recordings, mobile device data, social media content, and digital forensic artifacts, which are indispensable for criminal investigations, arrests, and successful prosecutions. The growing volume and complexity of digital crime underscore the continuous and escalating demand from this sector for robust and scalable DEM platforms.

Beyond traditional law enforcement, the legal sector represents a significant segment of potential customers. This includes private law firms specializing in criminal defense, corporate litigation, intellectual property, and civil disputes, as well as public prosecutor offices and district attorney's offices. For these legal professionals, DEM systems are vital for organizing case files, reviewing digital evidence, ensuring chain of custody, and preparing compelling presentations for court. The ability to quickly access, redact, and analyze relevant digital information can significantly impact the outcome of legal proceedings, driving demand for solutions that enhance efficiency and evidential integrity throughout the entire legal process from discovery to verdict. This demand is further amplified by the increasing prevalence of e-discovery requirements and the digitization of legal workflows.

Furthermore, corporate enterprises across various industries are increasingly recognizing the necessity of DEM solutions for internal investigations, compliance audits, and intellectual property protection. Corporate security teams, human resources departments, and legal counsel within large organizations utilize DEM to manage evidence related to employee misconduct, fraud, data breaches, and regulatory non-compliance. Similarly, government agencies outside of direct law enforcement, such as intelligence services, border patrol, and regulatory bodies, require sophisticated DEM systems for national security, data governance, and policy enforcement. The BFSI (Banking, Financial Services, and Insurance) and healthcare sectors also represent growing customer segments, driven by stringent regulatory environments (e.g., HIPAA, FINRA), the need to combat fraud, and the imperative to protect sensitive customer and patient data, making DEM an essential tool for maintaining trust and operational integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 6.5 Billion |

| Market Forecast in 2032 | USD 16.7 Billion |

| Growth Rate | 14.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Motorola Solutions, Inc., Axon Enterprise, Inc., NICE Public Safety (NICE Systems Ltd.), Genetec Inc., Panasonic Corporation, Oracle Corporation, IBM Corporation, Veritone, Inc., OpenText Corporation, Nuix Pty Ltd., Cellebrite DI Ltd., MSAB (Micro Systemation AB), BlackBag Technologies (Acquired by Cellebrite), Magnet Forensics Inc., Digital Detective Group, Evidence.com (Axon), Encase (OpenText), FTK (Exterro Inc.), Securitas AB, Versaterm Public Safety (Versaterm Inc.) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Evidence Management Market Key Technology Landscape

The Digital Evidence Management (DEM) market is underpinned by a dynamic and evolving technology landscape, with continuous innovations driving greater efficiency, security, and analytical capabilities. Cloud computing stands as a cornerstone technology, providing scalable and secure infrastructure for storing vast quantities of digital evidence. Public, private, and hybrid cloud solutions offer flexibility, disaster recovery, and remote access, which are crucial for distributed investigative teams and ensuring business continuity. The shift towards cloud-native architectures further enhances agility and reduces the capital expenditure associated with on-premise hardware, allowing organizations to adapt quickly to changing data volumes and regulatory requirements.

Artificial Intelligence (AI) and Machine Learning (ML) are transformative forces within DEM, revolutionizing how evidence is processed and analyzed. AI algorithms are deployed for automated transcription of audio and video, facial recognition, object detection, and natural language processing (NLP) to extract insights from unstructured text data. ML models enhance predictive analytics, identify patterns in large datasets, and automate the redaction of sensitive information, significantly accelerating review times and improving accuracy. These technologies empower investigators to sift through massive amounts of data more effectively, uncover hidden connections, and prioritize critical evidence, thus streamlining the entire investigative workflow and improving case resolution rates.

Beyond AI and cloud, other critical technologies include advanced data analytics and visualization tools, which convert complex datasets into intuitive graphical representations, enabling faster comprehension and more effective courtroom presentations. Cybersecurity technologies, including robust encryption, access controls, and intrusion detection systems, are fundamental for protecting the integrity and confidentiality of digital evidence from unauthorized access or tampering. Blockchain technology is emerging as a promising solution for maintaining an immutable chain of custody, providing an irrefutable record of evidence handling and ensuring its authenticity. Furthermore, specialized forensic tools for mobile devices, IoT devices, and network forensics are crucial for the comprehensive collection and analysis of evidence from an ever-expanding array of digital sources, complementing the core DEM platforms and ensuring that no piece of crucial evidence is overlooked.

Regional Highlights

- North America: This region is a dominant force in the Digital Evidence Management market, characterized by early adoption of advanced technologies, significant investments in public safety and defense, and the presence of numerous key market players. The United States, in particular, drives substantial demand due to high crime rates, extensive use of body-worn cameras by law enforcement, and a robust legal framework that heavily relies on digital evidence. Canada also contributes to regional growth through its commitment to modernizing police forces and legal systems.

- Europe: The European market for DEM is largely influenced by stringent data protection regulations such as the General Data Protection Regulation (GDPR), which necessitates secure and compliant handling of digital evidence. Countries like the UK, Germany, and France are leading the adoption due to strong legal sectors, increasing cybercrime rates, and governmental initiatives to enhance digital forensic capabilities. The emphasis on data privacy and the need for robust chain-of-custody solutions are key regional drivers.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid digitalization, increasing internet penetration, and a growing awareness of cybersecurity threats. Emerging economies such as China, India, Japan, Australia, and South Korea are making significant investments in smart city initiatives, law enforcement modernization, and digital infrastructure. The increasing volume of digital data and the need for efficient investigative tools are fueling market expansion across diverse public and private sectors in the region.

- Latin America: This region presents an emerging market for DEM solutions, with countries like Brazil, Mexico, and Argentina gradually increasing their adoption rates. Growth is primarily driven by efforts to combat organized crime, enhance border security, and modernize outdated legal and investigative processes. While facing economic challenges, increasing governmental focus on digital security and justice system reforms is fostering demand for digital evidence management technologies.

- Middle East and Africa (MEA): The MEA region is experiencing steady growth in the DEM market, primarily influenced by rising governmental expenditures on national security, counter-terrorism efforts, and investments in smart infrastructure. Countries such as Saudi Arabia, UAE, and South Africa are leading the way in adopting advanced forensic technologies and digital evidence platforms. The need for robust systems to manage evidence from surveillance and intelligence operations is a significant factor driving market development in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Evidence Management Market.- Motorola Solutions, Inc.

- Axon Enterprise, Inc.

- NICE Public Safety (NICE Systems Ltd.)

- Genetec Inc.

- Panasonic Corporation

- Oracle Corporation

- IBM Corporation

- Veritone, Inc.

- OpenText Corporation

- Nuix Pty Ltd.

- Cellebrite DI Ltd.

- MSAB (Micro Systemation AB)

- Magnet Forensics Inc.

- Digital Detective Group

- Exterro Inc. (with FTK solutions)

- Securitas AB

- Versaterm Public Safety (Versaterm Inc.)

- Fujitsu Limited

- Hexagon AB

- Logikcull

Frequently Asked Questions

Analyze common user questions about the Digital Evidence Management market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Digital Evidence Management (DEM)?

Digital Evidence Management (DEM) refers to the comprehensive process and solutions for securely collecting, storing, analyzing, and presenting electronic data gathered from various sources, ensuring its integrity and admissibility in legal or investigative contexts.

Why is DEM crucial for law enforcement agencies?

DEM is crucial for law enforcement as it enables efficient handling of vast amounts of digital data (e.g., bodycam footage, mobile forensics), ensures chain of custody, enhances investigative speed, and provides verifiable evidence critical for successful prosecutions and maintaining public trust.

What are the primary benefits of cloud-based DEM solutions?

Cloud-based DEM solutions offer significant benefits including enhanced scalability for growing data volumes, improved accessibility for remote teams, reduced infrastructure costs, robust disaster recovery capabilities, and often stronger security protocols managed by cloud providers.

How does Artificial Intelligence (AI) impact the DEM market?

AI significantly impacts DEM by automating tedious tasks like evidence review and redaction, enhancing search and pattern recognition, providing predictive analytics, and improving transcription accuracy, thereby increasing efficiency and generating deeper insights from complex digital data.

What are the main challenges in adopting Digital Evidence Management systems?

Key challenges in DEM adoption include high initial implementation costs, ensuring data privacy and compliance with regulations, addressing interoperability issues with existing legacy systems, and the ongoing need for skilled personnel trained in digital forensics and advanced DEM technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager