Digital Payments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431135 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Digital Payments Market Size

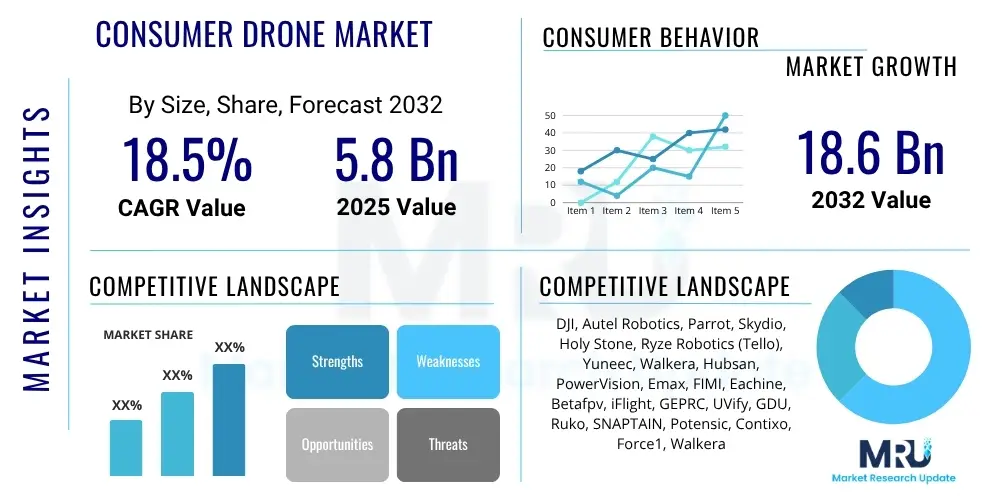

The Digital Payments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at $8.50 Trillion in 2025 and is projected to reach $26.75 Trillion by the end of the forecast period in 2032.

Digital Payments Market introduction

The Digital Payments Market encompasses all financial transactions conducted electronically without the direct exchange of physical cash. This broad category includes mobile payments, online banking, digital wallets, contactless payments, and various other forms of electronic funds transfer. The pervasive adoption of smartphones, coupled with expanding internet connectivity, has fundamentally transformed consumer behavior and business operations, propelling digital payments into a central role within the global economy. This market is characterized by continuous innovation aimed at enhancing user convenience, transaction security, and processing efficiency across diverse platforms and geographies.

The product description for digital payments extends beyond mere transaction processing to encompass a holistic ecosystem of services designed for ease of use, speed, and reliability. These services facilitate everything from peer-to-peer transfers and retail purchases to bill payments and cross-border remittances. Major applications span e-commerce, brick-and-mortar retail, utilities, transportation, and hospitality, driven by the inherent benefits of speed, reduced operational costs for businesses, and enhanced transparency for both consumers and enterprises. The market offers unparalleled convenience, allowing transactions to be completed anytime, anywhere, fostering financial inclusion by enabling access to formal financial services for underserved populations.

Key benefits of digital payments include enhanced security features such as encryption and tokenization, which significantly reduce the risks associated with cash handling and traditional payment methods. They also provide detailed transaction histories, simplifying budgeting and accounting for individuals and businesses alike. The market is primarily driven by the proliferation of mobile devices, the explosive growth of e-commerce, governmental initiatives promoting cashless economies, and the increasing demand for instant, seamless payment experiences. The global shift towards digital platforms, accelerated by recent global health crises, has solidified the indispensable nature of digital payment solutions, making them a cornerstone of modern financial infrastructure.

Digital Payments Market Executive Summary

The Digital Payments Market is experiencing robust growth driven by significant shifts in consumer preferences, technological advancements, and supportive regulatory frameworks. Business trends indicate a strong focus on enhancing payment security, streamlining checkout processes, and integrating diverse payment methods into a unified platform. There is a discernible move towards embedded finance and invisible payments, where transactions are seamlessly integrated into the user experience, often through subscriptions or one-click purchase options. Merchants are increasingly adopting advanced Point-of-Sale (POS) systems that support a wide array of digital payment types, including contactless card payments, mobile wallets, and QR code scans, recognizing the competitive advantage offered by convenience and speed. Furthermore, the rise of open banking initiatives is fostering greater interoperability and innovation, allowing third-party providers to offer novel payment solutions by securely accessing financial data with customer consent.

Regional trends reveal varying paces and adoption patterns, with Asia Pacific leading in terms of transaction volume and innovation, primarily propelled by massive mobile-first populations and aggressive digital transformation strategies in countries like China and India. North America and Europe are witnessing significant growth through the modernization of traditional banking infrastructure, the expansion of fintech ecosystems, and stringent regulatory pushes for consumer data protection and payment security. Latin America and the Middle East & Africa regions are emerging as high-growth markets, driven by increasing smartphone penetration, expanding internet access, and government initiatives aimed at financial inclusion and reducing reliance on cash. These regions present substantial opportunities for digital payment providers to cater to a rapidly evolving consumer base and underbanked populations, fostering economic development through accessible financial services.

Segment trends highlight the dominance of mobile payments, which continue to capture the largest share, fueled by the convenience and ubiquitous nature of smartphones. Digital wallets, offering multifaceted functionalities beyond mere payments such as loyalty programs and budgeting tools, are also experiencing accelerated adoption. The e-commerce sector remains a primary application area, continuously pushing the boundaries for faster and more secure online transaction processing. Furthermore, there is a growing interest in cross-border digital payments, addressing the complexities and high costs traditionally associated with international money transfers, with solutions leveraging blockchain and instant payment networks. The business-to-business (B2B) segment is also undergoing significant digitalization, moving away from manual invoicing and checks towards automated, integrated digital payment platforms that improve efficiency and cash flow management for enterprises of all sizes.

AI Impact Analysis on Digital Payments Market

Users frequently inquire about how Artificial Intelligence will revolutionize the digital payments landscape, specifically focusing on enhanced security, personalized user experiences, and the overall efficiency of transactions. Common concerns revolve around the potential for AI to detect and prevent sophisticated fraud, improve the accuracy of credit scoring, and offer predictive analytics for consumer spending behaviors. There is also significant interest in AI's role in automating customer support, simplifying complex financial processes, and ensuring regulatory compliance through intelligent data analysis. Users expect AI to make digital payments safer, faster, and more intuitive, while also anticipating the ethical implications surrounding data privacy and algorithmic bias in financial decision-making.

- AI significantly enhances fraud detection capabilities by analyzing vast datasets to identify anomalous transaction patterns in real-time, far surpassing traditional rule-based systems.

- Personalized payment experiences are enabled by AI, which learns user spending habits and preferences to offer tailored recommendations, loyalty programs, and financial insights.

- Operational efficiency is boosted as AI automates routine tasks such as reconciliation, dispute resolution, and customer service, reducing manual effort and processing times.

- Credit scoring and risk assessment are refined through AI algorithms that incorporate a broader range of data points, providing more accurate and inclusive evaluations for lending.

- Regulatory compliance is streamlined by AI tools that monitor transactions for suspicious activities, ensuring adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

- AI-powered chatbots and virtual assistants provide instant customer support, resolving queries and guiding users through payment processes, improving overall user satisfaction.

- Predictive analytics driven by AI helps businesses forecast market trends, optimize pricing strategies, and manage inventory more effectively based on anticipated consumer demand.

- Security protocols are continuously improved through AI's ability to adapt to new cyber threats and vulnerabilities, offering proactive defense mechanisms against evolving attack vectors.

- AI facilitates the development of intelligent payment routing and optimization, ensuring transactions are processed via the most efficient and cost-effective channels.

- Biometric authentication methods, often enhanced by AI, offer superior security and convenience, replacing passwords and PINs with facial recognition or fingerprint scans.

DRO & Impact Forces Of Digital Payments Market

The Digital Payments Market is significantly shaped by a confluence of powerful drivers, persistent restraints, compelling opportunities, and transformative impact forces. The primary drivers include the exponential growth in global smartphone penetration and internet connectivity, which make digital payment solutions accessible to an ever-wider demographic. The rapid expansion of e-commerce platforms, both business-to-consumer and increasingly business-to-business, necessitates seamless and secure digital transaction methods. Furthermore, governmental initiatives worldwide actively promote cashless economies through policies, incentives, and infrastructure development, viewing digital payments as crucial for financial inclusion, transparency, and economic growth. The convenience and speed offered by digital transactions, coupled with competitive offerings from fintech innovators, also act as strong motivators for widespread adoption among consumers and businesses alike, shifting preferences away from traditional cash-based systems.

Despite the strong growth trajectory, several restraints challenge the market's full potential. Chief among these are pervasive concerns regarding data privacy and cybersecurity. High-profile data breaches and the constant threat of fraud erode consumer trust, necessitating continuous investment in advanced security measures. The complex and often fragmented regulatory landscape across different countries and regions presents significant compliance hurdles for global digital payment providers. Moreover, the digital divide, particularly in developing economies, where access to internet infrastructure and digital literacy remains limited, impedes universal adoption. Additionally, the inherent cost of implementing and maintaining digital payment infrastructure, alongside the fees associated with processing transactions, can be a barrier for small merchants, who may prefer lower-cost, albeit less efficient, traditional methods.

Opportunities for growth are abundant, especially in emerging markets where large unbanked populations represent a vast untapped customer base for mobile-first payment solutions. The integration of advanced technologies like blockchain holds immense promise for enhancing the security, transparency, and efficiency of cross-border payments, potentially disrupting traditional remittance services. The burgeoning Internet of Things (IoT) market offers new frontiers for embedded payments, where devices themselves can initiate and complete transactions autonomously, such as smart refrigerators ordering groceries or connected cars paying for fuel. Strategic collaborations between fintech companies, traditional financial institutions, and e-commerce giants are also creating innovative payment ecosystems that cater to niche markets and specific industry needs, driving further market expansion. The continuous evolution of user interfaces and experience design, focusing on simplicity and accessibility, will unlock further opportunities.

The market is further shaped by several powerful impact forces. Technological advancements, particularly in AI, machine learning, and biometric authentication, are continuously reshaping the capabilities and security of digital payment systems, setting new industry standards. Changing consumer behavior, driven by a preference for instant gratification, personalization, and seamless experiences, directly influences product development and service delivery. The competitive landscape is intensely dynamic, with established financial institutions, tech giants, and agile fintech startups vying for market share, fostering innovation but also intense pricing pressure. Geopolitical factors and economic shifts can also impact market growth, influencing cross-border transaction volumes, investment in digital infrastructure, and consumer purchasing power. Regulatory changes, such as the introduction of open banking directives and stringent data protection laws, fundamentally alter operational parameters and competitive strategies, demanding continuous adaptation from market participants.

Segmentation Analysis

The Digital Payments Market is intricately segmented across various dimensions to provide a granular view of its structure and dynamics. This segmentation allows for a detailed analysis of market trends, competitive landscapes, and growth opportunities tailored to specific categories. Key parameters for segmentation typically include the component of the solution, the type of payment method, the end-user application, and the geographic region. Understanding these distinct segments is crucial for stakeholders to develop targeted strategies, optimize product offerings, and identify high-potential growth areas. The diverse nature of digital payment solutions, ranging from sophisticated enterprise platforms to simple consumer apps, necessitates a robust analytical framework that captures the nuances of each market niche and its unique value proposition.

- By Component

- Solutions

- Payment Gateways

- Payment Processing

- Payment Security and Fraud Management

- Billing and Subscription Management

- POS Solutions

- Tokenization

- Risk Management and Compliance Solutions

- Wallet Management

- Services

- Professional Services

- Consulting

- Implementation

- Support and Maintenance

- Managed Services

- Professional Services

- Solutions

- By Type

- Proximity Payments

- NFC (Near Field Communication)

- QR Code Payments

- Sound-based Payments

- Contactless Cards

- Remote Payments

- Online Payments (Web-based)

- Mobile Payments (App-based)

- Digital Wallets

- Bank Transfers

- Cryptocurrency Payments

- Email/SMS Payments

- Proximity Payments

- By Application

- Retail and E-commerce

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunications

- Travel and Hospitality

- Utilities and Public Sector

- Healthcare

- Media and Entertainment

- Transportation and Logistics

- Gaming

- Education

- By End-User

- Individuals/Consumers

- Businesses

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- Government Agencies

- By Deployment Model

- On-Premise

- Cloud-based

- By Transaction Type

- Business to Consumer (B2C)

- Business to Business (B2B)

- Consumer to Business (C2B)

- Consumer to Consumer (C2C)

- Government to Citizen (G2C)

Value Chain Analysis For Digital Payments Market

The value chain for the Digital Payments Market is a complex ecosystem involving multiple layers of participants, starting from foundational technology providers and extending all the way to the end consumer. Upstream activities involve entities responsible for developing the core infrastructure and technologies that enable digital payments. This includes software vendors creating payment gateway solutions, developers of security and fraud detection algorithms, and hardware manufacturers producing POS terminals, NFC chips, and biometric scanners. Traditional financial institutions, such as banks, also play a crucial upstream role by providing payment networks, clearing and settlement services, and issuing digital payment instruments like credit and debit cards. Furthermore, telecom providers are essential for providing the underlying network connectivity that mobile and online payments rely upon, forming a critical part of the initial infrastructure that underpins the entire digital payment ecosystem.

Midstream in the value chain, payment service providers (PSPs) and fintech companies aggregate these foundational technologies and services to create comprehensive payment solutions. These entities manage the complexity of integrating various payment methods, ensuring compliance with diverse regulatory requirements, and offering merchant services. They act as intermediaries between merchants, consumers, and financial networks, facilitating the smooth and secure flow of funds. This segment also includes digital wallet providers, platform developers for mobile banking applications, and innovators in blockchain-based payment solutions. These players are responsible for user interface development, customer support, and value-added services such as loyalty programs, budgeting tools, and personalized financial insights, striving to enhance the overall user experience and adoption rates across different market segments.

Downstream activities focus on the direct interaction with the end-users and the final delivery of payment services. This primarily involves merchants, both online e-commerce platforms and physical brick-and-mortar stores, who accept digital payments from consumers. These merchants integrate payment gateways into their websites or use POS systems that support various digital payment methods, directly benefiting from increased sales, reduced cash handling costs, and enhanced customer satisfaction. The distribution channels for digital payments are predominantly direct through mobile applications and web platforms, allowing consumers to directly access services like digital wallets or internet banking. Indirect channels can include partnerships with telecommunication companies to offer mobile money services or collaborations with various retailers to accept specific digital payment brands. The efficiency and reach of these downstream channels are critical for maximizing market penetration and widespread adoption of digital payment solutions, driving the ultimate success and growth of the entire digital payments market.

Digital Payments Market Potential Customers

The Digital Payments Market serves a vast and diverse array of potential customers, spanning individuals, businesses of all sizes, and governmental entities. At its core, the primary end-users are individual consumers who increasingly seek convenient, secure, and fast ways to manage their finances and conduct transactions. This includes tech-savvy millennials and Gen Z who have grown up with digital technologies, as well as older demographics adopting digital methods for ease of use and safety. These consumers utilize digital payments for everyday purchases, online shopping, bill payments, peer-to-peer transfers, and international remittances, driven by the desire for efficiency and instant gratification in their financial interactions. The convenience of not carrying cash or cards, coupled with the ability to track expenses digitally, makes digital payments highly attractive to this broad demographic.

Businesses form another critical segment of potential customers, ranging from micro-enterprises and small and medium-sized enterprises (SMEs) to large multinational corporations. For SMEs, digital payments offer cost-effective solutions for accepting payments, managing cash flow, and expanding their customer reach beyond geographical limitations, particularly for those operating online. Large enterprises benefit from digital payment solutions that streamline complex B2B transactions, facilitate supply chain finance, automate reconciliation processes, and enhance security for high-volume transactions. Across all business sizes, the demand for integrated payment solutions that offer robust analytics, fraud prevention, and seamless integration with existing enterprise resource planning (ERP) systems is a significant driver. Businesses are motivated by operational efficiency, reduced administrative burden, and the ability to cater to evolving consumer payment preferences.

Furthermore, government agencies and public sector organizations are increasingly becoming significant adopters and promoters of digital payments. Governments leverage digital payment systems for tax collection, disbursement of social welfare benefits, processing fees for public services, and improving overall financial transparency and efficiency. The push towards cashless economies in many nations is often spearheaded by government initiatives, aiming to reduce corruption, track financial flows more effectively, and bring more citizens into the formal financial system. Financial institutions, including banks and credit unions, also act as key customers, implementing digital payment technologies to modernize their services, enhance customer experience, and compete with agile fintech startups. The widespread utility and transformative impact of digital payment solutions ensure a continuously expanding base of diverse customers across every economic sector globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $8.50 Trillion |

| Market Forecast in 2032 | $26.75 Trillion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Visa, Mastercard, PayPal, Stripe, Square (Block Inc.), Fiserv, Adyen, Worldpay (FIS), Apple Pay, Google Pay, Alipay (Ant Group), WeChat Pay (Tencent), Amazon Pay, Payoneer, Global Payments, Checkout.com, Ayden, WEX Inc., Wirecard (though facing challenges, historically significant), Samsung Pay. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Payments Market Key Technology Landscape

The Digital Payments Market is defined by a dynamic and continuously evolving technology landscape, leveraging cutting-edge innovations to enhance security, speed, and user experience. Core to this landscape are mobile wallets, which integrate various payment methods, loyalty programs, and financial services into a single smartphone application. Near Field Communication (NFC) technology enables contactless payments through taps, offering unparalleled convenience in physical retail environments. QR codes have also emerged as a versatile and cost-effective solution for both proximity and remote payments, particularly prevalent in markets with high mobile penetration. These technologies collectively drive the shift away from physical cards and cash, creating a seamless and interconnected payment ecosystem that responds to the demands of a digitally native consumer base and efficient business operations.

Further strengthening the market's technological backbone are advanced security protocols and emerging innovations. Tokenization, for instance, replaces sensitive card data with a unique, encrypted token during transactions, significantly reducing the risk of data breaches. Biometric authentication, including fingerprint, facial, and iris recognition, provides a highly secure and convenient method for verifying user identity, moving beyond traditional passwords and PINs. The advent of blockchain technology holds immense potential, particularly for cross-border payments, by offering enhanced transparency, immutability, and efficiency, bypassing traditional intermediaries and reducing transaction costs. Cloud computing platforms underpin the scalability and flexibility of digital payment infrastructure, allowing providers to rapidly deploy services, manage vast amounts of data, and offer reliable, always-on payment processing capabilities.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly transforming the operational aspects of digital payments. AI algorithms are crucial for real-time fraud detection, capable of analyzing massive transaction datasets to identify suspicious patterns and prevent illicit activities with high accuracy. ML also powers personalized financial recommendations, optimizing user experiences by suggesting relevant offers, budgeting tools, and payment methods based on individual spending habits. Beyond these, APIs (Application Programming Interfaces) are foundational for open banking initiatives, enabling seamless integration between financial institutions and third-party developers, fostering innovation and creating a more interconnected financial ecosystem. The synergy of these technologies continues to drive the evolution of digital payments, making them more intelligent, secure, and integrated into daily life, while paving the way for future advancements like IoT-enabled payments and virtual reality commerce.

Regional Highlights

- North America: This region is a mature market characterized by high consumer awareness and adoption of digital payment technologies. It boasts significant innovation in fintech, mobile wallets, and contactless payments, driven by a robust economy and strong investment in financial technology infrastructure. The United States and Canada lead in terms of transaction value and the proliferation of payment processing solutions.

- Europe: The European market is highly influenced by regulatory initiatives such as PSD2 (Revised Payment Services Directive), which has fostered open banking and fierce competition among payment service providers. Countries like the UK, Germany, and the Nordic nations are at the forefront of digital payment adoption, with a strong emphasis on real-time payments and advanced security features.

- Asia Pacific (APAC): APAC is the fastest-growing and largest market for digital payments globally, propelled by a massive mobile-first population, rapid urbanization, and increasing internet penetration. China and India are powerhouses in this region, with ubiquitous mobile payment ecosystems like Alipay and WeChat Pay dominating daily transactions. Southeast Asian countries are also experiencing explosive growth, driven by financial inclusion initiatives and a young, digitally-native population.

- Latin America: This region presents significant growth potential, characterized by increasing smartphone penetration and a large underbanked population. Governments and fintech companies are actively working to accelerate financial inclusion through mobile payment solutions and digital wallets, aiming to reduce reliance on cash and formalize the economy. Brazil and Mexico are key markets driving regional expansion.

- Middle East and Africa (MEA): The MEA market is witnessing substantial investments in digital infrastructure and fintech startups, particularly in the GCC countries (Saudi Arabia, UAE) and parts of Africa. Driven by government visions for cashless societies and a young, dynamic population, mobile money and digital banking services are rapidly expanding, offering convenient and secure alternatives to traditional banking.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Payments Market.- Visa

- Mastercard

- PayPal

- Stripe

- Square (Block Inc.)

- Fiserv

- Adyen

- Worldpay (FIS)

- Apple Pay

- Google Pay

- Alipay (Ant Group)

- WeChat Pay (Tencent)

- Amazon Pay

- Payoneer

- Global Payments

- Checkout.com

- WEX Inc.

- Samsung Pay

- ACI Worldwide

- Ingenico (Worldline)

Frequently Asked Questions

What is the projected growth rate of the Digital Payments Market?

The Digital Payments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. This robust growth is primarily driven by increasing smartphone adoption, the expansion of e-commerce, and various government initiatives aimed at promoting cashless economies worldwide. The market's significant expansion reflects a global shift in consumer and business preferences towards more convenient, secure, and efficient transaction methods. Continued technological advancements and heightened demand for seamless financial experiences are expected to sustain this accelerated growth trajectory throughout the forecast period.

How does AI impact the security of digital payments?

AI significantly enhances the security of digital payments by providing advanced capabilities in real-time fraud detection and prevention. AI algorithms analyze vast datasets of transaction patterns, user behavior, and network activity to identify anomalies and suspicious transactions that traditional rule-based systems might miss. This proactive approach helps in detecting sophisticated fraud schemes more effectively, minimizing financial losses for both consumers and businesses. Furthermore, AI contributes to adaptive security measures, continuously learning from new threats and evolving attack vectors to strengthen defense mechanisms, making digital payment platforms more resilient against cyber threats and unauthorized access.

What are the primary drivers of the Digital Payments Market?

The Digital Payments Market is primarily driven by several key factors. Firstly, the global proliferation of smartphones and widespread internet connectivity has made digital payment solutions accessible to a vast population. Secondly, the explosive growth of e-commerce, coupled with the increasing preference for online shopping, necessitates secure and convenient digital transaction methods. Thirdly, government initiatives and regulatory frameworks promoting cashless economies play a significant role by incentivizing digital adoption and fostering a supportive environment. Lastly, the inherent benefits of digital payments, such as speed, convenience, and enhanced transparency, continuously attract both individual consumers and businesses, accelerating the shift away from traditional cash transactions.

Which regions are leading the adoption of digital payments?

Asia Pacific (APAC) stands out as the leading region in terms of digital payment adoption and innovation, largely due to its immense mobile-first population, rapid urbanization, and proactive digital transformation strategies in countries like China and India. North America and Europe also demonstrate high adoption rates, driven by robust fintech ecosystems, advanced infrastructure, and regulatory support for secure and efficient payment systems. These regions are characterized by mature markets, continuous technological advancements, and a strong consumer preference for contactless and mobile payment solutions. Emerging markets in Latin America and MEA are experiencing rapid growth as well, fueled by increasing smartphone penetration and efforts to enhance financial inclusion.

What are the main challenges facing the Digital Payments Market?

The Digital Payments Market faces several key challenges that impact its widespread adoption and growth. Chief among these is cybersecurity and fraud risk; consumers and businesses harbor concerns about data breaches and financial fraud, necessitating continuous investment in advanced security technologies. Another significant challenge is the complex and fragmented regulatory landscape across different countries and regions, which can create compliance hurdles for international payment providers. Furthermore, the digital divide, particularly in developing economies, where limited internet access and digital literacy persist, hinders universal adoption. High implementation costs for merchants and the potential for technological obsolescence also present ongoing challenges within this rapidly evolving market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager