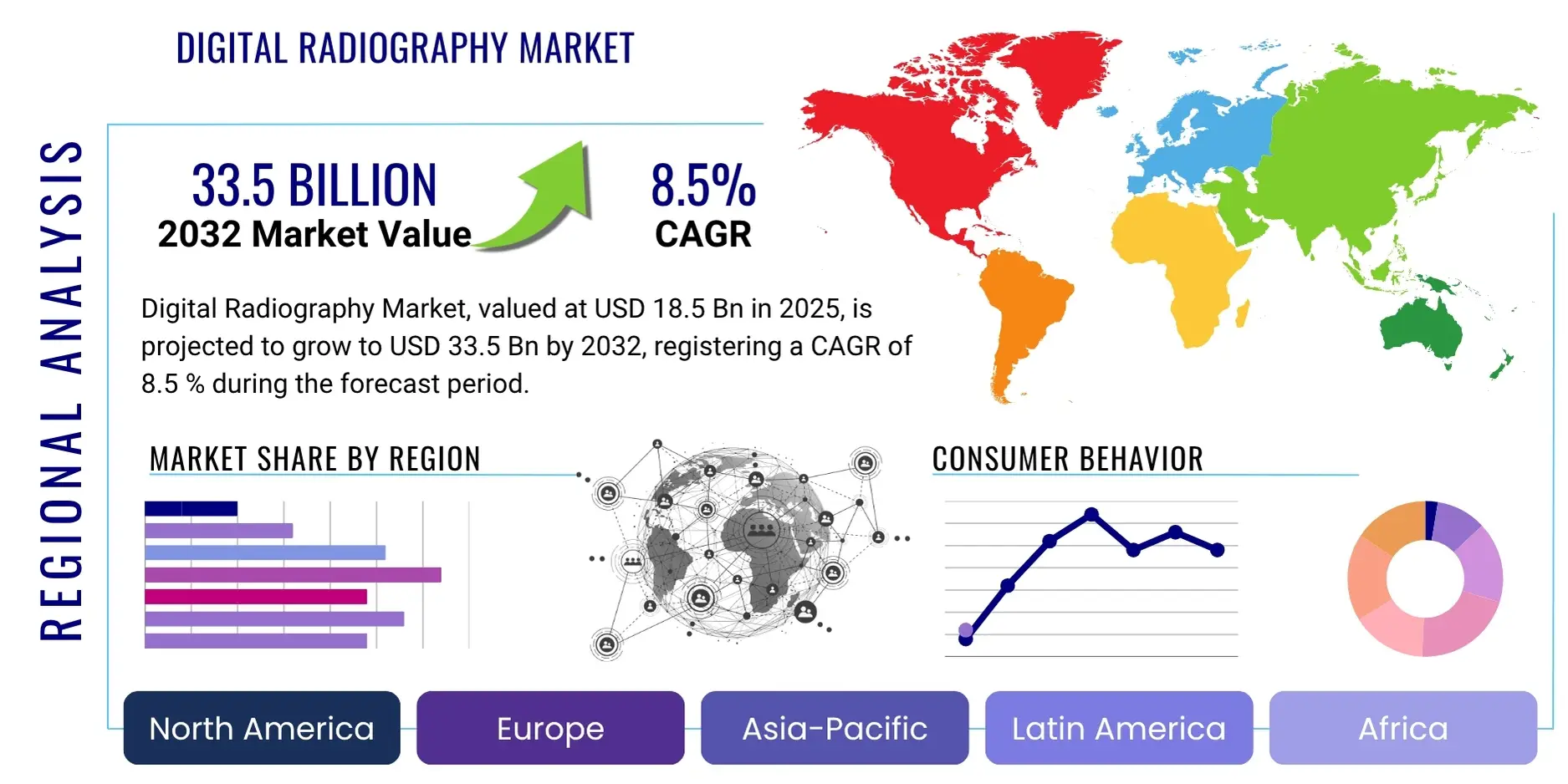

Digital Radiography Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428199 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Digital Radiography Market Size

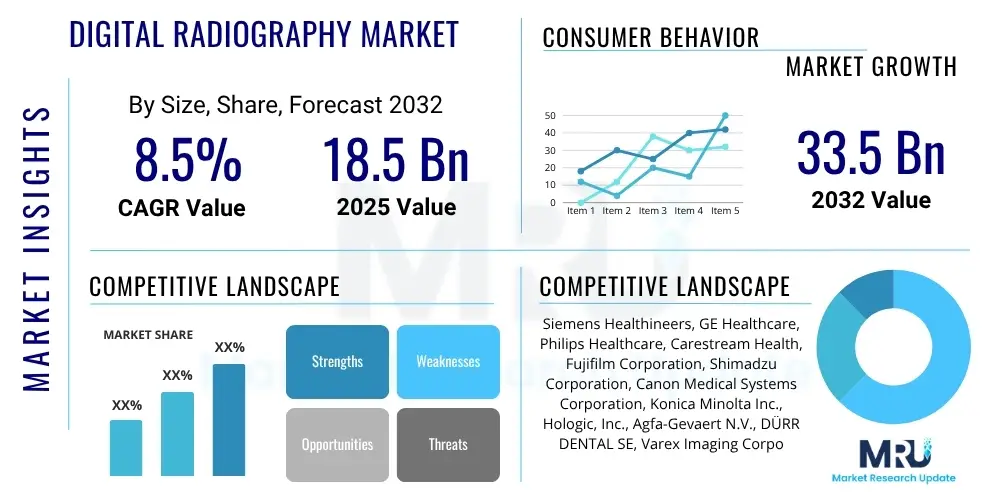

The Digital Radiography Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 18.5 Billion in 2025 and is projected to reach USD 33.5 Billion by the end of the forecast period in 2032.

Digital Radiography Market introduction

The Digital Radiography (DR) market encompasses a sophisticated array of imaging technologies that have revolutionized medical diagnostics by replacing traditional film-based radiography with digital sensors. These systems capture X-ray images and convert them directly into digital data, offering immediate image viewing, enhanced processing capabilities, and streamlined workflow in various healthcare settings. The primary product segments include Flat Panel Detectors (FPDs), which can be further categorized by detector material like Cesium Iodide (CsI) and Gadolinium Oxysulfide (GOS), along with Charge-Coupled Devices (CCDs) and Complementary Metal-Oxide-Semiconductor (CMOS) sensors. These technologies collectively contribute to superior image quality, reduced radiation exposure, and improved diagnostic accuracy across a multitude of applications.

Major applications of digital radiography span a wide spectrum of medical fields, including general radiography for bone and chest imaging, mammography for breast cancer screening, dental imaging for oral health assessment, and fluoroscopy for real-time visualization of internal structures. Beyond clinical diagnostics, DR systems also find utility in veterinary medicine for animal imaging and increasingly in industrial applications for non-destructive testing and security screening. The universal benefit across these applications includes rapid image acquisition, elimination of chemical processing, ease of image storage and retrieval, and seamless integration with Picture Archiving and Communication Systems (PACS) and Hospital Information Systems (HIS), thereby significantly improving patient care and operational efficiency.

Several pivotal factors are driving the robust expansion of the digital radiography market. A significant driver is the increasing global prevalence of chronic diseases such as cardiovascular conditions, respiratory ailments, and orthopedic issues, all of which necessitate frequent and accurate diagnostic imaging. The rapidly aging global population is another crucial factor, as older demographics are more prone to various health conditions requiring advanced medical imaging. Furthermore, continuous technological advancements, including improvements in detector sensitivity, image processing algorithms, and the development of portable and wireless DR systems, are enhancing the utility and accessibility of these technologies. Government initiatives and funding programs aimed at modernizing healthcare infrastructure and promoting early disease detection also play a vital role in propelling market growth.

Digital Radiography Market Executive Summary

The Digital Radiography Market is experiencing dynamic growth, propelled by a confluence of evolving business trends. Healthcare providers globally are increasingly adopting digital imaging solutions to enhance diagnostic efficiency, reduce operational costs associated with film processing, and improve patient throughput. This transition is further fueled by the demand for higher image quality and lower radiation doses, which digital systems inherently offer. Strategic partnerships between technology providers and healthcare institutions are becoming more common, fostering innovation and facilitating the integration of advanced DR solutions into existing infrastructures. Furthermore, a growing emphasis on value-based care models is encouraging the adoption of technologies that can deliver superior diagnostic outcomes and improve overall patient management, positioning digital radiography as a critical investment.

Regional trends reveal varied adoption rates and market dynamics. North America and Europe currently represent the largest market shares, driven by well-established healthcare infrastructures, high healthcare expenditure, and early adoption of advanced medical technologies. These regions are also witnessing significant investments in research and development, leading to continuous product innovation. The Asia Pacific region is emerging as the fastest-growing market, primarily due to expanding healthcare infrastructure, rising awareness about early disease diagnosis, increasing disposable incomes, and supportive government policies aimed at improving public health. Countries like China, India, and Japan are at the forefront of this growth, driven by a large patient pool and a rapid shift from analog to digital systems. Latin America, the Middle East, and Africa are also showing promising growth, albeit from a smaller base, as healthcare access and investment improve.

Segmentation trends highlight the dominance of Flat Panel Detectors (FPDs) within the market, attributed to their superior image quality and faster acquisition times. Within FPDs, both Cesium Iodide and Gadolinium Oxysulfide technologies are widely adopted, each offering distinct advantages depending on the specific application requirements. Portable DR systems are gaining significant traction, driven by the increasing need for bedside imaging in critical care units, emergency departments, and remote diagnostic services. Hospitals and diagnostic centers remain the largest end-users, but specialty clinics and ambulatory surgical centers are rapidly increasing their adoption of DR technology due to its efficiency and diagnostic capabilities. The integration of artificial intelligence and machine learning is poised to further enhance these segments by offering advanced image analysis and workflow automation.

AI Impact Analysis on Digital Radiography Market

The integration of Artificial Intelligence (AI) into the Digital Radiography market is fundamentally transforming diagnostic imaging, addressing user expectations for enhanced accuracy, efficiency, and patient outcomes. Users frequently inquire about AI's potential to improve image interpretation, reduce diagnostic errors, and accelerate workflow in busy clinical environments. There is significant interest in how AI algorithms can assist in the early detection of subtle abnormalities, especially in complex cases, and how these systems can help prioritize critical findings for radiologists. Concerns often revolve around the reliability and validation of AI models, the potential for algorithmic bias, data privacy, and the impact on the radiologist's role. Expectations are high for AI to reduce repetitive tasks, allowing medical professionals to focus more on complex diagnoses and patient interaction, ultimately leading to more personalized and effective treatment plans.

AI's influence extends beyond mere image analysis; it is reshaping the entire diagnostic pathway. Users are keen to understand how AI can optimize imaging protocols, thereby minimizing radiation dosage without compromising image quality. There's also a strong demand for AI-powered solutions that can integrate seamlessly with existing PACS and RIS systems to provide real-time clinical decision support. The concept of AI as a 'second reader' or an 'intelligent assistant' is widely explored, aiming to reduce inter-observer variability and ensure consistent diagnostic quality across different practitioners and institutions. Furthermore, the role of AI in training and education for future radiologists is a recurring theme, with a focus on how these technologies can equip new professionals with advanced analytical tools.

The strategic deployment of AI in digital radiography is expected to unlock new capabilities, fostering a more precise and proactive approach to patient care. While the benefits in terms of speed and accuracy are clear, the industry is also grappling with the ethical implications of AI, particularly regarding accountability for diagnostic errors and maintaining human oversight. Addressing these challenges through robust validation, transparent algorithm design, and clear regulatory frameworks is crucial for widespread adoption. Ultimately, AI is viewed as a powerful tool to augment human expertise, allowing healthcare systems to manage an ever-increasing volume of imaging data more effectively and deliver higher quality, patient-centered care.

- Enhanced Diagnostic Accuracy: AI algorithms improve the detection of subtle anomalies, reducing false positives and negatives.

- Optimized Workflow Efficiency: Automation of routine tasks like image sorting, protocol optimization, and report generation expedites diagnostic processes.

- Reduced Radiation Dose: AI-powered image reconstruction and denoising techniques allow for diagnostic quality images with lower X-ray exposure.

- Early Disease Detection: AI can identify early indicators of diseases like cancer, cardiovascular issues, and bone pathologies, facilitating timely intervention.

- Personalized Medicine: Advanced AI analytics can correlate imaging findings with patient data for more tailored treatment strategies.

- Predictive Analytics: AI models can forecast disease progression or treatment response based on imaging biomarkers.

- Improved Image Quality: AI-based post-processing enhances image clarity, contrast, and resolution, aiding better visualization.

- Operational Cost Reduction: Automation and efficiency gains lead to lower operational costs for healthcare facilities.

- Data Management and Integration: AI facilitates better organization, retrieval, and integration of large imaging datasets with electronic health records.

- Decision Support Systems: AI provides clinical decision support to radiologists, offering evidence-based insights and flagging critical findings.

DRO & Impact Forces Of Digital Radiography Market

The Digital Radiography (DR) market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute its Impact Forces. Among the primary drivers is the escalating global prevalence of chronic and lifestyle-related diseases, such as osteoporosis, various cancers, and cardiovascular disorders, all of which necessitate frequent and precise diagnostic imaging. This is compounded by the demographic shift towards an aging global population, which inherently requires more medical interventions and diagnostic procedures. Technological advancements in DR systems, including improvements in detector technology, image processing software, and the development of portable and wireless solutions, significantly enhance diagnostic capabilities and operational efficiency, further fueling market expansion. Moreover, government initiatives in various countries aimed at modernizing healthcare infrastructure and promoting early disease detection through advanced imaging techniques provide substantial impetus for market growth.

Despite the strong growth drivers, the DR market also faces several significant restraints. The high initial capital investment required for acquiring and implementing advanced digital radiography systems remains a major barrier, particularly for smaller hospitals and diagnostic centers in developing regions with limited budgets. Additionally, the complexities and challenges associated with integrating new DR systems into existing healthcare IT infrastructures, such as Picture Archiving and Communication Systems (PACS) and Radiology Information Systems (RIS), can deter potential adopters. Stringent regulatory frameworks and prolonged approval processes for new medical devices also pose challenges for manufacturers, potentially delaying market entry for innovative products. Furthermore, persistent concerns regarding radiation exposure, even though digital systems generally reduce it, can lead to public apprehension and necessitate continuous education and awareness campaigns.

Opportunities within the digital radiography market are abundant and promising. The burgeoning growth in emerging economies, particularly in Asia Pacific, Latin America, and the Middle East, presents vast untapped potential due to improving healthcare spending, increasing health awareness, and the rapid expansion of healthcare infrastructure. The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) into DR systems offers a significant opportunity for advancements in image analysis, diagnostic accuracy, and workflow automation, leading to more precise and efficient patient care. Furthermore, the development of highly portable and compact DR systems is opening new avenues for point-of-care diagnostics, emergency medicine, and remote healthcare services, enhancing accessibility. The rising demand for teleradiology and remote diagnostic capabilities, especially post-pandemic, also presents a substantial growth opportunity, allowing expert interpretations across geographical boundaries.

Segmentation Analysis

The Digital Radiography Market is comprehensively segmented based on various critical parameters including type, portability, application, and end-user, providing a granular view of market dynamics and growth potential across different sectors. This detailed segmentation allows for a deeper understanding of specific market niches, technological preferences, and demand patterns, enabling stakeholders to formulate targeted strategies. The evolution of digital radiography technology continues to influence these segments, with continuous innovation in detector technology and imaging software driving market shifts. Each segment reflects unique operational requirements, patient demographics, and clinical workflows, underscoring the versatility and adaptability of digital radiography solutions across the healthcare continuum.

Analysis of these segments reveals distinct growth trajectories and competitive landscapes. For instance, the Flat Panel Detector (FPD) segment consistently dominates the market due to its superior image quality and efficiency, with continued advancements in detector materials and pixel pitch. The increasing need for flexible and mobile imaging solutions is propelling the portable DR segment, particularly for critical care and emergency situations. Within applications, general radiography remains the largest segment, but specialized areas like mammography and dental imaging are experiencing robust growth fueled by screening programs and increasing awareness. End-user segmentation highlights the significant purchasing power of hospitals and diagnostic centers, while the emergence of specialty clinics and ambulatory surgical centers as key adopters underscores a decentralized shift in healthcare delivery.

Understanding these segmentations is paramount for market players to identify high-growth areas, allocate resources effectively, and develop products and services that cater to specific market needs. The intricate interdependencies between technology, application, and end-user segments mean that innovation in one area often creates ripple effects across others. For example, advancements in AI for image analysis might enhance diagnostic capabilities across all applications and end-users. The continuous evolution of healthcare policies, reimbursement structures, and patient demands further necessitate a dynamic approach to analyzing and adapting to these segmented market trends, ensuring sustained competitiveness and market relevance for digital radiography solutions providers.

- By Type:

- Flat Panel Detectors (FPDs)

- Cesium Iodide (CsI)

- Gadolinium Oxysulfide (GOS)

- Charge-Coupled Devices (CCDs)

- Complementary Metal-Oxide-Semiconductor (CMOS)

- Flat Panel Detectors (FPDs)

- By Portability:

- Portable Digital Radiography Systems

- Fixed Digital Radiography Systems

- By Application:

- General Radiography

- Mammography

- Dental Imaging

- Fluoroscopy

- Veterinary

- Security and Industrial Imaging

- Other Applications

- By End-User:

- Hospitals

- Diagnostic Centers

- Specialty Clinics

- Ambulatory Surgical Centers (ASCs)

- Research & Academic Institutions

Value Chain Analysis For Digital Radiography Market

The value chain for the Digital Radiography (DR) market is a complex ecosystem encompassing raw material suppliers, component manufacturers, system integrators, distribution channels, and end-users, with each stage adding significant value to the final product. Upstream activities begin with the sourcing of critical raw materials such as scintillators (like Cesium Iodide and Gadolinium Oxysulfide), silicon wafers for semiconductors, and various metals and plastics. This stage also involves the specialized manufacturing of crucial components like X-ray tubes, high-voltage generators, flat panel detectors, and image processing software. Key players in this upstream segment often specialize in highly technical areas, ensuring the quality and precision of the core technologies that define DR systems. Their ability to innovate and provide reliable, high-performance components directly impacts the overall quality and cost-effectiveness of the final DR solution.

Midstream activities involve the assembly and integration of these components into complete digital radiography systems. This phase typically includes system design, software development for image acquisition and processing, hardware integration, and rigorous testing to ensure performance, safety, and regulatory compliance. System integrators and original equipment manufacturers (OEMs) play a crucial role here, bringing together diverse components from various suppliers to create functional and marketable DR products. This stage requires significant engineering expertise, quality control, and a deep understanding of clinical requirements to produce systems that meet the demanding standards of medical diagnostics. Efficient manufacturing processes and supply chain management are paramount to control costs and optimize production cycles.

Downstream activities focus on bringing the finished DR systems to end-users through various distribution channels, followed by installation, training, and after-sales support. Distribution typically occurs through a combination of direct sales forces, authorized distributors, and third-party resellers, each targeting specific geographical regions or customer segments. Direct channels often serve large hospital networks and government institutions, providing personalized sales and support. Indirect channels, including independent dealers and value-added resellers, are crucial for reaching smaller clinics and expanding market penetration. Post-sales services, including maintenance, software updates, and technical support, are vital for ensuring system longevity and customer satisfaction. The effectiveness of these downstream activities directly influences market reach, customer loyalty, and the overall profitability of DR system providers.

Digital Radiography Market Potential Customers

The primary potential customers for Digital Radiography (DR) products are diverse entities within the healthcare sector that rely heavily on advanced diagnostic imaging for patient care and medical research. Hospitals, ranging from large university medical centers to smaller community hospitals, represent the largest and most significant segment of end-users. These institutions require a full spectrum of DR systems for various departments, including radiology, emergency medicine, orthopedics, and intensive care units, to manage a high volume of diverse patient needs. Their purchasing decisions are often driven by the need for high throughput, seamless integration with existing IT infrastructure, superior image quality, and robust after-sales support. As healthcare hubs, hospitals continuously invest in upgrading their imaging capabilities to meet evolving clinical demands and improve diagnostic accuracy.

Diagnostic imaging centers and standalone radiology clinics constitute another substantial customer segment. These facilities specialize in providing a wide range of imaging services and often seek DR systems that offer high efficiency, cost-effectiveness, and the ability to handle a high patient turnover while maintaining exceptional image quality. For these centers, factors such as rapid image acquisition, compact design for space optimization, and advanced networking capabilities for teleradiology services are critical considerations. The growing trend of outpatient care and the need for specialized imaging services outside of traditional hospital settings are driving increased adoption of DR systems in these dedicated diagnostic environments, allowing for focused and efficient service delivery.

Beyond hospitals and diagnostic centers, specialty clinics, such as orthopedic clinics, pulmonology centers, and oncology clinics, are increasingly adopting DR technology for specialized diagnostic needs relevant to their respective fields. Ambulatory Surgical Centers (ASCs) also represent a growing customer base, utilizing DR for pre-operative assessments and intra-operative imaging. Furthermore, the veterinary sector is a significant, albeit niche, customer, requiring DR systems for animal diagnostics, particularly in large animal hospitals and specialized veterinary practices. Academic and research institutions also purchase DR systems for medical education, clinical trials, and developing new imaging techniques, contributing to the advancement of the field. This broad customer base underscores the pervasive utility and critical role of digital radiography across the modern healthcare landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 18.5 Billion |

| Market Forecast in 2032 | USD 33.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Healthineers, GE Healthcare, Philips Healthcare, Carestream Health, Fujifilm Corporation, Shimadzu Corporation, Canon Medical Systems Corporation, Konica Minolta Inc., Hologic, Inc., Agfa-Gevaert N.V., DÜRR DENTAL SE, Varex Imaging Corporation, Samsung Medison, Stephanix, Swissray, Trivitron Healthcare, Medy-Ting, Planmeca Oy, Control-X Medical, DRGEM Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Radiography Market Key Technology Landscape

The Digital Radiography market is defined by a rapidly evolving technological landscape, driven by continuous innovation aimed at enhancing image quality, reducing radiation dose, improving workflow efficiency, and expanding diagnostic capabilities. At the core of this landscape are various detector technologies, primarily Flat Panel Detectors (FPDs), which are categorized into direct and indirect conversion types. Indirect FPDs, utilizing a scintillator layer (such as Cesium Iodide or Gadolinium Oxysulfide) to convert X-rays into visible light before converting light into an electrical signal, are widely prevalent due to their excellent image quality and efficiency. Direct FPDs, employing amorphous selenium, directly convert X-rays into an electrical charge, offering high spatial resolution, particularly valued in applications like mammography. Alongside FPDs, Charge-Coupled Devices (CCDs) and Complementary Metal-Oxide-Semiconductor (CMOS) sensors also play a role, particularly in dental and specialized imaging due to their compact size and cost-effectiveness.

Beyond detector technology, advancements in image processing software are crucial to the digital radiography ecosystem. Sophisticated algorithms are continually being developed to enhance image contrast, reduce noise, and correct for artifacts, thereby improving diagnostic accuracy and clarity. The integration of advanced computational photography techniques allows for optimal visualization of both soft tissues and bone structures in a single exposure. Furthermore, the development of dose-reduction technologies is a paramount concern, leading to innovations such as iterative reconstruction algorithms and advanced exposure control systems that minimize patient radiation exposure without compromising image quality. Wireless and portable DR systems, enabled by advancements in battery technology, wireless data transmission (e.g., Wi-Fi, Bluetooth), and lightweight materials, are significantly expanding the utility and accessibility of digital radiography, allowing for imaging in various clinical settings beyond traditional radiology departments, including emergency rooms, operating theaters, and remote locations.

The most transformative technological trend currently impacting the digital radiography market is the increasing integration of Artificial Intelligence (AI) and Machine Learning (ML). AI algorithms are being deployed for a multitude of tasks, from automated image analysis for detecting subtle pathologies (e.g., lung nodules, fractures, breast lesions) to optimizing image acquisition parameters and streamlining workflow. AI-powered tools can prioritize critical cases, reduce measurement variability, and provide decision support to radiologists, enhancing efficiency and accuracy. Furthermore, advanced networking capabilities and cloud computing are facilitating the seamless storage, retrieval, and sharing of large imaging datasets, supporting teleradiology services and enabling collaborative diagnostics. The convergence of these technological advancements is making digital radiography systems more intelligent, efficient, and versatile, continually pushing the boundaries of medical imaging and patient care.

Regional Highlights

- North America: This region holds a dominant share in the digital radiography market, driven by its advanced healthcare infrastructure, high healthcare expenditure, significant research and development investments, and early adoption of innovative medical technologies. The presence of key market players and a high prevalence of chronic diseases also contribute to its leading position.

- Europe: Europe represents another substantial market, characterized by stringent regulatory standards, a well-established healthcare system, and a strong focus on improving diagnostic accuracy and patient safety. Countries like Germany, the UK, and France are major contributors, propelled by technological advancements and government support for healthcare modernization.

- Asia Pacific (APAC): APAC is poised for the highest growth rate, fueled by rapidly expanding healthcare infrastructure, increasing healthcare spending, growing awareness about early disease detection, and a large patient pool. Economic development in countries like China, India, and Japan is accelerating the shift from analog to digital imaging systems.

- Latin America: This region is experiencing steady growth, driven by improving access to healthcare, increasing investments in medical facilities, and rising demand for advanced diagnostic services. Economic stability and governmental initiatives aimed at upgrading healthcare systems are key factors for market expansion.

- Middle East and Africa (MEA): The MEA region is witnessing emerging growth, largely attributed to increasing healthcare investments, a growing medical tourism sector, and efforts to modernize healthcare facilities, particularly in countries like Saudi Arabia and UAE. However, disparities in healthcare access and economic development remain challenges.

- United States: As the largest single country market within North America, the U.S. demonstrates high demand for cutting-edge DR systems due to its robust reimbursement policies, prevalence of sophisticated diagnostic centers, and continuous technological innovation in medical imaging.

- China: A critical market within APAC, China's digital radiography sector is experiencing exponential growth, spurred by a vast population, significant government investment in healthcare infrastructure, and rapid technological adoption. The focus on local manufacturing and innovation is also a key driver.

- Germany: A leader in Europe, Germany's market benefits from a strong economy, high healthcare spending, a focus on precision medicine, and the presence of major medical technology manufacturers and research institutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Radiography Market.- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Carestream Health

- Fujifilm Corporation

- Shimadzu Corporation

- Canon Medical Systems Corporation

- Konica Minolta Inc.

- Hologic, Inc.

- Agfa-Gevaert N.V.

- DÜRR DENTAL SE

- Varex Imaging Corporation

- Samsung Medison

- Stephanix

- Swissray

- Trivitron Healthcare

- Medy-Ting

- Planmeca Oy

- Control-X Medical

- DRGEM Corporation

Frequently Asked Questions

What is digital radiography and how does it differ from traditional X-ray?

Digital radiography (DR) is an advanced form of X-ray imaging where digital sensors are used instead of traditional photographic film to capture X-ray images. The key differences include immediate image availability for review, superior image quality with enhanced processing capabilities, reduced radiation exposure for patients, and easier storage and sharing of images through digital networks, eliminating the need for chemical processing.

What are the primary drivers for the growth of the Digital Radiography Market?

The market's growth is primarily driven by the increasing prevalence of chronic diseases and an aging global population necessitating frequent diagnostic imaging. Additionally, continuous technological advancements in DR systems, the demand for early and accurate disease diagnosis, and supportive government initiatives for modernizing healthcare infrastructure are significant growth factors.

How is Artificial Intelligence impacting the Digital Radiography Market?

AI is profoundly impacting DR by enhancing diagnostic accuracy through automated image analysis, improving workflow efficiency by streamlining tasks, and enabling earlier detection of subtle abnormalities. AI also aids in optimizing imaging protocols to reduce radiation dose and provides clinical decision support, ultimately leading to more precise and personalized patient care.

What are the main types of digital radiography detectors?

The main types of digital radiography detectors include Flat Panel Detectors (FPDs), which are further divided into Cesium Iodide (CsI) and Gadolinium Oxysulfide (GOS) technologies, and Charge-Coupled Devices (CCDs). FPDs are dominant due to their high image quality and efficiency, while CCDs are often used in specific applications like dental imaging.

Which regions are leading the adoption of digital radiography technology?

North America and Europe currently lead in the adoption of digital radiography technology due to their well-established healthcare infrastructures, high healthcare spending, and early embrace of advanced medical innovations. However, the Asia Pacific region is rapidly emerging as the fastest-growing market, driven by expanding healthcare infrastructure and increasing awareness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Mobile Digital Radiography (DR) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Non-Destructive Testing Market Size Report By Type (Traditional NDT Method, Visual Testing, Magnetic Particle Testing, Liquid Penetrant Testing, Eddy Current Testing, Ultrasonic Testing, Radiographic Testing, Digital/Advanced NDT Method, Digital Radiography (DR), Phased Array Ultrasonic Testing (PAUT ), Pulsed Eddy Current (PEC), Time-Of-Flight Diffraction (TOFD), Alternating Current Field Measurement (ACFM), Automated Ultrasonic Testing (AUT)), By Application (Services, Equipment, Oil & Gas, Manufacturing, Aerospace and Defense, Construction, Automotive, Power Generation, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- X-ray Inspection Systems Market Size Report By Type (Digital Radiography (DR), Computed Tomography (CT)), By Application (General Industry, Automotive Industry, Packaging, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Digital Radiography Market Size Report By Type (CR Tech Digital X-Ray System, DR Tech Digital X-Ray System), By Application (Dental, Orthopedics, General Surgery, Veterinarian, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- X-ray Inspection Machines Market Statistics 2025 Analysis By Application (General industry, Automotive industry, Packaging), By Type (Digital Radiography (DR), Computed Tomography (CT)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager