Direct-to-chip Liquid Cooling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429236 | Date : Oct, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Direct-to-chip Liquid Cooling Market Size

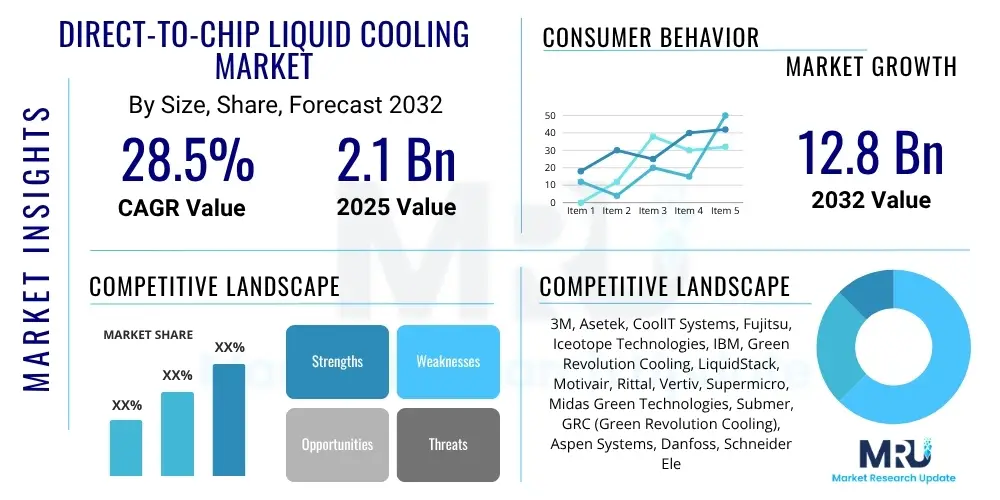

The Direct-to-chip Liquid Cooling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2025 and 2032. The market is estimated at USD 2.1 billion in 2025 and is projected to reach USD 12.8 billion by the end of the forecast period in 2032.

Direct-to-chip Liquid Cooling Market introduction

Direct-to-chip liquid cooling involves the precise application of a liquid coolant directly to the surface of high-heat-generating components, such as CPUs, GPUs, and ASICs, within a server or computing system. This advanced thermal management solution is designed to efficiently remove significant amounts of heat, often exceeding the capabilities of traditional air cooling methods. The primary objective is to maintain optimal operating temperatures for these critical components, thereby enhancing performance, ensuring reliability, and extending hardware lifespan, particularly in environments with high computing demands.

Major applications for direct-to-chip liquid cooling span across various sectors, including hyperscale data centers, high-performance computing (HPC) facilities, artificial intelligence (AI) and machine learning (ML) infrastructures, enterprise data centers, and emerging edge computing deployments. The benefits of adopting this technology are substantial, encompassing superior thermal efficiency, reduced power consumption for cooling, decreased physical footprint due to higher rack densities, lower noise levels, and improved overall system stability. These advantages are crucial in an era where processor power densities are continuously escalating, pushing the limits of conventional air cooling. The market is primarily driven by the exponential growth in data processing requirements, particularly from AI and HPC workloads, coupled with an increasing global emphasis on energy efficiency and sustainable data center operations.

This cooling method typically utilizes cold plates mounted directly onto the chips, through which a dielectric fluid or treated water circulates to absorb heat. This heated fluid is then routed to a heat exchanger, often a Cooling Distribution Unit (CDU), where it transfers its heat to a secondary loop, which might be a facility water loop or an outdoor dry cooler, before returning to the chips. This closed-loop system ensures efficient heat dissipation while preventing contamination and minimizing fluid loss. The continuous innovation in cold plate design, fluid dynamics, and intelligent control systems is further solidifying direct-to-chip liquid cooling as an indispensable technology for the next generation of computing infrastructure.

Direct-to-chip Liquid Cooling Market Executive Summary

The Direct-to-chip Liquid Cooling Market is experiencing robust growth, primarily propelled by the escalating demand for high-performance computing (HPC), artificial intelligence (AI), and hyperscale data centers. Business trends indicate a significant shift among major technology providers and data center operators towards adopting liquid cooling solutions to manage the increasing thermal design power (TDP) of advanced processors. This adoption is driven by the need for enhanced energy efficiency, higher rack densities, and improved computing performance. Strategic partnerships between chip manufacturers, server vendors, and liquid cooling solution providers are becoming more prevalent, aiming to offer integrated and optimized thermal management systems. Furthermore, the modularity and scalability of newer liquid cooling systems are attracting diverse end-users, from large enterprises to smaller edge computing installations.

Regionally, North America continues to lead the market, fueled by the presence of numerous hyperscale data centers, a strong focus on technological innovation, and significant investments in AI and HPC infrastructure. Europe is also a key growth region, with stringent energy efficiency regulations and a commitment to sustainable data center practices driving the adoption of advanced cooling technologies. The Asia Pacific (APAC) region is projected to witness the fastest growth, primarily due to rapid data center expansion, increasing digitalization initiatives, and rising investments in cloud services and AI capabilities across countries like China, India, and Japan. Latin America, the Middle East, and Africa are emerging markets, showing gradual adoption as their digital infrastructure matures and awareness of energy-efficient solutions increases.

Segmentation trends highlight the dominance of the data center segment, encompassing both hyperscale and enterprise facilities, as the primary end-user for direct-to-chip liquid cooling. Within components, cold plates and cooling distribution units (CDUs) are critical segments experiencing significant technological advancements. Two-phase direct-to-chip cooling, while currently a smaller segment, is gaining traction due to its superior thermal transfer capabilities and potential for greater energy efficiency, indicating a future growth area. The increasing demand for specialized fluids, such as dielectric coolants, for immersion and hybrid systems further underscores the evolving needs within the market. This diversified demand across various segments points to a dynamic and expanding market landscape.

AI Impact Analysis on Direct-to-chip Liquid Cooling Market

The burgeoning demands of Artificial Intelligence (AI) workloads have irrevocably transformed the thermal management landscape, making direct-to-chip liquid cooling not merely an option, but a necessity. Users frequently inquire about how AI's insatiable hunger for computational power impacts data center heat generation, the limitations of traditional air cooling for AI servers, and the specific ways in which liquid cooling facilitates the deployment and performance of AI. The core themes revolve around AI's unique thermal challenges, the enabling role of liquid cooling in scaling AI infrastructure, and the subsequent implications for energy efficiency and operational costs. Users are concerned about the ability to run dense AI models without throttling, the longevity of expensive AI hardware, and the environmental footprint of AI, all of which direct-to-chip liquid cooling directly addresses.

The computational intensity of modern AI, particularly deep learning and machine learning, requires highly dense server configurations packed with powerful CPUs, GPUs, and specialized AI accelerators. These components generate unprecedented levels of heat flux, often exceeding 700W per chip, pushing far beyond the practical limits of air-cooling methods. Air cooling struggles to efficiently dissipate such concentrated heat, leading to performance degradation, increased component failure rates, and higher energy consumption due to powerful fans. Consequently, data center operators and AI researchers are actively seeking more effective cooling solutions that can keep these high-TDP (Thermal Design Power) chips within their optimal temperature ranges without sacrificing performance or increasing overall operational expenditure.

Direct-to-chip liquid cooling emerges as the definitive solution, directly addressing these critical thermal bottlenecks. By bringing a coolant into immediate contact with the heat-generating surface, it offers an order of magnitude increase in heat transfer efficiency compared to air. This allows for significantly higher power densities per rack, enabling more AI compute power in a smaller physical footprint, which is crucial for hyperscalers and HPC facilities. Moreover, by effectively managing heat, liquid cooling helps maintain consistent chip performance, prevents thermal throttling, and extends the lifespan of expensive AI hardware. It also contributes substantially to energy efficiency, as liquid has a higher specific heat capacity than air, leading to reduced fan power consumption and lower overall data center Power Usage Effectiveness (PUE) for AI-intensive operations.

- Enables higher power density of AI processors (GPUs, TPUs) per server and rack.

- Prevents thermal throttling of AI accelerators, ensuring sustained peak performance.

- Extends the lifespan of expensive AI hardware by maintaining optimal operating temperatures.

- Reduces energy consumption for cooling, improving data center Power Usage Effectiveness (PUE) for AI workloads.

- Facilitates the deployment of next-generation AI infrastructure with increasingly higher TDP chips.

- Supports higher rack densities, allowing more AI compute capacity in a smaller physical footprint.

- Minimizes operational noise compared to air-cooled AI server racks.

- Opens opportunities for waste heat reuse from AI infrastructure.

DRO & Impact Forces Of Direct-to-chip Liquid Cooling Market

The Direct-to-chip Liquid Cooling Market is profoundly influenced by a complex interplay of driving forces, inherent restraints, and burgeoning opportunities that collectively shape its growth trajectory and adoption rates. A primary driver is the relentless increase in chip power density across various computing architectures, including CPUs, GPUs, and specialized AI accelerators, which generate heat far beyond the capacity of conventional air-cooling systems. This technological push is complemented by a growing demand for energy efficiency in data centers, where liquid cooling offers significantly lower Power Usage Effectiveness (PUE) compared to air, leading to substantial operational cost savings and reduced environmental impact. The proliferation of Artificial Intelligence (AI), High-Performance Computing (HPC), and hyperscale cloud infrastructure, all reliant on maximizing compute per square foot, further fuels the need for efficient thermal management solutions like direct-to-chip liquid cooling.

Despite these strong drivers, the market faces several restraining factors. The initial capital expenditure (CapEx) associated with implementing direct-to-chip liquid cooling solutions can be significantly higher than air cooling, which presents a barrier for smaller enterprises or those with limited budgets. Furthermore, the perceived complexity of integrating liquid cooling systems into existing data center infrastructures, including plumbing, leak detection, and maintenance protocols, can deter potential adopters. A lack of widespread standardization across different vendor solutions also poses challenges in terms of interoperability and long-term upgradeability. Additionally, concerns regarding potential leaks, although increasingly mitigated by advanced engineering, can create hesitancy among some data center operators.

Nevertheless, numerous opportunities are emerging that promise to overcome these restraints and accelerate market expansion. The continuous innovation in cooling technologies, such as advanced cold plate designs, more efficient Cooling Distribution Units (CDUs), and reliable leak detection systems, is improving system performance and reliability while potentially lowering costs over time. The growing focus on sustainability and green data center initiatives globally creates a strong incentive for adopting energy-efficient liquid cooling. Moreover, the expanding use cases in edge computing, telecommunications, and even certain industrial and automotive applications, which require compact and efficient cooling for powerful processors in non-traditional environments, present new avenues for market growth. The increasing availability of modular and retrofittable solutions is also simplifying deployment, making liquid cooling more accessible to a broader range of data center operators. These impact forces collectively define the dynamic landscape of the direct-to-chip liquid cooling market.

Segmentation Analysis

The Direct-to-chip Liquid Cooling Market is meticulously segmented to provide a detailed understanding of its diverse components, technologies, and applications. This segmentation allows for precise market analysis, identifying key growth areas, competitive landscapes, and evolving consumer preferences. The market is primarily categorized by component type, offering insights into the demand for various system elements like cold plates, pumps, and cooling distribution units. Further segmentation by cooling type distinguishes between single-phase and two-phase systems, reflecting different levels of thermal efficiency and application suitability. End-use industries represent a crucial dimension, highlighting the sectors that are most significantly adopting these advanced cooling solutions. Lastly, segmentation by fluid type provides an understanding of the coolants preferred across different liquid cooling architectures.

- By Component

- Cold Plates

- Cooling Distribution Units (CDUs)

- Pumps

- Heat Exchangers

- Manifolds

- Piping & Connectors

- Coolants (Water, Dielectric Fluids)

- Control Systems & Sensors

- By Type

- Single-Phase Liquid Cooling

- Two-Phase Liquid Cooling

- By End-Use Industry

- Data Centers (Hyperscale, Enterprise)

- High-Performance Computing (HPC)

- Artificial Intelligence (AI) & Machine Learning (ML)

- Edge Computing

- Telecommunications

- Gaming & Professional Workstations

- Automotive (Autonomous Driving, Infotainment)

- Industrial & Manufacturing

- Others

- By Fluid Type

- Water-based Coolants

- Dielectric Fluids (Mineral Oil, Synthetic Fluids, Fluorocarbons)

Value Chain Analysis For Direct-to-chip Liquid Cooling Market

The value chain for the Direct-to-chip Liquid Cooling Market encompasses a series of interconnected stages, from the sourcing of raw materials to the final integration and end-user support. The upstream segment involves the procurement of specialized materials, such as high-thermal-conductivity metals (copper, aluminum), advanced plastics for manifolds and connectors, and various chemical compounds for coolants (e.g., deionized water treatments, dielectric fluids). Key players at this stage include material suppliers, component manufacturers specializing in high-precision parts like cold plates, pumps, and heat exchangers, and technology providers developing advanced sensors and control systems. The quality and innovation at this initial stage are crucial for the overall performance and reliability of the cooling solution.

Midstream activities primarily involve the design, manufacturing, and assembly of integrated liquid cooling systems. This includes the engineering of specific cold plate designs for various chip architectures, the production of Cooling Distribution Units (CDUs) that manage the flow and temperature of the coolant, and the assembly of entire rack-level or row-level cooling solutions. This stage requires significant R&D investment to ensure compatibility with diverse server platforms and to optimize thermal performance and energy efficiency. Companies specializing in server manufacturing, system integrators, and dedicated liquid cooling solution providers are central to this part of the value chain, focusing on offering complete, deployable systems that meet specific customer requirements.

The downstream segment focuses on the distribution, installation, and ongoing maintenance of direct-to-chip liquid cooling systems to the end-users. Distribution channels can be direct, through sales teams of the cooling solution providers, or indirect, via value-added resellers (VARs), system integrators, and channel partners who often combine cooling solutions with other data center infrastructure. Installation services, commissioning, and post-sales support, including monitoring, maintenance, and fluid management, are critical for ensuring the longevity and optimal operation of these complex systems. End-users, primarily hyperscale data centers, HPC facilities, and enterprise IT departments, drive demand at this stage, seeking reliable and efficient cooling that can support their high-density, high-performance computing needs. This entire value chain emphasizes precision engineering, robust supply chain management, and strong customer support.

Direct-to-chip Liquid Cooling Market Potential Customers

Potential customers for direct-to-chip liquid cooling solutions are primarily organizations grappling with intense computational workloads and the associated thermal management challenges. The foremost segment includes hyperscale data center operators, such as major cloud service providers (e.g., AWS, Google Cloud, Microsoft Azure), who require immense processing power and seek to maximize rack density while minimizing energy consumption. These entities are continuously investing in advanced cooling technologies to support their rapidly expanding infrastructure for cloud services, AI/ML, and big data analytics. Another significant customer group comprises High-Performance Computing (HPC) facilities, including national laboratories, universities, and research institutions, which deploy supercomputers for complex scientific simulations, weather modeling, and advanced engineering tasks. For these users, optimal thermal management is directly linked to computational performance and the ability to run uninterrupted, highly intensive calculations.

Beyond the hyperscalers and HPC sector, enterprise data centers, particularly those in financial services, telecommunications, and media & entertainment, are increasingly adopting liquid cooling as their internal computing demands grow. These enterprises often run proprietary applications that require high-density servers, and they are motivated by the need for energy efficiency, reduced data center footprint, and enhanced reliability for mission-critical operations. The burgeoning fields of Artificial Intelligence (AI) and Machine Learning (ML) research and deployment also represent a rapidly expanding customer base. Companies and institutions focusing on AI development require dense arrays of GPUs and AI accelerators, which generate significant heat, making direct-to-chip liquid cooling essential for maintaining performance and protecting valuable hardware. Furthermore, emerging applications in edge computing, where compact yet powerful servers operate in less controlled environments, are creating new demand for robust and efficient cooling solutions.

The telecom sector is another growing segment, with the rollout of 5G networks requiring more powerful and energy-efficient computing infrastructure at the network edge, often in constrained spaces. The automotive industry, particularly for autonomous driving development and advanced infotainment systems, is also becoming a niche but important customer, as these applications integrate high-performance processors that demand specialized thermal management. Finally, gaming and professional workstation users, particularly those with extreme overclocking needs or specialized content creation requirements, represent a smaller but growing segment seeking direct-to-chip cooling for maximum performance and stability. These diverse end-users are united by the common need to efficiently dissipate high levels of heat generated by powerful microprocessors, ensuring system integrity, performance, and energy savings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.1 billion |

| Market Forecast in 2032 | USD 12.8 billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, Asetek, CoolIT Systems, Fujitsu, Iceotope Technologies, IBM, Green Revolution Cooling, LiquidStack, Motivair, Rittal, Vertiv, Supermicro, Midas Green Technologies, Submer, GRC (Green Revolution Cooling), Aspen Systems, Danfoss, Schneider Electric, Nortek Air Solutions, Deltak Manufacturing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Direct-to-chip Liquid Cooling Market Key Technology Landscape

The Direct-to-chip Liquid Cooling Market is characterized by a rapidly evolving technological landscape, driven by the relentless pursuit of higher thermal efficiency, improved reliability, and simplified integration. At the core are advancements in cold plate design, which are becoming increasingly sophisticated to maximize contact area and fluid flow over high-heat-flux components like CPUs, GPUs, and specialized AI accelerators. Innovations include microchannel designs, jet impingement techniques, and vapor chamber integration, all aimed at enhancing heat transfer coefficients at the chip interface. Furthermore, the development of more robust and flexible materials for cold plates and manifold systems, such as corrosion-resistant alloys and advanced polymers, is improving system longevity and reducing the risk of leaks.

Another critical area of technological innovation lies in Cooling Distribution Units (CDUs) and their intelligent control systems. Modern CDUs are designed for greater energy efficiency, often incorporating variable speed pumps and advanced heat exchangers to optimize coolant flow and temperature based on real-time server workloads. Integration of AI-powered monitoring and predictive maintenance algorithms within CDUs allows for proactive leak detection, fault prediction, and dynamic optimization of cooling parameters, thus enhancing system reliability and reducing downtime. The move towards modular and hot-swappable CDU designs also simplifies maintenance and upgrades in large data center environments.

The market is also witnessing significant developments in two-phase cooling technologies, which utilize the latent heat of vaporization for superior thermal transfer. While still a niche, advancements in dielectric coolants (such as fluorocarbons and specialized engineered fluids) and closed-loop two-phase systems are making this highly efficient method more viable and scalable. Additionally, progress in quick disconnect couplings, leak detection sensors, and automated fluid management systems is addressing key concerns regarding system integrity and ease of operation. Integration with existing data center infrastructure, including facility water loops and energy recovery systems for waste heat reuse, is also a growing focus, aiming to maximize overall energy efficiency and sustainability of data center operations.

Regional Highlights

- North America: This region stands as the largest market for direct-to-chip liquid cooling, primarily driven by the concentration of hyperscale data centers, major cloud service providers, and extensive high-performance computing (HPC) facilities. The early adoption of advanced thermal management solutions by tech giants and significant R&D investments in AI and machine learning technologies contribute to its dominance. Strict environmental regulations and a strong emphasis on energy efficiency also accelerate the demand for liquid cooling to reduce the carbon footprint of rapidly expanding digital infrastructure.

- Europe: Europe represents a robust growth market, influenced by stringent data privacy laws, a focus on sustainability, and a growing number of green data center initiatives. Countries like Germany, the UK, France, and the Nordics are investing heavily in advanced data center infrastructure, often incorporating liquid cooling to meet ambitious PUE targets and reduce operational costs. Government incentives and a strong commitment to renewable energy sources further support the adoption of efficient cooling technologies across various industries.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid digital transformation, burgeoning cloud computing adoption, and massive investments in data center expansion, particularly in countries such as China, India, Japan, and South Korea. The increasing demand for AI, IoT, and 5G technologies necessitates high-density computing, thereby driving the need for efficient liquid cooling solutions. Government support for digitalization and the growth of local hyperscalers also play a critical role in market acceleration.

- Latin America: This region exhibits emerging growth, with increasing investments in data center infrastructure and cloud services across key economies like Brazil and Mexico. While still in nascent stages compared to developed markets, the growing recognition of the benefits of energy-efficient cooling and the expansion of local IT services are gradually driving the adoption of direct-to-chip liquid cooling solutions.

- Middle East and Africa (MEA): The MEA region is witnessing steady growth, largely driven by government-led digitalization initiatives, smart city projects, and diversification efforts away from oil economies. Countries like the UAE and Saudi Arabia are investing in state-of-the-art data centers, leading to an increased demand for advanced cooling technologies to support their ambitious technological agendas and manage server heat in challenging climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Direct-to-chip Liquid Cooling Market.- 3M

- Asetek

- CoolIT Systems

- Fujitsu

- Iceotope Technologies

- IBM

- Green Revolution Cooling (GRC)

- LiquidStack

- Motivair

- Rittal

- Vertiv

- Supermicro

- Midas Green Technologies

- Submer

- Aspen Systems

- Danfoss

- Schneider Electric

- Nortek Air Solutions

- Deltak Manufacturing

- OptiCool Technologies

Frequently Asked Questions

Analyze common user questions about the Direct-to-chip Liquid Cooling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is direct-to-chip liquid cooling?

Direct-to-chip liquid cooling is an advanced thermal management technique where a liquid coolant directly contacts high-heat-generating components like CPUs and GPUs to efficiently remove heat, ensuring optimal performance and extending hardware lifespan.

Why is direct-to-chip liquid cooling becoming essential?

It's essential due to the escalating power density and heat output of modern processors (especially for AI/HPC), which overwhelm traditional air cooling. Liquid cooling offers superior heat dissipation, enabling higher performance and density.

What are the main benefits of using direct-to-chip liquid cooling?

Key benefits include enhanced thermal efficiency, prevention of chip throttling, increased server rack density, significant reduction in data center energy consumption (lower PUE), quieter operation, and extended hardware longevity.

Which industries are the primary adopters of direct-to-chip liquid cooling?

Primary adopters include hyperscale data centers, high-performance computing (HPC) facilities, artificial intelligence (AI) and machine learning (ML) research centers, and large enterprise data centers requiring high-density computing.

What are the future trends in the direct-to-chip liquid cooling market?

Future trends include further advancements in two-phase cooling, greater adoption of dielectric fluids, integrated intelligent control systems for predictive maintenance, modular and retrofittable solutions, and increased focus on waste heat reuse for sustainability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager