Dissolved Gas Analyzer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427226 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Dissolved Gas Analyzer Market Size

The Dissolved Gas Analyzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 420 million in 2025 and is projected to reach USD 725 million by the end of the forecast period in 2032.

Dissolved Gas Analyzer Market introduction

The Dissolved Gas Analyzer (DGA) market is a critical segment within the electrical power industry, providing essential diagnostic tools for the health monitoring of oil-filled electrical equipment such as transformers, tap changers, and circuit breakers. These devices detect and quantify specific gases dissolved in insulating oil, which are by-products of thermal and electrical faults. The ability to identify these fault gases, including hydrogen (H2), carbon monoxide (CO), carbon dioxide (CO2), methane (CH4), ethane (C2H6), ethylene (C2H4), and acetylene (C2H2), allows utility operators and industrial facility managers to anticipate potential equipment failures, schedule preventative maintenance, and prevent catastrophic outages, thereby ensuring grid reliability and operational safety. The technology underpins predictive maintenance strategies, shifting from reactive repairs to proactive asset management.

The core functionality of DGA technology relies on principles such as gas chromatography (GC), photoacoustic spectroscopy (PAS), and near-infrared (NIR) absorption, enabling the precise separation and measurement of fault gases. Modern DGA solutions range from laboratory-based instruments that offer high accuracy and comprehensive analysis to on-site portable units for rapid diagnosis and continuous online monitors for real-time surveillance. The demand for these sophisticated analytical tools is primarily driven by the imperative to extend the operational lifespan of aging electrical infrastructure, comply with stringent regulatory standards for grid stability, and optimize capital expenditure by minimizing unscheduled downtime. Furthermore, the increasing integration of renewable energy sources and the expansion of smart grid initiatives necessitate more robust and continuous monitoring solutions, placing DGA technology at the forefront of power asset management.

Key applications of Dissolved Gas Analyzers span across electric utilities, power generation plants, industrial manufacturing sectors, and specialized applications such as railway electrification. The paramount benefit derived from DGA implementation is the enhanced reliability and safety of high-voltage electrical assets. By providing early warnings of incipient faults, DGAs enable timely interventions, reducing the risk of costly equipment damage, extensive power outages, and potential hazards to personnel. This proactive approach not only optimizes maintenance schedules and resource allocation but also contributes significantly to extending asset longevity and improving the overall efficiency of power transmission and distribution networks. The strategic advantage of DGA is its ability to transform raw data into actionable insights, underpinning informed decision-making for critical infrastructure.

Dissolved Gas Analyzer Market Executive Summary

The Dissolved Gas Analyzer market demonstrates robust growth, propelled by several intertwined business trends, including the global push for digitalization in asset management, the increasing average age of power infrastructure, and the expansion of renewable energy capacity. The transition towards smart grids and the adoption of Industry 4.0 principles are significantly influencing market dynamics, favoring continuous online monitoring solutions over traditional discrete sampling methods. Businesses are increasingly investing in advanced DGA systems that offer integrated data analytics, cloud connectivity, and remote diagnostic capabilities to enhance operational efficiency and minimize downtime. Furthermore, the emphasis on sustainability and energy efficiency mandates better asset health management, positioning DGA technology as an indispensable tool for maintaining peak performance and reducing environmental impact through proactive fault prevention.

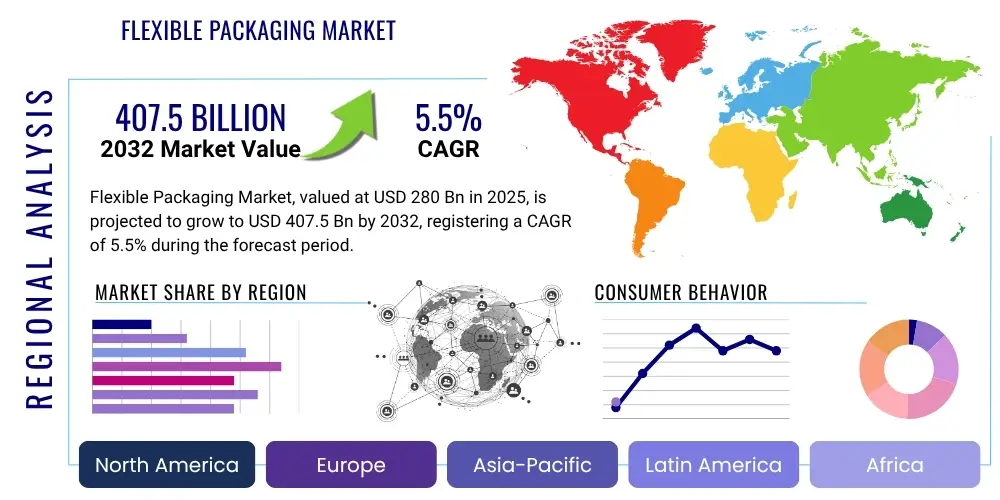

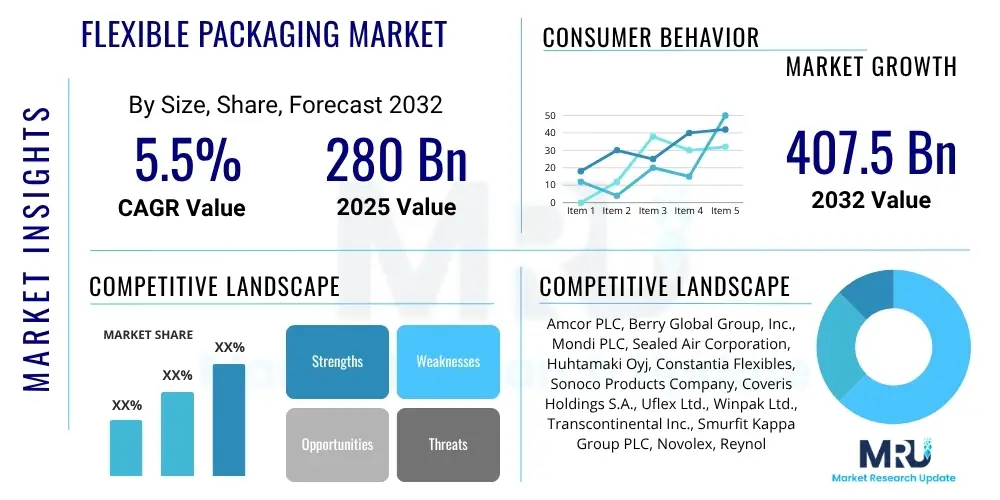

Regionally, the market exhibits diverse growth patterns. Asia Pacific, particularly countries like China and India, represents a high-growth region due to extensive investments in grid expansion, urbanization, and rapid industrialization, which necessitate significant power infrastructure development and subsequent monitoring requirements. North America and Europe, characterized by mature grids and an aging fleet of transformers, drive demand for DGA solutions focused on asset life extension, predictive maintenance, and regulatory compliance. These regions are also early adopters of advanced DGA technologies, including AI-powered analytics and integrated monitoring platforms. Emerging economies in Latin America and Africa are gradually increasing their adoption as their power grids develop and the understanding of proactive maintenance benefits grows, albeit at a slower pace due to economic constraints and infrastructure maturity levels.

Segmentation trends reveal a clear shift towards online DGA systems, which are preferred for continuous, real-time monitoring of critical assets, offering unparalleled insights into equipment health compared to portable or laboratory-based alternatives. Technology-wise, while gas chromatography remains the gold standard for comprehensive analysis, photoacoustic spectroscopy and micro-electromechanical systems (MEMS)-based sensors are gaining traction for their compact size, cost-effectiveness, and suitability for single-gas or multi-gas detection in online applications. End-user demand is predominantly driven by electric utilities, followed by industrial facilities and power generation companies, all seeking to mitigate risks associated with equipment failure. The market is also seeing an increased focus on solution-oriented offerings, where DGA devices are integrated into broader asset performance management (APM) platforms, providing a holistic view of asset health and operational performance.

AI Impact Analysis on Dissolved Gas Analyzer Market

The integration of Artificial Intelligence (AI) into the Dissolved Gas Analyzer market is profoundly transforming how electrical asset health is monitored and managed, addressing key user questions around predictive accuracy, operational efficiency, and data overload. Users are primarily concerned with how AI can enhance the precision of fault detection, automate analysis processes, reduce false positives, and provide clearer, more actionable insights from vast datasets generated by DGA devices. There is significant interest in AIs ability to move beyond simple fault classification to predicting the severity and progression of faults, thereby optimizing maintenance schedules and resource allocation. Concerns also revolve around the data requirements for training robust AI models, the interpretability of AI-driven recommendations, and the seamless integration of AI platforms with existing DGA hardware and broader enterprise asset management systems. The market anticipates AI to deliver more resilient and intelligent power grids by enabling proactive decision-making.

- AI enhances DGA data interpretation through advanced pattern recognition, identifying subtle fault signatures often missed by traditional methods.

- Predictive analytics powered by AI allows for earlier detection of incipient faults and forecasting of potential equipment failures, extending asset lifespan.

- Automation of DGA data analysis reduces human error and accelerates the diagnostic process, leading to more efficient asset management.

- AI-driven anomaly detection improves accuracy by learning normal operating conditions and flagging deviations with higher precision, minimizing false alarms.

- Optimization of maintenance schedules and resource allocation is achieved through AI-informed risk assessments and prioritization of assets requiring intervention.

- Seamless integration with existing SCADA and APM systems is facilitated by AI, creating a more cohesive and intelligent grid monitoring ecosystem.

- Reduced operational costs are realized through predictive maintenance strategies that minimize unexpected downtime and extend the interval between costly overhauls.

DRO & Impact Forces Of Dissolved Gas Analyzer Market

The Dissolved Gas Analyzer market is significantly influenced by a dynamic interplay of drivers, restraints, opportunities, and pervasive impact forces that collectively shape its growth trajectory. Key drivers include the global aging electrical infrastructure, demanding continuous monitoring and predictive maintenance to avert costly failures and extend asset life. The rapid expansion of smart grids and the increasing integration of renewable energy sources further necessitate robust DGA solutions for maintaining grid stability and reliability. Stringent regulatory mandates concerning power quality, safety, and environmental protection also compel utilities and industrial operators to adopt advanced DGA technologies. Furthermore, the growing awareness among asset owners regarding the substantial financial losses associated with unplanned outages serves as a powerful incentive for investing in proactive diagnostic tools, ensuring operational continuity and optimizing capital expenditure on critical assets.

Despite these strong drivers, the market faces several restraints. The high initial capital investment required for advanced online DGA systems can be a deterrent for smaller utilities or those with limited budgets. The complexity of interpreting DGA data, especially for non-expert personnel, and the need for specialized training for operation and maintenance also pose challenges, potentially hindering widespread adoption in certain regions. Furthermore, the presence of various DGA technologies with differing levels of accuracy and sensitivity can create confusion for buyers in selecting the most appropriate solution for their specific needs, leading to prolonged decision-making cycles. The limited standardization across DGA platforms and data reporting formats can also impede seamless integration into broader asset management systems.

Opportunities for market growth are abundant, particularly with the advent of AI and machine learning for enhanced data analytics, enabling more sophisticated fault diagnostics and predictive capabilities. The increasing demand for integrated solutions that combine DGA with other monitoring technologies (e.g., partial discharge, temperature, moisture) presents avenues for innovation and value creation. Expanding markets in developing economies, driven by urbanization and industrialization, offer significant untapped potential for DGA adoption as their power grids mature. Furthermore, the evolution of DGA sensors towards smaller, more cost-effective, and highly accurate designs promises to make these technologies more accessible and widely deployable, fostering new applications beyond traditional utility sectors. The growing emphasis on cybersecurity for critical infrastructure also opens opportunities for DGA solutions with enhanced data security features.

Segmentation Analysis

The Dissolved Gas Analyzer market is comprehensively segmented to provide granular insights into its diverse components, allowing for a precise understanding of market dynamics across various dimensions. These segmentations typically include analyses based on technology type, deployment mode, application, and end-user industry. Each segment exhibits unique growth drivers, adoption rates, and competitive landscapes, reflecting the varied requirements and priorities of different stakeholders within the electrical power ecosystem. Understanding these distinct segments is crucial for market participants to tailor their product offerings, develop targeted marketing strategies, and identify specific growth pockets, thereby maximizing market penetration and achieving sustainable competitive advantage in a complex and evolving industry.

- By Technology: Gas Chromatography (GC), Photoacoustic Spectroscopy (PAS), Infrared (IR) Spectroscopy, Micro-electromechanical Systems (MEMS), Fuel Cell-based.

- By Deployment Mode: Online/Continuous DGA, Portable DGA, Laboratory-based DGA.

- By Application: Transformer Monitoring, Switchgear Monitoring, Cable Monitoring, Circuit Breaker Monitoring, On-load Tap Changer (OLTC) Monitoring.

- By End-User: Electric Utilities, Power Generation Companies, Industrial Manufacturing (e.g., Oil & Gas, Mining, Steel), Railway & Transportation, Data Centers.

- By Service: Installation & Commissioning, Calibration & Maintenance, Data Analysis & Consulting, Training & Support.

Dissolved Gas Analyzer Market Value Chain Analysis

The Dissolved Gas Analyzer markets value chain is a complex ecosystem encompassing raw material suppliers, component manufacturers, DGA system developers, distributors, and end-users, alongside critical service providers. The upstream segment involves the sourcing of specialized components such as gas sensors, detectors, microcontrollers, communication modules, and precision mechanical parts. Manufacturers of these highly specialized components contribute significantly to the performance and reliability of the final DGA product. Strong relationships with reliable component suppliers are crucial for ensuring product quality, managing costs, and sustaining innovation in an evolving technological landscape. Research and development activities also represent a foundational upstream investment, fostering advancements in sensor technology and analytical algorithms.

Midstream activities primarily focus on the design, assembly, and testing of the complete DGA systems. This involves integrating various components, developing proprietary software for data acquisition and analysis, and ensuring rigorous quality control and calibration processes. Leading DGA manufacturers invest heavily in advanced manufacturing facilities and engineering expertise to produce highly accurate, robust, and user-friendly devices. The midstream also includes the development of analytics platforms and software interfaces that translate raw gas concentration data into actionable insights for asset managers. Downstream activities are centered on reaching the end-user market, involving direct sales forces, a network of distributors, and system integrators. These channels are responsible for market penetration, customer relationship management, and providing localized support.

Distribution channels play a pivotal role in delivering DGA solutions to diverse end-users. Direct sales are common for large-scale utility projects and strategic accounts, allowing for direct engagement, customized solutions, and post-sales support. Indirect channels, through authorized distributors and value-added resellers (VARs), are crucial for reaching a broader customer base, especially in geographically dispersed markets, and for smaller-scale industrial applications. These partners often provide local installation, training, and first-line maintenance services, enhancing customer accessibility and satisfaction. The value chain is further augmented by service providers offering installation, calibration, maintenance, data interpretation, and training, which are essential for ensuring the optimal performance and longevity of DGA systems throughout their operational lifecycle.

Dissolved Gas Analyzer Market Potential Customers

The primary potential customers for Dissolved Gas Analyzers are entities with significant investments in oil-filled electrical equipment, particularly high-voltage transformers and switchgear, whose reliable operation is critical for their core functions. The largest segment comprises electric utilities, including transmission system operators (TSOs) and distribution system operators (DSOs), responsible for maintaining extensive power grids and ensuring consistent electricity supply. These organizations face immense pressure to minimize outages, optimize asset utilization, and comply with stringent regulatory standards, making DGA an indispensable tool for their predictive maintenance strategies. The aging infrastructure in many developed nations further amplifies their need for continuous and precise asset health monitoring to extend the operational life of existing equipment.

Beyond utilities, power generation companies, encompassing thermal, hydro, nuclear, and renewable energy plants (e.g., large-scale wind and solar farms with step-up transformers), represent another significant customer base. The uninterrupted operation of their transformers is vital for stable power output and revenue generation, driving the demand for advanced DGA systems to prevent catastrophic failures. Industrial manufacturing sectors, such as oil and gas refineries, petrochemical plants, mining operations, steel mills, and heavy manufacturing facilities, also constitute key potential customers. These industries often operate extensive internal power distribution networks with critical transformers, where an outage can lead to massive production losses and safety hazards, making DGA investments highly justifiable.

Furthermore, specialized applications and emerging markets contribute to the customer landscape. Railway and transportation infrastructure, particularly for electrified rail systems, relies on robust transformer stations, creating a niche but growing demand for DGA technology. Data centers, with their mission-critical power supply systems, are increasingly adopting DGA for their transformers to ensure uninterrupted service. Public infrastructure projects, telecommunications facilities, and large commercial campuses also represent potential buyers, driven by the need for reliable power infrastructure. The expansion of smart cities and microgrids is expected to broaden the customer base further, as these initiatives emphasize distributed generation and robust local grid management, all requiring sophisticated asset monitoring solutions like DGA.

Dissolved Gas Analyzer Market Key Technology Landscape

The technology landscape for the Dissolved Gas Analyzer market is characterized by continuous innovation aimed at improving accuracy, speed, portability, and integration capabilities, responding to the evolving needs of asset managers. Gas Chromatography (GC) remains a foundational technology, revered for its high precision and ability to comprehensively analyze all fault gases. While traditional laboratory GC systems offer the highest accuracy, advancements have led to compact, field-deployable GC units and even online GC systems, which provide near real-time, multi-gas analysis directly on transformer sites. The robustness and proven reliability of GC make it a preferred choice for detailed diagnostics and critical asset monitoring, despite its higher cost and complexity compared to other methods. Ongoing research focuses on miniaturizing GC columns and improving carrier gas management for online applications.

Photoacoustic Spectroscopy (PAS) and Near-Infrared (NIR) absorption spectroscopy are gaining significant traction due to their ability to provide rapid, selective, and maintenance-free multi-gas analysis without the need for carrier gases. PAS-based DGAs are particularly favored for online monitoring applications, offering advantages in terms of compact size, long-term stability, and immunity to cross-interferences. These technologies convert gas absorption into an acoustic signal, which is then measured, providing direct concentration readings. The simplicity of design, coupled with sufficient accuracy for most online monitoring requirements, positions PAS and NIR as strong contenders for widespread adoption, particularly where continuous, reliable data is paramount and comprehensive GC-level analysis is not always required. Further advancements aim to enhance the detection limits and expand the range of detectable gases for these spectroscopic methods.

Emerging and complementary technologies, such as Micro-electromechanical Systems (MEMS) sensors and advanced electrochemical sensors, are also impacting the DGA market. MEMS-based sensors offer ultra-compact form factors, lower power consumption, and cost-effectiveness, making them ideal for integration into distributed monitoring networks and smaller equipment. While currently primarily used for single-gas or limited multi-gas detection (e.g., H2, CO), ongoing development promises improved selectivity and sensitivity for a wider array of fault gases. Fuel cell-based sensors specifically for hydrogen detection also offer a simple, cost-effective solution for early fault indication. The integration of these diverse sensor technologies with advanced analytics, artificial intelligence, and robust communication protocols is defining the future of the DGA market, enabling smarter, more proactive, and holistic asset management solutions for the modern power grid.

Regional Highlights

- Asia Pacific: Emerging as the fastest-growing market, driven by extensive investments in power infrastructure expansion, rapid industrialization, and urbanization in countries like China, India, and Southeast Asia. The region is witnessing significant adoption of DGA technologies to support new grid installations and manage increasing electricity demand.

- North America: A mature market characterized by an aging electrical grid, fostering high demand for DGA solutions focused on asset life extension, predictive maintenance, and ensuring grid reliability. Strong regulatory frameworks and advanced technology adoption drive innovation and market growth.

- Europe: Exhibits consistent growth propelled by stringent environmental regulations, smart grid initiatives, and the need to maintain existing critical infrastructure. Countries such as Germany, the UK, and France are leading the adoption of advanced online DGA systems and integrated monitoring platforms.

- Middle East & Africa: An evolving market with increasing investments in power generation and transmission projects, particularly in Gulf Cooperation Council (GCC) countries and parts of Africa. The regions focus on infrastructure development and industrial expansion is gradually boosting DGA adoption.

- Latin America: Demonstrates steady growth, influenced by government initiatives to modernize power grids, expand electrification, and improve energy infrastructure reliability. Brazil and Mexico are key markets within this region, showing increased interest in predictive maintenance technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dissolved Gas Analyzer Market.- GE Grid Solutions (Alstom Grid)

- OMICRON Electronics GmbH

- Morgan Schaffer Ltd. (acquired by Doble Engineering Company)

- Doble Engineering Company

- Siemens Energy AG

- Weidmann Electrical Technology AG

- ABB Ltd.

- SDMyers Inc.

- Vaisala Oyj

- Qualitrol Corp.

- ZURC GASEGUR (ZUMBACH)

- LumaSense Technologies Inc. (acquired by Advanced Energy Industries, Inc.)

Frequently Asked Questions

What is a Dissolved Gas Analyzer (DGA) and why is it important?

A Dissolved Gas Analyzer (DGA) is a diagnostic instrument used to detect and quantify specific gases dissolved in the insulating oil of electrical equipment like transformers. It is crucial because these gases are by-products of thermal and electrical faults, providing early warning signs of potential equipment failure, enabling proactive maintenance, and preventing costly outages and safety hazards.

What types of gases do DGAs typically detect?

DGAs typically detect key fault gases including hydrogen (H2), carbon monoxide (CO), carbon dioxide (CO2), methane (CH4), ethane (C2H6), ethylene (C2H4), and acetylene (C2H2). The specific combination and concentration of these gases help identify the nature and severity of an incipient fault.

What are the main types of DGA systems available?

The main types of DGA systems are laboratory-based, portable, and online/continuous. Laboratory systems offer high accuracy for comprehensive analysis, portable units provide quick on-site diagnostics, and online systems offer real-time, continuous monitoring for critical assets, providing immediate fault detection and trending data.

How does Artificial Intelligence (AI) enhance DGA capabilities?

AI enhances DGA by improving data interpretation, enabling predictive analytics for fault forecasting, automating analysis processes to reduce human error, and providing more precise anomaly detection. AI helps transform raw DGA data into actionable insights, leading to optimized maintenance schedules and improved asset reliability.

Who are the primary end-users of Dissolved Gas Analyzers?

The primary end-users of Dissolved Gas Analyzers are electric utilities (transmission and distribution companies), power generation plants (thermal, hydro, nuclear, renewables), and large industrial manufacturing facilities (e.g., oil & gas, mining, steel) that rely heavily on the continuous operation of high-voltage electrical equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Online Dissolved Gas Analyzer Market Statistics 2025 Analysis By Application (Power Transformer, Transmission & Distributor Transformer, Others), By Type (Multi Gas Analyzers, Single Gas Analyzers), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Dissolved Gas Analyzer Market Statistics 2025 Analysis By Application (Power Transformer, Distributor Transformer), By Type (Multi Gas Analyzers, Single Gas Analyzers), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager