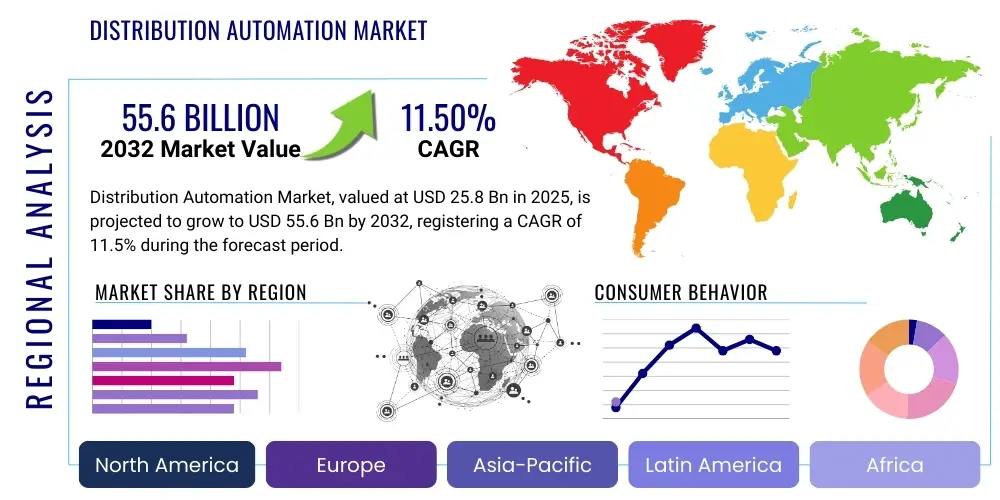

Distribution Automation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427635 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Distribution Automation Market Size

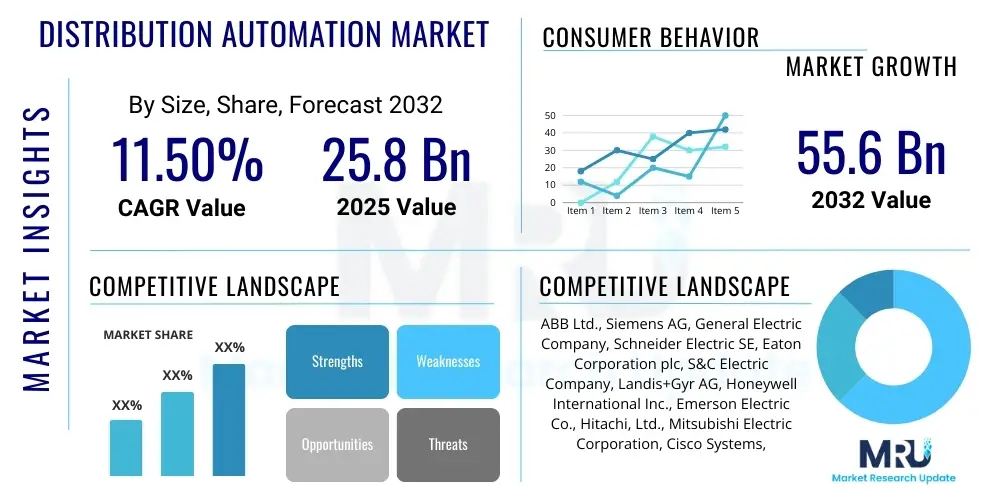

The Distribution Automation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2025 and 2032. The market is estimated at USD 25.8 Billion in 2025 and is projected to reach USD 55.6 Billion by the end of the forecast period in 2032.

Distribution Automation Market introduction

The Distribution Automation (DA) Market encompasses a sophisticated suite of technologies and systems designed to enhance the efficiency, reliability, and security of electrical power distribution networks. At its core, DA involves the integration of intelligent electronic devices, advanced communication infrastructure, and control systems to monitor, analyze, and optimize grid operations in real-time. This includes hardware components such as smart sensors, reclosers, fault circuit indicators, and Remote Terminal Units (RTUs), alongside advanced software platforms like Distribution Management Systems (DMS) and Outage Management Systems (OMS). Major applications span across utility companies, industrial facilities, and smart city initiatives, all seeking to modernize their aging infrastructure, accommodate the influx of distributed energy resources (DERs) like solar and wind, and improve overall grid resilience. The inherent benefits of DA are manifold, including significant reductions in outage durations and frequency, improved power quality, optimized energy flow, and reduced operational costs through automation of routine tasks. The primary driving factors for this markets expansion are the global push for grid modernization, increasing demand for reliable electricity, the imperative to integrate diverse renewable energy sources seamlessly, and the growing focus on enhancing energy efficiency and sustainability. Furthermore, the rising adoption of smart grid technologies and the strategic investments by governments and private entities in digitalizing energy infrastructure are propelling the market forward, transforming traditional passive networks into active, intelligent, and self-healing systems capable of responding dynamically to operational challenges and consumer demands.

Distribution Automation Market Executive Summary

The Distribution Automation Market is experiencing robust growth driven by a convergence of business trends, regional development priorities, and evolving technological segment demands. Key business trends underscore the shift towards digitalization, with utilities increasingly investing in IoT-enabled devices, advanced analytics, and cloud-based solutions to gain granular insights into grid performance and implement predictive maintenance strategies. The emphasis on cybersecurity is paramount, as interconnected DA systems present new vulnerabilities that require sophisticated protection mechanisms, driving demand for secure communication protocols and robust data encryption. Furthermore, the integration of distributed energy resources, such as rooftop solar and electric vehicle charging infrastructure, is compelling utilities to adopt more dynamic and flexible DA solutions capable of managing bidirectional power flows and maintaining grid stability. Regional trends highlight significant investment disparities and growth opportunities. North America and Europe, with their mature infrastructures and stringent regulatory mandates for grid reliability and carbon reduction, are leading the adoption of advanced DA technologies, focusing on replacing aging assets and integrating renewables. The Asia Pacific region is emerging as a critical growth engine, propelled by rapid urbanization, substantial investments in new smart grid projects, and the escalating demand for electricity in developing economies. Conversely, Latin America, the Middle East, and Africa are showing nascent but accelerating growth, primarily driven by infrastructure development initiatives and efforts to reduce technical and commercial losses. Segment trends indicate a strong demand for software components, particularly advanced ADMS platforms that offer comprehensive control and optimization capabilities, while hardware such as smart sensors and reclosers continues to form the foundational layer. Communication technologies, especially wireless and fiber optic solutions, are crucial enablers, ensuring the seamless data exchange necessary for real-time automation. This dynamic interplay of technological advancement, strategic investments, and evolving regulatory landscapes is shaping a vibrant and expanding market.

AI Impact Analysis on Distribution Automation Market

The integration of Artificial Intelligence (AI) into the Distribution Automation Market is rapidly transforming traditional grid operations, addressing critical user concerns regarding reliability, efficiency, and resilience. Common inquiries from utilities and industry stakeholders often revolve around how AI can preempt outages, optimize energy flow in real-time, and manage the complexity introduced by distributed energy resources. Users are keenly interested in AIs capability to enhance predictive maintenance by analyzing vast datasets from smart sensors, thereby identifying potential equipment failures before they occur. Another significant area of interest is AIs role in advanced fault detection, isolation, and service restoration (FDIR), where its ability to quickly pinpoint fault locations and reconfigure the network autonomously can drastically reduce outage durations and improve customer satisfaction. Moreover, there is considerable expectation for AI to optimize voltage and reactive power management, ensuring stable grid performance and minimizing energy losses, particularly in networks with high penetration of intermittent renewable generation.

Beyond operational improvements, the market is exploring AIs potential in demand-side management and grid forecasting. Utilities question how AI can accurately predict electricity consumption patterns and renewable energy generation, enabling more informed decision-making for resource allocation and grid planning. The ability of AI to process and derive insights from diverse data sources—including weather patterns, historical load data, and consumer behavior—is seen as crucial for developing more resilient and adaptive distribution networks. Stakeholders also ponder the challenges associated with AI adoption, such as data privacy, the need for robust cybersecurity measures, and the development of a skilled workforce capable of deploying and managing AI-driven systems. Despite these challenges, the prevailing sentiment is that AI will be an indispensable tool for future grid operations, moving beyond simple automation to enable genuinely intelligent, self-optimizing, and self-healing power distribution systems.

The impact extends to strategic decision-making, where AI can aid in network expansion planning, asset investment strategies, and the design of more efficient tariff structures. Users are looking for AI to provide a competitive edge by lowering operational expenditures (OPEX) and capital expenditures (CAPEX) through smarter resource utilization and optimized asset lifecycles. The overarching theme is one of leveraging AI to transform the distribution network into a proactive, rather than reactive, entity, capable of anticipating and mitigating issues, thereby delivering higher quality and more reliable power to end-consumers while navigating the complexities of a modern, decarbonized energy landscape.

- Enhanced predictive maintenance: AI analyzes sensor data to forecast equipment failures, preventing unscheduled outages.

- Optimized grid operations: AI dynamically adjusts power flow, voltage, and reactive power for peak efficiency and stability.

- Advanced fault detection, isolation, and restoration (FDIR): AI rapidly identifies faults, isolates affected sections, and re-routes power to minimize downtime.

- Improved integration of distributed energy resources (DERs): AI manages bidirectional power flows and intermittency from renewables.

- Accurate demand forecasting: AI predicts consumption patterns to optimize generation and grid planning.

- Cybersecurity enhancement: AI detects and responds to cyber threats in real-time within DA systems.

- Automated decision-making: AI enables faster, data-driven operational responses without human intervention.

- Resource optimization: AI aids in efficient asset management and strategic network planning.

DRO & Impact Forces Of Distribution Automation Market

The Distribution Automation Market is profoundly shaped by a dynamic interplay of drivers, restraints, opportunities, and broader impact forces that collectively dictate its growth trajectory and adoption patterns. A primary driver is the accelerating global imperative for grid modernization, as aging infrastructure in many developed economies necessitates significant upgrades to meet modern reliability and efficiency standards. Simultaneously, the rapid integration of renewable energy sources, such as solar PV and wind power, into distribution networks demands sophisticated automation solutions to manage their inherent intermittency and bidirectional power flows, ensuring grid stability. The escalating global electricity demand, fueled by population growth, industrialization, and electrification of transport, further pushes utilities to invest in DA to enhance capacity, reduce losses, and maintain service quality. Smart city initiatives worldwide also serve as a substantial catalyst, with integrated DA systems forming the backbone of efficient energy management within urban environments. Furthermore, a growing emphasis on energy efficiency and sustainability objectives by governments and corporations alike mandates the deployment of technologies that can optimize energy consumption and minimize environmental impact.

Despite these powerful drivers, several significant restraints challenge the markets growth. The substantial initial capital investment required for DA infrastructure, including advanced hardware, software, and communication networks, poses a considerable barrier, particularly for smaller utilities or those in developing regions with limited budgets. Cybersecurity concerns represent another critical impediment; as DA systems become more interconnected and digital, they become more vulnerable to sophisticated cyberattacks, necessitating continuous investment in robust security measures and protocols. A persistent lack of standardization across different vendors and technologies creates interoperability challenges, hindering seamless integration and complicating system management. Moreover, the shortage of a skilled workforce proficient in deploying, operating, and maintaining complex DA systems is a significant bottleneck. Regulatory hurdles, including slow approval processes and outdated policies that may not adequately support smart grid investments, can further delay market adoption and stifle innovation. These restraints underscore the need for collaborative efforts among industry stakeholders, policymakers, and educational institutions to address the multifaceted challenges hindering widespread DA implementation.

Opportunities within the Distribution Automation Market are vast and evolving, primarily driven by technological advancements and emerging energy paradigms. The proliferation of microgrids and distributed energy resources (DERs) presents a fertile ground for DA expansion, as these localized energy systems require advanced automation for optimal management, resilience, and grid interconnection. The development of advanced sensors, meters, and communication technologies, including 5G and IoT, creates new avenues for real-time data acquisition and precise control, enhancing DA capabilities. The application of sophisticated analytics, machine learning, and artificial intelligence offers opportunities for predictive maintenance, optimized asset management, and proactive fault prevention. Emerging economies, particularly in Asia Pacific and parts of Africa, represent significant untapped markets where new grid infrastructure is being developed, offering a clean slate for implementing cutting-edge DA solutions. Beyond these, broader impact forces such as economic growth, which enables greater utility investment, and technological advancements, which reduce costs and improve performance, play pivotal roles. Regulatory environments that incentivize grid modernization and resilience, alongside societal demands for sustainable and reliable energy, collectively exert profound influence on the markets direction and pace of innovation.

Segmentation Analysis

The Distribution Automation Market is comprehensively segmented to provide a detailed understanding of its diverse components and applications. This segmentation allows for granular analysis of market dynamics, revealing growth opportunities and key trends across various technologies, deployment models, and end-user verticals. The market can be dissected by component, distinguishing between hardware, software, and services, each playing a crucial role in enabling a fully automated and intelligent distribution grid. Hardware components form the physical backbone, including intelligent electronic devices like reclosers, fault circuit indicators, and RTUs, while software encompasses the sophisticated applications that manage and optimize grid operations. Services, such as consulting, installation, and maintenance, ensure the seamless integration and continued performance of DA systems. Further segmentation by communication technology, application, and end-user provides deeper insights into the specific needs and adoption patterns within the evolving energy landscape.

- By Component

- Hardware (e.g., Reclosers, Sectionalizers, Capacitors, Voltage Regulators, Smart Sensors, RTUs)

- Software (e.g., ADMS, SCADA, GIS, Outage Management Systems)

- Services (e.g., Consulting, Integration, Installation, Maintenance & Support)

- By Communication Technology

- Wired (e.g., Fiber Optic, DSL, Power Line Carrier)

- Wireless (e.g., Cellular, RF Mesh, Satellite)

- By Application

- Fault Detection, Isolation, and Restoration (FDIR)

- Volt/VAR Optimization (VVO)

- SCADA Systems

- Load Management

- Geographic Information Systems (GIS)

- Substation Automation

- Feeder Automation

- By End-User

- Utilities (e.g., Investor-Owned Utilities, Municipal Utilities, Rural Electric Cooperatives)

- Industrial

- Commercial

Distribution Automation Market Value Chain Analysis

The Distribution Automation Markets value chain is a complex ecosystem involving multiple stakeholders, from component manufacturers to end-users, each contributing to the creation, delivery, and utilization of intelligent grid solutions. The upstream segment of the value chain is dominated by raw material suppliers and component manufacturers who provide the fundamental building blocks for DA systems. This includes producers of semiconductors, sensors, communication modules, power electronics, and specialized hardware such as intelligent electronic devices (IEDs), reclosers, and fault indicators. These suppliers are critical for ensuring the quality, reliability, and technological sophistication of the core DA equipment. Simultaneously, software developers play a vital role in the upstream by creating the algorithms, platforms, and applications that enable real-time monitoring, control, and optimization of the distribution network. This collaborative upstream activity sets the foundation for the entire DA solution, emphasizing innovation in both hardware and software to meet evolving grid requirements.

Moving downstream, the value chain involves system integrators, solution providers, and service companies responsible for assembling these diverse components into cohesive and functional DA systems tailored to specific utility or industrial needs. System integrators are crucial intermediaries, combining hardware, software, and communication technologies from various vendors to create customized solutions, ensuring interoperability and seamless operation. Following deployment, service providers offer a range of support functions, including installation, commissioning, training, maintenance, and ongoing technical support, which are essential for the long-term performance and reliability of DA infrastructure. The downstream activities also encompass the distribution channels through which these solutions reach end-users. These channels can be direct, where DA solution providers engage directly with utilities or large industrial clients, offering bespoke systems and comprehensive support. This direct approach often involves extensive consultations and customization to meet the unique operational requirements and existing infrastructure of the client.

Indirect distribution channels involve partnerships with value-added resellers (VARs), local distributors, and engineering, procurement, and construction (EPC) firms that market and implement DA solutions on behalf of primary manufacturers. These indirect channels can broaden market reach, particularly in regions where direct engagement is less feasible or where local expertise is preferred. The entire value chain is characterized by a high degree of technical expertise, necessitating specialized knowledge in electrical engineering, information technology, and communication networks. Effective collaboration and strong partnerships across the value chain are vital for delivering robust, scalable, and secure distribution automation solutions that address the complex challenges of modern power grids. The efficiency of this value chain directly impacts the cost, deployment speed, and overall effectiveness of DA initiatives, influencing market adoption and the rate of grid modernization globally.

Distribution Automation Market Potential Customers

The Distribution Automation Market caters to a diverse array of potential customers, primarily entities responsible for the generation, transmission, and distribution of electricity, as well as large-scale consumers of power. Foremost among these are electric utility companies, encompassing investor-owned utilities (IOUs), municipal utilities, and rural electric cooperatives. IOUs, driven by profit motives and extensive customer bases, invest heavily in DA to improve reliability, reduce operational costs, and meet regulatory performance targets. Municipal utilities and rural co-ops, while often having smaller service territories, are increasingly adopting DA to enhance service quality, manage peak loads efficiently, and integrate local renewable energy sources, thereby ensuring stable and affordable power for their communities. These utilities are the bedrock of the DA market, constantly seeking innovative solutions to modernize aging infrastructure, improve outage response times, and prepare for the complexities of a decarbonized and decentralized energy future.

Beyond traditional utilities, large industrial facilities represent another significant segment of potential customers. Industries such as manufacturing plants, chemical processing units, and data centers rely on highly stable and reliable power supplies for their continuous operations. Power disturbances or outages can lead to substantial financial losses due to production downtime, equipment damage, and safety hazards. Consequently, these industrial customers invest in DA solutions to implement localized grid automation, improve power quality, enable seamless transfer to backup power sources, and manage their internal distribution networks with greater efficiency and resilience. Their specific needs often involve tailored solutions that can integrate with existing industrial control systems and comply with stringent operational safety standards, making them a crucial segment for specialized DA offerings that address unique industrial automation requirements.

Furthermore, the emergence of smart cities and microgrid operators expands the customer base for Distribution Automation. Smart cities are leveraging DA as a foundational component of their energy management strategies, aiming to create more sustainable, efficient, and resilient urban environments. This includes optimizing public lighting, managing electric vehicle charging infrastructure, and integrating distributed generation at a community level. Microgrid operators, whether for campuses, military bases, or remote communities, depend on DA to autonomously manage their local power generation and consumption, ensuring energy independence and continuous service during grid outages. These customers are often pioneers in adopting cutting-edge DA technologies, driven by a desire for energy self-sufficiency, enhanced resilience, and the ability to integrate diverse energy resources within a localized, optimized framework. The demand from these varied customer segments ensures a robust and expanding market for Distribution Automation solutions across the globe.

Distribution Automation Market Key Technology Landscape

The Distribution Automation Market is characterized by a sophisticated and evolving technological landscape, driven by advancements in digital communication, sensor technology, and intelligent control systems. At its core, Supervisory Control and Data Acquisition (SCADA) systems remain fundamental, providing the framework for real-time monitoring and control of distribution assets. However, modern DA extends far beyond traditional SCADA, integrating advanced capabilities for more dynamic grid management. Advanced Distribution Management Systems (ADMS) stand out as a pivotal technology, combining SCADA, Outage Management Systems (OMS), and Distribution Geographic Information Systems (GIS) into a unified platform. ADMS provides a comprehensive view of the network, enabling functions like fault location, isolation, and service restoration (FLISR), volt/VAR optimization (VVO), and advanced load management, thereby significantly enhancing grid reliability and efficiency. These systems are crucial for managing the increasing complexity of todays distribution networks, particularly with the influx of distributed energy resources and dynamic load profiles.

Intelligent Electronic Devices (IEDs) are foundational hardware components, including smart relays, reclosers, sectionalizers, and fault circuit indicators (FCIs), which are deployed across the distribution grid to collect data, perform local control actions, and communicate with central control systems. These devices are increasingly equipped with advanced processing capabilities and communication modules, allowing for more autonomous operation and faster response times. Communication networks are another critical enabler, providing the necessary infrastructure for real-time data exchange between field devices and central control systems. A blend of wired (e.g., fiber optics, power line carrier) and wireless (e.g., cellular, RF mesh, Wi-Fi) technologies is utilized, with growing adoption of secure, high-bandwidth solutions to support the vast data requirements of modern DA. The rise of the Internet of Things (IoT) is profoundly impacting this landscape, enabling a pervasive network of interconnected sensors and devices that provide unprecedented visibility into grid performance, offering real-time data for analytics and proactive management.

Furthermore, cloud computing and big data analytics are becoming indispensable for processing and deriving actionable insights from the immense volumes of data generated by DA systems. Cloud platforms offer scalable and secure infrastructure for hosting ADMS and other DA applications, facilitating remote access and collaboration, while big data analytics tools are used to identify patterns, predict failures, and optimize grid operations. Geographic Information Systems (GIS) provide the spatial context for DA, allowing utilities to visualize their network assets, plan maintenance, and simulate various operational scenarios. Emerging technologies such as Artificial Intelligence (AI) and Machine Learning (ML) are being integrated for advanced forecasting, predictive maintenance, and optimized resource allocation, pushing the boundaries of what DA can achieve. The convergence of these diverse technologies is creating intelligent, self-healing, and highly resilient distribution networks capable of meeting the demands of a dynamic and decentralized energy future.

Regional Highlights

- North America: The region is a pioneer in Distribution Automation adoption, driven by stringent grid reliability standards, aging infrastructure modernization initiatives, and significant investments in smart grid technologies. High penetration of renewable energy sources and a strong focus on enhancing grid resilience against extreme weather events further propel market growth. The United States and Canada are leading, with mature regulatory frameworks and a robust ecosystem of technology providers and utilities.

- Europe: European countries are rapidly implementing DA solutions to achieve ambitious decarbonization targets, integrate a high share of renewable energy, and enhance grid efficiency. Regulatory mandates for smart grid deployment and cross-border energy trading are key drivers. Western European nations, particularly Germany, the UK, and France, are at the forefront, focusing on VVO, FDIR, and advanced metering infrastructure (AMI) integration.

- Asia Pacific: This region is experiencing the fastest growth, fueled by rapid urbanization, industrialization, and substantial investments in new power infrastructure, especially in emerging economies like China, India, and Southeast Asian countries. Increasing electricity demand, efforts to reduce power losses, and the development of smart cities are major catalysts. Government support and large-scale utility modernization projects are accelerating DA deployment.

- Latin America: The market in Latin America is developing, with countries like Brazil and Mexico investing in DA to address issues of grid instability, reduce technical losses, and improve power quality. Economic development and increasing energy demand are key drivers, though initial investment costs and regulatory complexities remain challenges.

- Middle East & Africa (MEA): This region is an emerging market, driven by ambitious diversification plans, smart city developments (e.g., NEOM in Saudi Arabia), and efforts to improve energy access and reliability. Countries in the GCC region are leading the investment in modern grid infrastructure and DA technologies, aiming to support economic growth and integrate renewable energy sources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Distribution Automation Market.- ABB Ltd.

- Siemens AG

- General Electric Company

- Schneider Electric SE

- Eaton Corporation plc

- S&C Electric Company

- Landis+Gyr AG

- Honeywell International Inc.

- Emerson Electric Co.

- Hitachi, Ltd.

- Mitsubishi Electric Corporation

- Cisco Systems, Inc.

- Oracle Corporation

- Itron, Inc.

- OSIsoft, LLC (now part of AVEVA Group plc)

Frequently Asked Questions

What is Distribution Automation (DA)?

Distribution Automation (DA) refers to the use of intelligent electronic devices, advanced communication systems, and control software to monitor, control, and optimize the operation of an electrical distribution grid in real-time. Its primary goal is to enhance grid reliability, efficiency, and resilience by automating various functions, reducing manual intervention, and improving response to disturbances.

How does Distribution Automation improve grid reliability and efficiency?

DA significantly improves reliability by enabling rapid fault detection, isolation, and service restoration (FDIR), which minimizes outage durations and affected customer numbers. It enhances efficiency through Volt/VAR Optimization (VVO), load management, and optimized energy flow, reducing technical losses and improving power quality across the network.

What are the main components of a Distribution Automation system?

Key components typically include intelligent electronic devices (IEDs) like smart sensors, reclosers, and RTUs for data collection and local control; advanced communication infrastructure (wired and wireless); and sophisticated software platforms such as Advanced Distribution Management Systems (ADMS), SCADA, and Outage Management Systems (OMS) for centralized control and analysis.

What challenges does the Distribution Automation Market face?

The market faces challenges such as high initial capital investment requirements, cybersecurity risks associated with interconnected systems, a lack of standardization among different vendors, and a shortage of skilled personnel capable of deploying and maintaining complex DA technologies. Regulatory hurdles and integration complexities with legacy infrastructure also pose significant obstacles.

What is the future outlook for the Distribution Automation Market?

The future outlook is highly positive, driven by continuous grid modernization efforts, increasing integration of distributed energy resources (DERs), and the imperative for enhanced grid resilience against climate change and cyber threats. Advanced analytics, AI, machine learning, and 5G communication will further transform DA, enabling more autonomous, self-healing, and intelligent distribution networks capable of supporting sustainable energy transitions and smart city initiatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Smart Distribution For Residential Application Market Size Report By Type (Distribution Automation Terminal, Intelligent Medium Voltage Switchgear, Complete Set of Low Voltage Electrical Equipment), By Application (Power Systems, Intelligent Building, Petrochemical, Medical, Metallurgy, Traffic, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Smart Distribution For Industrial Application Market Size Report By Type (Distribution Automation Terminal, Intelligent Medium Voltage Switchgear, Complete Set of Low Voltage Electrical Equipment), By Application (Power Systems, Intelligent Building, Petrochemical, Medical, Metallurgy, Traffic, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Smart Distribution For Commercial Application Market Size Report By Type (Distribution Automation Terminal, Intelligent Medium Voltage Switchgear, Complete Set of Low Voltage Electrical Equipment), By Application (Power Systems, Intelligent Building, Petrochemical, Medical, Metallurgy, Traffic, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Distribution Automation Solutions Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (System-level Distribution Automation Solutions, Customer-level Distribution Automation Solutions), By Application (Industrial, Commercial, Residential), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Distribution Automation Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Monitoring and Control Devices, Power Quality and Efficiency Devices, Switching and Power Reliability Devices), By Application (Industrial, Commercial, Residential Sector), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager