Distribution Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431139 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Distribution Transformer Market Size

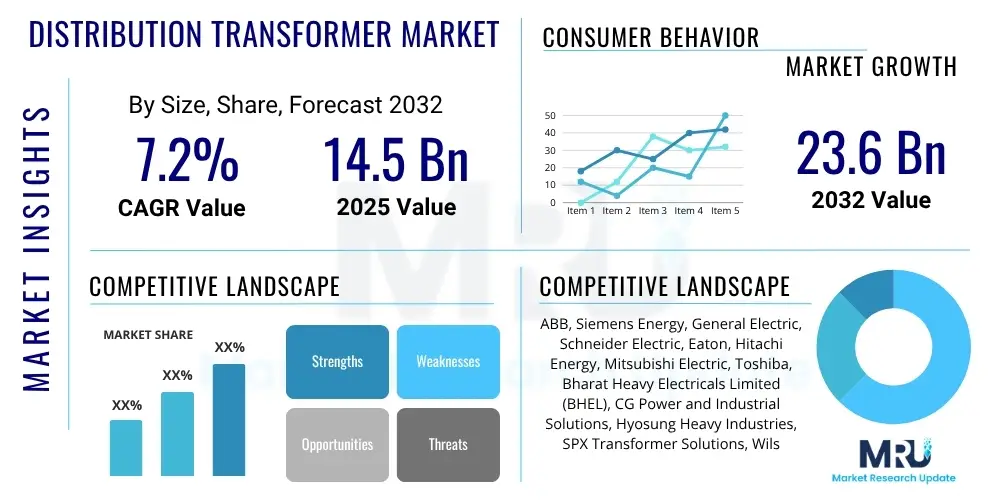

The Distribution Transformer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. The market is estimated at USD 14.5 billion in 2025 and is projected to reach USD 23.6 billion by the end of the forecast period in 2032.

Distribution Transformer Market introduction

Distribution transformers are integral and ubiquitous components of the electrical power distribution system, functioning as the final stage in the process of delivering electricity to end-users. Their primary role is to step down high-voltage electricity, typically received from transmission lines or sub-transmission networks, to a safe and usable voltage level (e.g., 400V, 240V, or 120V) for direct consumption by residential, commercial, and industrial consumers. These static devices operate on the principle of electromagnetic induction, consisting of two or more coils (windings) wound around a common laminated steel core, which is optimized to minimize energy losses. The core itself is generally made of grain-oriented electrical steel (GOES) or, increasingly, amorphous metal for enhanced efficiency, while the windings are typically constructed from copper or aluminum. The entire assembly is usually housed in a robust tank filled with an insulating and cooling medium, such as mineral oil, synthetic ester, or, for dry-type units, encapsulated in resin or impregnated with varnish, providing both electrical insulation and thermal management.

The product landscape within the distribution transformer market is diverse, catering to a wide array of application requirements and environmental conditions. Transformers are categorized by their cooling and insulation methods into oil-filled and dry-type variants. Oil-filled transformers, with their superior cooling capabilities and established reliability, remain predominant in outdoor utility applications and larger industrial settings. Conversely, dry-type transformers, known for their enhanced fire safety, reduced environmental footprint, and lower maintenance, are increasingly favored for indoor installations, urban areas, and sensitive environments like hospitals, data centers, and commercial complexes. Further distinctions are made by the number of phases (single-phase for residential, three-phase for industrial and commercial), and by power ratings, which can range from small pole-mounted units for individual homes to larger pad-mounted or substation-integrated transformers serving entire neighborhoods or factories. The adaptability and modularity of these designs ensure that specific power demands and safety regulations across different sectors can be effectively met.

The benefits derived from efficient distribution transformers are profound, directly impacting grid stability, energy costs, and public safety. By ensuring precise voltage regulation and minimizing energy losses during the final stage of electricity delivery, they contribute significantly to overall grid efficiency and reduce the carbon footprint associated with power generation. Reliable operation of these transformers is crucial for maintaining an uninterrupted power supply, thereby bolstering economic productivity and public convenience. The driving forces behind the continued expansion of this market are compelling and multifaceted. Foremost among these is the relentless global increase in electricity consumption, driven by population growth, rapid urbanization, and the expanding industrial base in emerging economies. Secondly, substantial investments in modernizing and replacing aging electrical infrastructure in developed nations are creating a consistent demand for newer, more efficient, and technologically advanced units. Thirdly, the accelerating integration of renewable energy sources such as solar and wind power into national grids necessitates flexible and smart distribution transformers capable of managing bidirectional power flow and variable generation. Lastly, stringent global regulations promoting energy efficiency and environmental sustainability are compelling manufacturers to innovate, pushing the market towards more eco-friendly and high-performance solutions, thus ensuring its dynamic growth over the forecast period.

Distribution Transformer Market Executive Summary

The Distribution Transformer Market is presently experiencing a robust growth phase, propelled by a convergence of global economic development, significant infrastructure investments, and a pronounced shift towards sustainable energy systems. Business trends indicate a strong emphasis on smart manufacturing practices, integrating Industry 4.0 technologies such as IoT, automation, and data analytics to optimize production lines, enhance product quality, and accelerate time-to-market. There is a discernible strategic pivot by leading manufacturers towards developing advanced, digitally enabled transformers equipped with sophisticated sensors and communication capabilities for real-time monitoring and control. This move is crucial for facilitating predictive maintenance, improving asset performance management, and seamlessly integrating with evolving smart grid frameworks. Competitive dynamics are characterized by ongoing market consolidation, as major players engage in strategic mergers, acquisitions, and partnerships to expand their geographical footprint, diversify product offerings, and leverage technological synergies, aiming to secure a competitive edge in a rapidly transforming industry.

Geographically, market trends reveal Asia Pacific as the undeniable powerhouse, not only holding the largest market share but also projecting the highest growth rates throughout the forecast period. This accelerated expansion is primarily a result of extensive investments in new power generation and distribution infrastructure to support burgeoning populations and rapid industrialization, particularly evident in economic giants like China and India, along with emerging economies in Southeast Asia. Conversely, mature markets in North America and Europe are witnessing sustained demand primarily from critical grid modernization initiatives, the systematic replacement of end-of-life transformers, and the increasing imperative to integrate substantial capacities of renewable energy into their existing electrical networks. Meanwhile, Latin America and the Middle East & Africa are emerging as high-potential growth regions, spurred by significant urbanization, widespread electrification projects, and robust economic development, especially within their respective energy and industrial sectors, which demand resilient and expanded power infrastructure.

A closer examination of segment trends illustrates distinct dynamics within the market. Oil-filled transformers continue to command the largest market share, largely due to their proven track record of reliability, cost-effectiveness, and suitability for a broad spectrum of outdoor and high-power applications, despite persistent environmental and safety considerations. However, the dry-type transformer segment is registering an accelerated growth trajectory, primarily driven by heightened safety regulations, increasing fire hazard mitigation requirements, and their intrinsic suitability for deployment in indoor environments, densely populated urban centers, and sensitive commercial and industrial facilities such as data centers and hospitals. Furthermore, the market is observing a significant upward trend in the demand for higher power rating transformers, particularly within industrial and large-scale utility applications, a direct reflection of the escalating capacity requirements of modern power grids. This granular segmentation analysis underscores a highly dynamic and competitive market landscape, where technological innovation, evolving regulatory frameworks, and diverse regional development priorities are key determinants of market adoption patterns and future growth trajectories.

AI Impact Analysis on Distribution Transformer Market

Common user inquiries concerning Artificial Intelligence's influence on the Distribution Transformer Market predominantly revolve around its potential to usher in an era of unprecedented operational efficiency, enhanced predictive capabilities, and superior grid resilience. Stakeholders are particularly keen on understanding how AI can facilitate a paradigm shift from conventional, time-based maintenance schedules to advanced, real-time condition-based monitoring. This transition promises to significantly extend the operational lifespan of existing assets, drastically reduce the incidence of unscheduled downtimes, and thereby minimize substantial operational expenditures. There are high expectations for AI algorithms to revolutionize fault detection, enabling the identification of anomalies with a far greater degree of accuracy and speed, while simultaneously contributing to more sophisticated and adaptive load management strategies within the rapidly evolving frameworks of smart grids. Furthermore, there is considerable interest and anticipation regarding AI's potential role in optimizing the very design and manufacturing processes of future transformers, making them inherently more efficient, robust, and precisely tailored to the specific and dynamic requirements of modern grid infrastructure.

Despite the palpable excitement surrounding AI's potential, several concerns frequently emerge in user discussions. These primarily revolve around the significant initial investment barriers associated with integrating and deploying complex AI systems into existing legacy infrastructure, which can be a substantial deterrent for many utility companies and manufacturers. Another critical area of concern is the imperative for establishing robust cybersecurity frameworks to effectively safeguard sensitive operational data and protect critical infrastructure components from sophisticated cyber threats that emerge with increased connectivity. Challenges pertaining to the interoperability of disparate legacy systems with new, AI-enabled technologies also pose considerable implementation hurdles. Moreover, there is an ongoing discussion about the potential for workforce displacement in traditional maintenance and operational roles, underscoring the pressing need for comprehensive reskilling and upskilling initiatives to equip personnel with the necessary competencies to manage and leverage AI-driven systems effectively. Despite these formidable challenges, the overarching sentiment within the industry remains optimistic, reflecting a firm belief in AI's inherent capacity to deliver substantial improvements in grid reliability, achieve significant reductions in operational expenditures, and foster the development of a more adaptive, intelligent, and sustainable electricity distribution network capable of gracefully handling the complexities of renewable energy integration and inherently fluctuating demand patterns.

- Enhanced Predictive Maintenance and Fault Diagnostics: AI algorithms analyze vast datasets from sensors on transformers to predict potential equipment failures with high accuracy, enabling proactive maintenance scheduling and significantly reducing unexpected outages and costly repairs.

- Optimized Grid Load Balancing and Voltage Regulation: AI systems continuously monitor grid conditions, allowing for real-time adjustment of transformer tap settings and dynamic load distribution, which enhances energy efficiency, minimizes losses, and ensures stable voltage supply across the network.

- Seamless Smart Grid Integration: AI acts as a central intelligence layer, facilitating robust communication and and coordination between distribution transformers and other smart grid components, supporting decentralized energy generation and intelligent demand-side management.

- Advanced Asset Performance Management: By leveraging AI for data analysis, utilities can gain deeper insights into the operational health and remaining useful life of their transformer fleet, optimizing capital expenditure planning, maintenance cycles, and asset replacement strategies.

- Improved Design and Manufacturing Processes: AI-powered simulation and optimization tools allow engineers to create more efficient and robust transformer designs, predict material performance, and streamline manufacturing workflows, leading to reduced costs and faster production.

- Proactive Cybersecurity and Anomaly Detection: AI algorithms continuously analyze network traffic and operational data for unusual patterns, enabling early detection and mitigation of cyber threats or unusual operational anomalies that could compromise grid security.

- Energy Theft Identification and Revenue Protection: AI systems can analyze smart meter data to identify patterns indicative of non-technical losses, such as electricity theft, helping utilities to improve revenue collection and enhance grid integrity.

DRO & Impact Forces Of Distribution Transformer Market

The Distribution Transformer Market is profoundly influenced by a complex interplay of powerful drivers, inherent restraints, emerging opportunities, and broader external impact forces, all of which collectively define its evolutionary trajectory and competitive landscape. A paramount driver is the inexorable global surge in electricity demand, fueled by an expanding global population, accelerating urbanization rates, and robust industrial expansion, particularly prominent in rapidly developing economies. This escalating demand necessitates significant expansions and reinforcements of existing power distribution networks, thereby creating a sustained and substantial demand for new distribution transformers. Concurrently, developed economies are confronting the critical challenge of an aging grid infrastructure, which mandates extensive modernization and replacement initiatives to enhance reliability, reduce energy losses, and comply with contemporary safety standards, further stimulating market growth. Additionally, the global pivot towards sustainable energy sources has led to a significant increase in the integration of renewable energy projects such as solar farms and wind power installations. These intermittent generation sources require sophisticated and adaptable distribution transformers capable of managing bidirectional power flows and ensuring grid stability, thus acting as a crucial catalyst for market expansion.

Despite these potent drivers, the market is simultaneously constrained by several formidable factors that can impede its growth potential. A significant restraint is the substantial capital expenditure required not only for the establishment and expansion of advanced transformer manufacturing facilities but also for the extensive installation and commissioning processes, particularly for larger and specialized units. This high initial investment can be a deterrent for new market entrants and can strain the budgets of utility companies, especially in regions with limited financial resources. Furthermore, the market is highly susceptible to the volatility of raw material prices, particularly for essential components like high-grade electrical steel, copper or aluminum for windings, and transformer oil. Unpredictable fluctuations in commodity markets introduce considerable cost uncertainties for manufacturers, directly impacting production costs, profit margins, and ultimately, the final pricing of distribution transformers for end-users. Moreover, the industry operates within an increasingly complex and stringent regulatory landscape, encompassing strict energy efficiency standards, environmental protection mandates (e.g., regulations on hazardous materials, noise levels), and comprehensive safety protocols. Adhering to these evolving regulations necessitates continuous research and development, product innovation, and rigorous compliance efforts, often leading to increased production costs and potentially longer product development cycles.

Amidst these challenges, the Distribution Transformer Market is replete with significant opportunities, predominantly centered around technological innovation and emerging market penetration. The rapid evolution of smart grid technologies presents a monumental opportunity for the widespread integration of intelligent transformers equipped with advanced sensors, communication modules, and embedded analytics capabilities, enabling unprecedented levels of grid resilience, operational efficiency, and real-time control. The growing global imperative for energy efficiency and environmental sustainability is fostering a robust demand for innovative, low-loss, and eco-friendly transformers, such as amorphous metal core and ester-filled units, thereby opening new product development avenues. Additionally, substantial market opportunities exist in emerging economies across Africa, Latin America, and various parts of Asia, where electrification rates are still improving and significant infrastructure development projects are underway. These regions offer vast potential for market penetration and growth as they build out their foundational power distribution networks. Broader impact forces, including the relentless pace of technological advancements in materials science, digital systems, and manufacturing automation, which continuously push the boundaries of transformer performance. Evolving environmental policies globally, particularly those related to climate change and carbon reduction, exert pressure on the industry to adopt greener solutions. Global macroeconomic trends, influencing infrastructure spending and investment confidence, alongside geopolitical stability impacting raw material supply chains and international trade, also play a critical role in shaping the market's future landscape and strategic directions for all stakeholders.

Segmentation Analysis

The Distribution Transformer Market is meticulously segmented across various crucial parameters, offering a granular and comprehensive understanding of its intricate dynamics, demand patterns, and technological preferences within different operational contexts and geographical regions. This multi-dimensional segmentation is indispensable for market participants, including manufacturers, suppliers, utility companies, and investors, as it provides actionable insights necessary for strategic decision-making, targeted product development, precise market forecasting, and effective market entry strategies. By dissecting the market into these distinct components, stakeholders can accurately identify specific growth drivers, competitive landscapes, and unmet needs within each segment, enabling the formulation of highly optimized business strategies.

The segmentation by type, specifically differentiating between oil-filled and dry-type transformers, highlights the diverse application scenarios and inherent advantages of each. Oil-filled transformers, with their superior cooling capabilities and established economic efficiency, traditionally dominate large-scale outdoor utility and heavy industrial applications. Their robust design and lower initial cost continue to make them a preferred choice in many markets. Conversely, the dry-type transformer segment is experiencing accelerated adoption due to its enhanced safety features, particularly concerning fire hazards, minimal environmental impact (as they do not use liquid coolants), and reduced maintenance requirements. These attributes make dry-type units ideal for indoor, urban, and environmentally sensitive areas such as data centers, hospitals, and high-rise commercial buildings where safety and environmental considerations are paramount. This bifurcation underscores a clear market evolution driven by evolving regulatory landscapes and increasing emphasis on safety and sustainability.

Further granularity is achieved through segmentation by phase (single-phase and three-phase), reflecting the fundamental differences in electricity distribution architectures and power requirements. Single-phase transformers are commonly deployed in residential areas and light commercial applications where lower power demands are prevalent and cost-efficiency is a key consideration. In contrast, three-phase transformers are indispensable for industrial facilities, large commercial complexes, and extensive utility grid applications that require substantial power and higher voltage levels for operating heavy machinery and critical infrastructure. The segmentation by insulation type (oil, dry, gas), power rating (e.g., Below 500 kVA, 501 kVA – 2,500 kVA, Above 2,500 kVA), and diverse application areas (Residential, Commercial, Industrial, Utility) further refines the market analysis. This allows for a detailed examination of how specific technological advancements, regulatory mandates, and end-user demands influence adoption patterns and create distinct growth opportunities within each specialized market niche, collectively painting a holistic picture of the distribution transformer market's complex structure.

- By Type: This fundamental segmentation distinguishes transformers based on their insulation and cooling medium, dictating their application suitability and performance characteristics.

- Oil-filled Transformers: These units utilize mineral oil or advanced synthetic ester fluids for both electrical insulation and efficient heat dissipation. They are highly efficient, cost-effective, and primarily deployed in outdoor environments for utility substations, industrial sites, and rural distribution networks, offering excellent cooling for high power ratings.

- Dry-type Transformers: Employing air, solid insulating materials like cast resin, or vacuum pressure impregnated (VPI) coils for insulation and cooling, dry-type transformers are renowned for their enhanced safety (non-flammable), minimal environmental impact, and suitability for indoor, urban, and sensitive applications such as hospitals, data centers, and high-rise commercial buildings where fire risk and limited space are critical considerations.

- By Phase: Classification based on the number of electrical phases the transformer is designed to handle, directly correlating with the power system architecture.

- Single Phase Transformers: Primarily used in residential and light commercial applications, these transformers step down voltage for single-phase power distribution, common in many household and small business settings.

- Three Phase Transformers: Essential for robust industrial machinery, large commercial establishments, and the backbone of utility power distribution grids, these units handle three-phase power, offering higher efficiency and capacity for heavy loads.

- By Insulation: Categorization focusing on the specific type of insulating material utilized, impacting safety, environmental profile, and operational characteristics.

- Oil Insulated Transformers: This segment constitutes the largest share, leveraging various types of oil (mineral, natural ester, synthetic ester) for superior insulation and cooling, primarily for outdoor utility and industrial installations.

- Dry Insulated Transformers: Encompasses units insulated by air, solid resin (cast resin transformers), or vacuum pressure impregnated (VPI) types, valued for fire safety, low maintenance, and suitability for indoor applications.

- Gas Insulated Transformers: A specialized niche utilizing inert gases like SF6 or environmentally friendly alternatives for insulation, offering compact design and enhanced safety in specific high-voltage applications or confined spaces.

- By Power Rating: Segmentation according to the maximum apparent power (measured in kVA) a transformer can continuously deliver, reflecting diverse application requirements.

- Below 500 kVA: This category serves smaller-scale power distribution needs, typically found in residential areas, small commercial enterprises, and light industrial facilities.

- 501 kVA – 2,500 kVA: Common for medium-sized commercial buildings, industrial facilities, and suburban utility grid applications, balancing capacity and footprint.

- Above 2,500 kVA: Designed for high-power demanding applications in large industrial complexes, major utility substations, and critical infrastructure, requiring robust construction and advanced cooling.

- By Application: Classification based on the end-use sector where the transformers are installed and utilized, reflecting distinct market drivers and operational environments.

- Residential: Transformers that deliver power to individual homes, apartment complexes, and local community developments, ensuring stable and safe electricity for household appliances and lighting.

- Commercial: Supplying power to a wide range of commercial establishments, including office buildings, shopping malls, hospitals, hotels, data centers, and other commercial institutions, often with stringent uptime requirements.

- Industrial: Meeting the rigorous and often fluctuating power demands of manufacturing plants, processing industries, mining operations, oil & gas facilities, and heavy industrial complexes, where reliability and capacity are paramount.

- Utility: Essential components of public and private electricity distribution networks, deployed in substations, overhead lines, and underground systems to reliably deliver power from the transmission grid to various end-users.

Value Chain Analysis For Distribution Transformer Market

The value chain for the Distribution Transformer Market is an intricate, multi-stage process that systematically adds value from the initial sourcing of raw materials through to the final installation and after-sales support of the product. Understanding this chain is crucial for identifying cost drivers, potential efficiencies, and strategic leverage points for market participants. The upstream segment of this value chain is foundational, encompassing the meticulous procurement of a diverse array of specialized raw materials that critically determine the transformer's performance, durability, and overall cost. Key inputs include high-grade electrical steel, predominantly grain-oriented electrical steel (GOES) or increasingly amorphous metal alloys for the core, high-purity copper or aluminum for windings, and a variety of advanced insulating materials such as mineral oil, synthetic ester fluids, kraft paper, or epoxy resins. Essential structural components like robust steel tanks, bushings, tap changers, and cooling accessories are also sourced from specialized suppliers. The efficiency, reliability, and cost-competitiveness of these raw material and component suppliers are paramount, as fluctuations in global commodity prices for metals like copper and steel can significantly impact manufacturing costs and, consequently, the final market pricing and profitability of distribution transformers. Strategic long-term supplier relationships and robust supply chain management are thus critical for mitigating risks and ensuring stable production.

Following the procurement phase, the core manufacturing process represents the most intensive value-adding stage, involving the precise engineering design, fabrication, assembly, and rigorous testing of the transformers in accordance with stringent national and international standards (e.g., IEEE, IEC). This stage encompasses several complex steps: the cutting and stacking of electrical steel laminations to form the transformer core, the winding of primary and secondary coils (often involving specialized machinery for precision winding), the intricate assembly of the core-coil structure, and its placement into the transformer tank. For oil-filled units, this is followed by vacuum drying and filling with dielectric fluid. Dry-type transformers undergo resin casting or vacuum pressure impregnation. Manufacturers invest heavily in research and development to innovate in areas such as reduced losses, smart capabilities, and eco-friendly designs. The adoption of advanced manufacturing technologies, including automation, robotics, and digital quality control systems, is increasingly prevalent to improve production efficiency, ensure consistent product quality, and accelerate time-to-market for new and customized solutions. This stage also demands a highly skilled workforce, extensive engineering expertise, and significant capital investment in machinery and testing facilities.

The downstream segment of the value chain focuses on the efficient distribution, sales, and delivery of finished distribution transformers to a diverse base of end-users. Distribution channels are varied and typically categorized into direct and indirect approaches. Direct distribution involves sales directly from transformer manufacturers to major electric utility companies, large industrial enterprises, or significant commercial developers, often through long-term contracts, framework agreements, and direct engagement with their engineering and procurement teams. This channel allows for custom solutions and direct technical support. Indirect distribution, conversely, leverages a network of specialized distributors, wholesalers, electrical contractors, and system integrators. These intermediaries play a crucial role in expanding market reach, particularly to smaller utility cooperatives, commercial building contractors, and individual industrial clients. They often provide valuable logistical support, inventory management, localized technical expertise, and sometimes installation and after-sales services, bridging the gap between manufacturers and a broader customer base. The effectiveness and optimization of these distribution networks are critical determinants of market penetration, customer accessibility, and overall sales volume. Post-sales services, including installation support, commissioning, maintenance, and repair, also form an increasingly important part of the value chain, ensuring product longevity and customer satisfaction, and often representing an additional revenue stream for manufacturers and their partners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 14.5 billion |

| Market Forecast in 2032 | USD 23.6 billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens Energy, General Electric, Schneider Electric, Eaton, Hitachi Energy, Mitsubishi Electric, Toshiba, Bharat Heavy Electricals Limited (BHEL), CG Power and Industrial Solutions, Hyosung Heavy Industries, SPX Transformer Solutions, Wilson Transformer Company, TBEA Co. Ltd., Shandong Luneng Electric Co. Ltd., Jiangsu Huapeng Transformer Co. Ltd., ZTR Control Systems, WEG S.A., Prolec GE, VAUDE Group, Virginia Transformer Corp., MGM Transformer Company, Delta Star, Inc., Ermco, Inc., Hyundai Electric & Energy Systems Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Distribution Transformer Market Key Technology Landscape

The Distribution Transformer Market is undergoing a profound and accelerating technological transformation, primarily driven by the urgent global imperative for enhanced energy efficiency, superior grid resilience, and profound environmental sustainability. A cornerstone of this evolution is the pervasive proliferation of smart transformers, which transcend their conventional role of mere voltage conversion by integrating highly advanced sensors, robust communication modules, and sophisticated embedded processing capabilities. These intelligent devices are capable of continuous, real-time monitoring of a comprehensive array of critical operational parameters, including load profiles, precise voltage levels, operational temperatures, and even incipient partial discharges. This constant stream of invaluable data facilitates the implementation of highly proactive and predictive maintenance strategies, enabling utility operators to anticipate and effectively address potential failures long before they escalate into costly and disruptive outages. This significantly enhances overall grid reliability, minimizes operational expenditures, and extends the useful lifespan of critical assets. Furthermore, smart transformers are becoming an indispensable component of the broader smart grid ecosystem, actively facilitating dynamic grid optimization, intelligent demand response management, and the seamless integration of distributed energy resources, thereby contributing to a far more adaptive, flexible, and robust power network architecture.

Another pivotal technological advancement reshaping the market is the widespread adoption and continuous improvement of amorphous metal core distribution transformers (AMDTs). These innovative transformers utilize a unique amorphous metal alloy in their core, distinguished by its non-crystalline atomic structure. This distinct material property drastically reduces core losses, specifically no-load losses, by up to 70% compared to conventional transformers that rely on traditional grain-oriented electrical steel (GOES) cores. While AMDTs typically entail a higher initial capital outlay, their exceptional energy efficiency translates into substantial long-term operational savings for utilities and end-users, alongside a significant reduction in greenhouse gas emissions. This aligns perfectly with increasingly stringent global energy efficiency mandates and ambitious environmental regulations. Concurrently, the growing emphasis on developing eco-friendly and intrinsically fire-safe power solutions has vigorously spurred innovations in insulation materials. This has led to the accelerated development and greater market acceptance of ester-filled transformers, which utilize biodegradable and less flammable natural or synthetic ester liquids instead of conventional mineral oil. Additionally, advanced dry-type transformers, incorporating sophisticated cast resin or vacuum pressure impregnation (VPI) technologies, are gaining significant traction, particularly for deployment in urban, indoor, and sensitive industrial applications where fire safety, environmental impact, and compact footprints are paramount considerations.

Beyond the core materials and insulation technologies, the distribution transformer market is increasingly leveraging advanced digital technologies to revolutionize asset lifecycle management, enhance operational performance, and foster continuous innovation. The deployment of sophisticated remote diagnostic tools, coupled with the application of digital twin technology, allows manufacturers and operators to create precise virtual models of physical transformers. These digital twins enable comprehensive condition monitoring, facilitate predictive maintenance through AI-powered analytics, and permit the simulation of various operational scenarios to optimize performance and predict maintenance needs with remarkable accuracy, thereby extending asset life and boosting overall efficiency. Advanced manufacturing processes, characterized by higher levels of automation, robotic assembly, and precision engineering, are also contributing significantly to the production of more reliable, consistent, and higher-performing distribution transformers, ensuring that new units not only meet but often exceed the stringent demands of modern power grids, ultimately contributing to a more sustainable, resilient, and intelligent global energy future. Furthermore, the integration of IoT sensors and communication modules directly into transformers allows for granular data collection and remote control, fundamentally transforming how these critical assets are managed and maintained throughout their operational lifespan.

Regional Highlights

- North America: The North American market for distribution transformers is predominantly characterized by an urgent imperative to modernize and replace an extensive, aging electrical grid infrastructure. This region is witnessing substantial and sustained investments in cutting-edge smart grid technologies, the progressive digitalization of existing power networks, and the robust integration of diverse renewable energy sources, such as solar and wind power, into the national grids. These factors collectively drive a consistent demand for technologically advanced, highly efficient, and durable distribution transformers. Additionally, stringent energy efficiency standards and reliability mandates imposed by regulatory bodies in both the United States and Canada further propel this demand, alongside a resilient commercial and industrial sector growth that requires a continuously stable and reliable power supply. The focus is increasingly on intelligent, fault-tolerant transformers that can support a decentralized energy architecture and enhance overall grid resilience against extreme weather events.

- Europe: Europe represents a mature but highly dynamic market, strongly driven by ambitious decarbonization goals, aggressive renewable energy deployment targets, and comprehensive smart grid initiatives outlined by the European Union and individual member states. The primary emphasis here is on upgrading and reinforcing existing infrastructure to effectively manage complex bidirectional power flows emanating from increasingly distributed renewable energy generation, alongside a steadfast commitment to enhancing energy efficiency across the entire distribution network. Strict environmental regulations, such as those promoting circular economy principles and sustainable product design, are compelling widespread adoption of advanced, eco-friendly transformer technologies, including ester-filled units and sophisticated dry-type transformers. Key economies like Germany, France, the United Kingdom, and the Nordic countries are at the forefront of these transformations, underpinned by robust policy frameworks, significant research and development investments, and a strong public and private sector collaboration to achieve sustainable energy transition objectives.

- Asia Pacific (APAC): The Asia Pacific region undeniably stands as the largest and most rapidly expanding market for distribution transformers globally. This unparalleled growth is primarily fueled by a potent combination of accelerating urbanization, unprecedented industrialization, and sustained economic growth across major economies, most notably China, India, Japan, South Korea, and the burgeoning nations of Southeast Asia. Massive governmental and private sector investments in new power generation capacity, extensive grid expansion projects aimed at achieving universal electricity access, and the establishment of vast new industrial zones are the core drivers of this immense demand for distribution transformers. Furthermore, government-led initiatives for developing smart cities, promoting rural electrification, and upgrading existing power infrastructure to support a rapidly growing population and industrial base contribute significantly to the market's continuous expansion, making APAC a pivotal region influencing global market dynamics and technological trends.

- Latin America: The Latin American market for distribution transformers is experiencing steady and consistent growth, largely propelled by ongoing substantial infrastructure development projects, increasing urbanization rates across the continent, and concerted efforts to expand and improve electricity access in both urban and rural areas. Major economies like Brazil, Mexico, Argentina, and Chile are investing significantly in grid reinforcement, modernization initiatives, and the development of new power transmission and distribution lines to support burgeoning industrial and commercial sectors. The increasing integration of renewable energy projects, particularly hydroelectric, solar, and wind power, coupled with a pressing need to reduce pervasive transmission and distribution losses, further stimulates the demand for more efficient and robust distribution transformers across the region. Policy support for rural electrification and industrial growth also plays a crucial role in shaping market opportunities.

- Middle East and Africa (MEA): The MEA region presents a high-potential market characterized by ambitious long-term development plans such as Saudi Vision 2030 and similar strategic initiatives in the UAE, focusing on economic diversification, the establishment of futuristic smart cities, and large-scale infrastructure overhauls. In the Middle East, substantial investments in critical power infrastructure to support rapid urban development and mega-projects drive demand. Across various African nations, robust population growth and significant electrification initiatives aimed at drastically improving energy access for underserved communities are key drivers. The expansion and modernization of critical sectors, including the traditional oil and gas industry, mining, and emerging manufacturing bases, further create a substantial and growing demand for reliable, resilient, and often climate-appropriate distribution transformers tailored to the region's unique environmental challenges and operational requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Distribution Transformer Market.- ABB

- Siemens Energy

- General Electric

- Schneider Electric

- Eaton

- Hitachi Energy

- Mitsubishi Electric

- Toshiba

- Bharat Heavy Electricals Limited (BHEL)

- CG Power and Industrial Solutions

- Hyosung Heavy Industries

- SPX Transformer Solutions

- Wilson Transformer Company

- TBEA Co. Ltd.

- Shandong Luneng Electric Co. Ltd.

- Jiangsu Huapeng Transformer Co. Ltd.

- ZTR Control Systems

- WEG S.A.

- Prolec GE

- VAUDE Group

- Virginia Transformer Corp.

- MGM Transformer Company

- Delta Star, Inc.

- Ermco, Inc.

- Hyundai Electric & Energy Systems Co. Ltd.

Frequently Asked Questions

What are the primary drivers for the Distribution Transformer Market growth?

The market is primarily driven by the escalating global electricity demand fueled by accelerating urbanization and industrialization, comprehensive grid modernization and vital replacement initiatives for aging infrastructure, and the rapidly growing integration of diverse renewable energy sources into existing power grids worldwide.

What is the key distinction between oil-filled and dry-type distribution transformers?

The fundamental distinction lies in their insulation and cooling mediums: oil-filled transformers employ liquid dielectric (typically mineral oil or ester fluid) for superior cooling and insulation, making them highly efficient and cost-effective for outdoor utility and industrial use. In contrast, dry-type transformers utilize air or solid dielectric materials, offering enhanced fire safety, minimal environmental impact, and ideal suitability for indoor, urban, or fire-sensitive applications like data centers and hospitals.

How is Artificial Intelligence (AI) influencing the future of distribution transformers and grid operations?

Artificial Intelligence is significantly influencing the future by enabling advanced predictive maintenance and precise fault diagnosis, optimizing grid load balancing and voltage regulation in real-time for improved efficiency, facilitating seamless integration within smart grid ecosystems, enhancing comprehensive asset management and lifecycle planning, and ultimately contributing to more resilient, adaptive, and intelligent power distribution networks.

Which geographical region currently holds the largest market share in the Distribution Transformer Market, and what factors contribute to its dominance?

The Asia Pacific (APAC) region currently commands the largest market share. Its dominance is primarily attributed to rapid urbanization, extensive industrialization, and substantial governmental and private sector investments in new power generation capacity, widespread grid expansion projects, and critical infrastructure development across key economies such as China, India, and Southeast Asian nations.

What are the main challenges faced by manufacturers and stakeholders in the Distribution Transformer Market today?

Manufacturers and stakeholders face several key challenges, including high initial capital expenditure for both production and installation, significant volatility in raw material prices (e.g., copper, electrical steel), increasingly stringent global regulatory standards for energy efficiency and environmental impact, and the complexities associated with managing diverse and often global supply chains amidst intense market competition.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager