Dog Food and Snacks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429528 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Dog Food and Snacks Market Size

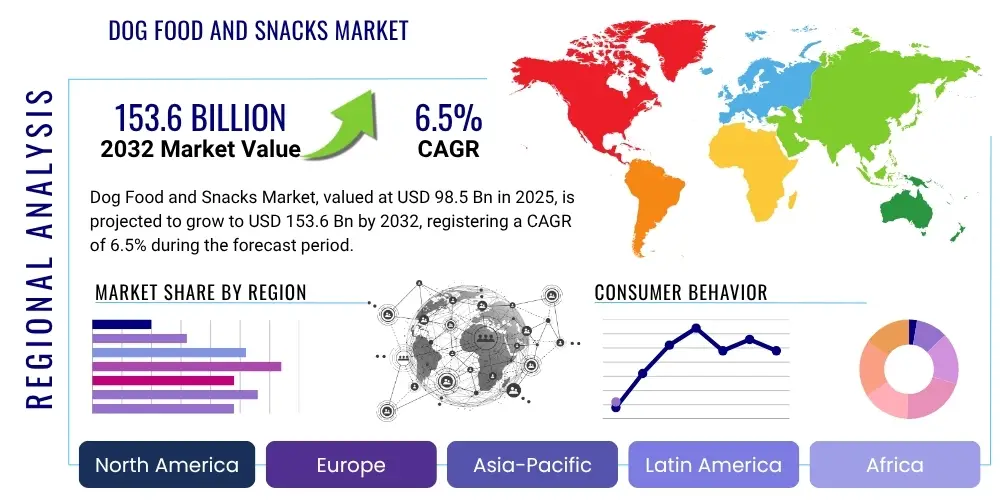

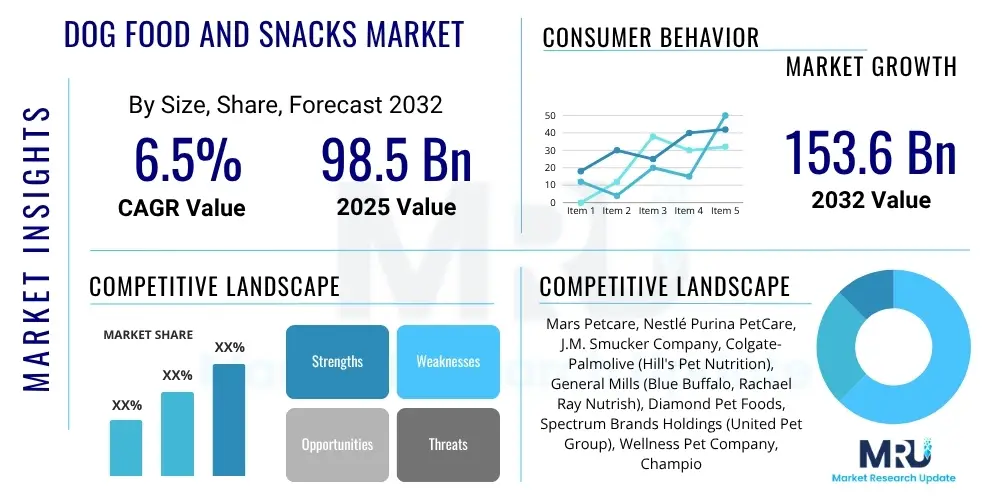

The Dog Food and Snacks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 98.5 billion in 2025 and is projected to reach USD 153.6 billion by the end of the forecast period in 2032.

Dog Food and Snacks Market introduction

The Dog Food and Snacks Market is experiencing robust expansion, fundamentally driven by an accelerating global trend of pet humanization. This phenomenon sees pets increasingly regarded as integral family members, compelling owners to invest more significantly in their companions' health, wellness, and overall quality of life. The market encompasses a vast array of products designed to cater to canine nutritional needs and behavioral enrichment, ranging from staple dry kibble and nutrient-dense wet foods to functional treats, specialized dietary supplements, and innovative chews aimed at promoting dental health. These products serve critical roles, providing complete and balanced daily nutrition essential for growth, maintenance, and energy, acting as vital tools for positive reinforcement during training, and offering specific therapeutic solutions for various health conditions such as allergies, obesity, or joint issues. The inherent benefits extend beyond basic sustenance, contributing to improved coat health, enhanced immune systems, better digestive function, and prolonged vitality, which directly align with evolving consumer expectations for higher quality, transparently sourced, and beneficial pet food offerings.

Products within this sector are characterized by their diverse formulations and intended uses. Dog food, the primary component, provides essential macronutrients and micronutrients necessary for canine health across all life stages, often tailored for specific breeds, sizes, or health requirements. Dog snacks, conversely, serve purposes beyond daily sustenance, including training rewards, dental hygiene support, joint health supplementation, and simply offering a treat. The underlying product descriptions often highlight specific ingredient profiles such as grain-free, limited ingredient, organic, or ethically sourced components, reflecting a growing consumer demand for transparency and naturalness in pet diets. Manufacturers are increasingly focusing on innovations in palatability, digestibility, and functional benefits to differentiate their offerings in a competitive landscape.

Major applications for dog food include providing comprehensive daily nutrition for puppies, adult dogs, and senior dogs, ensuring optimal growth, energy levels, and disease prevention. For dog snacks, applications predominantly involve behavioral training, where treats are used as positive reinforcement to teach commands and encourage desirable behaviors. Dental chews are specifically designed to help reduce plaque and tartar buildup, promoting oral health. Furthermore, a significant segment of the market is dedicated to therapeutic or veterinary diets, formulated to manage specific health conditions under veterinary guidance, such as gastrointestinal sensitivities, kidney disease, or weight management. The primary driving factors for market growth include the continuously rising rates of global pet ownership, particularly in developing regions, coupled with increasing disposable incomes in developed economies that enable higher spending on premium and specialized pet care items. Heightened consumer awareness regarding pet health and nutrition, alongside the expansion of e-commerce channels, further propels market momentum by improving product accessibility and facilitating informed purchasing decisions among pet owners seeking optimal health outcomes for their canine companions.

Dog Food and Snacks Market Executive Summary

The Dog Food and Snacks Market is undergoing significant transformation, marked by several prominent business trends. A key trend is the consolidation of the market through strategic mergers and acquisitions, as larger corporations seek to expand their product portfolios and geographical reach, often acquiring smaller, innovative brands focused on natural or specialty ingredients. Simultaneously, there is a substantial shift towards direct-to-consumer (DTC) sales models, enabling brands to build stronger relationships with pet owners, gather valuable consumer data, and offer personalized product recommendations. Sustainability and ethical sourcing are becoming paramount, influencing ingredient selection, packaging decisions, and overall supply chain management, driven by a growing segment of environmentally conscious consumers. Furthermore, investment in research and development for personalized nutrition solutions, leveraging data analytics and advanced ingredient science, is redefining product offerings, moving beyond generic formulations to highly tailored diets that address individual pet needs. This focus on premiumization and value-added products, despite potential economic fluctuations, continues to characterize the market's growth trajectory, reflecting the enduring commitment of pet owners to their companions' well-being.

Regionally, the market exhibits diverse growth patterns and maturity levels. North America and Europe represent mature markets, characterized by high rates of pet ownership, substantial disposable incomes, and well-established pet food industries. These regions are primary drivers of premiumization, natural ingredient trends, and specialized diets, acting as innovation hubs for new product categories. The Asia Pacific (APAC) region, however, stands out as the fastest-growing market, propelled by rapidly increasing pet ownership, urbanization, and rising middle-class incomes, particularly in countries like China, India, and Southeast Asian nations. This growth is fueled by a burgeoning awareness of pet health and nutrition, leading to increased demand for branded and higher-quality pet food products. Latin America is also experiencing significant expansion, as economic development and cultural shifts lead to greater adoption of pets and a subsequent rise in spending on their care. The Middle East and Africa (MEA) region, while smaller in market size, demonstrates emerging potential as pet ownership becomes more prevalent and pet care infrastructure develops, albeit at a slower pace compared to other regions.

Segment trends reveal a distinct consumer preference for healthier, more natural, and functional product offerings. The natural and organic segment, free from artificial additives, preservatives, and by-products, continues to outperform conventional categories, reflecting pet owners' desire for human-grade ingredients. Grain-free formulations, though subject to some debate, maintain popularity among consumers concerned about potential allergies or sensitivities. Functional foods and treats, enriched with ingredients like probiotics, omega fatty acids, glucosamine, and chondroitin, are experiencing significant demand as owners seek proactive solutions for joint health, digestive wellness, skin and coat health, and immune support. The veterinary diet segment also shows consistent growth, driven by an aging pet population and increased prevalence of chronic diseases requiring specialized nutritional management. Furthermore, the convenience factor associated with various distribution channels, particularly the robust growth of online retail, is reshaping purchasing habits, making a wider array of specialized products accessible to a broader consumer base and contributing to the overall dynamism of the Dog Food and Snacks Market.

AI Impact Analysis on Dog Food and Snacks Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Dog Food and Snacks Market frequently revolve around themes of personalization, efficiency, product innovation, and supply chain optimization. Pet owners are curious about how AI can enable highly customized nutritional plans tailored to their dog's breed, age, activity level, and specific health conditions, moving beyond general recommendations. There is also a strong interest in how AI can streamline the manufacturing process, improve quality control, and enhance the transparency of ingredient sourcing. Furthermore, questions arise about AI's potential in developing novel ingredients or formulations that address complex canine health issues, as well as its role in predictive analytics for pet health and market trends. Concerns often touch upon data privacy for pet health records and the potential for job displacement within traditional manufacturing roles, balanced by expectations for superior product quality and more informed consumer choices. The overarching sentiment is one of cautious optimism, acknowledging AI's transformative potential while seeking assurance regarding ethical implementation and tangible benefits for pet well-being.

- AI-driven personalized nutrition: Custom diet formulations based on breed, age, weight, activity, and health data.

- Optimized supply chain management: Predictive analytics for ingredient sourcing, inventory, and logistics, reducing waste and costs.

- Enhanced quality control: AI vision systems detecting contaminants or inconsistencies in production lines.

- Smart feeding devices: IoT-enabled feeders with AI capabilities for portion control, feeding schedules, and health monitoring.

- Predictive health insights: Analyzing vast datasets to identify patterns related to pet health, enabling proactive dietary adjustments.

- New product development: AI accelerating R&D by simulating ingredient interactions and predicting palatability or efficacy.

- Consumer engagement: AI-powered chatbots and recommendation engines offering tailored advice and product suggestions.

- Manufacturing efficiency: Automation and robotics integrated with AI for improved production speed and accuracy.

DRO & Impact Forces Of Dog Food and Snacks Market

The Dog Food and Snacks Market is primarily driven by several compelling factors. The escalating trend of pet humanization globally is a major catalyst, as owners increasingly treat their pets as family members, leading to a willingness to spend more on premium, high-quality, and health-focused products. This is further supported by a significant increase in pet ownership rates across various demographics and geographical regions, particularly in emerging economies where disposable incomes are on the rise. Growing awareness among pet owners regarding the crucial link between nutrition and long-term pet health also drives demand for specialized and functional diets. Furthermore, the robust expansion of e-commerce platforms has significantly enhanced product accessibility, offering a wider variety of specialized dog food and snacks to a broader consumer base, thereby stimulating market growth and allowing niche brands to thrive. These drivers collectively create a dynamic environment for innovation and market expansion within the pet food industry.

Despite the strong growth drivers, the market faces notable restraints that could impede its expansion. Volatility in the cost of raw materials, including meat proteins, grains, and specialty ingredients, presents a continuous challenge for manufacturers, affecting pricing strategies and profit margins. The increasingly stringent regulatory landscape governing pet food safety, labeling, and ingredient sourcing in various regions imposes compliance burdens on companies, potentially increasing operational costs and market entry barriers. Public health concerns related to pet food recalls due to contamination or undeclared allergens can severely impact consumer trust and brand reputation, leading to significant financial losses and market disruption. Moreover, the perceived high price point of premium and specialized dog food products may limit adoption in price-sensitive consumer segments, especially during economic downturns, thereby constraining overall market growth potential. Addressing these restraints effectively requires strategic sourcing, robust quality control, and transparent communication with consumers.

Opportunities within the Dog Food and Snacks Market are abundant and diverse, promising continued innovation and expansion. The burgeoning demand for personalized nutrition solutions, leveraging advanced data analytics and biotechnological advancements, represents a significant growth avenue, allowing for highly tailored dietary plans based on individual pet characteristics. The increasing consumer preference for sustainable and ethically sourced ingredients, including plant-based proteins and insect-based formulations, opens new product development pathways that align with environmental consciousness. Expanding into emerging markets, particularly in Asia Pacific and Latin America, where pet ownership is rising rapidly and pet care infrastructure is developing, offers substantial untapped potential. Furthermore, the integration of technology, such as smart feeding devices with IoT capabilities and AI-driven platforms for health monitoring, creates opportunities for value-added services and products that enhance convenience and pet well-being. These opportunities encourage strategic investments and collaborations, fostering a competitive yet innovative market landscape. The confluence of these drivers, restraints, and opportunities creates complex impact forces that continuously shape market dynamics, requiring agile strategies from market participants to navigate evolving consumer demands, regulatory pressures, and technological advancements.

Segmentation Analysis

The Dog Food and Snacks Market is extensively segmented to reflect the diverse needs of canine companions and the varied preferences of their owners. This comprehensive segmentation allows market players to identify specific consumer groups and tailor product development, marketing strategies, and distribution channels accordingly. The market is typically categorized by product type, ingredient type, distribution channel, pricing category, life stage, and health condition, each representing a distinct value proposition and target demographic. Understanding these segments is crucial for analyzing market dynamics, competitive landscapes, and future growth opportunities, as consumer behavior often varies significantly across these classifications. The granularity of these segments highlights the industry's maturation and its increasing focus on specialized and customized solutions for pet health and well-being.

- By Product Type:

- Dry Food (Kibble): The largest segment, offering convenience, cost-effectiveness, and dental benefits.

- Wet Food (Canned/Pouches): Provides hydration, palatability, and often used for older or picky eaters.

- Treats and Chews: Includes training treats, dental chews, functional treats, and recreational chews.

- Veterinary Diets: Specialized formulations for specific health conditions, requiring veterinary recommendation.

- Supplements: Vitamins, minerals, probiotics, joint support, and other nutritional enhancers.

- By Ingredient Type:

- Animal-Derived: Poultry, beef, lamb, fish, pork as primary protein sources.

- Plant-Derived: Grains (rice, corn, wheat), legumes (peas, lentils), vegetables, fruits.

- Grain-Free: Formulations avoiding common grains, catering to specific dietary preferences or sensitivities.

- Organic and Natural: Products made with certified organic ingredients or minimal processing and no artificial additives.

- Novel Proteins: Such as insect protein, venison, duck, offering alternatives for sensitive dogs.

- By Distribution Channel:

- Specialty Pet Stores: Offer a wide range of premium products and expert advice.

- Supermarkets and Hypermarkets: Broad accessibility, convenience, and a variety of mainstream brands.

- Online Retail: Rapidly growing channel, offering extensive product selection, competitive pricing, and home delivery.

- Veterinary Clinics: Primary channel for prescription diets and specialized health products.

- Other Channels: Farm supply stores, mass merchandisers, direct-to-consumer (DTC).

- By Pricing Category:

- Economy: Budget-friendly options, typically with standard ingredients.

- Mid-Range: Balanced quality and price, popular among a wide consumer base.

- Premium: High-quality ingredients, specialized formulations, often with health benefits.

- Super-Premium/Ultra-Premium: Focus on human-grade ingredients, unique formulations, and advanced nutritional science.

- By Life Stage:

- Puppy: Formulations supporting rapid growth and development.

- Adult: Maintenance diets for healthy adult dogs.

- Senior: Tailored for older dogs, addressing joint health, weight management, and cognitive function.

- All Life Stages: Products suitable for dogs of any age.

- By Health Condition:

- Weight Management: Low-calorie or high-fiber diets.

- Digestive Health: Formulations with probiotics, prebiotics, and easily digestible ingredients.

- Allergy Care/Sensitive Skin & Stomach: Limited ingredient diets or novel protein sources.

- Joint Support: Enriched with glucosamine, chondroitin, and omega-3 fatty acids.

- Urinary Health: Diets designed to support urinary tract function.

Value Chain Analysis For Dog Food and Snacks Market

The value chain for the Dog Food and Snacks Market begins with a complex upstream analysis focused on the sourcing and procurement of raw materials. This initial stage is critical and involves obtaining high-quality protein sources such as meat, poultry, and fish, as well as plant-based ingredients like grains, vegetables, and fruits. Key players in this segment include agricultural suppliers, rendering plants, and ingredient processors who must adhere to stringent quality and safety standards. The increasing demand for natural, organic, and ethically sourced ingredients adds complexity to this phase, requiring manufacturers to establish robust supplier relationships, implement traceability systems, and often engage in sustainable procurement practices. Any disruption or quality compromise at this stage can have significant downstream implications, impacting product integrity, brand reputation, and consumer trust, thereby emphasizing the importance of rigorous supplier qualification and continuous monitoring.

Following the upstream activities, the raw materials move into the manufacturing and processing phase, where formulation, production, and packaging take place. This stage involves complex processes such as extrusion for dry kibble, thermal processing for wet foods, and specialized techniques for treats and supplements. Manufacturers invest heavily in research and development to create nutritionally balanced, palatable, and safe products that meet specific dietary requirements and consumer preferences. Quality control, food safety testing, and adherence to regulatory guidelines are paramount throughout the manufacturing process. Once produced, products enter the distribution channels, which include both direct and indirect routes. Direct distribution involves manufacturers selling directly to consumers through their own e-commerce platforms or branded stores, fostering closer relationships and offering personalized services. Indirect distribution, which constitutes a larger portion of the market, involves leveraging a network of wholesalers, distributors, and retailers to reach the end consumer efficiently. This multi-layered approach ensures broad market penetration and availability across diverse retail environments.

The downstream analysis focuses on how products reach the end-users and the mechanisms for consumption. Key distribution channels include specialty pet stores, which often provide expert advice and a curated selection of premium products; supermarkets and hypermarkets, offering convenience and broad accessibility for mass-market brands; and the rapidly expanding online retail segment, which provides extensive product variety, competitive pricing, and home delivery services. Veterinary clinics also serve as a crucial channel, particularly for therapeutic diets and supplements, where professional medical guidance is necessary. The direct-to-consumer model is gaining traction, allowing brands to bypass traditional retail intermediaries, manage their brand image, and gather direct customer feedback. These channels collectively ensure that dog food and snacks are readily available to pet owners. The end-users or buyers of these products are predominantly individual pet owners, but also include breeders, kennels, animal shelters, and veterinary practices. The effectiveness of the value chain relies on seamless coordination between all these segments, from ingredient sourcing to product delivery, to ensure consumer satisfaction and drive market growth while maintaining product quality and safety standards.

Dog Food and Snacks Market Potential Customers

The primary potential customers for the Dog Food and Snacks Market are diverse, encompassing a broad spectrum of individuals and entities that care for canine companions. The largest segment consists of individual pet owners who prioritize the health, nutrition, and well-being of their dogs, viewing them as cherished family members. This demographic includes various income levels, age groups, and lifestyles, from millennials opting for premium, organic foods to retirees seeking specialized diets for their aging pets. These owners often conduct extensive research, read product reviews, and seek recommendations from veterinarians or pet care professionals to make informed purchasing decisions. Their purchasing motivations are driven by factors such as product quality, ingredient transparency, brand reputation, efficacy in addressing specific health concerns, and increasingly, ethical sourcing and sustainability practices. The strong emotional bond between owners and their dogs directly translates into a willingness to invest in high-quality food and treats.

Beyond individual households, several other entities represent significant potential customers. Professional dog breeders require high-quality nutrition to support the health of breeding animals and ensure the optimal growth and development of puppies, often purchasing in bulk and seeking specialized formulations. Commercial kennels and dog boarding facilities are also key buyers, needing cost-effective yet nutritious options to feed a large number of dogs on a regular basis. Animal shelters and rescue organizations represent another important customer segment, relying on donations or budget-friendly options to provide essential sustenance for the animals under their care. Furthermore, veterinary clinics, while often serving as a distribution channel for specific therapeutic diets, are also direct buyers for in-house use, especially for hospitalizing or recovering animals. Each of these customer groups possesses unique purchasing criteria, volume requirements, and brand preferences, necessitating tailored product offerings and marketing approaches from manufacturers within the Dog Food and Snacks Market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 98.5 billion |

| Market Forecast in 2032 | USD 153.6 billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mars Petcare, Nestlé Purina PetCare, J.M. Smucker Company, Colgate-Palmolive (Hill's Pet Nutrition), General Mills (Blue Buffalo, Rachael Ray Nutrish), Diamond Pet Foods, Spectrum Brands Holdings (United Pet Group), Wellness Pet Company, Champion Petfoods (Orijen, Acana), Freshpet, JustFoodForDogs, The Farmer's Dog, Royal Canin, Pedigree, IAMS, Eukanuba, Nature's Variety, Nulo, Canidae Pet Food, Merrick Pet Care. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dog Food and Snacks Market Key Technology Landscape

The Dog Food and Snacks Market is increasingly being shaped by advanced technological innovations across its entire value chain, from ingredient sourcing to personalized feeding. In manufacturing, sophisticated extrusion technologies are continuously evolving to produce dry kibble with enhanced nutritional integrity, palatability, and digestibility, often incorporating novel ingredients and specialized coatings. Precision nutrition is a burgeoning area, utilizing advanced analytical tools and bioinformatics to formulate diets that precisely meet a dog's specific needs, considering genetic predispositions, activity levels, and health conditions. Furthermore, the development of functional ingredient encapsulation technologies ensures the stability and targeted delivery of sensitive nutrients like probiotics, enzymes, and vitamins, thereby maximizing their efficacy within pet food matrices. These advancements in processing and formulation are critical for meeting the growing demand for high-quality, health-beneficial, and highly specialized pet food products.

Beyond production, smart technologies are profoundly impacting how pet food is delivered and consumed. The proliferation of smart feeding devices, often integrated with Internet of Things (IoT) capabilities, allows pet owners to automate feeding schedules, control portion sizes remotely, and monitor their dog's eating habits. These devices can collect valuable data on consumption patterns, which, when analyzed, provide insights into a pet's health and dietary needs. Artificial Intelligence (AI) and machine learning algorithms are being deployed to analyze this data, along with veterinary records and breed-specific information, to offer personalized dietary recommendations and even predict potential health issues. This shift towards data-driven pet care enables a more proactive and tailored approach to canine nutrition, moving beyond traditional one-size-fits-all solutions and enhancing the overall well-being of pets through informed feeding strategies. Packaging technology is also advancing with features like resealable bags for freshness, sustainable and biodegradable materials, and even smart packaging with QR codes for enhanced traceability and consumer information access.

The application of biotechnology and advanced ingredient science is also a significant aspect of the technology landscape. Research into novel protein sources, such as insect-based proteins or cultivated meat alternatives, is driven by sustainability concerns and the need for hypoallergenic options. Genetic sequencing and microbiome analysis are providing deeper insights into canine digestive health, leading to the development of highly targeted prebiotics and probiotics. Robotics and automation are becoming increasingly common in manufacturing facilities, improving efficiency, consistency, and reducing human error in production. Furthermore, blockchain technology is being explored to enhance supply chain transparency and traceability, allowing consumers to verify the origin and journey of ingredients from farm to bowl, addressing concerns about product safety and ethical sourcing. These technologies collectively underscore a future where dog food and snacks are not just sustenance, but a highly customized, intelligently managed, and transparently sourced component of comprehensive pet health management, continuously adapting to both scientific advancements and evolving consumer expectations for their beloved canine companions.

Regional Highlights

- North America: This region holds the largest market share, driven by high rates of pet ownership, significant disposable incomes, and a strong culture of pet humanization. The United States is a dominant force, characterized by a mature market with a robust demand for premium, natural, organic, and specialized dog food and snacks. Innovation in functional ingredients, veterinary diets, and subscription-based pet food services is particularly strong here. Canada also exhibits substantial growth, mirroring U.S. trends with an emphasis on health and wellness.

- Europe: The European market is a significant contributor, marked by high pet ownership, particularly in Western European countries like Germany, the UK, and France. There is a strong consumer preference for natural, organic, and locally sourced ingredients, along with a rising demand for sustainable and ethically produced pet food. Stringent food safety regulations and a focus on animal welfare also shape product development and market dynamics, encouraging continuous innovation in transparent labeling and high-quality formulations.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by increasing urbanization, rising disposable incomes, and a cultural shift towards pet adoption, especially in emerging economies such as China, India, Japan, and Australia. The expanding middle class in these countries is driving greater expenditure on premium and branded pet food products. Convenience and accessibility through modern retail channels and booming e-commerce platforms are key factors accelerating market penetration and growth across the diverse consumer landscape of the region.

- Latin America: This region presents considerable growth potential, with increasing pet ownership and a growing awareness of pet health and nutrition. Countries like Brazil, Mexico, and Argentina are leading the market expansion, as economic development and cultural influences lead to greater investment in pet care. While economy and mid-range products historically dominated, there is a clear upward trend in demand for higher-quality and specialized dog food as consumer incomes and education levels rise, fostering market diversification.

- Middle East and Africa (MEA): The MEA market is currently smaller but exhibits promising long-term growth prospects. Rising disposable incomes, westernization of pet ownership trends, and increasing availability of international pet food brands are contributing to its nascent development. Growth is observed in urban centers, with increasing demand for packaged pet food over traditional feeding methods. Infrastructure development for pet care services and retail is gradually improving, paving the way for further market expansion in the coming years.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dog Food and Snacks Market.- Mars Petcare

- Nestlé Purina PetCare

- J.M. Smucker Company

- Colgate-Palmolive (Hill's Pet Nutrition)

- General Mills (Blue Buffalo, Rachael Ray Nutrish)

- Diamond Pet Foods

- Spectrum Brands Holdings (United Pet Group)

- Wellness Pet Company

- Champion Petfoods (Orijen, Acana)

- Freshpet

- JustFoodForDogs

- The Farmer's Dog

- Royal Canin

- Pedigree

- IAMS

- Eukanuba

- Nature's Variety

- Nulo

- Canidae Pet Food

- Merrick Pet Care

Frequently Asked Questions

What are the primary drivers for the growth of the Dog Food and Snacks Market?

The primary drivers include the escalating trend of pet humanization, where pets are treated as family members, leading to increased spending on their care. Additionally, rising global pet ownership rates, growing disposable incomes, enhanced consumer awareness regarding pet health and nutrition, and the widespread adoption of e-commerce platforms significantly propel market expansion.

Which product segments are showing the most significant growth within the market?

The segments exhibiting the most significant growth are premium, natural, and organic dog food, along with functional treats and veterinary diets. Consumers are increasingly seeking products with high-quality ingredients, specialized formulations for specific health benefits, and those free from artificial additives, reflecting a broader trend towards healthier pet lifestyles.

How is AI impacting the Dog Food and Snacks Market?

AI is transforming the market through personalized nutrition solutions, optimizing supply chain management for efficiency and traceability, and enhancing quality control in manufacturing. It also contributes to smart feeding devices for automated feeding and health monitoring, and aids in new product development by simulating ingredient interactions and predicting palatability.

What are the main distribution channels for dog food and snacks?

The main distribution channels include specialty pet stores, which offer premium products and expert advice; supermarkets and hypermarkets for broad accessibility; and online retail, which is a rapidly growing channel offering convenience, extensive selection, and competitive pricing. Veterinary clinics also serve as a crucial channel for prescription diets and specialized health products.

Which geographic region currently dominates the Dog Food and Snacks Market and why?

North America currently dominates the Dog Food and Snacks Market. This dominance is attributed to high pet ownership rates, substantial disposable incomes, a strong cultural emphasis on pet humanization, and a well-established infrastructure for pet care and product innovation, especially in premium and specialized segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager