Dragline Excavator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430181 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Dragline Excavator Market Size

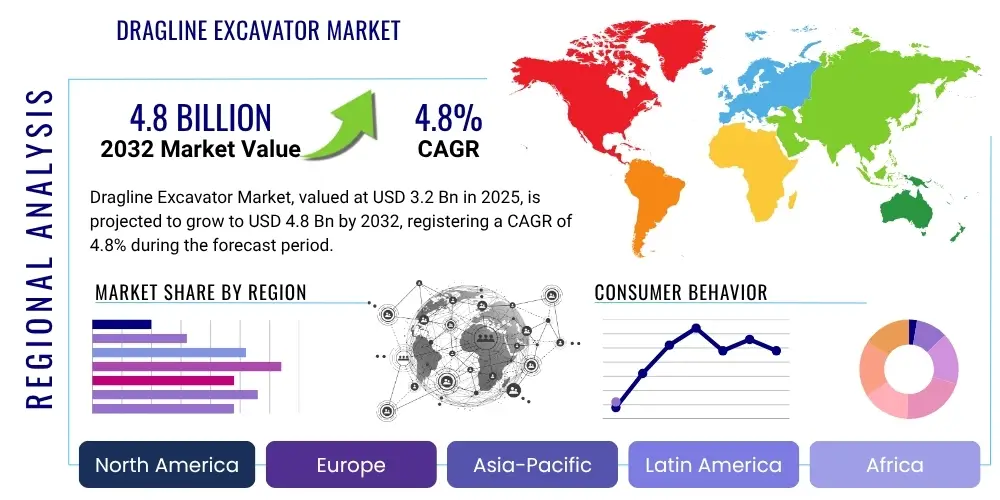

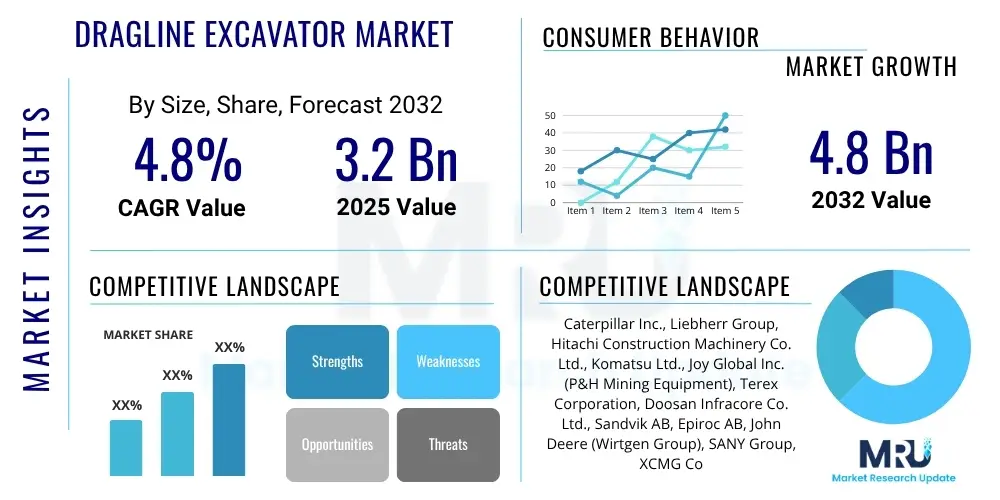

The Dragline Excavator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 3.2 billion in 2025 and is projected to reach USD 4.8 billion by the end of the forecast period in 2032.

Dragline Excavator Market introduction

The Dragline Excavator Market encompasses the global industry involved in the manufacturing, sale, and servicing of large-scale excavation equipment primarily used in open-pit mining operations and major earthmoving projects. These colossal machines, distinguished by their long boom and suspended bucket, are engineered for high-volume overburden removal and mineral extraction, playing a critical role in industries such as coal, lignite, oil sands, and various aggregates.

Dragline excavators are renowned for their impressive digging depth, reach, and material handling capacity, making them indispensable for operations requiring the movement of vast quantities of earth over extended distances. Key benefits include operational efficiency, reduced per-ton operating costs in suitable applications, and the ability to operate continuously in demanding environments. The market's growth is predominantly driven by increasing global demand for minerals and energy resources, significant investments in large-scale mining projects, and a continuous push for enhanced productivity and operational safety in the heavy earthmoving sector.

Dragline Excavator Market Executive Summary

The Dragline Excavator Market is experiencing a period of significant evolution, shaped by a confluence of global economic forces, technological advancements, and shifting environmental regulations. Business trends indicate a strong emphasis on automation, digitalization, and the integration of smart technologies to enhance operational efficiency, reduce downtime, and improve safety standards. Leading manufacturers are investing heavily in research and development to offer more fuel-efficient models, reduce carbon footprints, and provide advanced predictive maintenance solutions, driven by the escalating operating costs and environmental compliance pressures faced by mining companies.

Regionally, the Asia Pacific continues to emerge as a dominant market, fueled by robust industrial growth, extensive coal mining activities in countries like India, China, and Australia, and significant infrastructure development projects. North America and Europe maintain a stable demand, particularly for upgrades and replacement of existing fleets, alongside a growing interest in electric and hybrid dragline solutions to meet stringent emissions targets. Latin America and the Middle East and Africa regions present considerable opportunities driven by new mining project developments and increased commodity extraction.

Segment trends highlight a preference for higher capacity draglines that can handle greater volumes of material, offering economies of scale to large mining operations. There is also a discernible shift towards models incorporating advanced sensor technologies, GPS guidance systems, and remote monitoring capabilities to optimize performance. The demand for robust after-sales support, spare parts availability, and comprehensive service agreements is also a critical factor influencing purchasing decisions across all segments.

AI Impact Analysis on Dragline Excavator Market

User questions frequently revolve around how artificial intelligence can transform the traditionally heavy-duty and labor-intensive operations of dragline excavators. Common concerns include how AI can enhance efficiency, mitigate operational risks, prolong equipment lifespan, and reduce reliance on highly skilled human operators. Users are keen to understand the practical applications of AI in real-time decision-making, predictive maintenance, and autonomous functionalities to address the complexities and high costs associated with dragline operations.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data to forecast potential equipment failures, optimizing maintenance schedules and reducing unplanned downtime.

- Optimized Operational Efficiency: AI-driven systems can analyze digging patterns, material characteristics, and swing angles to recommend optimal operational parameters, maximizing material moved per cycle.

- Autonomous Operation Capabilities: AI enables semi-autonomous or fully autonomous digging cycles, improving consistency, precision, and reducing operator fatigue in repetitive tasks.

- Improved Safety Protocols: AI-powered collision avoidance systems and real-time hazard detection enhance safety for personnel and equipment on site.

- Energy Consumption Optimization: AI systems can manage power delivery and motor control to minimize energy usage, especially in electric-powered draglines, leading to significant cost savings.

- Data-Driven Performance Insights: AI processes vast amounts of operational data, providing actionable insights into machine performance, productivity bottlenecks, and training needs.

- Remote Monitoring and Diagnostics: AI facilitates sophisticated remote diagnostics, allowing technicians to identify and troubleshoot issues from off-site locations, improving response times.

DRO & Impact Forces Of Dragline Excavator Market

The Dragline Excavator Market is shaped by a dynamic interplay of driving forces, significant restraints, and emerging opportunities, all subjected to various impact forces. The primary drivers include the burgeoning global demand for minerals such as coal, copper, and iron ore, which necessitates large-scale, efficient overburden removal in open-pit mines. Simultaneously, global infrastructure development projects, especially in emerging economies, contribute to the demand for heavy earthmoving equipment. Technological advancements in automation, digitalization, and electrification also act as significant drivers, improving the performance, safety, and environmental footprint of modern draglines.

However, the market faces considerable restraints, notably the exceedingly high capital investment required for purchasing and deploying dragline excavators, which can be prohibitive for smaller mining operations. Stringent environmental regulations aimed at reducing carbon emissions and minimizing ecological disruption place pressure on manufacturers to develop more sustainable solutions, adding to production costs. Operational complexities, the need for a highly skilled workforce, and the long lead times for manufacturing and installation also act as significant barriers to market entry and expansion.

Opportunities in the market are abundant, particularly with the growing emphasis on sustainable mining practices and the development of electric and hybrid dragline models that offer reduced emissions and lower operating costs. The expansion of mining activities into new, previously inaccessible regions due to advanced geological surveying techniques also presents avenues for growth. Moreover, the increasing adoption of automation and AI-driven solutions to enhance efficiency and safety offers manufacturers a competitive edge. Impact forces such as fluctuating commodity prices directly influence mining investments, while regulatory landscapes dictate operational standards, and geopolitical stability can affect project timelines and supply chains.

Segmentation Analysis

The Dragline Excavator Market is comprehensively segmented to provide a detailed understanding of its diverse operational landscape, catering to various industry requirements and geographical demands. These segmentation categories allow for a granular analysis of market dynamics, identifying specific growth areas, competitive advantages, and potential challenges within different product types, capacities, applications, and regional concentrations. Understanding these segments is crucial for stakeholders to tailor their strategies effectively, focusing on areas with the highest growth potential and addressing the specific needs of end-users.

- By Type:

- Walking Draglines

- Crawler Draglines

- Stationary Draglines

- By Operating Weight Capacity:

- Light Duty (Below 1000 tons)

- Medium Duty (1000-3000 tons)

- Heavy Duty (Above 3000 tons)

- By Bucket Capacity:

- Less than 30 Cubic Meters

- 30-60 Cubic Meters

- More than 60 Cubic Meters

- By Drive Type:

- Electric Drive

- Diesel-Electric Drive

- Hybrid Drive

- By Application:

- Coal Mining

- Lignite Mining

- Oil Sands Mining

- Phosphate Mining

- Iron Ore Mining

- Other Mineral Mining

- Heavy Construction & Quarrying

- By End-Use Industry:

- Mining & Quarrying

- Construction

- Public Works

- By Sales Channel:

- Direct Sales

- Distributors/Dealers

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Dragline Excavator Market

The value chain for the Dragline Excavator Market is extensive and complex, beginning with the upstream supply of highly specialized raw materials and components, and extending through manufacturing, distribution, and ultimately to the end-user. The upstream segment involves the sourcing of high-strength steel, advanced alloys, specialized hydraulic systems, electrical components, and sophisticated control systems from a global network of suppliers. Manufacturers often engage in long-term relationships with these suppliers to ensure the quality, reliability, and timely delivery of critical parts, which are essential given the bespoke nature and sheer scale of dragline construction.

The core of the value chain lies in the manufacturing and assembly process, where leading companies design, fabricate, and assemble these massive machines. This stage demands significant engineering expertise, advanced manufacturing facilities, and rigorous quality control. Post-manufacturing, the downstream activities focus on distribution, sales, installation, and comprehensive after-sales support. Distribution channels typically involve a combination of direct sales from manufacturers to major mining corporations and heavy construction firms, complemented by a network of specialized dealers and distributors who handle sales, service, and spare parts for specific regional markets or smaller operators.

Both direct and indirect distribution strategies are employed to reach a diverse customer base. Direct sales are often preferred for very large, customized draglines sold to global mining giants, allowing for direct communication and tailored solutions. Indirect channels, through authorized dealers and service providers, are crucial for broader market penetration, offering localized sales support, technical assistance, training, and maintenance services. The entire value chain emphasizes long-term customer relationships, given the substantial investment in draglines, and focuses on maximizing equipment uptime through efficient service and parts supply, ensuring operational continuity for end-users.

Dragline Excavator Market Potential Customers

The primary potential customers and end-users of dragline excavators are large-scale enterprises engaged in industries requiring the massive removal and relocation of earth and minerals. These entities typically operate on projects with long durations and substantial material volumes, where the efficiency and capacity of draglines provide significant economic advantages. The capital-intensive nature of dragline acquisition means that customers are often well-established, financially robust organizations with long-term strategic plans for their operational sites.

Leading among these customers are major global mining corporations involved in the extraction of commodities such as coal, lignite, copper, iron ore, and oil sands. These companies utilize draglines for overburden removal to expose valuable mineral seams, a process that demands continuous, high-volume excavation. The economic viability of these mining operations is often directly tied to the efficient functioning and scale of their dragline fleet, making reliable equipment and comprehensive service paramount in their purchasing decisions.

Beyond traditional mining, potential customers also include large civil engineering and construction firms undertaking mega-projects like dam construction, canal dredging, and major land reclamation. Government agencies involved in public works or state-owned mining enterprises also represent a significant customer segment, particularly in countries with extensive natural resources. These end-users prioritize equipment longevity, operational efficiency, safety features, and the availability of robust after-sales support to ensure their projects remain on schedule and within budget.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.2 billion |

| Market Forecast in 2032 | USD 4.8 billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Liebherr Group, Hitachi Construction Machinery Co. Ltd., Komatsu Ltd., Joy Global Inc. (P&H Mining Equipment), Terex Corporation, Doosan Infracore Co. Ltd., Sandvik AB, Epiroc AB, John Deere (Wirtgen Group), SANY Group, XCMG Construction Machinery Co. Ltd., Volvo Construction Equipment, Atlas Copco, Hyundai Construction Equipment Co. Ltd., Manitowoc Company Inc., Shantui Construction Machinery Co. Ltd., Sumitomo Heavy Industries Ltd., Link-Belt Cranes (LBX Company), Zoomlion Heavy Industry Science and Technology Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dragline Excavator Market Key Technology Landscape

The Dragline Excavator Market is characterized by a rapidly evolving technological landscape, driven by the imperative to enhance productivity, improve safety, and reduce environmental impact. Modern draglines are sophisticated machines integrating a multitude of advanced systems that optimize every aspect of their operation. Core technological advancements include the widespread adoption of electric drive systems, which offer higher energy efficiency, lower emissions, and reduced operating costs compared to traditional diesel-electric setups, aligning with global sustainability goals.

Automation and digitalization are central to the current technological paradigm. This includes the implementation of GPS and GNSS (Global Navigation Satellite System) for precise positioning and navigation, allowing for highly accurate digging and dumping. Telematics and IoT (Internet of Things) devices provide real-time operational data, enabling remote monitoring of machine health, performance metrics, and asset utilization. Predictive maintenance, powered by AI and machine learning algorithms, analyzes this data to forecast potential component failures, thereby minimizing unplanned downtime and optimizing maintenance schedules, leading to significant cost savings and increased machine availability.

Furthermore, the integration of advanced control systems, operator assist technologies, and semi-autonomous functions is becoming standard, enhancing operational consistency and reducing the physical demands on operators. Advanced materials, such as high-strength steel and composite components, contribute to reduced machine weight and improved structural integrity, extending lifespan and improving efficiency. Robotics are also finding niche applications in complex maintenance tasks and remote inspections. These technological innovations collectively aim to deliver smarter, safer, and more environmentally responsible excavation solutions to the global mining and heavy construction industries.

Regional Highlights

- Asia Pacific: The Asia Pacific region holds the largest share in the Dragline Excavator Market and is projected to exhibit the highest growth rate during the forecast period. This dominance is primarily attributed to extensive coal mining activities in countries like China, India, and Australia, coupled with significant investments in infrastructure development projects. Rapid industrialization and urbanization across the region continue to fuel the demand for extracted minerals, directly driving the need for high-capacity excavation equipment. Governments and private entities are increasingly investing in modernizing mining operations, leading to higher adoption rates of advanced dragline technologies.

- North America: North America represents a mature yet stable market for dragline excavators, characterized by significant existing mining operations, particularly in coal, oil sands, and copper. The market here is driven by the need for equipment replacement, upgrades, and a strong focus on operational efficiency and safety. Innovation in automation and environmentally friendly solutions, including electric drive systems, is a key trend. The presence of major global manufacturers and advanced technological infrastructure also supports market growth, with an emphasis on optimizing existing fleets through digital integration.

- Europe: The European Dragline Excavator Market is characterized by stringent environmental regulations and a gradual shift towards cleaner energy sources, impacting coal mining but creating demand for efficiency and technological advancement in other extractive industries. While the market size may be smaller compared to APAC, there is a strong emphasis on sustainable mining practices, the adoption of electric and hybrid draglines, and the integration of smart technologies for optimized operations. Countries like Germany and Poland, with active lignite mining, remain significant contributors.

- Latin America: Latin America offers considerable growth opportunities, driven by its rich deposits of copper, iron ore, and other minerals. Countries such as Chile, Brazil, and Peru are major players in global mineral supply, fostering demand for robust and efficient excavation equipment. Economic development and foreign investments in the mining sector are key drivers. The market is also seeing an increase in demand for comprehensive service and support solutions to maintain uptime in remote operational areas.

- Middle East and Africa (MEA): The MEA region is emerging as a growth market, propelled by new mining project developments, particularly in phosphate, bauxite, and coal in parts of Africa, and ongoing infrastructure projects in the Middle East. Increased government spending on mineral resource extraction and diversification away from oil economies are contributing factors. The demand for reliable, durable equipment capable of operating in challenging environmental conditions is paramount in this region, alongside a growing interest in energy-efficient solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dragline Excavator Market.- Caterpillar Inc.

- Liebherr Group

- Hitachi Construction Machinery Co. Ltd.

- Komatsu Ltd.

- Joy Global Inc. (P&H Mining Equipment)

- Terex Corporation

- Doosan Infracore Co. Ltd.

- Sandvik AB

- Epiroc AB

- John Deere (Wirtgen Group)

- SANY Group

- XCMG Construction Machinery Co. Ltd.

- Volvo Construction Equipment

- Atlas Copco

- Hyundai Construction Equipment Co. Ltd.

- Manitowoc Company Inc.

- Shantui Construction Machinery Co. Ltd.

- Sumitomo Heavy Industries Ltd.

- Link-Belt Cranes (LBX Company)

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

Frequently Asked Questions

What is a dragline excavator and what are its primary uses?

A dragline excavator is a large piece of heavy equipment used in civil engineering and surface mining. It consists of a bucket operated by ropes from a long boom, primarily used for excavating overburden and coal at open-pit mines, or for dredging and large-scale earthmoving operations due to its extensive reach and digging depth.

How do dragline excavators contribute to mining efficiency?

Dragline excavators significantly boost mining efficiency by providing high-volume material handling capabilities, minimizing the need for multiple smaller machines. Their long reach reduces re-handling of material, and continuous operation optimizes the overburden removal process, leading to lower per-ton operating costs and increased productivity on large-scale projects.

What are the key technological advancements in modern dragline excavators?

Modern draglines incorporate key technologies such as electric drive systems for energy efficiency, GPS and IoT for precise operation and real-time monitoring, AI-powered predictive maintenance, and semi-autonomous control systems. These innovations enhance performance, reduce downtime, improve safety, and lower environmental impact.

What is the typical lifespan of a dragline excavator?

With proper maintenance and scheduled overhauls, a dragline excavator can have a operational lifespan of 30 to 50 years, and sometimes even longer. Their robust construction and modular design allow for extensive component replacement and upgrades, ensuring long-term utility in demanding mining environments.

What are the main environmental considerations associated with dragline operations?

Environmental considerations include significant land disturbance, noise pollution, and potential for dust emissions. Modern draglines address these through efforts to improve fuel efficiency, reduce emissions with electric drives, implement noise reduction technologies, and utilize advanced planning software for optimized land rehabilitation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager