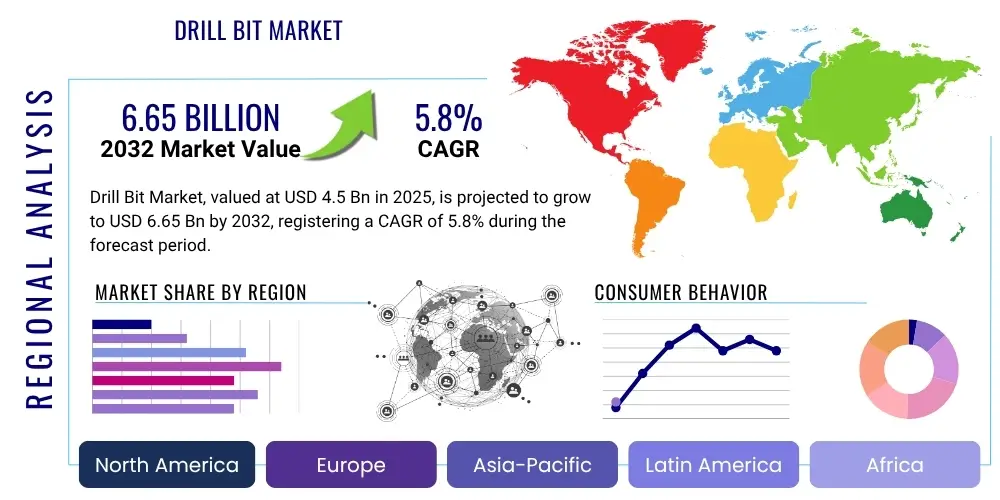

Drill Bit Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429538 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Drill Bit Market Size

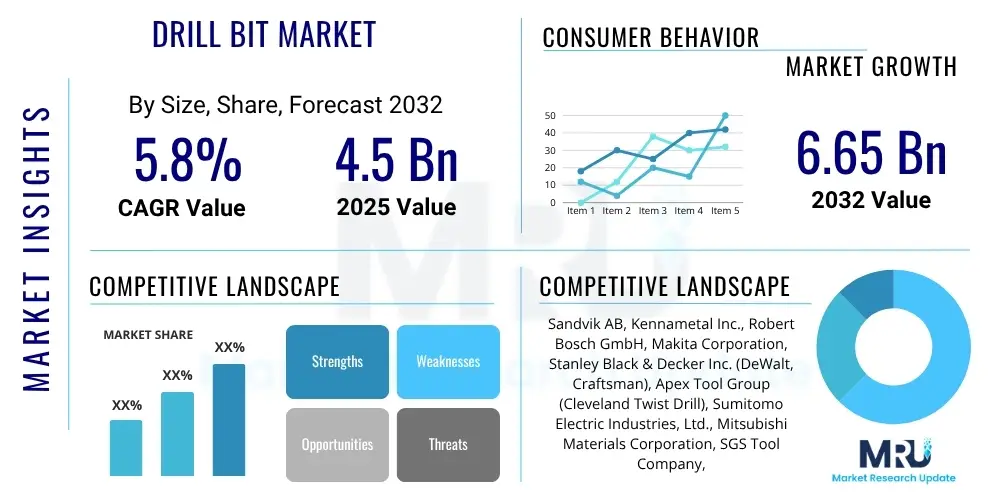

The Drill Bit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 4.5 Billion in 2025 and is projected to reach USD 6.65 Billion by the end of the forecast period in 2032.

Drill Bit Market introduction

The global drill bit market is a critical component of numerous industrial and domestic sectors, playing an indispensable role in material removal, shaping, and fastening processes. Drill bits are cutting tools used to create cylindrical holes, typically in solid materials. Their fundamental design involves a rotating shaft with cutting edges at the tip, designed to penetrate various substrates ranging from wood and metal to concrete, plastics, and geological formations. The market encompasses a vast array of drill bit types, each engineered with specific geometries, materials, and coatings to optimize performance for particular applications, thereby ensuring efficiency, precision, and durability across a diverse operational landscape. This foundational technology is integral to manufacturing, construction, resource extraction, and numerous other value chains, underscoring its pervasive economic importance.

The product portfolio within the drill bit market is extensive, featuring twist drill bits, spade bits, auger bits, masonry bits, hammer drill bits, hole saws, core bits, and specialized bits for applications like countersinking or reaming. These tools are manufactured from various materials, including high-speed steel (HSS), cobalt steel, solid carbide, and diamond-tipped alloys, chosen based on the hardness of the workpiece material and the desired cutting speed and tool life. Advanced coatings such as titanium nitride (TiN), titanium aluminum nitride (TiAlN), and diamond-like carbon (DLC) are often applied to enhance wear resistance, reduce friction, and extend the lifespan of the bits, thereby improving overall operational efficiency and cost-effectiveness. The selection of the appropriate drill bit is crucial for achieving optimal results, preventing tool damage, and ensuring operator safety.

Major applications for drill bits span across heavy industries, light manufacturing, and consumer sectors. In construction, they are vital for creating anchor points, fitting structural components, and installing utilities. The oil and gas sector relies heavily on robust drill bits for exploration and extraction, penetrating deep geological formations. Manufacturing industries, including automotive, aerospace, and general fabrication, utilize drill bits for assembly, prototyping, and production lines. Furthermore, the woodworking, metalworking, and DIY markets represent significant segments, driving demand for a broad range of general-purpose and specialized bits. The market is driven by global infrastructure development, increasing manufacturing output, continuous advancements in material science, and the persistent need for efficient and precise drilling solutions in an expanding array of technical applications.

Drill Bit Market Executive Summary

The Drill Bit Market is currently experiencing robust growth, propelled by a confluence of accelerating industrialization, burgeoning infrastructure projects globally, and continuous technological advancements in manufacturing and materials science. Business trends indicate a strong move towards performance-oriented solutions, with significant investment in research and development to produce drill bits capable of drilling harder materials at higher speeds with extended tool life. Manufacturers are focusing on developing application-specific drill bits, incorporating advanced geometries, and utilizing superior coatings to meet the stringent demands of modern industries such as aerospace, automotive, and energy. Furthermore, the increasing adoption of automation and robotics in drilling operations is driving demand for highly precise and durable drill bits, capable of consistent performance in automated environments, thereby reshaping production strategies and supply chain dynamics within the market.

Regionally, the market exhibits diverse growth patterns. Asia Pacific stands out as the fastest-growing region, fueled by rapid urbanization, extensive infrastructure development in countries like China, India, and Southeast Asian nations, and the expansion of their manufacturing bases. North America and Europe, while mature markets, continue to be significant revenue contributors, characterized by a demand for high-performance, specialized drill bits driven by advanced manufacturing sectors, a strong emphasis on precision engineering, and sustained activities in the oil and gas industry. Latin America and the Middle East and Africa regions are showing promising growth, primarily due to increased investments in mining, oil and gas exploration, and burgeoning construction sectors. These regional dynamics highlight the importance of localized market strategies and product offerings tailored to specific economic and industrial requirements.

Segmentation trends within the drill bit market reveal significant shifts and opportunities. By material, carbide and diamond-tipped drill bits are gaining prominence due to their superior hardness and wear resistance, essential for drilling through advanced alloys and composite materials. The application segment sees robust demand from the oil and gas sector, followed closely by general manufacturing and construction, as these industries continue to expand their operational footprints. The shift towards sustainable and efficient drilling practices is also influencing product development, with a focus on bits that reduce energy consumption and material waste. Moreover, the DIY and consumer segments remain stable, driven by home improvement projects and hobbyist activities, often requiring versatile and user-friendly drill bit sets. These segment-specific trajectories underscore the diverse end-user needs and the market's adaptive capacity to evolving industrial and consumer landscapes.

AI Impact Analysis on Drill Bit Market

The integration of Artificial Intelligence (AI) is poised to revolutionize the drill bit market by addressing critical user questions regarding efficiency, precision, and tool longevity. Users are increasingly seeking solutions that can optimize drilling parameters, predict tool wear, and enhance overall operational safety and cost-effectiveness. AI-driven systems are expected to provide insights into optimal drilling speeds, feed rates, and pressure based on real-time data from sensors embedded in drilling equipment, mitigating common concerns about premature tool failure and inefficient material removal. The demand for "smart" drill bits that can communicate performance data, coupled with AI for predictive maintenance and automated process adjustments, is a key theme, reflecting expectations for reduced downtime and improved productivity in demanding industrial applications. Furthermore, AI is anticipated to play a role in advanced material design for drill bits, facilitating the development of novel alloys and coatings with superior characteristics.

- AI-powered predictive maintenance for drill bits, reducing unexpected failures and optimizing replacement cycles.

- Real-time drilling parameter optimization using machine learning algorithms to maximize efficiency and precision.

- Development of smart drill bits with integrated sensors for data collection and feedback to AI systems.

- AI-driven material science advancements for designing new drill bit compositions and coatings with enhanced durability.

- Automated quality control and defect detection during drill bit manufacturing processes.

- Simulation and virtual testing of drill bit performance under various conditions, saving time and resources.

- Supply chain optimization for drill bit manufacturers and distributors, enhancing inventory management and logistics.

DRO & Impact Forces Of Drill Bit Market

The drill bit market is significantly influenced by a dynamic interplay of drivers, restraints, opportunities, and external impact forces that collectively shape its trajectory and competitive landscape. Key drivers include the consistent growth in global construction activities, fueled by urbanization and infrastructure development projects in emerging economies, alongside a resurgence in manufacturing sectors such as automotive, aerospace, and general fabrication. The increasing demand for energy, particularly from the oil and gas industry for exploration and production, further boosts the need for specialized and high-performance drilling tools. Technological advancements, encompassing new material compositions, advanced coatings, and innovative bit geometries, are enhancing tool efficiency and durability, thereby stimulating market demand and expanding application possibilities across various industries. Additionally, the flourishing DIY and home improvement markets also contribute substantially to the overall market growth, requiring a diverse range of general-purpose drill bits.

However, the market also faces notable restraints. Volatility in the prices of raw materials, such as steel, tungsten carbide, and diamond, directly impacts manufacturing costs and profit margins for drill bit producers. Intense competition from both established market leaders and emerging regional players often leads to price erosion and necessitates continuous innovation to maintain market share. Environmental regulations and stringent safety standards, particularly in mining and oil and gas operations, can increase operational complexities and compliance costs. Furthermore, the limited lifespan of drill bits as consumables, despite advancements in durability, inherently requires frequent replacement, which while driving sales, also poses a cost burden for end-users and prompts continuous research into extended tool life. Economic downturns or global crises can also dampen investment in key end-use industries, temporarily reducing demand for drilling tools.

Opportunities within the drill bit market are substantial and diverse. The advent of smart drilling technologies, integrating IoT sensors and AI for predictive maintenance and performance optimization, presents a significant avenue for growth and product differentiation. Expanding markets in developing regions with burgeoning industrial sectors offer untapped potential for new market entrants and established players alike. Moreover, continuous research and development into advanced materials like ceramics, composites, and novel super-hard alloys promise to unlock new levels of performance, enabling drilling in increasingly challenging applications. Customization and specialized drill bit solutions for niche industries, coupled with the rising adoption of additive manufacturing techniques for producing complex geometries, also represent lucrative growth areas. The global push towards renewable energy infrastructure, such as wind turbine installations, also creates new demand for specific drilling applications.

Segmentation Analysis

The drill bit market is extensively segmented to reflect its diverse applications, material compositions, and end-user requirements, providing a detailed framework for understanding market dynamics and identifying specific growth opportunities. This comprehensive segmentation allows for a granular analysis of demand patterns, technological preferences, and regional consumption trends across various industrial and consumer sectors. Understanding these segments is crucial for manufacturers to tailor their product offerings, develop targeted marketing strategies, and allocate resources effectively to capitalize on specific market niches and emerging trends.

- By Type

- Twist Drill Bits

- SDS Drill Bits (Slotted Drive Shaft)

- Masonry Drill Bits

- Auger Drill Bits

- Spade Drill Bits

- Hole Saws

- Core Drill Bits

- Step Drill Bits

- Countersink Bits

- Router Bits

- Brad Point Drill Bits

- Forstner Bits

- Taper Drill Bits

- Reamer Bits

- By Material

- High-Speed Steel (HSS)

- Cobalt Steel

- Solid Carbide

- Diamond-Tipped (PCD)

- Carbide-Tipped

- Black Oxide

- Titanium Nitride (TiN) Coated

- Titanium Aluminum Nitride (TiAlN) Coated

- Diamond-Like Carbon (DLC) Coated

- Ceramic

- By Application

- Construction

- Oil and Gas

- Mining

- General Manufacturing

- Automotive

- Aerospace and Defense

- Woodworking

- Metalworking

- Electronics

- Medical

- Energy (Renewable, Power Generation)

- By End-User

- Industrial (Professional Contractors, Heavy Industry)

- Commercial (Workshops, SMEs)

- Residential (DIY, Home Improvement)

- By Sales Channel

- Online Retail

- Offline Retail (Hardware Stores, Supermarkets, Specialty Stores)

- Distributors/Wholesalers

- Direct Sales

Value Chain Analysis For Drill Bit Market

The value chain for the drill bit market is a complex ecosystem, starting from the sourcing of raw materials and extending to the final delivery to end-users, encompassing multiple critical stages. The upstream segment involves the extraction and processing of essential raw materials such as various steel alloys, tungsten carbide, industrial diamonds, and other specialized materials required for manufacturing high-performance drill bits. Key players in this stage include mining companies, metal refiners, and chemical processors, who supply high-quality, standardized materials to drill bit manufacturers. Research and development activities also form a crucial part of the upstream segment, focusing on innovative material compositions, advanced coatings, and cutting-edge design geometries to enhance drill bit performance and extend tool life. The quality and availability of these raw materials directly impact the cost-effectiveness and performance attributes of the finished products.

Moving downstream, the value chain encompasses the manufacturing, distribution, and sales phases. Manufacturers transform raw materials into finished drill bits using advanced machining, grinding, coating, and heat treatment processes. This stage demands significant capital investment in specialized machinery and skilled labor. Once manufactured, the drill bits enter the distribution network, which is characterized by a blend of direct and indirect channels. Direct distribution involves manufacturers selling directly to large industrial clients, original equipment manufacturers (OEMs), or major construction firms, often through dedicated sales teams. This approach allows for closer client relationships and customized solutions, particularly for specialized or high-volume orders, ensuring technical support and direct feedback channels.

Indirect distribution, on the other hand, involves a broader network of wholesalers, regional distributors, and retail outlets. Wholesalers purchase in bulk from manufacturers and then supply to smaller retailers, hardware stores, and online platforms. Retail channels, including both brick-and-mortar stores and e-commerce platforms, serve the commercial, residential, and DIY segments, making products easily accessible to a wide range of end-users. The choice of distribution channel often depends on the type of drill bit, its target end-user, and the geographical reach desired by the manufacturer. Efficient logistics and supply chain management are paramount in the downstream segment to ensure timely delivery, competitive pricing, and broad market penetration, ultimately influencing customer satisfaction and market share across diverse segments.

Drill Bit Market Potential Customers

The drill bit market caters to a vast and varied spectrum of potential customers, spanning across numerous industrial, commercial, and residential sectors. Industrial end-users represent the largest and most demanding segment, encompassing heavy industries such as construction, oil and gas, mining, and aerospace. Construction companies consistently require a wide array of drill bits for tasks ranging from foundation drilling to interior fittings, driven by urban development and infrastructure projects. Oil and gas exploration and production firms are critical consumers, demanding highly durable and specialized drill bits capable of penetrating diverse and challenging geological formations at extreme depths and temperatures. Mining operations also heavily rely on robust drill bits for excavation and resource extraction, where performance and reliability are paramount for operational efficiency and safety. These sectors demand high-performance, durable, and application-specific tools that can withstand harsh operating conditions and deliver consistent results.

Beyond heavy industries, the manufacturing sector constitutes another significant segment of potential customers. This includes automotive manufacturers, general fabrication shops, electronics producers, and companies involved in precision engineering. These customers utilize drill bits for assembly, prototyping, and mass production, requiring tools that deliver high precision, excellent surface finish, and extended tool life. The aerospace and defense industries, with their stringent quality requirements and use of advanced materials, demand highly specialized and often custom-designed drill bits for critical applications. Medical device manufacturers also fall into this category, using miniature and highly precise drill bits for creating intricate components. The consistent drive for efficiency, accuracy, and cost-effectiveness in manufacturing operations directly influences their procurement decisions for drill bits.

Commercial customers, including professional tradespersons such as carpenters, electricians, plumbers, and mechanics, along with smaller workshops and service providers, form a substantial part of the market. These professionals require versatile and reliable drill bits for their daily tasks across various materials and applications. Finally, the residential and DIY (Do-It-Yourself) market segment represents a broad consumer base, driven by home improvement projects, repairs, and hobbyist activities. This segment typically demands more user-friendly, general-purpose, and often bundled drill bit sets, available through retail channels. The varied requirements across these customer groups necessitate a diverse product offering, ranging from high-performance industrial-grade tools to affordable and accessible consumer-grade options, underscoring the broad market reach of drill bits.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.5 Billion |

| Market Forecast in 2032 | USD 6.65 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik AB, Kennametal Inc., Robert Bosch GmbH, Makita Corporation, Stanley Black & Decker Inc. (DeWalt, Craftsman), Apex Tool Group (Cleveland Twist Drill), Sumitomo Electric Industries, Ltd., Mitsubishi Materials Corporation, SGS Tool Company, Widia Products Group, CERATIZIT S.A., Starrett, Atlas Copco AB, Regal Cutting Tools, Dormer Pramet (Sandvik Group), OSG Corporation, Guhring Inc., Titex (Walter AG), Seco Tools (Sandvik Group), WIDIA (Kennametal Inc.). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drill Bit Market Key Technology Landscape

The drill bit market is continuously evolving through significant technological advancements, primarily focused on enhancing performance, durability, and efficiency. One of the most impactful areas is material science, where innovations in alloys and composites are leading to the development of drill bits capable of withstanding extreme temperatures, pressures, and abrasive conditions. High-performance steels, cobalt alloys, and especially tungsten carbide, are being further refined and integrated with advanced ceramics or cermets to achieve superior hardness and wear resistance. Polycrystalline Diamond (PCD) and monocrystalline diamond cutting edges are becoming standard for drilling ultra-hard materials like composites, ceramics, and superalloys, which are increasingly prevalent in aerospace, automotive, and medical industries. Research into new binder materials and grain structures for cemented carbides is also pushing the boundaries of tool life and cutting performance.

Another crucial technological frontier lies in surface engineering and advanced coatings. Techniques such as Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) are widely employed to apply ultra-hard, low-friction coatings like Titanium Nitride (TiN), Titanium Aluminum Nitride (TiAlN), Aluminum Titanium Nitride (AlTiN), and Diamond-Like Carbon (DLC). These coatings significantly improve the wear resistance, heat dissipation, and lubricity of drill bits, thereby extending their operational life and allowing for higher cutting speeds and feed rates. The development of multi-layer and gradient coatings is further optimizing these properties for specific applications, enabling drill bits to perform efficiently in challenging environments where high temperatures and aggressive wear are common, reducing the frequency of tool changes and improving productivity. Innovations in coating adhesion and thickness consistency are also critical for maximizing coating benefits.

Furthermore, the integration of smart technologies and advanced manufacturing processes is revolutionizing the drill bit landscape. Additive manufacturing, particularly selective laser melting (SLM) for metals, is enabling the creation of complex drill bit geometries and internal cooling channels that were previously impossible with traditional manufacturing methods. This allows for optimized chip evacuation, improved coolant delivery, and reduced thermal stress on the cutting edge, leading to enhanced performance. The incorporation of sensor technology and IoT capabilities into drill bits and drilling systems is another significant trend. These "smart drill bits" can monitor real-time parameters such as temperature, vibration, torque, and wear, providing invaluable data for predictive maintenance, process optimization through AI and machine learning algorithms, and ensuring consistent quality and safety in automated drilling operations. This holistic approach, from material to intelligent operation, drives the market forward.

Regional Highlights

- North America: This region represents a mature yet highly innovative drill bit market, driven by robust manufacturing sectors in automotive, aerospace, and general fabrication, alongside substantial activity in the oil and gas industry. The demand here leans towards high-performance, specialized drill bits that incorporate advanced materials and coatings to meet stringent precision and durability requirements. The presence of leading global manufacturers and a strong emphasis on R&D contribute to continuous product innovation and technological leadership. Infrastructure development and a significant DIY market also maintain consistent demand, while automation trends further encourage the adoption of smart drilling solutions.

- Europe: Characterized by a strong focus on precision engineering, advanced manufacturing, and stringent environmental regulations, Europe is a key market for high-quality, efficient, and sustainable drill bits. Countries like Germany, France, and the UK lead in automotive, aerospace, and medical device manufacturing, driving demand for specialized carbide and diamond-tipped bits. There is a growing emphasis on energy-efficient drilling solutions and tools designed for specific material applications. The presence of robust R&D ecosystems and a skilled workforce also propels advancements in drill bit technology, including surface treatments and intelligent tool monitoring systems.

- Asia Pacific (APAC): APAC is the fastest-growing region in the drill bit market, fueled by rapid industrialization, extensive infrastructure development, and burgeoning manufacturing bases in countries like China, India, Japan, and South Korea. Massive construction projects, expanding automotive production, and increasing investments in electronics and general manufacturing are major demand drivers. The region also sees significant activity in mining and, in some areas, oil and gas exploration. While price sensitivity is a factor, there is also a rising demand for high-performance and specialized drill bits as industries modernize and adopt advanced manufacturing techniques.

- Latin America: This region's drill bit market growth is significantly influenced by its rich natural resources, particularly in mining (copper, iron ore) and oil and gas exploration and production. Countries like Brazil, Mexico, and Chile are key contributors to regional demand. Infrastructure projects and a developing manufacturing sector also play a role. The market often seeks robust and cost-effective drill bit solutions capable of handling challenging geological conditions. Investment in regional industrial development and resource extraction activities will continue to shape market expansion.

- Middle East and Africa (MEA): The MEA market is primarily driven by extensive oil and gas exploration and production activities, particularly in Saudi Arabia, UAE, and other Gulf nations, which require highly specialized and durable drill bits for deep and challenging wells. Significant construction and infrastructure projects, fueled by economic diversification efforts and rapid urbanization, also contribute substantially to demand. While the market for industrial-grade drill bits is strong, there is also a growing presence of consumer and commercial segments, supported by expanding retail and distribution networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drill Bit Market.- Sandvik AB

- Kennametal Inc.

- Robert Bosch GmbH

- Makita Corporation

- Stanley Black & Decker Inc. (DeWalt, Craftsman)

- Apex Tool Group (Cleveland Twist Drill)

- Sumitomo Electric Industries, Ltd.

- Mitsubishi Materials Corporation

- SGS Tool Company

- Widia Products Group

- CERATIZIT S.A.

- The L.S. Starrett Company

- Atlas Copco AB

- Regal Cutting Tools

- Dormer Pramet (Sandvik Group)

- OSG Corporation

- Guhring Inc.

- Titex (Walter AG)

- Seco Tools (Sandvik Group)

- WIDIA (Kennametal Inc.)

Frequently Asked Questions

What are the primary types of drill bits available in the market?

The market offers a wide array of drill bit types, each designed for specific applications and materials. Common types include twist drill bits for general-purpose drilling in metal and wood, masonry bits for concrete and stone, spade bits for large holes in wood, auger bits for deep wood drilling, and hole saws for cutting large diameter holes. Specialized bits like SDS for hammer drills, core bits, and countersink bits also cater to niche requirements, ensuring optimal performance for diverse tasks across industrial, commercial, and residential settings.

How do I choose the correct drill bit for a specific material or task?

Selecting the correct drill bit is crucial for efficiency, safety, and achieving desired results. Consider the material you are drilling into; for instance, HSS or cobalt bits are suitable for metal, carbide-tipped or masonry bits for concrete, and brad point or spade bits for wood. Also, factor in the required hole size and depth. For harder materials or repetitive tasks, consider drill bits with advanced coatings like TiN or diamond-tipped for extended durability and performance. Always match the drill bit type to the drill machine's capabilities and the specific demands of the task.

What materials are commonly used to manufacture drill bits, and what are their benefits?

Drill bits are primarily manufactured from high-speed steel (HSS), cobalt steel, solid carbide, and often tipped with diamond or carbide. HSS bits are cost-effective and suitable for general-purpose drilling in softer materials. Cobalt steel offers higher heat resistance and is preferred for harder metals. Solid carbide bits are extremely hard and rigid, ideal for high-precision drilling in very hard materials and for use in CNC machines. Diamond-tipped (PCD) bits are used for cutting abrasive materials like ceramics, glass, and composites, offering superior hardness and wear resistance, while various coatings further enhance tool life and performance.

What are the key technological advancements shaping the drill bit market?

Technological advancements in the drill bit market are primarily focused on material science, surface engineering, and smart integration. Innovations in advanced alloys, tungsten carbide grades, and diamond synthesis enhance tool hardness and durability. Advanced coatings like Titanium Nitride (TiN) and Diamond-Like Carbon (DLC) significantly improve wear resistance and reduce friction. Furthermore, additive manufacturing enables complex geometries for optimized chip evacuation and cooling, while the integration of sensors and AI is leading to "smart" drill bits that offer real-time performance monitoring and predictive maintenance, thereby boosting efficiency and operational intelligence.

What impact do global economic trends and sustainability initiatives have on the drill bit market?

Global economic trends significantly influence the drill bit market as they affect infrastructure spending, manufacturing output, and consumer purchasing power. Economic growth typically boosts demand from construction, automotive, and oil and gas sectors, while downturns can lead to reduced industrial activity. Sustainability initiatives are driving demand for more durable and energy-efficient drill bits, as industries seek to reduce material waste and energy consumption. This includes a preference for tools with longer lifespans, improved recyclable materials, and manufacturing processes with smaller environmental footprints, aligning with broader corporate responsibility goals and regulatory pressures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Drill Bit Market Size Report By Type (Roller Cone Bit, Fixed Cutter Bit), By Application (Onshore, Offshore), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Oil And Gas Drill Bit Market Size Report By Type (Fixed Cutter, Polycrystalline Diamond Compact , Milled Tooth, Tungsten Carbide Inserts), By Application (On-shore, Off-shore), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Downhole Drill Bit Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Fixed Cutter Drill Bit, Roller Cone Drill Bit, Others), By Application (Oil Field, Gas Field), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Roller Cone Downhole Drill Bit Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Natural Diamond Bit, Other), By Application (Oil Field, Gas Field), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager