Driver and Occupant Monitoring Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427524 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Driver and Occupant Monitoring Systems Market Size

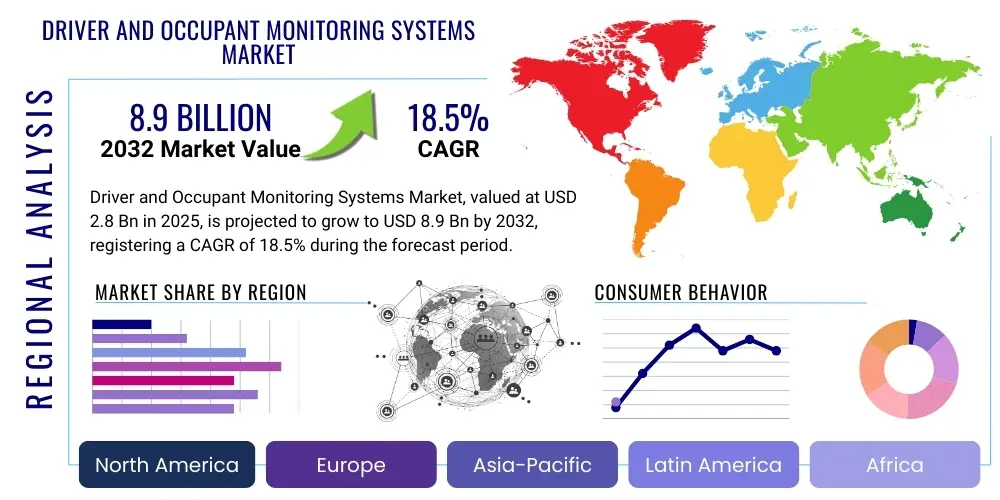

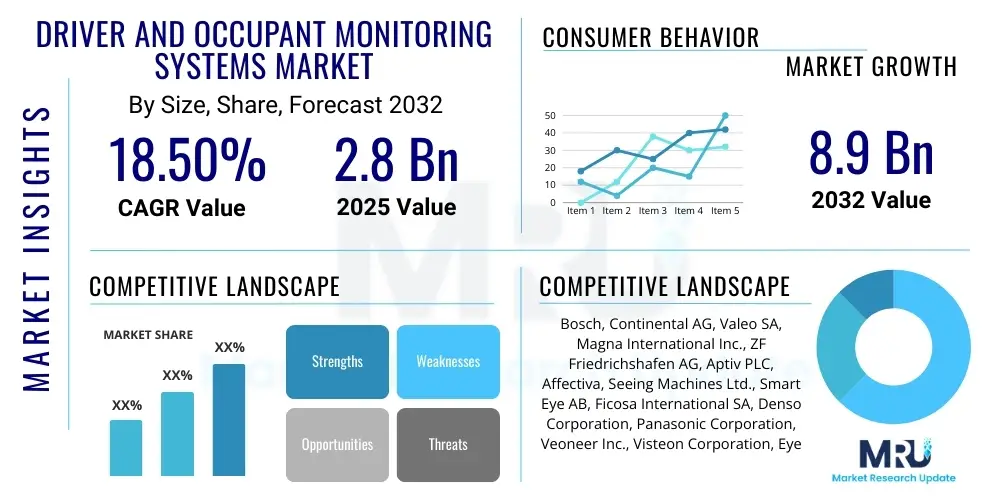

The Driver and Occupant Monitoring Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 2.8 Billion in 2025 and is projected to reach USD 8.9 Billion by the end of the forecast period in 2032.

Driver and Occupant Monitoring Systems Market introduction

The Driver and Occupant Monitoring Systems (DOMS) market encompasses advanced technologies designed to monitor the status and behavior of vehicle occupants and drivers. These systems primarily utilize cameras, sensors, and artificial intelligence algorithms to detect key indicators such as drowsiness, distraction, seatbelt usage, child presence, and passenger health. The core product offering involves integrated hardware and software solutions that provide real-time data and alerts, enhancing vehicle safety and facilitating the evolution of autonomous driving capabilities. Major applications span passenger vehicles, commercial fleets, and increasingly, public transportation, aiming to mitigate accident risks and improve overall road safety.

The primary benefits of DOMS include a significant reduction in road accidents caused by driver fatigue or inattention, improved passenger safety through detection of unbuckled passengers or left-behind children, and the enablement of personalized in-cabin experiences. Furthermore, these systems are crucial for regulatory compliance, as governments worldwide introduce stricter safety standards for new vehicles. Driving factors for market expansion include escalating concerns over road safety, the rapid adoption of advanced driver-assistance systems (ADAS), and the imperative for real-time occupant data to support higher levels of autonomous vehicle functionality. The integration of sophisticated AI and machine learning techniques allows these systems to offer more precise and reliable monitoring, making them indispensable for the future of intelligent mobility.

Driver and Occupant Monitoring Systems Market Executive Summary

The Driver and Occupant Monitoring Systems (DOMS) market is experiencing robust growth, driven by an accelerating focus on automotive safety and the advancement of autonomous vehicle technologies. Business trends indicate a move towards greater integration of DOMS with existing ADAS platforms, fostering partnerships between sensor manufacturers, software developers, and Tier 1 automotive suppliers to create comprehensive safety solutions. There is also a notable trend in the commercial vehicle segment, where fleet operators are increasingly adopting DOMS to enhance driver accountability, optimize operational efficiency, and reduce insurance liabilities. The market is seeing innovation in AI-powered analytics, leading to more accurate and proactive threat detection, moving beyond simple alerts to predictive interventions.

Regional trends highlight Asia-Pacific as a dominant and rapidly expanding market, primarily due to increasing vehicle production, stringent safety mandates in countries like China and Japan, and a large consumer base embracing new automotive technologies. North America and Europe continue to be strong markets, propelled by advanced regulatory frameworks, high consumer awareness of safety features, and significant investments in autonomous vehicle research and development. In terms of segments, camera-based monitoring systems are leading the market, offering versatile and cost-effective solutions for both driver and occupant surveillance. The software segment, particularly AI and machine learning algorithms, is poised for significant growth, as it underpins the intelligence and accuracy of these monitoring systems, enabling sophisticated behavioral analysis and real-time intervention capabilities.

AI Impact Analysis on Driver and Occupant Monitoring Systems Market

The integration of Artificial Intelligence (AI) into Driver and Occupant Monitoring Systems (DOMS) represents a transformative shift, fundamentally enhancing their capabilities and market dynamics. Users frequently inquire about how AI improves the accuracy and reliability of detecting complex states like micro-sleeps, cognitive distraction, or emotional distress in drivers. There are also significant concerns and expectations regarding data privacy, the ethical implications of constant surveillance, and how AI-driven systems might personalize safety features without becoming intrusive. Users anticipate AI will enable predictive analytics, moving DOMS from reactive alerting to proactive intervention, ultimately contributing to safer roads and more comfortable in-cabin experiences, while addressing the underlying need for robust data security and transparency.

AIs impact extends to improving the robustness of detection in diverse conditions, such as varying lighting, occlusions, and a wide range of driver demographics. Machine learning algorithms, trained on vast datasets of real-world driving scenarios, allow DOMS to differentiate between benign actions and genuine safety risks with unprecedented precision. This capability is crucial for reducing false positives and ensuring that alerts are only triggered when necessary, thereby maintaining driver acceptance and trust in the system. Furthermore, AI facilitates the continuous improvement of DOMS through over-the-air updates, allowing systems to learn from new data and adapt to evolving driving behaviors and environmental factors, keeping the technology at the forefront of safety innovation.

The profound influence of AI is also evident in its ability to process multiple data streams simultaneously from various sensors—cameras, pressure pads, lidar—to create a holistic understanding of the in-cabin environment. This multi-modal data fusion is essential for distinguishing between a child on a seat and an inanimate object, or identifying subtle indicators of driver impairment that might be missed by single-sensor systems. As autonomous driving levels advance, AI-powered DOMS will become critical for seamless transitions between human and autonomous control, ensuring driver readiness and engagement, and serving as a vital safety redundancy. This ongoing evolution positions AI as the core intelligence driving the next generation of driver and occupant monitoring solutions, addressing complex safety challenges and paving the way for more intuitive and reliable vehicle interactions.

- Enhanced accuracy in detecting distraction and fatigue through deep learning.

- Real-time, context-aware analysis of driver behavior and occupant status.

- Personalization of in-cabin safety alerts and comfort features.

- Predictive analytics for proactive accident prevention and risk mitigation.

- Facilitation of seamless human-machine interaction in autonomous vehicles.

- Improved data processing and fusion from multiple sensor modalities.

- Ethical considerations and privacy management for continuous monitoring.

DRO & Impact Forces Of Driver and Occupant Monitoring Systems Market

The Driver and Occupant Monitoring Systems (DOMS) market is profoundly shaped by a confluence of driving forces, inherent restraints, and emerging opportunities, all operating under significant impact forces. Key drivers include the escalating global concerns about road safety, leading to increasingly stringent automotive safety regulations and mandates from governmental bodies and consumer advocacy groups worldwide. The rapid evolution and integration of Advanced Driver-Assistance Systems (ADAS) and the progression towards higher levels of autonomous driving also necessitate sophisticated DOMS for monitoring driver readiness and occupant safety. Furthermore, growing consumer demand for advanced safety features and personalized in-cabin experiences significantly propels market expansion, pushing manufacturers to innovate.

Despite these powerful drivers, the DOMS market faces several significant restraints. High implementation costs associated with advanced sensor technology, AI software, and integration into complex vehicle architectures can deter broader adoption, especially in cost-sensitive segments. Privacy concerns surrounding continuous in-cabin surveillance and the collection of personal data present a substantial challenge, requiring robust data security measures and clear regulatory guidelines to build consumer trust. Technical complexities in integrating diverse sensor types and ensuring reliable performance across varying environmental conditions and driver demographics also pose hurdles. Additionally, the risk of false positives or nuisance alerts can lead to driver annoyance and potential disengagement with the system, undermining its effectiveness.

Amidst these challenges, considerable opportunities are emerging. The ongoing development of fully autonomous vehicles (Level 4 and 5) presents a long-term growth avenue, as DOMS will be essential for managing human-machine handovers and ensuring occupant safety in driverless modes. The expansion into commercial fleets, ride-sharing services, and public transport offers immediate market growth, driven by operational efficiency, insurance benefits, and public safety requirements. Advancements in sensor technology, such as compact and low-cost infrared cameras, radar, and lidar, coupled with more powerful edge computing capabilities, promise to make DOMS more accessible and accurate. The aftermarket segment also offers potential for retrofitting existing vehicles with advanced monitoring solutions. Impact forces, such as the high bargaining power of large automotive OEMs and Tier 1 suppliers, alongside the constant threat of new technological entrants, further shape the competitive landscape and drive continuous innovation within the market.

Segmentation Analysis

The Driver and Occupant Monitoring Systems (DOMS) market is extensively segmented to understand the diverse components, applications, and technologies that constitute its ecosystem. This segmentation provides clarity on market dynamics, identifying key growth areas and competitive landscapes across various dimensions. Understanding these segments is crucial for stakeholders to tailor strategies, identify niche opportunities, and develop targeted solutions that address specific market needs, ranging from hardware components to advanced software applications and vehicle types.

The segmentation primarily categorizes the market based on the type of monitoring, the underlying technology used, the vehicle types it serves, and the channels through which these systems are distributed. This granular breakdown allows for a comprehensive analysis of trends such as the shift from traditional sensor-based systems to camera-centric and AI-powered solutions, or the differing demands between passenger vehicles and commercial fleets. Each segment offers distinct growth trajectories and competitive considerations, reflecting the multifaceted nature of the automotive safety and intelligent mobility industries, ensuring a holistic view of market penetration and future expansion possibilities.

- By Component:

- Sensors (Pressure, Steering Angle, Inertial, Radar)

- Cameras (Infrared, RGB)

- Software (AI/ML Algorithms, Image Processing)

- Electronic Control Unit (ECU)

- Others (Microphones, Haptic Feedback Devices)

- By Monitoring Type:

- Driver Monitoring Systems (DMS)

- Occupant Monitoring Systems (OMS)

- By Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Trucks, Buses, Vans)

- Robo-Taxis/Autonomous Shuttles

- By Offering:

- Hardware

- Software

- Services (Integration, Maintenance, Updates)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Driver and Occupant Monitoring Systems Market Value Chain Analysis

The value chain for Driver and Occupant Monitoring Systems (DOMS) is complex, involving multiple layers of specialized suppliers and integrators, from raw material procurement to final product deployment and after-sales support. Upstream activities primarily involve the sourcing of critical electronic components, such as semiconductor wafers, camera lenses, image sensors, and various microcontrollers and processors. These are typically supplied by specialized component manufacturers to Tier 2 and Tier 1 automotive suppliers. The quality and reliability of these foundational components are paramount, as they directly impact the performance and accuracy of the sophisticated monitoring systems. Raw material suppliers play a crucial role in providing the basic building blocks for these advanced technologies.

Midstream in the value chain, Tier 1 suppliers and dedicated technology firms are responsible for integrating these components, developing proprietary software and AI algorithms, and assembling the complete DOMS units. This involves extensive research and development to create robust computer vision systems, develop advanced machine learning models for behavioral analysis, and ensure seamless integration of hardware and software. These Tier 1 suppliers then deliver integrated modules or complete systems to automotive Original Equipment Manufacturers (OEMs), who incorporate them into new vehicles. The strategic partnerships and collaborations at this stage are vital for ensuring interoperability, meeting specific OEM requirements, and accelerating time-to-market for innovative solutions.

Downstream activities focus on distribution and end-user engagement. The primary distribution channel is direct, with Tier 1 suppliers selling directly to automotive OEMs for factory installation in new vehicles. However, an indirect distribution channel exists through the aftermarket, where independent component manufacturers and system integrators offer DOMS solutions for retrofitting existing vehicles, often through automotive electronics retailers and specialized service centers. After-sales support, including software updates, maintenance, and data analysis services, also forms a critical part of the downstream value chain, ensuring long-term system performance and customer satisfaction. This intricate network of direct and indirect channels ensures broad market reach and addresses diverse consumer and commercial needs within the automotive sector.

Driver and Occupant Monitoring Systems Market Potential Customers

The potential customer base for Driver and Occupant Monitoring Systems (DOMS) is broad and expanding, primarily driven by safety imperatives, regulatory compliance, and the ongoing evolution of automotive technology. The most significant end-users and buyers are automotive Original Equipment Manufacturers (OEMs), who integrate these systems into their new vehicle models to meet stringent safety standards and differentiate their products with advanced features. OEMs are increasingly viewing DOMS as a standard safety feature rather than a premium add-on, leading to widespread adoption across various vehicle segments, from entry-level to luxury vehicles. Their demand is for integrated, reliable, and cost-effective solutions that can be seamlessly incorporated into vehicle architectures.

Beyond traditional passenger vehicle OEMs, commercial fleet operators represent a rapidly growing customer segment. Companies managing large fleets of trucks, buses, taxis, and ride-sharing vehicles are keen adopters of DOMS to enhance driver safety, improve operational efficiency, reduce insurance premiums, and ensure compliance with hours-of-service regulations. These operators prioritize systems that offer robust data logging, real-time alerts, and comprehensive analytics for driver behavior, fatigue management, and incident reconstruction. The ability of DOMS to mitigate risks associated with distracted or drowsy driving translates directly into tangible benefits for fleet profitability and safety records.

Other significant potential customers include ride-sharing companies, who require advanced monitoring to ensure both driver and passenger safety, especially as they explore autonomous vehicle deployments. Insurance providers are also emerging as key stakeholders, potentially incentivizing DOMS adoption through reduced premiums for vehicles equipped with these safety technologies. Furthermore, the aftermarket segment caters to individual vehicle owners and smaller businesses looking to upgrade existing vehicles with advanced safety features, driven by personal safety concerns or a desire to comply with emerging local regulations. As autonomous vehicle technology matures, operators of robo-taxis and autonomous shuttles will also become crucial customers, requiring sophisticated DOMS to monitor occupant status and ensure safety in the absence of a human driver.

Driver and Occupant Monitoring Systems Market Key Technology Landscape

The Driver and Occupant Monitoring Systems (DOMS) market is characterized by a rapidly evolving technological landscape, leveraging advanced sensing, processing, and artificial intelligence capabilities. At its core, the technology relies heavily on various sensor types, primarily infrared (IR) cameras, which are highly effective in low-light conditions and for detecting subtle physiological cues such as eye gaze, blink rates, and head pose, indicative of driver drowsiness or distraction. These camera systems often work in conjunction with advanced optics and filters to enhance image clarity and reduce interference. Beyond visual data, pressure sensors embedded in seats can detect occupant presence, weight distribution, and even seatbelt usage, while radar and lidar technologies may be employed for more precise occupant positioning and vital sign monitoring in advanced systems.

Central to the intelligence of DOMS is the sophisticated application of Artificial Intelligence (AI) and Machine Learning (ML) algorithms, particularly in the domain of computer vision. These algorithms are trained on vast datasets of human behavior to accurately identify patterns associated with fatigue, distraction, cognitive load, and various occupant states. Deep learning networks, such as Convolutional Neural Networks (CNNs), enable real-time analysis of video feeds and sensor data, allowing systems to make rapid and accurate inferences. Edge computing is increasingly critical, as it allows for immediate data processing directly within the vehicle, reducing latency and reliance on cloud connectivity, which is essential for real-time safety interventions.

Further technological advancements include biometrics, such as advanced eye-tracking and facial recognition, which can identify individual drivers and personalize vehicle settings or detect specific emotional states. Gesture recognition is also being explored to allow for intuitive control of in-cabin features without diverting driver attention. The integration of these disparate technologies, coupled with high-performance Electronic Control Units (ECUs) and robust software platforms, creates comprehensive DOMS that are not only capable of detecting risks but also of integrating with other vehicle systems, such as ADAS, to provide timely warnings or even intervene, thus shaping the future of proactive vehicle safety and intelligent in-cabin experiences.

Regional Highlights

The global Driver and Occupant Monitoring Systems (DOMS) market exhibits distinct growth patterns and drivers across different geographical regions, influenced by varying regulatory frameworks, consumer adoption rates, and technological advancements. Asia Pacific stands out as the leading and fastest-growing market, primarily propelled by burgeoning automotive production in countries like China, Japan, South Korea, and India. Increasing disposable incomes, a rising awareness of vehicle safety, and the proactive implementation of new safety mandates, particularly in China and Japan, are significant factors contributing to this regions dominance. Furthermore, robust investments in autonomous vehicle research and development, coupled with a large and tech-savvy consumer base, position Asia Pacific as a critical hub for DOMS innovation and deployment.

North America and Europe represent mature markets for DOMS, characterized by stringent safety regulations and a high demand for advanced automotive technologies. In North America, initiatives by organizations like the National Highway Traffic Safety Administration (NHTSA) advocating for enhanced driver safety technologies, combined with strong consumer demand for state-of-the-art safety features, are key market drivers. Europe, similarly, benefits from the European New Car Assessment Programme (Euro NCAP) standards, which increasingly emphasize driver and occupant monitoring as essential components for higher safety ratings. The presence of major automotive OEMs and Tier 1 suppliers, alongside significant research activities in autonomous driving, ensures continuous innovation and market penetration in these regions. The focus here is not just on basic safety but on advanced, integrated solutions that contribute to overall vehicle intelligence and passenger comfort.

The Rest of the World, encompassing regions like Latin America, the Middle East, and Africa, is anticipated to witness gradual but steady growth. This growth is primarily driven by improving economic conditions, increasing vehicle parc, and a growing recognition of the importance of road safety, often influenced by global safety standards. While regulatory frameworks may be less developed compared to other regions, there is a growing trend towards adopting international safety benchmarks, leading to increased demand for DOMS in both OEM and aftermarket segments. Countries in these regions are also observing investments in infrastructure and smart city initiatives, which could further accelerate the adoption of advanced automotive safety technologies over the forecast period, albeit at a slower pace than the more established markets.

- North America: Strong regulatory push for safety, high consumer awareness, significant R&D in autonomous vehicles.

- Europe: Euro NCAP mandates, focus on integrated safety systems, presence of leading automotive manufacturers.

- Asia Pacific: Highest growth, increasing vehicle production, stringent safety regulations (China, Japan), large consumer base.

- Latin America: Emerging market, growing awareness of road safety, increasing vehicle penetration.

- Middle East & Africa: Developing market, improving infrastructure, potential for fleet management adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Driver and Occupant Monitoring Systems Market.- Bosch (Robert Bosch GmbH)

- Continental AG

- Valeo SA

- Magna International Inc.

- ZF Friedrichshafen AG

- Aptiv PLC

- Affectiva (acquired by Smart Eye)

- Seeing Machines Ltd.

- Smart Eye AB

- Ficosa International SA

- Denso Corporation

- Panasonic Corporation

- Veoneer Inc.

- Visteon Corporation

- EyeSight Technologies Ltd.

Frequently Asked Questions

What is a Driver and Occupant Monitoring System (DOMS)?

A Driver and Occupant Monitoring System (DOMS) is an in-vehicle technology that uses cameras, sensors, and artificial intelligence to monitor the drivers state (e.g., drowsiness, distraction) and occupant behavior (e.g., seatbelt use, child presence) to enhance safety and comfort.

How do DOMS improve road safety?

DOMS significantly improve road safety by detecting dangerous driver states like fatigue or distraction in real-time, issuing alerts, and identifying unsafe occupant conditions, thereby preventing accidents and ensuring passenger well-being. They can also support safe transitions in autonomous vehicles.

Are there privacy concerns with Driver and Occupant Monitoring Systems?

Yes, privacy concerns regarding continuous in-cabin data collection are a common consideration. Manufacturers are addressing this through on-device processing (edge computing), anonymization techniques, and clear data usage policies to protect personal information while ensuring safety.

What are the main drivers for the growth of the DOMS market?

The primary drivers include increasingly stringent global automotive safety regulations, the rapid adoption of Advanced Driver-Assistance Systems (ADAS), growing consumer demand for advanced safety features, and the progression towards higher levels of autonomous driving capabilities.

What role does AI play in Driver and Occupant Monitoring Systems?

AI is crucial for DOMS, enabling accurate real-time detection of complex human behaviors such as micro-sleeps, cognitive distraction, and emotional states. It processes multi-modal sensor data, enhances predictive capabilities, and personalizes in-cabin safety features for improved system effectiveness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager