Drone Sensor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429317 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Drone Sensor Market Size

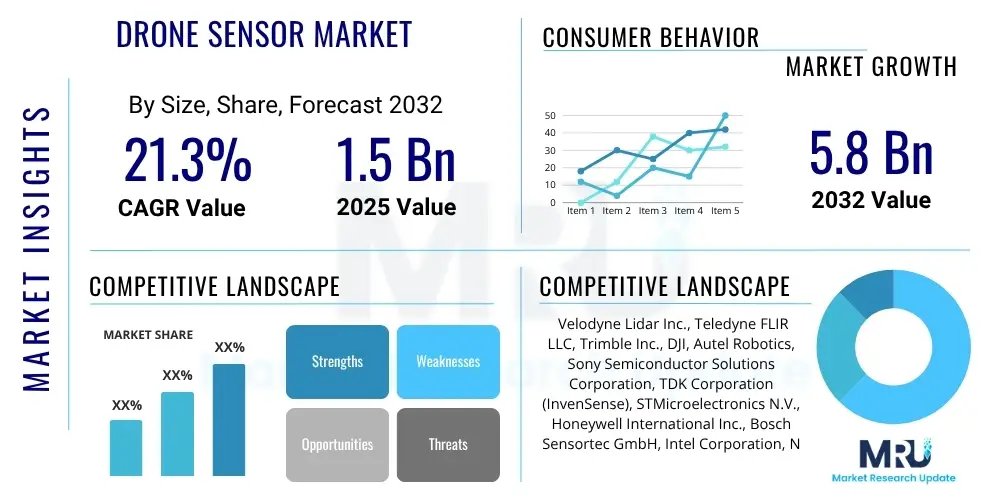

The Drone Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.3% between 2025 and 2032. The market is estimated at USD 1.5 Billion in 2025 and is projected to reach USD 5.8 Billion by the end of the forecast period in 2032.

Drone Sensor Market introduction

The drone sensor market represents a critical and rapidly expanding segment within the broader unmanned aerial vehicle (UAV) ecosystem. These sophisticated devices are the "eyes and ears" of drones, enabling them to collect vast amounts of data, perceive their environment, and execute complex tasks with remarkable precision. The foundational role of sensors extends across various drone types, from compact consumer models to advanced industrial and military UAVs, underscoring their indispensable nature for modern aerial operations. As drone technology continues to mature and integrate into diverse sectors, the demand for more advanced, reliable, and versatile sensor solutions is experiencing exponential growth, driving innovation and market expansion globally.

Drone sensors encompass a wide array of technological instruments, each designed for specific data acquisition and environmental interaction purposes. This includes high-resolution electro-optical/infrared (EO/IR) cameras for visual and thermal imaging, LiDAR (Light Detection and Ranging) systems for 3D mapping and terrain modeling, multispectral and hyperspectral sensors for detailed agricultural and environmental analysis, and Inertial Measurement Units (IMUs) and Global Positioning System (GPS) modules for precise navigation and stabilization. Beyond these, ultrasonic, radar, and gas sensors further diversify the data collection capabilities, allowing drones to perform specialized functions such as obstacle avoidance in challenging environments or detecting specific chemical signatures, significantly enhancing their operational utility and safety across a multitude of applications.

The major applications of drone sensors span across vital industries including agriculture for crop health monitoring, construction for site mapping and progress tracking, infrastructure inspection for identifying faults in pipelines and power lines, and defense for surveillance and reconnaissance missions. The benefits derived from these applications are profound, ranging from enhanced operational efficiency and significant cost reductions to improved safety by removing human operators from hazardous environments, and the ability to gather highly accurate, real-time data from previously inaccessible areas. Key driving factors propelling this market forward include the continuous miniaturization of sensors, remarkable advancements in AI and machine learning for data processing and autonomous decision-making, increasing adoption of drones across commercial and military sectors, and a burgeoning global demand for precise, actionable aerial intelligence for informed decision-making across enterprise and governmental operations.

Drone Sensor Market Executive Summary

The drone sensor market is currently witnessing dynamic shifts driven by aggressive technological innovation, expanding application horizons, and evolving regulatory frameworks. Key business trends indicate a strategic move towards consolidation among sensor manufacturers and drone OEMs, often through partnerships and acquisitions, to offer integrated solutions that streamline deployment and enhance user experience. There is a discernible focus on developing specialized sensor payloads tailored for niche applications, such as high-precision LiDAR for autonomous vehicle development or advanced multispectral cameras for climate change monitoring. Furthermore, the market is seeing a surge in demand for AI-powered analytics platforms that transform raw sensor data into actionable insights, pushing the industry towards value-added services beyond mere hardware provision.

Regional trends highlight North America and Europe as frontrunners in drone sensor adoption, attributed to robust regulatory support for commercial drone operations, established industrial bases, and significant investment in R&D across defense, agriculture, and infrastructure sectors. These regions benefit from a high degree of technological readiness and strong innovation ecosystems. Concurrently, the Asia Pacific region is demonstrating the most rapid growth, fueled by extensive infrastructure development projects, burgeoning agricultural mechanization, and increasing military modernization efforts in countries like China, India, and Japan. Latin America and the Middle East & Africa are emerging markets, with rising applications in mining, oil and gas, and public safety, indicating a diversified global demand landscape that promises sustained growth across all geographic territories.

Within the segmentation landscape, the market is experiencing notable trends across various sensor types and end-use industries. High-resolution imaging sensors, including thermal and multispectral variants, are experiencing escalating demand, particularly for detailed inspection and agricultural health monitoring. LiDAR sensors are gaining traction for precise 3D mapping and modeling in construction and urban planning, showcasing their unique capabilities. There is a growing emphasis on integrated sensor solutions that combine multiple sensor types with advanced data fusion algorithms to provide a more comprehensive and accurate environmental perception. This trend towards holistic sensing packages, coupled with a focus on smaller, lighter, and more power-efficient designs, is fundamentally reshaping product development strategies and competitive dynamics within the drone sensor market, indicating a future of increasingly sophisticated and adaptable aerial data collection capabilities.

AI Impact Analysis on Drone Sensor Market

Artificial Intelligence (AI) is profoundly revolutionizing the drone sensor market, moving beyond mere data capture to sophisticated data interpretation, real-time decision-making, and autonomous operational capabilities. Common user questions often revolve around how AI can enhance the accuracy and efficiency of drone-collected data, what specific AI applications are prevalent in drone sensor technologies, and the extent to which AI can enable fully autonomous drone operations. Users are keenly interested in leveraging AI to transform raw sensor input into actionable intelligence, such as automating the identification of anomalies in infrastructure inspections, optimizing agricultural treatments based on crop health, or enhancing threat detection in surveillance missions. The expectation is that AI will unlock greater operational efficiencies, reduce manual analytical effort, and enable drones to perform tasks that were previously either too complex or impossible.

The integration of AI algorithms directly into drone sensor systems, or into the post-processing workflows, allows for unprecedented levels of data analysis and operational optimization. This includes sophisticated object detection and classification, where AI models can identify specific assets, defects, or environmental features from visual, thermal, or LiDAR data with high precision. Furthermore, AI facilitates advanced sensor fusion, combining data from multiple sensor types (e.g., RGB, thermal, LiDAR) to create a richer, more accurate environmental model, improving situational awareness and reliability. The ability of AI to learn from vast datasets enables predictive analytics, forecasting potential equipment failures or environmental changes, and allowing for proactive interventions rather than reactive responses, thereby significantly increasing the value proposition of drone-based data collection across various industrial applications.

Looking ahead, the influence of AI on drone sensors is set to deepen, driving the evolution towards more intelligent and self-sufficient drone systems. Users anticipate advancements in edge AI, where processing occurs onboard the drone in real-time, reducing latency and reliance on ground-based infrastructure. This will empower drones to make critical decisions independently, such as dynamically adjusting flight paths to avoid unexpected obstacles or instantly identifying and tracking targets during complex missions. While the benefits are clear, concerns also exist regarding the ethical implications of autonomous decision-making, data privacy, and the robust validation of AI models to ensure reliability and prevent biases. Addressing these concerns will be crucial for the continued, responsible growth and integration of AI within the drone sensor market, fostering trust and widespread adoption for advanced aerial intelligence solutions.

- Enhanced data interpretation and analytics, including automated object detection, classification, and anomaly identification.

- Real-time decision-making capabilities for autonomous flight, dynamic mission execution, and adaptive obstacle avoidance.

- Improved sensor fusion and data synthesis from disparate sensor types for more accurate and comprehensive environmental perception.

- Predictive maintenance for drone components and monitored assets based on continuous sensor data analysis.

- Automated anomaly detection and precise localization in critical infrastructure inspections, reducing manual review time.

- Optimized flight path planning and intelligent navigation in complex or dynamic environments, minimizing human intervention.

- Advanced situational awareness and threat assessment in surveillance, security, and defense applications.

- Machine learning for pattern recognition in large datasets, enabling deeper insights in agriculture, environmental monitoring, and urban planning.

DRO & Impact Forces Of Drone Sensor Market

The drone sensor market is significantly propelled by a convergence of technological advancements and expanding operational needs across global industries. A primary driver is the accelerating demand for drones in diverse applications, from precision agriculture and construction site management to critical infrastructure inspection and national security, each requiring specialized and highly accurate data acquisition capabilities enabled by advanced sensors. Concurrently, continuous technological advancements in sensor miniaturization, improved resolution, enhanced spectral capabilities, and reduced power consumption are making drone integration more feasible and cost-effective. The growing adoption of Artificial Intelligence (AI) and Machine Learning (ML) for processing and interpreting sensor data further amplifies this market's momentum, enabling actionable insights from vast datasets and fostering a greater return on investment for drone operations. The imperative for high-precision, real-time data across sectors for informed decision-making also acts as a powerful catalyst, ensuring sustained growth and innovation within this essential technology segment.

Despite robust growth drivers, the drone sensor market faces several notable restraints that could temper its expansion. High initial investment costs associated with advanced sensor payloads and sophisticated drone platforms can be prohibitive for smaller enterprises or those with limited capital budgets. This financial barrier sometimes hinders widespread adoption, particularly in developing economies. Regulatory hurdles and complex, often inconsistent, airspace regulations across different countries and regions pose significant operational challenges, limiting where and how drones can be deployed. Furthermore, technical limitations such as limited flight endurance and payload capacity of drones can restrict the operational scope and duration of sensor missions. Data processing complexities, including the sheer volume of data generated by high-fidelity sensors and the expertise required for its analysis, also present a significant bottleneck. Finally, cybersecurity concerns related to data integrity, privacy, and the potential for unauthorized access to sensitive information collected by drones represent a critical challenge that requires robust solutions and trusted frameworks.

Looking ahead, the drone sensor market is rife with opportunities that promise to reshape its landscape and accelerate future growth. The emergence of novel applications, such as urban air mobility (UAM), package delivery, and advanced climate research, will open entirely new avenues for sensor integration and development. The synergistic integration with 5G technology is poised to revolutionize real-time data transmission and enhance command and control capabilities for drones, unlocking unprecedented operational efficiencies. Furthermore, the development of sophisticated multi-sensor fusion platforms that seamlessly combine data from various sensor types to provide a holistic environmental understanding will cater to increasingly complex mission requirements. Expanding adoption in developing economies, driven by investment in infrastructure, agriculture, and public safety, represents a vast untapped market with significant growth potential. Lastly, advancements in autonomous systems and edge computing capabilities will further empower sensors to perform real-time analysis and decision-making onboard the drone, reducing reliance on ground infrastructure and expanding operational reach.

Segmentation Analysis

The drone sensor market is meticulously segmented across various dimensions, providing a granular view of its intricate structure and diverse offerings. This segmentation is crucial for understanding the specific dynamics, technological demands, and growth trajectories within different market niches. The primary segmentation criteria typically include the type of sensor technology employed, the classification of the drone platform, the specific application for which the sensors are utilized, and the ultimate end-use industry benefiting from the drone-derived data. Each segment possesses distinct characteristics, market drivers, and competitive landscapes, collectively reflecting the extensive range of capabilities and specialized requirements that define the modern drone sensor ecosystem and guide strategic market development.

- By Sensor Type:

- Image Sensors (RGB, Thermal, Multispectral, Hyperspectral)

- LiDAR Sensors

- RADAR Sensors

- Inertial Measurement Units (IMU)

- GPS/GNSS Sensors

- Ultrasonic Sensors

- Pressure Sensors

- Chemical Sensors

- Gas Sensors

- Magnetic Sensors

- By Drone Type:

- Fixed-Wing Drones

- Rotary-Wing Drones (Multi-Rotor, Single-Rotor)

- Hybrid Drones

- By Application:

- Mapping and Surveying

- Inspection and Monitoring

- Surveillance and Reconnaissance

- Precision Agriculture

- Delivery Services

- Search and Rescue

- Environmental Monitoring

- Security and Public Safety

- Wildlife Monitoring

- Photography and Cinematography

- By End-Use Industry:

- Agriculture

- Construction

- Defense & Military

- Energy & Utilities

- Mining

- Logistics & Transportation

- Insurance

- Media & Entertainment

- Real Estate

- Government & Public Safety

- Forestry and Conservation

- Academia and Research

Value Chain Analysis For Drone Sensor Market

The value chain for the drone sensor market is a complex ecosystem beginning with upstream activities that focus on the fundamental components and technological innovation essential for sensor manufacturing. This initial stage involves the research and development of novel sensing technologies, the fabrication of micro-electromechanical systems (MEMS), and the production of optical components, semiconductors, and specialized materials like infrared detectors or high-purity silicon. Key players in this segment include specialized component manufacturers and material science companies, whose contributions are critical for defining the performance, size, and efficiency characteristics of the final sensor products. Investment in advanced materials and precision engineering at this stage directly impacts the capabilities and cost-effectiveness of the sensors ultimately integrated into drone platforms, establishing the technological foundation for the entire market.

Midstream activities in the value chain primarily involve the design, assembly, and integration of these core components into functional drone sensor modules. This phase includes sophisticated calibration, quality assurance, and testing processes to ensure optimal performance and reliability under diverse operational conditions. Sensor manufacturers and module integrators are the dominant entities here, focusing on combining various sensing elements with necessary processing units and communication interfaces to create ready-to-use payloads for drones. Furthermore, this stage often includes the development of proprietary software and firmware that govern sensor operation, data acquisition protocols, and preliminary data processing, adding significant value. The ability to innovate in integration and packaging is crucial, as it directly affects the ease of adoption by drone manufacturers and the overall efficiency of drone systems.

The downstream segment of the drone sensor market value chain is where the integrated sensors are commercialized and utilized by end-users. This involves the distribution channels, which can be direct from sensor manufacturers to drone OEMs (Original Equipment Manufacturers), or indirect through a network of specialized distributors and system integrators who bundle sensors with drone platforms and analytics software. Service providers form another critical part of this segment, offering drone-as-a-service (DaaS) solutions, where they deploy drones equipped with specific sensors to collect data for clients in agriculture, construction, inspection, and other sectors. Post-sales support, maintenance, and ongoing software updates are also vital downstream activities, ensuring long-term customer satisfaction and optimal sensor performance. The effectiveness of these downstream channels in delivering complete, actionable solutions is paramount for unlocking the full market potential of drone sensor technology and driving widespread adoption across diverse industries.

Drone Sensor Market Potential Customers

The drone sensor market targets a broad spectrum of potential customers, primarily encompassing end-users and buyers across various industrial, commercial, and governmental sectors. Commercial enterprises represent a significant customer base, driven by the need for enhanced operational efficiency, cost reduction, and improved data accuracy. This includes large-scale agricultural enterprises leveraging multispectral sensors for precision farming, construction companies utilizing LiDAR and photogrammetry for site mapping and progress monitoring, and energy and utility providers deploying thermal and visual sensors for infrastructure inspection of power lines, pipelines, and solar farms. These customers seek solutions that can mitigate risks, streamline workflows, and provide actionable insights to optimize their core business operations, making reliable and high-performance drone sensors indispensable tools for modern enterprise management and strategic decision-making in a competitive global economy.

Government agencies and defense organizations constitute another critical segment of potential customers, with distinct and often highly specialized requirements for drone sensors. Defense and military forces require advanced EO/IR sensors, radar, and hyperspectral imaging for surveillance, reconnaissance, intelligence gathering, and target acquisition, prioritizing robust, high-performance, and secure solutions for national security applications. Public safety entities, such as police, fire departments, and search and rescue teams, are increasingly adopting thermal sensors, high-resolution cameras, and gas detectors for emergency response, disaster assessment, and incident management, where rapid and accurate situational awareness is paramount. These governmental buyers often have stringent procurement processes, demanding solutions that meet specific technical standards, regulatory compliance, and security protocols, highlighting the need for robust and dependable drone sensor technologies.

Beyond traditional industrial and governmental buyers, emerging sectors and research institutions also represent a growing segment of potential customers for drone sensors. Environmental monitoring organizations utilize a variety of sensors for pollution detection, wildlife tracking, deforestation assessment, and climate research, requiring highly sensitive and accurate instruments for scientific data collection. Logistics and transportation companies are exploring drone sensors for inventory management, last-mile delivery, and supply chain monitoring, seeking efficiencies and new operational paradigms. Academic institutions and research laboratories also purchase advanced drone sensors for various scientific studies, experimental projects, and the development of new drone applications. The continuous evolution of drone capabilities and the increasing awareness of their benefits are consistently expanding the pool of potential customers, driving further diversification and innovation within the drone sensor market ecosystem globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.5 Billion |

| Market Forecast in 2032 | USD 5.8 Billion |

| Growth Rate | 21.3% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Velodyne Lidar Inc., Teledyne FLIR LLC, Trimble Inc., DJI, Autel Robotics, Sony Semiconductor Solutions Corporation, TDK Corporation (InvenSense), STMicroelectronics N.V., Honeywell International Inc., Bosch Sensortec GmbH, Intel Corporation, NVIDIA Corporation, Parrot Drones SAS, Microchip Technology Inc., u-blox AG, Safran S.A., Raytheon Technologies (Collins Aerospace), Leonardo S.p.A., BAE Systems plc, L3Harris Technologies Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drone Sensor Market Key Technology Landscape

The technological landscape of the drone sensor market is characterized by rapid innovation and a convergence of various cutting-edge disciplines, fundamentally shaping the capabilities and applications of modern drones. At its core, the market relies on advancements in core sensing technologies, prominently featuring high-resolution imaging sensors such as RGB, thermal, multispectral, and hyperspectral cameras. These sensors continuously evolve with higher pixel densities, improved low-light performance, and enhanced spectral bands, allowing for unprecedented detail and specificity in data collection. LiDAR (Light Detection and Ranging) technology is also central, providing highly accurate 3D point clouds for mapping, modeling, and obstacle detection, with ongoing developments focusing on solid-state LiDAR for reduced size, cost, and increased durability. Additionally, robust Inertial Measurement Units (IMUs) and precise Global Navigation Satellite System (GNSS) receivers are indispensable for stable flight, accurate positioning, and reliable navigation, continuously improving with enhanced signal processing and multi-constellation support.

Beyond the fundamental sensor hardware, the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms represents a transformative technological shift in the drone sensor market. AI is increasingly deployed for onboard processing and analysis of sensor data, enabling real-time object detection, classification, anomaly identification, and autonomous decision-making, which significantly enhances operational efficiency and reduces post-mission processing time. Sensor fusion techniques are becoming more sophisticated, combining data from multiple sensor types (e.g., visual, thermal, LiDAR, radar) to create a more comprehensive and robust environmental perception model, thereby improving accuracy and reliability in complex scenarios. Furthermore, the rise of edge computing allows for sensor data processing directly on the drone, minimizing latency and bandwidth requirements for data transmission, which is crucial for applications demanding immediate action and autonomy in remote or connectivity-challenged environments, thus pushing the boundaries of drone intelligence and operational independence.

Looking to the future, the key technology landscape for drone sensors is being further influenced by advancements in communication technologies, materials science, and power management. The integration of 5G connectivity is poised to revolutionize data transmission speeds and reliability, enabling seamless real-time control and high-volume data streaming from drones to ground stations or cloud platforms. Miniaturization continues to be a paramount technological driver, with MEMS (Micro-Electro-Mechanical Systems) technology enabling smaller, lighter, and more power-efficient sensors that can be integrated into increasingly compact drone designs without sacrificing performance. Innovations in battery technology and alternative power sources are extending drone flight times, allowing for longer sensor deployment and expanded mission ranges. Furthermore, the development of specialized chemical and gas sensors, coupled with advanced data analytics, is opening up new frontiers in environmental monitoring, industrial safety, and public health applications, indicating a future where drone sensors are not just seeing the world, but actively understanding and interacting with it on a molecular level.

Regional Highlights

- North America: This region leads the market in terms of technological innovation and commercial adoption, particularly in defense, precision agriculture, and infrastructure inspection. The United States and Canada are pivotal, driven by significant R&D investments, a robust startup ecosystem, and favorable regulatory advancements supporting commercial drone operations. High demand for advanced mapping, surveying, and security applications further solidifies its market position.

- Europe: Europe exhibits strong growth propelled by increasing investments in smart city initiatives, energy and utilities inspection, and environmental monitoring. Countries like Germany, the UK, and France are at the forefront, leveraging supportive regulatory frameworks and a focus on sustainable and efficient industrial operations. The region benefits from robust academic research and collaboration in drone and sensor technologies.

- Asia Pacific (APAC): The APAC region is witnessing the most rapid expansion, fueled by massive infrastructure development projects, large-scale agricultural operations, and burgeoning defense spending in countries such as China, India, Japan, and Australia. The growing manufacturing base for drones and components, coupled with increasing adoption in logistics and mining, makes APAC a dynamic and high-growth market for drone sensors.

- Latin America: This region is an emerging market with growing applications in precision agriculture, mining, and surveillance, particularly in Brazil and Mexico. While still in nascent stages compared to other regions, increasing foreign investments and a growing recognition of drone technology's benefits are driving market expansion. Regulatory landscapes are evolving to accommodate rising drone usage.

- Middle East & Africa (MEA): The MEA market is primarily driven by government investments in security, oil & gas infrastructure monitoring, and smart city developments, notably in the UAE and Saudi Arabia. South Africa is also a key player in mining and environmental monitoring. The region is characterized by significant demand for surveillance and industrial inspection, with increasing strategic interest in advanced drone capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drone Sensor Market.- Velodyne Lidar Inc.

- Teledyne FLIR LLC

- Trimble Inc.

- DJI

- Autel Robotics

- Sony Semiconductor Solutions Corporation

- TDK Corporation (InvenSense)

- STMicroelectronics N.V.

- Honeywell International Inc.

- Bosch Sensortec GmbH

- Intel Corporation

- NVIDIA Corporation

- Parrot Drones SAS

- Microchip Technology Inc.

- u-blox AG

- Safran S.A.

- Raytheon Technologies (Collins Aerospace)

- Leonardo S.p.A.

- BAE Systems plc

- L3Harris Technologies Inc.

Frequently Asked Questions

What are the primary types of sensors used in drones and their main functions?

Drone sensors encompass a wide range of technologies, including RGB cameras for visible light imaging, thermal sensors for temperature detection, multispectral and hyperspectral sensors for detailed agricultural analysis, LiDAR for 3D mapping, RADAR for adverse weather detection, Inertial Measurement Units (IMUs) for stability, and GPS/GNSS for precise positioning. Each sensor type serves to collect specific data, enabling various applications from visual inspection to complex environmental analysis and autonomous navigation capabilities for comprehensive aerial data acquisition.

How do drone sensors contribute to precision agriculture and agricultural efficiency?

In precision agriculture, drone sensors are indispensable for optimizing crop management and enhancing yields. Multispectral and hyperspectral sensors analyze crop health by detecting variations in plant reflectance, identifying stress factors like disease, pests, or nutrient deficiencies at an early stage. Thermal sensors monitor irrigation efficiency and water stress, while LiDAR provides accurate terrain models for optimized planting and targeted spraying. This data enables farmers to apply resources precisely where needed, reducing waste, improving crop quality, and significantly boosting overall agricultural efficiency and sustainability.

What are the main applications of drone sensors in critical infrastructure inspection?

Drone sensors revolutionize critical infrastructure inspection by providing safe, cost-effective, and highly detailed assessments. High-resolution RGB cameras and thermal imagers are used to detect structural defects, corrosion, or heat anomalies in power lines, pipelines, bridges, and wind turbines. LiDAR systems generate precise 3D models for deformation analysis and volumetric measurements, while gas sensors can detect leaks in industrial facilities. These applications reduce the need for hazardous manual inspections, minimize downtime, and enable proactive maintenance strategies, significantly improving the safety and longevity of vital infrastructure assets globally.

What role does Artificial Intelligence (AI) play in enhancing drone sensor capabilities?

Artificial Intelligence profoundly enhances drone sensor capabilities by transforming raw data into actionable intelligence. AI algorithms enable advanced data processing for tasks such as automated object detection, classification, and anomaly identification in real-time. This allows drones to perform autonomous navigation, optimize flight paths, and make intelligent decisions independently. Furthermore, AI facilitates sensor fusion, integrating data from multiple sensor types for a more comprehensive environmental understanding, and supports predictive analytics for proactive maintenance. Ultimately, AI makes drone operations smarter, more efficient, and capable of addressing complex analytical challenges with minimal human intervention, unlocking greater value from aerial data.

What are the key challenges facing the growth and adoption of the drone sensor market?

The drone sensor market faces several key challenges impacting its growth and widespread adoption. These include the high initial investment costs for advanced sensor payloads and sophisticated drone platforms, which can be prohibitive for some users. Complex and often inconsistent regulatory frameworks across different regions create operational hurdles, limiting deployment flexibility. Technical constraints such as limited drone battery life and payload capacity restrict mission duration and sensor integration options. Furthermore, managing and processing the vast volumes of data generated by high-fidelity sensors presents significant analytical and storage challenges. Lastly, cybersecurity concerns regarding data privacy and the integrity of collected information remain critical issues that demand robust solutions for continued market confidence and expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager