Drones for Emergency Responders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427927 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Drones for Emergency Responders Market Size

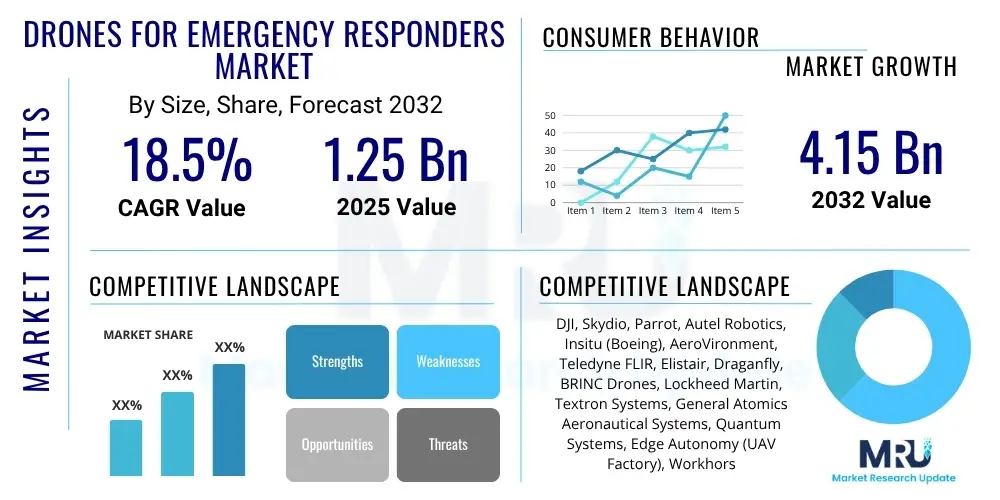

The Drones for Emergency Responders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 1.25 billion in 2025 and is projected to reach USD 4.15 billion by the end of the forecast period in 2032.

Drones for Emergency Responders Market introduction

The Drones for Emergency Responders Market encompasses a sophisticated ecosystem of unmanned aerial vehicles (UAVs) specifically designed and deployed to support critical operations during emergencies and disaster scenarios. These specialized drones are equipped with advanced sensors, communication systems, and payload capabilities, enabling them to provide invaluable assistance to public safety agencies, humanitarian organizations, and disaster management teams. Their primary objective is to enhance situational awareness, expedite search and rescue efforts, facilitate rapid damage assessment, and improve overall operational efficiency and safety for human responders in hazardous environments.

Products within this market range from compact, highly agile quadcopters used for close-range reconnaissance to larger, more enduring fixed-wing or hybrid VTOL (Vertical Take-Off and Landing) platforms capable of covering extensive areas. Key applications span a wide spectrum of emergency services, including search and rescue missions in rugged terrains or collapsed structures, aerial firefighting support through thermal imaging and hot-spot detection, law enforcement surveillance and pursuit, and comprehensive disaster assessment following natural catastrophes. The inherent benefits of these drones, such as their ability to access dangerous or inaccessible locations, provide real-time data feeds, and operate without risking human lives, position them as indispensable tools in modern emergency response protocols.

The market's robust growth is predominantly driven by continuous technological advancements in drone capabilities, including enhanced battery life, improved sensor integration, and increasingly autonomous flight modes. Furthermore, the rising frequency and intensity of natural disasters globally, coupled with a growing emphasis on responder safety and efficiency, are significantly accelerating adoption rates. Governments and public safety organizations worldwide are recognizing the cost-effectiveness and operational advantages offered by these unmanned systems compared to traditional methods, thereby fueling sustained investment and innovation within this vital sector.

Drones for Emergency Responders Market Executive Summary

The Drones for Emergency Responders Market is experiencing dynamic growth, characterized by significant business trends that underscore its evolution into a critical component of global public safety infrastructure. A notable trend is the increasing consolidation within the industry, with larger defense and technology firms acquiring specialized drone manufacturers to expand their portfolios and integrate advanced capabilities. Furthermore, there is a growing emphasis on strategic partnerships between hardware providers, software developers, and service companies to offer comprehensive, end-to-end solutions, moving beyond mere drone sales to full-service operational support, including training, maintenance, and data analysis. This shift towards integrated solutions reflects a market demand for holistic emergency response tools that are readily deployable and seamlessly integrated into existing command structures.

Regional trends reveal diverse adoption patterns and growth drivers across geographies. North America, particularly the United States, stands as a mature market with high adoption rates, driven by proactive government initiatives, robust funding for public safety technologies, and a strong presence of key technological innovators. Europe is also a significant market, albeit with more fragmented regulatory frameworks that can influence deployment strategies, focusing on applications such as urban search and rescue and cross-border disaster cooperation. The Asia Pacific region is emerging as a high-growth market, propelled by its susceptibility to natural disasters, increasing urbanization, and burgeoning investments in advanced public safety infrastructure, especially in countries like Japan, China, and Australia. Latin America, the Middle East, and Africa are showing nascent but rapidly accelerating adoption, primarily driven by a need to overcome geographical challenges and enhance security capabilities with limited human resources.

Segmentation trends indicate a strong demand for specialized drone types and integrated component solutions. Rotary-wing drones, owing to their vertical take-off and landing capabilities and maneuverability, remain dominant for close-range inspection and confined-space operations. However, hybrid and fixed-wing drones are gaining traction for long-duration, wide-area surveillance. In terms of applications, search and rescue, along with firefighting support, are consistently leading segments, while law enforcement and hazardous materials incident response are rapidly expanding. The component segment highlights a surge in demand for advanced sensor payloads (e.g., thermal, LiDAR, chemical detection) and sophisticated software for autonomous flight, real-time data processing, and predictive analytics, emphasizing the market's shift towards intelligent and data-driven emergency response solutions.

AI Impact Analysis on Drones for Emergency Responders Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Drones for Emergency Responders Market frequently revolve around how AI can enhance operational capabilities, improve decision-making under pressure, and ensure safety and efficiency. Users often inquire about the extent of automation AI can bring to drone missions, such as autonomous navigation in complex environments or intelligent object recognition for identifying survivors or hazards. Concerns are also raised about the ethical implications of AI-driven surveillance, data privacy, and the potential for AI to displace human roles, alongside questions about the robustness and reliability of AI systems in critical, high-stress situations. Expectations include AI providing faster, more accurate data analysis, predictive insights for resource allocation, and advanced communication functionalities to streamline emergency operations.

The integration of AI is fundamentally transforming the Drones for Emergency Responders market by enabling unprecedented levels of autonomy and intelligence. AI algorithms are now powering advanced flight control systems, allowing drones to navigate autonomously through smoke, debris, or dense forests, significantly reducing the cognitive load on human operators and enhancing mission success rates in challenging conditions. Furthermore, AI-driven computer vision systems provide real-time object detection and classification, allowing drones to quickly identify missing persons, locate fire hotspots, or pinpoint hazardous materials from aerial footage, converting raw data into actionable intelligence with remarkable speed and accuracy. This capability is paramount for improving response times and ensuring more targeted interventions.

Beyond automation and recognition, AI is also crucial for predictive analytics and data synthesis within emergency response scenarios. Machine learning models can analyze vast datasets collected by drones – including thermal imagery, geographic information, and historical incident data – to predict potential disaster progression, optimize search patterns, and even recommend resource deployment strategies. This predictive power allows emergency services to move from reactive to proactive responses, mitigating risks and maximizing the impact of limited resources. Additionally, AI facilitates enhanced communication and coordination by processing complex sensor inputs and presenting critical information in an intuitive format to multiple stakeholders simultaneously, fostering seamless interoperability among diverse response teams.

- Enhanced Autonomous Navigation: AI enables drones to plan optimal flight paths, avoid obstacles dynamically, and operate in GPS-denied environments, improving safety and efficiency for search and rescue operations.

- Real-time Object Recognition: AI-powered computer vision identifies survivors, victims, specific hazards (e.g., fire, gas leaks), and critical infrastructure damage from aerial imagery, drastically speeding up assessment and response.

- Predictive Analytics: Machine learning algorithms analyze environmental data, historical patterns, and live feeds to forecast disaster progression, identify potential risks, and optimize resource deployment strategies.

- Improved Data Processing and Analysis: AI rapidly processes vast amounts of sensor data (thermal, LiDAR, multispectral) to create actionable intelligence, such as detailed 3D maps of disaster zones or precise temperature readings of burning structures.

- Swarm Intelligence: Future AI integration will allow multiple drones to operate collaboratively as a coordinated swarm, covering larger areas more efficiently and sharing information autonomously to achieve complex mission objectives.

- Decision Support Systems: AI assists human operators by filtering out irrelevant data, highlighting critical anomalies, and suggesting optimal courses of action based on real-time situational awareness.

- Enhanced Communication and Connectivity: AI-driven systems can optimize communication links, manage data flow in congested areas, and facilitate seamless data sharing between drones, ground teams, and command centers.

DRO & Impact Forces Of Drones for Emergency Responders Market

The Drones for Emergency Responders Market is shaped by a confluence of powerful drivers, significant restraints, compelling opportunities, and a diverse range of impact forces. Key drivers propelling market growth include the relentless pace of technological advancements, which continually enhance drone capabilities in terms of endurance, payload capacity, sensor sophistication, and autonomous functions. The escalating frequency and intensity of natural disasters globally, coupled with ongoing geopolitical instability and the resulting humanitarian crises, create an urgent and expanding demand for efficient and safe emergency response tools. Furthermore, the demonstrated cost-effectiveness of drone operations compared to manned aircraft or extensive ground teams, especially for tasks like aerial reconnaissance and rapid assessment, serves as a strong economic incentive for adoption by public safety agencies.

Despite the strong growth trajectory, several restraints challenge the market's full potential. Stringent and often evolving regulatory frameworks, particularly concerning airspace integration, beyond visual line of sight (BVLOS) operations, and data privacy, pose significant hurdles to widespread deployment and standardization. Public perception and concerns regarding privacy, noise pollution, and the potential misuse of drone technology also introduce resistance in certain communities. Technical limitations, such as battery life, payload capacity constraints for certain heavy-duty applications, and vulnerability to adverse weather conditions, continue to require technological breakthroughs. The high initial investment costs for advanced drone systems and the need for specialized training for operators also present barriers to entry for smaller organizations or those with limited budgets.

However, these challenges are balanced by abundant opportunities for market expansion and innovation. The increasing integration of Artificial Intelligence and Machine Learning promises to unlock unprecedented levels of autonomy, predictive analytics, and real-time decision support, making drones even more intelligent and effective. The development of specialized payloads, including chemical sensors, advanced communication relays, and precision delivery systems, opens up new application areas beyond traditional search and rescue. Emerging markets, particularly in Asia Pacific, Latin America, and Africa, where disaster resilience infrastructure is still developing, represent significant untapped potential for drone adoption. Furthermore, the growing trend of public-private partnerships can accelerate research, development, and deployment, addressing both technological and financial barriers.

The market is also influenced by various impact forces. Technologically, breakthroughs in battery efficiency, miniaturization of sensors, advanced materials science for drone construction, and robust cybersecurity measures are continually redefining capabilities. Economically, the shift towards service-based models (Drone-as-a-Service) reduces upfront costs for end-users, expanding accessibility, while the overall economic impact of faster disaster recovery efforts underscores the value proposition. Socially, the increasing acceptance of drones for public safety, driven by successful deployments and educational initiatives, is improving adoption rates, while ethical considerations remain a key area of public discourse. Politically, government funding for disaster preparedness, cross-border cooperation in emergency response, and the development of harmonized regulations will play a critical role in shaping the market's future landscape. Environmentally, drones offer a less intrusive method for monitoring ecological disasters, assessing damage to natural habitats, and aiding in wildlife protection during crises.

Segmentation Analysis

The Drones for Emergency Responders Market is broadly segmented across several crucial dimensions to provide a detailed understanding of its diverse landscape and growth opportunities. These segmentations allow for a granular analysis of market dynamics, revealing specific areas of demand, technological preferences, and operational requirements within the emergency response ecosystem. Key categories include drone type, application, component, end-user, range, and payload capacity, each reflecting distinct characteristics and evolving needs of emergency service providers. This comprehensive breakdown assists stakeholders in identifying niche markets, tailoring product development, and devising targeted market entry strategies that align with the specific requirements of various emergency scenarios and operational environments.

The segmentation by drone type distinguishes between rotary-wing, fixed-wing, and hybrid models, recognizing their different operational strengths; rotary-wing for precision and hover capabilities, fixed-wing for endurance and speed over large areas, and hybrids for combining the best of both. Application segmentation categorizes the market by the specific emergency service function, such as search and rescue, firefighting, or law enforcement, highlighting the diverse operational contexts. Component segmentation breaks down the market into hardware (e.g., airframe, sensors), software (e.g., flight control, data analytics), and services (e.g., training, maintenance), reflecting the integral parts of a complete drone solution. End-user segmentation identifies the primary organizations deploying these drones, ranging from public safety agencies to national defense forces. Further segmentation by range and payload capacity addresses the varying operational distances and carrying requirements crucial for different emergency missions.

- By Drone Type

- Rotary Wing (Multi-rotor, Single-rotor)

- Fixed Wing

- Hybrid (VTOL Fixed-wing)

- By Application

- Search and Rescue (SAR)

- Firefighting Support (Wildfires, Structural Fires)

- Law Enforcement (Surveillance, Crowd Control, Evidence Collection)

- Disaster Management (Damage Assessment, Humanitarian Aid Delivery)

- Hazardous Material (HAZMAT) Incidents

- Environmental Monitoring (Post-Disaster Impact)

- By Component

- Hardware

- Airframe

- Propulsion Systems (Motors, Propellers)

- Navigation Systems (GPS, IMUs)

- Sensors (Thermal, EO/IR, LiDAR, Hyperspectral, Gas Detectors)

- Communication Modules (Radio, Satellite, 5G)

- Batteries & Power Management

- Payloads (Cameras, Extinguishers, Medical Supplies)

- Software

- Flight Control & Autonomy Software

- Data Analytics & Image Processing Software

- Mission Planning & Management Software

- Ground Control Station (GCS) Software

- Services

- Training & Certification

- Maintenance, Repair, and Overhaul (MRO)

- Data Processing & Analysis Services

- Customization & Integration Services

- Hardware

- By End-User

- Public Safety Agencies (Police, Fire Departments, EMS)

- Government & Defense Agencies (Federal Emergency Management, Military)

- Disaster Response Organizations (NGOs, Humanitarian Aid)

- Private Security & Industrial Response Teams

- By Range

- Short-Range (Up to 5 km)

- Medium-Range (5 km - 20 km)

- Long-Range (Over 20 km)

- By Payload Capacity

- Light (< 5 kg)

- Medium (5 kg - 25 kg)

- Heavy (> 25 kg)

Value Chain Analysis For Drones for Emergency Responders Market

A comprehensive value chain analysis for the Drones for Emergency Responders Market highlights the interconnected stages from raw material sourcing to end-user deployment, illustrating how value is added at each step. The upstream segment involves the foundational elements, beginning with suppliers of critical raw materials such as lightweight composites (carbon fiber, advanced plastics), aluminum, and specialized alloys that form the drone airframe. This stage also includes manufacturers of highly specialized electronic components like microcontrollers, GPS modules, Inertial Measurement Units (IMUs), and advanced semiconductors, which are vital for the drone's navigation and processing capabilities. Additionally, suppliers of high-capacity batteries (e.g., LiPo, solid-state) and efficient propulsion systems (motors, propellers) constitute a significant part of the upstream value, ensuring the core operational capabilities of the drones. The quality and innovation at this stage directly impact the drone's performance, durability, and cost-efficiency.

Moving downstream, the value chain progresses to the manufacturing and integration phase, where various components are assembled into complete drone systems. This midstream segment primarily consists of drone manufacturers who design, develop, and produce the physical UAVs, integrating the airframes, propulsion, navigation, and communication systems. Complementing this are software developers who create the sophisticated flight control algorithms, mission planning tools, data processing applications, and AI-driven analytics platforms that turn raw hardware into intelligent, actionable tools. Payload manufacturers, specializing in critical sensors such as thermal cameras, electro-optical/infrared (EO/IR) cameras, LiDAR units, and gas detectors, also play a pivotal role, customizing these technologies for specific emergency response needs. System integrators frequently bridge these two areas, ensuring seamless functionality between hardware and software components, and often providing bespoke solutions to meet complex client requirements.

The final stages of the value chain involve distribution, sales, and post-sales support, directly impacting how drones reach their end-users. Distribution channels are typically a mix of direct sales and indirect approaches. Direct sales involve manufacturers selling directly to large government agencies, defense organizations, or major public safety departments, often through competitive bidding processes and long-term contracts. Indirect channels involve a network of distributors, resellers, and value-added integrators who provide drones, accessories, training, and ongoing support to smaller municipal fire departments, local law enforcement, or specialized private response teams. Post-sales services, including maintenance, repair, and overhaul (MRO), technical support, software updates, and advanced operator training, are crucial for ensuring the long-term operational readiness and effectiveness of these critical assets. The effectiveness of these channels, coupled with comprehensive support services, significantly enhances customer satisfaction and market penetration.

Drones for Emergency Responders Market Potential Customers

The potential customers for Drones for Emergency Responders are diverse, encompassing a wide array of governmental, public safety, and private sector entities with critical needs for rapid, safe, and efficient response capabilities during emergencies. At the forefront are Public Safety Agencies, which include municipal and state police departments, fire departments (both urban and rural), and Emergency Medical Services (EMS) organizations. These entities are increasingly adopting drones for tasks such as aerial surveillance during active incidents, search and rescue operations for missing persons, assessing structural integrity after fires, and providing real-time situational awareness to incident commanders, thereby enhancing responder safety and operational effectiveness.

Beyond local public safety, a significant segment of potential customers comprises various Government and Defense Agencies at federal, national, and international levels. This includes Federal Emergency Management Agencies (FEMAs) responsible for coordinating large-scale disaster responses, national guards, and military units involved in civil support operations or humanitarian aid. These organizations require high-end, robust drone systems capable of long-range operations, advanced data collection, and integration with national command structures for comprehensive disaster assessment, resource deployment, and long-term recovery planning. Their procurement often involves specialized contracts and adherence to strict regulatory and security protocols, emphasizing reliability, security, and interoperability.

Furthermore, Disaster Response Organizations, including non-governmental organizations (NGOs) and international humanitarian aid groups, represent a growing customer base. These organizations leverage drones for rapid damage assessment in remote or inaccessible areas, mapping affected zones, and facilitating the delivery of critical supplies in post-disaster scenarios. Private entities with significant infrastructure or hazardous operations, such as industrial complexes, energy companies, and large agricultural operations, also serve as potential customers. They utilize drones for internal emergency response, monitoring environmental spills, assessing damage to critical infrastructure, and ensuring worker safety during incidents, demonstrating a proactive approach to risk management and disaster preparedness within their specific operational domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.25 Billion |

| Market Forecast in 2032 | USD 4.15 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DJI, Skydio, Parrot, Autel Robotics, Insitu (Boeing), AeroVironment, Teledyne FLIR, Elistair, Draganfly, BRINC Drones, Lockheed Martin, Textron Systems, General Atomics Aeronautical Systems, Quantum Systems, Edge Autonomy (UAV Factory), Workhorse Group, Yuneec, Holy Stone, Aerialtronics, Pixhawk |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drones for Emergency Responders Market Key Technology Landscape

The Drones for Emergency Responders Market is characterized by a rapidly evolving technological landscape, driven by the need for enhanced performance, reliability, and autonomy in critical situations. A fundamental aspect of this landscape is the continuous innovation in sensor technology, which includes high-resolution electro-optical/infrared (EO/IR) cameras for day and night operations, thermal imaging for detecting heat signatures through smoke or darkness, and LiDAR (Light Detection and Ranging) for creating precise 3D maps of disaster zones, even in adverse weather conditions. Advanced gas detectors and chemical sensors are also becoming integral payloads, enabling the identification of hazardous materials from a safe distance, significantly improving responder safety during HAZMAT incidents. These sensor capabilities are paramount for effective situational awareness and data collection in diverse emergency scenarios.

Autonomous flight systems, powered by advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms, represent another cornerstone of the technology landscape. These systems enable drones to perform complex missions with minimal human intervention, including obstacle avoidance in cluttered environments, autonomous navigation in GPS-denied areas (e.g., inside buildings or caves), and intelligent path planning for optimal coverage in search patterns. The integration of AI also extends to on-board data processing and real-time analytics, allowing drones to automatically identify objects of interest (e.g., human forms, vehicle wreckage, fire sources) and relay actionable intelligence instantly to ground teams. This level of autonomy not only increases efficiency but also reduces the risk of human error during high-stress operations.

Furthermore, robust communication systems are critical for maintaining control and data flow, especially in remote or communication-compromised areas. This includes secure, long-range radio links, satellite communication for global reach, and the emerging integration of 5G technology for high-bandwidth, low-latency data transmission. Battery technology continues to be a key focus, with advancements in lithium-ion and solid-state batteries aiming to extend flight times and reduce charging cycles, thereby increasing operational endurance. The development of anti-jamming and anti-spoofing technologies ensures the drone's resilience against malicious interference. Finally, the growing interest in swarm intelligence, where multiple drones operate cooperatively to achieve common objectives, and the increasing focus on cybersecurity for drone systems and data integrity, highlight the ongoing efforts to make these unmanned platforms more capable, secure, and integrated into future emergency response strategies.

Regional Highlights

- North America: This region stands as a dominant force in the Drones for Emergency Responders Market, primarily driven by early adoption, significant government investment in public safety technology, and a robust ecosystem of innovators. The United States, in particular, showcases high market penetration due to extensive funding from federal agencies like FEMA and DHS, coupled with a proactive approach to integrating UAVs into police, fire, and search and rescue operations. Strict regulatory advancements are continuously being made to accommodate BVLOS operations and expand drone usage, fueling advanced research and development in autonomy and payload capabilities. Canada also demonstrates strong growth, leveraging drones for vast area surveillance in national parks and remote regions, crucial for wildfire management and remote search and rescue.

- Europe: The European market is characterized by diverse regulatory landscapes and varied adoption rates among member states. Countries such as the UK, Germany, and France are leading in the integration of drones for urban search and rescue, disaster assessment, and law enforcement, often supported by EU-funded initiatives for emergency preparedness. The focus here is on developing harmonized regulations and interoperable systems across borders, especially for coordinated responses to large-scale disasters. There is also a strong emphasis on data privacy and ethical considerations in drone deployment, influencing product development towards secure and compliant solutions. Northern European countries are increasingly using drones for maritime rescue and environmental monitoring.

- Asia Pacific (APAC): This region is emerging as the fastest-growing market, primarily due to its high susceptibility to natural disasters, rapid urbanization, and increasing government investments in modernizing emergency response infrastructure. Japan, China, Australia, and South Korea are at the forefront, leveraging advanced drone technology for earthquake and typhoon relief, flood monitoring, and extensive search and rescue operations. China, with its vast manufacturing capabilities, is a major producer and consumer of drones, pushing innovations in swarm technology and AI integration. Australia's large, sparsely populated areas make drones indispensable for bushfire management and long-range surveillance. The region's diverse geographical challenges necessitate a wide range of specialized drone applications.

- Latin America: The market in Latin America is in its nascent stages but is experiencing significant growth, driven by the increasing need for efficient disaster response in areas prone to earthquakes, volcanic eruptions, and extreme weather events. Countries like Brazil, Mexico, and Chile are investing in drones for infrastructure inspection after disasters, search and rescue in remote mountainous or jungle terrains, and law enforcement support. Challenges include budgetary constraints and the need for robust regulatory frameworks, but opportunities are abundant for cost-effective, rugged drone solutions tailored to the region's unique geographical and climatic conditions.

- Middle East and Africa (MEA): This region is witnessing a gradual but steady adoption of drones for emergency response, largely influenced by security concerns, border surveillance, and humanitarian aid efforts in conflict-affected or remote areas. Countries like the UAE and Saudi Arabia are investing heavily in advanced public safety technologies, including sophisticated drone fleets for urban and desert search operations. In Africa, drones are being explored for delivering medical supplies to hard-to-reach communities, monitoring environmental changes contributing to disasters, and supporting anti-poaching efforts that sometimes intersect with emergency response in wilderness areas. The market here is driven by the need to overcome logistical challenges and enhance capabilities with limited traditional infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drones for Emergency Responders Market.- DJI

- Skydio

- Parrot

- Autel Robotics

- Insitu (Boeing)

- AeroVironment

- Teledyne FLIR

- Elistair

- Draganfly

- BRINC Drones

- Lockheed Martin

- Textron Systems

- General Atomics Aeronautical Systems

- Quantum Systems

- Edge Autonomy (UAV Factory)

- Workhorse Group

- Yuneec

- Holy Stone

- Aerialtronics

- Pixhawk (PX4)

Frequently Asked Questions

Analyze common user questions about the Drones for Emergency Responders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary uses of drones in emergency response?

Drones are primarily used for search and rescue operations, rapid damage assessment following natural disasters, aerial support for firefighting (e.g., thermal imaging for hot-spot detection), law enforcement surveillance and evidence collection, and hazardous material incident monitoring. They provide critical real-time situational awareness without risking human lives.

How is AI transforming drone capabilities for emergency services?

AI is transforming drone capabilities by enabling enhanced autonomous navigation, real-time object recognition (identifying survivors or hazards), predictive analytics for disaster progression, and advanced data processing. This allows drones to operate more intelligently, efficiently, and autonomously, providing faster and more accurate actionable intelligence to responders.

What are the main challenges facing the adoption of drones in emergency response?

Key challenges include navigating complex and often restrictive regulatory frameworks for airspace integration and Beyond Visual Line of Sight (BVLOS) operations, addressing public perception and privacy concerns, overcoming technical limitations like battery life and payload capacity, and managing the significant initial investment costs for advanced systems and specialized training.

Which regions are leading the market for emergency responder drones?

North America, particularly the United States, currently leads the market due to early adoption, substantial government investment, and strong technological innovation. Europe also holds a significant share, with countries like the UK, Germany, and France actively integrating drones. The Asia Pacific region, driven by high disaster frequency and increasing investments, is emerging as the fastest-growing market.

What types of sensors are crucial for emergency responder drones?

Crucial sensors include high-resolution electro-optical/infrared (EO/IR) cameras for visual and night vision capabilities, thermal cameras for detecting heat signatures through smoke or darkness, LiDAR for 3D mapping and terrain modeling, and specialized gas or chemical detectors for hazardous material incidents. These sensors provide comprehensive data for effective decision-making.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager