Drug Discovery Outsourcing Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427974 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Drug Discovery Outsourcing Services Market Size

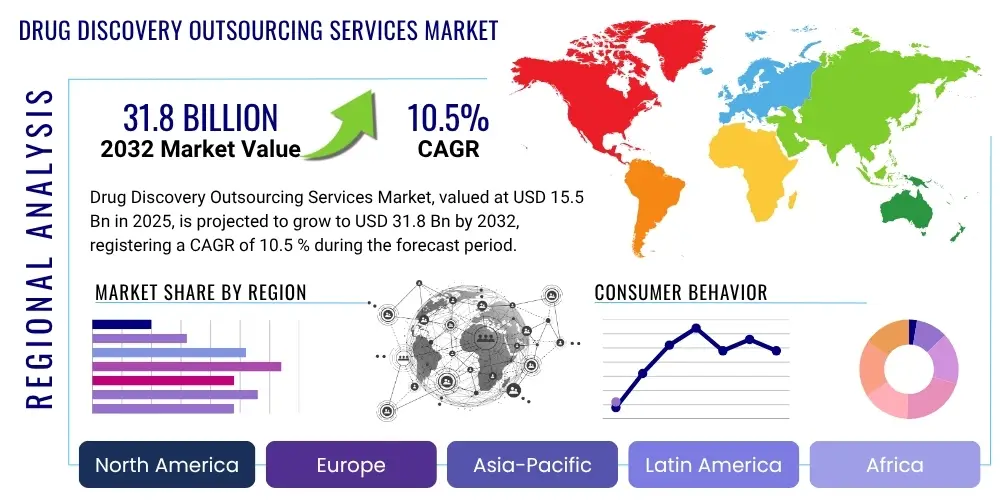

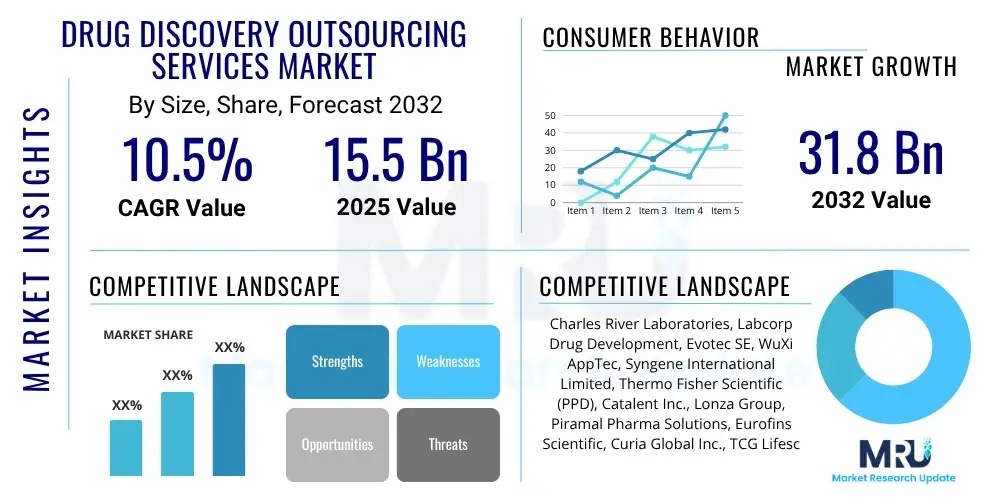

The Drug Discovery Outsourcing Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2032. The market is estimated at USD 15.5 Billion in 2025 and is projected to reach USD 31.8 Billion by the end of the forecast period in 2032.

Drug Discovery Outsourcing Services Market introduction

The Drug Discovery Outsourcing Services market encompasses specialized scientific and technical services that pharmaceutical, biotechnology, and academic institutions contract to external providers. These services support the entire early-stage drug development process, from target identification and validation, through hit identification, lead optimization, and extending into crucial preclinical development activities. The primary objective of outsourcing is to leverage specialized expertise, advanced technological platforms, and cost efficiencies offered by Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs). This strategic approach fundamentally accelerates the time-to-market for novel therapeutics, managing the escalating complexity and financial demands of modern drug research and development.

Product descriptions within this market include a comprehensive array of services such as advanced medicinal chemistry for designing new chemical entities, sophisticated assay development for high-throughput screening, extensive ADME/Tox (Absorption, Distribution, Metabolism, Excretion, and Toxicology) studies to assess drug-likeness and safety, in-depth pharmacokinetics and pharmacodynamics analyses, and cutting-edge computational chemistry and bioinformatics for predictive modeling. Major applications of these services are observed across diverse therapeutic areas, including oncology, infectious diseases, neurological disorders, and cardiovascular diseases, where the inherent complexity and capital intensiveness of R&D necessitate strategic external partnerships to drive innovation and address unmet medical needs efficiently.

Driving factors for the significant market growth include the continuously escalating costs of in-house drug discovery, the pressing global demand for new drug therapies to combat prevalent diseases, the impending patent expirations of blockbuster drugs compelling robust R&D efforts for pipeline replenishment, and the increasing adoption of transformative technologies such as artificial intelligence and machine learning in discovery processes. Furthermore, the burgeoning number of small and medium-sized biopharmaceutical companies, often with limited internal R&D infrastructure, heavily relies on outsourcing to bring their innovative molecules to fruition. This reliance significantly bolsters overall market expansion and fosters a dynamic ecosystem of innovation across the biopharmaceutical sector globally.

Drug Discovery Outsourcing Services Market Executive Summary

The Drug Discovery Outsourcing Services Market is experiencing robust and sustained growth, driven by a confluence of business trends prioritizing efficiency, specialization, and strategic cost management within the global pharmaceutical and biotechnology sectors. Companies are increasingly externalizing complex, capital-intensive, and resource-heavy early-stage R&D activities to specialized Contract Research Organizations (CROs). This strategic shift aims to accelerate drug development timelines, manage rising R&D expenditures, and gain expedited access to advanced scientific platforms that may be uneconomical to maintain in-house. A notable business trend is the increasing formation of integrated, long-term strategic partnerships between pharmaceutical giants and large CROs, moving beyond transactional outsourcing to foster deeper collaborations built on shared expertise and risk mitigation.

Regional trends indicate North America and Europe as the dominant markets, primarily due to the presence of a mature pharmaceutical industry, substantial and consistent R&D investments, and a robust ecosystem of highly specialized CROs and academic institutions. These regions benefit from supportive regulatory environments and a rich history of pharmaceutical innovation. Concurrently, the Asia Pacific (APAC) region, led by rapidly developing economies such as China and India, is emerging as the fastest-growing market. This surge is attributed to significantly lower operational costs, a vast and skilled scientific talent pool, and progressively improving regulatory frameworks, positioning APAC as an attractive and strategic hub for outsourcing drug discovery services. Latin America and the Middle East & Africa also demonstrate promising growth, driven by expanding healthcare sectors and the strategic imperative of pharmaceutical companies to globalize their R&D footprint.

Analysis of segment trends within the Drug Discovery Outsourcing Services Market reveals strong demand across various service categories, with advanced medicinal chemistry, comprehensive in vitro and in vivo biology assays, and rigorous ADME/Tox studies remaining pivotal. In terms of therapeutic areas, oncology, immunology, and rare diseases are witnessing substantial activity, reflecting critical unmet medical needs and significant investment in these fields. From an end-user perspective, both large pharmaceutical corporations and agile small and medium-sized biotechnology companies are key contributors to market revenue; however, smaller biotechs often exhibit a greater reliance on comprehensive, integrated outsourcing partners for their entire discovery pipeline. The continuous evolution of scientific methodologies, coupled with the profound integration of digital technologies, particularly artificial intelligence and machine learning, is dynamically reshaping segment growth, propelling innovation and enhancing the scope of outsourced services.

AI Impact Analysis on Drug Discovery Outsourcing Services Market

Common user questions about AI's impact on the Drug Discovery Outsourcing Services Market frequently revolve around its potential to revolutionize the speed, precision, and overall success rates of critical drug discovery phases, including target identification, intricate lead optimization, and robust candidate selection. Users are keen to understand how AI-driven platforms will seamlessly integrate into existing outsourcing models, its implications for workforce skills and potential displacement, and concerns regarding data security and intellectual property protection in an AI-driven environment. There is a strong expectation that AI will dramatically truncate drug discovery timelines, substantially reduce costly late-stage failure rates, and make the entire process considerably more efficient and economically viable. However, skepticism and concern frequently arise concerning the rigorous validation of complex AI algorithms, the interpretability of their predictions, and the potential regulatory hurdles associated with obtaining approval for AI-driven drug discoveries. Ultimately, stakeholders seek to understand if AI will democratize drug discovery further, making advanced R&D capabilities more accessible, or if it will consolidate power among technologically advanced CROs.

The profound integration of artificial intelligence (AI) and machine learning (ML) algorithms is unequivocally transforming the landscape of drug discovery outsourcing, orchestrating a paradigm shift from conventional, laborious methods to highly predictive, data-driven, and systematic approaches. Outsourcing providers are now making substantial and strategic investments in developing and deploying cutting-edge AI platforms to not only augment but also revolutionize their service offerings. This enables them to perform significantly faster and more comprehensive screening of vast chemical and biological libraries, achieve remarkably accurate prediction of complex drug-target interactions, and execute highly optimized compound design with unprecedented precision. This wave of technological advancement empowers CROs to deliver higher-quality drug candidates that possess superior ADME/Tox profiles and enhanced pharmacological properties, thereby substantially de-risking the early stages of drug development for their discerning clients. The tangible impact of AI is particularly palpable and transformative in specialized areas such as virtual screening, de novo drug design, and drug repurposing, where algorithms analyze complex biological data with unparalleled speed and analytical depth.

This technological leap, propelled by AI, unequivocally translates into a formidable competitive advantage for those outsourcing providers that are adept at harnessing AI effectively and responsibly. It simultaneously necessitates the cultivation of a new, sophisticated skill set within the CRO industry, emphasizing proficiency in data science, advanced bioinformatics, and computational biology to manage and interpret AI outputs. Clients are increasingly seeking partners who can unequivocally demonstrate profound expertise in applying AI to solve intricate biological problems, expecting not merely standard services, but intelligent, data-driven solutions that dramatically accelerate their pipeline progression and enhance discovery success rates. As AI tools and methodologies continue their inexorable march towards greater sophistication and predictive power, the scope and ambition of outsourced drug discovery are expanding exponentially. This enables the undertaking of more ambitious and previously intractable projects, facilitating the exploration of novel targets and complex disease mechanisms, and ultimately fostering an unparalleled era of innovation across the entire biopharmaceutical ecosystem.

- Accelerated hit identification and lead optimization through virtual screening and predictive modeling.

- Improved accuracy in predicting drug efficacy and toxicity, reducing late-stage failures.

- Enhanced target identification and validation by analyzing complex biological datasets.

- Streamlined data analysis and interpretation, enabling faster decision-making.

- Personalized medicine development through AI-driven biomarker discovery and patient stratification.

- Optimized experimental design and resource allocation for greater efficiency.

DRO & Impact Forces Of Drug Discovery Outsourcing Services Market

The Drug Discovery Outsourcing Services Market is fundamentally shaped by a complex and dynamic interplay of powerful drivers, inherent restraints, and compelling opportunities, all contributing to its evolving trajectory. Among the primary drivers, the relentlessly escalating costs associated with in-house pharmaceutical research and development stand out prominently, exerting immense pressure on pharmaceutical and biotechnology companies to seek more economically viable and strategically efficient external solutions. The inherently increasing complexity of modern drug discovery, demanding highly specialized scientific expertise, state-of-the-art technological platforms, and sophisticated instrumentation, further acts as a powerful catalyst propelling the widespread adoption of outsourcing. Moreover, the global surge in the prevalence of chronic, infectious, and rare diseases intensifies the urgent demand for novel therapeutic interventions, consequently escalating overall R&D activity, much of which is strategically channeled through outsourced services to expedite development. The persistent challenge of patent expirations for blockbuster drugs, commonly referred to as the 'patent cliff,' unequivocally compels pharmaceutical giants to aggressively innovate and rapidly replenish their pipelines with new revenue-generating assets, a strategic imperative frequently addressed through robust outsourcing partnerships to accelerate the discovery of next-generation therapies.

Conversely, the market encounters several formidable restraints that temper its growth and necessitate careful consideration. Paramount among these are the profound concerns surrounding intellectual property (IP) protection and the maintenance of stringent data confidentiality, which represent significant barriers, particularly when engaging with external service providers that handle sensitive proprietary information. The potential for variability in quality control, the inherent complexities of cross-organizational communication, and the critical need for meticulous vendor management and oversight can also deter some companies from fully embracing extensive outsourcing. Furthermore, navigating the labyrinthine and often divergent regulatory complexities across myriad international geographies, coupled with the formidable challenge of establishing seamless and truly integrated workflows between a client's internal R&D teams and external Contract Research Organizations (CROs), represent additional operational hurdles that demand sophisticated strategic planning and execution. Ensuring consistently high quality of deliverables and unwavering adherence to rigorous compliance standards, including GLP (Good Laboratory Practice) guidelines, are absolutely paramount for fostering successful and sustainable outsourcing partnerships, mitigating risks, and maintaining trust.

Despite these considerable challenges, the Drug Discovery Outsourcing Services Market is replete with numerous and compelling opportunities that promise to drive future expansion and innovation. The continuous advent and rapid adoption of novel scientific and technological paradigms, such as advanced genomics, cutting-edge proteomics, metabolomics, and sophisticated bioinformatics, are perpetually creating new avenues for highly specialized outsourced services that offer unprecedented insights into disease mechanisms and drug action. The intensifying global focus on developing personalized medicine approaches and the burgeoning field of biologics, including antibodies and cell and gene therapies, are opening up lucrative niche markets for CROs possessing specific, deep expertise in these complex modalities. Additionally, the rapid proliferation and growth of the global biotech startup ecosystem, which inherently often lacks the extensive in-house R&D infrastructure of larger pharmaceutical entities, represents a vast and expanding client base for comprehensive outsourcing providers. The ongoing globalization of drug discovery, with emerging markets not only presenting new and diverse patient populations for clinical trials but also offering highly cost-effective research environments and talent pools, continues to significantly expand the geographical scope and strategic appeal of outsourcing opportunities. Finally, the formation of sophisticated, long-term strategic alliances and integrated partnerships between leading pharmaceutical companies and innovative CROs, offering holistic, end-to-end services, stands as a pivotal opportunity for both market expansion and the creation of profound, synergistic value across the entire drug development lifecycle, from initial discovery to preclinical validation.

Segmentation Analysis

The Drug Discovery Outsourcing Services Market is meticulously segmented across various crucial parameters to offer a profoundly granular and comprehensive understanding of its intricate dynamics, underlying trends, and future growth trajectories. These strategic market segmentations are instrumental in enabling stakeholders to accurately analyze evolving market trends, precisely identify lucrative growth pockets within niche areas, and gain invaluable insights into the ever-shifting competitive landscape. The primary axes of segmentation typically revolve around the specific type of service being offered by CROs, the distinct therapeutic area that is being addressed by the drug discovery efforts, and the ultimate end-user or client leveraging these specialized services. This multifaceted approach accurately reflects the diverse requirements, intricate complexities, and highly specialized nature inherent to modern drug discovery research and development. Further analytical granularity is achieved by segmenting the market based on the precise phase of the drug discovery process, ranging from the foundational target identification to the critical lead optimization stage, thereby illustrating the full, extensive spectrum of outsourced activities and their respective market contributions, which are pivotal for strategic planning and investment decisions within this competitive domain.

- Service Type: This segment categorizes the market based on the specific scientific and technical services provided by outsourcing partners, reflecting the diverse stages and requirements of drug discovery.

- Medicinal Chemistry

- Biology Services (in vitro and in vivo)

- ADME/Tox Studies

- High-Throughput Screening (HTS)

- Bioinformatics & Computational Chemistry

- Pharmacokinetics/Pharmacodynamics (PK/PD)

- Target Identification & Validation

- Lead Identification & Optimization

- Custom Synthesis & Process Chemistry

- Therapeutic Area: This segmentation highlights the disease categories where drug discovery outsourcing efforts are concentrated, driven by prevalent diseases and unmet medical needs.

- Oncology

- Infectious Diseases

- Neurology

- Cardiovascular Diseases

- Immunology

- Metabolic Disorders

- Rare Diseases

- Inflammatory Diseases

- End-User: This segment distinguishes between the types of organizations that procure drug discovery outsourcing services, reflecting their varying needs and internal capabilities.

- Pharmaceutical & Biopharmaceutical Companies

- Biotechnology Companies

- Academic & Research Institutes

- Phase: This segment categorizes outsourcing activities based on the specific stage of the drug discovery continuum.

- Target ID & Validation

- Hit Generation & Lead Identification

- Lead Optimization

- Pre-clinical Development

Value Chain Analysis For Drug Discovery Outsourcing Services Market

The value chain within the Drug Discovery Outsourcing Services Market is an intricate network of interconnected activities and diverse stakeholders, each contributing uniquely to the overall process of transforming a nascent scientific concept into a viable drug candidate. At the foundational, upstream segment of this value chain reside the critical suppliers of essential raw materials, highly specialized reagents, complex biological assays, and state-of-the-art instrumentation that are indispensable for conducting rigorous drug discovery research. These upstream providers form the bedrock, furnishing Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) with the fundamental tools, chemical building blocks, and analytical equipment required for their extensive research activities. The uncompromising quality, consistent availability, and advanced capabilities of these upstream components directly and profoundly influence the efficiency, reliability, and ultimate success rates of the outsourced drug discovery services. Furthermore, providers of sophisticated software solutions, advanced bioinformatics platforms, and cutting-edge Artificial Intelligence (AI) and Machine Learning (ML) tools play an increasingly pivotal upstream role, enabling CROs to offer highly advanced computational chemistry, predictive modeling, and sophisticated data analysis services, which are now integral to modern drug discovery.

The central, most active segment of the value chain is occupied by the Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) themselves. These specialized entities represent the operational core, diligently leveraging their deep scientific expertise, extensive technological infrastructure, and highly skilled human capital to meticulously perform a wide array of drug discovery services. This includes complex medicinal chemistry synthesis, comprehensive in vitro and in vivo biology studies, rigorous ADME/Tox assessments, advanced high-throughput screening (HTS), and intricate pharmacokinetics/pharmacodynamics (PK/PD) analyses. The operational excellence, stringent quality assurance mechanisms, unwavering adherence to regulatory standards, and continuous capacity for innovation demonstrated by these CROs are absolutely critical for consistently delivering high-value, reliable, and impactful results to their diverse clientele. The primary distribution channel for these highly specialized services is predominantly direct, characterized by bespoke contracts, strategic alliances, and long-term partnerships established directly between the outsourcing provider and the client pharmaceutical, biotechnology, or academic institution. However, emerging indirect channels, such as specialized consulting firms or aggregators that act as intermediaries, are gaining traction. These indirect facilitators strategically connect clients with the most suitable CROs, often offering curated selections of services tailored to very specific project requirements, thereby streamlining the vendor selection process and adding another layer of value to the chain.

The downstream segment of the value chain is comprised of the ultimate end-users, primarily encompassing large pharmaceutical and biopharmaceutical companies, dynamic small and medium-sized biotechnology firms, and respected academic and research institutions. These clients are the ultimate beneficiaries and consumers of the advanced insights, optimized compounds, and validated data generated by the CROs. They meticulously integrate these outsourced results and promising compounds into their internal drug development pipelines, aiming to efficiently progress them towards rigorous clinical trials, regulatory approvals, and eventual market launch. The true success and ultimate value of the outsourced services are intrinsically measured by their direct contribution to significantly de-risking and substantially accelerating the client's overall drug discovery efforts, moving novel therapies from concept to commercialization with greater speed and certainty. The entire value chain is fundamentally characterized by an intense emphasis on collaborative synergy, secure and efficient data exchange protocols, and the robust protection of invaluable intellectual property. Seamless integration and transparent communication between the outsourcing provider and the client are not merely beneficial but absolutely crucial for achieving successful outcomes within the highly competitive, capital-intensive, and stringently regulated global pharmaceutical industry, ensuring that innovations are translated into tangible patient benefits.

Drug Discovery Outsourcing Services Market Potential Customers

The cohort of potential customers and primary end-users for Drug Discovery Outsourcing Services is remarkably diverse, spanning a comprehensive spectrum of entities embedded within the global life sciences ecosystem, each possessing distinct needs and strategic imperatives. Large pharmaceutical and established biopharmaceutical companies consistently represent the most significant segment of this customer base. Despite possessing extensive, well-resourced in-house R&D capabilities, these industry giants are increasingly engaging in strategic outsourcing to effectively manage surges in workload, gain expedited access to highly specialized and proprietary technologies that are not available internally, and optimize the considerable costs associated with the early, capital-intensive stages of drug discovery. For these sophisticated organizations, outsourcing provides unparalleled strategic flexibility, allowing them to judiciously reallocate and concentrate their valuable internal resources on core competencies such as late-stage clinical development, regulatory affairs, and commercialization, while external, expert partners efficiently handle the resource-heavy, time-consuming, and often high-risk discovery phases, thereby enhancing overall pipeline efficiency and strategic focus.

Another absolutely critical and rapidly expanding segment of potential customers comprises small to medium-sized biotechnology companies (SMEs) and an ever-growing array of innovative biotech startups. These agile companies typically operate with inherently limited financial resources, constrained infrastructural capabilities, and often lean scientific personnel, rendering comprehensive outsourcing not merely a strategic option but an indispensable operational necessity. For a vast majority of these biotechs, Contract Research Organizations (CROs) effectively function as extended virtual R&D departments, providing a full suite of end-to-end drug discovery services that span the entire continuum from fundamental target validation to intricate lead optimization. This invaluable partnership model empowers biotechnology companies to rapidly advance their innovative drug candidates through various discovery milestones without incurring the prohibitive upfront capital investment required to establish and meticulously maintain extensive in-house laboratories, thereby democratizing access to highly sophisticated and otherwise inaccessible drug discovery capabilities and accelerating their path to market. The ability to leverage external expertise allows these smaller entities to remain agile, focus on innovation, and compete effectively with larger players.

Furthermore, distinguished academic and esteemed research institutes are progressively emerging as increasingly vital clients for drug discovery outsourcing services. Universities, government-funded research organizations, and public health bodies, deeply engaged in fundamental scientific research and the initial identification of promising drug candidates, frequently encounter requirements for highly specialized services such as advanced high-throughput screening, complex custom chemical synthesis, or intricate ADME/Tox studies that often lie beyond the scope of their internal technical capabilities or available funding. By strategically partnering with expert CROs, these institutions can more efficiently and effectively translate their groundbreaking scientific discoveries and innovative research findings into tangible, developable therapeutic compounds, significantly accelerating the crucial transition from basic bench science to potential bedside applications. The dynamic evolution of the global research landscape, coupled with a concerted, increasing global emphasis on fostering translational medicine initiatives, is further amplifying this segment's demand for specialized external expertise, state-of-the-art resources, and advanced technological platforms, underscoring the broad and growing appeal of drug discovery outsourcing across the entire scientific community.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.5 Billion |

| Market Forecast in 2032 | USD 31.8 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Charles River Laboratories, Labcorp Drug Development, Evotec SE, WuXi AppTec, Syngene International Limited, Thermo Fisher Scientific (PPD), Catalent Inc., Lonza Group, Piramal Pharma Solutions, Eurofins Scientific, Curia Global Inc., TCG Lifesciences, Aragen Life Sciences, Jubilant Biosys, IQVIA, Recipharm, GenScript Biotech, Almac Group, Albany Molecular Research Inc. (AMRI), Aurigene Discovery Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drug Discovery Outsourcing Services Market Key Technology Landscape

The technological landscape underpinning the Drug Discovery Outsourcing Services Market is rapidly evolving, driven by advancements that enhance efficiency, accuracy, and predictability in early-stage research. Key technologies include high-throughput screening (HTS) systems, which enable rapid testing of thousands or millions of compounds against biological targets, significantly accelerating hit identification. Automated liquid handling systems, robotics, and integrated laboratory information management systems (LIMS) are crucial for streamlining HTS workflows, ensuring data integrity, and improving overall throughput. These automation technologies are foundational for CROs handling large-scale compound libraries and complex biological assays, allowing them to deliver results faster and with greater consistency, ultimately optimizing client project timelines and resource utilization in a competitive environment.

Computational chemistry and advanced bioinformatics tools are another cornerstone of the modern drug discovery outsourcing landscape. These technologies encompass molecular modeling, precise docking simulations, comprehensive virtual screening, and rigorous quantitative structure-activity relationship (QSAR) analysis, all of which are instrumental in rational drug design and lead optimization. The transformative integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is profoundly impacting this area, offering advanced predictive analytics for drug-target interactions, forecasting ADME/Tox properties with greater certainty, and enabling innovative de novo drug design. AI-powered platforms can sift through vast datasets of biological and chemical information, identifying novel drug candidates and optimizing existing ones with unprecedented speed, precision, and predictive power, thereby substantially de-risking the entire discovery process and enhancing the probability of success.

Furthermore, an array of technologies centered around advanced 'omics' disciplines—such as genomics, proteomics, and metabolomics—are increasingly gaining critical importance for precise target identification and thorough validation. These technologies provide an unparalleled, deep understanding of disease mechanisms at a granular molecular level. Complementary analytical techniques, including advanced mass spectrometry, high-resolution imaging systems (e.g., high-content screening), and sophisticated flow cytometry, are also becoming indispensable for conducting intricate in vitro and in vivo studies. These methods furnish detailed, mechanistic insights into drug action, cellular responses, and systemic pharmacological effects. The continuous and vigorous development, coupled with the widespread adoption, of these highly sophisticated and interconnected technologies, empowers outsourcing providers to offer more comprehensive, innovative, and high-value services. This strategic technological leadership positions them at the very forefront of pharmaceutical research and development, solidifying their indispensable role as vital partners in the relentless global endeavor to discover and bring groundbreaking new medicines to patients in need, thereby continuously expanding the capabilities and impact of outsourced drug discovery.

Regional Highlights

- North America: Dominates the market due to a robust biopharmaceutical industry, significant R&D investments, and the pervasive presence of numerous globally recognized key players, cutting-edge research institutions, and a vast network of highly specialized Contract Research Organizations (CROs). The region benefits from a favorable regulatory environment, strong intellectual property protection frameworks, and a high adoption rate of outsourcing models by both large pharmaceutical corporations and burgeoning biotechnology startups. Significant government funding for biomedical research further solidifies its market dominance and continuous innovation capacity.

- Europe: Europe represents a mature and highly competitive market, boasting a strong foundational research base and a vibrant pharmaceutical ecosystem, particularly concentrated in countries such as the United Kingdom, Germany, Switzerland, and France. The region's consistent emphasis on the development of innovative drugs, a growing number of dynamic biotechnology startups, and collaborative academic-industrial partnerships significantly contribute to its steady market growth. However, stringent regulatory requirements and diverse national healthcare systems can sometimes present complexities that CROs must adeptly navigate, often leading to specialized service offerings and necessitating robust compliance strategies.

- Asia Pacific (APAC): Emerging as the fastest-growing and most dynamic region in the drug discovery outsourcing landscape, APAC is propelled by several compelling factors. These include significantly lower operational and labor costs, an accelerating pace of R&D activities by rapidly developing domestic pharmaceutical and biotechnology companies, and the availability of a vast, highly skilled, and cost-effective scientific talent pool across countries like China, India, Japan, and South Korea. Government initiatives actively promoting life sciences R&D, coupled with improving regulatory frameworks and increasing foreign direct investment, further bolster market expansion, positioning APAC as a crucial strategic hub for global drug discovery outsourcing.

- Latin America, Middle East, and Africa (MEA): While currently smaller in market share compared to established regions, Latin America and the MEA region exhibit promising and accelerating growth potential. This upward trajectory is primarily attributed to increasing investments in healthcare infrastructure, a rising prevalence of chronic and infectious diseases necessitating novel therapeutic solutions, and a growing emphasis on fostering local biopharmaceutical R&D capabilities. The expanding patient populations and evolving regulatory landscapes in these regions are increasingly attracting global pharmaceutical companies and CROs seeking to diversify their R&D operations and tap into new market opportunities, signaling a gradual but steady integration into the global outsourcing ecosystem.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drug Discovery Outsourcing Services Market, encompassing a broad range of global and regional providers that are crucial to the industry's innovation and growth. These companies are instrumental in providing specialized services that drive the pharmaceutical and biotechnology pipelines forward.- Charles River Laboratories

- Labcorp Drug Development

- Evotec SE

- WuXi AppTec

- Syngene International Limited

- Thermo Fisher Scientific (PPD)

- Catalent Inc.

- Lonza Group

- Piramal Pharma Solutions

- Eurofins Scientific

- Curia Global Inc.

- TCG Lifesciences

- Aragen Life Sciences

- Jubilant Biosys

- IQVIA

- Recipharm

- GenScript Biotech

- Almac Group

- Albany Molecular Research Inc. (AMRI)

- Aurigene Discovery Technologies

Frequently Asked Questions

Analyze common user questions about the Drug Discovery Outsourcing Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most compelling primary benefits of outsourcing drug discovery for pharmaceutical companies?

Outsourcing drug discovery offers a multitude of compelling benefits, including substantial reductions in overall operational and capital expenditures, invaluable access to highly specialized scientific expertise and cutting-edge technological platforms, significantly accelerated research and development timelines, and enhanced strategic flexibility in managing and allocating R&D resources. These advantages collectively de-risk and expedite the complex process of drug development, allowing companies to focus on core competencies and achieve faster market entry.

How is Artificial Intelligence (AI) fundamentally transforming the drug discovery outsourcing landscape?

Artificial Intelligence (AI) is profoundly transforming drug discovery outsourcing by dramatically accelerating hit identification and lead optimization through advanced virtual screening and predictive modeling. It significantly improves the accuracy of forecasting drug efficacy and toxicity, enables more precise target identification and validation by analyzing vast biological datasets, and streamlines complex data analysis and interpretation, ultimately leading to faster, more efficient, and data-driven drug candidate selection and development. AI enhances both speed and precision in the discovery pipeline.

What are the most significant challenges and restraints faced in the drug discovery outsourcing market?

The drug discovery outsourcing market faces several significant challenges, including persistent and critical concerns over the protection of intellectual property (IP) and data confidentiality. Other key restraints involve ensuring consistent quality control across diverse projects, overcoming potential communication barriers and integration complexities between client and CRO teams, and adeptly navigating the intricate and often divergent regulatory landscapes prevalent across various international geographies, which demand meticulous compliance and robust risk management strategies.

Which therapeutic areas are currently witnessing the highest levels of outsourcing activity and investment?

Therapeutic areas currently experiencing the highest levels of outsourcing activity and strategic investment include oncology (cancer research), infectious diseases (e.g., antivirals, antibacterials), neurology (neurodegenerative disorders), cardiovascular diseases, and immunology (autoimmune and inflammatory conditions). This intense focus reflects critical unmet medical needs, high disease burdens, and substantial ongoing R&D investments in these complex fields, often requiring specialized external expertise and technological capabilities for efficient progress.

Who are the primary types of end-users or customers leveraging drug discovery outsourcing services?

The primary types of end-users or customers leveraging drug discovery outsourcing services are broadly categorized into large pharmaceutical and biopharmaceutical companies seeking augmented capacity and specialized expertise, small to medium-sized biotechnology firms and startups that often rely on CROs as virtual R&D departments due to limited in-house resources, and academic and research institutes looking to translate fundamental scientific discoveries into potential therapeutic candidates more efficiently and effectively. This diverse client base underscores the widespread utility and strategic importance of outsourcing across the life sciences sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager