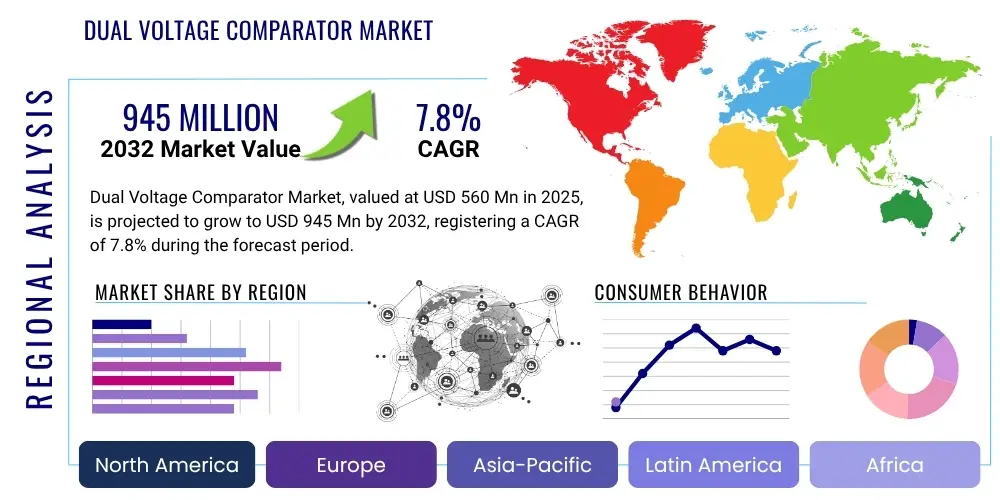

Dual Voltage Comparator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430294 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Dual Voltage Comparator Market Size

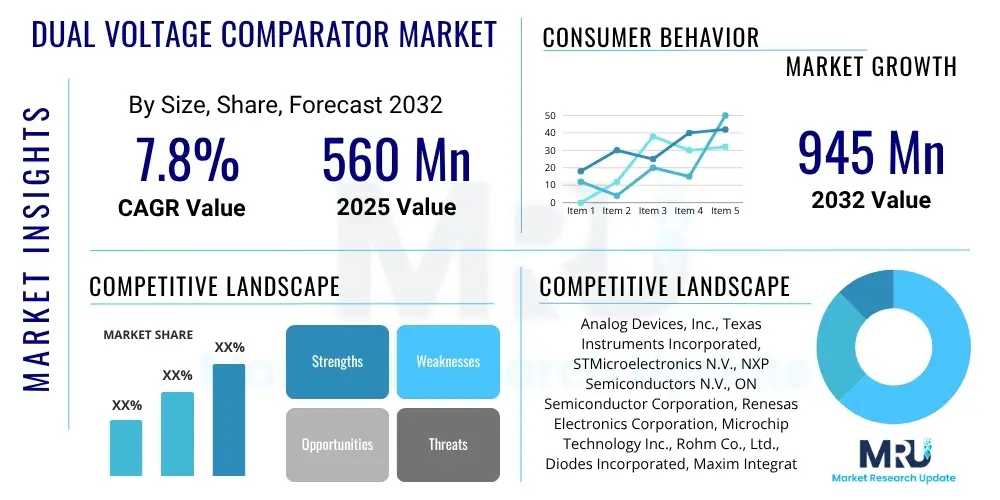

The Dual Voltage Comparator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 560 Million in 2025 and is projected to reach USD 945 Million by the end of the forecast period in 2032.

Dual Voltage Comparator Market introduction

The Dual Voltage Comparator Market encompasses a critical segment within the analog integrated circuit industry, offering essential components for a wide array of electronic systems. A dual voltage comparator is an electronic device designed to compare two distinct voltage inputs and produce a digital output indicating which input voltage is higher. This fundamental functionality makes them indispensable for threshold detection, signal conditioning, window detection, and timing applications across various sectors. The inherent precision, speed, and efficiency of these components are paramount in modern electronics, where reliable decision-making based on voltage levels is frequently required.

These specialized comparators are characterized by their ability to handle two independent voltage comparison channels within a single package, offering space-saving and cost-effective solutions for complex circuit designs. Key benefits include improved system performance, reduced component count, and enhanced reliability in environments where multiple voltage monitoring points are necessary. They are vital for scenarios demanding accurate voltage monitoring, such as battery management systems, power supply supervision, motor control, and various forms of sensor interfacing. The driving factors behind their increasing adoption include the relentless miniaturization of electronic devices, the proliferation of connected technologies, and the rising demand for sophisticated power management and control systems across industrial, automotive, and consumer electronics applications.

Major applications span diverse industries, from detecting overvoltage or undervoltage conditions in automotive systems to monitoring battery charge levels in portable consumer devices and implementing precise control loops in industrial automation equipment. The versatility of dual voltage comparators in translating analog voltage differences into actionable digital signals underscores their foundational role in modern electronic design, facilitating smarter and more autonomous systems. Their continuous evolution in terms of speed, power efficiency, and integration capabilities further solidifies their market presence and growth trajectory.

Dual Voltage Comparator Market Executive Summary

The Dual Voltage Comparator Market is experiencing robust growth, driven by pervasive trends across business, regional, and segment landscapes. Technologically, the push for smaller, more power-efficient, and higher-precision devices is shaping product development, leading to innovations in package sizes, operating voltages, and response times. Economic factors, such as increasing investments in industrial automation, renewable energy, and electric vehicles, are creating significant demand for reliable voltage monitoring solutions. Societal shifts towards smart homes, wearable technology, and enhanced automotive safety features further underscore the necessity for advanced dual voltage comparators, which underpin many of these intelligent systems by providing critical real-time voltage data for decision-making and control.

Regionally, Asia Pacific continues to dominate the market due to its extensive manufacturing base for consumer electronics, automotive components, and industrial equipment, coupled with burgeoning markets for IoT devices. North America and Europe also maintain strong market positions, driven by significant R&D investments, advanced industrial infrastructure, and a high adoption rate of sophisticated electronics in automotive and medical sectors. Emerging economies in Latin America, the Middle East, and Africa are showing accelerated growth, propelled by rapid industrialization, urbanization, and increasing access to advanced technologies, leading to a growing demand for electronic components, including dual voltage comparators, in new infrastructure and manufacturing initiatives.

Segmentation trends reveal a strong emphasis on low-power and high-speed comparators, catering to the needs of battery-operated devices and real-time control systems, respectively. The automotive sector is a particularly strong growth area, fueled by the transition to electric vehicles (EVs), advanced driver-assistance systems (ADAS), and complex in-car infotainment systems, all of which rely heavily on precise voltage monitoring. Industrial applications, including process control, robotics, and power management, also represent a significant and expanding segment, benefiting from the enhanced reliability and robust performance offered by modern dual voltage comparators in challenging operational environments. The consumer electronics segment, driven by devices like smartphones, laptops, and wearables, consistently demands smaller, more integrated, and power-efficient solutions, pushing manufacturers to innovate in compact packaging and ultra-low power consumption designs.

AI Impact Analysis on Dual Voltage Comparator Market

User questions regarding the impact of AI on the Dual Voltage Comparator Market often revolve around how artificial intelligence will influence the design, manufacturing, and application of these fundamental analog components. Key themes include the potential for AI-driven design optimization tools to create more efficient and precise comparators, the role of comparators in AI-powered edge devices, and whether AI could eventually automate or even supersede the need for traditional voltage comparison in certain advanced systems. Concerns are frequently raised about the adaptability of current comparator technologies to increasingly complex AI-centric architectures, as well as the opportunities for new market niches driven by AI's expansion into various industries. There is also interest in understanding how AI might enhance testing and quality control processes for these components.

While AI does not directly perform voltage comparison in its core functions, its pervasive integration into smart devices and industrial systems profoundly impacts the demand and specifications for dual voltage comparators. AI algorithms require vast amounts of data, often collected from sensors that translate physical phenomena into electrical signals. Dual voltage comparators play a crucial role in conditioning these signals, performing critical threshold detection, and ensuring signal integrity before data is processed by AI-enabled microcontrollers or specialized AI accelerators. For instance, in an autonomous vehicle equipped with AI for perception and decision-making, comparators ensure that sensor inputs (e.g., from LIDAR, radar, cameras) are correctly digitized and within operational parameters, thus directly contributing to the reliability of AI inference.

Moreover, the energy efficiency and power management demands of AI processing units, particularly at the edge, drive the need for highly efficient power supply monitoring, where dual voltage comparators are indispensable. AI-driven systems demand optimal power delivery and fault detection to ensure continuous and reliable operation. The increasing complexity of AI hardware also necessitates advanced diagnostics and monitoring, where comparators can provide immediate feedback on voltage irregularities. The future integration of AI in manufacturing processes may also lead to more sophisticated design automation and predictive maintenance for comparator production lines, enhancing overall quality and reducing costs. Thus, the relationship between AI and dual voltage comparators is synergistic, with AI driving demand for improved comparator performance and comparators enabling the robust operation of AI systems.

- AI-enabled devices increase demand for low-power, high-speed, and compact dual voltage comparators for embedded sensing and control.

- AI-driven design automation tools could optimize comparator performance, reducing design cycles and improving power efficiency or precision.

- Comparators are critical for power management and battery supervision in AI-powered edge computing devices and IoT applications.

- Increased complexity of AI systems in automotive and industrial sectors necessitates more robust and reliable voltage monitoring through comparators.

- AI in manufacturing and quality control can improve the production efficiency and defect detection of dual voltage comparator chips.

- Emergence of intelligent sensor hubs incorporating AI might integrate comparator functionality for pre-processing analog signals.

DRO & Impact Forces Of Dual Voltage Comparator Market

The Dual Voltage Comparator Market is shaped by a dynamic interplay of drivers, restraints, and opportunities, collectively forming the impact forces that dictate its growth trajectory. Key drivers include the exponential growth of the Internet of Things (IoT) ecosystem, which demands ubiquitous sensing and intelligent control at the edge, heavily relying on efficient voltage comparison for device operation, battery management, and sensor interface. The relentless expansion of the automotive sector, particularly with the advent of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), necessitates robust and precise voltage monitoring for critical safety and performance functions. Additionally, the industrial automation trend, marked by increased deployment of robotics, process control systems, and smart factory initiatives, continuously fuels the demand for high-reliability comparators capable of operating in harsh industrial environments. Miniaturization in consumer electronics, coupled with a focus on extended battery life, further propels the need for smaller, lower-power dual voltage comparators.

However, the market also faces certain restraints. The increasing integration of multiple functionalities into System-on-Chip (SoC) solutions can sometimes reduce the demand for discrete comparator components, as comparison functions become embedded within larger ICs. This trend, while offering benefits in terms of space and cost for end-users, poses a challenge to specialized comparator manufacturers. Furthermore, market maturity in certain traditional application areas and intense price competition, particularly for general-purpose comparators, can compress profit margins. Design complexity, especially for high-precision or ultra-low power comparators, coupled with stringent quality and reliability requirements in critical applications like medical and automotive, demands significant R&D investment, which can be a barrier for smaller players. Supply chain volatility and geopolitical factors can also introduce uncertainties in production and distribution, impacting market stability and growth.

Opportunities for growth are abundant and diversified. The ongoing development of advanced sensing technologies for environmental monitoring, smart cities, and healthcare applications presents new avenues for dual voltage comparators, particularly those optimized for low-power operation and high accuracy. The burgeoning renewable energy sector, including solar inverters and battery energy storage systems, requires sophisticated power management and protection circuits that frequently utilize dual voltage comparators. Moreover, the demand for enhanced safety and security systems, encompassing industrial safety, access control, and surveillance, offers additional market expansion prospects. Strategic partnerships between comparator manufacturers and system integrators, along with investments in emerging markets, are expected to unlock further growth potential. The continuous innovation in materials science and semiconductor manufacturing processes also offers opportunities to develop next-generation comparators with superior performance characteristics, pushing the boundaries of what these devices can achieve in terms of speed, precision, and power efficiency.

Segmentation Analysis

The Dual Voltage Comparator Market is comprehensively segmented to provide a detailed understanding of its diverse landscape, enabling stakeholders to identify specific growth areas and market dynamics. These segmentations typically categorize the market based on the type of comparator, the speed of operation, power consumption characteristics, target application areas, and the specific end-user industries they serve. Each segment reflects unique technological requirements and market demands, influenced by factors such as device complexity, operational environment, and performance priorities, contributing to a granular view of the market's structure and potential for expansion. Understanding these divisions is crucial for strategic planning and product development in the analog IC industry.

- By Type

- General Purpose Comparators: Versatile, cost-effective for a wide range of applications where extreme precision or speed is not critical.

- High Speed Comparators: Designed for applications requiring rapid response times, such as data acquisition systems, high-frequency circuits, and communication equipment.

- Low Power Comparators: Optimized for minimal current consumption, essential for battery-powered devices, IoT nodes, and portable electronics.

- Precision Comparators: Offer very low offset voltage and high accuracy, crucial for instrumentation, medical devices, and high-end industrial control.

- Window Comparators: Specifically designed to detect if an input voltage falls within a defined range.

- By Application

- Threshold Detection: Common use in various circuits to determine if a signal crosses a predefined voltage level.

- Oscillator Circuits: Used in relaxation oscillators and waveform generators.

- Switching Power Supplies: For voltage regulation and protection within power management units.

- Analog-to-Digital Conversion (ADC): In successive approximation ADCs and flash ADCs, comparators are fundamental.

- Battery Management Systems: Critical for monitoring charge levels, overcharge/discharge protection, and cell balancing in multi-cell batteries.

- Motor Control: For precise speed and position control in industrial and automotive motors.

- By End-User Industry

- Automotive: Includes electric vehicles (EVs), hybrid electric vehicles (HEVs), advanced driver-assistance systems (ADAS), infotainment, and engine control units (ECUs).

- Industrial: Encompasses factory automation, process control, robotics, power management for industrial machinery, and test and measurement equipment.

- Consumer Electronics: Mobile phones, tablets, laptops, wearables, smart home devices, and portable medical electronics.

- Telecommunications: Networking equipment, base stations, optical communication modules, and data center infrastructure.

- Medical & Healthcare: Diagnostic equipment, patient monitoring systems, implantable devices, and laboratory instruments.

- Aerospace & Defense: Avionics, radar systems, satellite communications, and ruggedized electronic systems.

- Energy & Utilities: Renewable energy systems (solar, wind), smart grids, power distribution, and energy storage solutions.

- By Operating Voltage

- Low Voltage Comparators (e.g., 1.8V, 3.3V): Suited for modern digital systems and battery-powered devices.

- High Voltage Comparators (e.g., 5V, 12V, or higher): Used in industrial and automotive applications with higher power rails.

- By Package Type

- Surface Mount Device (SMD): Small form factors like SOT, SC70, TSSOP, SOIC, crucial for miniaturization.

- Through-Hole Device (THD): Larger packages like DIP, still used in certain industrial and prototyping applications.

Value Chain Analysis For Dual Voltage Comparator Market

The value chain for the Dual Voltage Comparator Market begins with upstream activities, primarily involving the raw material suppliers and semiconductor foundries. This initial stage is critical, as it dictates the fundamental quality and cost structure of the end product. Suppliers provide essential materials such as silicon wafers, various metals for interconnects, and specialized chemicals for fabrication processes. Semiconductor foundries, including major players like TSMC, Samsung Foundry, and GlobalFoundries, leverage advanced lithography and deposition techniques to manufacture the integrated circuits from these raw materials, transforming design specifications into physical chips. The reliability and consistency of these upstream partners are paramount, as any disruption or quality issue at this stage can significantly impact the entire value chain. Investment in R&D for new semiconductor materials and manufacturing processes also takes place at this stage, focusing on enhancing performance, reducing power consumption, and improving cost-effectiveness of comparator circuits.

Moving downstream, the value chain encompasses the design and intellectual property (IP) development, component manufacturing, assembly, testing, and packaging phases. Leading analog IC companies, such as Analog Devices, Texas Instruments, and STMicroelectronics, invest heavily in designing proprietary comparator architectures, focusing on features like low offset voltage, high speed, low power consumption, and wide operating temperature ranges. After fabrication at the foundries, the bare dies are then assembled into various package types (e.g., SOIC, SOT, TSSOP) and subjected to rigorous testing to ensure they meet specified electrical and environmental performance criteria. This stage adds significant value through brand reputation, quality assurance, and the integration of advanced features tailored for specific application segments. The packaging not only protects the delicate silicon but also provides the electrical connections to the outside world, influencing the thermal performance and board-level integration.

The final stages of the value chain involve distribution channels and reaching the end-users. Distribution can be direct, where manufacturers sell directly to large original equipment manufacturers (OEMs) or key industrial clients, particularly for specialized or high-volume orders. This direct channel allows for close collaboration, customization, and technical support, fostering strong long-term relationships. Alternatively, an indirect distribution model involves leveraging a network of authorized distributors, resellers, and online platforms. These intermediaries play a crucial role in reaching a broader customer base, including small and medium-sized enterprises (SMEs), prototyping labs, and individual engineers. Companies like Digi-Key, Mouser Electronics, and Arrow Electronics provide extensive catalogs, technical resources, and logistics support, ensuring widespread availability of dual voltage comparators. End-users span diverse industries such as automotive, industrial, consumer electronics, telecommunications, and medical, each integrating these comparators into their final products for various voltage monitoring, signal conditioning, and control applications. The efficiency of this distribution network is key to market penetration and responsiveness to diverse customer needs globally.

Dual Voltage Comparator Market Potential Customers

Potential customers for the Dual Voltage Comparator Market are broadly categorized by their operational needs and the industries they serve, all requiring precise and reliable voltage comparison functionalities within their electronic systems. A significant segment comprises Original Equipment Manufacturers (OEMs) across various sectors, including automotive electronics manufacturers who integrate comparators into battery management systems, engine control units, and ADAS modules for voltage regulation and fault detection. Industrial automation companies represent another core customer base, utilizing these components in programmable logic controllers (PLCs), motor drives, robotics, and process control equipment to monitor sensor outputs and ensure operational safety and efficiency in demanding environments. These customers prioritize robustness, wide operating temperature ranges, and long-term reliability.

Furthermore, consumer electronics manufacturers are major buyers, integrating dual voltage comparators into products like smartphones, laptops, wearables, and smart home devices. Their primary drivers include miniaturization, ultra-low power consumption for extended battery life, and cost-effectiveness to meet competitive market demands. Telecommunications equipment providers, including those developing networking hardware, base stations, and data center infrastructure, also constitute an important customer segment, requiring high-speed comparators for signal integrity, power supply monitoring, and clock synchronization in complex digital systems. Additionally, the burgeoning medical and healthcare industry relies on these components for patient monitoring devices, diagnostic equipment, and implantable medical devices, where precision, reliability, and low power are critically important for patient safety and device functionality. The continuous innovation and expansion within these diverse industries ensure a consistent and growing demand for advanced dual voltage comparators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 560 Million |

| Market Forecast in 2032 | USD 945 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Analog Devices, Inc., Texas Instruments Incorporated, STMicroelectronics N.V., NXP Semiconductors N.V., ON Semiconductor Corporation, Renesas Electronics Corporation, Microchip Technology Inc., Rohm Co., Ltd., Diodes Incorporated, Maxim Integrated (now part of Analog Devices), Monolithic Power Systems, Inc., Linear Technology (now part of Analog Devices), Cypress Semiconductor (now part of Infineon), New Japan Radio Co., Ltd., Kionix Inc., Torex Semiconductor Ltd., Nordic Semiconductor ASA, Semtech Corporation, Intersil Corporation (now part of Renesas), Toshiba Electronic Devices & Storage Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dual Voltage Comparator Market Key Technology Landscape

The Dual Voltage Comparator Market is continuously evolving, driven by advancements in semiconductor technology and increasing demands for higher performance, lower power consumption, and smaller form factors. The core technologies employed primarily revolve around different semiconductor processes, notably CMOS (Complementary Metal-Oxide-Semiconductor) and BiCMOS (Bipolar-CMOS). CMOS technology is widely adopted for its low power consumption and high integration density, making it ideal for battery-powered devices and complex digital-analog mixed-signal designs. Modern CMOS comparators are continuously being refined to offer improved speed-power trade-offs and reduced offset voltages, which are critical for precision applications. Innovations in sub-micron and nanometer CMOS processes enable the creation of highly compact and efficient dual voltage comparators, fitting into the ever-shrinking footprints of modern electronic devices while maintaining robust performance.

BiCMOS technology, which combines the advantages of both bipolar and CMOS transistors, is another significant technological pillar. Bipolar transistors provide high gain and excellent noise performance, while CMOS transistors offer low power dissipation and high input impedance. This combination allows for comparators that deliver superior speed and precision characteristics, often preferred in applications requiring very fast response times and stable operation across varying temperatures, such as in high-frequency signal processing, industrial control, and automotive systems. The development in advanced packaging technologies also plays a crucial role. Smaller packages like DFN, SC70, and SOT are becoming standard, enabling high-density board layouts and facilitating integration into compact devices. Chip-scale packages (CSPs) and wafer-level chip-scale packages (WLCSPs) represent the forefront of miniaturization, offering significant space savings.

Beyond material and packaging, innovations in circuit design techniques are pivotal. These include sophisticated offset voltage cancellation techniques, such as auto-zeroing and chopping, which significantly enhance the precision of comparators by minimizing inherent input offset voltage errors that can accumulate over time or due to temperature variations. Advancements in ultra-low power design methodologies are extending battery life in portable and IoT devices, allowing comparators to operate on microwatts or even nanowatts of power. Furthermore, the integration of additional features like built-in references, hysteresis control, and open-drain or push-pull outputs directly onto the comparator chip adds versatility and simplifies external circuitry for designers. The ongoing pursuit of higher operating speeds, wider supply voltage ranges, and enhanced electromagnetic compatibility (EMC) further defines the key technological trends shaping the dual voltage comparator market, ensuring their continued relevance and evolution in an increasingly complex electronic landscape.

Regional Highlights

- Asia Pacific (APAC): Dominates the market due to robust manufacturing capabilities in consumer electronics, automotive, and industrial sectors. Countries like China, Japan, South Korea, and India are key players, experiencing rapid industrialization, increasing IoT adoption, and significant government initiatives in smart infrastructure.

- North America: Characterized by strong R&D, early adoption of advanced technologies, and a significant presence of leading semiconductor companies. High demand from the automotive (ADAS, EVs), aerospace, and telecommunications sectors drives market growth.

- Europe: A mature market with stringent regulatory standards, particularly in the automotive (safety, emission controls), industrial automation, and medical sectors. Germany, France, and the UK are key contributors, focusing on high-precision and robust comparators for critical applications.

- Latin America: An emerging market showing steady growth, driven by increasing industrialization, infrastructure development, and growing consumer electronics adoption. Countries like Brazil and Mexico are experiencing expanding manufacturing bases and demand for electronic components.

- Middle East & Africa (MEA): A rapidly developing region with significant investments in smart city projects, renewable energy, and industrial diversification initiatives. This creates new opportunities for dual voltage comparators in power management and control systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dual Voltage Comparator Market.- Analog Devices, Inc.

- Texas Instruments Incorporated

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- Microchip Technology Inc.

- Rohm Co., Ltd.

- Diodes Incorporated

- Maxim Integrated (now part of Analog Devices)

- Monolithic Power Systems, Inc.

- New Japan Radio Co., Ltd.

- Torex Semiconductor Ltd.

- Semtech Corporation

- Infineon Technologies AG (includes former Cypress Semiconductor)

- Toshiba Electronic Devices & Storage Corporation

- Kionix Inc.

- Nordic Semiconductor ASA

- Microsemi Corporation (now part of Microchip Technology)

- Vishay Intertechnology, Inc.

Frequently Asked Questions

What is a dual voltage comparator and how does it function?

A dual voltage comparator is an integrated circuit that takes two analog voltage inputs and provides a digital output indicating which input voltage is higher. It typically contains two independent comparator circuits within a single package, allowing for simultaneous comparison of two different sets of voltage inputs. Its primary function is to detect threshold crossings and provide a clear digital signal, often used for decision-making in electronic systems.

What are the primary applications of dual voltage comparators?

Dual voltage comparators are widely used in various applications including battery management systems for monitoring charge and discharge levels, power supply supervision for over/under-voltage detection, motor control systems, signal conditioning, window detection, and in basic analog-to-digital conversion circuits. They are critical in automotive, industrial automation, and consumer electronics for precise voltage monitoring and control.

How do dual voltage comparators contribute to the efficiency of IoT devices?

For IoT devices, dual voltage comparators are crucial for efficient power management and sensor interfacing. They enable low-power threshold detection for sensor signals, allowing the main microcontroller to remain in a low-power state until a significant event occurs. This helps extend battery life and improves the overall energy efficiency of connected devices, which is vital for long-term, autonomous operation.

What key parameters should be considered when selecting a dual voltage comparator?

Key parameters for selecting a dual voltage comparator include propagation delay (speed), quiescent current (power consumption), input offset voltage (precision), hysteresis (noise immunity), operating temperature range, supply voltage range, and output type (e.g., open-drain, push-pull). The specific application requirements will dictate the optimal balance of these parameters.

What is the future outlook for the Dual Voltage Comparator Market?

The future outlook for the Dual Voltage Comparator Market is positive, driven by continued growth in automotive electrification, industrial automation, the proliferation of IoT devices, and advancements in renewable energy systems. Innovations in ultra-low power, high-speed, and precision comparators, alongside continued miniaturization and integration into complex systems, will sustain market expansion. Emerging applications in AI-powered edge devices will further fuel demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager