E-Bike Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429793 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

E-Bike Battery Market Size

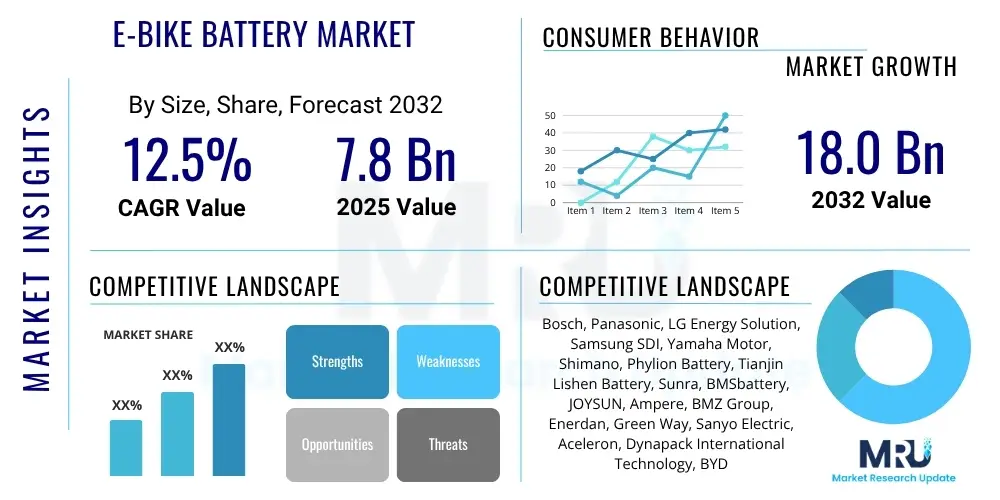

The E-Bike Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at $7.8 Billion in 2025 and is projected to reach $18.0 Billion by the end of the forecast period in 2032.

E-Bike Battery Market introduction

The E-Bike Battery Market comprises the global ecosystem involved in the research, development, manufacturing, and distribution of energy storage units specifically engineered to power electric bicycles. These batteries are foundational to the functionality of e-bikes, providing the necessary electrical power to the motor, which in turn offers pedal assistance or full electric propulsion. The market's robust expansion is intrinsically linked to the escalating global adoption of e-bikes across a multitude of applications, including daily urban commuting, diverse recreational activities, and commercial last-mile delivery services. As the cornerstone of e-bike performance, battery technology directly influences an e-bike's range, power, and overall user satisfaction. The predominant product within this market segment is the rechargeable lithium-ion battery, highly favored for its exceptional energy density, relatively lightweight profile, and extended cycle life, which collectively outperform older battery chemistries such as lead-acid or nickel-metal hydride alternatives.

The versatility of E-Bike Batteries enables their deployment across a broad spectrum of applications, each catering to specific consumer and commercial needs. For instance, urban commuters increasingly rely on e-bikes as an efficient, environmentally conscious, and time-saving mode of transport, effectively circumventing traffic congestion and mitigating public transport reliance. Recreational cyclists, ranging from casual riders to adventure enthusiasts, leverage the augmented power and extended range provided by these batteries to explore more challenging terrains or embark on longer journeys with reduced physical strain. Moreover, the commercial sector has witnessed a significant uptake, with businesses in food delivery, parcel services, and various logistics operations integrating e-bikes into their fleets. This commercial adoption is driven by the operational efficiencies, reduced fuel costs, and diminished carbon footprint that e-bikes offer, particularly in dense urban landscapes. These diverse applications collectively underscore the critical role of advanced battery technology in enhancing accessibility to cycling and promoting sustainable mobility solutions globally.

Several pivotal driving factors are synergistically propelling the sustained growth of the E-Bike Battery Market. A primary catalyst is the escalating global consciousness regarding environmental sustainability and the imperative to reduce greenhouse gas emissions, positioning e-bikes as a viable and eco-friendly alternative to conventional fossil-fuel-dependent vehicles. This momentum is further amplified by supportive governmental policies, financial incentives, and urban development initiatives worldwide that actively encourage the adoption of electric vehicles, including e-bikes, and invest in robust cycling infrastructure. The persistent challenges of urbanization, characterized by increasing traffic congestion and limited parking in metropolitan areas, inherently elevate the appeal of e-bikes as an agile and efficient mode of personal transport. Furthermore, ongoing technological breakthroughs in battery chemistry, coupled with continuous innovation in energy density, charging speed, and inherent safety features, consistently enhance the performance and attractiveness of e-bike batteries. This technological progression, combined with a gradual reduction in manufacturing costs, renders e-bikes more accessible and affordable to an expanding demographic, thereby cementing the market's robust growth trajectory.

E-Bike Battery Market Executive Summary

The E-Bike Battery Market is experiencing dynamic shifts influenced by overarching business trends, distinct regional market developments, and significant segment-specific transformations. Current business trends illustrate a strategic emphasis on vertical integration within the e-bike and battery manufacturing sectors, as companies seek to exert greater control over quality assurance, optimize production costs, and fortify their supply chains against disruptions. A pronounced focus is evident on the development and integration of sophisticated Battery Management Systems (BMS), which are crucial for real-time performance monitoring, predictive maintenance capabilities, and bolstering overall battery safety and longevity. This technological push is complemented by an increasing prevalence of strategic partnerships and collaborative ventures across the industry, particularly for accelerating innovations in areas such as ultra-fast charging capabilities and advanced battery recycling methodologies, reflecting a collective industry commitment towards enhanced sustainability and operational efficiency. Furthermore, the market is observing a trend towards modular and swappable battery designs, which not only simplify battery replacement and upgrades but also significantly boost consumer convenience and extend the functional lifespan of e-bikes.

From a regional perspective, the Asia Pacific (APAC) continues its dominance in the E-Bike Battery Market, primarily propelled by its vast manufacturing infrastructure, particularly in countries like China and India, and a high rate of e-bike adoption driven by dense urban populations and economic factors. Europe represents a burgeoning market, characterized by vigorous growth fueled by stringent environmental regulations, generous government subsidies promoting electric mobility, and a deeply ingrained cycling culture. Nations such as Germany, the Netherlands, and France are at the forefront of this expansion, demonstrating a strong consumer inclination towards premium e-bike models equipped with advanced battery solutions. North America is steadily emerging as a significant growth region, driven by increasing consumer awareness regarding sustainable transportation, continuous improvements in cycling infrastructure, and a surging interest in e-bikes for both recreational and commuting purposes. While Latin America, the Middle East, and Africa currently exhibit nascent growth, they hold substantial potential for future expansion as economic development progresses and investments in green mobility solutions gain traction across these regions.

An in-depth analysis of segmentation trends reveals the continued preeminence of Lithium-ion (Li-ion) batteries, attributed to their superior energy density, extended cycle life, and consistent performance profile. Although Li-ion technology remains dominant, there is active research and development into next-generation battery chemistries, including solid-state batteries, which promise even greater energy density and enhanced safety. Within the Li-ion segment, a discernible trend indicates a rising demand for higher capacity batteries, typically exceeding 500 Wh, to support the requirements of longer-range e-bikes and more powerful motor systems. The market is also witnessing a diversification in voltage offerings, with 36V and 48V remaining standard, while higher voltages are increasingly adopted for specialized performance-oriented e-bikes. Applications such as urban commuting and recreational riding continue to be primary demand drivers, with the commercial delivery segment showing particularly accelerated growth. The aftermarket for replacement batteries is also expanding significantly, fueled by the growing installed base of e-bikes and a consumer desire to prolong product utility, thus contributing to the principles of a circular economy within the e-bike industry.

AI Impact Analysis on E-Bike Battery Market

User inquiries concerning the influence of Artificial Intelligence (AI) on the E-Bike Battery Market predominantly revolve around how AI can fundamentally elevate battery performance, fortify safety mechanisms, prolong operational longevity, and optimize the overall user experience. Key areas of interest frequently include the capacity of AI to proactively identify and predict potential battery failures, intelligently manage intricate charging and discharging cycles for optimal efficiency, and dynamically personalize power delivery in response to real-time riding conditions and user preferences. Consumers express notable concerns about maximizing battery lifespan, effectively preventing hazardous thermal runaway incidents, and receiving actionable insights for informed battery maintenance and timely replacement. There is also a pervasive expectation that AI will play a transformative role in fostering more sustainable battery utilization through advanced charge optimization and sophisticated energy recovery systems, while simultaneously accelerating the development of innovative, next-generation battery chemistries. Furthermore, a recurring theme in user questions relates to the seamless integration of AI within broader e-bike ecosystems, enabling advanced diagnostic capabilities and offering predictive insights that benefit both individual riders and original equipment manufacturers.

- AI-powered Battery Management Systems (BMS) integrate sophisticated algorithms for real-time monitoring of critical parameters like voltage, current, and temperature, enabling predictive analytics to optimize performance, enhance safety protocols, and prevent potential failures.

- Advanced predictive maintenance algorithms, driven by AI, analyze historical usage data and current battery health indicators to anticipate degradation patterns and identify potential issues before they become critical, thereby extending the overall lifespan of the battery.

- AI-optimized charging protocols dynamically adjust charging rates and patterns based on factors such as battery age, temperature, and specific usage history, significantly reducing degradation, maximizing charge efficiency, and preparing the battery for optimal performance.

- Enhanced thermal management systems leverage AI to predict and prevent overheating by intelligently controlling cooling mechanisms and power output, thereby improving overall battery safety and reducing the risk of thermal runaway.

- Personalized power delivery and highly accurate range estimation for riders are achieved through AI, which adapts assistance levels and calculates remaining range based on real-time factors like terrain, rider input, current battery state, and even historical riding data, optimizing the riding experience.

- AI facilitates battery second-life applications and more efficient recycling processes by accurately assessing the residual capacity and health of used batteries, guiding their repurposing for less demanding energy storage solutions or sorting them for material recovery.

- AI plays a crucial role in battery design and material discovery, employing machine learning to analyze vast datasets of material properties and simulations, accelerating the identification and development of new, more energy-dense, efficient, and sustainable battery chemistries.

- Integration with smart city infrastructure allows AI to optimize charging station availability based on demand patterns, manage grid load effectively, and even support intelligent energy distribution within urban environments, contributing to broader smart mobility initiatives.

DRO & Impact Forces Of E-Bike Battery Market

The E-Bike Battery Market operates within a complex framework influenced by a dynamic combination of drivers, restraints, and opportunities, collectively forming the pivotal impact forces that dictate its growth trajectory and competitive landscape. A primary driver is the accelerating global imperative towards environmental sustainability and the urgent necessity to drastically reduce carbon emissions, positioning e-bikes as an undeniably attractive, eco-friendly alternative to conventional internal combustion engine vehicles. This powerful environmental impetus is synergistically reinforced by supportive governmental policies, attractive consumer subsidies, and forward-thinking urban planning initiatives across numerous jurisdictions, all actively fostering the adoption of cycling infrastructure and promoting electric mobility solutions. Continuous technological advancements, specifically in areas such as increased battery energy density, accelerated charging speeds, and enhanced inherent safety features, consistently elevate the appeal and functional practicality of e-bikes, while the ongoing optimization and gradual reduction in manufacturing costs for these sophisticated battery units render e-bikes increasingly accessible and affordable to a burgeoning global consumer base. Furthermore, the persistent challenges of escalating fuel costs and pervasive urban traffic congestion compellingly encourage commuters to seek out highly efficient and economical modes of personal transport, thereby directly stimulating the demand and adoption of e-bikes on a massive scale.

Despite the formidable growth drivers, the E-Bike Battery Market confronts several notable restraints that pose significant challenges to its unbridled expansion. The relatively substantial initial capital outlay required for purchasing premium e-bikes, predominantly attributable to the sophisticated battery component, can act as a significant financial barrier to entry for a segment of potential consumers. Safety concerns, particularly those surrounding the infrequent yet high-impact incidents of thermal runaway and associated battery fires, critically influence consumer perception and necessitate the implementation of exceptionally stringent safety standards and robust quality control measures across the industry. The profound reliance on a finite supply of critical raw materials such as lithium, cobalt, and nickel, which are intrinsically susceptible to considerable price volatility and intricate geopolitical supply chain disruptions, represents a substantial and ongoing challenge for manufacturers. Moreover, the development of comprehensive and readily accessible charging infrastructure in nascent or rapidly expanding e-bike markets, coupled with the inherent complexities and high costs associated with sustainable battery recycling processes, also present formidable hurdles that demand innovative solutions and concerted, collaborative efforts from industry stakeholders to effectively mitigate their adverse impact on the market's long-term growth prospects and sustainability.

Notwithstanding these restraints, the E-Bike Battery Market is characterized by abundant and significant opportunities for both established market players and emerging innovators to strategically capitalize upon. The relentless pursuit and development of advanced battery chemistries, such as the promising solid-state batteries, which hold immense potential for substantially higher energy density, dramatically faster charging times, and an inherently improved safety profile compared to current liquid electrolyte-based Li-ion batteries, are poised to unlock entirely new avenues for groundbreaking product innovation and market differentiation. The burgeoning trend of sophisticated battery swapping stations and flexible subscription models offers unparalleled convenience and significantly reduces the upfront cost burden for consumers, thereby possessing the transformative potential to overcome some of the most prominent existing market restraints. The exponential growth of the shared e-mobility sector and the increasing proliferation of commercial fleet operations, particularly for last-mile delivery services, collectively present a monumental commercial opportunity for high-volume battery demand. Furthermore, the innovative exploration of second-life applications for depleted e-bike batteries, where they can be ingeniously repurposed for less demanding energy storage needs in other sectors, robustly contributes to the principles of a circular economy and adds substantial value across the entire product lifecycle, showcasing a commitment to resource efficiency and environmental stewardship. These compelling opportunities, meticulously coupled with ongoing, intensive research and development investments, are strategically positioned to vigorously propel the market forward, ensuring its sustained vitality and expansion.

Segmentation Analysis

The E-Bike Battery Market is meticulously segmented across a variety of crucial parameters, offering a granular and comprehensive understanding of its intricate structure, underlying dynamics, and diverse operational facets. These segmentation criteria are instrumental in dissecting market preferences, monitoring the adoption rates of specific technologies, and identifying distinct application areas that drive demand. The primary categories for market segmentation include battery type, nominal voltage, energy capacity (measured in Watt-hours), specific application scenarios, and the prevailing sales channels through which products reach consumers. A thorough analysis of these segments consistently reveals evolving consumer demands, quantifies the impact of technological advancements on the available product offerings, and illuminates the strategic distribution pathways embraced by market participants. Comprehending these granular segmentations is critically important for businesses aiming to precisely tailor their product development strategies, refine their marketing campaigns for maximum resonance, effectively identify high-growth niches, and proactively anticipate future market shifts. This analytical rigor empowers stakeholders to make exceptionally well-informed decisions pertaining to product innovation, strategic market entry, and optimizing their competitive positioning within the rapidly expanding and increasingly sophisticated e-bike ecosystem.

- By Battery Type: This segment categorizes batteries based on their chemical composition and technological foundation, directly influencing performance characteristics, cost, and environmental impact.

- Lithium-ion (Li-ion): Dominant due to high energy density, long cycle life, and lightweight properties. Includes various chemistries like NMC, NCA, and LFP.

- Lead-Acid: Older technology, heavier, lower energy density, and shorter lifespan; primarily used in entry-level or less demanding e-bikes due to lower cost.

- Nickel-Metal Hydride (NiMH): Offers better performance than lead-acid but inferior to Li-ion; rarely used in new e-bikes due to cost and performance tradeoffs.

- Others (e.g., Solid-state in R&D): Includes advanced chemistries and emerging technologies such as solid-state batteries, which promise future breakthroughs in safety and energy density, currently in research and early development stages for e-bikes.

- By Voltage: This segmentation reflects the power output capabilities of the battery, which dictates the motor's performance and the e-bike's overall power and speed.

- 24V: Typically found in entry-level e-bikes or those with lower power requirements, offering basic pedal assist.

- 36V: The most common standard, balancing power and range, suitable for a wide range of commuter and recreational e-bikes.

- 48V: Offers higher power and greater torque, popular for cargo e-bikes, mountain e-bikes, and those requiring more robust performance.

- 52V and Above: Used in high-performance e-bikes, often for specialized applications like aggressive mountain biking or speed pedelecs, providing maximum power output.

- By Capacity: Defined by the energy stored in Watt-hours (Wh), capacity directly correlates with the e-bike's potential range on a single charge.

- Less than 400 Wh: Suitable for short commutes, occasional rides, or entry-level models where extended range is not the primary concern.

- 400 Wh - 500 Wh: Standard capacity for many urban and recreational e-bikes, offering a good balance of range and weight.

- 500 Wh - 600 Wh: Increasingly popular for riders seeking longer ranges, more challenging terrains, or those who commute significant distances.

- Above 600 Wh: High-capacity batteries designed for extensive touring, long-distance commuting, high-performance mountain e-bikes, or cargo e-bikes requiring maximum range.

- By Application: This segment classifies batteries based on the primary use case of the e-bike, influencing battery design, durability, and capacity requirements.

- Commuting: Focus on reliability, moderate range, and frequent charging; often integrated discreetly into the bike frame.

- Recreational: Emphasizes extended range for leisure rides, touring, and gentle off-road use; may prioritize lighter weight for easier handling.

- Cargo/Delivery: Requires high capacity and robust durability for carrying heavy loads over long distances, often with quick-swapping capabilities.

- Mountain E-bikes: Demands high power output for challenging climbs, extreme durability against shocks and vibrations, and often high capacity for extended trail rides.

- Others (e.g., Folding E-bikes, Fat-Tire E-bikes): Specialized applications requiring compact size (folding), enhanced weather resistance (fat-tire), or unique power delivery profiles.

- By Sales Channel: This segmentation differentiates how e-bike batteries are distributed and sold to the market.

- Original Equipment Manufacturer (OEM): Batteries supplied directly to e-bike manufacturers for integration into new e-bikes, typically involving large volume contracts and specific customization.

- Aftermarket: Batteries sold as replacements for existing e-bikes or as upgrades, distributed through retailers, online platforms, and specialized e-bike stores.

Value Chain Analysis For E-Bike Battery Market

The value chain within the E-Bike Battery Market is characterized by its intricate and multi-stage nature, commencing with the rigorous upstream sourcing and refinement of critical raw materials and extending meticulously through sophisticated manufacturing processes, precise assembly, strategic distribution channels, and ultimately culminating in the direct engagement with the end-user. The upstream segment of this chain is fundamentally concerned with the extraction, processing, and refinement of essential minerals such as lithium, cobalt, nickel, manganese, and graphite, which are indispensable components for the production of advanced battery cells. This foundational stage also encompasses the specialized manufacturing of key battery components, including high-performance cathodes, anodes, electrolytes, sophisticated separators, and the indispensable Battery Management Systems (BMS) which regulate battery functions. The implementation of robust supply chain management practices and the establishment of strategic, long-term partnerships with reliable raw material suppliers are absolutely critical at this juncture to effectively mitigate the inherent risks of price volatility and to ensure a consistent, uninterrupted supply, especially given the fierce global demand for these resources across various electric vehicle industries. Manufacturers in this initial phase frequently allocate substantial investments into intensive research and development efforts, aimed at optimizing material utilization, enhancing cell efficiency, and improving overall performance metrics, thereby laying the groundwork for the quality of the final product.

Progressing further downstream, the value chain encompasses the meticulous assembly of individual battery cells into fully functional and integrated battery packs. This process demands exceptionally precise engineering to guarantee the highest standards of safety, ensure long-term durability, and optimize operational efficiency. These meticulously assembled battery packs are then supplied directly to E-bike manufacturers, also known as Original Equipment Manufacturers (OEMs), who seamlessly integrate them into their diverse e-bicycle designs and models. The efficacy of the distribution channel is paramount in bridging the crucial gap between the manufacturers and the diverse end-users. Direct distribution channels involve the direct sale of e-bikes from manufacturers to consumers, typically facilitated through proprietary websites, dedicated brand showrooms, or exclusive flagship stores. This direct approach offers manufacturers enhanced control over brand messaging, customer relationship management, and the overall purchasing experience. In contrast, indirect channels, which are considerably more prevalent and widespread, involve a network of wholesalers, regional distributors, specialized e-bike retailers, and broader sporting goods stores. These indirect pathways are instrumental in achieving extensive market penetration and providing localized customer support, comprehensive sales services, and essential after-sales maintenance, catering to a wider geographical reach and diverse consumer preferences. The inherent complexities associated with safe battery handling, stringent logistics, and regulatory compliance further necessitate the involvement of highly specialized distribution networks and expertise throughout this phase.

The strategic interplay between direct and indirect distribution mechanisms profoundly impacts market reach, brand visibility, and the depth of customer engagement. Indirect channels typically leverage well-established retail infrastructures and benefit from inherent consumer trust, often providing invaluable hands-on product demonstrations and comprehensive after-sales service capabilities. Conversely, direct channels frequently yield higher profit margins for manufacturers and facilitate direct, unfiltered customer feedback, which is invaluable for enabling rapid product iterations and responsive design improvements. The aftermarket segment, dedicated to catering for replacement batteries, constitutes another vital and expanding component of the overall value chain. This segment relies on a blend of both direct-to-consumer and indirect retail strategies to effectively reach existing e-bike owners whose original batteries have naturally degraded over time or have reached their end-of-life cycle. This represents a consistent and recurring demand stream within the market. Effective and holistic management of this entire, intricate value chain, spanning from the responsible sourcing of raw materials to the meticulous end-of-life battery recycling and the innovative exploration of potential second-life applications, is absolutely fundamental for ensuring sustainable growth, fostering long-term competitiveness, and upholding environmental responsibility within the dynamic and evolving E-Bike Battery Market. The efficiency, ethical considerations, and environmental stewardship demonstrated at each sequential stage profoundly contribute to the overall market impact and its future viability.

E-Bike Battery Market Potential Customers

The E-Bike Battery Market serves an expansive and heterogeneous array of potential customers, ranging from individual consumers seeking personal mobility solutions to large-scale commercial enterprises and fleet operators, each distinguished by their specific requirements, purchasing priorities, and usage patterns. Primarily, individual end-users represent a substantial and foundational segment of the market. This broad category includes daily urban commuters who actively seek an efficient, environmentally conscious, and economically viable alternative to conventional transportation methods, particularly within congested urban environments where traffic and parking are perpetual challenges. Alongside commuters, recreational riders form another significant customer group, encompassing enthusiasts engaged in leisure cycling, adventurous mountain biking, or extensive touring. These riders highly value the extended range and robust power assistance that advanced e-bike batteries provide, enabling them to confidently navigate longer distances or conquer more challenging terrains with significantly reduced physical exertion. For these individual customers, key purchasing considerations often revolve around battery longevity, unwavering reliability, and sufficient capacity tailored to their specific riding styles, intended usage frequency, and anticipated range requirements.

Beyond the individual consumer, the commercial sector constitutes a rapidly expanding and strategically important customer base for e-bike batteries. A prominent example includes various delivery services—such as food delivery, parcel services, and local logistics—which are increasingly integrating e-bikes into their operational fleets due to their undeniable operational efficiency, considerably lower running costs compared to motor vehicles, and their significantly reduced environmental footprint within dense urban landscapes. Furthermore, fleet operators responsible for managing shared e-bike programs, both publicly funded and privately operated, represent a major customer segment. These commercial entities require exceptionally durable, high-cycle-life batteries capable of withstanding frequent charging and diverse usage patterns, often under demanding conditions. For these commercial buyers, purchasing decisions extend well beyond the initial procurement cost to encompass the total cost of ownership, which includes critical factors such as long-term maintenance expenses, anticipated battery replacement frequency, and overall energy consumption efficiency. The ability to offer robust battery solutions with advanced telemetry for fleet management and quick-swapping capabilities to maximize operational uptime is a significant differentiator for suppliers targeting this segment.

In addition to these direct end-users and commercial operators, e-bike manufacturers, or Original Equipment Manufacturers (OEMs), are pivotal "customers" within the broader value chain. These OEMs procure e-bike batteries in substantial bulk quantities for seamless integration into their diverse product lines. This business-to-business segment is profoundly influenced by factors such as the reliability and reputation of battery suppliers, the pace and relevance of technological innovation offered, the flexibility for customization options to meet specific bike designs, and strict adherence to international safety certifications and quality standards. The aftermarket segment, which specifically caters to the needs of existing e-bike owners whose original batteries have reached their natural end-of-life or have sustained damage, represents a consistent and predictable recurring demand stream. These diverse customer profiles collectively underscore the broad appeal, multifaceted utility, and sustained market demand for e-bike batteries. This intricate market dynamic highlights the strategic necessity for battery manufacturers and suppliers to offer a comprehensive range of products, meticulously tailored to address the varying performance requirements, diverse budget constraints, and application-specific demands encountered across the entire spectrum of the E-Bike Battery Market. Understanding these customer nuances is paramount for strategic market positioning and successful product deployment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $7.8 Billion |

| Market Forecast in 2032 | $18.0 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Panasonic, LG Energy Solution, Samsung SDI, Yamaha Motor, Shimano, Phylion Battery, Tianjin Lishen Battery, Sunra, BMSbattery, JOYSUN, Ampere, BMZ Group, Enerdan, Green Way, Sanyo Electric, Aceleron, Dynapack International Technology, BYD, Coslight International Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

E-Bike Battery Market Key Technology Landscape

The E-Bike Battery Market's technological landscape is in a constant state of evolution, primarily driven by relentless innovation aimed at significantly enhancing energy density, optimizing charging efficiency, bolstering inherent safety features, and extending the overall operational lifespan of battery units. Lithium-ion (Li-ion) technology remains the undisputed cornerstone of this market, with intensive ongoing research and development efforts meticulously focused on optimizing cathode and anode material compositions. This includes exploring advanced chemistries such as nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA), alongside the growing adoption of lithium iron phosphate (LFP) for its enhanced safety and cycle life, all with the overarching objective of achieving higher power output, greater range, and improved stability. Concurrently, substantial developmental efforts are being channeled into creating more sophisticated Battery Management Systems (BMS), which are absolutely critical for real-time monitoring of individual cell voltage, temperature, and current. These advanced BMS units ensure safe operational parameters, actively prevent detrimental overcharging or deep discharge scenarios, and significantly extend battery life through intelligent cell balancing algorithms and predictive diagnostics. Increasingly, these smart BMS units are integrating advanced connectivity features, enabling remote diagnostics, over-the-air software updates, and sophisticated performance monitoring, which collectively enhance the user experience and streamline maintenance processes.

The horizon of e-bike battery technology is also being reshaped by several promising emerging innovations. Solid-state batteries, although predominantly in the research and development phase for widespread commercial e-bike applications, hold transformative potential. Their promise lies in offering substantially higher energy density, dramatically faster charging times, and a significantly superior safety profile due to the elimination of flammable liquid electrolytes. Manufacturers are also deeply engaged in pioneering innovative cell designs and advanced packaging techniques, meticulously engineered to minimize weight and physical size while simultaneously maximizing energy capacity, thereby enabling more compact and aesthetically integrated battery solutions within e-bike frames. Fast charging technology constitutes another critical area of intense development, directly addressing the paramount consumer demand for quicker turnarounds and reduced downtime. This involves the deployment of sophisticated charging algorithms meticulously paired with compatible battery chemistries that can safely handle high current inputs without compromising the long-term health or safety of the battery pack. Furthermore, the intelligent integration of regenerative braking systems into modern e-bikes represents a notable technological trend, facilitating the partial recovery of kinetic energy during deceleration, which in turn extends the effective range of the battery and significantly contributes to its overall operational efficiency, offering a tangible benefit to riders.

Moreover, the market is witnessing continuous advancements in battery casing and robust protection mechanisms, utilizing highly durable yet lightweight materials that provide exceptional resistance to physical impact, vibrational stress, and challenging environmental factors such as moisture and dust. The principles of modularity and standardization are gaining increasing importance, enabling easier battery swapping, promoting greater compatibility across diverse e-bike models or brands, and potentially catalyzing the widespread growth of shared e-mobility services and a thriving aftermarket for replacement units. Innovations within battery manufacturing processes, encompassing improved electrode coating techniques, advanced cell assembly automation, and precision laser welding, are significantly contributing to overall cost reduction, enhancing product consistency, and improving the scalability of battery production. These multifaceted technological progressions are not merely refining the performance characteristics of current e-bike offerings but are fundamentally paving the way for the next generation of more efficient, inherently safer, and sustainably sound electric mobility solutions. This profound technological evolution is a direct influencer of increased consumer adoption and the sustained, vigorous expansion of the global E-Bike Battery Market, underscoring the industry's commitment to pushing the boundaries of electric propulsion.

Regional Highlights

- Asia Pacific (APAC): The Asia Pacific region stands as the undisputed global leader in the E-Bike Battery Market, primarily fueled by its unparalleled e-bike production volumes and exceptionally high rates of consumer adoption. Countries such as China, India, and Japan are at the forefront of this dominance, benefiting from robust manufacturing capabilities and a vast, dense consumer base that increasingly opts for e-bikes as an affordable, efficient, and convenient mode of urban transport. Strong governmental support for electric mobility initiatives, coupled with rapid urbanization and the continuous expansion of cycling infrastructure, further amplify demand across the region. The competitive landscape in APAC is characterized by a mix of large domestic manufacturers and international players, all striving to cater to a diverse range of price points and performance expectations.

- Europe: Europe exhibits a dynamic and rapidly expanding E-Bike Battery Market, driven by a powerful confluence of stringent environmental policies, comprehensive emission regulations, and substantial government subsidies designed to incentivize e-bike purchases. Nations like Germany, the Netherlands, and France are leading this growth, demonstrating a strong consumer preference for e-bikes for both daily commuting and recreational pursuits. The European market tends to gravitate towards premium e-bike models and advanced battery technologies, with a significant emphasis on safety, durability, and integration with smart features. The focus on sustainable transportation and health benefits underpins the steady increase in e-bike adoption, translating into consistent demand for high-quality batteries.

- North America: North America is emerging as a significant high-growth market for E-Bike Batteries, propelled by increasing consumer awareness regarding sustainable transportation options, continuous improvements in cycling infrastructure, and a surging interest in outdoor recreational e-bikes. The region is witnessing growing investments in urban e-mobility initiatives and a gradual but discernible shift away from conventional fossil-fuel-powered vehicles, particularly in metropolitan areas. While starting from a lower base compared to APAC and Europe, the market here is characterized by a strong demand for performance-oriented e-bikes and a readiness to adopt innovative battery solutions, signaling robust future expansion potential.

- Latin America: Latin America demonstrates nascent yet promising growth within the E-Bike Battery Market. The region is experiencing increasing urbanization trends and a growing demand for cost-effective, efficient transportation solutions amidst challenging traffic conditions. Economic development, coupled with increasing awareness campaigns about the benefits of electric mobility, is gradually contributing to the expansion of the e-bike and its associated battery market in key countries such as Brazil and Mexico. Although the market is still in its early stages, the potential for widespread adoption in densely populated urban centers is substantial, driven by affordability and convenience.

- Middle East and Africa (MEA): The Middle East and Africa represent a developing market for E-Bike Batteries with significant long-term potential. Growing interest in diversifying energy sources away from fossil fuels, ambitious urban development projects focusing on green infrastructure, and increasing investments in sustainable transportation could collectively catalyze future market growth. While cultural and infrastructural factors currently pose certain challenges, regions with suitable climatic conditions for cycling and proactive government support for e-mobility are expected to see increasing adoption rates, particularly for leisure and specialized commercial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the E-Bike Battery Market.- Bosch (Germany)

- Panasonic (Japan)

- LG Energy Solution (South Korea)

- Samsung SDI (South Korea)

- Yamaha Motor Co., Ltd. (Japan)

- Shimano Inc. (Japan)

- Phylion Battery (China)

- Tianjin Lishen Battery Joint-Stock Co., Ltd. (China)

- Sunra (China)

- BMSbattery (China)

- JOYSUN (China)

- Ampere (India)

- BMZ Group (Germany)

- Enerdan (Netherlands)

- Green Way (USA)

- Sanyo Electric (Japan)

- Aceleron (UK)

- Dynapack International Technology (Taiwan)

- BYD Company Ltd. (China)

- Coslight International Group (China)

Frequently Asked Questions

What is the average lifespan of an E-Bike battery and how can it be extended?

The average lifespan of a modern E-Bike battery, typically a lithium-ion type, generally ranges from 2 to 5 years, or between 500 and 1000 full charge cycles, largely dependent on usage intensity, consistent charging habits, and prevailing environmental conditions. To significantly extend battery operational life, users should avoid frequent deep discharges, store the battery partially charged (e.g., 50-70%) in a cool, dry place when not in use, utilize the manufacturer-provided charger exclusively, and prevent exposure to extreme temperatures, both hot and cold. Regular, partial charging is generally better than always discharging to zero.

Are E-Bike batteries universally interchangeable between different brands or models?

No, E-Bike batteries are generally not universally interchangeable between different brands, or even sometimes between distinct models from the same manufacturer. This lack of universal compatibility stems from significant variations in nominal voltage, energy capacity (Wh), physical dimensions, proprietary mounting mechanisms, and specific connector systems. Attempting to use an incompatible battery can lead to damage to the e-bike's electrical system, reduced performance, or pose serious safety risks. It is imperative to always verify battery compatibility with the e-bike manufacturer or a certified dealer before considering a replacement or upgrade.

What are the primary factors that significantly impact the range of an E-Bike battery?

The effective range achievable from an E-Bike battery on a single charge is influenced by a multitude of interacting factors. Key determinants include the battery's total energy capacity (measured in Watt-hours), the type and topology of the terrain being ridden (e.g., flat versus hilly), the rider's weight, the specific level of pedal assist selected, tire pressure (properly inflated tires reduce rolling resistance), ambient wind resistance, prevailing environmental temperatures (extreme cold can reduce efficiency), and the overall efficiency of the e-bike's motor and other mechanical components. Employing higher levels of motor assistance will deplete the battery faster, thereby reducing range, while a higher capacity battery typically offers a longer range under similar riding conditions.

What is the approximate cost associated with replacing an E-Bike battery?

The cost to replace an E-Bike battery can exhibit substantial variability, typically ranging anywhere from $300 for basic models to well over $1000 for high-capacity, premium brand batteries. This wide price spectrum is primarily influenced by the battery's specific brand, its underlying chemical composition (e.g., Li-ion type), its nominal voltage, and crucially, its energy capacity (Wh). Generally, batteries with greater energy capacity and those from renowned, established brands command higher prices. While aftermarket options may exist at potentially more diverse price points, it is essential to ensure they meet quality and safety standards comparable to original equipment.

What essential safety precautions should E-Bike battery owners adhere to?

To ensure safe operation and longevity of E-Bike batteries, owners must adhere to several critical safety precautions. Always use only the charger specifically provided or approved by the e-bike manufacturer; never use generic or incompatible chargers. Avoid exposing the battery to extreme temperatures, both excessively hot and freezing cold, as these can degrade performance and pose safety risks. It is crucial never to puncture, disassemble, or physically damage the battery pack. Store the battery in a cool, dry, and well-ventilated area, away from direct sunlight, flammable materials, and out of reach of children. Promptly investigate and address any unusual signs such as swelling, strange odors, excessive heat during charging, or visible damage, and seek professional inspection if any concerns arise.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager