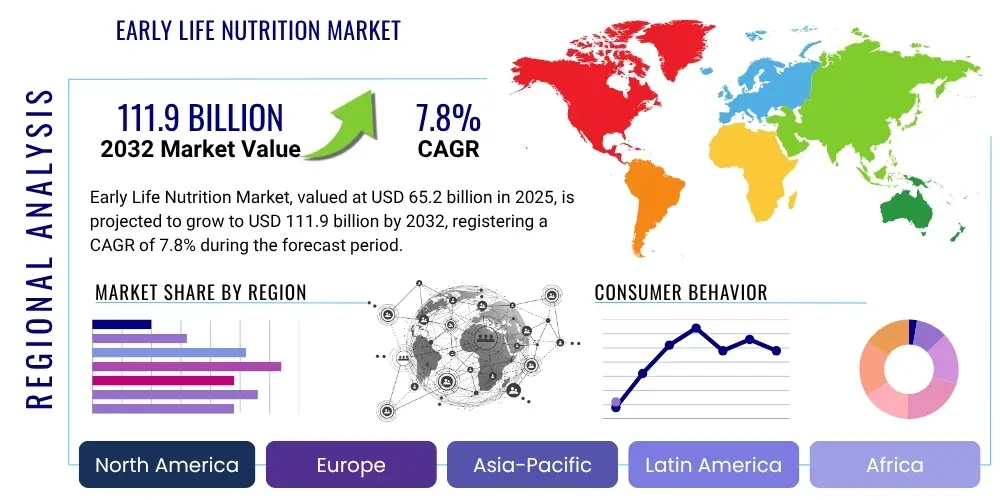

Early Life Nutrition Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429240 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Early Life Nutrition Market Size

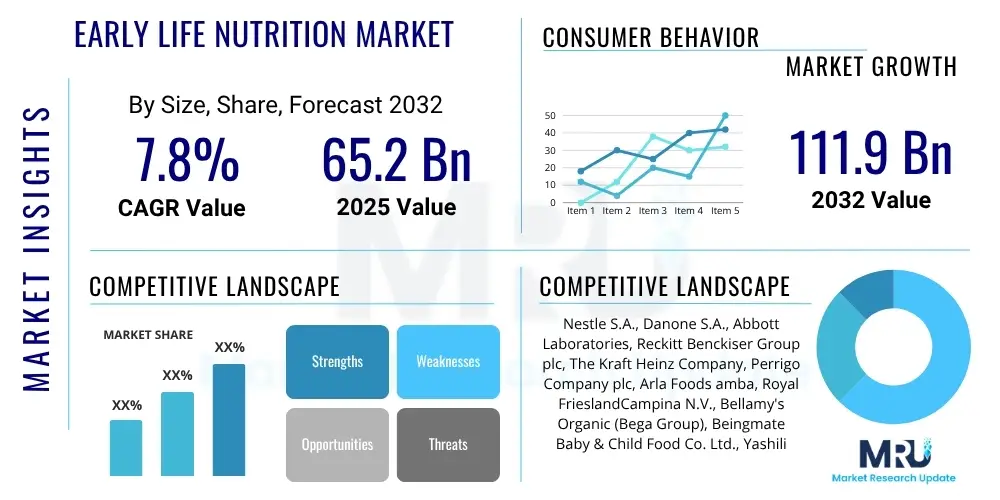

The Early Life Nutrition Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 65.2 billion in 2025 and is projected to reach USD 111.9 billion by the end of the forecast period in 2032.

Early Life Nutrition Market introduction

The Early Life Nutrition market encompasses a meticulously developed and diverse range of food products and dietary supplements specifically formulated to cater to the unique and critical nutritional requirements of infants and young children, typically from birth up to three years of age. These specialized products are engineered to support optimal physical growth, cognitive development, and overall well-being during the most formative stages of human life. The segment includes a broad spectrum of offerings such as infant formula designed for newborns, follow-on formula for older infants, toddler milk, various categories of baby food including purees, cereals, and snacks, and specialized nutritional supplements. Each product category adheres to exceptionally stringent safety and quality standards mandated by global health organizations and regulatory bodies, ensuring the utmost care and protection for this vulnerable demographic.

The major applications for early life nutrition products are predominantly centered around providing essential nutrients in situations where breastfeeding is not feasible, insufficient, or as a crucial complement to breastfeeding as infants transition to solid foods. Infant formula, for instance, serves as a complete nutritional substitute for breast milk, meticulously designed to mimic its complex composition and provide all necessary macronutrients and micronutrients. Baby foods, on the other hand, play a vital role in introducing solids, varied textures, and new flavors to developing palates, thereby supporting the gradual diversification of a child's diet. These products collectively offer immense benefits, delivering a precise blend of vital vitamins, minerals, proteins, healthy fats, and carbohydrates crucial for brain development, immune system strengthening, bone growth, and overall physical maturation, effectively addressing potential nutritional gaps and ensuring comprehensive dietary support for infants and toddlers globally.

The market's sustained growth is propelled by an amalgamation of significant and interconnected factors. Globally, increasing birth rates, particularly in emerging economies, naturally expand the target consumer base. Furthermore, the rising number of working mothers necessitates convenient, reliable, and nutritionally complete feeding solutions, driving demand for ready-to-use and easy-to-prepare products. Enhanced parental awareness regarding the paramount importance of precise early childhood nutrition for long-term health outcomes, often fueled by educational campaigns and healthcare professional recommendations, plays a pivotal role. Simultaneously, rising disposable incomes in developing regions enable greater access to premium and specialized nutritional products. Rapid urbanization, evolving modern lifestyles, and continuous advancements in food science and technology further contribute significantly to sustained product innovation and market expansion, leading to a wider availability of diverse and specialized nutritional offerings that cater to a broad spectrum of infant and toddler needs worldwide, including solutions for specific dietary requirements or medical conditions.

Early Life Nutrition Market Executive Summary

The Early Life Nutrition market is presently navigating a dynamic landscape, characterized by significant business trends focused intently on innovation, sustainability, and the profound rebuilding of consumer trust. A prominent trend involves the escalating demand for organic, natural, and clean-label ingredients, reflecting parents' increasing scrutiny of product origins and composition. This is coupled with a strong emphasis on integrating functional ingredients such as prebiotics, probiotics, Human Milk Oligosaccharides (HMOs), and specific fatty acids like DHA and ARA, all strategically designed to closely mimic the health benefits and immunological properties found in breast milk. Furthermore, companies are making substantial investments in cutting-edge research and development to pioneer personalized nutrition solutions, aiming to address highly specific dietary needs, such as allergen-free formulations, plant-based alternatives, or products tailored for infants with metabolic disorders. This innovation is often complemented by commitments to transparent sourcing, ethical manufacturing practices, and the adoption of environmentally friendly packaging solutions to resonate with the values of contemporary, health-conscious parents.

From a regional perspective, the market exhibits highly diverse growth trajectories and strategic priorities. Asia Pacific continues its trajectory as the largest and fastest-growing region, primarily fueled by its vast population base, rapidly increasing birth rates in key countries like India and Indonesia, and a burgeoning middle class with escalating disposable incomes. Enhanced parental awareness of infant health and the pervasive expansion of e-commerce platforms also act as significant accelerators in this region, making products more accessible. North America and Europe, while representing more mature and established markets, demonstrate consistent, albeit steadier, growth, largely driven by a strong emphasis on premiumization, the continuous introduction of highly specialized and value-added formulas, and a persistent demand for convenience-oriented products that align with busy parental lifestyles. Latin America, the Middle East, and Africa are increasingly recognized as critical emerging opportunities, with growing urbanization, improving healthcare infrastructure, and evolving dietary habits contributing significantly to market expansion and the wider adoption of modern nutritional products.

Segment-wise, infant formula steadfastly maintains its dominance in market share, underscored by its indispensable role as a complete breast milk substitute when required, and the continuous introduction of highly advanced formulations incorporating novel ingredients. However, the baby food segment is simultaneously experiencing robust and accelerated growth, particularly within categories such as organic purees, nutrient-dense healthy snacks, and easy-to-prepare meal options. This surge reflects a prevailing trend among parents who seek convenient, yet demonstrably nutritious, alternatives to home-prepared meals. Moreover, the burgeoning market for specialized formulas, meticulously engineered to address common infant health issues like colic, allergies, reflux, or prematurity, further highlights a significant overarching trend towards sophisticated product differentiation and an increased focus on catering to an ever-wider and more specific spectrum of early life nutritional requirements.

AI Impact Analysis on Early Life Nutrition Market

Common user questions regarding the transformative impact of Artificial Intelligence (AI) on the Early Life Nutrition market frequently center on its profound potential to revolutionize product development cycles, dramatically enhance supply chain efficiencies, and facilitate the delivery of highly personalized nutritional advice. Users are particularly keen to understand precisely how AI can be leveraged to identify novel, beneficial ingredients, optimize complex formula compositions for maximum efficacy and safety, and ensure unparalleled product safety through advanced data analytics and predictive modeling across the entire value chain. There is also substantial interest in AI's burgeoning role in processing and interpreting vast quantities of sensitive health data, ranging from genomic information to real-time feeding patterns, to offer exquisitely tailored dietary recommendations for infants, thereby addressing individual genetic predispositions, specific sensitivities, or unique developmental needs. Conversely, significant concerns consistently emerge regarding the critical importance of data privacy, the complex ethical implications inherent in AI-driven health interventions, and the absolute necessity for robust regulatory oversight to prevent misinformation, ensure fairness, and preclude any potential misuse of highly sensitive health information within this exceptionally critical and vulnerable sector.

- AI-driven precision formulation: Optimizing nutrient ratios, ingredient synergies, and processing parameters based on vast datasets, clinical research, and individual infant developmental needs, moving towards a more scientifically informed product design.

- Personalized nutrition recommendations: Utilizing AI to analyze a composite of data points including infant genetic profiles, microbiome data, growth charts, health records, and real-time feeding patterns to suggest tailored dietary plans, addressing specific allergies or developmental milestones.

- Enhanced supply chain traceability and transparency: Implementing AI alongside blockchain technology for end-to-end monitoring of every ingredient and finished product, ensuring authenticity, preventing counterfeiting, and guaranteeing safety from farm sourcing through to consumer delivery.

- Advanced quality control and safety assurance: Deploying AI-powered computer vision, machine learning algorithms, and sensor technologies for real-time detection of minute contaminants, anomalies, or defects in manufacturing processes and packaging, significantly reducing recall risks.

- Predictive analytics for market trends and demand forecasting: Leveraging AI algorithms to analyze consumer behavior, social media sentiment, sales data, and demographic shifts to accurately forecast consumer preferences, anticipate demand fluctuations, and proactively guide product innovation and inventory management strategies.

- Improved consumer engagement and support: Utilizing AI-powered chatbots, virtual assistants, and sophisticated recommendation engines to provide parents with instant, accurate, and personalized advice on feeding schedules, product usage, nutritional queries, and general infant health concerns 24/7.

- Accelerated research and development: AI algorithms analyzing complex biological data, scientific literature, and clinical trial results to rapidly identify novel compounds, potential functional ingredients, and accelerate the discovery and validation of beneficial innovations in infant nutrition science.

DRO & Impact Forces Of Early Life Nutrition Market

The Early Life Nutrition market's trajectory is profoundly shaped by a complex interplay of inherent drivers, formidable restraints, emergent opportunities, and influential external impact forces. Principal drivers include a consistently rising global population, particularly in high-growth regions, coupled with an increasing awareness among modern parents about the irreplaceable role of optimal nutrition during critical early developmental stages. The growing prevalence of working mothers globally generates an escalating demand for convenient, safe, and reliable feeding solutions that seamlessly integrate into busy lifestyles. Furthermore, sustained and significant investments by manufacturers in cutting-edge research and development are continually introducing highly advanced, specialized, and fortified formulations, including those addressing specific medical needs or allergies, which further propels market expansion. These factors collectively act as powerful catalysts for market growth, particularly evident in emerging economies where the adoption rates of commercial early life nutrition products are accelerating rapidly. However, the market simultaneously grapples with substantial restraints, such as exceptionally stringent regulatory frameworks and protracted approval processes for new products and ingredients across various jurisdictions, which can impede innovation, delay market entry, and significantly increase compliance costs for manufacturers. High production costs associated with sourcing premium ingredients, ensuring sterile manufacturing environments, and employing advanced processing technologies, alongside the potential for frequent product recalls that severely erode precious consumer trust, also pose considerable challenges to the market's sustained growth and overall stability.

Despite these significant restraints, the market is rife with abundant strategic opportunities that market players can skillfully leverage to capitalize on evolving consumer demands and technological advancements. The burgeoning demand for organic, natural, and transparent "clean-label" early life nutrition products represents a substantial avenue for growth, directly reflecting a broader, global consumer trend towards healthier, safer, and ethically sourced options for their children. Moreover, the explosive growth and pervasive penetration of the e-commerce sector offer unprecedented reach and accessibility, enabling brands to establish direct-to-consumer models, overcome geographical barriers, and expand their market presence globally with greater efficiency and precision. The transformative potential of personalized nutrition, facilitated by advancements in genomics, microbiome research, and sophisticated data analytics, represents a groundbreaking opportunity to offer highly tailored dietary solutions for infants based on their unique individual needs, genetic predispositions, or specific health conditions. Additionally, continuous innovation in sustainable packaging solutions, focused on reducing environmental impact while enhancing convenience and product safety, offers a distinct competitive advantage, appealing strongly to the increasing cohort of environmentally conscious parents.

Impact forces acting on the Early Life Nutrition market extend beyond direct drivers and restraints, encompassing broader socio-economic, environmental, and technological paradigm shifts. Global birth rates, profoundly influenced by demographic trends, economic stability, and evolving family planning policies, directly dictate the size and characteristics of the potential consumer base. Shifting cultural perceptions and attitudes regarding breastfeeding versus commercial formula feeding continue to significantly shape demand dynamics and consumption patterns across different regions and demographics. Ongoing technological innovations in food science, encompassing areas like biotechnology, fermentation, and nanotechnology, are constantly unveiling new possibilities for product enrichment, ingredient synthesis, and enhanced safety protocols. Furthermore, evolving dietary guidelines and recommendations from international health organizations such such as the World Health Organization (WHO), alongside national government initiatives promoting infant health and nutrition, can substantially influence product development pipelines, marketing strategies, and consumer acceptance. Manufacturers are thus compelled to adapt swiftly and proactively to these continually changing standards and recommendations to maintain market relevance, uphold their competitive advantage, and ensure robust product safety within this highly sensitive and rigorously regulated industry.

Segmentation Analysis

The Early Life Nutrition market is meticulously segmented across various critical dimensions to provide a comprehensive and granular understanding of its intricate components, diverse product offerings, and heterogeneous consumer preferences. This detailed segmentation is an indispensable tool, enabling manufacturers and marketers to craft highly targeted product development initiatives, implement precise marketing strategies, and optimize distribution approaches. By dissecting the market along these specific lines, companies can ensure their products are not only effectively formulated but also appropriately positioned to meet the specific nutritional needs, lifestyle requirements, and purchasing behaviors of distinct consumer groups. The analysis typically considers key dimensions such as product type, the physical form of the product, the primary distribution channels utilized, and the specific age group for which the product is intended, each dimension revealing unique market dynamics and uncovering crucial growth opportunities within the overarching early life nutrition landscape.

- Product Type: This segmentation differentiates products based on their core function and composition.

- Infant Formula: The largest segment, including Milk-based (standard), Soy-based (for lactose intolerance or dairy allergy), Organic (free from pesticides/hormones), Hydrolyzed (for easier digestion or allergy management), Anti-colic, Anti-reflux, and specialized formulations for Premature infants, each tailored to specific needs.

- Baby Food: A rapidly growing segment encompassing Cereals (first solid foods), Purees (diverse flavors like Fruit, Vegetable, and Meat), Snacks (designed for self-feeding like Puffs, Rusks, and teething wafers), and Drinks (fortified juices or Toddler Milk).

- Nutritional Supplements: Includes targeted supplements such as Vitamin drops (e.g., Vitamin D), Mineral supplements (e.g., iron), and Probiotic supplements, designed to address specific nutritional deficiencies or support gut health.

- Form: This categorizes products based on their physical consistency and preparation method, impacting convenience and usage.

- Powder: Predominantly for infant formula and cereals, offering advantages of longer shelf life, lower shipping costs, and flexibility for customization in preparation.

- Liquid: Includes Ready-to-feed formula (ultimate convenience), convenience drinks, and certain pre-prepared purees, offering ease of use without preparation.

- Solid: Encompasses spoon-fed purees, textured foods, snacks, and finger foods specifically designed for older infants and toddlers transitioning to more varied diets.

- Distribution Channel: This segmentation highlights the primary avenues through which products reach consumers.

- Supermarkets/Hypermarkets: Major retail outlets providing extensive product ranges, competitive pricing, and high accessibility, acting as a primary point of purchase for mass-market products.

- Pharmacies/Drug Stores: Offering specialized formulas, medical-grade nutrition, and often provide expert advice from pharmacists, catering to specific health-related needs.

- Convenience Stores: Catering to immediate, on-the-go needs with a limited but essential product selection, crucial for emergency purchases.

- Online Retail: A rapidly growing and transformative segment driven by unparalleled convenience, wider product selection, competitive pricing, home delivery, and detailed product information, significantly altering consumer purchasing habits.

- Age Group: This crucial segmentation aligns products with the developmental stage and nutritional needs of the child.

- 0-6 Months: Primarily focuses on infant formula and breast milk substitutes, providing complete nutrition for newborns.

- 6-12 Months: Marks the introduction of complementary solid foods, follow-on formulas, and first-stage baby foods as infants begin diversification.

- 12-36 Months: Includes toddler milk, advanced baby foods with varied textures, and specialized snacks tailored for the nutritional and developmental requirements of growing toddlers.

Value Chain Analysis For Early Life Nutrition Market

The value chain for the Early Life Nutrition market represents an exceptionally intricate and highly regulated network, commencing from the meticulous sourcing of raw materials and extending through every stage of production, distribution, and ultimately, the final consumption of products by infants and young children. The upstream analysis focuses intensely on the procurement of exceptionally high-quality and safe ingredients. These typically include premium dairy components such as milk powders, whey proteins, and lactoferrin, alongside plant-based proteins like soy, and a spectrum of essential micronutrients including vitamins, minerals, prebiotics, probiotics, and specialized fatty acids such as DHA and ARA. Suppliers of these critical raw materials are indispensable to ensuring the nutritional integrity, purity, and safety of the final products, often requiring adherence to rigorous quality control standards, certifications (e.g., organic, non-GMO), and robust traceability systems to guarantee origin and prevent contamination. Manufacturers invest substantially in extensive research and development to formulate products that precisely meet specific nutritional profiles, developmental milestones, and comply with strict national and international regulatory standards, followed by highly controlled processing, blending, sterilization, and packaging operations conducted in state-of-the-art facilities designed to maintain absolute sterility and product stability.

The downstream analysis in the Early Life Nutrition market encompasses the comprehensive processes of manufacturing, distribution, marketing, and the eventual sale of finished products to the ultimate consumer. This stage involves a robust and often complex network of intermediaries and channels that collectively facilitate broad market reach and product accessibility. Distribution channels are remarkably diverse and strategically chosen, including traditional physical retail formats such as sprawling supermarkets and hypermarkets that offer extensive product ranges and high visibility, specialized pharmacies and drug stores providing health-focused products and expert advice, and convenience stores catering to immediate consumer needs. These indirect channels are pivotal, relying on wholesalers and regional distributors who efficiently manage logistics, warehousing, inventory control, and ensure timely product delivery across vast geographical areas, often involving specialized cold chain management for certain sensitive ingredients or products. The operational efficiency and strategic partnerships within this network are crucial for ensuring that products are readily available and in optimal condition at the point of sale.

The interplay between direct and indirect distribution channels is strategically critical for achieving optimal market penetration and fostering deep consumer engagement within the Early Life Nutrition sector. While less prevalent for mass-market early life nutrition products, direct-to-consumer (D2C) sales models, often facilitated through brand-specific online portals or specialized health clinics, allow for invaluable direct customer relationships, highly targeted marketing, and the provision of personalized advice and support. Conversely, indirect channels form the robust backbone of the market, ensuring widespread availability and convenience. Effective management of these intricate channels, which includes precise inventory management, adherence to strict cold chain logistics where applicable, and strategic product placement within retail environments, is paramount for securing market success. The entire value chain is characterized by an unwavering emphasis on quality assurance, product safety, and comprehensive traceability protocols, extending meticulously from the sourcing of every minute ingredient to the moment the final product is consumed by infants and young children, reflecting the immense responsibility manufacturers bear in this highly sensitive and regulated industry.

Early Life Nutrition Market Potential Customers

The primary potential customers and end-users of early life nutrition products are predominantly parents and legal guardians of infants and toddlers, typically spanning the age range from birth up to three years. This crucial demographic segment is primarily driven by the fundamental and deeply ingrained need to provide optimal nutrition for the healthy growth, robust development, and overall well-being of their children, especially in circumstances where breastfeeding is not feasible, insufficient, or as a vital component of a comprehensive complementary feeding strategy. Factors profoundly influencing their purchasing decisions are multifaceted and include paramount concerns such as product safety and purity, comprehensive nutritional completeness, established brand reputation and trust, credible recommendations from healthcare professionals (pediatricians, dietitians), convenience of preparation and use, and an increasingly critical focus on ingredient transparency, organic certifications, and allergen-free formulations. They represent an exceptionally discerning, protective, and informed consumer base, consistently willing to invest in products that unequivocally promise the safest and most beneficial outcomes for their children's foundational health and development.

Beyond individual households, other significant potential customers include a range of institutional buyers that play a vital role in providing specialized care and support. These include hospitals, particularly neonatal intensive care units (NICUs) where highly specialized early life nutrition products are essential for premature infants or those with complex medical conditions, as well as general pediatric wards and childcare facilities that require reliable and safe nutritional provisions for daily care. These institutions often have specific procurement processes and require products that meet rigorous medical standards and are suitable for diverse patient needs. Furthermore, governmental programs focused on public health initiatives, such as national infant feeding programs, and non-governmental organizations (NGOs) involved in humanitarian aid or emergency relief efforts, constitute another vital customer segment. These entities frequently purchase bulk quantities of early life nutrition products to combat malnutrition, provide essential dietary support to vulnerable child populations in crisis zones, or ensure basic nutritional access for underserved communities. Their purchasing decisions are often driven by efficacy, cost-effectiveness, logistical feasibility, and strict compliance with public health standards and safety protocols, making them critical stakeholders in the broader market ecosystem.

The market also significantly extends to expectant parents, who represent a crucial future customer base actively seeking comprehensive information and making preliminary purchasing decisions even prior to their child's birth. This highly receptive group is influenced by pre-natal education, targeted advertising campaigns, peer recommendations, and insights from parenting communities. Moreover, a diverse group of healthcare professionals, including pediatricians, registered dietitians, lactation consultants, and nurses, plays an indirect yet profoundly influential role as key opinion leaders and trusted advisors. Their recommendations, based on scientific evidence, extensive clinical experience, and the specific physiological needs of the child, often guide parents towards specific brands or types of early life nutrition products. Their endorsement acts as a powerful validator, making them a crucial touchpoint in the customer journey and a significant factor in shaping market demand, fostering brand loyalty, and driving product adoption across various segments of the highly sensitive early life nutrition market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 65.2 billion |

| Market Forecast in 2032 | USD 111.9 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestle S.A., Danone S.A., Abbott Laboratories, Reckitt Benckiser Group plc, The Kraft Heinz Company, Perrigo Company plc, Arla Foods amba, Royal FrieslandCampina N.V., Bellamy's Organic (Bega Group), Beingmate Baby & Child Food Co. Ltd., Yashili International Holdings Ltd., Biostime (Health and Happiness International Holdings Ltd.), Else Nutrition Holdings Inc., Plum Organics (Campbell Soup Company), HiPP GmbH & Co. Vertrieb KG, Aspen Pharmacare Holdings Limited, Fonterra Co-operative Group, Mead Johnson (Reckitt Benckiser). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Early Life Nutrition Market Key Technology Landscape

The Early Life Nutrition market is undergoing profound technological transformations aimed at significantly enhancing product safety, optimizing nutritional value, and improving consumer convenience. Key technologies currently deployed or rapidly emerging include advanced processing methods such as High-Pressure Processing (HPP) and sophisticated aseptic packaging techniques, which are crucial for preserving the delicate nutrient content of products and extending shelf life without necessitating excessive heat treatment or the addition of chemical preservatives. Traditional spray drying technology remains paramount for the efficient production of powdered infant formula, with continuous innovations focused on meticulously optimizing particle size, solubility, and dispersion properties to ensure superior dissolution, improved palatability, and enhanced bioavailability of nutrients. Furthermore, cutting-edge nutrient encapsulation techniques are increasingly being utilized to protect highly sensitive ingredients like fragile probiotics, susceptible vitamins, and essential fatty acids such as DHA and ARA from degradation due to environmental factors or digestive processes, thereby ensuring their stability and effective delivery to the infant's developing digestive and immune systems.

Beyond the manufacturing floor, the technology landscape extensively encompasses innovative ingredient development and sophisticated scientific research tools that are revolutionizing product composition. Advances in biotechnology and precision fermentation are enabling the sustainable and scalable production of novel ingredients, most notably Human Milk Oligosaccharides (HMOs) which meticulously mimic those naturally found in breast milk, offering significant immune system support and gut health benefits. Concurrently, the application of advanced genetic sequencing and proteomic analysis in research and development is allowing for an unprecedented understanding of individual infant nutritional needs with far greater precision. This deeper insight into genetic predispositions, metabolic pathways, and nutrient absorption capabilities is actively paving the way for the creation of highly specialized and truly personalized early life nutritional formulations, enabling manufacturers to cater to diverse developmental stages, specific genetic requirements, and even mitigate the risks associated with certain health conditions or allergies much more effectively than ever before.

Digital technologies are equally transformative, reshaping market operations, streamlining supply chains, and dramatically enhancing consumer interaction. Robust traceability solutions, frequently incorporating immutable blockchain technology, are becoming indispensable for ensuring unparalleled transparency and absolute authenticity of both raw ingredients and finished products. These systems provide parents with invaluable peace of mind regarding product safety, origin, and ethical sourcing, building critical trust. Artificial intelligence (AI) and machine learning (ML) algorithms are increasingly deployed throughout the product lifecycle, from optimizing ingredient compositions and predicting market trends with greater accuracy to facilitating highly efficient quality control through advanced defect detection and real-time process monitoring. E-commerce platforms leverage sophisticated data analytics to deeply understand consumer behavior, personalize marketing campaigns, and offer tailored product recommendations. Moreover, user-friendly mobile applications now seamlessly provide parents with instant access to comprehensive product information, customized feeding schedules, expert nutritional advice, and direct customer support, thereby intricately integrating technology into every facet of the early life nutrition ecosystem, from its initial conception and production through to its final consumption and post-purchase support.

Regional Highlights

- North America: The Early Life Nutrition market in North America, particularly across the United States and Canada, is prominently characterized by a robust and sustained demand for premium, organic, and highly specialized products. Elevated disposable incomes, exceptionally advanced healthcare infrastructures, and a significant societal focus on health-conscious consumption, including organic, non-GMO, and clean-label offerings, actively drive product innovation and market expansion. Key trends encompass the rapid growth of plant-based and allergen-free formulas catering to diverse dietary needs, alongside a strong emphasis on products fortified with functional ingredients like probiotics and DHA to support comprehensive infant development.

- Europe: The European market, spanning economically mature nations such as Germany, the UK, and France, represents a highly developed segment defined by its exceptionally stringent regulatory standards and deep-seated consumer trust in established brands. Consumer preferences in this region strongly gravitate towards organic, natural, and environmentally sustainable products, often demanding clear ethical sourcing and transparent production practices. Innovation is heavily concentrated on incorporating advanced functional ingredients (e.g., specific HMOs, prebiotics) and meticulously exploring novel, sustainable alternative protein sources, all while maintaining uncompromised adherence to the highest quality and safety protocols demanded by European Union regulations.

- Asia Pacific (APAC): The APAC region stands as the largest and most dynamically growing market for Early Life Nutrition globally, largely propelled by its vast population, including rapidly expanding middle classes in populous countries such as China, India, Indonesia, and Vietnam. Rising birth rates, accelerating urbanization, increasing disposable incomes, and a significantly enhanced parental awareness regarding the critical importance of infant nutrition collectively contribute to an exceptionally robust and escalating demand. This region serves as a crucial battleground for both entrenched multinational corporations and nimble local players, with a strong emphasis on advanced infant formula and a rapidly expanding e-commerce sector that facilitates unparalleled product accessibility and consumer engagement across diverse geographies.

- Latin America: The Early Life Nutrition market across Latin American countries, including prominent economies like Brazil and Mexico, is experiencing steady and consistent growth. This expansion is attributed to improving economic conditions, increased access to healthcare services, and a gradual yet perceptible shift in consumer preferences away from traditional feeding practices towards commercially available and scientifically formulated early life nutrition products. While there is a strong and persistent demand for affordable yet nutritionally complete options to address widespread needs, a nascent but rapidly expanding market for premium and highly specialized products is also emerging, driven by a growing urbanized and affluent consumer segment.

- Middle East and Africa (MEA): The MEA region presents substantial and compelling growth opportunities for the Early Life Nutrition market, primarily propelled by consistently high birth rates, escalating disposable incomes in oil-rich nations, and ongoing processes of urbanization and modernization across various countries. However, the market landscape is notably diverse, characterized by varied cultural preferences, fragmented regulatory frameworks, and differing levels of economic development, meaning that market penetration and product acceptance can vary considerably from one country to another. There is a burgeoning demand for both basic, fortified nutritional products to address general needs and an increasing interest in more advanced, specialized formulations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Early Life Nutrition Market.- Nestle S.A.

- Danone S.A.

- Abbott Laboratories

- Reckitt Benckiser Group plc

- The Kraft Heinz Company

- Perrigo Company plc

- Arla Foods amba

- Royal FrieslandCampina N.V.

- Bellamy's Organic (Bega Group)

- Beingmate Baby & Child Food Co. Ltd.

- Yashili International Holdings Ltd.

- Biostime (Health and Happiness International Holdings Ltd.)

- Else Nutrition Holdings Inc.

- Plum Organics (Campbell Soup Company)

- HiPP GmbH & Co. Vertrieb KG

- Aspen Pharmacare Holdings Limited

- Fonterra Co-operative Group

- Mead Johnson (Reckitt Benckiser)

Frequently Asked Questions

What are the primary growth drivers for the Early Life Nutrition market?

The primary growth drivers for the Early Life Nutrition market are multifaceted, including rising global birth rates, particularly in developing economies where populations are expanding. Concurrently, increasing disposable incomes enable more parents to afford premium and specialized nutrition products. The growing number of working mothers necessitates convenient and reliable feeding solutions, while heightened parental awareness regarding the crucial role of optimal nutrition in early childhood development significantly boosts demand for high-quality products. Continuous innovation in product formulations, incorporating advanced ingredients and health benefits, also fuels market expansion.

How is technology impacting product innovation in early life nutrition?

Technology profoundly impacts product innovation by enabling advanced processing techniques like High-Pressure Processing (HPP) to preserve nutrient content and extend shelf life. Biotechnology plays a pivotal role in developing novel ingredients such as Human Milk Oligosaccharides (HMOs) that mimic breast milk benefits. Artificial Intelligence (AI) and machine learning are increasingly used for optimizing nutrient profiles, predicting consumer preferences, and enabling personalized nutrition solutions tailored to individual infant needs. Furthermore, digital tools enhance supply chain traceability, ensuring product authenticity and safety from sourcing to consumption.

What are the key regulatory challenges facing the early life nutrition industry?

The early life nutrition industry faces significant regulatory challenges due to its highly sensitive nature. These include exceptionally stringent and often fragmented regulatory frameworks across different countries, requiring extensive testing and documentation for product safety and marketing claims. Companies must navigate lengthy approval processes for new ingredients and product formulations, which can delay market entry. Maintaining continuous compliance with evolving international and national safety standards, effectively managing potential product recalls, and establishing clear ethical guidelines for product promotion are ongoing and complex challenges that significantly impact market operations and innovation.

Which regions are expected to show the most significant growth in early life nutrition?

Asia Pacific (APAC) is unequivocally anticipated to exhibit the most substantial growth in the Early Life Nutrition market over the forecast period. This is primarily driven by its vast population base, rapidly increasing birth rates in key nations like India and Indonesia, ongoing urbanization trends, and rising disposable incomes. A growing emphasis on infant health and nutrition, coupled with the widespread adoption of e-commerce platforms, further accelerates market expansion in the region. Emerging markets in Latin America and the Middle East & Africa are also projected to contribute significantly to market growth, driven by similar socio-economic and demographic shifts.

What is the role of personalized nutrition in the future of the Early Life Nutrition market?

Personalized nutrition is poised to play a transformative and increasingly central role in the future of the Early Life Nutrition market. By leveraging advanced genetic insights, individual infant health data (including microbiome analysis and medical history), and sophisticated AI-driven analytics, this approach aims to offer highly tailored dietary solutions. Such customization can address specific nutritional needs, manage allergies or sensitivities more effectively, and support optimal development at various stages of infancy. This shift moves beyond a generalized, one-size-fits-all model towards highly precise and individualized feeding regimens, promising improved health outcomes and parental satisfaction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager