Edible Insects Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428440 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Edible Insects Market Size

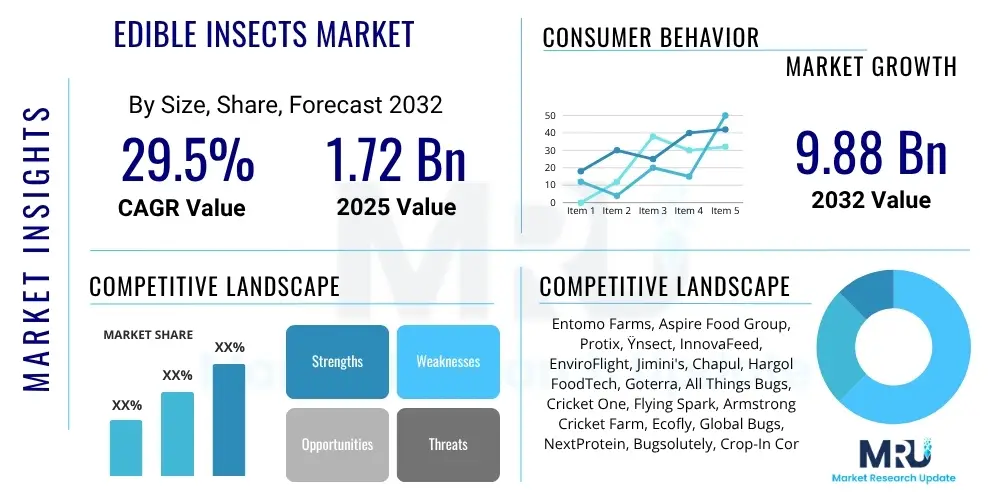

The Edible Insects Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 29.5% between 2025 and 2032. The market is estimated at USD 1.72 Billion in 2025 and is projected to reach USD 9.88 Billion by the end of the forecast period in 2032.

Edible Insects Market introduction

The Edible Insects Market is an emerging sector driven by increasing global awareness of sustainable food sources, the nutritional benefits of insects, and the urgent need for alternative protein. This market encompasses a range of insect species processed into various forms, including whole insects, flours, protein bars, and snacks, catering to both human consumption and animal feed applications. The product description for edible insects spans from minimally processed whole roasted insects, appealing to adventurous eaters, to highly refined insect protein powders seamlessly integrated into conventional food products, addressing concerns about neophobia while delivering essential nutrients.

Major applications of edible insects primarily include human food and beverages, where they are utilized in protein bars, snack foods, bakery items, and even gourmet cuisine. Beyond direct human consumption, a significant and rapidly expanding application lies within the animal feed sector, particularly for aquaculture, poultry, and pet food, offering a more sustainable and nutrient-rich alternative to traditional soy or fishmeal. The inherent benefits of edible insects are compelling, featuring high protein content, essential amino acids, healthy fats, vitamins (B12, B5, B2), and minerals (iron, zinc, magnesium).

Driving factors for market growth are multifaceted. Environmental sustainability stands as a paramount driver, with insect farming requiring significantly less land, water, and feed, and emitting fewer greenhouse gases compared to conventional livestock. Furthermore, growing global population and escalating food security concerns, particularly in regions prone to resource scarcity, underscore the role of insects as an efficient and scalable protein source. Evolving dietary preferences towards sustainable and healthy options, coupled with progressive regulatory frameworks in Western markets and established cultural acceptance in many Asian, African, and Latin American countries, are further accelerating market expansion and innovation.

Edible Insects Market Executive Summary

The Edible Insects Market is undergoing rapid transformation, marked by dynamic business trends, evolving regional consumption patterns, and diversified segment growth. Businesses in this sector are increasingly focusing on scaling up production through advanced farming technologies, such as vertical farms and automated rearing systems, to meet rising demand efficiently and sustainably. There is a strong emphasis on research and development to enhance palatability, extend shelf life, and diversify product offerings, moving beyond niche products to mainstream food ingredients. Strategic partnerships between insect farmers, food processors, and major food manufacturers are becoming prevalent, aiming to integrate insect-derived ingredients into a wider range of consumer products and animal feed formulations. Investment in marketing and consumer education campaigns is also a key trend, addressing persistent cultural barriers and improving public perception.

Regional trends indicate that while Asia Pacific has a long history of entomophagy and remains a dominant market, Europe and North America are experiencing significant growth, albeit from a lower base. In these Western markets, the growth is fueled by sustainability concerns, health-conscious consumers, and increasing regulatory clarity, particularly from bodies like the European Food Safety Authority (EFSA) approving new insect species for food use. Latin America and Africa also present considerable opportunities, leveraging existing traditional consumption practices and addressing local food security challenges through scalable insect farming initiatives. The Middle East is an emerging region with nascent interest, primarily driven by innovations in alternative protein and sustainable agriculture.

Segment trends highlight the dominance of specific insect types like crickets and mealworms, which are widely accepted and amenable to large-scale farming. Cricket powder, in particular, has seen substantial uptake as a protein ingredient in various food products due to its mild flavor and versatility. The human consumption segment is diversifying, with innovative snack products, protein bars, and pasta fortified with insect protein gaining traction. Simultaneously, the animal feed segment, especially for aquaculture and pet food, is experiencing robust growth, driven by the strong nutritional profile of insects and the push for sustainable feed ingredients. Black soldier fly larvae are particularly prominent in the animal feed sector due to their rapid growth and efficient bioconversion capabilities, offering a circular economy solution for organic waste management.

AI Impact Analysis on Edible Insects Market

Users frequently inquire about how artificial intelligence can revolutionize insect farming and product development within the edible insects market. Key questions often center on optimizing rearing conditions, ensuring quality and safety, streamlining supply chains, and potentially influencing consumer perception. The general expectation is that AI can significantly enhance efficiency, enable greater scalability, reduce operational costs, and contribute to the standardization of products, thereby accelerating market acceptance. There is also a strong interest in AI's role in personalized nutrition and developing innovative, insect-based food formulations that appeal to diverse palates. Furthermore, queries touch upon predictive analytics for market demand and sustainable resource management in insect aquaculture, reflecting a holistic view of AI's potential across the value chain.

- AI optimizes insect rearing conditions (temperature, humidity, feed) for faster growth and higher yield.

- Predictive analytics supports early detection of diseases and pests in insect farms, improving biosecurity.

- Automated monitoring systems powered by AI ensure consistent quality control and food safety during processing.

- AI-driven supply chain management enhances efficiency from farm to table, reducing waste and logistics costs.

- Personalized nutrition development utilizes AI to create insect-based products tailored to individual dietary needs.

- Market trend analysis using AI helps producers identify consumer preferences and innovate new edible insect products.

- Robotics and AI automate harvesting and sorting processes, reducing labor costs and increasing operational scalability.

DRO & Impact Forces Of Edible Insects Market

The Edible Insects Market is shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the global imperative for environmental sustainability, as insect farming offers a significantly lower ecological footprint compared to traditional livestock, consuming less land, water, and emitting fewer greenhouse gases. This aligns with increasing consumer and corporate demand for eco-friendly protein sources. The high nutritional value of insects, rich in protein, essential amino acids, healthy fats, vitamins, and minerals, further fuels their adoption as a superfood and a viable solution to combat malnutrition and food insecurity in a growing global population. Moreover, the rising global population necessitates efficient protein alternatives, positioning edible insects as a key solution. Regulatory advancements and cultural shifts, particularly in Western markets, where scientific endorsement and novel food approvals are paving the way for wider acceptance, are critical catalysts for market expansion. The established traditional consumption in many parts of the world provides a foundational market base and demonstrates long-term viability.

Despite these strong drivers, significant restraints temper market growth. Consumer aversion, or neophobia, remains a major hurdle, with many individuals in Western cultures viewing insects as unappetizing or unsanitary. Overcoming this requires extensive marketing, education, and innovative product development that masks the insect origin. Initial high production costs, especially for sophisticated, scalable farming technologies and processing methods, can make insect-based products less competitive on price compared to conventional protein sources, although these costs are expected to decrease with economies of scale. The lack of standardized global regulations for insect farming, processing, and labeling creates complexity for international trade and market entry. Furthermore, potential allergy concerns, particularly for individuals allergic to shellfish, necessitate clear labeling, and cultural barriers rooted in historical dietary habits or religious beliefs can slow down adoption in certain demographics.

Opportunities for growth are abundant and diverse. The burgeoning pet food industry offers a significant avenue for insect protein, valued for its hypoallergenic properties and sustainability profile. Similarly, the aquaculture and livestock feed sectors are increasingly looking to insect meal as a sustainable and nutritious alternative to soy and fishmeal, driving demand for industrial-scale insect production. Product innovation remains a vast opportunity, with potential to develop new formats like insect-based vegan meat alternatives, functional foods, and pharmaceutical applications. Expanding into emerging markets, where insect consumption is already culturally accepted, presents immediate growth prospects. Ongoing technological advancements in farming, such as automation, precision agriculture, and genetic selection, promise to enhance efficiency, reduce costs, and improve the quality of farmed insects, thereby bolstering market competitiveness. Impact forces, such as climate change, can indirectly affect wild insect populations, emphasizing the importance of controlled farming. However, potential zoonotic disease concerns, though minimal in commercially farmed insects, highlight the need for stringent biosecurity and safety protocols to maintain consumer trust.

Segmentation Analysis

The Edible Insects Market is comprehensively segmented across various dimensions including product type, insect type, application, and distribution channel, reflecting the diverse approaches to product development and market penetration. This segmentation allows for a granular understanding of consumer preferences, technological advancements, and strategic opportunities within distinct market niches. Each segment plays a crucial role in the overall market landscape, from the initial sourcing and processing of specific insect species to their final application in human food, animal feed, or other industries, and how they reach the end consumer. The market's dynamic nature is further emphasized by ongoing innovations within these segments, leading to novel product formulations and expanded use cases.

- Product Type:

- Whole Insects

- Insect Powder/Flour

- Insect Paste

- Insect Protein Bars

- Insect Snacks

- Insect-Based Beverages

- Others (e.g., oils, extracts)

- Insect Type:

- Crickets (Gryllus assimilis, Acheta domesticus)

- Mealworms (Tenebrio molitor)

- Black Soldier Fly Larvae (Hermetia illucens)

- Grasshoppers/Locusts

- Ants

- Silkworms

- Palm Weevils

- Others

- Application:

- Human Consumption

- Food & Beverages

- Protein Supplements

- Confectionery

- Bakery Products

- Animal Feed

- Pet Food

- Aquaculture Feed

- Poultry Feed

- Livestock Feed

- Pharmaceuticals

- Cosmetics

- Fertilizers

- Human Consumption

- Distribution Channel:

- Online Retail (E-commerce)

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Direct Sales (Farm to Consumer)

- Restaurants/Foodservice

Value Chain Analysis For Edible Insects Market

The value chain for the Edible Insects Market is intricate, beginning with upstream activities focused on the rearing and initial processing of insects, moving through midstream processing and ingredient manufacturing, and culminating in downstream distribution to end-users. The upstream segment primarily involves insect breeding and rearing farms, which are responsible for the controlled cultivation of various insect species under optimized conditions. This stage also includes suppliers of specialized feed for insects, as well as manufacturers of farming equipment, such as climate control systems, rearing crates, and automated feeding mechanisms. Efficiency and scalability at this initial stage are crucial for the economic viability of the entire chain, driving investment in vertical farming and advanced biosecurity measures.

Midstream activities involve the primary processing of harvested insects, which includes cleaning, drying, milling into powders, or extracting oils and proteins. This segment is characterized by specialized processing facilities that ensure product safety, quality, and adherence to regulatory standards. These processors then supply insect ingredients to food manufacturers, who formulate final products such as protein bars, snacks, pet food, or aquaculture feed. The transformation from raw insect material to a market-ready ingredient or product requires significant R&D in food technology to address sensory attributes, extend shelf life, and integrate seamlessly into diverse applications. This stage often involves quality assurance testing and packaging to meet consumer expectations and regulatory requirements.

The downstream segment focuses on the distribution and sales of edible insect products to end-users. Distribution channels are varied and include both direct and indirect methods. Direct channels involve sales directly from insect farms or processors to consumers via online platforms or farm-gate sales, fostering transparency and brand loyalty. Indirect channels, which form the bulk of market reach, encompass sales through conventional retail outlets such as supermarkets, hypermarkets, convenience stores, and specialty food shops. E-commerce platforms have emerged as a significant channel, offering convenience and access to a wider consumer base, particularly for novel food products. Additionally, the foodservice industry, including restaurants and catering services, plays a role in introducing consumers to insect-based culinary experiences, further expanding market reach and enhancing public acceptance.

Edible Insects Market Potential Customers

The Edible Insects Market targets a diverse range of potential customers, segmented broadly into those seeking sustainable food solutions, health and wellness enthusiasts, and industries requiring alternative protein sources for feed. Health-conscious consumers represent a significant end-user segment, drawn to the high protein content, essential nutrients like B vitamins, iron, and zinc, and the healthy fats found in edible insects. This group often includes athletes and individuals adopting specific dietary lifestyles, such as paleo or gluten-free, who are actively looking for nutrient-dense and novel protein options. Their purchasing decisions are influenced by nutritional labels, ingredient transparency, and the perceived functional benefits of insect-based products.

Environmentally aware consumers form another core customer base. This demographic is deeply concerned with the ecological footprint of their food choices and is actively seeking alternatives that minimize environmental impact. They are motivated by the lower resource consumption (water, land, feed) and reduced greenhouse gas emissions associated with insect farming compared to traditional animal agriculture. This segment often overlaps with those who prioritize ethical and sustainable sourcing, making them receptive to the narrative of insects as a responsible protein choice. Their engagement is often driven by educational campaigns highlighting the ecological advantages and the overall sustainability story of edible insects, leading to adoption of insect-based snacks, flours, and protein supplements.

Beyond human consumption, a crucial segment of potential customers includes industries that require sustainable and high-quality protein for animal feed. The pet food industry, for instance, is increasingly adopting insect protein due to its hypoallergenic properties, high digestibility, and environmental benefits, catering to pet owners who seek premium, sustainable, and often novel ingredients for their animals. Similarly, the aquaculture industry, facing pressures to find sustainable alternatives to fishmeal, and the poultry and livestock feed sectors are recognizing insect meal, particularly from black soldier fly larvae, as an efficient and environmentally sound protein source. These industrial customers are driven by factors such as feed conversion rates, nutritional efficacy, cost-effectiveness at scale, and regulatory compliance regarding sustainable sourcing, making them key buyers in the business-to-business segment of the edible insects market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.72 Billion |

| Market Forecast in 2032 | USD 9.88 Billion |

| Growth Rate | 29.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Entomo Farms, Aspire Food Group, Protix, Ÿnsect, InnovaFeed, EnviroFlight, Jimini's, Chapul, Hargol FoodTech, Goterra, All Things Bugs, Cricket One, Flying Spark, Armstrong Cricket Farm, Ecofly, Global Bugs, NextProtein, Bugsolutely, Crop-In Corporation, Hexafly |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Edible Insects Market Key Technology Landscape

The Edible Insects Market is profoundly influenced by advancements in its key technology landscape, which primarily focuses on optimizing insect rearing, processing, and product development to ensure scalability, efficiency, and safety. Automated insect farming systems are central to this evolution, integrating robotics and IoT sensors to precisely control environmental parameters such as temperature, humidity, and ventilation within vertical farming setups. These technologies allow for year-round production, maximizing yields while minimizing resource consumption, and are crucial for the large-scale industrialization required to meet growing market demand. Furthermore, the development of specialized and sustainable insect feed formulations is a key technological area, leveraging concepts like circular economy by converting organic waste into high-quality insect biomass.

The application of artificial intelligence (AI) and machine learning (ML) is rapidly transforming the market, providing predictive analytics for growth optimization and disease prevention in insect colonies. AI-powered systems can monitor insect health, detect anomalies, and even automate sorting and harvesting processes, significantly reducing labor costs and human error. Beyond farming, advanced processing techniques are vital for converting raw insects into palatable and stable ingredients. This includes sophisticated drying methods (e.g., freeze-drying, microwave drying), advanced milling techniques for fine powders, and innovative extraction methods to isolate proteins, oils, and chitin, ensuring high purity and functionality. These technologies are critical for overcoming consumer neophobia by presenting insects in a familiar and appealing format, such as protein flours or concentrated oils.

Genetic selection and biotechnology also represent a significant technological frontier. Researchers are actively working on selective breeding programs to develop insect strains with enhanced growth rates, improved feed conversion ratios, and higher nutritional content. This involves understanding insect genomics to identify traits that can be optimized for commercial farming. Additionally, innovations in packaging technology are essential for preserving the freshness and extending the shelf life of insect-based products, while also ensuring clear labeling regarding nutritional content and potential allergens. The convergence of these technologies across the entire value chain is pivotal for making edible insects a mainstream, competitive, and sustainable protein source for both human and animal consumption, driving down costs and improving product quality and consistency.

Regional Highlights

- North America: This region is experiencing significant growth, driven by increasing consumer interest in sustainable protein and health foods. Regulatory frameworks, while still developing, are becoming clearer, supporting startups and product innovation. Major focus on protein powders, bars, and snacks.

- Europe: A leading market for edible insects, primarily due to strong regulatory support from the European Food Safety Authority (EFSA) approving several insect species for novel food status. High consumer awareness regarding environmental sustainability and animal welfare fuels demand. Product diversification is prevalent, from snacks to ingredient integration.

- Asia Pacific (APAC): The largest market globally, characterized by a long history of entomophagy and traditional consumption patterns in countries like Thailand, China, and Vietnam. Modern insect farming and processing are growing rapidly, driven by food security concerns, rising incomes, and the potential for export to Western markets.

- Latin America: An emerging market with strong traditional consumption in certain areas, particularly Mexico. Increasing awareness of nutritional benefits and sustainability is fostering new businesses. The region holds significant potential for scaling up insect farming for both human consumption and animal feed.

- Middle East and Africa (MEA): A nascent but promising market, especially for addressing food security challenges and promoting sustainable agriculture. While traditional consumption exists in some African countries, the modern industry is still in its early stages, with growing interest in sustainable protein sources and innovative farming solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Edible Insects Market.- Entomo Farms

- Aspire Food Group

- Protix

- Ÿnsect

- InnovaFeed

- EnviroFlight

- Jimini's

- Chapul

- Hargol FoodTech

- Goterra

- All Things Bugs

- Cricket One

- Flying Spark

- Armstrong Cricket Farm

- Ecofly

- Global Bugs

- NextProtein

- Bugsolutely

- Crop-In Corporation

- Hexafly

Frequently Asked Questions

Are edible insects safe to eat?

Yes, when farmed and processed under hygienic conditions, edible insects are safe for consumption. Regulatory bodies like EFSA in Europe have approved several species, and many cultures have consumed insects for centuries without issues. Proper cooking and processing are crucial.

What are the main benefits of consuming edible insects?

Edible insects are highly nutritious, rich in protein, essential amino acids, healthy fats, vitamins (especially B12), and minerals (iron, zinc). They also boast significant environmental benefits, requiring less land, water, and feed, and emitting fewer greenhouse gases compared to traditional livestock.

What do edible insects taste like?

The flavor of edible insects varies by species and preparation. Crickets often have a nutty, earthy taste. Mealworms can be described as having a mild, slightly nutty, or even mushroom-like flavor. Grasshoppers are often savory and somewhat similar to shrimp or roasted nuts. Many are subtle enough to blend into other foods.

Are there any regulations for edible insects?

Regulations vary significantly by region. The European Union has a Novel Food Regulation that requires specific approvals for edible insect species. North America is developing guidelines, with some insects generally recognized as safe. Asia and Africa often have established traditional consumption practices that guide local markets.

Where can I buy edible insects or insect-based products?

Edible insect products are increasingly available. You can find them in specialty food stores, health food shops, major supermarkets (especially in Europe), and widely online through e-commerce platforms. Restaurants and foodservice providers are also beginning to feature insect-based dishes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager