Electric Construction Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430562 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Electric Construction Equipment Market Size

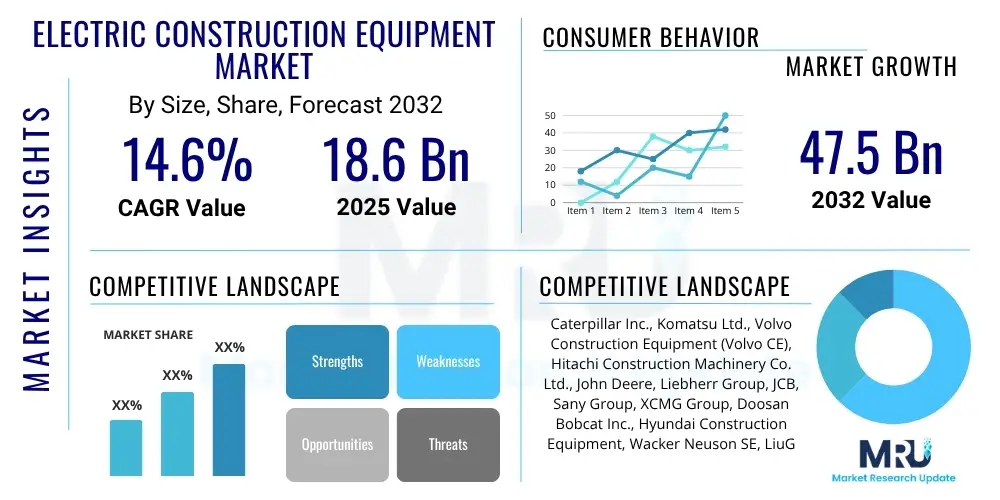

The Electric Construction Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.6% between 2025 and 2032. The market is estimated at USD 18.6 Billion in 2025 and is projected to reach USD 47.5 Billion by the end of the forecast period in 2032.

Electric Construction Equipment Market introduction

The Electric Construction Equipment market encompasses a rapidly evolving sector focused on developing and deploying heavy machinery powered by electricity, primarily batteries, as an alternative to traditional fossil-fuel-driven engines. These machines include electric excavators, loaders, dozers, dump trucks, and compact equipment, designed to offer superior environmental performance and operational efficiency. The primary applications span urban construction projects, indoor demolition, mining operations, road building, and infrastructure development, particularly in areas sensitive to noise and emissions, such as residential zones and enclosed spaces. The inherent benefits of electric construction equipment include significantly reduced greenhouse gas emissions, lower operational noise, decreased fuel costs, and often, enhanced operator comfort due to less vibration and heat. These advantages, coupled with stringent environmental regulations and growing corporate sustainability mandates, are vigorously driving the market's expansion.

The product description for electric construction equipment highlights its core innovation: the replacement of internal combustion engines with electric powertrains. This shift facilitates zero-emission operation at the point of use, addressing critical environmental concerns such as climate change and air pollution. Major applications for these robust machines are diverse, ranging from large-scale civil engineering projects to smaller, localized urban developments, and even specialized tasks in sensitive ecological areas. The equipment's ability to operate quietly makes it ideal for nighttime work in populated areas, minimizing disruption. Furthermore, lower maintenance requirements compared to diesel engines contribute to a reduced total cost of ownership over the lifespan of the machinery. Key driving factors accelerating market adoption include government incentives for electrification, increasing fuel prices for conventional equipment, and advancements in battery technology that enhance power density, charging speed, and durability, making electric alternatives increasingly viable for demanding construction tasks.

Electric Construction Equipment Market Executive Summary

The Electric Construction Equipment market is witnessing robust growth, driven by an accelerating global shift towards sustainable infrastructure development and stringent environmental regulations. Key business trends indicate a strong focus on research and development by leading manufacturers to improve battery range, charging infrastructure, and machine performance parity with diesel counterparts. The market is characterized by increasing partnerships between traditional heavy equipment manufacturers and electric powertrain specialists, aiming to accelerate product innovation and market penetration. Regional trends show Europe and North America at the forefront of adoption, propelled by ambitious decarbonization goals and supportive policies, while Asia Pacific, particularly China and India, is emerging as a significant growth hub due to rapid urbanization and increasing environmental awareness. The market is also experiencing a surge in demand for compact electric equipment, ideal for urban settings, with heavier machinery gradually gaining traction as battery technology advances.

Segmentation trends reveal a preference for battery-electric models over hybrid electric solutions in many applications, reflecting a stronger commitment to zero-emission operations. Compact equipment, such as mini-excavators and skid-steer loaders, currently dominates the market, benefiting from lower battery requirements and easier integration into existing urban construction frameworks. However, advancements in high-power battery systems and rapid charging solutions are progressively making larger equipment, like medium-sized excavators and wheel loaders, more commercially viable. The rental sector is playing a pivotal role in market expansion, allowing construction companies to trial electric equipment without significant upfront capital investment. This widespread adoption is further supported by a growing emphasis on smart construction, where electric machinery integrates seamlessly with digital platforms for enhanced efficiency, predictive maintenance, and operational optimization. The market’s trajectory is firmly set towards a future where electric construction equipment becomes the standard, supported by continuous technological innovation and evolving infrastructure.

AI Impact Analysis on Electric Construction Equipment Market

User inquiries about AI's impact on electric construction equipment frequently revolve around how artificial intelligence can enhance operational efficiency, improve safety, enable predictive maintenance, and facilitate autonomous capabilities. Common concerns include the complexity of integrating AI, data security, and the necessity for specialized operator training. Users anticipate that AI will revolutionize equipment functionality by optimizing battery management, improving work site productivity through intelligent automation, and extending machine lifespan via proactive diagnostic systems. Expectations are high for AI to address current challenges such as range anxiety and charging logistics by providing smart energy management solutions. The overarching theme is a desire for AI to elevate electric construction equipment beyond mere electrification, transforming it into intelligent, self-optimizing, and safer assets.

- Predictive Maintenance: AI algorithms analyze operational data to forecast equipment failures, minimizing downtime and maintenance costs.

- Autonomous Operation: AI enables self-driving and remote-controlled capabilities, enhancing safety and efficiency in hazardous environments.

- Optimized Charging: Intelligent systems manage battery charging cycles to maximize battery lifespan and operational readiness.

- Enhanced Safety: AI-powered sensors and cameras detect obstacles and potential hazards, preventing accidents on construction sites.

- Data-driven Insights: AI processes vast amounts of telemetry data to provide actionable insights into performance, fuel efficiency, and asset utilization.

- Workload Optimization: AI systems can analyze project requirements and machine capabilities to optimize task assignments and operational sequences.

DRO & Impact Forces Of Electric Construction Equipment Market

The Electric Construction Equipment market is significantly shaped by a confluence of driving forces, inherent restraints, and burgeoning opportunities. Key drivers include increasingly stringent environmental regulations globally, pushing for reduced emissions and noise pollution, particularly in urban areas. Government incentives, such as tax credits and subsidies for zero-emission vehicles, further accelerate adoption. The lower total cost of ownership (TCO) over the equipment's lifespan, driven by reduced fuel and maintenance expenses, presents a compelling economic advantage. Furthermore, corporate sustainability goals and improved operator working conditions due to quieter and vibration-free operation contribute substantially to market growth. Technological advancements in battery energy density, fast charging solutions, and electric motor efficiency are continually overcoming performance barriers, making electric options more viable for heavy-duty applications.

Despite strong drivers, several restraints challenge rapid market expansion. The high upfront purchase cost of electric construction equipment compared to conventional diesel machines remains a significant barrier for many buyers. Limited charging infrastructure on construction sites, especially in remote or rapidly changing environments, poses logistical challenges and concerns about operational downtime. Battery limitations, including range anxiety, relatively longer charging times for some models, and the overall weight and lifespan of current battery technologies, also present hurdles. Performance concerns in extreme weather conditions and the need for specialized training for maintenance personnel add to these complexities. Opportunities, however, abound, particularly in developing economies with burgeoning infrastructure projects and a strong push for sustainable development. Niche applications, such as indoor work, tunneling, and sensitive urban areas, present immediate adoption potential. Innovations in battery swapping technologies, smart grid integration, and the retrofitting of existing diesel fleets with electric powertrains offer substantial avenues for future growth. The overall impact forces are primarily shaped by regulatory pressure, continuous technological innovation, evolving economic viability, and the growing societal demand for environmentally responsible construction practices.

Segmentation Analysis

The Electric Construction Equipment market is comprehensively segmented to provide a detailed understanding of its diverse components and growth trajectories. These segmentations allow for granular analysis of market dynamics, identifying key areas of innovation, adoption trends, and competitive landscapes. The market is primarily broken down by equipment type, power source, battery type, application, end-user, and power output, each category reflecting distinct market needs and technological maturities. Understanding these segments is crucial for stakeholders to tailor strategies, develop targeted products, and optimize distribution channels in this rapidly evolving industry.

- By Equipment Type:

- Excavators (Mini, Compact, Medium, Heavy)

- Loaders (Skid-steer, Wheel, Backhoe)

- Dozers

- Articulated Dump Trucks

- Compact Track Loaders

- Forklifts

- Others (e.g., Rollers, Telehandlers)

- By Power Source:

- Battery Electric

- Hybrid Electric

- By Battery Type:

- Lithium-ion

- Lead-acid

- Others (e.g., Nickel-Metal Hydride, Solid-state - emerging)

- By Application:

- Building & Construction (Residential, Commercial, Infrastructure)

- Mining

- Agriculture & Forestry

- Utilities

- Landscaping

- Waste Management

- Others

- By End-User:

- Rental Companies

- Construction Companies

- Municipalities & Government

- Mining Companies

- Others

- By Power Output:

- Less than 50 kW

- 50-150 kW

- More than 150 kW

Value Chain Analysis For Electric Construction Equipment Market

The value chain for the Electric Construction Equipment market is complex and integrated, starting from the extraction of raw materials and extending to the end-use and servicing of the machinery. The upstream segment involves suppliers of critical raw materials, such as lithium, nickel, cobalt, and copper, essential for battery production and electric motor components. It also includes manufacturers of sophisticated electronic components, electric motors, inverters, control systems, and advanced battery packs. These specialized component suppliers play a crucial role in the performance and cost-effectiveness of the final electric equipment. Strong supplier relationships and robust supply chain management are paramount due to the strategic importance of these high-tech components and potential geopolitical sensitivities surrounding raw material sourcing. Innovation in this upstream segment directly influences the capabilities and competitiveness of the downstream products.

The downstream segment of the value chain is dominated by Original Equipment Manufacturers (OEMs) who design, assemble, and market the complete electric construction machines. These OEMs integrate components from various upstream suppliers, conducting extensive research and development to optimize performance, ergonomics, and safety features. Following manufacturing, the distribution channel plays a vital role in reaching the end-customers. This typically involves a network of authorized dealers and distributors who handle sales, provide after-sales support, spare parts, and maintenance services. Rental companies also form a significant part of the downstream value chain, providing access to electric equipment for businesses that prefer not to incur large capital expenditures. Direct sales from OEMs to large corporations or government entities are also common for significant fleet acquisitions. The proliferation of digital platforms is increasingly enabling more direct and indirect distribution, offering enhanced transparency and efficiency across the entire value chain, from initial product inquiry to long-term service agreements.

Electric Construction Equipment Market Potential Customers

The potential customers for Electric Construction Equipment span a wide array of industries and organizational types, all seeking to achieve operational efficiency, environmental compliance, and long-term cost savings. Construction companies, from large-scale civil engineering firms managing infrastructure projects to smaller residential builders, represent a significant customer base, driven by increasing mandates for green building practices and urban noise reduction. Mining operations, particularly those with underground facilities or a strong focus on sustainability, are increasingly investing in electric equipment to improve air quality for workers and reduce ventilation costs. Furthermore, municipalities and government agencies constitute a growing segment, as they often lead by example in adopting eco-friendly technologies for public works, urban maintenance, and environmental protection initiatives.

Beyond these primary segments, landscaping businesses, particularly those operating in noise-sensitive areas like parks, golf courses, and residential communities, are finding electric compact equipment highly beneficial. Utility companies, for their maintenance and infrastructure work, also present a strong demand, valuing the reliability and quiet operation of electric machinery. Rental companies form a crucial category of buyers, as they cater to a diverse clientele seeking flexible access to electric equipment without the commitment of direct purchase, thereby acting as an important conduit for market penetration. As the technology matures and charging infrastructure expands, the customer base is expected to diversify further, including waste management companies and agricultural enterprises, all eager to capitalize on the environmental and economic advantages offered by electric construction equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 18.6 Billion |

| Market Forecast in 2032 | USD 47.5 Billion |

| Growth Rate | 14.6% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment (Volvo CE), Hitachi Construction Machinery Co. Ltd., John Deere, Liebherr Group, JCB, Sany Group, XCMG Group, Doosan Bobcat Inc., Hyundai Construction Equipment, Wacker Neuson SE, LiuGong Machinery Co. Ltd., Epiroc AB, Sandvik AB, Kubota Corporation, Zoomlion Heavy Industry Science and Technology Co., Ltd., CNH Industrial N.V. (Case Construction Equipment, New Holland Construction), Faresin Industries, Green Machine |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Construction Equipment Market Key Technology Landscape

The Electric Construction Equipment market is undergoing a significant technological transformation, driven by innovations across several key areas that enhance performance, efficiency, and sustainability. Central to this evolution is advancements in battery technology, primarily focused on increasing energy density, extending battery lifespan, and reducing charging times. Lithium-ion batteries continue to dominate, but research into solid-state batteries promises even greater safety, energy density, and faster charging capabilities, potentially revolutionizing the market in the coming years. Complementing battery advancements are developments in electric powertrains, including highly efficient electric motors and sophisticated power electronics (inverters and converters) that optimize energy flow and machine control. These technologies are crucial for delivering the necessary torque and power required for heavy construction tasks while minimizing energy losses.

Beyond core electrification components, the integration of digital technologies such as telematics, IoT sensors, and advanced control systems is transforming electric construction equipment into smart, connected machines. Telematics provides real-time data on machine performance, location, and operational status, enabling remote monitoring and predictive maintenance. IoT sensors gather granular data that feed into AI and machine learning algorithms, which are increasingly used for optimizing operational efficiency, automating tasks, and enhancing safety features like collision avoidance. Furthermore, the development of robust charging infrastructure, including fast chargers and potentially battery swapping stations, is critical to overcome range anxiety and ensure continuous operation. Emerging technologies like hydrogen fuel cells also hold promise for heavier-duty, long-duration applications where battery-electric solutions might face limitations, offering another pathway for zero-emission construction machinery in the future.

Regional Highlights

- North America: This region is a leading market, characterized by significant government investment in infrastructure projects and growing environmental regulations. Strong corporate sustainability initiatives and high adoption rates of advanced construction technologies further propel market growth, particularly in the United States and Canada.

- Europe: Europe stands at the forefront of the electric construction equipment market, driven by stringent emission standards, ambitious decarbonization targets, and supportive government policies. Countries like Norway, Sweden, Germany, and the UK are witnessing rapid adoption, fueled by incentives and a robust research and development ecosystem focused on sustainable solutions.

- Asia Pacific (APAC): The APAC region represents a burgeoning market, primarily fueled by rapid urbanization, substantial infrastructure development, and increasing awareness of environmental issues in economies like China, India, Japan, and South Korea. Government push for clean energy and large-scale construction projects contribute significantly to its growth potential.

- Latin America: An emerging market with increasing investment in infrastructure and mining sectors. While still in nascent stages, the growing focus on sustainability and efficiency gains positions countries like Brazil, Chile, and Mexico as potential growth hubs for electric construction equipment.

- Middle East and Africa (MEA): This region is characterized by substantial investments in mega-projects and a rising emphasis on diversifying economies away from fossil fuels. Although adoption is currently lower, the long-term potential is significant, especially with developing smart cities and sustainable infrastructure initiatives across the UAE, Saudi Arabia, and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Construction Equipment Market.- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment (Volvo CE)

- Hitachi Construction Machinery Co. Ltd.

- John Deere

- Liebherr Group

- JCB

- Sany Group

- XCMG Group

- Doosan Bobcat Inc.

- Hyundai Construction Equipment

- Wacker Neuson SE

- LiuGong Machinery Co. Ltd.

- Epiroc AB

- Sandvik AB

- Kubota Corporation

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- CNH Industrial N.V. (Case Construction Equipment, New Holland Construction)

- Faresin Industries

- Green Machine

Frequently Asked Questions

Analyze common user questions about the Electric Construction Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using electric construction equipment?

Electric construction equipment offers significant benefits including zero tailpipe emissions, reduced noise pollution, lower operational costs due to decreased fuel consumption and maintenance, and improved operator comfort from less vibration. These advantages contribute to environmental sustainability and economic efficiency on job sites.

What are the main challenges hindering the growth of the electric construction equipment market?

Key challenges include the high upfront purchase cost compared to conventional diesel machines, limited charging infrastructure availability, concerns about battery range and charging times, and the need for specialized training for maintenance and operation personnel. Overcoming these requires significant investment and technological advancements.

How does the performance of electric construction equipment compare to diesel models?

Modern electric construction equipment is increasingly designed to match or exceed the performance of diesel counterparts in terms of power, torque, and lift capacity, especially for compact and medium-sized machines. Advancements in battery and electric motor technology are continuously closing any performance gaps, ensuring high productivity.

What types of electric construction equipment are currently available in the market?

The market offers a growing range of electric construction equipment including mini and compact excavators, wheel loaders, skid-steer loaders, compact track loaders, forklifts, and even larger equipment like medium excavators and articulated dump trucks. The variety is expanding rapidly across different power outputs and applications.

Which regions are leading the adoption of electric construction equipment?

Europe and North America are currently leading in the adoption of electric construction equipment, driven by stringent environmental regulations, government incentives, and a strong focus on sustainable development. Asia Pacific, particularly China and India, is rapidly emerging as a significant market due to urbanization and infrastructure growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager