Electric Distribution Utility Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428122 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Electric Distribution Utility Market Size

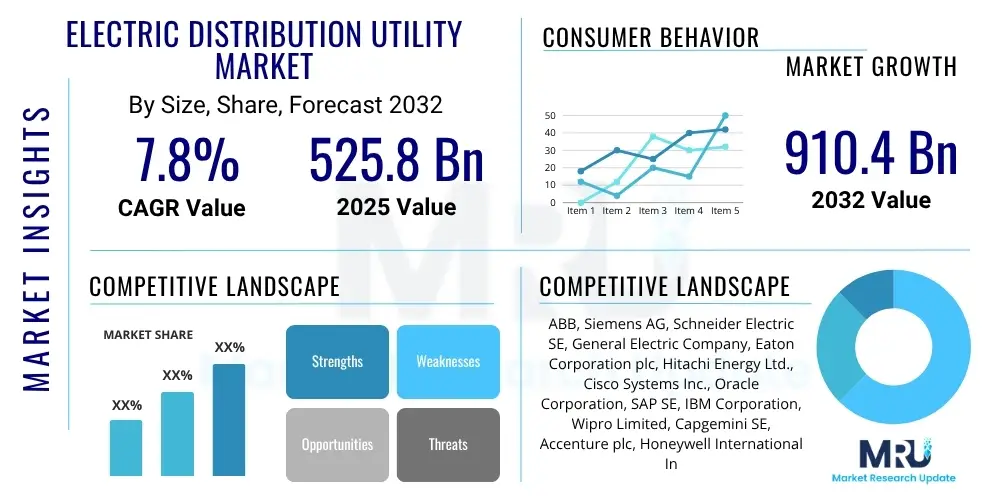

The Electric Distribution Utility Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 525.8 Billion in 2025 and is projected to reach USD 910.4 Billion by the end of the forecast period in 2032.

Electric Distribution Utility Market introduction

The Electric Distribution Utility Market represents the indispensable backbone of modern energy infrastructure, responsible for the crucial last-mile delivery of electricity from high-voltage transmission lines to end-users across residential, commercial, industrial, and agricultural sectors. This complex ecosystem integrates a sophisticated network of physical assets, including substations, transformers, poles, power lines, and advanced metering infrastructure, all meticulously managed to ensure an uninterrupted and stable power supply. The core "product" of this market is the efficient and reliable distribution of electricity, augmented by a growing suite of digital solutions and services designed to optimize grid performance, enhance operational visibility, and facilitate seamless consumer interaction. The inherent complexity of managing diverse load profiles, intermittent renewable energy sources, and an aging infrastructure underscores the market's continuous need for innovation and modernization.

Key benefits emanating from a well-functioning electric distribution utility market are multifaceted, encompassing enhanced grid stability and resilience against disturbances, significant reductions in technical and commercial losses, improved speed and accuracy of outage detection and restoration, and the seamless integration of distributed energy resources (DERs) such as rooftop solar and localized storage. These improvements contribute directly to economic productivity, public safety, and environmental sustainability. The market is primarily driven by relentless growth in global electricity demand, fueled by demographic shifts, rapid urbanization, and industrial expansion in emerging economies. Concurrently, the urgent imperative for grid modernization, particularly in developed regions burdened by aging infrastructure, and the global push towards decarbonization through accelerated renewable energy integration, serve as powerful catalysts. Furthermore, the pervasive adoption of smart grid technologies, digitalization initiatives, and a heightened focus on energy efficiency and customer experience are collectively reshaping the market landscape, steering it towards a more intelligent, adaptive, and sustainable future, capable of supporting a decentralized energy paradigm and electric vehicle proliferation.

Electric Distribution Utility Market Executive Summary

The Electric Distribution Utility Market is currently navigating a period of profound transformation, characterized by robust business trends that prioritize technological advancement, operational resilience, and environmental stewardship. A predominant trend involves significant capital allocation towards grid modernization initiatives, encompassing the deployment of smart grid technologies, advanced analytics platforms, and widespread distribution automation. These investments are aimed at bolstering operational efficiency, mitigating outage durations, and effectively managing the burgeoning complexity introduced by bidirectional power flows from distributed energy resources (DERs). Furthermore, the industry is witnessing a strategic pivot towards proactive and predictive maintenance regimes, leveraging data-driven insights to optimize asset lifecycles and reduce unforeseen expenditures. The escalating threat landscape of cybersecurity necessitates continuous investment in resilient infrastructure and robust protective measures, influencing all aspects of planning and operations within this critical sector. These overarching trends are collectively steering the market towards a more intelligent, adaptable, and environmentally conscious electricity delivery system.

Regional dynamics within the Electric Distribution Utility Market are highly diverse, reflecting varying stages of economic development, regulatory frameworks, and national energy priorities. North America and Europe stand as pioneers in smart grid adoption and comprehensive renewable energy integration, driven by ambitious climate targets, supportive governmental policies, and a critical need to upgrade decades-old infrastructure. This has led to accelerated deployment of Advanced Metering Infrastructure (AMI) and sophisticated Distribution Management Systems (DMS). Conversely, the Asia Pacific region, led by economic powerhouses like China and India, represents an unparalleled growth engine, fueled by rapid industrialization, burgeoning urban populations, and an escalating demand for reliable electricity access. This region is witnessing massive investments in both new grid construction and the modernization of existing networks, often incorporating advanced technologies from the outset. Latin America, the Middle East, and Africa are also demonstrating burgeoning market activity, albeit with different drivers; Latin America focuses on reducing system losses and improving reliability, while MEA concentrates on electrification initiatives and strategic diversification of energy portfolios. Across all regions, the market's segmentation trends underscore a strong emphasis on integrating sophisticated software solutions for real-time grid management, predictive analytics, and enhanced customer engagement, alongside sustained demand for high-performance hardware and specialized professional services for seamless implementation and ongoing support.

AI Impact Analysis on Electric Distribution Utility Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Electric Distribution Utility Market frequently delve into AI's transformative potential across critical operational domains. Stakeholders are particularly interested in understanding how AI can significantly enhance grid reliability and resilience by predicting and proactively mitigating potential equipment failures and system anomalies, thereby minimizing costly downtime and improving service continuity. Another key area of focus involves AI's pivotal role in optimizing the integration of diverse and often intermittent renewable energy sources, ensuring grid stability despite variable generation patterns. Furthermore, there is widespread curiosity about AI's capabilities in refining energy demand forecasting, enabling more precise load management, and fostering greater energy efficiency through smart consumption patterns. Beyond operational benefits, users also express concerns regarding the cybersecurity implications of AI-driven systems within essential public infrastructure, alongside the ethical frameworks necessary for responsible deployment of such powerful technologies.

The profound influence of Artificial Intelligence (AI) within the Electric Distribution Utility Market is rapidly emerging as a cornerstone for future-proofing grid operations and strategic decision-making. AI algorithms possess an unparalleled capacity to process and derive actionable insights from the immense volumes of data generated by smart meters, sensors, substations, and other grid components. This capability allows utilities to transition from traditional reactive maintenance and operational models to highly predictive and proactive strategies, fundamentally bolstering the overall resilience, efficiency, and adaptability of the electricity distribution system. The integration of AI tools promises a significantly smarter, more responsive, and self-healing grid that can dynamically adjust to fluctuations in energy demand, manage intermittent supply from renewable sources with greater precision, and rapidly identify and neutralize potential system anomalies or cyber threats. As the utility sector intensifies its embrace of digital transformation, AI is unequivocally positioned as a pivotal enabling technology, driving the evolution towards decentralized, digitized, and highly optimized power distribution networks that are essential for meeting the demands of a sustainable and interconnected energy future.

- AI-driven predictive maintenance leverages machine learning to analyze historical data and real-time sensor readings, forecasting potential equipment failures (e.g., transformers, circuit breakers) with high accuracy, thus enabling proactive repairs, reducing unplanned outages, and extending asset lifespans.

- Grid optimization capabilities are significantly enhanced by AI, which dynamically adjusts power flow, voltage levels, and reactive power compensation across the distribution network, leading to minimized technical losses, improved power quality, and greater operational efficiency.

- Seamless integration of distributed energy resources (DERs), such as rooftop solar, wind turbines, and battery storage, is facilitated by AI algorithms that predict their output variability and coordinate their optimal dispatch and consumption, ensuring grid stability and maximizing renewable energy utilization.

- Advanced demand forecasting accuracy is achieved through AI and machine learning models, which process vast datasets including weather patterns, historical consumption, and economic indicators, enabling utilities to precisely manage peak loads, optimize energy procurement, and implement targeted demand-response programs.

- Cybersecurity posture is substantially strengthened by AI's ability to monitor network traffic and operational technology (OT) systems in real-time, detecting anomalous patterns, identifying potential cyber threats or intrusions, and initiating automated responses faster than humanly possible, thereby protecting critical infrastructure.

- Automated outage management and rapid restoration processes are revolutionized by AI, which can pinpoint the exact location of faults, diagnose causes, and intelligently route power to minimize service interruptions, significantly reducing outage durations and enhancing customer satisfaction.

- The development and autonomous operation of microgrids benefit immensely from AI, allowing for optimized energy management within localized grids, ensuring self-sufficiency during main grid outages, and efficient interaction when connected to the broader network.

- AI facilitates enhanced customer engagement by providing personalized energy consumption insights, recommending optimized usage patterns, and enabling more effective participation in demand-response initiatives, leading to greater energy literacy and satisfaction.

- Strategic asset management and long-term infrastructure planning are significantly improved by AI, offering data-driven insights into asset health, performance trends, and optimal investment strategies for upgrades, replacements, and network expansion.

DRO & Impact Forces Of Electric Distribution Utility Market

The Electric Distribution Utility Market is intrinsically shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively constitute the fundamental impact forces determining its evolutionary trajectory. Prominent among the drivers is the inexorable growth in global electricity demand, spurred by relentless population expansion, accelerating urbanization, and robust industrialization across both developed and emerging economies. This necessitates continuous and substantial investments in upgrading, expanding, and digitalizing distribution infrastructure to meet the burgeoning energy needs. A pivotal driver is the escalating integration of renewable energy sources, such as solar photovoltaic (PV) and wind power, into the grid; their inherent intermittency and distributed nature demand sophisticated grid management systems capable of handling bidirectional power flows and ensuring grid stability. Furthermore, proactive governmental policies and stringent regulatory mandates worldwide, emphasizing grid modernization, energy efficiency, climate resilience, and reduced carbon emissions, serve as powerful accelerators for technological adoption and infrastructure development. The broader digital transformation sweeping across industries, coupled with the critical need to enhance grid resilience against escalating climate change impacts and growing cybersecurity threats, further amplifies the impetus for utilities to embrace innovative distribution solutions.

However, the market's progression is simultaneously tempered by a series of significant restraints. A primary impediment is the formidable capital expenditure required for comprehensive grid modernization initiatives, including the replacement of aging infrastructure and the deployment of advanced smart grid technologies. These substantial upfront costs often pose a considerable financial burden for utilities, particularly those operating within restrictive regulatory environments or constrained by limited access to capital. The complex, and often protracted, regulatory approval processes can significantly delay innovation and the adoption of nascent technologies, creating an environment of uncertainty for both utilities and technology providers. The escalating sophistication and frequency of cybersecurity threats represent a pervasive and costly restraint, demanding continuous investment in robust protective measures and skilled personnel to safeguard increasingly interconnected critical infrastructure. Moreover, resistance to change from consumers, labor unions, or internal organizational structures can hinder the effective implementation of new technologies such as smart meters or dynamic pricing models, necessitating extensive public education and stakeholder engagement. The environmental and social impacts associated with new infrastructure development, including land acquisition and visual aesthetics, also present considerable challenges that must be navigated effectively.

Despite these formidable restraints, the Electric Distribution Utility Market is abundant with compelling opportunities poised to catalyze transformative growth and innovation. The rapid proliferation of distributed energy resources (DERs) presents a significant opportunity for utilities to foster greater local energy independence, enhance grid resilience, and potentially create new revenue streams through the provision of grid services from these decentralized assets. The revolutionary advancements in energy storage technologies, particularly utility-scale battery systems, offer transformative potential for grid optimization, peak load management, and the seamless integration of high levels of variable renewable generation. Furthermore, the exponential growth of electric vehicles (EVs) and the associated demand for charging infrastructure represent a substantial new frontier, necessitating intelligent distribution network upgrades and smart charging solutions. The pervasive application of advanced analytics, artificial intelligence (AI), and machine learning (ML) for predictive maintenance, highly accurate demand forecasting, and real-time operational optimization offers unparalleled potential to enhance efficiency and reliability. The ongoing digitalization trend, encompassing the Internet of Things (IoT) devices, big data platforms, and cloud computing, provides fertile ground for developing more efficient, reliable, and profoundly customer-centric distribution services, ultimately leading towards a truly adaptive, sustainable, and future-proof energy ecosystem.

Segmentation Analysis

The Electric Distribution Utility Market is subject to a meticulous segmentation analysis, providing an exhaustive breakdown of its diverse operational components, technological underpinnings, and extensive application domains. This granular segmentation is paramount for deciphering complex market dynamics, identifying specific growth vectors, and strategically allocating investments across the multifaceted utility landscape. Fundamentally, the market is dissected by component type, which delineates between the tangible physical hardware essential for electricity delivery and the sophisticated software platforms that orchestrate grid intelligence and management, complemented by a range of critical support services. Subsequent layers of segmentation typically differentiate between the broader operational stages within the utility value chain and categorize the market by the specific technological innovations driving its evolution, such as smart grid frameworks and advanced metering solutions. Furthermore, a comprehensive analysis includes segmentation by the varied applications of distributed electricity and the diverse end-user profiles, each presenting distinct demands and operational requisites. This multi-dimensional approach to market segmentation equips stakeholders with the precision required to formulate targeted strategies, address localized challenges, and capitalize on emergent opportunities across the entire spectrum of electricity distribution.

- By Component: This segment distinguishes between the physical infrastructure and the digital tools that form the backbone of electricity distribution.

- Hardware: Encompasses tangible assets critical for distribution, including Smart Meters (for advanced consumption monitoring and two-way communication), Distribution Transformers (to step down voltage for end-use), Substations (for voltage transformation and switching), Distribution Automation Units (for remote control and fault isolation), Circuit Breakers, Switchgears, and Feeder Automation devices.

- Software: Refers to the intelligent applications and platforms that manage, monitor, and optimize grid operations. Key software solutions include Geographical Information Systems (GIS) for spatial network management, Supervisory Control and Data Acquisition (SCADA) for real-time control, Outage Management Systems (OMS) for rapid fault identification and restoration, Distribution Management Systems (DMS) for comprehensive network control, Meter Data Management (MDM) for processing smart meter data, Energy Management Systems (EMS) for optimizing generation and load, and various Analytics Software for predictive insights.

- Services: Includes the expertise and support required for deployment, operation, and maintenance. These comprise Consulting Services (for strategic planning and technology adoption), Integration & Implementation Services (for seamless system deployment), Support & Maintenance Services (for ongoing operational continuity), and Managed Services (for outsourced operational management).

- By Operation: This segment categorizes the market based on the stage of electricity delivery.

- Transmission Systems: Involves the high-voltage infrastructure responsible for transporting bulk electricity over long distances from generation sources to regional substations, connecting different parts of the grid.

- Distribution Systems: Focuses on the medium and low-voltage networks that deliver electricity from distribution substations directly to individual end-users, managing local grids and last-mile delivery.

- By Technology: This segment highlights the core technological innovations driving market advancement.

- Smart Grid: Represents the overarching framework of advanced infrastructure that integrates communication, sensing, and control technologies to enhance grid efficiency, reliability, and sustainability.

- Microgrid: Refers to localized power grids capable of operating autonomously or connected to the main grid, often incorporating distributed generation and storage for enhanced resilience.

- Advanced Metering Infrastructure (AMI): Systems comprising smart meters, communication networks, and data management systems, enabling two-way communication between utilities and meters for detailed consumption data and remote services.

- SCADA Systems: Industrial control systems used for remote monitoring and control of various processes within the electric distribution network, ensuring real-time operational oversight.

- Geographic Information Systems (GIS): Software systems for capturing, storing, analyzing, and managing spatial data, crucial for network mapping, asset management, and planning.

- Cybersecurity Solutions: Technologies and strategies implemented to protect critical utility infrastructure, data, and operational networks from cyber threats and attacks.

- Energy Storage Systems: Devices and technologies (e.g., battery storage, pumped hydro) used to store electrical energy for later use, crucial for grid stability, renewable energy integration, and peak shaving.

- By Application: This segment delineates electricity usage based on consumer type and demand profile.

- Residential: Encompasses power delivery to individual households for domestic electricity consumption, driving demand for reliable and affordable energy.

- Commercial: Includes electricity supply to businesses, office buildings, retail establishments, and service industries, often requiring consistent power quality and smart building integration.

- Industrial: Pertains to power provision for manufacturing plants, factories, heavy industries, and industrial complexes, characterized by high energy consumption and stringent reliability requirements.

- Agricultural: Covers electricity use for irrigation systems, farming machinery, livestock facilities, and other agricultural operations, with specific seasonal and power quality demands.

- By End-User: This segment identifies the ultimate consumers or managers of electricity services.

- Utilities: Public and private power providers that own, operate, and maintain the electricity distribution infrastructure, acting as the core players in the market.

- Independent Power Producers (IPPs): Entities that generate electricity and sell it to utilities or directly to large consumers, influencing the supply side of the market.

- Commercial & Industrial (C&I) Enterprises: Large energy consumers that often manage their own internal distribution networks, engage in self-generation (e.g., rooftop solar), or participate in demand response programs.

- Government & Municipalities: Public sector entities responsible for critical infrastructure, public services, and increasingly, smart city initiatives, demanding resilient and sustainable distribution solutions.

Value Chain Analysis For Electric Distribution Utility Market

The value chain of the Electric Distribution Utility Market is an intricate, multi-tiered structure that systematically traces the flow of electricity from its genesis at power generation facilities through to its final consumption points, with a particular emphasis on the crucial transmission and distribution segments. The upstream component of this value chain commences with the generation of electricity, sourcing from a diverse portfolio of resources including conventional fossil fuels, nuclear power, and an increasingly dominant share of renewable energy technologies like solar, wind, and hydropower. This initial stage requires monumental capital investment in power plants and associated infrastructure, involving specialized equipment manufacturers and raw material suppliers. Following generation, the electricity enters the transmission segment, where it is transported over vast geographical distances at extremely high voltages through an extensive network of high-voltage lines, towers, and bulk substations. The primary objective here is to minimize energy losses during long-haul transport, ensuring a stable and secure supply to regional load centers before it is prepared for local distribution. Key participants in this upstream and midstream segment include independent power producers (IPPs), large-scale utility generators, equipment providers for generation and transmission, and engineering, procurement, and construction (EPC) firms.

As electricity moves further downstream, it enters the distribution segment, the core focus of this market analysis. At this stage, the high-voltage electricity received from the transmission network is progressively stepped down through a series of distribution substations and transformers to lower voltages suitable for safe and practical use by commercial, industrial, and residential end-users. This involves a highly localized and complex network comprising overhead and underground power lines, poles, switches, fault detectors, and advanced metering infrastructure (AMI). Utilities diligently manage this expansive network, performing critical functions such as load balancing, voltage regulation, reactive power compensation, and rapid outage response to ensure consistent and reliable service delivery. The distribution channel in its traditional form is largely direct, with the incumbent utility company serving as the sole provider of electricity to consumers within its designated service territory. However, the contemporary landscape is increasingly introducing indirect elements, particularly with the proliferation of distributed energy resources (DERs) where consumers (prosumers) can generate and feed surplus power back into the grid, altering the unidirectional flow of electricity and fostering new interaction models within the value chain.

The direct channels within the Electric Distribution Utility Market are predominantly characterized by the conventional utility model, where a single, often regulated, entity assumes comprehensive responsibility for owning, operating, and maintaining the entire distribution infrastructure, along with billing and customer service, within a defined geographic area. This model emphasizes vertical integration or close coordination across generation, transmission, and distribution functions to ensure system reliability and stability. In contrast, the emergence and growth of indirect channels are driven by the ongoing decentralization of energy systems and market liberalization trends. These indirect channels involve a broader ecosystem of third-party players, including energy service companies (ESCOs) that provide energy efficiency and management solutions, aggregators that pool distributed resources, and independent energy retailers that purchase power from various sources and sell it to consumers. For example, an ESCO might manage a commercial client's entire energy portfolio, integrating onsite generation, energy storage, and demand-side management, potentially procuring energy from competitive markets rather than solely from the local utility. The increasing sophistication of digital technologies, such as IoT-enabled grid devices, cloud-based analytics, and blockchain for energy trading, further enhances the complexity and opens new avenues for both direct and indirect engagement, facilitating a more dynamic, responsive, and potentially competitive energy distribution landscape for all stakeholders.

Electric Distribution Utility Market Potential Customers

The spectrum of potential customers for the Electric Distribution Utility Market is remarkably extensive and diverse, reflecting the fundamental and pervasive reliance on electricity across nearly every facet of modern society and economy. At the forefront of this customer base are the electric utilities themselves, encompassing both publicly owned municipal utilities and investor-owned private companies. These entities are the primary purchasers of equipment, software, and services within the market, as they bear the core responsibility for constructing, maintaining, upgrading, and operating the intricate distribution infrastructure. Their continuous need for improved efficiency, enhanced reliability, greater resilience against external shocks, and compliance with evolving regulatory mandates drives substantial and sustained demand for innovative solutions across all segments of the distribution utility value chain. Investments from these traditional utility players are foundational to the market's health and growth, as they strive to modernize aging assets, integrate new technologies, and meet ever-increasing consumer expectations for uninterrupted power supply.

Beyond the direct utility operators, a vast array of end-users represents significant and growing potential customer segments. This includes large industrial enterprises, such as manufacturing plants, chemical facilities, and data centers, which require highly reliable, high-quality power for their continuous and often mission-critical operations. Many industrial customers are increasingly investing in their own on-site generation (e.g., cogeneration, solar PV), microgrids, and sophisticated energy management systems to reduce costs, enhance energy security, and meet sustainability targets, thus becoming purchasers of specialized distribution equipment and intelligent control systems. Commercial entities, ranging from large retail chains and office complexes to healthcare facilities and educational institutions, also constitute a substantial customer base, driven by needs for efficient energy use, demand response capabilities, and integration with smart building technologies. Their demand often focuses on advanced metering, power quality solutions, and energy management platforms that can reduce operational expenses and improve environmental performance.

Furthermore, residential consumers, while individually small in scale, collectively represent an enormous and influential customer segment. The widespread adoption of smart homes, electric vehicles (EVs), and distributed generation like rooftop solar panels at the residential level is transforming their role from passive consumers to active participants in the energy ecosystem. This shift fuels the demand for smart metering infrastructure, home energy management systems, and services that facilitate two-way communication and grid interaction. Finally, government agencies and municipalities are critical stakeholders, often tasked with overseeing public infrastructure, providing essential services, and spearheading ambitious smart city initiatives. Their focus is typically on ensuring robust, resilient, and sustainable distribution solutions for public buildings, transportation networks, and critical services, often leading to investments in microgrids for public facilities, public EV charging infrastructure, and advanced grid technologies that support urban development and environmental goals. This diverse customer landscape necessitates a broad portfolio of solutions capable of addressing unique requirements and challenges across all sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 525.8 Billion |

| Market Forecast in 2032 | USD 910.4 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens AG, Schneider Electric SE, General Electric Company, Eaton Corporation plc, Hitachi Energy Ltd., Cisco Systems Inc., Oracle Corporation, SAP SE, IBM Corporation, Wipro Limited, Capgemini SE, Accenture plc, Honeywell International Inc., Itron Inc., Landis+Gyr Group AG, Advanced Control Systems Inc., Open Systems International Inc. (OSI Inc.), S&C Electric Company, Hubbell Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Distribution Utility Market Key Technology Landscape

The Electric Distribution Utility Market is undergoing an unprecedented technological renaissance, primarily driven by the imperative to cultivate more efficient, reliable, resilient, and sustainable electricity grids. At the epicenter of this transformation is the pervasive adoption of Smart Grid technologies, which fundamentally integrate advanced digital communication, sensing, and control capabilities across the entire electricity network. This encompasses the widespread deployment of Advanced Metering Infrastructure (AMI) that facilitates two-way communication between utilities and consumers, enabling dynamic pricing, robust demand response programs, and granular consumption data. Concurrently, Distribution Automation (DA) systems are being extensively implemented to allow for remote monitoring, control, and automated fault detection and isolation of grid components, thereby drastically minimizing outage durations and improving restoration times. This convergence of Information Technology (IT) and Operational Technology (OT) is a defining characteristic, fostering real-time data exchange, integrated management, and enhanced situational awareness across the intricate distribution network.

Furthermore, the contemporary technology landscape is profoundly shaped by the escalating integration of Distributed Energy Resources (DERs), such as rooftop solar photovoltaic (PV) systems, small-scale wind turbines, battery energy storage systems, and electric vehicles. This necessitates the deployment of sophisticated Distributed Energy Resource Management Systems (DERMS) and advanced grid management platforms capable of intelligently orchestrating bidirectional power flows, managing voltage fluctuations, and maintaining grid stability amidst variable generation profiles. Geographic Information Systems (GIS) remain indispensable for precise asset mapping, comprehensive network planning, efficient outage management, and visualizing grid data in a spatial context. Supervisory Control and Data Acquisition (SCADA) systems, while foundational for monitoring and controlling grid operations, are evolving rapidly to integrate with advanced analytics, machine learning algorithms, and cloud-based platforms for predictive insights, enhanced automation, and remote operational capabilities. The rapid advancements and declining costs of energy storage technologies, particularly utility-scale batteries, are also critical enablers, offering flexible solutions for frequency regulation, voltage support, peak load shaving, and augmenting grid resilience.

The burgeoning fields of Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing core aspects of utility operations, from highly accurate demand forecasting and proactive predictive maintenance to optimizing network planning and fortifying cybersecurity. AI algorithms meticulously process massive datasets of operational, historical, and environmental data to identify intricate patterns, predict potential equipment failures before they manifest, and optimize the dispatch of various grid resources for maximal efficiency. Concurrently, cybersecurity solutions are undergoing rapid advancements, incorporating AI-driven anomaly detection, blockchain for secure data transactions, and advanced encryption techniques to safeguard critical infrastructure from an increasingly sophisticated array of cyber threats targeting interconnected smart grid components. The development and strategic deployment of microgrids are also gaining significant traction, providing localized energy resilience for critical facilities, military bases, and remote communities. These self-contained power systems leverage a synergistic combination of DERs, energy storage, and intelligent control systems, often with AI at their core, to operate autonomously during main grid disturbances, thereby showcasing a compelling vision for a more decentralized, resilient, and future-ready electricity distribution paradigm.

Regional Highlights

The Electric Distribution Utility Market exhibits substantial regional heterogeneity, a characteristic driven by a complex interplay of diverse energy policies, varying levels of economic development, unique regulatory frameworks, and distinct rates of technological absorption. A comprehensive understanding of these regional nuances is absolutely critical for market stakeholders seeking to identify lucrative growth opportunities, formulate tailored market entry strategies, and effectively navigate the inherent operational complexities across different geographic landscapes. Each region presents a distinctive amalgamation of market drivers and specific challenges that collectively dictate the pace, scope, and strategic direction of grid modernization efforts and investment in sophisticated distribution infrastructure. This segmented view allows for targeted analysis and localized strategic planning, optimizing resource allocation and maximizing market impact.

For instance, mature markets like North America and Europe are grappling with the dual imperatives of extensively upgrading aging grid infrastructure, some of which dates back a century, and aggressively pursuing decarbonization goals. This situation compels significant investments in advanced smart grid technologies, comprehensive renewable energy integration solutions, and robust cybersecurity enhancements to bolster grid resilience and reliability. These regions are at the forefront of deploying sophisticated Advanced Metering Infrastructure (AMI), advanced Distribution Automation (DA) systems, and highly intelligent Energy Management Systems (EMS) to manage complex energy flows. In stark contrast, the Asia Pacific region, spearheaded by economic powerhouses such as China and India, is experiencing an unparalleled surge in market growth. This is primarily fueled by rapid urbanization, massive industrial expansion, and ambitious electrification initiatives aimed at providing universal energy access. This dynamic environment leads to a simultaneous focus on constructing extensive new distribution infrastructure while vigorously modernizing existing networks to meet burgeoning electricity demand and seamlessly integrate large-scale renewable energy projects. Concurrently, regions such as Latin America, the Middle East, and Africa, while having nascent smart grid markets in many areas, are demonstrating escalating interest and investment in modernizing their grids to significantly improve reliability, drastically reduce system losses, and expand energy access, often enabling them to bypass older technologies and leapfrog directly to advanced solutions.

- North America: This is a mature and highly developed market characterized by substantial ongoing investments in comprehensive smart grid technologies, extensive grid modernization programs focused on asset renewal and digital transformation, and robust cybersecurity enhancements designed to bolster infrastructure resilience and operational reliability. A strong regulatory emphasis on renewable energy integration, the proliferation of distributed energy resources (DERs), and the increasing demand for electric vehicle (EV) charging infrastructure are key drivers.

- Europe: A global leader in decarbonization efforts, Europe is characterized by aggressive targets for reducing carbon emissions and an extensive, multi-faceted integration of diverse renewable energy sources. This drives an urgent demand for highly advanced distribution management systems (DMS), sophisticated smart grid solutions, and innovative energy storage technologies. The region also exhibits a strong focus on enhancing energy efficiency, developing resilient microgrids, and improving cross-border grid synchronization for regional energy security.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally, APAC is propelled by unprecedented rates of industrialization, rapid urbanization, and a continuously escalating demand for reliable electricity. This necessitates colossal investments in both building entirely new distribution infrastructure and extensively upgrading existing networks. Major economies like China and India are undertaking ambitious smart city projects and deploying large-scale renewable energy generation, driving significant technological adoption.

- Latin America: An emerging market that is increasingly prioritizing investments in grid modernization initiatives primarily aimed at combating persistently high transmission and distribution losses, a critical challenge for many national grids. The region is also focused on expanding widespread electricity access to underserved populations, substantially improving overall grid reliability, and strategically integrating its abundant hydropower and other diverse renewable energy sources into the distribution network.

- Middle East and Africa (MEA): This region presents a varied landscape of development, with Gulf Cooperation Council (GCC) countries making substantial investments in advanced smart grids and large-scale renewable energy projects as part of their strategic economic diversification efforts. In contrast, many parts of Africa are experiencing significant potential and investment in off-grid and mini-grid solutions to expand electrification access for remote and rural populations, alongside efforts to upgrade existing urban grids.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Distribution Utility Market.- ABB

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Eaton Corporation plc

- Hitachi Energy Ltd.

- Cisco Systems Inc.

- Oracle Corporation

- SAP SE

- IBM Corporation

- Wipro Limited

- Capgemini SE

- Accenture plc

- Honeywell International Inc.

- Itron Inc.

- Landis+Gyr Group AG

- Advanced Control Systems Inc.

- Open Systems International Inc. (OSI Inc.)

- S&C Electric Company

- Hubbell Inc.

Frequently Asked Questions

Analyze common user questions about the Electric Distribution Utility market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of an electric distribution utility and its importance?

The primary role of an electric distribution utility is to reliably and efficiently deliver electricity from the high-voltage transmission system to diverse end-users (residential, commercial, industrial, agricultural) at appropriate voltage levels. Its importance lies in being the critical last-mile link ensuring stable power supply, economic productivity, and public safety across communities.

How do smart grids impact the efficiency and resilience of electric distribution utilities?

Smart grids profoundly impact utilities by integrating advanced digital communication, sensors, and control systems, enabling two-way communication, real-time monitoring, automated fault detection, and optimized power flow. This leads to significantly enhanced operational efficiency, greater grid resilience against disturbances, reduced power losses, and improved integration of variable renewable energy sources.

What are the main driving factors contributing to the growth of this market?

Key growth drivers include escalating global electricity demand driven by urbanization and industrialization, the urgent need for grid modernization and replacement of aging infrastructure, the accelerated integration of renewable energy sources, and continuous technological advancements in smart grid solutions, energy storage, and electric vehicle infrastructure.

What are the significant challenges electric distribution utilities currently face?

Electric distribution utilities currently face substantial challenges such as the high capital expenditure required for comprehensive grid modernization, complex and evolving regulatory environments, the increasing sophistication of cybersecurity threats, managing the intermittency of renewable energy sources, and effectively integrating a growing number of distributed energy resources while maintaining overall grid stability.

How is Artificial Intelligence (AI) transforming operations within electric distribution?

Artificial Intelligence (AI) is transforming operations by enabling highly accurate predictive maintenance of assets, optimizing grid asset management and network planning, enhancing energy demand forecasting accuracy, automating rapid outage detection and response, and substantially strengthening cybersecurity protocols, thereby fostering more intelligent, proactive, and resilient distribution networks capable of dynamic adaptation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager