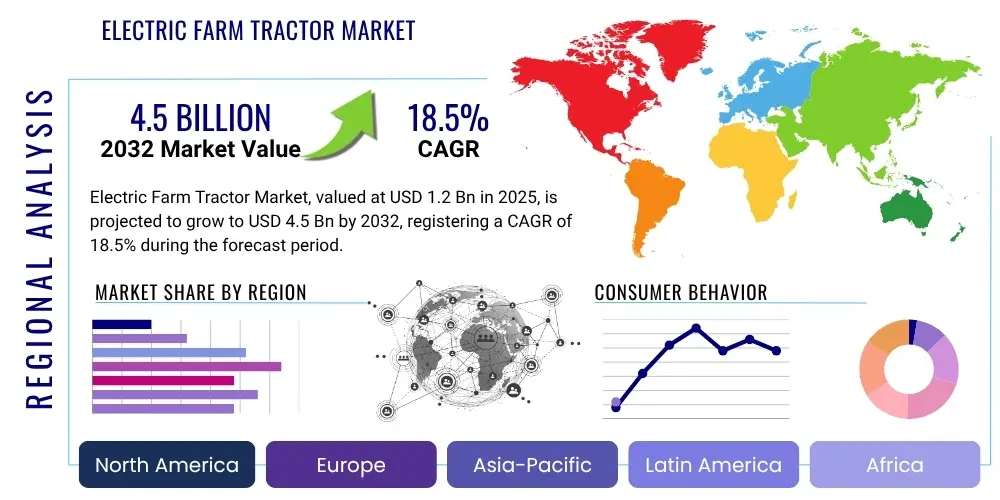

Electric Farm Tractor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430799 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Electric Farm Tractor Market Size

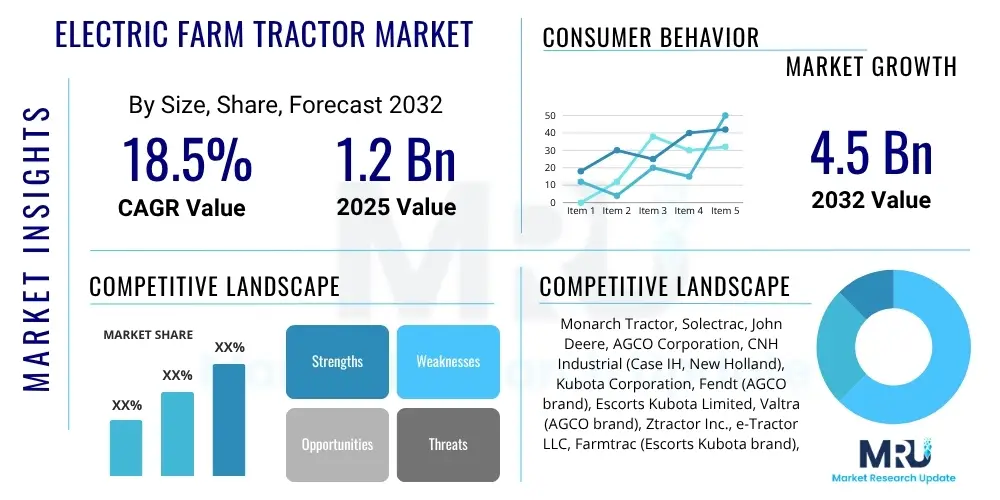

The Electric Farm Tractor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at $1.2 Billion in 2025 and is projected to reach $4.5 Billion by the end of the forecast period in 2032.

Electric Farm Tractor Market introduction

The Electric Farm Tractor Market represents a pivotal shift in agricultural machinery, driven by a global imperative for sustainability and operational efficiency. These advanced machines, powered by sophisticated battery-electric powertrains, offer a compelling alternative to traditional diesel-fueled tractors, addressing environmental concerns through zero direct emissions and significantly reducing noise pollution. The introduction of electric farm tractors heralds a new era of farming, providing solutions that align with modern ecological standards and offer substantial long-term economic advantages to farmers seeking to modernize their operations and reduce their carbon footprint.

Electric farm tractors are characterized by their innovative product design, often incorporating modular battery packs, advanced telematics, and smart connectivity features. These tractors are engineered for a wide array of agricultural applications, ranging from light-duty tasks such as mowing and material handling to more intensive operations like planting, tillage, and harvesting. Their electric motors deliver instant torque, offering superior performance characteristics, particularly in tasks requiring consistent power delivery. The versatility and adaptability of these tractors make them suitable for diverse farm sizes and types, from small organic farms to large-scale commercial agricultural enterprises.

The inherent benefits of electric farm tractors extend beyond environmental compliance, encompassing significant operational savings due to lower fuel and maintenance costs. The integration of electric power enables seamless compatibility with precision agriculture technologies, including GPS guidance, autonomous operation capabilities, and data-driven farming practices, which further optimize resource utilization and enhance yield potential. This confluence of sustainability, economic viability, and technological advancement serves as a primary driving factor, propelling the market forward amidst increasing demand for efficient and environmentally responsible farming solutions across the global agricultural landscape.

Electric Farm Tractor Market Executive Summary

The Electric Farm Tractor Market is experiencing robust growth, fueled by several transformative business trends that emphasize sustainability, technological integration, and operational cost reduction. Major agricultural machinery manufacturers are heavily investing in research and development to expand their electric tractor portfolios, while innovative startups are entering the market with disruptive technologies, including fully autonomous electric models. Strategic partnerships between technology providers, battery manufacturers, and traditional farm equipment companies are accelerating product development and market penetration. Furthermore, emerging business models, such as equipment-as-a-service or battery leasing options, are addressing the initial high capital expenditure, making these advanced machines more accessible to a broader range of farmers and agricultural businesses, thereby driving market expansion.

Regionally, the market exhibits dynamic trends with Europe and North America currently leading in terms of adoption and innovation. Stringent emission regulations, significant government subsidies for electric vehicle adoption in agriculture, and a strong emphasis on sustainable farming practices in these regions are primary catalysts for growth. The Asia Pacific region, particularly countries like China and India, is emerging as a significant growth hub, driven by increasing mechanization, government support for agricultural modernization, and a growing awareness of environmental impacts. Latin America and the Middle East and Africa are also showing nascent but promising growth, as farmers in these regions look for cost-effective and environmentally friendly solutions to enhance productivity and address labor shortages.

Segmentation trends within the Electric Farm Tractor Market highlight a diverse range of preferences and evolving technological capabilities. Tractors with lower power outputs (less than 50 HP) are gaining traction for specialty crops, vineyards, and smaller farms, emphasizing maneuverability and efficiency. Mid-range (50-100 HP) and high-power (greater than 100 HP) electric tractors are being developed to cater to demanding field operations, with a focus on extended battery life and rapid charging capabilities. The market is also seeing a clear differentiation based on autonomy levels, from manual operation with electric drive to advanced semi-autonomous and fully autonomous systems that promise unprecedented levels of precision and labor efficiency, reflecting a broader trend towards smart farming and automation in agriculture.

AI Impact Analysis on Electric Farm Tractor Market

Users frequently inquire about how Artificial Intelligence (AI) fundamentally transforms the functionality and value proposition of electric farm tractors, particularly regarding operational autonomy, enhanced precision in farming tasks, and predictive maintenance capabilities. Key concerns often revolve around the practical benefits for yield optimization, labor efficiency, and overall return on investment, alongside questions regarding the ease of integration and the reliability of AI-driven systems in real-world agricultural environments. There is a clear expectation that AI will not only automate repetitive tasks but also provide actionable insights, making farming operations more intelligent, sustainable, and less labor-intensive. Users also seek to understand the implications for data privacy and cybersecurity in highly connected autonomous farm ecosystems, highlighting the importance of robust and secure AI infrastructure.

- AI enables advanced autonomous navigation and operation, reducing human intervention and labor costs.

- Precision agriculture is significantly enhanced through AI algorithms that analyze sensor data for optimal planting, spraying, and harvesting.

- Predictive maintenance systems, powered by AI, monitor tractor health, anticipate failures, and minimize downtime, optimizing operational efficiency.

- AI-driven analytics provide real-time insights into soil conditions, crop health, and weather patterns, informing decision-making for maximizing yields.

- Improved resource management, including optimized water and fertilizer use, is achieved through AI’s ability to micro-manage field operations.

- Enhanced safety features and obstacle detection are integrated using AI-powered vision systems, reducing accidents in the field.

- AI facilitates fleet management and coordination of multiple electric tractors, optimizing workflow across large agricultural operations.

- Adaptive learning capabilities allow tractors to improve performance over time by analyzing past operational data and adjusting parameters.

DRO & Impact Forces Of Electric Farm Tractor Market

The Electric Farm Tractor Market is significantly propelled by several key drivers, including a global increase in environmental consciousness and stringent regulatory frameworks aimed at reducing carbon emissions from agricultural activities. Farmers are increasingly motivated by the potential for substantial operational cost savings, primarily through reduced fuel expenses and lower maintenance requirements compared to traditional diesel tractors. Furthermore, governments worldwide are offering various incentives, subsidies, and grants to encourage the adoption of electric vehicles in agriculture, making the initial investment more palatable. The seamless integration of electric tractors with advanced precision agriculture technologies and smart farming solutions further enhances their appeal, offering improved efficiency, data-driven decision-making, and optimized resource utilization across farm operations.

Despite the strong growth potential, several restraints challenge the widespread adoption of electric farm tractors. The relatively high initial purchase cost, compared to conventional diesel tractors, remains a significant barrier for many farmers, particularly those operating smaller farms with limited capital. The development of robust and extensive charging infrastructure in rural and remote agricultural areas is still in its nascent stages, posing logistical challenges for continuous operation. Moreover, limitations in current battery technology, such as energy density, charging time, and overall battery lifespan, can restrict the operational range and duty cycle of electric tractors, impacting their suitability for very large farms or extended working hours. Farmer skepticism towards new, unproven technologies and a lack of awareness regarding the long-term benefits also contribute to slower adoption rates in certain regions.

Opportunities for growth in this market are abundant, driven by continuous advancements in battery technology that promise greater energy density, faster charging, and extended lifespans, making electric tractors more competitive. The increasing focus on developing advanced autonomous capabilities, powered by AI and sophisticated sensor fusion, offers the potential for fully automated farming, drastically reducing labor costs and increasing precision. Emerging markets present significant untapped potential as they seek to modernize their agricultural practices with sustainable and efficient technologies. Additionally, the ongoing integration of IoT and telematics solutions with electric tractors will unlock new functionalities, such as remote monitoring, predictive analytics, and over-the-air software updates, enhancing their overall value proposition and ensuring continuous innovation in agricultural machinery.

Segmentation Analysis

The Electric Farm Tractor Market is comprehensively segmented to provide a granular understanding of its diverse components, allowing stakeholders to identify specific growth areas and tailor strategies effectively. This segmentation considers various aspects of the product, including power output, battery capacity, the primary application for which the tractor is designed, and its level of autonomous capability. Each segment reflects unique operational demands, technological specifications, and end-user preferences within the agricultural sector, illustrating the market's multifaceted nature and its continuous evolution towards specialized and intelligent farming solutions.

- By Power Output:

- Less than 50 HP: Ideal for vineyards, orchards, small farms, and landscaping.

- 50-100 HP: Suitable for mid-sized farms, general utility, and livestock operations.

- Greater than 100 HP: Designed for large-scale farming, heavy tillage, and demanding field tasks.

- By Battery Capacity:

- Less than 50 kWh: Generally found in compact tractors for shorter duration tasks.

- 50-100 kWh: Common in mid-range tractors, balancing power and operational time.

- Greater than 100 kWh: Employed in high-power tractors requiring extended heavy-duty operation.

- By Application:

- Tillage: Preparation of soil for planting, including plowing and harrowing.

- Harvesting: Gathering mature crops from the fields.

- Spraying: Application of pesticides, herbicides, or fertilizers.

- Planting & Seeding: Sowing seeds and young plants.

- Material Handling: Moving loads, feed, and other farm materials.

- Other Applications: Mowing, haying, specialty crop management, etc.

- By Autonomy Level:

- Manual: Electrically powered tractors controlled entirely by an operator.

- Semi-Autonomous: Tractors with features like auto-steer, GPS guidance, and partial automation of tasks.

- Fully Autonomous: Self-driving tractors capable of performing tasks without direct human supervision.

Value Chain Analysis For Electric Farm Tractor Market

The value chain for the Electric Farm Tractor Market is intricate, beginning with the upstream analysis that encompasses the sourcing and processing of critical raw materials. This includes lithium, cobalt, nickel, and graphite for battery manufacturing, high-grade steel and composite materials for chassis and body construction, and advanced semiconductors and sensors for control systems and autonomous functionalities. Key upstream players involve mining companies, chemical processors, and specialized component manufacturers producing electric motors, power electronics, and sophisticated sensor arrays. The efficiency and sustainability of these upstream processes are crucial, influencing both the cost and environmental footprint of the final product, necessitating robust supply chain management and ethical sourcing practices from initial stages.

Further along the value chain, the manufacturing and assembly phase involves the integration of these components into complete electric farm tractors. Original Equipment Manufacturers (OEMs) design, engineer, and assemble the tractors, often incorporating modular battery systems and advanced software platforms. Downstream analysis focuses on the distribution, sales, and aftermarket services. Distribution channels typically include established dealer networks, specialized agricultural equipment retailers, and, increasingly, direct sales models through online platforms or dedicated brand stores. These channels are responsible for reaching the end-users—farmers, agricultural cooperatives, and various agricultural enterprises—and providing them with not only the product but also essential support services, training, and financing options.

The distinction between direct and indirect distribution plays a significant role in market reach and customer engagement. Direct sales allow manufacturers to build strong relationships with customers, gather direct feedback, and offer customized solutions, often appealing to larger commercial farms or early adopters. Indirect distribution through robust dealer networks, conversely, leverages existing infrastructure, local presence, and established customer relationships, which is vital for providing widespread sales, service, and spare parts availability, particularly in geographically diverse agricultural regions. Aftermarket services, including maintenance, repairs, software updates, and battery recycling, form a critical part of the value chain, ensuring product longevity and customer satisfaction, and presenting ongoing revenue streams for manufacturers and service providers throughout the product lifecycle.

Electric Farm Tractor Market Potential Customers

The primary potential customers for electric farm tractors encompass a broad spectrum of agricultural stakeholders, ranging from small-scale family farms to large, industrial agricultural enterprises. Small and medium-sized farms, particularly those focused on organic produce, specialty crops such as fruits and vegetables, vineyards, and equestrian facilities, represent a significant customer segment. These farms are often driven by a strong commitment to environmental stewardship, seeking to reduce their carbon footprint and comply with local sustainability regulations, for which electric tractors offer an ideal solution due to their zero-emission operation and reduced noise levels. The lower operational costs associated with electricity, compared to volatile diesel prices, also present an attractive economic proposition for these cost-conscious operators, directly influencing their purchasing decisions and fostering a transition towards greener machinery.

Larger agricultural corporations and commercial farming operations constitute another crucial segment of potential customers. These entities are increasingly focused on maximizing efficiency, optimizing yields through precision agriculture, and adopting advanced technologies to reduce labor dependency. Electric farm tractors, especially those with semi-autonomous and fully autonomous capabilities, align perfectly with these objectives, offering consistent performance, enhanced data collection, and the potential for 24/7 operation with minimal human oversight. The integration with existing smart farming ecosystems, coupled with the ability to achieve substantial fuel and maintenance savings across a large fleet, makes these advanced machines a strategic investment for enhancing productivity and competitiveness in the global market. Furthermore, the corporate social responsibility initiatives of large agricultural businesses often drive them towards sustainable practices, making electric tractors a favorable choice.

Beyond traditional farming, the market also targets specific niche segments including municipal parks and recreation departments, large landscaping companies, and golf courses that require quiet, non-polluting machinery for grounds maintenance. Agricultural cooperatives and governmental agricultural programs seeking to promote sustainable farming practices and provide modernized equipment to their members or constituents also represent significant bulk purchasers. Research institutions and educational farms focused on agricultural innovation and sustainable practices are early adopters, utilizing electric tractors for their research and demonstration purposes. These diverse end-user profiles underscore the broad appeal and versatility of electric farm tractors, driven by a convergence of environmental, economic, and technological benefits that resonate across various agricultural and related sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $1.2 Billion |

| Market Forecast in 2032 | $4.5 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Monarch Tractor, Solectrac, John Deere, AGCO Corporation, CNH Industrial (Case IH, New Holland), Kubota Corporation, Fendt (AGCO brand), Escorts Kubota Limited, Valtra (AGCO brand), Ztractor Inc., e-Tractor LLC, Farmtrac (Escorts Kubota brand), Cummins Inc. (Powertrain solutions), CLAAS Group, Deutz-Fahr (SDF Group), Yanmar Co. Ltd., Goldoni (Argo Tractors S.p.A.), Mahindra & Mahindra Ltd., Sonalika Tractors, SDF Group (Same Deutz-Fahr) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Farm Tractor Market Key Technology Landscape

The Electric Farm Tractor Market is underpinned by a rapidly evolving technological landscape that converges advanced battery systems, sophisticated electric powertrains, and intelligent software integrations. At the core are high-density lithium-ion battery packs, which are continuously improving in energy capacity, charging speed, and cycle life, enabling longer operational durations and more efficient power delivery for demanding agricultural tasks. These battery systems are complemented by robust electric motors that offer instant torque and high efficiency, often paired with advanced power electronics for precise motor control and energy management. Innovations in battery thermal management systems are also critical, ensuring optimal performance and safety across varied environmental conditions encountered in farming operations, thereby extending the overall lifespan of the tractor's core power unit.

Beyond the fundamental electrification, the market is profoundly shaped by the integration of cutting-edge digital technologies. Global Positioning System (GPS) and Real-Time Kinematic (RTK) technology provide centimeter-level accuracy for autonomous navigation and precision farming applications, allowing for optimized planting, spraying, and harvesting paths, which minimize resource waste and maximize yield. The advent of artificial intelligence (AI) and machine learning (ML) algorithms is revolutionizing operational intelligence, enabling predictive analytics for maintenance, real-time crop health monitoring through computer vision, and adaptive task execution based on environmental conditions. These AI systems contribute significantly to the autonomous capabilities of electric tractors, allowing them to perform complex operations with minimal human intervention, enhancing both efficiency and safety in the field.

Furthermore, the technology landscape includes the development of advanced human-machine interfaces (HMI), intuitive control systems, and telematics for remote monitoring and management of tractor fleets. Fast charging technologies, including both wired and wireless inductive charging solutions, are crucial for minimizing downtime and maximizing productivity. The incorporation of sensor fusion technology, combining data from various sensors such as lidar, radar, ultrasonic, and cameras, enhances situational awareness and enables robust obstacle detection and avoidance, which is paramount for safety in autonomous operations. Lastly, the emphasis on modular design and over-the-air (OTA) software updates ensures that electric farm tractors can be continuously improved and adapted to new functionalities, ensuring long-term relevance and sustained value for farmers in an ever-evolving agricultural technology ecosystem.

Regional Highlights

- North America: This region, particularly the United States and Canada, stands as a prominent market due to significant investments in smart agriculture, substantial government incentives for electric vehicle adoption, and a strong presence of major agricultural machinery manufacturers. Farmers are increasingly adopting electric tractors to enhance operational efficiency and comply with environmental regulations, with a growing emphasis on precision agriculture and autonomous solutions.

- Europe: Europe is a leading market, driven by stringent environmental regulations, robust government subsidies for sustainable farming practices, and high consumer demand for organically grown produce. Countries like Germany, France, and the Netherlands are at the forefront of electric tractor adoption, characterized by advanced technological innovation and a strong focus on reducing agricultural emissions and noise pollution in rural areas.

- Asia Pacific (APAC): The APAC region is poised for significant growth, fueled by increasing mechanization of agriculture, government initiatives to modernize farming practices, and growing awareness of environmental sustainability in populous nations like China, India, and Japan. Investment in agricultural infrastructure and the rising labor costs are key drivers for the adoption of efficient, electric solutions in this diverse region.

- Latin America: Countries such as Brazil and Argentina are emerging markets, characterized by large agricultural lands and a growing need for modern, efficient farming equipment. While initial adoption rates are slower, increasing environmental concerns, rising fuel prices, and the push for agricultural productivity improvements are gradually stimulating demand for electric farm tractors in this region.

- Middle East and Africa (MEA): The MEA region presents nascent opportunities, primarily driven by governmental efforts to enhance food security, diversify economies, and implement sustainable agricultural practices. Although challenges like infrastructure development and high initial costs persist, the long-term potential for electric farm tractors in reducing operational expenses and supporting climate-resilient agriculture is becoming increasingly recognized by local farming communities and policy makers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Farm Tractor Market.- Monarch Tractor: A pioneer in fully electric, autonomous smart tractors, known for its innovative technology and AI integration.

- Solectrac: Specializes in compact electric tractors, offering zero-emission alternatives for various farm sizes and tasks.

- John Deere: A global leader in agricultural machinery, actively investing in electric and autonomous tractor technologies to expand its traditional portfolio.

- AGCO Corporation: A major manufacturer with brands like Fendt and Valtra, developing electric drive solutions and hybrid concepts for advanced farming.

- CNH Industrial (Case IH, New Holland): Offering electric and alternative fuel tractor concepts, focusing on sustainable power solutions for diverse agricultural applications.

- Kubota Corporation: Known for its utility tractors, exploring electric models and sustainable technologies to meet global environmental demands.

- Fendt (AGCO brand): A premium brand within AGCO, featuring advanced electric tractor prototypes and precision farming capabilities.

- Escorts Kubota Limited: A joint venture focusing on developing and manufacturing agricultural machinery, including electric tractor variants for emerging markets.

- Valtra (AGCO brand): Innovating with electric front-loader solutions and hybrid technologies for versatile farm operations.

- Ztractor Inc.: A startup focused on fully autonomous electric tractors designed for a range of agricultural tasks from planting to harvesting.

- e-Tractor LLC: Developing heavy-duty electric tractors aimed at large-scale commercial farming, emphasizing power and endurance.

- Farmtrac (Escorts Kubota brand): Producing robust and affordable electric tractor options, particularly for the Asian market.

- Cummins Inc. (Powertrain solutions): A leading provider of powertrain components, supplying electric drive systems and battery technology to tractor manufacturers.

- CLAAS Group: A prominent manufacturer of harvesting machinery and tractors, exploring electric drive systems and sustainable power sources for its product lines.

- Deutz-Fahr (SDF Group): Offering a range of tractors, with ongoing research and development into electric and hybrid agricultural solutions.

- Yanmar Co. Ltd.: Focuses on compact utility tractors and construction equipment, with an increasing emphasis on electric and autonomous technologies.

- Goldoni (Argo Tractors S.p.A.): Specializes in compact and specialized tractors, actively developing electric models for vineyards and orchards.

- Mahindra & Mahindra Ltd.: A significant player in the global tractor market, committed to introducing electric tractor models and sustainable farming solutions.

- Sonalika Tractors: An Indian tractor manufacturer, investing in R&D for electric and smart farm equipment tailored for local and international markets.

- SDF Group (Same Deutz-Fahr): A major European tractor group, advancing electric and alternative fuel solutions across its brands.

Frequently Asked Questions

What are the primary benefits of electric farm tractors?

Electric farm tractors offer numerous advantages, including zero direct emissions, significantly reduced noise pollution, and lower operational costs due to cheaper electricity compared to diesel and reduced maintenance requirements. They also provide instant torque, enhanced integration with precision agriculture technologies, and improved operator comfort, contributing to more sustainable and efficient farming operations.

What is the projected growth rate of the electric farm tractor market?

The Electric Farm Tractor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. This robust growth reflects increasing environmental awareness, technological advancements, and rising demand for sustainable agricultural solutions globally.

What are the main challenges facing the adoption of electric farm tractors?

Key challenges include the high initial purchase cost compared to conventional tractors, the need for extensive charging infrastructure in rural areas, and current limitations in battery technology regarding capacity, charging time, and overall lifespan for prolonged heavy-duty operations. Farmer skepticism and a lack of widespread awareness also contribute to slower adoption rates.

How does AI enhance electric farm tractor capabilities?

AI significantly enhances electric farm tractors by enabling advanced autonomous navigation, optimizing precision agriculture tasks such as planting and spraying, and facilitating predictive maintenance. AI-driven analytics provide real-time insights for crop health and resource management, leading to improved yields, reduced labor, and greater operational efficiency.

Which regions are leading the adoption of electric farm tractors?

North America and Europe are currently leading in the adoption of electric farm tractors, driven by stringent environmental regulations, substantial government incentives, and a strong focus on technological innovation in agriculture. The Asia Pacific region is also emerging as a significant growth area, fueled by mechanization and sustainability initiatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager