Electric Off-Highway Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428027 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Electric Off-Highway Equipment Market Size

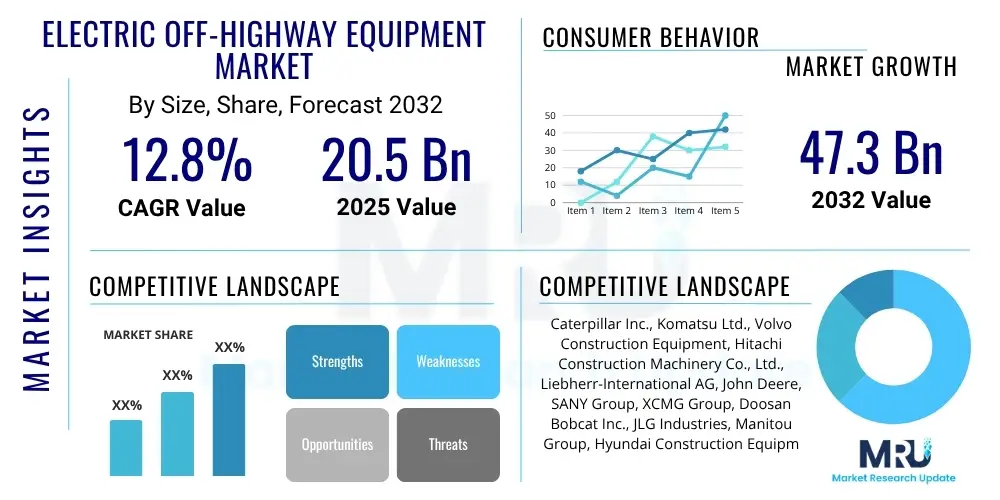

The Electric Off-Highway Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2025 and 2032. The market is estimated at USD 20.5 Billion in 2025 and is projected to reach USD 47.3 Billion by the end of the forecast period in 2032.

Electric Off-Highway Equipment Market introduction

The electric off-highway equipment market encompasses a broad range of heavy machinery and vehicles powered by electricity, designed for use in environments outside public roads. This includes construction machinery, mining equipment, agricultural tractors, material handling vehicles, and other specialized industrial apparatus. These machines primarily rely on battery-electric powertrains or hybrid-electric systems, replacing traditional internal combustion engines to achieve zero or low direct emissions, reduced noise pollution, and enhanced operational efficiency in demanding work conditions. The transition to electric power is a direct response to escalating environmental concerns, stringent regulatory mandates aimed at decarbonization, and the increasing economic viability driven by advancements in battery technology and charging infrastructure.

Key products in this evolving market segment include electric excavators, electric wheel loaders, electric dozers, electric forklifts, and electric articulated dump trucks, among others. Major applications span critical sectors such as infrastructure development, large-scale resource extraction, modern farming operations, and logistics. The adoption of electric off-highway equipment offers significant benefits, including substantial reductions in fuel consumption, lower maintenance requirements due to fewer moving parts, and improved operator comfort through quieter operation and reduced vibrations. These advantages contribute to a lower total cost of ownership over the equipment's lifecycle, making electric alternatives increasingly attractive to fleet managers and project developers seeking sustainable and economically sound solutions. Driving factors include global commitments to carbon neutrality, the imperative for cleaner urban development, and a growing emphasis on worker health and safety, all converging to accelerate the electrification trend within the heavy equipment industry.

Electric Off-Highway Equipment Market Executive Summary

The electric off-highway equipment market is experiencing robust growth, driven by an accelerating global push towards sustainable industrial practices and decarbonization targets. Business trends indicate a significant investment by leading original equipment manufacturers (OEMs) in research and development, focusing on enhancing battery performance, charging speed, and machine versatility. There is a discernible shift towards rental and leasing models for electric equipment, enabling smaller operators to access advanced technologies without significant upfront capital investment. Furthermore, digital integration, telematics, and remote diagnostics are becoming standard features, optimizing equipment utilization and predictive maintenance schedules, thereby improving overall operational efficiency and reducing downtime. The market is also witnessing consolidation and strategic partnerships as companies aim to leverage complementary expertise in electrification and heavy machinery.

Regionally, Europe and North America are at the forefront of electric off-highway equipment adoption, primarily due to stringent emission regulations, substantial government incentives, and a strong awareness of environmental sustainability. These regions benefit from well-developed charging infrastructure and a robust demand for green construction and mining practices. The Asia Pacific region, particularly China, Japan, and India, is emerging as a significant growth hub, driven by rapid urbanization, massive infrastructure projects, and increasing environmental consciousness, coupled with local manufacturing capabilities and policy support. Latin America and the Middle East & Africa are showing nascent but growing interest, particularly in mining and large-scale construction projects where the long-term operational cost benefits of electric machinery are gaining recognition, although charging infrastructure remains a key developmental hurdle.

Segmentation trends highlight that construction equipment, such as electric excavators and loaders, currently dominates the market due to the high volume of projects and immediate benefits in urban environments where noise and emissions are critical concerns. The mining sector is also rapidly electrifying, especially for underground operations, to improve air quality and safety while reducing ventilation costs. Agriculture and material handling segments are demonstrating steady growth, with electric forklifts and smaller electric utility vehicles already widely adopted, and larger electric agricultural machinery gaining traction as battery technology improves. The market is increasingly segmenting by power output and battery type, with lithium-ion batteries becoming the preferred choice due to their energy density and cycle life, influencing equipment design and performance across all application areas.

AI Impact Analysis on Electric Off-Highway Equipment Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the efficiency, safety, and operational capabilities of electric off-highway equipment. Key themes revolve around the potential for AI to optimize battery management, enable autonomous operations, facilitate predictive maintenance, and provide actionable insights from operational data. There is significant interest in how AI can extend machine life, reduce human error, and create more efficient work cycles, especially in complex and hazardous environments. Concerns often touch upon data security, the reliability of autonomous systems, and the initial investment required for AI integration, alongside the need for skilled personnel to manage and interpret AI-driven analytics. Users also anticipate AI's role in integrating electric fleets into broader smart construction or smart mining ecosystems, leading to highly optimized and interconnected operational environments.

- AI optimizes battery performance and extends life through intelligent charging and discharge cycle management.

- Predictive maintenance, enabled by AI algorithms, forecasts equipment failures, minimizing downtime and maintenance costs.

- AI drives autonomous operation capabilities, enhancing safety and efficiency in repetitive or hazardous tasks.

- Real-time operational data analysis by AI provides insights for optimizing routes, fuel consumption (in hybrids), and work patterns.

- Improved human-machine interface (HMI) with AI-powered assistance for operators, enhancing productivity and reducing fatigue.

- AI facilitates smart fleet management, enabling remote monitoring, diagnostics, and coordinated operation of multiple machines.

- Enhanced safety features through AI-powered obstacle detection, collision avoidance, and operator behavior monitoring.

- AI optimizes energy consumption by dynamically adjusting power output based on real-time task demands and terrain.

- Supports advanced telematics, providing comprehensive data streams for performance benchmarking and operational improvement.

- Enables intelligent diagnostics, helping technicians quickly identify and resolve complex electrical and mechanical issues.

DRO & Impact Forces Of Electric Off-Highway Equipment Market

The Electric Off-Highway Equipment Market is propelled by several significant drivers. Chief among these are the global imperative for decarbonization and stringent environmental regulations imposing stricter emission standards on internal combustion engine vehicles, which incentivizes the adoption of cleaner electric alternatives. The rapidly declining costs of battery technology, coupled with advancements in energy density and charging infrastructure, are making electric equipment increasingly competitive. Furthermore, the total cost of ownership (TCO) argument favors electric machines due to lower fuel expenses (electricity vs. diesel), reduced maintenance requirements stemming from fewer moving parts, and government incentives such as subsidies and tax credits, which collectively enhance the economic viability for operators. The benefits of reduced noise pollution and improved air quality also contribute to healthier work environments, especially in urban construction and enclosed mining sites, further driving demand.

However, the market faces notable restraints. The initial high upfront capital investment for electric off-highway equipment compared to their diesel counterparts remains a significant barrier for many potential buyers, particularly smaller enterprises. The perceived limitations of battery range and the availability of adequate charging infrastructure in remote or expansive project sites pose operational challenges and contribute to range anxiety. Additionally, the weight and energy density of current battery technologies can sometimes limit the sustained power and operational duration required for heavy-duty applications. The extended charging times and the need for significant electrical grid upgrades in certain areas also present practical hurdles to widespread adoption, requiring substantial planning and investment beyond just the equipment purchase.

Opportunities within this market are abundant and transformative. The continuous evolution of battery technology, including solid-state batteries and improved fast-charging capabilities, promises to address current limitations regarding range and charging times. The expansion into emerging markets, particularly in Asia Pacific and Latin America, driven by massive infrastructure projects and a growing awareness of sustainability, offers vast untapped potential. New applications for electric equipment, such as niche agricultural tasks, specialized industrial operations, and advanced material handling, are continually being explored. Moreover, the integration of autonomous capabilities and artificial intelligence (AI) with electric powertrains presents an opportunity to create highly efficient, safe, and intelligent machinery that can operate with minimal human intervention, unlocking new levels of productivity and operational savings. The development of robust recycling infrastructure for end-of-life batteries also presents a critical opportunity for sustainable market growth.

Impact forces on the market are multifaceted, encompassing technological, regulatory, economic, and competitive pressures. Technologically, breakthroughs in battery chemistry, motor efficiency, and power electronics are continually reshaping product offerings and performance benchmarks. Regulatory shifts, such as stricter emission standards and green public procurement policies, are creating a supportive environment for electric equipment. Economically, volatile fuel prices make electric alternatives more attractive, while the increasing focus on ESG (Environmental, Social, and Governance) criteria by investors and corporations drives demand for sustainable equipment. Competitively, the market is witnessing intense innovation, with established OEMs aggressively developing electric portfolios and new specialized players emerging, leading to diverse product options and competitive pricing. The societal impact of reduced pollution and noise in communities near operational sites further reinforces the positive market trajectory.

Segmentation Analysis

The Electric Off-Highway Equipment Market is comprehensively segmented to provide a detailed understanding of its diverse components and growth dynamics. These segments help in analyzing specific market trends, identifying key demand drivers, and assessing competitive landscapes across various product types, power sources, and application areas. The segmentation allows for a granular view of how different technologies and customer needs are shaping the market's evolution, offering insights for strategic planning and product development within the burgeoning electric machinery industry. Understanding these segments is crucial for stakeholders to pinpoint opportunities and allocate resources effectively within this rapidly electrifying sector.

- By Equipment Type

- Electric Excavators

- Electric Wheel Loaders

- Electric Dozers

- Electric Material Handlers (e.g., telescopic handlers, reach stackers)

- Electric Forklifts

- Electric Dump Trucks

- Electric Compact Track Loaders

- Electric Skid Steer Loaders

- Electric Graders

- Electric Backhoe Loaders

- Other Electric Off-Highway Equipment (e.g., utility vehicles, aerial work platforms)

- By Battery Type

- Lithium-ion Batteries

- Lead-acid Batteries

- Other Battery Technologies (e.g., Solid-state, Nickel-metal hydride)

- By Application

- Construction

- Mining

- Agriculture

- Material Handling

- Forestry

- Landscaping

- Other Applications (e.g., Municipal, Marine Ports)

- By Power Output

- Less than 50 kW

- 50 kW to 200 kW

- More than 200 kW

Value Chain Analysis For Electric Off-Highway Equipment Market

The value chain for the electric off-highway equipment market begins with the upstream suppliers of critical raw materials and components, which form the foundational elements of these advanced machines. This includes suppliers of lithium, cobalt, nickel, and other minerals essential for battery manufacturing, as well as manufacturers of high-performance electric motors, power electronics, inverters, and sophisticated control systems. These upstream participants are crucial for innovation in battery chemistry, motor efficiency, and overall system integration, directly impacting the performance, cost, and availability of electric equipment. Strategic partnerships and long-term supply agreements at this stage are vital for OEMs to ensure a stable supply of high-quality, cost-effective components, especially given the geopolitical sensitivities surrounding some raw materials.

Midstream activities involve the original equipment manufacturers (OEMs) who design, assemble, and test the electric off-highway machines. This stage incorporates advanced engineering, manufacturing processes, and quality control to integrate electric powertrains, battery packs, and control systems into robust chassis designed for demanding off-highway applications. OEMs are increasingly investing in specialized production lines, R&D facilities, and software development teams to differentiate their products through innovative features, improved performance metrics, and enhanced digital connectivity. This phase also includes the development of charging solutions, battery swapping technologies, and telematics systems that are integral to the holistic electric equipment offering. The ability of OEMs to manage complex supply chains and efficiently scale production is a key determinant of success in this competitive market.

Downstream, the value chain extends to distribution channels, end-users, and post-sales support. Distribution involves both direct sales from OEMs to large fleet operators and indirect sales through extensive dealer networks that provide local sales, service, and parts support. Rental companies also play a significant role, offering flexible access to electric equipment and helping to drive adoption. End-users span construction companies, mining operators, agricultural enterprises, logistics firms, and municipalities, all of whom seek efficient, sustainable, and reliable machinery. Post-sales services, including maintenance, repairs, parts supply, and battery recycling or second-life applications, are critical for ensuring customer satisfaction, maximizing equipment uptime, and promoting sustainability throughout the product lifecycle. The effectiveness of this downstream network directly influences market penetration and customer loyalty, making robust service infrastructure a competitive advantage.

The distribution channels for electric off-highway equipment encompass both direct and indirect approaches. Direct sales are typically preferred for large fleet procurements by major construction, mining, or agricultural companies, where OEMs can offer customized solutions, direct technical support, and potentially more favorable pricing. This allows for closer customer relationships and direct feedback loops for product improvement. Indirect channels, through a network of authorized dealers and distributors, are essential for reaching a broader customer base, including small and medium-sized enterprises (SMEs) and individual operators. These dealers provide localized sales expertise, financing options, maintenance services, and access to genuine spare parts, acting as crucial intermediaries that bridge the gap between manufacturers and diverse end-users. The rising prominence of online platforms and digital configurators also represents an evolving indirect channel, enhancing accessibility and streamlining the purchasing process for certain equipment types. Furthermore, the burgeoning equipment rental market serves as a hybrid channel, enabling both direct interaction with large rental companies and indirect access for numerous smaller users through the rental fleets.

Electric Off-Highway Equipment Market Potential Customers

The primary potential customers and end-users of electric off-highway equipment span a wide array of industries, each driven by specific operational needs and sustainability objectives. Within the construction sector, major players include large-scale general contractors involved in infrastructure development, commercial building, and residential construction. These companies are increasingly seeking electric excavators, loaders, and compact equipment to meet evolving urban emission regulations, reduce noise pollution in sensitive areas, and capitalize on the long-term operational cost savings offered by electric machinery. The ability to operate indoors or in confined spaces without exhaust fumes is a significant draw for tunnel construction, demolition, and specialized building projects, positioning construction as a leading adopter of electric off-highway solutions.

In the mining industry, electric off-highway equipment finds significant appeal, particularly for underground operations where ventilation costs are substantial, and air quality is a critical safety concern. Mining companies are investing in electric haul trucks, loaders, and drill rigs to improve worker health, reduce operational expenses associated with ventilation and fuel, and enhance overall productivity through automation. Surface mining operations also benefit from the reduced noise and emissions, aligning with corporate social responsibility initiatives and environmental compliance. Agricultural enterprises, ranging from large commercial farms to smaller independent growers, represent another growing customer base. They utilize electric tractors, utility vehicles, and specialized farm machinery to reduce fuel costs, minimize environmental impact, and take advantage of quieter operations that disturb livestock less and enable extended working hours without noise complaints.

Furthermore, material handling and logistics companies are significant end-users, with electric forklifts, reach stackers, and port equipment already widely adopted due to their efficiency, low emissions, and suitability for indoor and warehouse environments. Rental equipment companies also constitute a crucial customer segment, as they act as intermediaries, purchasing electric off-highway machines to offer them to a diverse client base that may not be ready for direct capital investment. Government agencies and municipal authorities also represent potential buyers, driven by public sector commitments to green procurement and sustainable urban development initiatives, using electric equipment for landscaping, public works, and maintenance tasks. The expanding interest in autonomous operations across these sectors further strengthens the demand for electric platforms, which are inherently more conducive to electrification and digital control, making them future-proof investments for a broad spectrum of industrial and commercial applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 20.5 Billion |

| Market Forecast in 2032 | USD 47.3 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Liebherr-International AG, John Deere, SANY Group, XCMG Group, Doosan Bobcat Inc., JLG Industries, Manitou Group, Hyundai Construction Equipment, Kubota Corporation, JCB (J.C. Bamford Excavators Ltd.), LiuGong Machinery Co., Ltd., Epiroc AB, Sandvik AB, Metso Outotec, Wacker Neuson SE, Kalmar (Cargotec Corporation) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Off-Highway Equipment Market Key Technology Landscape

The Electric Off-Highway Equipment Market is characterized by a dynamic and rapidly evolving technology landscape, with innovation focused on maximizing efficiency, performance, and sustainability. Central to this landscape are advancements in battery technology, primarily lithium-ion chemistries, which offer increasingly higher energy density, longer cycle life, and faster charging capabilities. Research and development are also exploring next-generation battery solutions, such as solid-state batteries, which promise even greater safety, energy density, and reduced weight. These battery improvements are crucial for extending the operational range and power output of heavy electric machinery, addressing one of the core challenges of electrification in demanding applications. Simultaneously, sophisticated battery management systems (BMS) are vital for optimizing battery performance, monitoring health, and ensuring safety during operation and charging cycles.

Beyond batteries, the market relies heavily on high-efficiency electric powertrains, which include advanced electric motors and power electronics. These systems are designed to deliver instant torque, precise control, and high energy conversion efficiency, often incorporating regenerative braking capabilities to recover energy during deceleration and extend operational time. Fast-charging technologies, including ultra-fast DC chargers and standardized charging interfaces, are essential for minimizing downtime and maximizing equipment utilization, particularly in demanding work environments. Wireless charging solutions are also being explored for certain applications to enhance convenience and operational flexibility. The integration of advanced telematics and IoT (Internet of Things) platforms allows for real-time remote monitoring of equipment performance, battery status, and operational parameters, enabling predictive maintenance and optimized fleet management.

Furthermore, the technology landscape is increasingly shaped by the adoption of automation and artificial intelligence (AI). Sensor fusion, GPS, LiDAR, and radar technologies are enabling increasingly sophisticated autonomous operation capabilities for tasks such as excavation, loading, and hauling, significantly enhancing safety and efficiency in repetitive or hazardous environments. AI algorithms are employed for predictive analytics, optimizing operational routes, managing energy consumption, and providing intelligent diagnostics to minimize unexpected breakdowns. The development of robust control software and sophisticated human-machine interfaces (HMIs) further enhances operator comfort and productivity, facilitating the transition from traditional diesel machines to advanced electric counterparts. These technological integrations are not only driving performance improvements but also creating a connected ecosystem that transforms how off-highway equipment is operated, maintained, and managed, ushering in an era of intelligent, sustainable heavy machinery.

Regional Highlights

- North America: This region is a significant market, driven by substantial infrastructure spending, increasing adoption of sustainable construction practices, and robust regulatory support for reducing emissions. Countries like the United States and Canada are witnessing growing demand for electric excavators, loaders, and material handling equipment, supported by technological readiness and strong investment in charging infrastructure development.

- Europe: Leading the global transition, Europe benefits from stringent environmental policies, ambitious decarbonization targets, and significant government incentives for electric vehicles and machinery. Nations such as Germany, France, the UK, and Nordic countries are pioneers in adopting electric off-highway equipment, particularly in urban construction and mining, emphasizing reduced noise and air pollution.

- Asia Pacific (APAC): Emerging as a high-growth region, APAC is characterized by rapid urbanization, massive infrastructure projects (especially in China, India, and Southeast Asia), and increasing awareness of environmental sustainability. China, in particular, is a major manufacturing hub and consumer, with local OEMs aggressively developing and deploying electric off-highway solutions. Japan and South Korea also contribute with advanced technology and strong industrial bases.

- Latin America: This region shows promising growth, particularly in the mining and construction sectors. Countries like Chile, Brazil, and Peru are exploring electric off-highway equipment to enhance operational efficiency, improve worker safety in mines, and align with global sustainability trends, though investment in charging infrastructure remains a key challenge.

- Middle East & Africa (MEA): The MEA region is witnessing increasing adoption due to large-scale construction projects (e.g., in Saudi Arabia and UAE) and a growing focus on diversifying economies away from fossil fuels. Green initiatives and smart city developments are creating opportunities for electric off-highway machinery, with an emphasis on sustainable practices and reduced operational costs in the long term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Off-Highway Equipment Market.- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- Hitachi Construction Machinery Co., Ltd.

- Liebherr-International AG

- John Deere

- SANY Group

- XCMG Group

- Doosan Bobcat Inc.

- JLG Industries

- Manitou Group

- Hyundai Construction Equipment

- Kubota Corporation

- JCB (J.C. Bamford Excavators Ltd.)

- LiuGong Machinery Co., Ltd.

- Epiroc AB

- Sandvik AB

- Metso Outotec

- Wacker Neuson SE

- Kalmar (Cargotec Corporation)

Frequently Asked Questions

What are the primary benefits of using electric off-highway equipment?

The primary benefits include significantly reduced emissions and noise pollution, lower operational costs due to decreased fuel consumption and maintenance, and improved operator comfort, contributing to a lower total cost of ownership over the equipment's lifespan.

What are the main challenges hindering the widespread adoption of electric off-highway equipment?

Key challenges involve the high initial capital investment, the current limitations in battery range and charging infrastructure, and the longer charging times compared to traditional refueling, which can impact operational efficiency in certain remote or intensive applications.

How is artificial intelligence (AI) impacting the Electric Off-Highway Equipment market?

AI is transforming the market by enabling predictive maintenance, optimizing battery management, facilitating autonomous operations for enhanced safety and efficiency, and providing data-driven insights for improved fleet management and operational planning.

Which applications are currently driving the most demand for electric off-highway equipment?

The construction sector, particularly urban infrastructure and specialized indoor projects, along with the mining industry for underground operations, and the material handling segment, are currently the main drivers of demand due to stringent regulations and operational advantages.

What is the future outlook for the Electric Off-Highway Equipment market?

The future outlook is robust, with strong growth anticipated due to continuous advancements in battery technology, expanding charging infrastructure, increasing environmental regulations, and growing government and corporate commitments to sustainability, making electric solutions more viable and attractive.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager