Electric Public Transport System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430284 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Electric Public Transport System Market Size

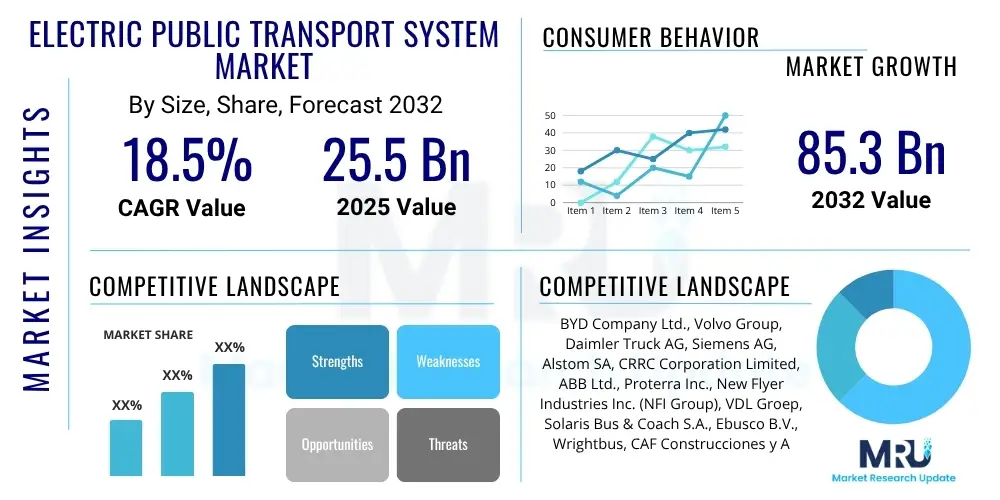

The Electric Public Transport System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at $25.5 Billion in 2025 and is projected to reach $85.3 Billion by the end of the forecast period in 2032.

Electric Public Transport System Market introduction

The Electric Public Transport System Market encompasses the development, manufacturing, and deployment of electrically powered vehicles and associated infrastructure for collective passenger movement within urban and intercity environments. This includes electric buses, trams, light rail, trains, and even some electric ferries, all designed to offer sustainable and efficient alternatives to traditional fossil fuel-dependent transport. These systems aim to reduce carbon emissions, mitigate noise pollution, and enhance urban air quality, aligning with global efforts towards decarbonization and sustainable urban development.

The product description for electric public transport systems typically involves advanced battery technologies, electric motors, robust charging infrastructure, and sophisticated control systems. Major applications span urban transit for daily commuting, intercity connections for regional travel, and specialized services like airport shuttles or tourist transport. The inherent benefits include lower operational costs due to reduced fuel consumption and maintenance, improved passenger experience with quieter rides, and significant environmental advantages through zero tailpipe emissions. The driving factors for this market are primarily stringent environmental regulations, growing government subsidies and incentives for electrification, rapid technological advancements in battery efficiency and charging solutions, and increasing public demand for greener and more efficient transport options in densely populated areas.

The continuous innovation in power electronics and energy management systems further enhances the viability and performance of these electric fleets. Cities worldwide are recognizing the long-term economic and ecological advantages of transitioning their public transit networks to electric power, prompting significant investments in both vehicles and the necessary grid upgrades. This shift is not merely about replacing existing vehicles but about fundamentally transforming urban mobility landscapes, making them more resilient and sustainable for future generations.

Electric Public Transport System Market Executive Summary

The Electric Public Transport System market is experiencing robust expansion, driven by accelerating global commitments to climate action and ambitious decarbonization targets set by governments and municipalities. Business trends indicate a strong focus on public private partnerships, where technology providers and infrastructure developers collaborate with transit authorities to deploy comprehensive electric mobility solutions. There is also a notable trend towards modular and scalable charging infrastructure solutions, capable of supporting diverse fleet sizes and operational demands. Manufacturers are increasingly integrating smart technologies like telematics and predictive maintenance into their electric vehicles, improving operational efficiency and reducing downtime. The competitive landscape is characterized by established automotive players diversifying into electric commercial vehicles, alongside emerging pure-play electric transport innovators.

Regional trends reveal Asia Pacific, particularly China, as a dominant force in market adoption, benefiting from strong government support and high urbanization rates driving demand for mass transit. Europe is also a key region, with progressive environmental policies and significant investments in electric bus and tram networks across various cities. North America is showing accelerated growth, partly due to federal and state-level incentives aimed at reducing emissions and modernizing aging public transport infrastructure. Latin America, the Middle East, and Africa are nascent but rapidly developing markets, with increasing pilot projects and long-term electrification plans emerging as urban populations expand and environmental awareness grows, signaling a global shift towards sustainable transit.

Segment trends highlight electric buses as the largest and most rapidly growing segment due to their versatility and relatively lower infrastructure investment compared to rail systems. Battery electric vehicles (BEV) dominate within the power source segment, though advancements in fuel cell electric vehicles (FCEV) are presenting alternative long-range solutions. The charging infrastructure segment is witnessing substantial investment and innovation, crucial for supporting widespread fleet electrification. Urban transit remains the primary application area, but intercity electric rail and specialized electric shuttles are also gaining traction. The market is also seeing a shift towards integrated service offerings, where vehicle provision, charging, and maintenance are bundled, simplifying adoption for transit operators.

AI Impact Analysis on Electric Public Transport System Market

User inquiries about AI's impact on electric public transport frequently center on how artificial intelligence can enhance efficiency, safety, and overall operational intelligence. Common questions revolve around AI's role in optimizing route planning, managing energy consumption, and implementing predictive maintenance to prevent breakdowns. Users are keen to understand how AI can improve passenger flow, personalize travel experiences, and contribute to the autonomous operation of electric vehicles. There are also concerns regarding data privacy, the ethical implications of AI-driven decision-making, and the initial investment and complexity associated with integrating advanced AI systems into existing infrastructure. Expectations are high for AI to deliver substantial operational savings and contribute to a more seamless, responsive, and safer public transport network.

Artificial intelligence is set to revolutionize electric public transport by providing capabilities that go beyond traditional operational management. Through sophisticated data analytics, AI algorithms can process vast amounts of real-time information from vehicles, sensors, and traffic patterns to make immediate and informed decisions. This leads to more dynamic scheduling, adaptive service adjustments based on demand fluctuations, and more accurate arrival predictions, significantly improving passenger satisfaction and operational fluidity. Furthermore, AI plays a pivotal role in optimizing charging strategies for electric fleets, ensuring vehicles are charged efficiently during off-peak hours or when renewable energy sources are abundant, thereby reducing energy costs and grid strain. Its ability to learn from historical data allows for continuous improvement in these critical areas.

The integration of AI also profoundly impacts safety and maintenance protocols within electric public transport systems. AI-powered diagnostic tools can monitor vehicle performance in real time, detecting anomalies and predicting potential component failures before they occur, shifting from reactive repairs to proactive maintenance schedules. This predictive capability minimizes unexpected downtime, extends the lifespan of expensive assets, and enhances overall fleet reliability. For safety, AI can assist in driver assistance systems, object detection, and even autonomous driving capabilities for certain segments, reducing human error and improving incident response times. Ultimately, AI transforms electric public transport into a smarter, more resilient, and ultimately more user-centric ecosystem.

- Enhanced route and schedule optimization through real-time traffic and demand analysis.

- Predictive maintenance for electric vehicles and charging infrastructure, minimizing downtime.

- Optimized energy management for charging processes, reducing electricity costs and grid impact.

- Improved passenger experience via personalized information, dynamic signage, and on-demand services.

- Autonomous driving capabilities for specific segments like shuttles, increasing operational efficiency.

- Advanced safety features including obstacle detection, driver assistance, and incident prevention.

- Dynamic pricing and fare collection systems based on demand and capacity.

- Better resource allocation for drivers and vehicles through AI-driven planning.

DRO & Impact Forces Of Electric Public Transport System Market

The Electric Public Transport System market is powerfully influenced by a confluence of driving forces, significant restraints, and emerging opportunities, all contributing to its dynamic impact. Key drivers include the urgent global imperative for decarbonization and stringent environmental regulations aimed at reducing urban pollution, which push governments and municipalities to invest heavily in electric fleets. Rapid technological advancements in battery energy density, charging speeds, and vehicle performance are making electric options increasingly viable and attractive. Furthermore, rising fuel prices for conventional vehicles make the operational cost savings of electric systems more compelling, while increasing public awareness and demand for sustainable urban living bolster political will and investment. These factors collectively create a strong momentum for market growth, underpinned by significant policy support and consumer preference shifts towards eco-friendly mobility solutions.

Despite the strong tailwinds, several restraints temper the growth potential of the Electric Public Transport System market. The high upfront capital expenditure for purchasing electric vehicles and installing extensive charging infrastructure remains a significant barrier, especially for developing economies or budget-constrained municipalities. Challenges associated with battery range limitations, particularly in colder climates or for long-distance routes, along with concerns about the availability and reliability of charging points, contribute to range anxiety. The existing grid infrastructure in many regions may not be fully equipped to handle the substantial energy demands of large-scale electric fleet charging, necessitating costly upgrades. Furthermore, the lack of standardized charging protocols and vehicle specifications can complicate procurement and interoperability, hindering seamless integration across different systems and regions. These hurdles demand concerted efforts in policy, technology, and infrastructure development to overcome.

Opportunities within the Electric Public Transport System market are vast and continually expanding, promising accelerated growth and innovation. The rapid evolution of battery technology, including solid-state batteries and other next-generation chemistries, holds the potential to significantly reduce costs, increase range, and shorten charging times. The development of smart city initiatives worldwide provides a fertile ground for integrating electric public transport with intelligent traffic management, smart grids, and autonomous mobility solutions, creating highly efficient and interconnected urban ecosystems. Emerging markets, with their burgeoning urban populations and often less developed existing transport infrastructure, represent significant greenfield opportunities for direct adoption of electric systems. Moreover, the circular economy principles focused on battery recycling and second-life applications are creating new business models and sustainability benefits. The continuous push for enhanced vehicle-to-grid (V2G) capabilities also offers potential for electric fleets to serve as mobile energy storage units, further enhancing grid stability and energy efficiency, transforming public transport into a dynamic component of the energy network.

Segmentation Analysis

The Electric Public Transport System market is meticulously segmented to provide a granular understanding of its diverse components and evolving dynamics. This segmentation allows for targeted strategic planning and investment, identifying specific growth areas across various vehicle types, essential components, primary applications, and operational models. The comprehensive analysis highlights that while electric buses currently hold a dominant share, other segments like electric trains and trams are pivotal for high-capacity routes, while advanced charging infrastructure forms the backbone of the entire ecosystem. Understanding these distinctions is critical for stakeholders looking to capitalize on specific market niches or develop integrated solutions.

- By Vehicle Type

- Electric Buses (Battery Electric Buses, Fuel Cell Electric Buses)

- Electric Trams/Light Rail

- Electric Trains (Commuter Rail, Metro, High-Speed Rail)

- Electric Ferries/Water Taxis

- Electric Vans/Shuttles

- By Component

- Battery Packs (Lithium-ion, Solid-state, Other advanced chemistries)

- Electric Motors

- Power Electronics (Inverters, Converters)

- Charging Infrastructure (Depot Chargers, On-route Chargers, Inductive Charging, Pantograph Charging)

- Telematics and Control Systems

- Energy Management Systems

- By Application

- Urban Transit

- Intercity Transit

- Last-Mile Connectivity

- Tourist Transport

- Specialized Transport (e.g., Airport Shuttles)

- By Power Source

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-in Hybrid Electric Vehicle (PHEV) (for transitional fleets)

- By End-User/Operator Type

- Government/Municipal Transport Authorities

- Public-Private Partnerships (PPP)

- Private Fleet Operators

Value Chain Analysis For Electric Public Transport System Market

The value chain for the Electric Public Transport System market begins with a complex upstream analysis focused on the extraction and processing of critical raw materials such as lithium, cobalt, nickel, and copper, essential for battery and motor manufacturing. This stage involves specialized mining companies and chemical processing firms. Following this, various component manufacturers produce key elements like battery cells and packs, electric motors, power electronics (inverters, converters), and advanced sensors. These component suppliers often operate globally, providing specialized parts to vehicle assemblers. The upstream segment is characterized by intense R&D to improve material efficiency, reduce costs, and enhance performance, especially in battery technology, which forms a significant portion of the total vehicle cost. Strong relationships and supply chain transparency in this segment are crucial for ensuring ethical sourcing and stable supply.

Moving downstream, the value chain encompasses vehicle assembly, system integration, and ultimately, the delivery and operation of electric public transport systems. Vehicle manufacturers integrate the various components, including chassis, powertrains, and control systems, to produce electric buses, trams, or trains. This stage often involves significant engineering and design capabilities to ensure vehicles meet stringent safety, performance, and accessibility standards. Following vehicle production, system integrators play a vital role in deploying comprehensive solutions, which include not only the vehicles but also the necessary charging infrastructure, energy management systems, and fleet management software. These integrators often work closely with public transport authorities to tailor solutions to specific operational requirements and urban layouts. The downstream activities are focused on delivering a complete, functional, and efficient transport system to the end-users.

The distribution channels for electric public transport systems are primarily direct and indirect, often involving a blend of approaches due to the scale and complexity of procurement. Direct sales occur when public transport authorities or large private operators purchase vehicles and infrastructure directly from manufacturers, often through competitive bidding and long-term contracts. Indirect channels involve system integrators, consultants, or specialized project developers who facilitate the procurement and deployment process, often acting as intermediaries between manufacturers and end-users. These channels often include partnerships with utility companies for grid connection and energy supply. After-sales services, including maintenance, spare parts supply, and software updates, form a critical part of the distribution and ongoing support, ensuring the longevity and reliability of the electric public transport assets. This involves a network of service centers and technical support teams, often directly from manufacturers or through authorized service partners, ensuring continuous operational excellence.

Electric Public Transport System Market Potential Customers

The potential customers and end-users of Electric Public Transport Systems are diverse, primarily comprising governmental bodies and public entities responsible for urban and regional mobility. Municipal corporations and city transport authorities are key buyers, as they are tasked with developing, operating, and maintaining efficient and sustainable public transit networks within their jurisdictions. These entities often procure entire fleets of electric buses, trams, or light rail systems, along with the associated charging infrastructure, to meet public demand and achieve environmental targets. Their procurement decisions are heavily influenced by public policy, budgetary allocations, and the long-term operational and environmental benefits of electric transport, making them central to market growth and adoption.

Beyond traditional public authorities, the market also targets public-private partnerships (PPPs) and private fleet operators who manage various forms of collective transport. PPPs are increasingly common, combining public sector funding and regulatory oversight with private sector efficiency and technological expertise to deliver large-scale infrastructure projects. Private bus and shuttle operators, particularly those serving airports, corporate campuses, or tourist destinations, represent another significant customer segment looking to electrify their fleets to reduce operating costs, enhance their corporate image, and comply with evolving emission standards. As the drive for smart cities intensifies, urban planners and developers also emerge as potential customers, integrating electric transport solutions as foundational elements of future urban ecosystems, seeking comprehensive, zero-emission mobility platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $25.5 Billion |

| Market Forecast in 2032 | $85.3 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BYD Company Ltd., Volvo Group, Daimler Truck AG, Siemens AG, Alstom SA, CRRC Corporation Limited, ABB Ltd., Proterra Inc., New Flyer Industries Inc. (NFI Group), VDL Groep, Solaris Bus & Coach S.A., Ebusco B.V., Wrightbus, CAF Construcciones y Auxiliar de Ferrocarriles, Kinki Sharyo Co. Ltd., Stadler Rail AG, Škoda Transportation a.s., GreenPower Motor Company Inc., Scania AB, Hitachi Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Public Transport System Market Key Technology Landscape

The Electric Public Transport System market is continuously shaped by a dynamic and evolving technology landscape, with innovations focused on enhancing efficiency, range, charging capabilities, and overall system intelligence. At the core are advancements in battery technology, particularly the shift towards higher energy density lithium-ion batteries that offer longer ranges and faster charging times. Research into solid-state batteries promises even greater safety, energy density, and cycle life, potentially revolutionizing the market in the coming years. Beyond the batteries themselves, sophisticated Battery Management Systems (BMS) are crucial for optimizing battery performance, extending lifespan, and ensuring safety through precise monitoring and control of charge and discharge cycles.

Charging infrastructure technologies are equally vital, progressing rapidly from traditional plug-in depot charging to more advanced solutions like pantograph-based fast charging at bus stops, and even inductive charging pads embedded in roads for wireless power transfer. These innovations aim to minimize vehicle downtime and integrate seamlessly into urban environments. Power electronics, including efficient inverters and converters, play a critical role in managing the flow of electricity between the battery, motor, and auxiliary systems, maximizing energy conversion efficiency. The development of Vehicle-to-Grid (V2G) technology is also gaining traction, allowing electric public transport vehicles to feed surplus energy back to the grid during off-peak hours, thereby acting as mobile energy storage units and contributing to grid stability and resilience, creating a symbiotic relationship between transport and energy sectors.

Furthermore, the integration of digital technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and advanced telematics is transforming operational intelligence within electric public transport. IoT sensors embedded in vehicles and infrastructure collect vast amounts of data on performance, traffic, and environmental conditions, which AI algorithms then process to optimize routes, predict maintenance needs, and manage energy consumption more effectively. Cloud-based fleet management platforms provide real-time monitoring and control, enabling operators to make data-driven decisions. The future also holds increasing promise for autonomous driving capabilities, especially for shuttles and fixed-route systems, which could further enhance operational efficiency, reduce labor costs, and improve safety, making public transport even more responsive and intelligent.

Regional Highlights

- Asia Pacific (APAC): Dominates the global electric public transport market, largely driven by countries like China, which has aggressively adopted electric buses and trains due to severe urban pollution challenges and strong government mandates. India and Southeast Asian nations are rapidly catching up, investing heavily in modernizing their public transit networks with electric alternatives, fueled by rapid urbanization and infrastructure development projects. This region benefits from established manufacturing capabilities and significant government subsidies that incentivize electrification.

- Europe: A leading region in sustainable mobility, exhibiting robust growth in electric public transport, particularly in Western and Northern Europe. Countries like Germany, France, the UK, and the Netherlands are at the forefront, driven by stringent emission regulations, ambitious decarbonization targets, and substantial public funding for electric bus fleets and advanced tram networks. European cities often prioritize integrated, multi-modal electric transport solutions.

- North America: Witnessing significant momentum, especially in the United States and Canada, propelled by federal and state-level initiatives aimed at reducing emissions and upgrading aging infrastructure. Growing environmental awareness, coupled with increasing investments from public transit agencies and private operators, is accelerating the adoption of electric buses and school buses. The focus is also on developing resilient charging infrastructure.

- Latin America: An emerging market with increasing interest and pilot projects for electric public transport. Countries such as Chile, Colombia, and Brazil are leading the adoption of electric buses in major cities, aiming to combat air pollution and improve urban mobility. The market here is characterized by partnerships with international manufacturers and innovative financing models to overcome initial capital barriers.

- Middle East and Africa (MEA): Gradually progressing in the adoption of electric public transport, primarily in countries with smart city initiatives and significant investment capabilities, like the UAE and Saudi Arabia. The region is exploring electrification to diversify its energy landscape and enhance urban sustainability, often starting with electric bus fleets for public and tourist transport, with long-term infrastructure plans in development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Public Transport System Market.- BYD Company Ltd.

- Volvo Group

- Daimler Truck AG

- Siemens AG

- Alstom SA

- CRRC Corporation Limited

- ABB Ltd.

- Proterra Inc.

- New Flyer Industries Inc. (NFI Group)

- VDL Groep

- Solaris Bus & Coach S.A.

- Ebusco B.V.

- Wrightbus

- CAF Construcciones y Auxiliar de Ferrocarriles

- Kinki Sharyo Co. Ltd.

- Stadler Rail AG

- Škoda Transportation a.s.

- GreenPower Motor Company Inc.

- Scania AB

- Hitachi Ltd.

Frequently Asked Questions

What are the primary benefits of adopting Electric Public Transport Systems?

The main benefits include significantly reduced carbon emissions and air pollution, lower operational costs due to cheaper electricity and reduced maintenance, quieter vehicle operation improving urban soundscapes, and enhanced energy security through decreased reliance on fossil fuels. These systems contribute directly to a healthier and more sustainable urban environment.

What are the biggest challenges facing the widespread adoption of Electric Public Transport?

Key challenges involve the high upfront capital investment for electric vehicles and charging infrastructure, concerns about battery range and longevity, the need for extensive grid upgrades to support increased electricity demand, and the complexities of establishing standardized charging protocols. Overcoming these requires significant policy support and technological advancements.

How is charging infrastructure evolving to support large electric fleets?

Charging infrastructure is evolving rapidly, moving beyond basic depot charging to include advanced solutions like high-power pantograph charging at bus stops for quick top-ups, inductive wireless charging embedded in roadways, and smart charging systems that optimize energy use. The development of Vehicle-to-Grid (V2G) technology is also promising, allowing vehicles to contribute to grid stability.

Which regions are leading in the adoption of Electric Public Transport Systems?

Asia Pacific, particularly China, is a dominant leader due to extensive government support and rapid urbanization. Europe, with countries like Germany and the UK, also shows strong leadership driven by stringent environmental policies and significant public investments in electric bus and tram networks. North America is accelerating its adoption with increasing federal and state incentives.

What role does AI play in improving Electric Public Transport operations?

AI significantly enhances operations by optimizing routes and schedules in real-time, enabling predictive maintenance for vehicles and infrastructure, managing energy consumption for efficient charging, and improving overall passenger experience through dynamic information. AI also contributes to advanced safety features and the development of autonomous transport capabilities, making systems smarter and more efficient.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager