Electric Vehicle Battery Housing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428195 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Electric Vehicle Battery Housing Market Size

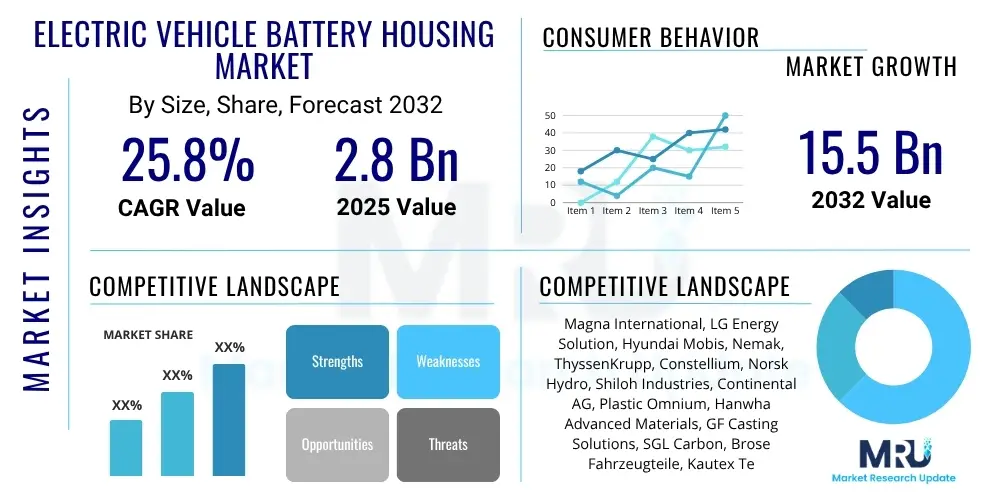

The Electric Vehicle Battery Housing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.8% between 2025 and 2032. The market is estimated at $2.8 Billion USD in 2025 and is projected to reach $15.5 Billion USD by the end of the forecast period in 2032.

Electric Vehicle Battery Housing Market introduction

The Electric Vehicle Battery Housing Market is a critical component within the rapidly expanding electric vehicle ecosystem, forming the protective enclosure for the battery cells, modules, and associated thermal management and electronic systems. This robust housing is engineered to shield the battery pack from external impacts, vibrations, moisture, and extreme temperatures, ensuring the safety and longevity of the EV's most expensive component. The fundamental product description encompasses a complex structural assembly, often incorporating advanced materials like aluminum alloys, high-strength steel, and composite materials, designed for optimal crashworthiness, thermal performance, and weight reduction. Its design is intrinsically linked to the vehicle's architecture, including skateboard platforms and module-based integration, significantly impacting vehicle performance, range, and overall structural integrity. The primary applications of these battery housings span the entire spectrum of electric vehicles, from passenger cars, including sedans, SUVs, and compact urban vehicles, to heavy-duty commercial vehicles such as electric buses, trucks, and vans, and even extending to specialized industrial EVs and marine applications. Each application demands specific design considerations regarding size, material strength, thermal dissipation capabilities, and resistance to environmental factors.

The benefits derived from advanced electric vehicle battery housings are multifaceted and profound, extending beyond mere protection. They contribute significantly to passenger safety by preventing thermal runaway propagation and containing potential hazards in the event of a collision. Furthermore, optimized housing designs facilitate efficient thermal management, which is crucial for extending battery life, enhancing charging speeds, and improving overall vehicle performance, especially in varying climatic conditions. Lightweighting initiatives through material innovation reduce the total vehicle weight, directly translating to increased range and improved energy efficiency, thereby addressing a primary consumer concern. Additionally, these housings play a pivotal role in simplifying battery pack assembly, enhancing manufacturability, and potentially reducing production costs through integrated designs and advanced manufacturing techniques. The driving factors propelling the growth of this market are numerous and powerful. Foremost among these is the accelerating global adoption of electric vehicles, spurred by stringent emissions regulations, government incentives, and increasing consumer awareness regarding environmental sustainability. Advancements in battery technology, leading to higher energy densities and faster charging capabilities, necessitate more sophisticated and safer housing solutions. Furthermore, ongoing innovations in material science, particularly in lightweight metals and advanced composites, along with improvements in manufacturing processes like extrusion, casting, and advanced joining techniques, are enabling the production of more efficient, safer, and cost-effective battery housings. The relentless pursuit of enhanced vehicle safety standards and the continuous drive for extended EV range are also paramount in stimulating demand and innovation within this vital market segment.

Electric Vehicle Battery Housing Market Executive Summary

The Executive Summary for the Electric Vehicle Battery Housing Market highlights a robust period of unprecedented growth and transformative innovation, underpinned by the global transition towards sustainable mobility. Business trends indicate a strong push towards strategic collaborations between material suppliers, component manufacturers, and original equipment manufacturers (OEMs) to co-develop advanced housing solutions that meet evolving performance, safety, and cost requirements. There is a discernible shift towards multi-material designs, leveraging the strengths of aluminum for lightweighting, steel for structural integrity, and composites for design flexibility and thermal insulation. Automation in manufacturing, including advanced robotics and digital twin technologies, is becoming increasingly prevalent to enhance production efficiency and precision. Furthermore, the market is experiencing a consolidation phase, with larger players acquiring specialized firms to broaden their material portfolios and technological capabilities, alongside a burgeoning ecosystem of startups introducing novel design concepts and manufacturing methodologies. The emphasis on modularity and standardization in housing designs is gaining traction to streamline production across various EV models and reduce time-to-market. Another critical business trend is the increasing focus on the recyclability and sustainability of housing materials, driven by regulatory pressures and corporate environmental responsibilities, leading to innovations in design for disassembly and the use of recycled content.

Regional trends reveal Asia Pacific, particularly China, as the dominant force in terms of both production and consumption of electric vehicle battery housings, largely due to the region's massive EV manufacturing base and supportive government policies. Europe is witnessing significant investments in local battery gigafactories and associated component manufacturing, driven by ambitious decarbonization targets and a strong focus on circular economy principles. North America is experiencing a resurgence in EV manufacturing, with substantial government incentives promoting domestic production and supply chain development, leading to increased demand for localized battery housing solutions. Emerging markets in Latin America, the Middle East, and Africa are showing nascent but growing potential as EV adoption slowly expands, creating future growth opportunities, though currently, they rely heavily on imports. Each region presents unique challenges and opportunities, influenced by local regulatory frameworks, infrastructure development, and consumer preferences. For instance, the demand for robust, high-performance housings for electric buses and trucks is particularly strong in urbanized regions of Asia and Europe, while North America’s diverse geography drives demand for varied thermal management solutions.

Segment trends underscore the increasing importance of material innovation, with aluminum alloys maintaining a leading position due to their lightweight and recyclable properties, closely followed by high-strength steel for its cost-effectiveness and excellent crash protection. Composites, including carbon fiber reinforced plastics (CFRP) and glass fiber reinforced plastics (GFRP), are gaining traction for premium and high-performance EVs where weight reduction is paramount and complex geometries are desired. The market is also segmented by vehicle type, with passenger EVs representing the largest share, although commercial EVs are projected to exhibit the fastest growth rates driven by fleet electrification. In terms of design, integrated housing solutions that form part of the vehicle's structural chassis (e.g., cell-to-pack or cell-to-chassis designs) are emerging as a key trend, offering improved space utilization, enhanced structural rigidity, and better thermal pathways. The continuous evolution of battery chemistries and energy densities is directly influencing housing design, demanding better thermal management integration and adaptable structures to accommodate larger battery packs. Furthermore, there is a growing interest in smart housings that incorporate sensors for real-time monitoring of battery health, temperature, and impact events, which contribute to predictive maintenance and enhanced safety. The interplay between material science, design engineering, and manufacturing efficiency is constantly reshaping these segments, pushing the boundaries of what is possible in battery housing technology.

AI Impact Analysis on Electric Vehicle Battery Housing Market

Common user questions regarding AI's impact on the Electric Vehicle Battery Housing Market often revolve around how artificial intelligence can enhance design optimization, manufacturing efficiency, and predictive maintenance. Users frequently inquire about AI's role in accelerating the material selection process, predicting material performance under various stress conditions, and automating complex design iterations for improved crashworthiness and thermal management. There is also significant interest in AI's application in streamlining production lines, identifying manufacturing defects in real-time, and optimizing supply chain logistics for battery housing components. Consumers and industry stakeholders alike are keen to understand how AI can contribute to the development of "smarter" battery housings capable of real-time monitoring and adaptive protection, ultimately leading to safer, more efficient, and longer-lasting electric vehicles. Concerns often include the initial investment costs, the need for specialized data scientists, and the ethical implications of autonomous decision-making in critical safety systems.

- Design Optimization: AI algorithms can rapidly analyze millions of design permutations for battery housings, optimizing for weight reduction, structural integrity, thermal management, and manufacturability simultaneously. Generative design tools powered by AI can autonomously create novel housing geometries that surpass human design capabilities in terms of efficiency and performance. This leads to more efficient use of materials and improved performance metrics such as crash absorption and heat dissipation, significantly cutting down development cycles.

- Material Selection and Performance Prediction: AI can sift through vast databases of material properties to identify optimal combinations for multi-material battery housings, considering factors like strength-to-weight ratio, corrosion resistance, and thermal conductivity. Machine learning models can predict how different materials and designs will perform under various stress, impact, and thermal conditions, reducing the need for extensive physical prototyping and testing, thereby accelerating material innovation and selection processes.

- Manufacturing Process Optimization: AI-driven analytics can monitor manufacturing lines in real-time, identifying bottlenecks, predicting equipment failures, and optimizing process parameters such as welding, bonding, and forming. This leads to higher production efficiency, reduced waste, and improved product consistency and quality. AI can also enhance robotic precision in assembly, ensuring tighter tolerances and higher reliability of the finished housing units.

- Quality Control and Defect Detection: Computer vision systems powered by AI can automatically inspect battery housings for microscopic cracks, welding inconsistencies, or material flaws that might be imperceptible to the human eye. This allows for immediate identification and rectification of defects, ensuring every housing unit meets stringent safety and quality standards before integration into the EV, dramatically reducing recall risks and warranty claims.

- Predictive Maintenance and Safety Monitoring: AI can integrate with sensors embedded within the battery housing to monitor real-time data on temperature, vibration, and impact forces. These AI systems can then predict potential failures, alert vehicle owners or manufacturers of impending issues, and even autonomously initiate safety protocols in critical situations, enhancing overall EV safety and reliability throughout its operational lifespan.

- Supply Chain Optimization: AI can analyze global supply chain data to predict demand fluctuations, optimize inventory levels for raw materials and components, and identify potential disruptions. This ensures a more resilient and cost-effective supply chain for battery housing manufacturers, minimizing delays and ensuring a steady flow of necessary resources, which is crucial in a volatile market.

DRO & Impact Forces Of Electric Vehicle Battery Housing Market

The Electric Vehicle Battery Housing Market is fundamentally shaped by a dynamic interplay of Drivers, Restraints, Opportunities, and a suite of Impact Forces that collectively determine its trajectory. Key drivers include the relentless global push for decarbonization and the subsequent governmental mandates and incentives promoting EV adoption, which directly translate into increased demand for battery housings. The continuous advancements in battery technology, leading to higher energy densities and faster charging capabilities, necessitate more sophisticated and robust housing solutions to ensure safety and thermal management. Consumer demand for extended EV range, enhanced safety features, and reduced vehicle weight also propels innovation in materials and design within the battery housing sector. Furthermore, the decreasing cost of EV batteries over time makes electric vehicles more accessible, thereby expanding the overall market for their components, including housings. The development of new manufacturing techniques, such as advanced casting, extrusion, and multi-material joining processes, enables the production of lighter, stronger, and more cost-effective housings, further driving market growth. The increasing focus on vehicle crash safety ratings, which often involve stringent battery protection requirements, consistently pushes manufacturers to invest in more resilient and impact-absorbing housing designs. Global initiatives for sustainable manufacturing also encourage the development of recyclable and environmentally friendly housing materials, aligning with broader industry goals and consumer values.

Despite these powerful drivers, several significant restraints challenge the market's growth. The high initial cost of advanced materials, such as specific aluminum alloys and carbon fiber composites, can inflate the overall production cost of battery housings, which may be passed on to the consumer, making EVs less competitive in certain segments. The complexity of designing and manufacturing multi-material housings, requiring specialized expertise and capital-intensive equipment for joining dissimilar materials, also poses a barrier. Supply chain vulnerabilities, particularly concerning critical raw materials like lithium, nickel, and specific alloys, can lead to price volatility and production delays. Furthermore, the lack of standardized battery pack dimensions and housing interfaces across different EV manufacturers creates fragmentation in the market, hindering economies of scale and increasing development costs. The intricate requirements for thermal management systems within the housing, coupled with the need for electromagnetic shielding and waterproofing, add layers of engineering complexity and cost. Additionally, the challenge of recycling advanced multi-material battery housings at the end of their lifecycle remains a significant hurdle, requiring innovative solutions to separate and reuse valuable materials, impacting environmental sustainability and overall cost-effectiveness. The relatively nascent stage of EV infrastructure in many regions also acts as a soft restraint, indirectly slowing down broader EV adoption and consequently, the demand for related components. Regulatory changes, though often supportive, can also introduce new, complex compliance requirements that necessitate costly redesigns and re-tooling.

Nevertheless, the market is rife with opportunities for innovation and expansion. The burgeoning trend towards 'cell-to-pack' and 'cell-to-chassis' battery integration offers a substantial opportunity for housing manufacturers to develop highly integrated structural components that simultaneously serve as part of the vehicle's frame, reducing weight and complexity. The increasing demand for commercial EVs, including electric trucks and buses, presents a lucrative segment requiring uniquely robust and scalable battery housing solutions. The advent of solid-state battery technology, while still in development, promises to reshape housing design by potentially offering simpler thermal management and more compact packaging, creating new design paradigms. Opportunities also lie in the development of smart housings equipped with sensors for real-time monitoring and predictive maintenance, enhancing safety and extending battery life. Furthermore, advancements in additive manufacturing (3D printing) open avenues for highly customized, geometrically complex, and lightweight housing components, allowing for rapid prototyping and localized production. The focus on circular economy principles presents an opportunity for companies to invest in R&D for easily recyclable materials and modular housing designs that facilitate repair and reuse. Expanding into emerging EV markets and catering to niche applications, such as electric off-road vehicles or drones, could also unlock new revenue streams. The continuous drive towards autonomous vehicles will also influence housing design, potentially requiring even more robust protection and sophisticated sensor integration for enhanced reliability in driverless operations. Finally, government incentives for domestic manufacturing and supply chain localization, particularly in North America and Europe, provide significant opportunities for regional players to scale up production and gain market share.

Segmentation Analysis

The Electric Vehicle Battery Housing Market is extensively segmented to reflect the diverse technological approaches, material preferences, and application-specific requirements prevalent across the industry. This segmentation provides a granular view of market dynamics, enabling stakeholders to understand the underlying trends and tailor their strategies effectively. The primary segmentation categories typically include material type, vehicle type, design type, and cooling system integration, each representing critical differentiation factors that influence performance, cost, and manufacturability of battery housing solutions. Analyzing these segments helps in identifying growth areas, competitive landscapes, and technological shifts within the market.

- By Material Type:

- Aluminum Alloys: Dominant due to excellent strength-to-weight ratio, corrosion resistance, and recyclability.

- Steel: High-strength steel, often used for cost-effectiveness and superior crash protection.

- Composites: Carbon Fiber Reinforced Plastics (CFRP) and Glass Fiber Reinforced Plastics (GFRP) for ultra-lightweight and complex geometries, typically in premium or performance EVs.

- Multi-Material Solutions: Combinations of aluminum, steel, and composites to leverage the benefits of each material, optimized for specific areas of the housing.

- By Vehicle Type:

- Passenger Electric Vehicles (EVs): Including sedans, SUVs, hatchbacks, and urban compact vehicles.

- Commercial Electric Vehicles (EVs): Encompassing electric buses, trucks, vans, and specialized industrial vehicles.

- By Design Type:

- Tray/Box Type: Traditional enclosed structure, often with a lid and base.

- Skateboard Chassis Integrated: Housing integrated directly into the vehicle's structural platform, enhancing rigidity and space utilization.

- Modular Design: Housing designed to accommodate interchangeable battery modules, offering flexibility and scalability.

- Cell-to-Pack/Cell-to-Chassis: Advanced designs where individual cells or modules are directly integrated into the housing or chassis without intermediate modules, maximizing energy density.

- By Cooling System Integration:

- Liquid-Cooled Housing: Designed to facilitate the circulation of liquid coolants around battery cells or modules for precise thermal management.

- Air-Cooled Housing: Incorporates channels for air circulation to dissipate heat, typically less complex and suitable for lower-power battery packs.

- Immersion-Cooled Housing: Designed for direct contact of battery cells with dielectric fluids for highly efficient thermal management.

Value Chain Analysis For Electric Vehicle Battery Housing Market

The value chain for the Electric Vehicle Battery Housing Market is a complex and highly integrated network, spanning from raw material extraction to the final assembly of electric vehicles, with significant interplay between multiple specialized industries. At the upstream end, the chain begins with the extraction and processing of fundamental raw materials such as bauxite for aluminum, iron ore for steel, and various petrochemicals for composite materials like carbon fibers and resins. These raw materials undergo intensive processing, including smelting, alloying, and polymerization, to produce primary forms like aluminum ingots, steel sheets, and composite prepregs. Specialized component manufacturers then convert these primary materials into the intricate parts required for battery housings, which includes casting and extrusion companies for aluminum, stamping and hydroforming specialists for steel, and advanced composite manufacturers for lightweight structures. This upstream segment is characterized by capital-intensive operations, globalized supply networks, and a strong emphasis on material science innovation to achieve desired properties such as high strength, light weight, and corrosion resistance. Strategic partnerships with mining companies and raw material suppliers are crucial for ensuring a stable and cost-effective supply, especially given the increasing demand for high-purity materials required for high-performance applications.

Moving downstream, the processed materials and components are then supplied to battery housing assembly specialists or directly to Tier 1 automotive suppliers. These entities are responsible for the complex manufacturing processes involved in assembling the multi-component housing, which can include advanced welding techniques (e.g., laser welding, friction stir welding), adhesive bonding, riveting, and sealing processes to ensure watertight and airtight integrity. Integration of thermal management systems, such as cooling plates and fluid lines, along with electrical insulation and crash absorption elements, also occurs at this stage. Quality control and rigorous testing, including crash simulations, vibration tests, and ingress protection (IP) ratings, are paramount to ensure the housing meets stringent automotive safety standards. Following assembly, these finished battery housings are then delivered to electric vehicle manufacturers (OEMs). OEMs integrate these housings with battery cells and modules, along with battery management systems (BMS), to create the complete battery pack, which is then installed into the vehicle chassis. This downstream phase requires significant engineering expertise and collaborative efforts between housing manufacturers and OEMs to ensure seamless integration, optimal performance, and adherence to vehicle-specific design parameters. The complexity of the battery pack assembly process, coupled with the critical safety functions of the housing, places a high demand on precision manufacturing and robust quality assurance protocols. Furthermore, the downstream includes the aftermarket segment, where replacement parts and specialized housing repair services may be required over the vehicle's lifespan, although this segment is currently smaller compared to OEM supply.

The distribution channel within the Electric Vehicle Battery Housing Market is predominantly direct, with manufacturers of battery housings supplying their products directly to electric vehicle OEMs or their designated Tier 1 battery pack integrators. This direct model is favored due to the highly customized nature of battery housings, which are often co-developed with specific vehicle platforms, and the critical performance and safety specifications involved. Long-term supply agreements and strategic partnerships are common, establishing robust and exclusive relationships between suppliers and buyers. For instance, a major EV manufacturer might partner with an aluminum extrusion specialist to design and supply a bespoke housing for their latest model. Indirect channels are less common but can include specialized distributors or integrators who might supply smaller volume manufacturers or provide aftermarket solutions, though the bulk of the market relies on direct procurement. The intricacy of the product, the need for stringent quality control, and the deep technical collaboration required between the supplier and the EV manufacturer make direct sales and engineering support essential. The emergence of 'gigafactories' and regional manufacturing hubs for EVs also influences distribution, favoring localized supply chains to minimize logistics costs and enhance responsiveness. The logistical complexity of shipping large, often fragile, battery housing components also reinforces the need for optimized, direct distribution routes, sometimes involving specialized transport solutions to ensure integrity from factory to assembly plant. The future may see more localized production and potentially a more diverse indirect channel for service and repair as the EV fleet ages and demand for replacement components grows outside of original equipment manufacturer warranties.

Electric Vehicle Battery Housing Market Potential Customers

The primary and most significant potential customers for the Electric Vehicle Battery Housing Market are unequivocally the Electric Vehicle Original Equipment Manufacturers (OEMs). These include established automotive giants rapidly transitioning their portfolios to electric, such as Tesla, Volkswagen, General Motors, Ford, BMW, Mercedes-Benz, Hyundai, Kia, Toyota, and Stellantis, as well as emerging pure-play EV manufacturers like Rivian, Lucid Motors, Nio, Xpeng, and BYD. These OEMs require customized, high-performance battery housings that integrate seamlessly with their specific vehicle platforms, offering optimal safety, thermal management, weight reduction, and structural integrity. Their purchasing decisions are driven by factors such as material innovation, manufacturing scalability, cost-effectiveness, adherence to stringent safety standards (e.g., UN ECE R100, FMVSS), and the ability of suppliers to meet complex design specifications and production volumes. The relationships with these customers are often characterized by long-term strategic partnerships and co-development initiatives, reflecting the critical nature of the battery housing component within the entire vehicle system. The increasing trend of OEMs insourcing battery pack assembly, or even cell manufacturing, means that they are directly procuring housing components from specialized manufacturers. Furthermore, commercial vehicle manufacturers, encompassing electric bus, truck, and van producers, represent another substantial customer segment, demanding even more robust and durable housing solutions capable of withstanding heavy loads and extensive operational cycles. These include companies like Daimler Truck, Volvo Group, PACCAR, BYD (for buses and trucks), and various last-mile delivery vehicle manufacturers.

Beyond the direct OEM market, another important segment of potential customers includes Tier 1 battery pack integrators or specialist battery system providers. These companies, such as LG Energy Solution, Samsung SDI, CATL, Panasonic, and SK Innovation, may procure battery housings from specialized manufacturers to build complete battery packs, which they then supply to various OEMs. This scenario often arises when OEMs prefer to outsource the complex task of battery pack integration, allowing these Tier 1 suppliers to leverage their expertise in cell and module assembly, thermal management, and BMS integration. These integrators look for housing suppliers that can offer modularity, high-volume production capabilities, excellent quality control, and the flexibility to adapt designs for different battery chemistries and vehicle applications. The growth of independent battery pack manufacturers signifies a growing market for specialized housing suppliers who can cater to multiple integrators rather than being tied to a single OEM. Moreover, companies involved in the conversion of internal combustion engine (ICE) vehicles to EVs, particularly in niche markets or for fleet applications, could represent a smaller but growing customer base, requiring more adaptable or custom-fabricated housing solutions for retrofit applications. Research and development institutions and advanced prototyping firms working on next-generation battery technologies or vehicle concepts also represent potential customers, albeit for smaller, specialized orders, driving early-stage innovation in housing design and materials. Lastly, as the EV market matures, there will be a nascent but growing aftermarket demand for replacement battery housings, driven by accident repairs or potential upgrades, creating a future customer segment for both OEMs and independent service providers. The circular economy initiatives might also create a market for refurbished or remanufactured housings, though this is still in early stages of development. The demand from various defense contractors and specialized heavy equipment manufacturers for electric off-road vehicles also constitutes a niche but high-value customer group, requiring exceptionally durable and resilient housing solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $2.8 Billion USD |

| Market Forecast in 2032 | $15.5 Billion USD |

| Growth Rate | 25.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Magna International, LG Energy Solution, Hyundai Mobis, Nemak, ThyssenKrupp, Constellium, Norsk Hydro, Shiloh Industries, Continental AG, Plastic Omnium, Hanwha Advanced Materials, GF Casting Solutions, SGL Carbon, Brose Fahrzeugteile, Kautex Textron, Röchling Automotive, Marelli, Yanfeng Automotive Interiors, Lear Corporation, Tenneco |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Vehicle Battery Housing Market Key Technology Landscape

The Electric Vehicle Battery Housing Market is undergoing a rapid technological evolution, driven by the relentless pursuit of enhanced safety, performance, and efficiency in electric vehicles. A pivotal aspect of this landscape is the advancement in material science, moving beyond conventional metals to incorporate advanced aluminum alloys, high-strength steels, and sophisticated composite materials. Innovations in aluminum technology include new extrusion and casting techniques that allow for complex geometries and integrated cooling channels, while specialized heat treatments improve crash energy absorption. For steel, ultra-high-strength steels (UHSS) are being developed that offer superior impact resistance with reduced thickness, contributing to lightweighting. In composites, the focus is on developing cost-effective, high-volume production methods for carbon fiber and glass fiber reinforced plastics, along with bio-based composites, offering unparalleled weight reduction and design flexibility for geometrically intricate housing components. Multi-material joining technologies, such as advanced welding (e.g., laser welding of dissimilar materials, friction stir welding), adhesive bonding, and hybrid joining processes, are crucial for effectively combining these diverse materials into a single, high-performance structure, overcoming challenges related to thermal expansion differences and galvanic corrosion.

Beyond materials, manufacturing processes are at the forefront of technological innovation. Advanced manufacturing techniques such as hydroforming for steel and aluminum enable the creation of complex, hollow structural components with improved stiffness-to-weight ratios. Die casting, particularly gigacasting for larger components, is becoming increasingly relevant for aluminum housings, offering significant advantages in terms of part consolidation, reduced assembly time, and enhanced dimensional accuracy. Additive manufacturing (3D printing) is also emerging as a game-changer, especially for prototyping and producing highly customized or geometrically optimized internal structures for thermal management or local reinforcement within the housing, though its application for large-scale production of entire housings is still maturing. Robotics and automation are integral to modern battery housing production lines, ensuring high precision, repeatability, and efficiency in assembly, sealing, and quality inspection. Digital twin technology and advanced simulation tools play a crucial role in design validation, crash analysis, thermal modeling, and manufacturing process optimization, significantly reducing development cycles and costs by enabling virtual testing before physical prototyping. This allows engineers to predict and refine housing performance under various real-world conditions, including extreme temperatures and impact scenarios, thereby ensuring robust safety and reliability.

Thermal management integration within the battery housing is another critical technology area. Innovations include integrated liquid cooling plates, direct immersion cooling solutions where cells are bathed in dielectric fluids, and sophisticated air-cooling designs that optimize airflow. These systems are designed to maintain optimal battery operating temperatures, preventing overheating or undercooling, which can severely impact battery life, performance, and safety. Furthermore, the development of fire protection and containment technologies, such as fire-retardant materials, intumescent coatings, and advanced venting systems, is paramount to prevent thermal runaway propagation within the housing in the event of cell failure. Functional integration is also a key trend, where the housing is not just a protective shell but an active component of the vehicle. This includes the development of 'smart' housings that incorporate embedded sensors for real-time monitoring of temperature, pressure, vibration, and impact events, feeding data to the battery management system (BMS) for predictive diagnostics and enhanced safety. The trend towards structural battery packs, where the housing itself becomes an integral, load-bearing part of the vehicle chassis (cell-to-pack and cell-to-chassis designs), represents the pinnacle of technological convergence, offering maximum space utilization, reduced weight, and improved vehicle rigidity. This holistic approach necessitates deep collaboration between material scientists, design engineers, manufacturing experts, and vehicle architects to achieve next-generation EV platforms.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market for electric vehicle battery housings, primarily driven by China's colossal EV manufacturing base and ambitious electrification targets. South Korea and Japan are also significant contributors, excelling in material science and advanced manufacturing techniques. The region benefits from robust government support for EV adoption and a well-established supply chain for battery components.

- Europe: A rapidly growing market, spurred by stringent emissions regulations, significant investments in battery gigafactories, and strong governmental incentives for EV purchases. Germany, France, and the Nordic countries are at the forefront of EV adoption and battery housing innovation, with a strong emphasis on sustainability and circular economy principles in manufacturing.

- North America: Experiencing substantial growth fueled by increasing consumer demand for EVs, supportive government policies (e.g., IRA in the US), and significant investments by traditional automotive giants in electrifying their fleets. The region is focusing on localizing the EV supply chain, creating ample opportunities for domestic battery housing production.

- Latin America: An emerging market with nascent but growing EV adoption. While smaller in scale, countries like Brazil and Mexico are showing increasing interest in electric mobility, creating future opportunities for battery housing manufacturers as EV production scales up in the region.

- Middle East and Africa (MEA): Currently represents a smaller share of the market, but has significant long-term potential due to strategic government visions for diversification away from fossil fuels and increasing infrastructure development for EVs, particularly in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Vehicle Battery Housing Market.- Magna International

- LG Energy Solution

- Hyundai Mobis

- Nemak

- ThyssenKrupp

- Constellium

- Norsk Hydro

- Shiloh Industries

- Continental AG

- Plastic Omnium

- Hanwha Advanced Materials

- GF Casting Solutions

- SGL Carbon

- Brose Fahrzeugteile

- Kautex Textron

- Röchling Automotive

- Marelli

- Yanfeng Automotive Interiors

- Lear Corporation

- Tenneco

Frequently Asked Questions

Analyze common user questions about the Electric Vehicle Battery Housing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an Electric Vehicle Battery Housing and why is it crucial?

An Electric Vehicle Battery Housing is the protective enclosure for an EV's battery pack, shielding cells and components from impacts, vibrations, and environmental factors. It is crucial for ensuring passenger safety by preventing thermal runaway, extending battery life through thermal management, and contributing to overall vehicle structural integrity and performance. Its robust design is fundamental to the reliability and longevity of an EV.

What materials are commonly used for EV battery housings, and why?

Common materials include aluminum alloys, high-strength steel, and composite materials (like CFRP and GFRP). Aluminum is favored for its lightweight properties, corrosion resistance, and excellent recyclability. Steel offers cost-effectiveness and superior crash protection. Composites provide ultra-lightweight solutions and design flexibility, often used in premium EVs where weight reduction is paramount. Multi-material solutions leverage the benefits of each for optimal performance and cost balance.

How do battery housing designs contribute to EV range and safety?

Battery housing designs significantly impact EV range by contributing to lightweighting. Lighter housings reduce overall vehicle weight, directly translating to increased energy efficiency and longer driving range. For safety, robust designs absorb crash energy, prevent external intrusion to the battery, and facilitate efficient thermal management to mitigate thermal runaway, thereby protecting occupants and the battery pack from damage during collisions or system malfunctions. Advanced designs often integrate directly into the vehicle's structural chassis for enhanced rigidity and crashworthiness.

What role does AI play in the future of Electric Vehicle Battery Housing design and manufacturing?

AI is set to revolutionize battery housing design and manufacturing by enabling rapid design optimization for weight, strength, and thermal performance using generative design. It can predict material behavior under various conditions, reduce physical prototyping, and enhance quality control through automated defect detection in manufacturing. AI also optimizes supply chains and enables smart housings with real-time monitoring for predictive maintenance, leading to safer, more efficient, and cost-effective production.

What are the key challenges and opportunities in the Electric Vehicle Battery Housing Market?

Key challenges include high material and manufacturing costs, complex multi-material joining processes, supply chain vulnerabilities, and the lack of standardization across OEMs. Opportunities arise from the growing commercial EV segment, advancements in structural battery pack designs (cell-to-pack/chassis), the potential impact of solid-state battery technology, innovations in smart housing technologies with integrated sensors, and the increasing focus on circular economy principles for material recycling and reuse.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager