Embedded Finance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430384 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Embedded Finance Market Size

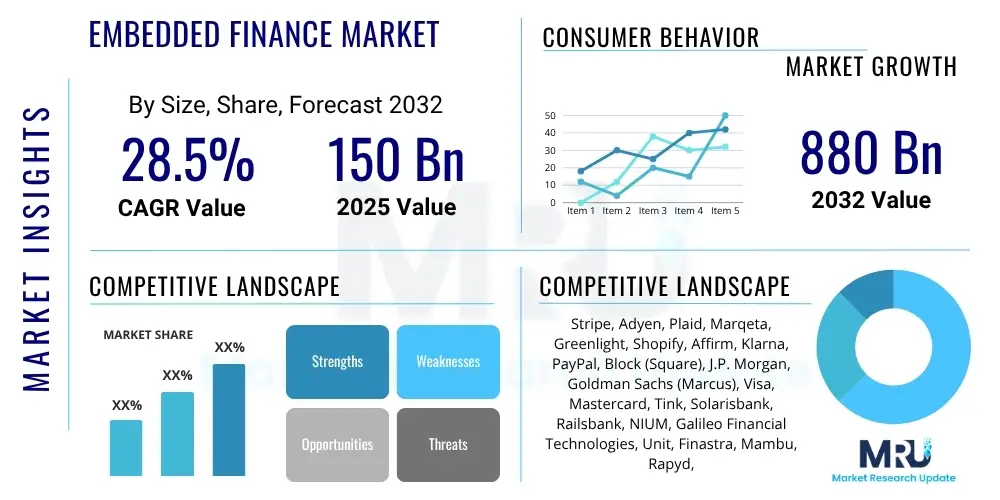

The Embedded Finance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2025 and 2032. The market is estimated at $150 Billion in 2025 and is projected to reach $880 Billion by the end of the forecast period in 2032.

Embedded Finance Market introduction

Embedded finance represents the seamless integration of financial services into non-financial products and platforms, allowing customers to access banking, lending, insurance, or payment solutions at the point of need. This innovative approach moves financial transactions from traditional institutions directly into the user experience of daily applications and services, enhancing convenience and efficiency. The product description encompasses a wide range of services, including embedded payments, embedded lending, embedded insurance, and embedded banking-as-a-service solutions, often powered by APIs and cloud infrastructure.

Major applications of embedded finance span across various sectors, notably e-commerce, retail, software-as-a-service (SaaS) platforms, mobility solutions, and healthcare. For instance, an e-commerce platform offering "buy now, pay later" options at checkout is a prime example of embedded lending. The core benefits include improved customer experience, new revenue streams for non-financial companies, increased customer loyalty, and reduced friction in financial transactions. It transforms the way businesses engage with their customers, making financial services an invisible, integrated part of their offering.

Driving factors for the growth of the embedded finance market include the accelerating pace of digital transformation across industries, a strong consumer demand for highly convenient and contextualized services, and the proliferation of accessible API technology that simplifies the integration of financial capabilities. Furthermore, the rise of the platform economy, coupled with a focus on enhancing customer lifetime value and creating sticky ecosystems, significantly contributes to market expansion. Businesses are increasingly recognizing the strategic advantage of offering embedded financial solutions to differentiate themselves and capture a greater share of customer spending.

Embedded Finance Market Executive Summary

The embedded finance market is experiencing robust growth driven by significant business trends, evolving regional landscapes, and distinct segmental shifts. Key business trends include the increasing digitalization of commerce, the proliferation of the API economy enabling seamless integration, and the strategic pivot of non-financial companies towards becoming financial service distributors. This shift fosters new partnerships between fintechs, banks, and technology platforms, creating a more interconnected financial ecosystem.

Regionally, North America and Europe lead in terms of market maturity and adoption, propelled by advanced technological infrastructure and supportive regulatory environments, particularly open banking initiatives in Europe. The Asia Pacific region is witnessing rapid expansion due to a large digitally native population, increasing smartphone penetration, and a significant unbanked or underbanked demographic seeking accessible financial solutions. Latin America and the Middle East and Africa are emerging as high-growth markets, driven by financial inclusion initiatives and a young, tech-savvy population eager for digital financial products.

Segment-wise, embedded payments currently dominate the market, benefiting from widespread e-commerce adoption and the demand for frictionless checkout experiences. Embedded lending is experiencing significant traction, especially in the "buy now, pay later" (BNPL) space, as businesses seek to provide flexible financing options at the point of sale. Embedded insurance and banking services, though nascent, are poised for substantial growth as companies explore comprehensive financial integration to enhance their value propositions and customer stickiness, indicating a broad and diversified expansion across financial product categories.

AI Impact Analysis on Embedded Finance Market

Common user questions regarding AI's impact on embedded finance frequently revolve around how it can enhance personalization, improve risk assessment, and detect fraud more effectively. Users are interested in how AI can create more tailored financial experiences and streamline operations. They also express concerns about data privacy, algorithmic bias, and the potential for job displacement, highlighting a desire for both innovation and ethical implementation. The key themes indicate an expectation that AI will make embedded financial services smarter, safer, and more user-centric, while also requiring robust governance.

- Enhanced personalization of financial products and services.

- Improved fraud detection and prevention through advanced anomaly detection.

- More accurate credit and risk assessment leveraging alternative data points.

- Automated customer support and personalized financial advice via AI-powered chatbots.

- Streamlined back-office operations and compliance processes.

- Predictive analytics for optimizing pricing and product offerings.

- Dynamic underwriting for embedded lending solutions.

- Real-time transaction monitoring for enhanced security.

- Development of adaptive financial product recommendations.

- Optimization of marketing and customer acquisition strategies.

DRO & Impact Forces Of Embedded Finance Market

The embedded finance market is propelled by a confluence of powerful drivers, tempered by specific restraints, while presenting numerous opportunities that collectively shape its impact forces. Primary drivers include the global push for digital transformation, strong consumer demand for seamless and convenient financial experiences integrated into their daily activities, and the imperative for non-financial companies to diversify revenue streams and enhance customer loyalty by offering value-added financial services. The widespread adoption of APIs and the reduction in the technical barriers to integrating financial services also significantly contribute to market expansion.

However, the market faces notable restraints, including the complex and evolving regulatory landscape across different geographies, which can impede rapid innovation and cross-border expansion. Data privacy and cybersecurity concerns remain paramount, requiring substantial investment in robust security infrastructure and compliance frameworks. The challenge of integrating legacy IT systems of incumbent financial institutions with modern fintech solutions, alongside a potential lack of standardization in API protocols, further acts as a barrier to entry and growth. Overcoming these hurdles is crucial for sustained market development.

Opportunities within the embedded finance market are abundant, particularly in underserved sectors like healthcare, real estate, and supply chain finance, where bespoke financial solutions can address specific industry needs. The potential for hyper-personalization, driven by advanced analytics and artificial intelligence, allows for the creation of highly relevant and timely financial products. Furthermore, expansion into emerging markets, where digital adoption is rapid and traditional financial access is limited, presents significant growth avenues. The market's impact forces are characterized by strong customer bargaining power due to the convenience offered, a moderate threat from new entrants given the technical and regulatory complexities, and an increasing reliance on strategic partnerships between fintechs, banks, and non-financial entities to drive innovation and market penetration.

Segmentation Analysis

The embedded finance market is broadly segmented to reflect the diverse nature of services offered, the specific applications they serve, and the end-users they target. This multi-faceted segmentation helps to understand the market's dynamics, identify key growth areas, and tailor strategies for different verticals. Each segment exhibits unique characteristics in terms of adoption rates, technological requirements, and regulatory considerations, providing a comprehensive view of the market structure and its future trajectory. The primary segmentation involves categorizing by the type of financial service embedded, the industry application, and the ultimate customer demographic.

- By Type

- Embedded Payments

- Embedded Lending

- Embedded Insurance

- Embedded Banking and Wealth Management

- By Application

- E-commerce and Retail

- SaaS Platforms and Business Software

- Mobility and Automotive

- Healthcare

- Real Estate

- Supply Chain Finance

- Travel and Hospitality

- Gaming and Entertainment

- By End-User

- Businesses (B2B)

- Consumers (B2C)

Value Chain Analysis For Embedded Finance Market

The value chain for the embedded finance market is a complex ecosystem involving various interconnected players working collaboratively to deliver seamless financial services. At the upstream level, the chain is dominated by technology infrastructure providers, core banking platform developers, API management platforms, and data analytics firms. These entities provide the foundational tools, cloud infrastructure, and data processing capabilities necessary for financial services to be integrated into non-financial applications. Fintech enablers and Banking-as-a-Service (BaaS) providers also play a crucial role, offering modular financial components that non-financial companies can leverage without developing them from scratch.

Moving downstream, the value chain encompasses the non-financial businesses that embed financial services into their core offerings. These include e-commerce giants, SaaS companies, automotive manufacturers, and various digital platforms that directly interface with the end-users. These companies become the distribution channels, leveraging their existing customer base and user experience to offer contextual financial products. The financial institutions, whether traditional banks or challenger banks, often act as the regulated entity providing the underlying licenses and capital, collaborating with fintechs for technology and distribution.

Distribution channels for embedded finance can be direct or indirect. Direct integration involves a company building or licensing financial capabilities to offer services under its own brand, becoming a direct distributor to its users. Indirect distribution typically involves white-label solutions or partnerships where a non-financial company partners with a fintech or BaaS provider to offer services, often branded by the partner but powered by the underlying provider. Both models aim to create a frictionless user experience, with the entire chain focused on delivering financial services where and when customers need them most, driving efficiency and customer satisfaction.

Embedded Finance Market Potential Customers

The embedded finance market targets a diverse array of potential customers, primarily categorized by the entities that embed financial services and the end-users who consume them. Non-financial businesses are the primary buyers of embedded finance solutions, seeking to enhance their core offerings and create new revenue streams. These include a wide spectrum of industries such as e-commerce platforms looking to offer "buy now, pay later" options, SaaS providers wanting to integrate invoicing and payment processing, and retail chains aiming to provide loyalty programs with integrated payment or credit features. The strategic imperative for these businesses is to reduce customer friction and increase engagement within their own ecosystems.

Beyond traditional businesses, the customer base extends to emerging digital platforms and specialized verticals. Mobility and automotive companies are exploring embedded insurance and financing for vehicles, while healthcare providers are looking into integrated payment plans for medical expenses. Real estate platforms are keen on embedding mortgage origination and property insurance, and travel agencies are considering integrated travel insurance and flexible payment options. Essentially, any business that has a frequent customer touchpoint and processes transactions or manages customer value can become a potential customer for embedded finance, as it enables them to become a financial hub for their users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $150 Billion |

| Market Forecast in 2032 | $880 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stripe, Adyen, Plaid, Marqeta, Greenlight, Shopify, Affirm, Klarna, PayPal, Block (Square), J.P. Morgan, Goldman Sachs (Marcus), Visa, Mastercard, Tink, Solarisbank, Railsbank, NIUM, Galileo Financial Technologies, Unit, Finastra, Mambu, Rapyd, Bond, DriveWealth |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Embedded Finance Market Key Technology Landscape

The technological underpinnings of the embedded finance market are diverse and sophisticated, enabling the seamless integration and delivery of financial services. Application Programming Interfaces (APIs) form the backbone, allowing different software systems to communicate and share data securely, thus enabling non-financial companies to plug into financial infrastructure without extensive development. Cloud computing provides the scalable, flexible, and cost-effective infrastructure necessary to host these services, handle large volumes of transactions, and ensure high availability, which is crucial for real-time financial operations. Microservices architecture, often deployed on cloud platforms, breaks down complex financial systems into smaller, independent, and manageable components, enhancing agility and enabling faster innovation.

Artificial Intelligence (AI) and Machine Learning (ML) are pivotal for enhancing various aspects of embedded finance, from personalized product recommendations and dynamic pricing to advanced fraud detection and real-time risk assessment. These technologies process vast amounts of data to derive actionable insights, making financial services smarter and more tailored to individual user behavior. Data analytics, encompassing big data processing and business intelligence tools, is essential for understanding customer needs, monitoring market trends, and optimizing product performance, enabling continuous improvement and strategic decision-making. Blockchain technology is also gaining traction, particularly for secure and transparent record-keeping, cross-border payments, and decentralized finance applications, promising enhanced security and efficiency for certain embedded financial use cases.

Furthermore, the emergence of Open Banking initiatives globally has significantly propelled the embedded finance landscape by mandating or encouraging banks to open up their data and services via APIs. This regulatory push fosters a more competitive and innovative environment, allowing third-party providers to build new financial products and services on top of existing banking infrastructure. Secure authentication technologies, such as multi-factor authentication and biometrics, are critical for ensuring the integrity and security of embedded financial transactions, building trust among users. Overall, the convergence of these advanced technologies creates a robust and agile framework that supports the rapid evolution and adoption of embedded finance solutions across various industries.

Regional Highlights

- North America: This region stands as a leader in embedded finance, characterized by a high rate of digital adoption, a robust technology ecosystem, and a strong venture capital landscape fostering innovation. The presence of major tech companies and innovative fintechs drives continuous development in embedded payments, lending, and BaaS solutions. Consumer acceptance of digital financial services is high, pushing businesses across e-commerce, SaaS, and mobility sectors to integrate financial offerings.

- Europe: Driven significantly by Open Banking regulations and initiatives like PSD2 (Revised Payment Services Directive), Europe has become a fertile ground for embedded finance. The region boasts a mature fintech ecosystem, with countries like the UK and Germany at the forefront. While regulatory complexity across member states can be a challenge, the emphasis on data sharing and interoperability fuels strong growth in banking-as-a-service and personalized financial products.

- Asia Pacific (APAC): APAC is a rapidly expanding market, distinguished by a massive digitally native population, high smartphone penetration, and a significant portion of unbanked or underbanked individuals. This creates immense demand for accessible digital financial solutions. Countries like China, India, and Southeast Asian nations are witnessing exponential growth in embedded payments and lending, often driven by super-apps and e-commerce platforms integrating a wide array of financial services.

- Latin America: This region represents a high-growth opportunity for embedded finance, primarily due to its young, mobile-first population, strong push for financial inclusion, and a burgeoning fintech scene. Countries like Brazil and Mexico are leading the charge, with solutions addressing local payment methods, micro-lending, and digital wallets. Embedded finance is seen as a key enabler for bridging gaps in traditional financial access.

- Middle East and Africa (MEA): The MEA region is characterized by accelerating digital transformation, increasing internet penetration, and supportive government initiatives promoting fintech innovation. While still in nascent stages compared to other regions, there is significant potential for growth, particularly in digital payments, remittances, and micro-lending solutions that cater to a largely cash-dependent economy. Investment in fintech infrastructure is rising, paving the way for broader embedded finance adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Embedded Finance Market.- Stripe

- Adyen

- Plaid

- Marqeta

- Greenlight

- Shopify

- Affirm

- Klarna

- PayPal

- Block (Square)

- J.P. Morgan

- Goldman Sachs (Marcus)

- Visa

- Mastercard

- Tink

- Solarisbank

- Railsbank

- NIUM

- Galileo Financial Technologies

- Unit

- Finastra

- Mambu

- Rapyd

- Bond

- DriveWealth

Frequently Asked Questions

What is Embedded Finance?

Embedded finance refers to the seamless integration of financial services like payments, lending, or insurance directly into non-financial products, services, or platforms, allowing customers to access them at the point of need without leaving their primary experience.

How does Embedded Finance benefit businesses?

Businesses benefit from embedded finance by creating new revenue streams, enhancing customer experience and loyalty, reducing transaction friction, and gaining valuable data insights into customer financial behavior, ultimately strengthening their core offerings.

What are the primary challenges in the Embedded Finance market?

Key challenges include navigating complex and fragmented regulatory landscapes, ensuring robust data privacy and cybersecurity, integrating with legacy IT systems, and establishing trust with consumers regarding the handling of their financial data by non-financial entities.

Which industries are most impacted by Embedded Finance?

Industries significantly impacted include e-commerce and retail (payments, BNPL), SaaS platforms (invoicing, payroll), mobility and automotive (insurance, financing), and increasingly healthcare and real estate, as they integrate relevant financial solutions.

What role does AI play in the future of Embedded Finance?

AI is crucial for the future of embedded finance by enabling hyper-personalization of financial products, enhancing fraud detection, improving risk assessment through predictive analytics, and automating customer service, leading to more intelligent and efficient services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager