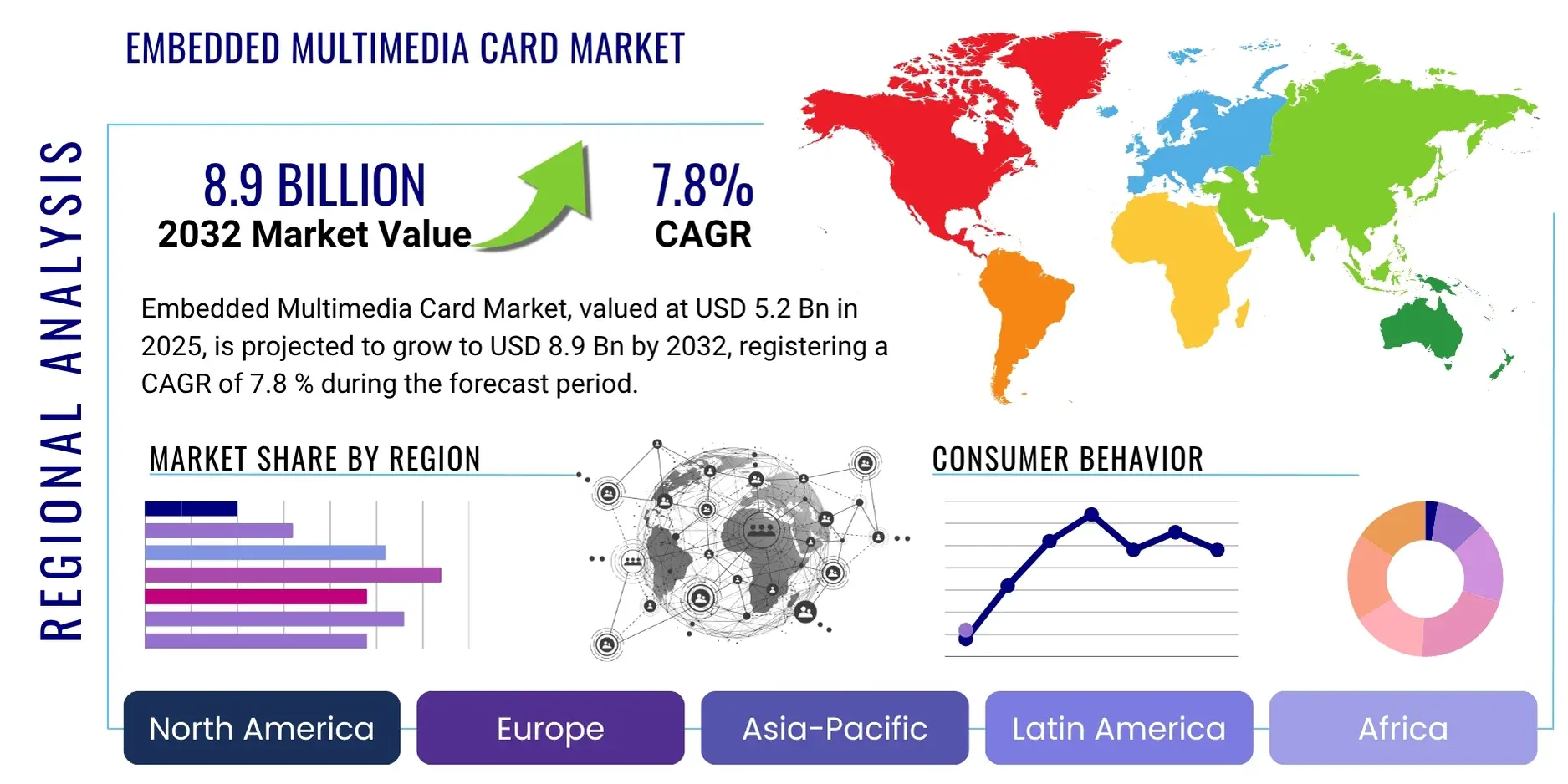

Embedded Multimedia Card Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428119 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Embedded Multimedia Card Market Size

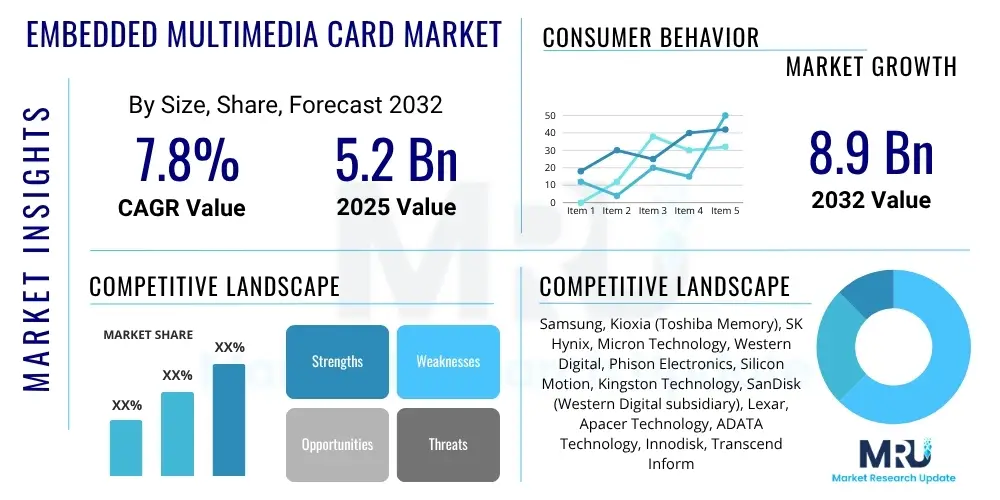

The Embedded Multimedia Card Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 5.2 Billion in 2025 and is projected to reach USD 8.9 Billion by the end of the forecast period in 2032.

Embedded Multimedia Card Market introduction

The Embedded Multimedia Card (eMMC) market encompasses a specialized form of flash memory widely utilized in various consumer electronics and industrial applications. eMMC serves as a highly integrated and cost-effective storage solution, combining a flash memory controller and NAND flash memory within a single package. This integration simplifies system design, reduces board space, and offers consistent performance, making it an ideal choice for embedded systems where compactness and reliability are paramount.

Major applications of eMMC include smartphones, tablets, automotive infotainment systems, industrial automation equipment, smart appliances, and IoT devices. Its benefits stem from its robust design, lower power consumption, and optimized performance for sequential read and write operations, which are crucial for operating systems and large file storage. The market is primarily driven by the escalating demand for smart devices, the expansion of the Internet of Things (IoT) ecosystem, and the continuous advancement in automotive electronics, all requiring efficient and reliable embedded storage solutions. The widespread adoption of eMMC across diverse sectors underscores its fundamental role in modern digital infrastructure.

Despite the emergence of newer, faster storage technologies like Universal Flash Storage (UFS), eMMC maintains a significant market presence due to its proven reliability, lower cost per gigabyte, and broad compatibility with existing hardware architectures. Its ease of integration and established supply chains also contribute to its sustained relevance, particularly in mid-range and entry-level devices where cost-effectiveness is a primary design consideration. The ongoing evolution of eMMC standards, such as eMMC 5.1, further enhances its performance and features, ensuring its continued viability in an increasingly data-centric world.

Embedded Multimedia Card Market Executive Summary

The Embedded Multimedia Card (eMMC) market is experiencing steady growth, fueled by several overarching business trends. The increasing proliferation of smart devices, ranging from smartphones and tablets to wearables and smart home appliances, continues to drive demand for integrated, high-performance storage solutions. Manufacturers are increasingly opting for eMMC due to its balanced performance-to-cost ratio, which is critical for mass-market consumer electronics. Furthermore, the automotive sector is emerging as a significant growth engine, with the rising integration of advanced infotainment systems, navigation units, and Advanced Driver-Assistance Systems (ADAS) necessitating robust and reliable embedded storage, a requirement perfectly met by eMMC technology. The industrial IoT domain also contributes significantly, requiring durable and efficient storage for edge computing and data logging in harsh environments.

Regionally, the Asia Pacific (APAC) continues to dominate the eMMC market, primarily due to its concentration of consumer electronics manufacturing hubs and a massive consumer base for smartphones and other smart devices. Countries like China, South Korea, Japan, and Taiwan are at the forefront of both production and consumption. North America and Europe are also witnessing substantial growth, particularly in the automotive and industrial sectors, driven by technological innovation and stringent regulatory standards for vehicle safety and industrial automation. Latin America, the Middle East, and Africa are showing promising growth trajectories, spurred by increasing smartphone penetration and digital transformation initiatives, leading to a rising demand for reliable embedded storage solutions across various applications.

In terms of segmentation, the market can be broadly categorized by type (e.g., eMMC 4.x, eMMC 5.x), capacity (e.g., 4GB-32GB, 64GB-128GB, 256GB and above), and application (e.g., smartphones, automotive, industrial IoT). The eMMC 5.x series currently holds the largest share, offering improved performance over its predecessors while maintaining cost efficiency. Higher capacity eMMC modules are seeing increased adoption as data storage requirements for applications grow. The smartphone segment remains the largest application area, though automotive and industrial IoT are rapidly expanding their market share. This diverse segmentation highlights the versatility and pervasive nature of eMMC technology across a multitude of end-use industries, reinforcing its essential role in the digital economy.

AI Impact Analysis on Embedded Multimedia Card Market

User inquiries regarding AI's influence on the Embedded Multimedia Card (eMMC) market frequently center on how artificial intelligence capabilities, particularly at the edge, will shape future storage requirements. Common questions revolve around whether eMMC can adequately support AI workloads, the demand for faster or more durable eMMC variants for AI applications, and the potential for AI to drive innovation in embedded storage design. There is a clear expectation that AI will necessitate storage solutions capable of handling increased data volumes for inference, machine learning model updates, and real-time data processing, often in resource-constrained environments. Users are also concerned about the energy efficiency of storage solutions when coupled with AI processors, given the power limitations inherent in many edge devices. The underlying theme is how eMMC, traditionally a workhorse for general embedded storage, will adapt to or benefit from the burgeoning AI landscape.

The convergence of AI with embedded systems is indeed creating new opportunities and demands for eMMC technology. Edge AI processing, where data is processed locally on devices rather than in the cloud, significantly increases the need for reliable, high-speed, and low-latency storage. eMMC modules, with their integrated controllers, can offer optimized performance for storing AI models, temporary data for inference, and logs generated by AI-driven applications. This shift towards edge intelligence means that devices like smart cameras, autonomous vehicles, and industrial IoT sensors will require more sophisticated embedded storage, driving demand for higher-capacity and potentially more robust eMMC variants that can withstand continuous read/write cycles associated with AI workloads. The focus is not just on raw speed, but on endurance and consistency of performance over the device's lifespan.

Moreover, AI's impact extends to the manufacturing and quality control processes within the eMMC market itself. AI-powered analytics can be used to optimize production lines, predict component failures, and improve yield rates, thereby enhancing the efficiency and reliability of eMMC production. Furthermore, the integration of AI functionalities into device operating systems will increase the storage footprint required for system software and application data, indirectly bolstering the demand for eMMC. The ability of eMMC to offer a cost-effective yet performant solution makes it particularly attractive for scaling AI into mass-market devices, where balancing computational power with storage capabilities and cost is crucial for widespread adoption. As AI algorithms become more complex and data-intensive, the requirements for embedded storage will continue to evolve, pushing the boundaries of eMMC capabilities.

- Increased demand for higher capacity eMMC modules for storing AI models and data at the edge.

- Requirement for enhanced eMMC endurance and reliability to support continuous AI-driven data logging and inference.

- Potential for AI to optimize eMMC manufacturing processes, improving efficiency and quality.

- Growth in eMMC adoption in AI-enabled devices such as autonomous vehicles, smart cameras, and industrial IoT sensors.

- Focus on lower power consumption eMMC solutions to support energy-efficient AI processing in portable and battery-powered devices.

- Development of eMMC with optimized firmware for faster boot times and quicker access to AI application data.

DRO & Impact Forces Of Embedded Multimedia Card Market

The Embedded Multimedia Card (eMMC) market is influenced by a dynamic interplay of drivers, restraints, opportunities, and inherent impact forces. Key drivers include the relentless growth of the Internet of Things (IoT) ecosystem, which necessitates compact and reliable storage for countless connected devices, from smart home gadgets to industrial sensors. The burgeoning automotive sector, particularly the demand for advanced infotainment systems, navigation, and ADAS units, is another significant impetus, requiring robust embedded storage solutions that can withstand harsh operating conditions. Furthermore, the sustained demand for cost-effective, integrated storage in mid-range and entry-level smartphones and tablets continues to underpin market expansion. The continuous evolution of eMMC standards, offering improved performance and capacity, also acts as a driver, ensuring its relevance.

However, the market faces several restraints. The primary challenge comes from the increasing adoption of Universal Flash Storage (UFS), a newer standard offering significantly higher performance, particularly in high-end smartphones and other premium devices. As UFS technology becomes more cost-effective, it poses a direct competitive threat to eMMC. Supply chain disruptions, exacerbated by geopolitical tensions and global economic fluctuations, also present a restraint, impacting production and availability of raw materials. Moreover, the general trend towards cloud-based storage for certain applications could marginally reduce the reliance on local embedded storage for some functionalities, although this is largely offset by the push for edge computing.

Opportunities for the eMMC market are abundant. The growing trend of artificial intelligence (AI) at the edge creates a demand for local, low-latency storage for AI inference and data logging in devices that operate independently of constant cloud connectivity. The proliferation of 5G networks is also expected to boost the market by enabling faster data transfer and processing in connected devices, many of which rely on eMMC. Emerging markets in Latin America, Africa, and parts of Asia present significant untapped potential for eMMC adoption as their digital infrastructure and consumer electronics markets mature. Furthermore, specialized industrial and medical applications, requiring highly reliable and durable embedded storage, offer niche growth avenues. The impact forces shaping the market include ongoing technological advancements in NAND flash memory, shifts in global economic conditions, regulatory changes affecting electronics manufacturing, and intense competitive pressures from alternative storage technologies.

Segmentation Analysis

The Embedded Multimedia Card (eMMC) market is intricately segmented to provide a detailed understanding of its diverse applications and technological variations. This segmentation helps in identifying key growth areas, understanding customer preferences, and strategizing market penetration. The primary segmentation revolves around the type of eMMC standard, its storage capacity, the specific application areas where it is deployed, and the end-use industries it serves. Each segment presents unique characteristics and growth drivers, reflecting the broad utility of eMMC across the digital landscape. Analyzing these segments is crucial for stakeholders to tailor their product offerings and market approaches effectively.

- By Type:

- eMMC 4.x

- eMMC 5.x (eMMC 5.0, eMMC 5.1)

- Other Advanced eMMC Standards

- By Capacity:

- Up to 32GB

- 64GB - 128GB

- 128GB - 256GB

- 256GB and Above

- By Application:

- Smartphones & Tablets

- Automotive Infotainment & ADAS

- Industrial & IoT Devices

- Wearable Devices

- Drones & Robotics

- Smart Appliances & Consumer Electronics

- By End-Use Industry:

- Consumer Electronics Manufacturing

- Automotive OEMs

- Industrial Automation

- Telecommunications

- Healthcare

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Embedded Multimedia Card Market

The value chain for the Embedded Multimedia Card (eMMC) market is a complex ecosystem involving multiple stages, from raw material sourcing to end-user distribution, each contributing to the final product's value. The upstream segment primarily involves the procurement of essential raw materials and components. This includes NAND flash memory wafers, which are the core storage components, controller integrated circuits (ICs), printed circuit boards (PCBs), and various packaging materials. Key players in this stage are semiconductor foundries, specialized IC designers, and material suppliers, who provide the foundational elements required for eMMC manufacturing. The quality and availability of these upstream components significantly impact the cost and performance of the final eMMC modules, making strong supplier relationships crucial for manufacturers.

Midstream activities involve the intricate processes of manufacturing, assembly, and testing of eMMC modules. This stage is dominated by major memory manufacturers and specialized eMMC module producers who integrate the NAND flash memory with the controller IC, encapsulate them into a standard package, and perform rigorous testing to ensure performance, reliability, and compatibility. These manufacturers invest heavily in R&D to develop advanced eMMC standards (like eMMC 5.1) and optimize firmware for enhanced speed and endurance. Efficiency in manufacturing and adherence to quality standards are paramount in this highly competitive segment, as even minor defects can impact device functionality and user experience.

The downstream segment focuses on the distribution and sales of finished eMMC products to various original equipment manufacturers (OEMs) and end-users. Distribution channels are typically categorized into direct and indirect routes. Direct distribution involves eMMC manufacturers selling directly to large-scale OEMs in sectors such as smartphones, automotive, and industrial IoT, often through long-term contracts and customized solutions. Indirect channels involve distributors, value-added resellers (VARs), and retailers who cater to smaller OEMs, system integrators, and the broader consumer electronics market. The choice of distribution channel often depends on the scale of the customer, the volume of demand, and the level of technical support required. Effective logistics and supply chain management are critical in the downstream segment to ensure timely delivery and market responsiveness, ultimately influencing market penetration and customer satisfaction.

Embedded Multimedia Card Market Potential Customers

The Embedded Multimedia Card (eMMC) market caters to a broad spectrum of potential customers, primarily consisting of Original Equipment Manufacturers (OEMs) and system integrators across diverse industries that require reliable and compact embedded storage solutions. The largest segment of buyers remains the consumer electronics manufacturers, particularly those producing smartphones, tablets, and smart TVs. These companies integrate eMMC modules into their devices to provide internal storage for operating systems, applications, and user data, balancing cost-effectiveness with adequate performance for the mass market. The continuous refresh cycles and increasing feature sets of consumer devices ensure a steady demand for eMMC, particularly for mid-range and entry-level models where budget constraints are significant.

Beyond consumer electronics, the automotive industry represents a rapidly expanding customer base for eMMC. Automotive OEMs and Tier 1 suppliers utilize eMMC for a variety of applications, including infotainment systems, navigation units, instrument clusters, and Advanced Driver-Assistance Systems (ADAS). In this sector, eMMC is valued for its robust design, ability to withstand extreme temperatures and vibrations, and long-term reliability crucial for critical vehicle functions. The increasing digitalization of vehicles and the push towards autonomous driving continue to fuel demand for high-end, automotive-grade eMMC solutions, making it a pivotal segment for market growth.

Furthermore, the industrial and Internet of Things (IoT) sectors constitute a significant and growing cohort of potential customers. This includes manufacturers of industrial automation equipment, medical devices, network infrastructure, and a wide array of smart sensors and edge computing devices. These buyers prioritize eMMC for its durability, consistent performance, and ability to operate in challenging environments with extended operating temperatures and continuous data logging requirements. System integrators developing custom embedded solutions for specialized applications, such as digital signage, kiosks, and surveillance systems, also frequently opt for eMMC due to its ease of integration and established ecosystem. The diverse requirements across these segments highlight the versatility and foundational importance of eMMC technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.2 Billion |

| Market Forecast in 2032 | USD 8.9 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung, Kioxia (Toshiba Memory), SK Hynix, Micron Technology, Western Digital, Phison Electronics, Silicon Motion, Kingston Technology, SanDisk (Western Digital subsidiary), Lexar, Apacer Technology, ADATA Technology, Innodisk, Transcend Information, GigaDevice, Longsys, Netac Technology, Maxio Technology, Foresee, YMTC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Embedded Multimedia Card Market Key Technology Landscape

The Embedded Multimedia Card (eMMC) market's technology landscape is defined by continuous innovation in NAND flash memory, controller design, and interface specifications, all aimed at enhancing performance, increasing capacity, and improving reliability. At its core, eMMC technology integrates NAND flash memory with a flash memory controller within a single Ball Grid Array (BGA) package. The evolution from earlier eMMC standards (e.g., eMMC 4.4, eMMC 4.5) to the more prevalent eMMC 5.0 and eMMC 5.1 has brought significant improvements in read/write speeds, boot times, and power efficiency. These advancements are critical for supporting the growing demands of modern operating systems and data-intensive applications in embedded devices.

Key technological developments include advancements in NAND flash types, such as the transition from Planar NAND to 3D NAND technology. 3D NAND allows for significantly higher storage densities and improved endurance by stacking memory cells vertically, enabling eMMC modules to offer capacities of 256GB and above in a compact form factor. Coupled with this, sophisticated flash controller designs incorporate advanced error correction code (ECC) algorithms, wear leveling techniques, and bad block management to extend the lifespan of the NAND flash and ensure data integrity. These controllers are crucial for optimizing performance, managing power consumption, and enhancing the overall reliability of the eMMC device, especially under sustained workloads found in automotive and industrial applications.

Furthermore, the eMMC interface itself continues to be refined to enhance data transfer rates and reduce latency. eMMC 5.1, for instance, introduced features like Command Queuing (CQ) and Cache Barrier, which optimize command processing and data consistency, leading to more efficient operations. While Universal Flash Storage (UFS) offers even higher performance, eMMC maintains a strong position due to its cost-effectiveness, established ecosystem, and adequate performance for a vast range of embedded applications. The ongoing development of firmware optimizations, low-power modes, and security features also plays a critical role in the eMMC technology landscape, ensuring its continued relevance and competitiveness in the evolving embedded storage market. Manufacturers are also exploring specialized eMMC variants designed for specific harsh environments or extended temperature ranges, catering to the unique needs of industrial and automotive customers.

Regional Highlights

- Asia Pacific (APAC): Dominates the eMMC market due to its robust manufacturing base for consumer electronics (smartphones, tablets) in countries like China, South Korea, Taiwan, and Japan. High smartphone penetration and rapid digitalization across the region further fuel demand for embedded storage.

- North America: Significant growth driven by increasing adoption in automotive infotainment and ADAS, as well as the expanding industrial IoT sector. Strong focus on technological innovation and edge AI applications also contributes to market expansion.

- Europe: A strong market for automotive applications, particularly with the emphasis on advanced in-car systems and autonomous driving initiatives. The industrial automation and smart home sectors also provide substantial demand for eMMC solutions.

- Latin America: Emerging market with increasing smartphone adoption and growing investment in digital infrastructure. This region presents considerable potential for eMMC growth in consumer electronics and nascent industrial applications.

- Middle East & Africa (MEA): Exhibits gradual growth fueled by rising internet penetration, increasing disposable incomes, and government initiatives promoting digital transformation. The demand for affordable smart devices drives eMMC adoption across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Embedded Multimedia Card Market.- Samsung

- Kioxia (Toshiba Memory)

- SK Hynix

- Micron Technology

- Western Digital

- Phison Electronics

- Silicon Motion

- Kingston Technology

- SanDisk (Western Digital subsidiary)

- Lexar

- Apacer Technology

- ADATA Technology

- Innodisk

- Transcend Information

- GigaDevice

- Longsys

- Netac Technology

- Maxio Technology

- Foresee

- YMTC

Frequently Asked Questions

What is an Embedded Multimedia Card (eMMC) and its primary function?

An eMMC is a highly integrated storage solution combining NAND flash memory and a controller in a single package. Its primary function is to provide reliable, non-volatile storage for operating systems, applications, and data in embedded devices, offering simplified design and optimized performance.

How does eMMC compare to newer storage technologies like UFS?

eMMC is a cost-effective, proven technology offering reliable performance for sequential read/write operations, ideal for mid-range devices. UFS offers significantly higher performance, particularly for random read/write, making it preferred for high-end smartphones and applications requiring faster data access.

What are the key drivers for the growth of the eMMC market?

Key drivers include the proliferation of IoT devices, increasing demand from the automotive sector for infotainment and ADAS, the continued need for cost-effective storage in consumer electronics, and advancements in eMMC standards offering improved performance.

Which industries are the major end-users of eMMC products?

Major end-users include consumer electronics manufacturers (smartphones, tablets, smart TVs), the automotive industry (infotainment, ADAS), and the industrial and IoT sectors (automation, medical devices, edge computing).

What impact does AI have on the eMMC market?

AI, particularly at the edge, drives demand for higher capacity, more durable, and energy-efficient eMMC modules for storing AI models, processing inference data, and supporting real-time analytics in devices like autonomous vehicles and smart sensors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager