Embedded Security Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430365 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Embedded Security Market Size

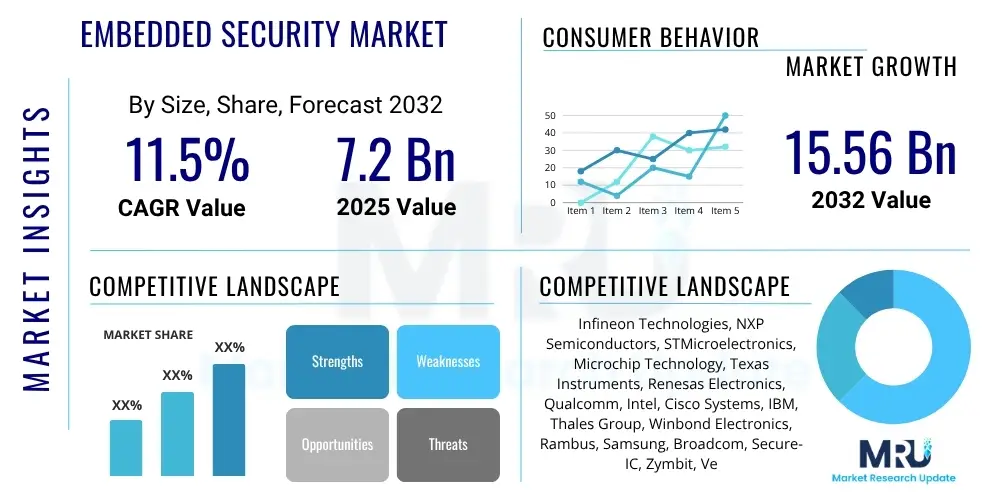

The Embedded Security Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2025 and 2032. The market is estimated at USD 7.2 Billion in 2025 and is projected to reach USD 15.56 Billion by the end of the forecast period in 2032.

Embedded Security Market introduction

The Embedded Security Market encompasses the technologies and strategies designed to protect embedded systems from various cyber threats. These systems, found in everything from IoT devices and automotive systems to industrial control units and consumer electronics, are often resource-constrained and operate in diverse environments, making their security a complex challenge. Embedded security products typically involve a combination of hardware-based, software-based, and firmware-based solutions to ensure the integrity, confidentiality, and availability of data and device functionality. These measures are crucial for preventing unauthorized access, data breaches, intellectual property theft, and device tampering, which can have significant financial, reputational, and safety implications.

Major applications of embedded security span across numerous industries. In the automotive sector, it protects vehicle ECUs, in-car networks, and communication channels from hacking, ensuring passenger safety and data privacy. For industrial control systems (ICS) and operational technology (OT), embedded security safeguards critical infrastructure from disruptive cyberattacks. The proliferation of IoT devices, from smart home gadgets to wearable technology, necessitates robust embedded security to protect personal data and prevent devices from being compromised and used as entry points for larger network attacks. The primary benefits include enhanced data integrity, secure authentication of devices and users, protection of sensitive intellectual property, and compliance with increasingly stringent regulatory standards.

The market's growth is predominantly driven by the pervasive expansion of the Internet of Things (IoT), leading to billions of interconnected devices, each presenting a potential attack surface. The escalating sophistication and frequency of cyberattacks targeting these embedded systems further underscore the critical need for advanced security solutions. Moreover, stringent regulatory frameworks and industry standards, particularly in sectors like automotive (e.g., ISO/SAE 21434) and healthcare (e.g., HIPAA), are compelling manufacturers to integrate robust security features from the design phase. The rising adoption of connected and autonomous vehicles, alongside the increasing demand for secure industrial automation, are also significant driving factors pushing the embedded security market forward.

Embedded Security Market Executive Summary

The embedded security market is experiencing robust growth, driven by the expanding landscape of connected devices and the escalating sophistication of cyber threats. Business trends indicate a significant push towards integrated security solutions, combining hardware and software layers, and a growing emphasis on security by design principles from the earliest stages of product development. Companies are increasingly investing in research and development to offer more resilient, scalable, and adaptable security platforms capable of addressing diverse embedded environments, from resource-constrained microcontrollers to complex automotive systems. There is also a notable trend toward partnerships and collaborations among semiconductor manufacturers, software providers, and cybersecurity firms to deliver comprehensive, end-to-end security offerings. Furthermore, the market is witnessing consolidation as larger players acquire specialized security firms to expand their portfolios and capabilities in this critical domain.

Regionally, North America and Europe continue to dominate the market due to early adoption of advanced technologies, stringent regulatory compliance mandates, and a high concentration of key market players and research institutions. However, the Asia Pacific region is projected to exhibit the highest growth rate, fueled by rapid industrialization, burgeoning IoT adoption across consumer electronics and manufacturing sectors, and increasing government initiatives to bolster cybersecurity infrastructure. Latin America, the Middle East, and Africa are also emerging as significant markets, driven by growing digitalization efforts and a rising awareness of cyber risks across various industries, prompting increased investment in embedded security solutions to protect nascent digital infrastructures.

Segment-wise, the hardware security component, including secure elements (SEs), trusted platform modules (TPMs), and hardware security modules (HSMs), is expected to maintain a dominant position due to its foundational role in providing root of trust and robust cryptographic operations. The software and services segments are also experiencing substantial growth, driven by the need for secure boot, firmware protection, secure over-the-air updates, and expert consulting services for embedded system design and implementation. The automotive and industrial sectors are anticipated to be the leading end-use industries, as the proliferation of connected cars and the critical nature of industrial control systems necessitate uncompromising security measures. Moreover, the demand for embedded security in consumer electronics and healthcare devices is steadily increasing, reflecting a broader market recognition of the importance of protecting user data and device functionality in a hyper-connected world.

AI Impact Analysis on Embedded Security Market

Users frequently inquire about how artificial intelligence (AI) will transform embedded security, seeking to understand both its protective capabilities and the new vulnerabilities it might introduce. Common questions revolve around AI's role in detecting sophisticated threats, enhancing anomaly detection, and automating security responses within resource-constrained embedded environments. There is also significant interest in how AI could be exploited by attackers, creating more intelligent and evasive malware targeting embedded systems, and the implications for privacy and data integrity. The key themes emerging from these inquiries highlight expectations for AI to provide proactive, predictive security, while also raising concerns about the complexity of integrating AI securely into deeply embedded systems and the potential for AI-driven attacks to bypass traditional defenses.

- Enhanced Threat Detection: AI algorithms analyze vast datasets to identify anomalous behavior patterns, predicting and detecting zero-day attacks more effectively in embedded systems.

- Automated Security Response: AI-driven systems can automatically isolate compromised devices, patch vulnerabilities, or trigger alerts without human intervention, speeding up incident response.

- Vulnerability Prediction: Machine learning models can predict potential vulnerabilities in code or hardware designs, enabling proactive security measures during development.

- Adaptive Security: AI allows embedded security systems to adapt to evolving threat landscapes, continuously learning from new attack vectors and updating defense mechanisms.

- New Attack Vectors: AI itself can be a target for attacks, such as adversarial machine learning, where attackers manipulate training data or models to bypass AI-based security.

- Increased Complexity: Integrating AI into embedded systems adds complexity to the security architecture, requiring specialized expertise for secure deployment and maintenance.

DRO & Impact Forces Of Embedded Security Market

The Embedded Security Market is significantly shaped by a confluence of driving forces, restraining factors, and emerging opportunities, all contributing to its dynamic growth trajectory and influencing the strategic decisions of market participants. The rapid expansion of the Internet of Things (IoT) ecosystem, with billions of devices entering various sectors, stands as a primary driver, as each new connected device represents a potential entry point for cyberattacks, thus necessitating robust embedded security measures. Alongside this, the escalating volume and sophistication of cyberattacks, including ransomware, malware, and state-sponsored attacks, directly impact embedded systems, pushing manufacturers and end-users to invest heavily in protective technologies. Furthermore, the introduction of stringent regulatory frameworks and industry standards, particularly in critical sectors like automotive, healthcare, and industrial control systems, mandates the integration of security from the design phase, thereby driving market demand for compliant solutions. The increasing adoption of connected and autonomous vehicles, which rely heavily on secure embedded systems for safe and reliable operation, also serves as a potent growth catalyst. These drivers collectively create a compelling need for advanced embedded security solutions to safeguard data, ensure operational integrity, and protect critical infrastructure against pervasive digital threats.

Despite these strong tailwinds, the embedded security market faces several significant restraints. One major challenge is the inherent complexity and high cost associated with implementing comprehensive embedded security solutions. Integrating security features into resource-constrained embedded systems often requires specialized hardware, software, and significant development effort, which can be prohibitive for smaller manufacturers or for devices with tight budget constraints. The lack of standardized security protocols and frameworks across diverse embedded ecosystems creates interoperability issues and makes it difficult for manufacturers to deploy universally secure solutions, leading to fragmented approaches. Moreover, the long lifecycle of many embedded systems, coupled with difficulties in performing secure over-the-air (OTA) updates, can leave devices vulnerable to emerging threats for extended periods. The global supply chain vulnerabilities, where malicious components or software can be introduced at various stages of manufacturing, also pose a substantial risk that is challenging to mitigate effectively, requiring end-to-end security visibility and trust. These restraints collectively highlight the practical and economic hurdles that must be overcome for broader and more effective adoption of embedded security.

Opportunities within the embedded security market are vast and continually expanding, driven by technological advancements and evolving market needs. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into embedded security solutions presents a significant opportunity to develop more intelligent threat detection, anomaly identification, and automated response capabilities, enhancing proactive defense mechanisms. The rollout of 5G networks, enabling faster and more pervasive connectivity for IoT and edge devices, necessitates new levels of embedded security to protect against novel attack surfaces and ensure the integrity of high-speed data transmission. The growing trend of edge computing, which processes data closer to the source, inherently demands robust embedded security at the edge to protect distributed processing units and sensitive data locally. Furthermore, the increasing focus on securing critical infrastructure in industries such as energy, utilities, and transportation, alongside the rising demand for secure-by-design principles in product development, offers substantial avenues for market expansion. The continuous evolution of cryptographic techniques, secure hardware architectures, and trusted execution environments also creates opportunities for developing more resilient and future-proof embedded security solutions, allowing the market to innovate and address complex security challenges effectively.

Segmentation Analysis

The Embedded Security Market is intricately segmented based on various factors, including component type, security type, and the diverse end-use industries it serves. This granular segmentation provides a clearer understanding of the market's dynamics, highlighting specific areas of growth, key technological preferences, and the varying security requirements across different applications. Each segment reflects unique challenges and opportunities, influencing product development, market strategies, and investment priorities for stakeholders. The market's overall growth is a composite of the individual performance of these segments, driven by factors such as technological advancements, regulatory pressures, and evolving threat landscapes. Understanding these distinct segments is crucial for market participants to tailor their offerings and maximize their impact within this critical cybersecurity domain.

- By Component

- Hardware (Secure Elements, Trusted Platform Modules (TPM), Hardware Security Modules (HSM))

- Software (Firmware Security, OS Security, Application Security)

- Services (Consulting, Implementation, Support & Maintenance, Managed Security Services)

- By Type

- Authentication and Encryption

- Secure Boot

- Secure Storage

- Key Management

- Trusted Execution Environment (TEE)

- Digital Rights Management (DRM)

- By End-Use Industry

- Automotive

- Industrial

- Consumer Electronics

- Healthcare

- Retail

- Government and Defense

- Telecommunication

- Others

Value Chain Analysis For Embedded Security Market

The value chain for the embedded security market begins with upstream activities, primarily involving the design and manufacturing of foundational hardware components and the development of core intellectual property. This stage includes semiconductor manufacturers who design and produce secure microcontrollers, processors with integrated security features, secure elements (SEs), trusted platform modules (TPMs), and hardware security modules (HSMs). IP core providers also play a crucial role, licensing secure design blocks, cryptographic accelerators, and secure boot technologies to chip designers. Material suppliers providing specialized substrates and packaging also form part of this upstream segment. Innovation in this stage focuses on creating inherently secure hardware architectures that provide a root of trust and robust tamper-resistance, which are fundamental to the entire security posture of an embedded system. The quality and trustworthiness of these initial components directly impact the effectiveness of all subsequent security layers.

Moving downstream, the value chain progresses through several stages including software and firmware development, system integration, and ultimately, deployment to end-users. After secure hardware components are manufactured, software developers and firmware engineers integrate operating system security features, secure boot mechanisms, cryptographic libraries, and application-level security protocols. Original Equipment Manufacturers (OEMs) then take these components and integrate them into their final products, such as connected cars, industrial controllers, smart home devices, or medical equipment. System integrators and value-added resellers (VARs) often play a critical role in customizing solutions and ensuring seamless integration into complex existing infrastructures. This stage involves rigorous testing, vulnerability assessments, and compliance checks to ensure the embedded system meets security standards before it reaches the end-user. The success of this downstream segment relies on effective collaboration between hardware providers, software developers, and system integrators to deliver comprehensive, end-to-end secure solutions.

The distribution channel for embedded security solutions is multifaceted, encompassing both direct and indirect approaches. Direct channels involve semiconductor manufacturers and specialized embedded security firms selling their products and services directly to large OEMs and Tier 1 suppliers in industries like automotive, industrial, and defense. This approach allows for tailored solutions, deep technical support, and closer collaboration on product development cycles. Indirect channels are equally vital and include a network of distributors, resellers, and system integrators who facilitate broader market reach, particularly for smaller OEMs or diverse end-user applications. These partners often provide value-added services such as pre-integration, customization, and local technical support, helping bridge the gap between technology providers and a wider customer base. The choice of distribution channel often depends on the complexity of the solution, the target market segment, and the level of customization required, with a trend towards hybrid models that combine the benefits of both direct engagement and broad partner reach to serve the diverse needs of the embedded security market.

Embedded Security Market Potential Customers

Potential customers for embedded security solutions represent a broad spectrum of industries, all characterized by their reliance on embedded systems for critical operations and product functionality. These end-users are increasingly aware of the severe consequences of security breaches, ranging from financial losses and reputational damage to safety hazards and regulatory penalties. The primary goal for these buyers is to protect their intellectual property, ensure the integrity and confidentiality of sensitive data, maintain device uptime, and secure user privacy. Their purchasing decisions are often driven by a combination of factors including evolving cyber threats, regulatory compliance requirements, the need for brand protection, and the imperative to deliver trustworthy and reliable products to their own customer base. The demand for embedded security is not just about compliance but also about competitive differentiation and mitigating risks in an increasingly connected world where every device is a potential target. Therefore, the market serves any entity that designs, manufactures, or deploys devices with embedded processors and connectivity, making the customer base highly diverse and continually expanding.

A significant segment of end-users comes from the automotive industry, including original equipment manufacturers (OEMs) and Tier 1 suppliers. These companies require robust embedded security to protect electronic control units (ECUs), in-vehicle networks, and external communication channels in connected and autonomous vehicles. The stakes are particularly high here, as security failures can lead to safety risks for passengers and expose vast amounts of vehicle and user data. Another crucial customer group comprises industrial manufacturers and operators of critical infrastructure, such as energy grids, water treatment plants, and smart factories. For these entities, embedded security is vital for safeguarding industrial control systems (ICS) and operational technology (OT) from cyberattacks that could disrupt essential services or lead to catastrophic failures. The integrity and availability of these systems are paramount, making embedded security an indispensable investment for ensuring operational resilience and national security.

Beyond these core sectors, the embedded security market also caters to a vast array of other industries. Consumer electronics manufacturers, producing smart home devices, wearables, and personal computing devices, are key customers, driven by the need to protect user data privacy and prevent their devices from being exploited in botnets or other malicious activities. Healthcare device manufacturers, including those developing medical wearables, diagnostic equipment, and remote patient monitoring systems, require stringent embedded security to comply with patient data privacy regulations (e.g., HIPAA) and ensure the reliable operation of life-critical devices. Additionally, the retail sector for point-of-sale (POS) systems, government and defense agencies for secure communication and critical infrastructure, and telecommunication providers for network equipment, all represent substantial segments of potential customers who demand advanced embedded security solutions to mitigate diverse and evolving cyber threats.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 7.2 Billion |

| Market Forecast in 2032 | USD 15.56 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies, NXP Semiconductors, STMicroelectronics, Microchip Technology, Texas Instruments, Renesas Electronics, Qualcomm, Intel, Cisco Systems, IBM, Thales Group, Winbond Electronics, Rambus, Samsung, Broadcom, Secure-IC, Zymbit, Verimatrix, ARM Holdings, Cypress Semiconductor (now Infineon). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Embedded Security Market Key Technology Landscape

The embedded security market is underpinned by a diverse and rapidly evolving technological landscape, driven by the need to protect increasingly complex and interconnected embedded systems from sophisticated cyber threats. At the core of this landscape are hardware-based security technologies, which provide a foundational "root of trust" that is difficult to compromise. These include Secure Elements (SEs), which are tamper-resistant microcontrollers designed to securely store cryptographic keys and perform secure operations; Trusted Platform Modules (TPMs), offering secure cryptographic functions and measurements of system integrity; and Hardware Security Modules (HSMs), providing cryptographic processing and key management for high-security applications. These hardware components are crucial for ensuring the integrity of the boot process, protecting critical data, and enabling secure authentication, forming the bedrock upon which higher-level security features are built. Their inherent tamper-resistance and isolation capabilities are vital in environments where physical access to devices is a concern, establishing a trusted execution environment for sensitive operations.

Complementing hardware security are various software and firmware-based technologies that extend protection throughout the system's lifecycle. Secure Boot is a critical mechanism that ensures only authenticated and authorized software is executed at startup, preventing malicious code injection during the boot process. Firmware protection techniques safeguard the embedded device's firmware from unauthorized modification or corruption, often through digital signatures and encryption. Cryptography, encompassing symmetric and asymmetric encryption algorithms, hashing functions, and digital signatures, is fundamental for securing data at rest and in transit, enabling secure communication and data confidentiality. Key management solutions are essential for securely generating, storing, distributing, and revoking cryptographic keys, which are the backbone of any secure system. Over-the-Air (OTA) update mechanisms, when implemented securely, allow for remote patching of vulnerabilities and updating of firmware, which is crucial for maintaining security posture over the long lifecycle of embedded devices, particularly in IoT deployments.

Emerging technologies are also playing an increasingly vital role in shaping the embedded security landscape. Trusted Execution Environments (TEEs) create an isolated, secure area within a processor to run sensitive code and protect critical data, even if the main operating system is compromised. These environments are becoming more prevalent in mobile and IoT devices, offering enhanced protection for critical applications. The adoption of AI and Machine Learning (ML) is growing, enabling embedded systems to perform intelligent threat detection, anomaly analysis, and predictive security, allowing for more proactive and adaptive defenses against evolving cyber threats. While still in nascent stages for deeply embedded contexts, blockchain technology is being explored for its potential in creating immutable ledgers for device identity, secure supply chain tracking, and distributed trust mechanisms, offering new paradigms for ensuring authenticity and integrity in complex embedded networks. These advanced technologies are continuously being integrated to address the dynamic and expanding attack surfaces presented by the proliferation of connected devices, aiming to provide more comprehensive, resilient, and intelligent security solutions.

Regional Highlights

- North America: This region holds a significant share of the embedded security market, driven by early adoption of advanced technologies, a robust cybersecurity infrastructure, and the presence of numerous key market players. Stringent regulatory mandates in sectors like defense, automotive, and healthcare also compel manufacturers to integrate sophisticated embedded security solutions. The high concentration of R&D activities and a strong focus on innovation contribute to the region's market leadership.

- Europe: Europe represents another substantial market for embedded security, largely influenced by stringent data protection regulations such as GDPR, which necessitate robust security measures across all connected devices. The thriving automotive industry in countries like Germany, with its strong emphasis on connected and autonomous vehicles, drives significant demand for embedded security. Additionally, the region's focus on industrial automation and critical infrastructure protection further fuels market growth.

- Asia Pacific (APAC): The APAC region is projected to experience the fastest growth in the embedded security market. This growth is attributed to rapid industrialization, massive investments in smart city projects, and the accelerating adoption of IoT devices across consumer electronics, manufacturing, and automotive sectors in countries like China, India, and Japan. Increased government initiatives to enhance cybersecurity capabilities and a growing awareness of cyber threats also contribute to the market expansion.

- Latin America: This region is an emerging market for embedded security, characterized by increasing digitalization across various industries and growing investments in smart infrastructure projects. While the market is still developing, rising concerns over cyberattacks and the need to protect sensitive data are driving the adoption of embedded security solutions, particularly in financial services, telecommunications, and government sectors.

- Middle East and Africa (MEA): The MEA region is witnessing steady growth in the embedded security market, primarily driven by digital transformation initiatives, particularly in Gulf Cooperation Council (GCC) countries. Investments in smart cities, critical infrastructure development, and growing cybersecurity awareness among businesses and governments are fostering the demand for robust embedded security solutions to protect nascent digital ecosystems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Embedded Security Market.- Infineon Technologies

- NXP Semiconductors

- STMicroelectronics

- Microchip Technology

- Texas Instruments

- Renesas Electronics

- Qualcomm

- Intel

- Cisco Systems

- IBM

- Thales Group

- Winbond Electronics

- Rambus

- Samsung

- Broadcom

- Secure-IC

- Zymbit

- Verimatrix

- ARM Holdings

- Cypress Semiconductor (now Infineon)

Frequently Asked Questions

What is embedded security?

Embedded security refers to the protective measures, both hardware and software, designed to safeguard embedded systems—such as those in IoT devices, cars, or industrial controls—from cyber threats like hacking, data breaches, and tampering, ensuring their integrity, confidentiality, and availability.

Why is embedded security important for IoT devices?

Embedded security is critical for IoT devices to protect sensitive user data, prevent unauthorized access or control of devices, and mitigate the risk of these devices being exploited as entry points for larger network attacks or botnets, thus ensuring privacy, safety, and operational integrity.

What are the key components of embedded security?

Key components of embedded security typically include hardware security modules (HSMs), trusted platform modules (TPMs), secure elements (SEs), secure boot mechanisms, cryptographic engines, secure firmware, and trusted execution environments (TEEs), working together to create a robust defense layer.

How do regulatory compliance standards affect the embedded security market?

Regulatory compliance standards, such as GDPR for data privacy or ISO/SAE 21434 for automotive cybersecurity, significantly impact the embedded security market by mandating specific security features and practices, compelling manufacturers to integrate advanced security from the design phase, and driving demand for compliant solutions.

What role does AI play in the future of embedded security?

AI is set to enhance embedded security by enabling more sophisticated threat detection, predictive vulnerability analysis, and automated response capabilities. It can help embedded systems adapt to new threats and identify anomalous behavior in real-time, although it also introduces new considerations for securing AI models themselves.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager