Endoscope Reprocessing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427526 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Endoscope Reprocessing Market Size

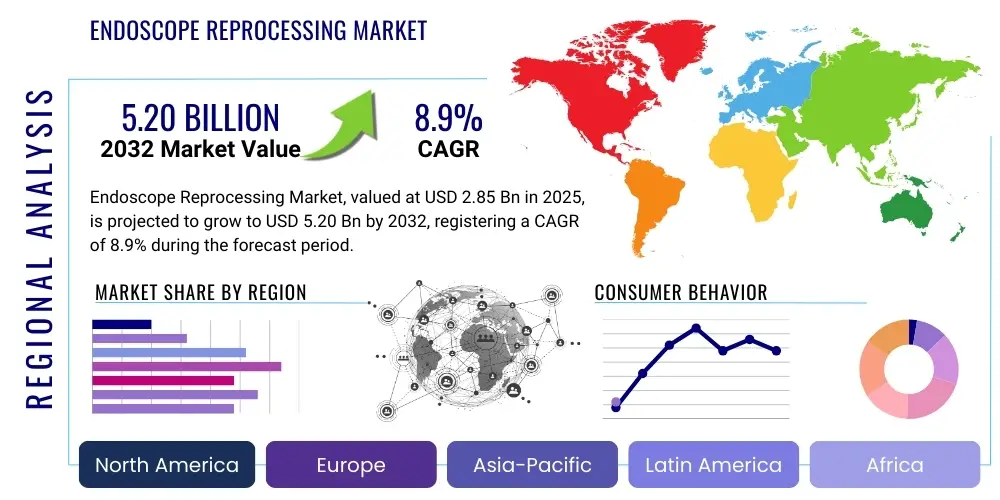

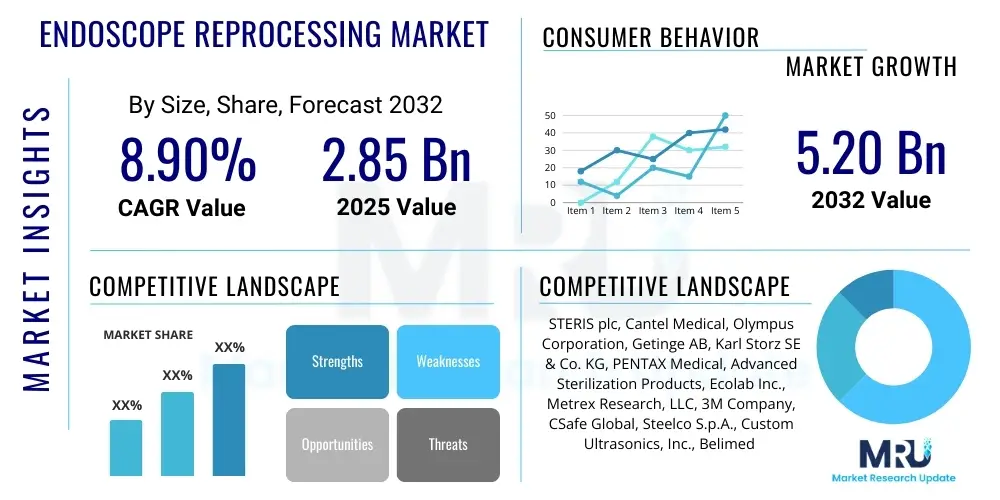

The Endoscope Reprocessing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2025 and 2032. The market is estimated at USD 2.85 billion in 2025 and is projected to reach USD 5.20 billion by the end of the forecast period in 2032.

Endoscope Reprocessing Market introduction

The Endoscope Reprocessing Market encompasses the technologies, products, and services dedicated to cleaning, disinfecting, and sterilizing flexible and rigid endoscopes to ensure patient safety and operational efficiency in healthcare settings. This critical process prevents hospital-acquired infections (HAIs) by eliminating microbial contamination after each use. Endoscopes, being complex medical devices with intricate channels, require meticulous reprocessing to remove bioburden and destroy pathogens, making specialized equipment and high-level disinfectants indispensable.

Key products within this market include automated endoscope reprocessors (AERs), enzymatic detergents, high-level disinfectants, sterilants, endoscope drying and storage cabinets, and tracking systems. These solutions are primarily utilized in hospitals, ambulatory surgical centers (ASCs), and diagnostic centers where endoscopic procedures are routinely performed. The overarching benefit of effective endoscope reprocessing is the drastic reduction in infection transmission risks, safeguarding both patients and healthcare personnel, while also extending the lifespan of expensive endoscopic equipment through proper maintenance.

Driving factors for market expansion include the escalating global incidence of HAIs, the increasing volume of endoscopic procedures across various medical specialties such as gastroenterology, pulmonology, and urology, and the continuous introduction of advanced endoscope designs that necessitate more sophisticated reprocessing methods. Furthermore, stringent regulatory guidelines and recommendations from health authorities worldwide, emphasizing the importance of validated reprocessing protocols, are compelling healthcare facilities to invest in advanced reprocessing solutions, thereby fueling market growth.

Endoscope Reprocessing Market Executive Summary

The Endoscope Reprocessing Market is experiencing robust growth driven by an elevated focus on patient safety and the imperative to prevent healthcare-associated infections (HAIs). Business trends indicate a strong shift towards automation, with automated endoscope reprocessors (AERs) gaining prominence due to their ability to standardize processes, reduce human error, and enhance reprocessing efficiency. Concurrently, there is an increasing demand for endoscope tracking and management systems, leveraging technologies like RFID and barcode scanning, to ensure full traceability and compliance. The market also observes a growing interest in outsourced reprocessing services, particularly among smaller healthcare facilities seeking to optimize costs and adhere to stringent guidelines without significant capital investment.

Regional trends highlight North America and Europe as dominant markets, primarily due to well-established healthcare infrastructures, high adoption rates of advanced medical technologies, and strict regulatory frameworks governing infection control. However, the Asia-Pacific region is projected to exhibit the fastest growth, propelled by expanding healthcare access, increasing medical tourism, a rising prevalence of chronic diseases necessitating endoscopic interventions, and improving awareness regarding infection prevention. Emerging economies within this region are rapidly investing in modern healthcare facilities, consequently boosting demand for sophisticated reprocessing solutions. Latin America, the Middle East, and Africa are also poised for steady growth, albeit from a smaller base, driven by healthcare infrastructure development and government initiatives to improve public health.

Segment-wise, the automated reprocessing segment is anticipated to witness substantial growth, attributed to the advantages it offers in terms of speed, consistency, and reduced risk of manual errors compared to traditional methods. Within consumables, the demand for high-level disinfectants and enzymatic detergents remains consistently high, essential for effective decontamination. End-use trends show hospitals as the largest segment, but ambulatory surgical centers (ASCs) are emerging as significant growth contributors, driven by the increasing shift of outpatient procedures to these cost-effective settings. The continuous innovation in endoscope design, including the introduction of highly complex and even single-use endoscopes, is also reshaping demand within various product and service segments.

AI Impact Analysis on Endoscope Reprocessing Market

Common user questions regarding the impact of AI on the Endoscope Reprocessing Market often center on its potential to enhance patient safety, streamline workflows, and mitigate the persistent challenge of human error. Users frequently inquire if AI can fully automate the reprocessing cycle, how it might contribute to better detection of residual bioburden, and whether it can provide real-time insights into reprocessing efficacy. There is also significant interest in AIs role in predictive maintenance for reprocessing equipment and its capacity to improve endoscope tracking and inventory management. Underlying these questions are concerns about the economic feasibility of integrating AI, the need for specialized training, and the ultimate impact on the demand for human technicians.

The overarching themes that emerge from these inquiries point towards a strong expectation that AI will bring unprecedented levels of precision, data-driven decision-making, and proactive problem-solving to a domain historically reliant on manual protocols and visual inspection. Users anticipate that AI could potentially reduce the variability inherent in human-performed tasks, providing a more consistent and verifiable standard of reprocessing. This focus on enhanced consistency and data validation reflects a broader industry push to eliminate the risk of cross-contamination and ensure every endoscope is safe for patient use.

Moreover, the discussion often extends to the long-term implications of AI, exploring its ability to collect and analyze vast amounts of reprocessing data to identify trends, predict equipment failures, and optimize resource allocation. This strategic application of AI is seen as crucial for improving overall operational efficiency and reducing the total cost of ownership for healthcare facilities. While there is a recognition of the initial investment and integration challenges, the potential for AI to transform endoscope reprocessing from a labor-intensive process to a highly intelligent and automated system is a key area of interest and expectation.

- AI-powered visual inspection systems for detecting residual debris and damage on endoscopes, significantly improving quality control.

- Predictive analytics for maintenance of automated reprocessing equipment, reducing downtime and extending asset life.

- Optimized workflow management and scheduling in reprocessing units, enhancing efficiency and throughput.

- Advanced endoscope tracking and inventory management systems, utilizing machine learning for improved traceability and utilization.

- AI-driven analysis of reprocessing data to identify trends, potential risks, and areas for process improvement, leading to enhanced patient safety protocols.

- Automated documentation and compliance reporting, reducing administrative burden and ensuring regulatory adherence.

DRO & Impact Forces Of Endoscope Reprocessing Market

The Endoscope Reprocessing Market is fundamentally shaped by a confluence of drivers, restraints, and opportunities, all operating under the influence of various impact forces. A primary driver is the alarming rise in healthcare-associated infections (HAIs), particularly those linked to improperly reprocessed endoscopes, which places immense pressure on healthcare facilities to adopt advanced and more reliable reprocessing protocols. This is further amplified by the steadily increasing global volume of endoscopic procedures for diagnosis and treatment of a wide range of conditions, necessitating efficient and safe reprocessing cycles. Technological advancements in both endoscope design and reprocessing equipment, such as multi-lumen endoscopes and automated reprocessing systems with improved efficacy and faster cycles, also serve as significant market drivers. Additionally, stringent regulatory guidelines from bodies like the FDA, CDC, and various national health authorities worldwide mandate meticulous reprocessing, compelling healthcare providers to invest in compliant solutions.

Despite these strong drivers, the market faces several significant restraints. The high initial capital expenditure associated with purchasing advanced automated endoscope reprocessors (AERs) and specialized drying and storage cabinets can be prohibitive, especially for smaller hospitals and clinics with limited budgets. There remains a persistent potential for human error in manual reprocessing steps, even with advanced equipment, leading to reprocessing failures and patient safety risks. Furthermore, the chemical exposure risks associated with certain high-level disinfectants and sterilants pose health concerns for reprocessing technicians, necessitating robust ventilation systems and personal protective equipment, which adds to operational costs. Limited awareness and infrastructure in developing regions also present a restraint, as adoption rates for modern reprocessing technologies remain low compared to developed nations.

Opportunities for market growth primarily lie in the ongoing innovation within the medical device sector. The emergence of single-use endoscopes, particularly for high-risk procedures or in resource-constrained settings, presents a disruptive but ultimately beneficial trend that could reduce reprocessing burden in specific niches. The integration of advanced technologies like AI, IoT, and blockchain for enhanced traceability, real-time monitoring, and data analytics in reprocessing workflows offers substantial opportunities for process optimization and improved safety. Furthermore, the expansion of healthcare infrastructure in emerging markets, coupled with increasing disposable incomes and rising health consciousness, opens new avenues for market penetration. Lastly, the growing trend of outsourcing endoscope reprocessing to specialized third-party services allows healthcare facilities to focus on core patient care while ensuring high standards of reprocessing without the overhead of in-house investment.

The impact forces influencing this market are predominantly regulatory pressures, which continually push for higher standards and greater accountability in reprocessing. Technological innovation acts as a constant force, driving the development of safer, more efficient, and more automated solutions. Patient safety demands are paramount, compelling the industry to prioritize infection prevention above all else. Economic factors, including healthcare budgets and reimbursement policies, also significantly influence investment decisions in reprocessing equipment. Finally, public health concerns, particularly following outbreaks linked to contaminated endoscopes, serve as powerful forces accelerating the adoption of best practices and advanced technologies.

Segmentation Analysis

The Endoscope Reprocessing Market is comprehensively segmented across several critical dimensions, including product type, end-use, and process, providing a detailed understanding of market dynamics and growth opportunities. This granular segmentation allows stakeholders to identify specific areas of investment, target key customer groups, and develop tailored strategies. The product segment encompasses a wide array of equipment, consumables, and tracking systems essential for a complete reprocessing cycle, reflecting the diverse needs of healthcare facilities. The end-use segmentation differentiates between the primary types of healthcare institutions that utilize endoscopes, each with distinct operational requirements and budget considerations.

Process segmentation further delineates between manual and automated reprocessing methods, highlighting the ongoing shift towards advanced, less labor-intensive solutions. This intricate market structure ensures that every aspect of the reprocessing workflow, from initial cleaning to storage, is addressed by specific solutions designed to optimize efficacy and safety. Understanding these segments is crucial for manufacturers to align their product development with market demands and for healthcare providers to select the most appropriate technologies for their operational scale and patient volumes. The market’s segmentation also underscores the complexity and multi-faceted nature of endoscope reprocessing, where a combination of products and processes is often required to meet the highest standards of infection prevention.

The consistent growth across various sub-segments, particularly within automated solutions and advanced consumables, indicates a strong market response to increasing regulatory scrutiny and the persistent challenge of preventing healthcare-associated infections. This segmentation framework serves as a vital tool for market analysis, strategic planning, and forecasting future trends, enabling businesses to navigate the competitive landscape effectively and capitalize on emerging opportunities within the highly specialized endoscope reprocessing domain.

- Product Type:

- Automated Endoscope Reprocessors (AERs)

- High-Level Disinfectants (HLDs) & Sterilants (e.g., Glutaraldehyde, Ortho-phthalaldehyde (OPA), Hydrogen Peroxide, Peracetic Acid)

- Enzymatic Detergents & Cleaning Solutions

- Brushes & Flushing Aids

- Endoscope Drying & Storage Cabinets

- Endoscope Tracking & Documentation Systems

- Leak Testers

- Other Accessories & Consumables

- End-Use:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

- Specialty Clinics

- Process:

- Manual Reprocessing

- Automated Reprocessing

- Type of Endoscope:

- Flexible Endoscopes

- Rigid Endoscopes

Endoscope Reprocessing Market Value Chain Analysis

The value chain for the Endoscope Reprocessing Market begins with upstream activities involving the sourcing of raw materials and components critical for manufacturing reprocessing equipment and consumables. This segment includes suppliers of chemicals (for disinfectants, detergents), electronic components (for AERs and tracking systems), plastics, metals, and precision engineering services. The quality and availability of these raw materials directly impact the manufacturing efficiency and final product quality, making robust supplier relationships crucial. Manufacturers then process these materials to produce a diverse range of products, including complex automated systems, specialized chemicals, and various accessories, adhering to strict quality control and regulatory standards.

Moving downstream, the products transition through various distribution channels to reach the end-users. The distribution landscape is multifaceted, involving both direct and indirect approaches. Direct sales involve manufacturers selling directly to large hospital networks, integrated delivery systems, or government healthcare agencies, often utilizing their own dedicated sales forces and technical support teams. This approach allows for closer customer relationships, customized solutions, and direct feedback loops. Indirect channels comprise a network of specialized medical device distributors, wholesalers, and third-party logistics providers who facilitate market penetration, particularly in fragmented markets or for smaller healthcare facilities. These distributors often provide warehousing, local support, and streamlined procurement processes, playing a vital role in market reach.

The ultimate destination in the value chain is the end-user, primarily hospitals, ambulatory surgical centers, and diagnostic centers, where the endoscope reprocessing products are critically utilized. Effective distribution ensures that these essential devices and consumables are readily available to healthcare professionals, preventing supply chain disruptions that could compromise patient safety. After-sales services, including installation, maintenance, technical support, and training, also form a crucial part of the downstream value chain, ensuring optimal performance of reprocessing equipment and compliance with evolving guidelines. The efficiency of this entire chain, from raw material sourcing to post-sale support, significantly impacts market responsiveness, product accessibility, and overall customer satisfaction in the highly regulated endoscope reprocessing sector.

Endoscope Reprocessing Market Potential Customers

The primary potential customers for the Endoscope Reprocessing Market are healthcare institutions that regularly perform endoscopic procedures and therefore require robust solutions for cleaning, disinfecting, and sterilizing these complex medical devices. Hospitals represent the largest segment of end-users due to the sheer volume and diversity of endoscopic procedures conducted within their various departments, including gastroenterology, pulmonology, urology, and surgery. This includes large public and private hospitals, academic medical centers, and university hospitals, all of which demand comprehensive reprocessing solutions, from high-throughput automated reprocessors to advanced tracking systems and a consistent supply of specialized consumables.

Ambulatory Surgical Centers (ASCs) constitute another significant and rapidly growing customer segment. As there is a global trend towards shifting less complex outpatient procedures from inpatient hospital settings to more cost-effective ASCs, the demand for efficient and compliant endoscope reprocessing solutions in these facilities is increasing exponentially. ASCs typically require solutions that are space-efficient, easy to operate, and meet stringent regulatory standards while managing a high volume of procedures. Diagnostic centers, particularly those specializing in gastrointestinal endoscopy or bronchoscopy, also form a crucial customer base, requiring dedicated reprocessing equipment and consumables to support their diagnostic services.

Furthermore, specialized clinics, such as those focusing on ophthalmology, ENT (Ear, Nose, and Throat), or pain management, which might utilize flexible or rigid endoscopes, also represent potential customers, albeit on a smaller scale. These diverse end-users all share the common imperative of ensuring patient safety through effective infection prevention, making reliable and efficient endoscope reprocessing an indispensable component of their operations. Manufacturers and service providers in this market must therefore tailor their offerings to address the specific needs, budget constraints, and regulatory environments of these varied healthcare providers.

Endoscope Reprocessing Market Key Technology Landscape

The Endoscope Reprocessing Market is characterized by a dynamic technology landscape continually evolving to meet the escalating demands for patient safety, operational efficiency, and regulatory compliance. Automated Endoscope Reprocessors (AERs) remain at the forefront, with advancements focused on reducing reprocessing cycle times, enhancing cleaning efficacy through optimized fluid dynamics and enzymatic dosing, and incorporating features like dual scope reprocessing capabilities to boost throughput. Newer AERs integrate advanced filtration systems, self-disinfection cycles, and comprehensive data logging for improved traceability and compliance. The shift towards single-pass systems and those compatible with a wider range of high-level disinfectants and sterilants marks a significant technological progression.

Beyond AERs, the market is seeing innovation in the consumables segment. High-level disinfectants (HLDs) and sterilants are continuously being refined to offer broader microbicidal activity, shorter contact times, and improved material compatibility, while also addressing concerns regarding environmental impact and technician safety. The development of advanced enzymatic detergents with multi-enzymatic formulations capable of breaking down complex bioburden is crucial for effective pre-cleaning. Furthermore, the integration of specialized brushes, flushing aids, and validated cleaning solutions designed for intricate endoscope channels ensures thorough removal of organic matter before disinfection.

A critical area of technological advancement lies in endoscope tracking and management systems. Solutions leveraging RFID (Radio-Frequency Identification), barcode scanning, and increasingly, IoT (Internet of Things) platforms, provide real-time visibility into the entire reprocessing cycle, from point-of-use cleaning to storage and patient utilization. These systems facilitate automated documentation, identify reprocessing bottlenecks, predict maintenance needs, and offer comprehensive audit trails, thereby minimizing human error and enhancing compliance. Additionally, advanced drying and storage cabinets that maintain a controlled, sterile environment for reprocessed endoscopes, often with HEPA-filtered air and active ventilation, are vital in preventing recontamination post-reprocessing, representing another key technological facet contributing to overall patient safety.

Regional Highlights

- North America: Dominant market share attributed to stringent regulatory frameworks, high adoption of advanced medical technologies, significant healthcare expenditure, and a large number of endoscopic procedures. The presence of major market players and well-established healthcare infrastructure further propels growth, particularly in the United States and Canada.

- Europe: A mature market with strong emphasis on patient safety and infection control, driven by robust regulatory guidelines from bodies like MHRA and EMA. Countries such as Germany, the UK, and France are key contributors, demonstrating high adoption of automated reprocessing solutions and increasing demand for traceable systems amidst rising HAI concerns.

- Asia-Pacific: Poised for the fastest growth, fueled by rapidly developing healthcare infrastructure, increasing prevalence of chronic diseases, rising medical tourism, and growing awareness regarding infection prevention. Emerging economies like China, India, and Japan are investing heavily in modern hospitals and advanced medical equipment, creating substantial market opportunities.

- Latin America: Experiencing steady growth as healthcare access expands and awareness of infection control improves. Brazil and Mexico are leading the regional market, driven by increasing government investments in healthcare and a growing volume of endoscopic diagnostic and therapeutic procedures.

- Middle East & Africa: Emerging market with increasing healthcare expenditure, particularly in the GCC countries, leading to the establishment of advanced medical facilities. The adoption of endoscope reprocessing solutions is gaining traction, albeit at a slower pace, driven by efforts to standardize healthcare practices and mitigate infection risks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Endoscope Reprocessing Market.- STERIS plc

- Cantel Medical (a STERIS company)

- Olympus Corporation

- Getinge AB

- Karl Storz SE & Co. KG

- PENTAX Medical (a HOYA Group Company)

- Advanced Sterilization Products (ASP) (a Fortive Corporation Company)

- Ecolab Inc.

- Metrex Research, LLC (a Danaher Corporation Company)

- 3M Company

- CSafe Global (formerly Controlled Environments)

- Steelco S.p.A.

- Custom Ultrasonics, Inc.

- Belimed AG

- Medizintechnik und Elektronik GmbH (MELAG)

Frequently Asked Questions

What is endoscope reprocessing and why is it crucial?

Endoscope reprocessing is the multi-step process of cleaning, disinfecting or sterilizing, and safely storing endoscopes after each patient use. It is crucial because endoscopes directly contact internal body tissues and fluids, making thorough reprocessing essential to prevent the transmission of infectious agents, thereby safeguarding patient health and preventing healthcare-associated infections.

What are the primary challenges in endoscope reprocessing?

Key challenges include the complex design of endoscopes with narrow lumens and intricate components, which make thorough cleaning difficult; the high capital cost of advanced reprocessing equipment; the potential for human error in manual steps; chemical exposure risks for reprocessing technicians; and the need for stringent adherence to evolving regulatory guidelines to ensure efficacy and compliance.

How do automated endoscope reprocessors (AERs) improve safety and efficiency?

AERs enhance safety by standardizing the reprocessing cycle, minimizing human variability, and precisely controlling disinfectant contact times and temperatures. They improve efficiency by automating multiple steps, reducing cycle times, and often allowing for the reprocessing of multiple scopes simultaneously, ensuring consistent and documented reprocessing outcomes.

What role do endoscope tracking systems play in the market?

Endoscope tracking systems utilize technologies like RFID or barcodes to provide real-time visibility and a complete audit trail for each endoscope through its entire lifecycle, from reprocessing to patient use. This ensures compliance with regulations, helps identify potential reprocessing failures, optimizes inventory management, and is vital for patient safety and infection control.

What is the impact of single-use endoscopes on the reprocessing market?

Single-use endoscopes eliminate the need for reprocessing, thereby removing the associated risks of infection transmission and the complexities of the reprocessing workflow. While they are a growing segment, they are not expected to fully replace reusable endoscopes due to cost and environmental factors. Instead, they complement the market by offering a sterile solution for specific high-risk or low-volume procedures, potentially reducing the overall reprocessing burden in certain areas.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager