EV Traction Inverter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428141 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

EV Traction Inverter Market Size

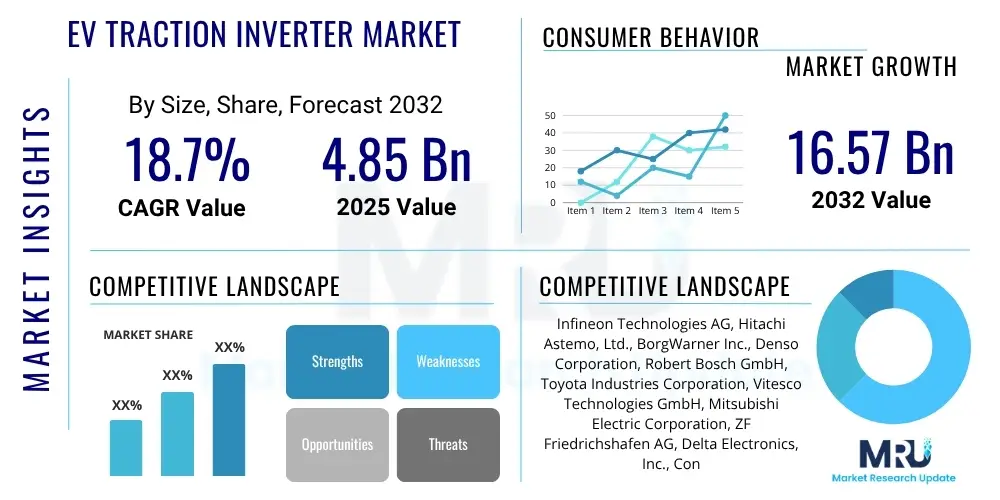

The EV Traction Inverter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.7% between 2025 and 2032. The market is estimated at USD 4.85 billion in 2025 and is projected to reach USD 16.57 billion by the end of the forecast period in 2032. This substantial growth is primarily driven by the accelerating global adoption of electric vehicles (EVs) across various segments, including passenger cars, commercial vehicles, and public transportation. The increasing demand for high-performance and energy-efficient power electronics is a critical factor propelling market expansion, as inverters play a pivotal role in converting direct current (DC) from the battery into alternating current (AC) to power the electric motor, and vice versa for regenerative braking.

The market's valuation reflects significant investments in research and development aimed at enhancing inverter efficiency, reducing size and weight, and improving power density. Innovations in semiconductor materials, such as silicon carbide (SiC) and gallium nitride (GaN), are revolutionizing traction inverter designs, enabling higher switching frequencies, lower power losses, and superior thermal performance compared to traditional silicon-based insulated-gate bipolar transistors (IGBTs). These technological advancements are not only improving EV performance and range but also contributing to the overall cost reduction of electric powertrains, making EVs more accessible and attractive to a broader consumer base.

EV Traction Inverter Market introduction

The EV Traction Inverter Market stands at the forefront of the electric vehicle revolution, serving as a critical component in the powertrain architecture that enables the efficient conversion and control of electrical energy. A traction inverter is essentially the brain of an EV's electric motor system, converting the DC power stored in the vehicle's battery into AC power required to drive the electric motor. It also manages the reverse process during regenerative braking, converting kinetic energy back into electrical energy to recharge the battery. This indispensable device directly impacts an EV's performance metrics, including acceleration, range, efficiency, and overall driving dynamics, by precisely controlling the motor's speed and torque.

Major applications of EV traction inverters span the entire spectrum of electric mobility, from battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) to fuel cell electric vehicles (FCEVs). They are deployed in passenger cars, light commercial vehicles, heavy-duty trucks, buses, and even electric two-wheelers. The benefits derived from advanced traction inverters are manifold, encompassing enhanced energy efficiency, leading to increased driving range, improved power density for compact vehicle designs, faster charging capabilities, and superior thermal management for prolonged system longevity. These benefits directly contribute to the overall appeal and viability of electric vehicles, addressing key consumer concerns related to range anxiety and performance.

Driving factors for this market are multifaceted and robust. Foremost is the global push towards decarbonization and stringent emission regulations, compelling automotive manufacturers to accelerate their EV production targets. Government incentives, subsidies for EV purchases, and investments in charging infrastructure further stimulate demand. Additionally, continuous advancements in battery technology, which provide higher energy densities and faster charging, complement the improvements in inverter technology. The growing consumer awareness regarding environmental sustainability and the diminishing total cost of ownership (TCO) for EVs also play a significant role in fostering market growth, creating a powerful ecosystem for the traction inverter market to thrive.

EV Traction Inverter Market Executive Summary

The EV Traction Inverter Market's executive summary reveals a dynamic landscape characterized by rapid technological evolution and aggressive market expansion, profoundly influenced by global electrification mandates. Business trends indicate a strong focus on strategic partnerships and mergers & acquisitions among traditional automotive suppliers and semiconductor companies to pool expertise in power electronics and software integration. There's an increasing emphasis on developing modular and scalable inverter solutions to cater to diverse vehicle platforms and power requirements, from compact urban EVs to high-performance sports cars and heavy commercial vehicles. Furthermore, the trend towards integrated powertrain solutions, where the inverter, motor, and gearbox are combined into a single compact unit, is gaining traction, promising improved efficiency and reduced manufacturing complexity.

Regional trends highlight Asia Pacific, particularly China, as the dominant force in terms of both production and consumption, driven by significant government support, a vast domestic market, and a robust EV manufacturing ecosystem. Europe is also a key growth region, propelled by stringent emission standards, ambitious EV targets, and a strong push for sustainable mobility. North America, while having a later start, is rapidly catching up with substantial investments in EV manufacturing capacity and charging infrastructure, supported by supportive government policies. These regional dynamics underscore the localized development of supply chains and specialized inverter solutions to meet specific market demands and regulatory frameworks across different geographies, fostering a globally competitive yet regionally nuanced market.

Segmentation trends indicate a strong shift towards silicon carbide (SiC) based inverters, particularly in high-performance and premium EV segments, due to their superior efficiency, higher power density, and improved thermal management capabilities compared to conventional IGBTs. While IGBTs continue to hold a significant share in cost-sensitive or lower-power applications, the rapid advancements and cost reductions in SiC technology are expanding its adoption across broader market segments. Furthermore, differentiation based on vehicle type (BEV, PHEV), power output (e.g., up to 100 kW, 100-200 kW, above 200 kW), and voltage architecture (400V vs. 800V) continues to define market segments, with an accelerating trend towards 800V systems for ultra-fast charging and higher performance. The ongoing innovation in materials science and packaging technologies is further refining these segments, enabling manufacturers to offer tailored solutions that meet specific OEM requirements for performance, cost, and reliability.

AI Impact Analysis on EV Traction Inverter Market

Common user questions regarding AI's impact on the EV Traction Inverter Market often revolve around how artificial intelligence can enhance inverter performance, efficiency, and reliability, as well as its role in predictive maintenance and design optimization. Users are curious about AI's potential to revolutionize the design phase by accelerating material selection and topology optimization, and its operational benefits like real-time fault detection and adaptive control strategies. There is also significant interest in how AI can contribute to extending the lifespan of these critical components, making EVs more robust and cost-effective. These inquiries highlight a collective expectation that AI will be a transformative force, moving inverters beyond static control systems to intelligent, self-optimizing units, and significantly improving the overall EV ecosystem.

AI's integration into the EV traction inverter domain promises a paradigm shift, moving beyond traditional control algorithms to adaptive, predictive, and self-learning systems. In the design and development phase, AI-driven simulations can optimize component layouts, thermal management pathways, and electromagnetic compatibility at an unprecedented speed, drastically reducing development cycles and costs. Machine learning algorithms can analyze vast datasets from material science, allowing engineers to discover novel semiconductor compositions or packaging techniques that yield higher efficiency and greater power density. This capability extends to predicting performance under various operating conditions, ensuring robustness and reliability long before physical prototypes are built, thereby enhancing the intrinsic quality of the inverter.

Operationally, AI will enable real-time optimization of inverter performance by dynamically adjusting switching frequencies and modulation techniques based on driving patterns, battery state of charge, and environmental conditions. This adaptive control can significantly boost energy efficiency and extend vehicle range by minimizing power losses. Furthermore, AI-powered predictive maintenance, by continuously monitoring inverter health parameters such as temperature, current harmonics, and vibration, can detect anomalies and foresee potential failures before they occur. This proactive approach minimizes downtime, reduces maintenance costs for vehicle owners and fleet operators, and enhances the overall safety and reliability of electric vehicles, fundamentally transforming the ownership experience.

- AI-driven design optimization for higher efficiency and power density.

- Real-time adaptive control for dynamic performance enhancement.

- Predictive maintenance and fault detection to improve reliability.

- Enhanced thermal management through AI-powered algorithms.

- Accelerated material discovery and selection for advanced semiconductors.

- Optimization of manufacturing processes for defect reduction.

- Integration with smart charging and grid management systems.

DRO & Impact Forces Of EV Traction Inverter Market

The EV Traction Inverter Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute its Impact Forces. Key drivers include the escalating global demand for electric vehicles, fueled by stringent environmental regulations, government incentives, and a growing consumer preference for sustainable transportation. Continuous technological advancements in power electronics, particularly the adoption of silicon carbide (SiC) and gallium nitride (GaN) devices, are enhancing inverter efficiency, power density, and reliability, thereby improving EV performance and range. Furthermore, increasing investments in EV manufacturing infrastructure and charging networks worldwide are creating a conducive environment for market expansion, reinforcing the demand for sophisticated traction inverters.

Conversely, several restraints impede the market's growth trajectory. The high initial cost of advanced traction inverters, especially those utilizing SiC technology, can be a barrier for mass-market EV adoption, although prices are gradually declining with economies of scale. Supply chain vulnerabilities, particularly concerning critical raw materials and semiconductor components, pose risks to production consistency and lead times. The complexity of thermal management in high-power inverters, coupled with the need for specialized engineering expertise, also presents a technical challenge. Additionally, the nascent stage of robust global recycling infrastructure for EV components, including inverters, raises long-term environmental and resource management concerns that need to be addressed.

Opportunities in the market are abundant and promising. The ongoing development of 800V and higher voltage architectures in EVs presents a significant opportunity for inverter manufacturers to innovate higher-voltage compatible and ultra-efficient designs, enabling faster charging and enhanced performance. The emerging segments of electric commercial vehicles, such as heavy-duty trucks and buses, represent untapped potential for high-power, robust traction inverters. Furthermore, the integration of artificial intelligence and machine learning for predictive maintenance, real-time optimization, and advanced fault diagnostics offers avenues for product differentiation and value addition. The long-term trend towards vehicle-to-grid (V2G) and vehicle-to-home (V2H) technologies also creates new functional requirements for inverters, driving innovation towards bidirectional power flow capabilities and smart grid integration, thereby expanding their utility beyond propulsion.

Segmentation Analysis

The EV Traction Inverter Market is highly fragmented and segmented based on various critical parameters, reflecting the diverse requirements of the electric vehicle industry. These segmentations allow for a granular analysis of market trends, competitive landscapes, and technological preferences across different vehicle types, power outputs, material technologies, and voltage architectures. Understanding these distinct segments is crucial for manufacturers to tailor their product offerings, for investors to identify high-growth areas, and for policymakers to formulate supportive regulations that cater to the specific needs of each market niche. The overarching goal of segmentation is to optimize resource allocation and strategic planning, ensuring that product development aligns with specific market demands and technological shifts, thereby driving efficiency and innovation across the value chain.

- By Vehicle Type

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

- By Power Output

- Up to 100 kW

- 100 kW to 200 kW

- Above 200 kW

- By Component

- Inverter Modules (e.g., IGBT, SiC)

- Capacitors

- Sensors

- Controller Units

- Cooling Systems

- By Technology

- Silicon (Si) / Insulated-Gate Bipolar Transistor (IGBT)

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

- By Voltage Type

- 400V

- 800V and Above

Value Chain Analysis For EV Traction Inverter Market

The value chain for the EV Traction Inverter Market is intricate and spans from raw material extraction to end-user deployment and aftermarket services, highlighting a multi-layered ecosystem of specialized suppliers and manufacturers. Upstream analysis reveals a critical dependence on the availability and processing of rare earth elements, copper, aluminum, and advanced semiconductor materials like silicon, silicon carbide, and gallium nitride. Companies involved in wafer fabrication, chip design, and packaging of power semiconductor modules form the foundational layer, providing the high-voltage, high-current switching components essential for inverter functionality. These suppliers often operate in highly specialized niches, requiring substantial R&D investment and intellectual property.

Midstream activities involve the core manufacturing and assembly of the traction inverter units. This stage includes designing the control logic, integrating semiconductor modules with capacitors, gate drivers, and cooling systems, and developing sophisticated software for motor control. Major automotive Tier-1 suppliers and specialized power electronics manufacturers dominate this segment, leveraging advanced manufacturing processes and stringent quality control. Downstream, the value chain extends to automotive original equipment manufacturers (OEMs) who integrate the traction inverters into their electric vehicle platforms. This phase also encompasses distribution channels, which can be direct, through long-term contracts between inverter suppliers and OEMs, or indirect, involving sales to smaller vehicle manufacturers or for aftermarket applications through distributors.

Direct distribution is prevalent for large-volume, strategic partnerships where inverter manufacturers work closely with OEMs during vehicle development. This collaboration ensures optimal integration and performance customization. Indirect channels typically cater to smaller-scale operations, specialized vehicle conversions, or the aftermarket segment where standardized inverter solutions are sought. The complexity of the product, requiring deep technical integration, makes direct supply relationships more common in the primary EV manufacturing sector. However, the aftermarket for replacements and upgrades, driven by an aging EV fleet and technological advancements, presents an evolving landscape for both direct sales and specialized distributors, emphasizing the importance of a robust service network.

EV Traction Inverter Market Potential Customers

Potential customers for the EV Traction Inverter Market primarily comprise entities involved in the production, operation, and maintenance of electric vehicles across various segments. At the forefront are automotive original equipment manufacturers (OEMs), who represent the largest and most critical customer base. These OEMs, ranging from established global automotive giants to emerging EV startups, require high-performance, reliable, and cost-effective traction inverters to integrate into their diverse range of electric passenger cars, SUVs, and luxury vehicles. Their purchasing decisions are heavily influenced by factors such as inverter efficiency, power density, thermal management capabilities, overall reliability, and the ability of suppliers to customize solutions to specific vehicle architectures and performance targets, often forming long-term strategic partnerships with inverter manufacturers.

Beyond passenger vehicles, commercial vehicle manufacturers constitute another significant segment of potential customers. This includes producers of electric buses, trucks (light, medium, and heavy-duty), and delivery vans. For these applications, traction inverters must be exceptionally robust, durable, and capable of handling higher power outputs and sustained operational demands, often under challenging environmental conditions. Public transportation authorities and logistics companies, through their fleet purchasing decisions, indirectly influence the demand for these commercial EV inverters. The imperative for fleet electrification to meet urban emission targets and reduce operational costs drives the demand in this sector, requiring specialized inverter solutions that optimize vehicle uptime and energy consumption.

Emerging segments also present growing opportunities. These include manufacturers of electric off-highway vehicles (e.g., construction equipment, agricultural machinery), electric marine vessels, and even specialized industrial applications that leverage EV powertrain technology. While smaller in volume compared to passenger cars, these sectors demand highly customized and often ruggedized inverter solutions. Additionally, aftermarket suppliers and service providers who cater to EV repair, maintenance, and performance upgrades also represent a niche customer base, requiring replacement parts or enhanced inverter units. The continuous evolution of EV technology and expanding application areas mean the customer base for traction inverters is steadily diversifying beyond traditional automotive manufacturing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.85 Billion |

| Market Forecast in 2032 | USD 16.57 Billion |

| Growth Rate | 18.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies AG, Hitachi Astemo, Ltd., BorgWarner Inc., Denso Corporation, Robert Bosch GmbH, Toyota Industries Corporation, Vitesco Technologies GmbH, Mitsubishi Electric Corporation, ZF Friedrichshafen AG, Delta Electronics, Inc., Continental AG, Nidec Corporation, LG Magna e-Powertrain, Toshiba Corporation, SEMIKRON Danfoss, Valeo S.A., Schaeffler AG, Magna International Inc., TDK Corporation, Fuji Electric Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EV Traction Inverter Market Key Technology Landscape

The EV Traction Inverter Market's technology landscape is undergoing a profound transformation, primarily driven by the relentless pursuit of higher efficiency, increased power density, and reduced system costs. At the core of this evolution are advancements in power semiconductor materials. Silicon Carbide (SiC) technology has emerged as a game-changer, offering significantly lower switching losses, higher operating temperatures, and superior thermal conductivity compared to traditional Silicon (Si) Insulated-Gate Bipolar Transistors (IGBTs). This allows for smaller, lighter, and more efficient inverters, directly contributing to extended EV range and faster charging capabilities, making SiC an increasingly preferred choice for high-performance and premium electric vehicles. The ongoing efforts in manufacturing yield improvement and cost reduction for SiC wafers are further accelerating its market penetration, making it viable for broader applications.

Alongside SiC, Gallium Nitride (GaN) is an emerging wide-bandgap semiconductor material that holds immense promise, particularly for very high-frequency switching applications and lower power segments, although its commercial adoption in high-power automotive traction inverters is still in earlier stages compared to SiC. Beyond semiconductor materials, integrated designs are a critical technological trend. Manufacturers are increasingly combining the inverter with the electric motor and gearbox into a single, compact e-axle unit. This integration reduces overall system weight and size, simplifies assembly, and improves electromagnetic compatibility and efficiency by minimizing interconnects. Such solutions pave the way for more flexible vehicle designs and optimized packaging, contributing to overall vehicle performance and cost-effectiveness.

Another crucial area of technological advancement lies in advanced thermal management systems. As inverters operate at higher power densities and frequencies, effective heat dissipation becomes paramount to ensure reliability and longevity. Innovations include direct liquid cooling, novel heatsink designs, and advanced packaging techniques that minimize thermal resistance. Furthermore, the development of sophisticated control algorithms and software-defined inverters is enhancing real-time performance optimization, fault diagnostics, and predictive maintenance. These smart inverters can adapt to varying driving conditions, optimize energy flow, and communicate with other vehicle systems, contributing to a more intelligent and efficient electric powertrain. The adoption of 800V battery architectures is also pushing inverter technology towards higher voltage ratings, demanding new designs and components capable of handling these increased electrical stresses while maintaining efficiency and reliability.

Regional Highlights

- Asia Pacific (APAC): Dominates the global EV traction inverter market, primarily led by China, which is the world's largest EV market and producer. Government support, extensive charging infrastructure development, and a strong local manufacturing base for both EVs and components drive significant growth. Countries like Japan, South Korea, and India are also witnessing increasing EV adoption and local production, fostering innovation and demand.

- Europe: A rapidly growing market driven by stringent emission regulations, ambitious decarbonization targets, and robust government incentives for EV purchases. Germany, Norway, France, and the UK are key markets with strong R&D capabilities and a focus on premium and high-performance EV segments, driving demand for advanced SiC-based inverters.

- North America: Experiencing substantial growth fueled by increasing consumer interest in EVs, significant investments by major automotive OEMs in electric vehicle production facilities, and supportive policies like tax credits. The United States and Canada are witnessing expanding charging networks and a shift towards electrification across various vehicle segments, including light-duty trucks and SUVs.

- Latin America: An emerging market with increasing awareness and initial stages of EV adoption, particularly in countries like Brazil and Mexico. While smaller in scale, the region presents long-term growth potential as infrastructure develops and policies become more supportive of electric mobility.

- Middle East and Africa (MEA): Currently a nascent market for EV traction inverters, but with growing interest in sustainable transportation solutions, particularly in the UAE and Saudi Arabia. Strategic investments in smart cities and renewable energy projects could accelerate EV adoption and subsequently, the demand for related components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EV Traction Inverter Market.- Infineon Technologies AG

- Hitachi Astemo, Ltd.

- BorgWarner Inc.

- Denso Corporation

- Robert Bosch GmbH

- Toyota Industries Corporation

- Vitesco Technologies GmbH

- Mitsubishi Electric Corporation

- ZF Friedrichshafen AG

- Delta Electronics, Inc.

- Continental AG

- Nidec Corporation

- LG Magna e-Powertrain

- Toshiba Corporation

- SEMIKRON Danfoss

- Valeo S.A.

- Schaeffler AG

- Magna International Inc.

- TDK Corporation

- Fuji Electric Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the EV Traction Inverter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an EV traction inverter?

The primary function of an EV traction inverter is to convert the direct current (DC) power from the battery into alternating current (AC) power to drive the electric motor. It also facilitates regenerative braking by converting kinetic energy back into DC to recharge the battery.

Why is Silicon Carbide (SiC) important for EV traction inverters?

Silicon Carbide (SiC) is crucial because it enables inverters to achieve higher efficiency, operate at higher switching frequencies and temperatures, and offer greater power density than traditional silicon-based inverters. This leads to extended EV range, faster charging, and more compact designs.

How do traction inverters contribute to an EV's driving range?

Traction inverters contribute to an EV's driving range by maximizing the efficiency of power conversion between the battery and the motor, minimizing energy losses during propulsion and optimizing energy recovery during regenerative braking. Highly efficient inverters ensure more of the battery's stored energy is used for driving.

What are the main factors driving the growth of the EV Traction Inverter Market?

Key growth drivers include the rapid global adoption of electric vehicles, stringent government emission regulations, increasing consumer environmental awareness, technological advancements in power electronics (especially SiC), and significant investments in EV charging infrastructure.

What role does artificial intelligence play in modern traction inverters?

Artificial intelligence in modern traction inverters enhances performance through AI-driven design optimization, real-time adaptive control for improved efficiency, and predictive maintenance for increased reliability and reduced downtime. AI helps inverters become smarter, more efficient, and longer-lasting components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager