Extractable and Leachable Testing Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428509 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Extractable and Leachable Testing Services Market Size

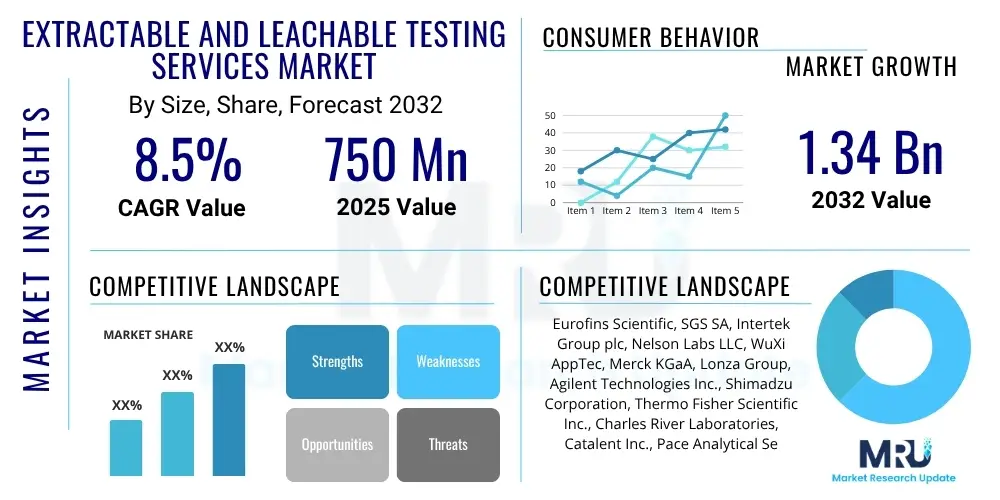

The Extractable and Leachable Testing Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 750 million in 2025 and is projected to reach USD 1.34 billion by the end of the forecast period in 2032.

Extractable and Leachable Testing Services Market introduction

The Extractable and Leachable E&L Testing Services Market is crucial for ensuring the safety and quality of pharmaceutical products, medical devices, and food packaging. E&L studies are designed to identify and quantify chemical compounds that may migrate from packaging materials, manufacturing components, or administration systems into a drug product or other sensitive matrices. These services are indispensable for meeting stringent regulatory requirements globally, protecting patient health, and maintaining product integrity throughout its lifecycle. The inherent complexity of these analyses, requiring highly specialized equipment and expertise, drives the demand for outsourcing to dedicated service providers.

The product description for E&L testing services encompasses a wide array of analytical techniques, including Gas Chromatography Mass Spectrometry GCMS, Liquid Chromatography Mass Spectrometry LCMS, Inductively Coupled Plasma Mass Spectrometry ICPMS, and various spectroscopic methods. These services involve a systematic approach to extract potential leachables under accelerated conditions, characterize them, and then perform toxicological risk assessments. Major applications span biopharmaceuticals, small molecule drugs, medical devices, combination products, and consumer health products where chemical interactions with contact materials must be thoroughly understood and controlled to prevent adverse effects on product quality, stability, or patient safety.

The benefits of utilizing E&L testing services are multifaceted, primarily centered on compliance with regulatory guidelines from bodies like the FDA, EMA, and ICH, which mandate comprehensive E&L assessments for product approval. Beyond compliance, these services mitigate risks associated with product recalls, safeguard brand reputation, and enhance patient safety by preventing exposure to harmful chemicals. Driving factors for market growth include the increasing stringency of global regulatory standards, a rising focus on patient safety, the growing complexity of pharmaceutical formulations and medical devices, and the pharmaceutical industry's trend towards outsourcing specialized analytical activities to leverage external expertise and reduce in-house infrastructure costs.

Extractable and Leachable Testing Services Market Executive Summary

The Extractable and Leachable Testing Services Market is experiencing robust expansion driven by escalating global regulatory pressures and a heightened awareness of product safety across the pharmaceutical, medical device, and food packaging industries. Business trends indicate a significant shift towards specialized contract research organizations CROs and contract development and manufacturing organizations CDMOs that can offer comprehensive E&L testing solutions, leveraging advanced analytical instrumentation and deep regulatory knowledge. Companies are increasingly seeking partners capable of navigating complex matrices and providing robust data packages essential for regulatory submissions, emphasizing the value of outsourcing to maintain compliance and accelerate time to market.

Regional trends reveal North America and Europe as dominant markets due to established pharmaceutical industries, stringent regulatory frameworks, and significant research and development investments. However, the Asia Pacific region is emerging as a high-growth market, propelled by expanding manufacturing capabilities, increasing healthcare expenditures, and a growing focus on quality and safety standards in countries like China, India, and South Korea. Latin America and the Middle East & Africa are also showing gradual growth, driven by regional pharmaceutical development initiatives and the adoption of international quality guidelines, albeit from a smaller base. The global market is characterized by a drive for harmonization of E&L guidelines, pushing companies to seek globally compliant testing strategies.

Segment trends highlight the dominance of the pharmaceutical and biopharmaceutical sectors within the E&L testing market, particularly due to the rise of complex biologics and combination products that pose unique E&L challenges. The medical device segment is also a substantial contributor, with continuous innovation in materials and device design necessitating rigorous testing. By type of service, routine testing and method development & validation services hold significant shares, reflecting both ongoing quality control needs and the demand for bespoke analytical solutions. The emphasis on advanced analytical techniques and data interpretation services is also growing, aligning with the industry's need for deeper insights into potential leachables and their toxicological profiles.

AI Impact Analysis on Extractable and Leachable Testing Services Market

Users frequently inquire about how Artificial Intelligence AI can enhance the efficiency, accuracy, and predictability of Extractable and Leachable testing. Common questions revolve around AI's ability to predict potential leachables, optimize extraction conditions, expedite data analysis, and improve toxicological risk assessments. There is a strong expectation that AI will streamline the E&L process, reduce manual errors, and provide deeper insights into complex datasets. Concerns often include the reliability of AI models with limited historical data, the need for robust validation, and the potential for job displacement, alongside the significant investment required for AI integration and the ethical considerations surrounding automated risk assessments. Users are keen to understand practical applications and the tangible benefits AI can deliver in this highly specialized analytical field.

- AI driven predictive modeling can identify high-risk components and materials, reducing the scope of extensive empirical testing.

- Automated data analysis tools powered by AI can quickly interpret complex chromatographic and spectroscopic data, identifying unknown compounds and streamlining reporting.

- AI can optimize experimental parameters for extraction and analytical methods, leading to more efficient and reproducible E&L studies.

- Machine learning algorithms can correlate chemical structures with potential toxicity, enhancing toxicological risk assessments and providing faster insights into patient safety profiles.

- AI can aid in managing vast E&L databases, facilitating knowledge retention, trend analysis, and regulatory compliance by flagging anomalies or potential issues proactively.

DRO & Impact Forces Of Extractable and Leachable Testing Services Market

The Extractable and Leachable E&L Testing Services Market is primarily driven by the ever-increasing stringency of global regulatory guidelines from bodies such as the FDA, EMA, and ICH, which mandate thorough E&L assessments for the approval of pharmaceutical products and medical devices. The growing complexity of drug formulations, particularly biologics and combination products, coupled with the innovation in medical device materials, necessitates advanced analytical capabilities that often surpass in-house capacities, thereby boosting outsourcing demand. Furthermore, a heightened industry focus on patient safety and quality assurance, alongside the rising costs of in-house analytical infrastructure and expertise, compels manufacturers to seek specialized third-party services, solidifying the market's growth trajectory.

Despite robust growth drivers, the market faces restraints such as the high initial investment required for sophisticated analytical equipment and skilled personnel, which can be a barrier for new entrants and smaller service providers. The variability and complexity of E&L studies across different product types and matrices pose significant technical challenges, demanding extensive method development and validation efforts. Additionally, a shortage of highly specialized analytical chemists and toxicologists with E&L expertise can impede service delivery and innovation. The lack of fully harmonized global E&L guidelines also creates complexities for companies operating across multiple regions, requiring adaptive testing strategies that can be resource-intensive.

Opportunities in the E&L testing services market are abundant, particularly in the development of advanced analytical techniques, including high-resolution mass spectrometry and enhanced automation, which can improve sensitivity, specificity, and throughput. The expansion into emerging markets, especially in Asia Pacific, offers significant growth potential as pharmaceutical manufacturing capabilities and regulatory standards evolve. The rising demand for E&L testing in novel areas such as advanced therapy medicinal products ATMPs, personalized medicine, and sustainable packaging solutions presents new avenues for service providers. Furthermore, the integration of data science and AI for predictive modeling and streamlined data interpretation offers transformative potential for efficiency and accuracy. The primary impact forces driving this market include regulatory mandates, technological advancements in analytical chemistry, the global expansion of pharmaceutical and medical device manufacturing, and the continuous pursuit of enhanced product and patient safety.

Segmentation Analysis

The Extractable and Leachable Testing Services Market is comprehensively segmented by product type, service type, and end-user, providing a granular view of its diverse applications and demands. This segmentation allows for a detailed understanding of the specific needs across different industries and the types of analytical solutions required. The market's structure reflects the specialized nature of E&L testing, distinguishing between various pharmaceutical and medical device categories that have unique material contact considerations and regulatory compliance pathways, highlighting the critical role of tailored service offerings in addressing complex challenges. Each segment contributes distinctly to the market dynamics, influenced by specific regulatory environments, product innovation cycles, and outsourcing trends.

- Product Type

- Pharmaceuticals

- Drug Products Biologics and Small Molecules

- Container Closure Systems CCS

- Manufacturing Components

- Excipients

- Medical Devices

- Implants

- Disposables

- Surgical Tools

- Combination Products

- Food Packaging

- Consumer Health Products

- Pharmaceuticals

- Service Type

- Extractables Studies

- Leachables Studies

- Method Development and Validation

- Toxicological Risk Assessment TRA

- Routine Testing and Quality Control

- Consulting Services

- End User

- Pharmaceutical and Biopharmaceutical Companies

- Medical Device Manufacturers

- Contract Research Organizations CROs

- Food and Beverage Companies

- Cosmetics and Personal Care Manufacturers

- Chemical and Petrochemical Companies

Value Chain Analysis For Extractable and Leachable Testing Services Market

The value chain for the Extractable and Leachable Testing Services Market begins with upstream activities focused on the development and manufacturing of specialized analytical equipment, reagents, and reference standards essential for E&L studies. Key upstream players include manufacturers of mass spectrometers, chromatographs, and spectroscopy instruments, as well as suppliers of high-purity solvents, certified reference materials, and glassware. Research and development in analytical chemistry also forms a crucial upstream component, continuously pushing the boundaries of detection limits and compound identification. The quality and availability of these foundational components directly impact the capabilities and efficiency of E&L testing service providers, forming a critical bottleneck or accelerator in the overall value delivery.

Midstream in the value chain are the E&L testing service providers themselves, which include specialized analytical laboratories, contract research organizations CROs, and some in-house capabilities of large pharmaceutical and medical device companies. These entities perform the core E&L studies, encompassing sample preparation, extraction, advanced analytical testing, data interpretation, and report generation. Their expertise lies in method development, validation, and adherence to stringent regulatory guidelines. The value added at this stage is significant, transforming raw materials and analytical techniques into actionable safety and quality data crucial for regulatory submissions and product launch. The efficiency of these service providers is often a key differentiator in a competitive market.

Downstream activities involve the direct utilization of E&L testing reports by pharmaceutical, biopharmaceutical, and medical device manufacturers for regulatory submissions, quality control, and product release decisions. These manufacturers are the primary end-users, relying on the robust data to demonstrate product safety and compliance to regulatory authorities such as the FDA, EMA, and Health Canada. Distribution channels for E&L services are predominantly direct, with service providers engaging directly with clients through sales teams, scientific liaison officers, and dedicated project managers. Indirect channels may include partnerships with consulting firms that advise clients on E&L strategies and recommend testing laboratories, or collaborations with larger CROs that subcontract specialized E&L work to expert partners, ensuring comprehensive service delivery to a broad client base.

Extractable and Leachable Testing Services Market Potential Customers

Potential customers and end-users of Extractable and Leachable testing services represent a broad spectrum of industries where product integrity and patient or consumer safety are paramount. The most prominent segment comprises pharmaceutical and biopharmaceutical companies, ranging from large multinational corporations to smaller biotech startups. These entities require E&L testing for new drug applications, generic drug development, biosimilar comparisons, and ongoing quality control for existing products. The increasing complexity of biologics, which often involve sensitive formulations and specialized delivery systems, further intensifies their demand for highly specialized E&L analysis. Manufacturers of sterile products, injectables, and oral solid dosages are continuous clients due to the direct patient contact and high regulatory scrutiny.

The medical device industry constitutes another significant customer base, encompassing manufacturers of implantable devices, disposable medical products, surgical instruments, and combination products which blend drugs and devices. With innovation constantly introducing new materials and design intricacies, these companies rely on E&L testing to ensure that no harmful chemicals leach from device components into the patient's body or interact adversely with a drug. Companies developing advanced wound care products, drug delivery systems, and diagnostic tools are also consistent buyers of these specialized services, aiming to meet biocompatibility standards and global health regulations, ensuring patient safety and product efficacy throughout the device's lifecycle.

Beyond the core pharmaceutical and medical device sectors, other industries demonstrate a growing need for E&L testing. Food and beverage companies, particularly those involved in packaged goods, require these services to assess potential migration of chemicals from packaging materials into food, ensuring compliance with food safety regulations and protecting consumer health. Similarly, manufacturers of cosmetics, personal care products, and even certain chemical and petrochemical industries that produce raw materials for these sectors, often seek E&L expertise to evaluate product safety and material purity. Contract Research Organizations CROs also act as significant buyers, often collaborating with specialized E&L labs to provide comprehensive testing solutions to their diverse client portfolios.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 750 million |

| Market Forecast in 2032 | USD 1.34 billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eurofins Scientific, SGS SA, Intertek Group plc, Nelson Labs LLC, WuXi AppTec, Merck KGaA, Lonza Group, Agilent Technologies Inc., Shimadzu Corporation, Thermo Fisher Scientific Inc., Charles River Laboratories, Catalent Inc., Pace Analytical Services LLC, Avomeen Analytical Services, Toxikon Corporation, Pacific BioLabs Inc., ALS Global, Element Materials Technology, Vivariant, Sygnature Discovery |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Extractable and Leachable Testing Services Market Key Technology Landscape

The Extractable and Leachable E&L Testing Services Market relies heavily on an advanced array of analytical technologies to identify and quantify trace levels of chemical compounds. Core to this landscape is chromatography, particularly Gas Chromatography Mass Spectrometry GCMS and Liquid Chromatography Mass Spectrometry LCMS. GCMS is widely used for volatile and semi-volatile organic compounds, offering high sensitivity and robust compound identification through its mass spectral library matching capabilities. LCMS, on the other hand, is indispensable for non-volatile, thermally labile, and polar compounds, often employing various ionization techniques like electrospray ionization ESI or atmospheric pressure chemical ionization APCI to accommodate a wide range of analytes. These combined chromatographic and spectrometric techniques form the backbone of E&L analysis, providing the necessary separation and identification power.

Beyond GCMS and LCMS, the technology landscape includes Inductively Coupled Plasma Mass Spectrometry ICPMS for elemental analysis, crucial for identifying inorganic extractables or leachables such as heavy metals that may originate from manufacturing equipment, catalysts, or raw materials. Fourier-transform infrared spectroscopy FTIR and Nuclear Magnetic Resonance NMR spectroscopy are also employed, primarily for structural elucidation of unknown compounds and confirming the identity of suspect analytes. These spectroscopic methods offer complementary information to mass spectrometry, providing a more comprehensive understanding of the chemical nature of the identified substances. The integration of high-resolution mass spectrometry HRMS, such as Q-TOF or Orbitrap platforms, is becoming increasingly prevalent due to its ability to provide accurate mass measurements and facilitate the identification of unknowns without prior reference standards, enhancing the scope and depth of E&L investigations.

Furthermore, automation and data processing technologies are increasingly pivotal in streamlining E&L workflows and handling the vast amounts of data generated. Automated sample preparation systems, robotic liquid handlers, and high-throughput screening platforms accelerate sample processing and reduce manual errors, improving overall laboratory efficiency. Advanced data processing software, equipped with chemometric tools and statistical analysis capabilities, assists in extracting meaningful insights from complex analytical data, identifying trends, and comparing profiles. The emerging role of AI and machine learning in predictive modeling and accelerated data interpretation is set to further revolutionize the E&L technology landscape, promising faster, more accurate, and more cost-effective testing solutions by predicting potential leachables and optimizing analytical conditions.

Regional Highlights

- North America: This region dominates the E&L testing services market due to a highly developed pharmaceutical and biotechnology industry, stringent regulatory oversight by the FDA, and significant R&D investments. The presence of numerous key market players and a robust healthcare infrastructure further solidify its leading position, with a strong emphasis on compliance and patient safety.

- Europe: Europe represents a substantial market share, driven by a well-established pharmaceutical sector and comprehensive regulatory frameworks like those from the European Medicines Agency EMA. Countries such as Germany, the UK, and France are key contributors, characterized by advanced research capabilities and a strong commitment to quality standards for medical devices and pharmaceuticals.

- Asia Pacific APAC: The APAC region is projected to exhibit the highest growth rate, fueled by expanding pharmaceutical manufacturing bases, rising healthcare expenditures, and increasing adoption of international quality standards. Rapid economic development in countries like China, India, and South Korea, coupled with a growing focus on drug safety and quality, makes this a lucrative market for E&L service providers.

- Latin America: This region shows steady growth, influenced by evolving healthcare infrastructure, increasing pharmaceutical production, and efforts to align with global regulatory benchmarks. Countries like Brazil and Mexico are leading the adoption of E&L testing, driven by local and international manufacturing companies seeking to ensure product quality and market access.

- Middle East and Africa MEA: The MEA market is gradually expanding, supported by investments in healthcare infrastructure and a nascent but growing pharmaceutical industry. While smaller in scale compared to other regions, increasing awareness of drug safety and the need for compliant products are fostering demand for specialized analytical services, often through partnerships with international CROs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Extractable and Leachable Testing Services Market.- Eurofins Scientific

- SGS SA

- Intertek Group plc

- Nelson Labs LLC

- WuXi AppTec

- Merck KGaA

- Lonza Group

- Agilent Technologies Inc.

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Charles River Laboratories

- Catalent Inc.

- Pace Analytical Services LLC

- Avomeen Analytical Services

- Toxikon Corporation

- Pacific BioLabs Inc.

- ALS Global

- Element Materials Technology

- Vivariant

- Sygnature Discovery

Frequently Asked Questions

Analyze common user questions about the Extractable and Leachable Testing Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Extractable and Leachable E&L testing?

E&L testing identifies and quantifies chemical compounds that can migrate from materials such as packaging, manufacturing components, or medical devices into a drug product or patient. It is critical for assessing product safety and regulatory compliance.

Why is E&L testing important for pharmaceuticals and medical devices?

It ensures patient safety by preventing exposure to potentially harmful chemicals and maintains product quality and efficacy. Regulatory bodies like the FDA and EMA mandate E&L studies for product approval to confirm safety and compliance.

What are the key analytical techniques used in E&L testing?

Common techniques include Gas Chromatography Mass Spectrometry GCMS for volatile compounds, Liquid Chromatography Mass Spectrometry LCMS for non-volatile compounds, and Inductively Coupled Plasma Mass Spectrometry ICPMS for elemental impurities. Fourier-transform infrared spectroscopy FTIR and Nuclear Magnetic Resonance NMR also aid in structural elucidation.

Which industries primarily benefit from E&L testing services?

The pharmaceutical, biopharmaceutical, and medical device industries are primary beneficiaries due to stringent safety regulations. Additionally, food packaging, consumer health products, and cosmetics sectors increasingly utilize these services to ensure product and consumer safety.

How does AI impact the future of E&L testing?

AI is expected to revolutionize E&L testing by enabling predictive modeling of leachables, optimizing extraction and analytical methods, automating complex data analysis, and enhancing toxicological risk assessments, leading to more efficient and accurate studies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager