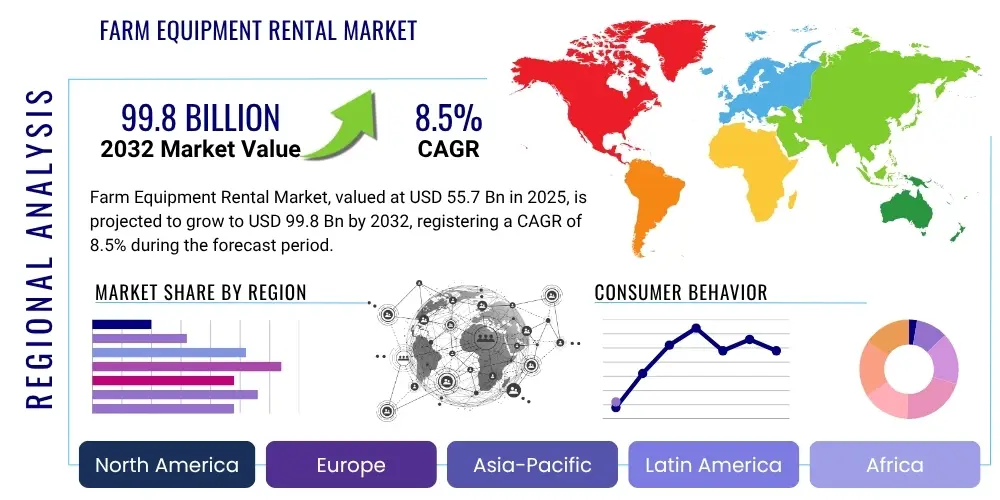

Farm Equipment Rental Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430367 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Farm Equipment Rental Market Size

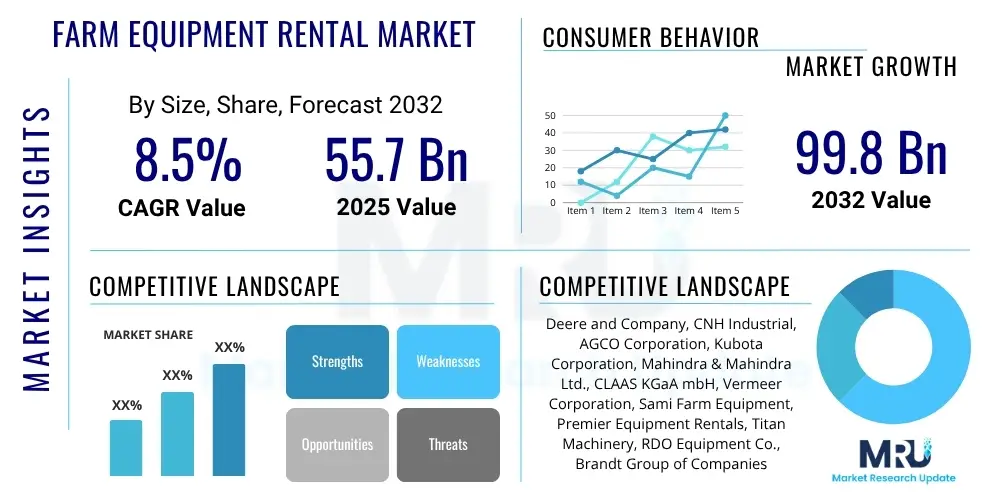

The Farm Equipment Rental Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 55.7 billion in 2025 and is projected to reach USD 99.8 billion by the end of the forecast period in 2032.

Farm Equipment Rental Market introduction

The Farm Equipment Rental Market encompasses the provision of various agricultural machinery and tools on a temporary lease basis to farmers, agricultural businesses, and other end-users. This market addresses the significant capital investment required for purchasing modern farm equipment, offering a flexible and cost-effective alternative for accessing advanced technology. The primary objective is to enhance agricultural productivity and efficiency without the burden of ownership, maintenance, and depreciation.

Products available for rent range from heavy-duty tractors and combine harvesters to specialized seeding, planting, tillage, irrigation, and crop protection equipment. These services are crucial for farmers facing fluctuating operational needs, seasonal demands, or those operating on a smaller scale where equipment purchase is financially unviable. The rental model provides immediate access to state-of-the-art machinery, allowing users to leverage precision agriculture capabilities and optimize their farming practices.

Major applications of rented farm equipment include land preparation (plowing, tilling), sowing, harvesting, irrigation, and pest control. The key benefits for users are reduced upfront costs, minimized maintenance expenses, access to the latest technological innovations, and the ability to scale operations efficiently. Driving factors for market growth include the increasing mechanization of agriculture, rising farm labor costs, government initiatives promoting equipment sharing, and the growing adoption of smart farming practices globally.

Farm Equipment Rental Market Executive Summary

The Farm Equipment Rental Market is experiencing robust growth, driven by evolving business trends that emphasize asset utilization and operational flexibility. A prominent business trend is the increasing shift towards subscription-based rental models and the development of sophisticated online platforms that streamline booking, tracking, and payment processes. Furthermore, there is a growing consolidation among rental providers and equipment manufacturers, leading to larger fleets and more comprehensive service offerings. Manufacturers are also increasingly integrating rental services into their core business strategies to capture a wider customer base and mitigate the impact of sales cycles.

Regionally, the market exhibits diverse growth patterns. Emerging economies in Asia Pacific and Latin America are witnessing significant expansion due to government support for agricultural modernization and the proliferation of small and medium-sized farms seeking affordable mechanization solutions. Developed regions like North America and Europe, while mature, are characterized by the adoption of high-tech and precision farming equipment through rental, driven by the need for efficiency, sustainability, and skilled labor shortages. The Middle East and Africa also present nascent opportunities as nations prioritize food security and agricultural development.

Segmentation trends highlight a strong demand across various equipment types, with tractors and harvesting machinery remaining paramount. However, specialized equipment for specific crops and precision farming tools are gaining traction. The market is also seeing a bifurcation in rental duration, with short-term rentals catering to seasonal peaks and long-term rentals addressing consistent operational needs for smaller farms. The increasing penetration of smart farm technologies, often accessible via rental, is influencing demand patterns across all segments, fostering a more informed and tech-savvy renter demographic.

AI Impact Analysis on Farm Equipment Rental Market

User inquiries regarding Artificial Intelligence (AI) in the farm equipment rental market frequently center on its ability to enhance efficiency, reduce operational costs, and improve access to advanced farming techniques. Common questions explore how AI can optimize equipment allocation, predict maintenance needs, and facilitate autonomous farming operations. Users are keen to understand the practical benefits, such as precision agriculture capabilities enabled by AI, and how these technologies can lead to better crop yields and more sustainable practices, ultimately impacting their bottom line and decision-making processes.

The key themes emerging from this analysis include the potential for AI to revolutionize fleet management through predictive analytics for equipment availability and maintenance, thereby minimizing downtime and maximizing utilization rates. There is also significant interest in AI-powered tools for optimizing rental pricing based on real-time demand, weather patterns, and soil conditions. Furthermore, users anticipate AI to drive the development of more sophisticated rental platforms, offering personalized recommendations and seamless integration with other farm management systems.

Concerns often revolve around the initial investment for AI-integrated machinery, data privacy, and the digital literacy required for adoption. However, the overarching expectation is that AI will make advanced farming more accessible and affordable through rental models, democratizing technology for a broader range of farmers. This will lead to more efficient resource management, improved environmental stewardship, and a more competitive agricultural landscape.

- AI optimizes equipment allocation and scheduling based on real-time data.

- Predictive maintenance driven by AI reduces downtime and extends equipment lifespan.

- AI-powered analytics inform dynamic pricing strategies for rental services.

- Integration of AI enables autonomous farming capabilities in rented equipment.

- Enhanced crop yield predictions and resource management through AI tools.

- Streamlined customer experience via AI-driven rental platforms and support.

- Improved efficiency in logistics and route planning for equipment delivery.

DRO & Impact Forces Of Farm Equipment Rental Market

The Farm Equipment Rental Market is significantly influenced by a confluence of driving, restraining, and opportunity forces. Key drivers include the prohibitively high initial cost of purchasing new farm machinery, which makes rental a more financially viable option for many farmers, especially small and medium-sized operations. The global imperative for increased food production coupled with a shrinking skilled agricultural workforce also propels the demand for mechanized solutions accessed through rental. Additionally, advancements in agricultural technology, such as smart farming and precision agriculture tools, are often too expensive for individual ownership but become accessible through rental services, driving market expansion. Government initiatives promoting farm mechanization and equipment sharing models further bolster market growth by providing subsidies or incentives.

However, the market faces several restraints. Issues such as the availability of specific equipment in remote or underserved areas, potential maintenance and repair complexities for rented machinery, and the risks associated with equipment damage or theft can deter potential renters. Seasonal demand fluctuations create logistical challenges for rental companies, leading to periods of underutilization or overstretch. Moreover, the lack of standardization in rental agreements and insurance policies across regions can create uncertainty. Competition from the sales of new, more efficient equipment and a robust used equipment market also presents a challenge, as farmers weigh rental against ownership options.

Opportunities for growth are abundant, particularly with the increasing integration of Internet of Things (IoT) and Artificial Intelligence (AI) for predictive maintenance, remote monitoring, and optimizing equipment performance. The expansion into developing economies, where agricultural mechanization is rapidly accelerating, offers vast untapped potential. The rise of sophisticated online rental platforms and mobile applications is simplifying the rental process, improving accessibility and transparency. Furthermore, the growing trend of specialized equipment for niche crop production and the increasing focus on sustainable farming practices present new avenues for rental companies to offer tailored solutions and value-added services, fostering long-term market development and innovation.

Segmentation Analysis

The Farm Equipment Rental Market is segmented to provide a granular understanding of demand patterns and supply dynamics across various dimensions. This segmentation helps identify specific market niches, target customer groups, and areas for strategic investment and product development. The market can be broadly categorized by equipment type, duration of rental, farm size, and primary application, each reflecting distinct user needs and operational contexts.

Understanding these segments is crucial for rental providers to tailor their fleets, service models, and marketing strategies effectively. For instance, the demand for high-horsepower tractors for long-term rental might come from large corporate farms, while small-scale farmers might prefer short-term leases for specialized implements during peak seasons. The evolving technological landscape also plays a significant role in shaping segment preferences, with a growing demand for GPS-enabled and smart farming equipment across all farm sizes and applications.

The detailed segmentation allows market participants to assess competitive landscapes within specific categories, identify underserved markets, and anticipate future trends driven by agricultural practices and technological advancements. This analytical approach supports strategic planning for fleet composition, pricing models, geographical expansion, and the development of value-added services such as technical support and operator training.

- By Equipment Type:

- Tractors

- Harvesters (Combine Harvesters, Forage Harvesters)

- Tillage Equipment (Plows, Harrows, Cultivators)

- Seeding and Planting Equipment (Planters, Seeders, Drills)

- Irrigation Equipment (Pivots, Sprinklers, Drip Systems)

- Sprayers (Boom Sprayers, Air Blast Sprayers)

- Loaders (Skid Steer Loaders, Front-end Loaders)

- Balers (Round Balers, Square Balers)

- Others (e.g., Mowers, Spreaders, Trailers)

- By Duration:

- Short-term Rental (Daily, Weekly)

- Long-term Rental (Monthly, Seasonal, Annually)

- By Farm Size:

- Small Farms (Less than 50 acres)

- Medium Farms (50-500 acres)

- Large Farms (More than 500 acres)

- By Application:

- Plowing and Cultivation

- Planting and Seeding

- Harvesting and Threshing

- Irrigation and Water Management

- Pest and Crop Protection

- Hay and Forage Production

- Post-Harvest Management

- Others

Value Chain Analysis For Farm Equipment Rental Market

The value chain for the Farm Equipment Rental Market begins with the upstream activities involving manufacturers of farm machinery and their component suppliers. These entities are responsible for the design, production, and assembly of diverse agricultural equipment, ranging from tractors to specialized implements. Key factors at this stage include technological innovation, quality control, and cost-efficient manufacturing practices. A robust supply chain for new equipment is essential to ensure rental companies have access to modern, reliable, and efficient machinery to build and refresh their fleets. Relationships with leading manufacturers often involve bulk purchasing agreements and access to service networks.

Moving downstream, the rental companies acquire, maintain, and manage the inventory of farm equipment. This crucial segment includes fleet management, logistics for equipment delivery and pickup, customer support, and value-added services like operator training or technical assistance. Distribution channels play a pivotal role in connecting rental providers with end-users. These can include direct rental outlets operated by manufacturers or specialized rental firms, independent dealers offering rental services, and increasingly, online platforms and mobile applications that facilitate peer-to-peer or business-to-customer rentals. These platforms enhance market reach, transparency, and convenience for farmers.

The direct channel involves farmers or agricultural businesses renting equipment directly from a rental company, often through a physical location or a dedicated online portal. This ensures direct interaction and tailored service. Indirect channels might involve third-party aggregators or brokers who connect farmers with available equipment from various rental providers. Effective management of the entire value chain, from procurement to customer service and end-of-life equipment management, is critical for optimizing efficiency, reducing operational costs, and ensuring customer satisfaction in the competitive farm equipment rental landscape.

Farm Equipment Rental Market Potential Customers

The primary potential customers for the Farm Equipment Rental Market are diverse, encompassing a wide spectrum of agricultural operations and related businesses. Small and medium-sized farmers represent a significant segment, as they often lack the capital to purchase expensive, specialized equipment outright. For these farmers, renting provides an economical way to access advanced machinery for specific tasks or seasonal needs, improving productivity without incurring significant debt or maintenance overheads. This demographic particularly benefits from the flexibility and cost-efficiency of rental models.

Additionally, large corporate farms and agricultural enterprises, while potentially owning extensive fleets, also utilize rental services to supplement their existing machinery during peak seasons, for specialized tasks, or when their own equipment is undergoing maintenance. This allows them to manage operational fluctuations efficiently and avoid capital expenditure on underutilized assets. Agricultural contractors who provide services like plowing, planting, or harvesting to multiple farms also constitute a key customer group, as renting enables them to scale their operations quickly and offer a broader range of services without heavy investment in diverse machinery.

Other potential customers include government agencies involved in land management or agricultural development projects, academic and research institutions conducting field trials, and new farmers entering the industry who need to minimize initial setup costs. The varying needs across these segments necessitate a diverse equipment fleet and flexible rental terms, underscoring the broad applicability and growing importance of the farm equipment rental market in supporting global agricultural activities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 55.7 billion |

| Market Forecast in 2032 | USD 99.8 billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere and Company, CNH Industrial, AGCO Corporation, Kubota Corporation, Mahindra & Mahindra Ltd., CLAAS KGaA mbH, Vermeer Corporation, Sami Farm Equipment, Premier Equipment Rentals, Titan Machinery, RDO Equipment Co., Brandt Group of Companies, H&E Equipment Services Inc., United Rentals, Sunbelt Rentals, Avis Industrial, Agri-Ease, FieldConnect, Xtreme Manufacturing, Volvo Construction Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Farm Equipment Rental Market Key Technology Landscape

The Farm Equipment Rental Market is increasingly characterized by advanced technological integration aimed at enhancing efficiency, traceability, and customer experience. Telematics and Global Positioning System (GPS) technologies are foundational, enabling rental companies to track equipment location, monitor usage hours, and gather operational data in real-time. This allows for optimized fleet management, proactive maintenance scheduling, and improved asset security. Farmers benefit from GPS-guided equipment for precision farming, leading to more accurate planting, spraying, and harvesting, which reduces waste and boosts yields.

The Internet of Things (IoT) plays a crucial role by connecting various sensors and devices on farm equipment, collecting vast amounts of data on engine performance, fuel consumption, soil conditions, and crop health. This data, when analyzed with Artificial Intelligence (AI) and machine learning algorithms, facilitates predictive maintenance, identifying potential failures before they occur, thereby minimizing downtime for rented machinery. AI also supports dynamic pricing models based on demand, weather, and equipment availability, and powers sophisticated recommendation systems for renters.

Furthermore, digital platforms and mobile applications are transforming the rental process. These platforms offer seamless online booking, payment processing, electronic contract signing, and direct communication channels between renters and providers. Remote monitoring capabilities allow both parties to assess equipment performance and troubleshoot issues from a distance. The adoption of these technologies ensures greater transparency, convenience, and operational effectiveness throughout the farm equipment rental ecosystem, driving sustained growth and innovation within the sector.

Regional Highlights

- North America: This region is a mature yet highly dynamic market for farm equipment rental, characterized by large-scale farming operations and a high degree of mechanization. The demand for advanced, high-horsepower equipment, often integrated with precision agriculture technologies like GPS and telematics, is robust. Farmers frequently rent to access specialized machinery for specific tasks or to supplement their own fleets during peak seasons, driven by the high cost of new equipment and a shortage of skilled labor. The presence of major agricultural machinery manufacturers and well-established rental infrastructure further supports market growth.

- Europe: The European market is defined by a strong focus on sustainable agriculture, precision farming, and regulatory compliance. Rental services are popular among diverse farm sizes, from small family farms to large cooperatives, seeking cost-effective access to modern, environmentally compliant machinery. There is a growing trend towards specialized equipment for organic farming and smart farming solutions, often facilitated through rental to manage investment costs. The market benefits from government policies supporting agricultural innovation and machinery sharing schemes.

- Asia Pacific (APAC): APAC is projected to be one of the fastest-growing regions, fueled by increasing population, rising food demand, and extensive government initiatives promoting agricultural mechanization in countries like India, China, and Southeast Asian nations. The region is dominated by small and medium-sized farms where equipment ownership is often unaffordable, making rental services a crucial component for improving productivity and efficiency. The adoption of basic to semi-advanced machinery on a rental basis is widespread, with a growing interest in technology-enabled equipment.

- Latin America: This region presents significant growth opportunities due to expanding agricultural land, increased focus on export-oriented agriculture, and a rising need for modern farming techniques. Countries like Brazil and Argentina are heavily investing in mechanization to boost crop yields and operational efficiency. Farm equipment rental supports both large-scale commercial farming and emerging smallholder operations by providing access to essential machinery without the prohibitive upfront investment, contributing to enhanced food security and economic development.

- Middle East and Africa (MEA): The MEA region is an emerging market for farm equipment rental, driven by ongoing efforts to diversify economies, enhance food security, and modernize agricultural practices. Investments in large-scale farming projects, particularly in water-scarce areas, are creating demand for advanced irrigation and specialized cultivation equipment. Rental services help overcome challenges such as limited capital, lack of technical expertise for maintenance, and the need for flexible machinery access in diverse climatic conditions, though market penetration is still relatively low compared to other regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Farm Equipment Rental Market.- Deere and Company (John Deere)

- CNH Industrial N.V. (Case IH, New Holland)

- AGCO Corporation

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- CLAAS KGaA mbH

- Vermeer Corporation

- Sami Farm Equipment

- Premier Equipment Rentals

- Titan Machinery Inc.

- RDO Equipment Co.

- Brandt Group of Companies

- H&E Equipment Services Inc.

- United Rentals, Inc.

- Sunbelt Rentals (Ashtead Group plc)

- Avis Industrial Corporation

- Agri-Ease Equipment & Rentals

- FieldConnect Inc.

- Xtreme Manufacturing LLC

- Volvo Construction Equipment

Frequently Asked Questions

What are the primary benefits of renting farm equipment versus purchasing it?

Renting farm equipment offers significant advantages such as reduced upfront capital expenditure, lower maintenance and storage costs, and immediate access to the latest agricultural technologies. It provides flexibility to scale operations based on seasonal demand without long-term commitment, mitigating depreciation risks and allowing farmers to allocate capital to other crucial farm investments.

How is technology impacting the farm equipment rental market?

Technology, including GPS, telematics, IoT, and AI, is profoundly impacting the market by enabling precision farming capabilities, optimizing fleet management, and facilitating predictive maintenance. Digital platforms and mobile apps streamline booking and tracking, enhancing efficiency and accessibility for renters, while real-time data analytics inform dynamic pricing and service personalization.

What types of farm equipment are most commonly available for rental?

The most commonly rented farm equipment includes a wide range of machinery vital for various agricultural tasks. This typically comprises tractors of different horsepower, combine harvesters, tillage equipment like plows and harrows, seeding and planting machinery, irrigation systems, and sprayers. Specialized equipment for hay, forage, and post-harvest management is also widely available.

Who are the typical customers for farm equipment rental services?

Typical customers for farm equipment rental services include small and medium-sized farmers seeking cost-effective access to modern machinery, large corporate farms requiring supplementary equipment during peak seasons or for specialized tasks, and agricultural contractors who need a flexible fleet to serve multiple clients. New farmers and those experimenting with diverse crops also frequently utilize rental options.

What is the future outlook for the Farm Equipment Rental Market?

The future outlook for the Farm Equipment Rental Market is robust, driven by increasing mechanization in agriculture, rising demand for food, and the prohibitive costs of new equipment. Integration of advanced technologies like AI and IoT will further enhance market efficiency and appeal. Emerging economies and the growing trend towards sustainable and precision farming are expected to fuel significant growth and innovation in rental services globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager