Fiber Optic Components Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429132 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fiber Optic Components Market Size

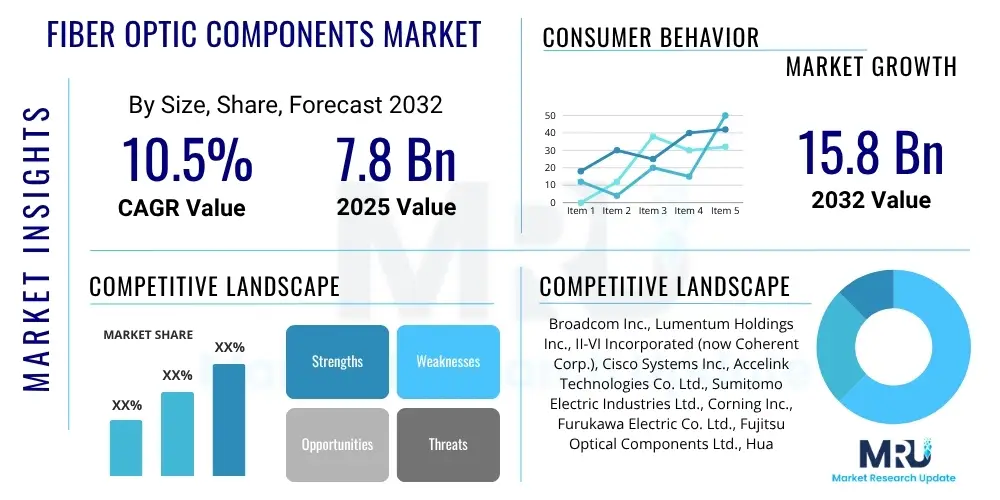

The Fiber Optic Components Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2032. The market is estimated at $7.8 billion in 2025 and is projected to reach $15.8 billion by the end of the forecast period in 2032.

Fiber Optic Components Market introduction

The Fiber Optic Components Market encompasses a broad range of essential devices and materials that enable the transmission and reception of data through optical fibers. These components are fundamental to modern communication networks, facilitating high-speed and high-bandwidth data transfer across various applications. Products typically include transceivers, cables, connectors, amplifiers, splitters, circulators, and attenuators, all designed to ensure efficient light propagation and signal integrity within optical networks. The unparalleled capacity of fiber optics to carry vast amounts of data over long distances with minimal loss makes it indispensable for today's digital infrastructure.

Major applications for fiber optic components span telecommunications, datacom, enterprise networking, FTTX deployments, and specialized sectors like medical devices, industrial automation, and defense. These components are critical for building out global internet backbones, connecting data centers, providing high-speed residential broadband, and enabling sophisticated sensor networks. The core benefits derived from fiber optic technology include its superior bandwidth capacity, significantly lower signal attenuation compared to copper cables, immunity to electromagnetic interference (EMI), enhanced data security, and lightweight, compact design. These inherent advantages position fiber optics as the preferred medium for future-proof communication infrastructure.

The market's robust growth is primarily driven by the escalating global demand for data, fueled by pervasive internet usage, the proliferation of cloud computing services, the rollout of 5G wireless networks, and the rapid expansion of the Internet of Things (IoT). These trends necessitate ever-increasing network speeds and capacities, directly translating into higher demand for advanced fiber optic components. Furthermore, significant investments in data center infrastructure and government initiatives aimed at improving broadband connectivity in underserved areas are also substantial catalysts propelling the market forward, fostering continuous innovation and widespread adoption of optical technologies.

Fiber Optic Components Market Executive Summary

The Fiber Optic Components Market is experiencing significant expansion, driven by robust business trends that prioritize high-speed data transmission and network infrastructure upgrades. Key business trends include the ongoing transition to higher data rates (such as 400G and 800G) in data centers, increasing investments in 5G network deployments globally, and the sustained demand for Fiber-to-the-Home/Building (FTTH/B) connectivity. Strategic collaborations, mergers, and acquisitions among major players are also shaping the competitive landscape, fostering innovation and consolidating market expertise. Furthermore, the push towards energy-efficient and compact optical modules, often utilizing silicon photonics, represents a critical development in product innovation aimed at reducing operational costs and enabling denser deployments, which directly impacts market dynamics and competitive offerings.

Regionally, Asia Pacific stands as the dominant market, propelled by massive investments in telecommunications infrastructure, rapid urbanization, and a large consumer base demanding high-speed internet access, particularly in countries like China, Japan, and India. North America and Europe are also demonstrating strong growth, primarily due to advanced 5G rollouts, extensive cloud computing infrastructure, and the continuous upgrade of existing broadband networks to fiber. Emerging markets in Latin America, the Middle East, and Africa are showing promising growth trajectories as they ramp up digital transformation initiatives and expand their communication backbones, presenting new opportunities for market players to penetrate previously underserved areas and capitalize on nascent demand for optical connectivity.

Segment-wise, transceivers represent the largest and fastest-growing segment, driven by their critical role in data center interconnects and telecommunication networks, particularly with the increasing adoption of higher data rates. Fiber optic cables and connectors also maintain substantial market shares due to their foundational necessity in any optical network build-out, with innovations focusing on improved durability, easier installation, and higher density. Passive components like splitters and amplifiers are seeing steady demand as network complexities increase and optical signal management becomes more critical. The diverse needs across various applications, from consumer-grade broadband to industrial sensing and defense systems, ensure a broad and resilient demand for a comprehensive suite of fiber optic components, thereby contributing to the market's overall segmentation and growth patterns.

AI Impact Analysis on Fiber Optic Components Market

User questions regarding AI's impact on the Fiber Optic Components Market frequently revolve around how artificial intelligence drives demand for specific component types, the implications for network infrastructure design, and whether AI can optimize the manufacturing or deployment of these components. Users are keen to understand if AI-driven applications, particularly large language models and advanced computing, necessitate higher bandwidth and lower latency connections, thereby directly influencing the specifications and volume of fiber optic component sales. Concerns often include the capacity requirements of AI data centers, the need for advanced optical transceivers capable of handling massive data flows, and the potential for AI to introduce new complexities or efficiencies within optical networks. The overarching theme is an expectation that AI will be a significant, if not primary, catalyst for future growth and innovation in fiber optic technology, reshaping both demand and operational paradigms.

- AI-driven data centers require massive bandwidth, boosting demand for high-speed fiber optic transceivers (400G, 800G, and beyond) and interconnects.

- Increased AI computing necessitates ultra-low latency optical networks, driving innovation in component design and network architecture to minimize signal delays.

- AI applications in network management can optimize fiber optic network performance, predicting potential failures, managing traffic, and enhancing resource allocation.

- AI is utilized in the design and manufacturing processes of fiber optic components, enabling more precise fabrication, quality control, and faster prototyping, leading to improved yield and reduced costs.

- Edge AI deployments amplify the need for robust and widespread fiber optic infrastructure to support distributed data processing and real-time inference at the network's periphery.

- The growth of machine learning and deep learning models fuels the demand for high-density fiber optic cabling within server racks and between data center facilities.

- AI-powered sensor networks increasingly leverage fiber optic components for enhanced data acquisition and communication in industrial, environmental, and defense applications.

DRO & Impact Forces Of Fiber Optic Components Market

The Fiber Optic Components Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, alongside significant impact forces. Key drivers include the exponential increase in global data traffic, primarily fueled by the proliferation of digital content, cloud services, and real-time applications. The aggressive rollout of 5G networks worldwide is a monumental catalyst, necessitating extensive fiber backhauls and fronthauls to support higher bandwidth and lower latency requirements of next-generation wireless communication. Furthermore, continuous investments in data center expansion and upgrades, coupled with government initiatives promoting ubiquitous broadband connectivity, particularly in developing regions, are creating a sustained demand for optical infrastructure. The undeniable benefits of fiber optics, such as superior bandwidth, enhanced security, and immunity to electromagnetic interference, reinforce its irreplaceable role in modern communication.

However, the market also faces notable restraints. The high initial investment required for deploying fiber optic networks can be a significant barrier for smaller service providers and in regions with limited capital. The complexity involved in the installation and maintenance of fiber optic cables and components, often requiring specialized skills and equipment, contributes to higher operational costs. Moreover, fiber optic cables are susceptible to physical damage during construction or environmental events, which can lead to costly repairs and service interruptions. Intense competition from alternative wireless technologies, although generally less capable in terms of raw bandwidth and latency, poses a challenge, particularly for last-mile connectivity where cost-effectiveness and ease of deployment are paramount considerations for specific market segments.

Despite these challenges, substantial opportunities exist for market expansion and innovation. Emerging applications in advanced sensing, medical diagnostics, and industrial automation are opening new vertical markets for specialized fiber optic components. The growing trend towards smart cities and smart homes, integrating various IoT devices, necessitates robust optical networks for seamless data exchange. Furthermore, the development of quantum computing and quantum communication technologies is expected to drive demand for highly specialized photonic components in the long term. Strategic geographical expansion into underserved and developing regions, coupled with continuous technological advancements like silicon photonics and pluggable optics, presents lucrative avenues for market players to capture new growth and maintain competitive advantage, thereby shaping the future trajectory of the fiber optic components industry.

Segmentation Analysis

The Fiber Optic Components Market is comprehensively segmented based on various factors, including component type, application, end-use, data rate, and type of fiber. This detailed segmentation allows for a nuanced understanding of market dynamics, specific demand drivers within each category, and the identification of high-growth areas. The diversity across these segments reflects the wide-ranging utility and integration of fiber optic technology across nearly all facets of modern digital infrastructure. Each segment possesses distinct technological requirements, competitive landscapes, and growth trajectories, making a granular analysis essential for strategic planning and market forecasting. Understanding these segments helps in identifying niche markets and tailoring product development to meet specific industry needs, thereby enhancing overall market penetration and revenue generation for component manufacturers and service providers.

- By Component:

- Transceivers (SFP, SFP+, QSFP, CFP, etc.)

- Cables (Single-Mode, Multi-Mode, Specialty Cables)

- Connectors (SC, LC, ST, FC, MPO/MTP)

- Amplifiers (EDFA, Raman Amplifiers)

- Splitters

- Circulators

- Isolators

- Switches

- Adapters

- Attenuators

- Optical Filters

- Couplers

- By Application:

- Telecommunication (Long-Haul, Metro, Access Networks)

- Datacom (Data Centers, Enterprise Networks)

- Enterprise (Campus Networks, Office Buildings)

- Industrial (Factory Automation, Process Control)

- Medical (Imaging, Sensing, Surgical Instruments)

- Defense and Government (Surveillance, Secure Communications)

- FTTX (FTTH, FTTB, FTTC)

- Broadcasting

- Oil and Gas

- Security Surveillance

- By End-Use:

- Telecommunications Providers

- Data Center Operators

- Cloud Service Providers

- Enterprises (Financial Services, IT, Retail)

- Government and Defense Organizations

- Healthcare Providers

- Industrial Automation Firms

- Cable Television (CATV) Providers

- Research and Development Institutions

- By Data Rate:

- 1G

- 10G

- 25G

- 40G

- 100G

- 400G

- 800G and above

- Specialty/Custom Rates

- By Type of Fiber:

- Single-Mode Fiber (SMF)

- Multi-Mode Fiber (MMF)

Value Chain Analysis For Fiber Optic Components Market

The value chain for the Fiber Optic Components Market is intricate, beginning with upstream raw material suppliers and extending through various manufacturing, integration, and distribution phases before reaching the end-users. Upstream analysis involves suppliers of critical raw materials such as high-purity silica for fiber preforms, various types of glass, and specialized plastics and metals required for connector housings, transceiver components, and protective cable jackets. These raw materials undergo sophisticated processing to form optical fibers and component sub-assemblies. This initial stage is crucial for ensuring the quality, purity, and performance characteristics of the final fiber optic components, as any impurity can significantly impact signal transmission quality and component longevity.

Midstream in the value chain, component manufacturers specialize in transforming these raw materials and sub-assemblies into functional fiber optic products. This includes the fabrication of optical fibers, the assembly of transceivers, connectors, amplifiers, and other passive components. These manufacturers often invest heavily in research and development to innovate new technologies, improve performance, and reduce production costs. Downstream analysis focuses on the entities that integrate these components into larger network systems and deliver them to end-users. This typically involves telecommunication equipment manufacturers, network system integrators, and value-added resellers (VARs) who design, install, and maintain entire optical networks for telecommunication companies, data centers, and enterprises.

The distribution channel for fiber optic components involves both direct and indirect sales. Direct sales are often preferred for large-volume orders and complex custom solutions, where manufacturers work closely with major telecommunication operators, large data center clients, or government agencies to provide tailored products and support. Indirect sales, on the other hand, leverage a network of distributors, wholesalers, and specialized resellers who serve smaller enterprises, regional service providers, and a broader range of industrial and commercial clients. These distributors play a vital role in providing local stock, technical support, and logistical efficiency, ensuring wider market reach and accessibility of fiber optic components to diverse customer segments, thus optimizing the entire supply chain from production to final deployment.

Fiber Optic Components Market Potential Customers

The Fiber Optic Components Market caters to a diverse range of potential customers and end-users, reflecting the pervasive demand for high-speed, reliable data transmission across various industries. Telecommunication companies represent a foundational customer segment, heavily investing in fiber optic components for their long-haul, metro, and access networks to support voice, data, and video services. Their continuous upgrades to 5G and FTTH infrastructure drive significant demand for transceivers, cables, and passive components. Data center operators and cloud service providers constitute another critical segment, requiring massive quantities of high-density, high-speed transceivers and interconnect solutions to manage the colossal data traffic generated by cloud computing, artificial intelligence, and big data analytics, continuously expanding their facilities and upgrading their internal and external network links.

Beyond the core telecom and data center sectors, enterprises across various industries are increasingly adopting fiber optic solutions for their internal networks, particularly large corporations, financial institutions, and educational campuses that require robust and secure high-bandwidth connectivity for their operations. Government and defense organizations are significant buyers, utilizing fiber optic components for secure communication networks, surveillance systems, and critical infrastructure projects where data integrity and security are paramount. The healthcare sector is also a growing customer, employing fiber optics in advanced medical imaging, diagnostic equipment, and surgical instruments, benefiting from its precision and immunity to electromagnetic interference in sensitive environments.

Furthermore, industrial automation firms leverage fiber optic components for reliable data transmission in harsh environments, connecting sensors, controllers, and machinery in smart factories and process control systems, where resilience and low latency are crucial. Cable television (CATV) providers continue to upgrade their networks to fiber, blending video, internet, and voice services for their subscribers. Research and development institutions, engaged in cutting-edge scientific exploration, also rely on high-performance fiber optic components for experimental setups, advanced sensing, and high-speed data acquisition. This broad spectrum of end-users underscores the indispensable nature of fiber optic technology in powering the global digital economy and facilitating innovation across numerous sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $7.8 Billion |

| Market Forecast in 2032 | $15.8 Billion |

| Growth Rate | CAGR 10.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Broadcom Inc., Lumentum Holdings Inc., II-VI Incorporated (now Coherent Corp.), Cisco Systems Inc., Accelink Technologies Co. Ltd., Sumitomo Electric Industries Ltd., Corning Inc., Furukawa Electric Co. Ltd., Fujitsu Optical Components Ltd., Huawei Technologies Co. Ltd., Finisar Corporation (now part of Coherent Corp.), Oclaro Inc. (now part of Lumentum), NeoPhotonics Corporation, Ciena Corporation, Infinera Corporation, CommScope Inc., Amphenol Corporation, TE Connectivity Ltd., Foxconn Interconnect Technology Ltd., Sensata Technologies Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Optic Components Market Key Technology Landscape

The Fiber Optic Components Market is characterized by a rapidly evolving technological landscape, with continuous innovation driving performance enhancements, cost reductions, and new application possibilities. A pivotal technology is Silicon Photonics, which integrates multiple optical components onto a single silicon chip, enabling smaller, more energy-efficient, and higher-bandwidth transceivers at lower manufacturing costs. This integration is critical for scaling data center interconnects and addressing the demands of next-generation networks. Another significant trend is the increasing adoption of Pluggable Optics, particularly in the form of QSFP-DD and OSFP modules, which support higher data rates like 400G and 800G, offering flexibility and upgradeability for network operators and data center architects. These modules are becoming standardized solutions for inter-rack and inter-data center connectivity, simplifying deployment and maintenance.

Coherent Optics is revolutionizing long-haul and metro networks by enabling ultra-high-speed data transmission over longer distances without regeneration. This technology employs complex modulation schemes to encode more data into each optical signal, significantly increasing spectral efficiency and network capacity. Advances in Quantum Photonics are also emerging, with research focused on developing components for quantum communication and computing, promising unprecedented levels of security and computational power, which could open entirely new markets for specialized fiber optic components. Furthermore, advanced packaging techniques, including chip-on-board (CoB) and 3D stacking, are crucial for producing more compact and powerful optical modules, reducing form factors while increasing density and thermal management efficiency, which is essential for deployments in confined spaces and high-performance computing environments.

Free Space Optics (FSO) represents an alternative or complementary technology, particularly for challenging last-mile connections or rapid deployments where laying fiber is impractical. While not strictly a fiber optic component, FSO often uses similar optical signaling and can interact with fiber optic networks at its terminals. Overall, the market's technological trajectory is toward greater integration, higher data rates, enhanced power efficiency, and more sophisticated signal processing capabilities. These advancements are not only meeting the escalating demands of existing applications but also paving the way for future innovations in areas like artificial intelligence, virtual reality, and distributed sensing, ensuring the continued relevance and growth of fiber optic technology as the backbone of the digital age, continually pushing the boundaries of what is possible in data communication.

Regional Highlights

- North America: A mature market with high penetration of advanced optical networks, driven by significant investments in 5G infrastructure, hyperscale data centers, and enterprise network upgrades. The United States and Canada lead in adopting cutting-edge fiber optic components for cloud computing and AI applications.

- Europe: Characterized by robust government initiatives to expand broadband connectivity (e.g., EU Gigabit Society goals) and increasing deployment of FTTH/B networks. Countries like Germany, the UK, and France are actively upgrading their telecom infrastructure, creating steady demand for advanced components.

- Asia Pacific (APAC): The largest and fastest-growing market, propelled by rapid urbanization, massive telecommunication infrastructure projects (especially in China and India), extensive 5G rollouts, and a booming digital economy. Japan and South Korea are leaders in fiber optic technology and deployment.

- Latin America: An emerging market with considerable growth potential, driven by improving economic conditions, increasing internet penetration, and efforts to bridge the digital divide. Brazil and Mexico are key countries investing in new fiber optic network infrastructure.

- Middle East and Africa (MEA): Experiencing significant growth due to substantial government investments in smart city projects, data center development, and enhanced connectivity. Countries like UAE, Saudi Arabia, and South Africa are spearheading these initiatives, fueling demand for modern fiber optic components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Optic Components Market.- Broadcom Inc.

- Lumentum Holdings Inc.

- Coherent Corp. (formerly II-VI Incorporated)

- Cisco Systems Inc.

- Accelink Technologies Co. Ltd.

- Sumitomo Electric Industries Ltd.

- Corning Inc.

- Furukawa Electric Co. Ltd.

- Fujitsu Optical Components Ltd.

- Huawei Technologies Co. Ltd.

- NeoPhotonics Corporation

- Ciena Corporation

- Infinera Corporation

- CommScope Inc.

- Amphenol Corporation

- TE Connectivity Ltd.

- Foxconn Interconnect Technology Ltd.

- Sensata Technologies Inc.

- Nokia Corporation

- ADVA Optical Networking SE

Frequently Asked Questions

What are the primary drivers of growth in the Fiber Optic Components Market?

The primary drivers include the exponential increase in global data traffic, widespread deployment of 5G networks, continuous expansion of cloud computing and data centers, and government initiatives aimed at enhancing broadband infrastructure worldwide.

How is artificial intelligence (AI) impacting the demand for fiber optic components?

AI significantly boosts demand for high-speed, low-latency fiber optic transceivers and interconnects, particularly for AI-driven data centers and edge computing, requiring networks capable of handling massive data volumes and rapid processing.

Which region holds the largest share in the Fiber Optic Components Market?

The Asia Pacific region currently holds the largest market share, driven by extensive investments in telecommunications infrastructure, rapid urbanization, and large-scale 5G deployments in countries like China, India, and Japan.

What key technological advancements are shaping the future of fiber optic components?

Key advancements include Silicon Photonics for integrated and energy-efficient components, Coherent Optics for ultra-high-speed long-haul transmission, and advanced packaging techniques for compact and high-performance modules.

What are the major challenges faced by the Fiber Optic Components Market?

Major challenges include high initial investment costs for network deployment, the complexity of installation and maintenance, the vulnerability of fiber cables to physical damage, and a shortage of skilled labor for specialized optical network operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager