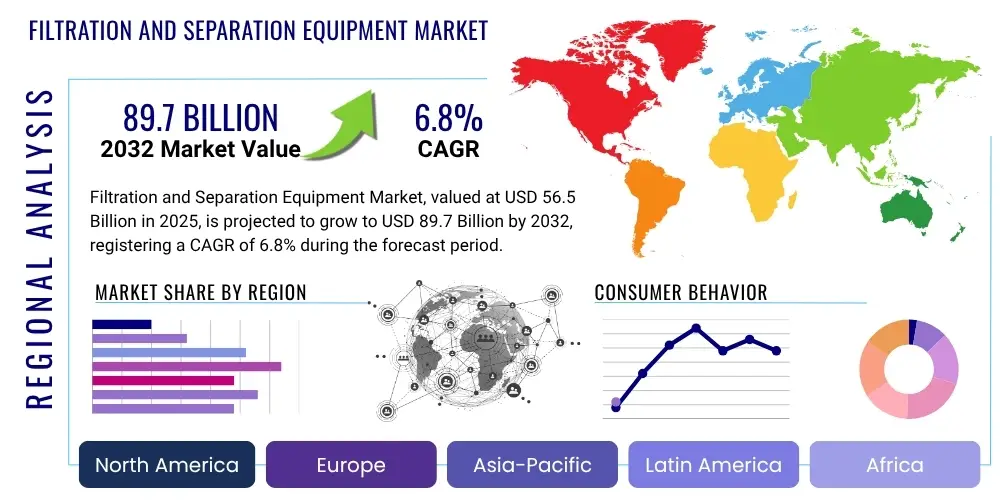

Filtration and Separation Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428998 | Date : Oct, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Filtration and Separation Equipment Market Size

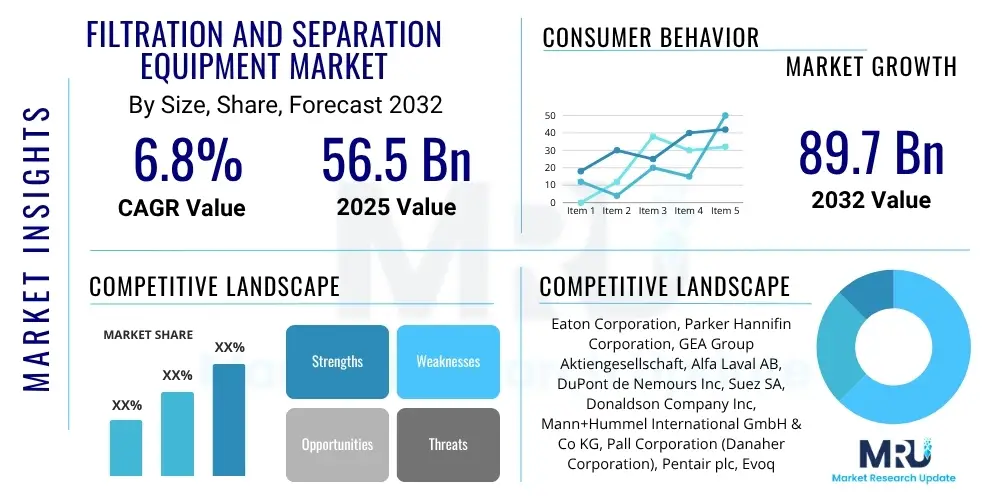

The Filtration and Separation Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 56.5 Billion in 2025 and is projected to reach USD 89.7 Billion by the end of the forecast period in 2032.

Filtration and Separation Equipment Market introduction

The Filtration and Separation Equipment Market encompasses a broad range of technologies and devices designed to remove impurities, particulate matter, and unwanted components from liquids, gases, and other process streams. This equipment is crucial across numerous industries for ensuring product purity, environmental compliance, operational efficiency, and worker safety. The products range from simple cartridge filters and bag filters to advanced membrane systems, centrifuges, and sophisticated air purification units, each tailored to specific separation challenges based on particle size, fluid characteristics, and desired output quality.

Major applications for filtration and separation equipment span critical sectors such as water and wastewater treatment, oil and gas, food and beverage, pharmaceuticals, chemicals, mining, and power generation. In water treatment, these systems are indispensable for producing potable water and treating industrial effluents to meet stringent discharge standards. In the pharmaceutical industry, ultra-pure conditions are essential, making advanced filtration vital for sterile processing and active pharmaceutical ingredient (API) production. The benefits of deploying these systems are substantial, including enhanced product quality, reduced operational costs through improved efficiency, compliance with environmental regulations, and the protection of downstream equipment from contamination and wear.

The market's growth is primarily driven by increasing industrialization, particularly in emerging economies, which necessitates robust solutions for process optimization and waste management. Stricter environmental regulations globally, especially concerning water quality and air emissions, are compelling industries to invest in advanced filtration and separation technologies. Furthermore, growing awareness about public health and safety, coupled with rising demand for purified products in the food, beverage, and pharmaceutical sectors, continues to fuel innovation and adoption within this dynamic market landscape.

Filtration and Separation Equipment Market Executive Summary

The global Filtration and Separation Equipment Market is poised for significant expansion, propelled by a confluence of evolving business trends, robust regional demand, and the continuous innovation within key market segments. Businesses are increasingly prioritizing sustainable operations, leading to a greater adoption of advanced filtration technologies that enable water reuse, energy efficiency, and reduced waste generation. The emphasis on operational resilience and supply chain optimization post-pandemic has also driven investments in reliable and high-performance separation solutions. Digitalization and automation are transforming the market, with intelligent filtration systems offering predictive maintenance and real-time performance monitoring, optimizing uptime and efficiency.

Regionally, Asia Pacific stands out as the fastest-growing market, primarily due to rapid industrialization, urbanization, and escalating demand for treated water and clean air in countries like China and India. North America and Europe, while mature markets, continue to demonstrate steady growth driven by stringent environmental regulations, technological advancements, and the need to upgrade aging infrastructure. Latin America and the Middle East and Africa are also witnessing considerable investments in new industrial projects and infrastructure development, creating substantial opportunities for filtration and separation equipment providers. Each region presents unique regulatory landscapes and industrial priorities that shape the specific demand for various types of separation technologies.

Segment-wise, liquid filtration remains the dominant category, driven by its pervasive use in water treatment, industrial processing, and food and beverage applications. However, air filtration is experiencing accelerated growth due to increasing concerns about air pollution and the rising demand for clean air in commercial and industrial settings. The membrane separation segment, known for its high efficiency and versatility, is anticipated to be a key growth driver, with innovations in materials and module designs continually expanding its applicability. End-user industries such as pharmaceuticals and biotechnology are driving demand for highly specialized and sterile filtration solutions, while the oil and gas sector continues to require robust equipment for separation of crude oil, gas, and water.

AI Impact Analysis on Filtration and Separation Equipment Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the Filtration and Separation Equipment Market, specifically questioning its capabilities in enhancing efficiency, enabling predictive maintenance, and optimizing operational costs. There is considerable interest in understanding the tangible applications of AI, such as real-time process control, anomaly detection, and autonomous system adjustments, and whether these advancements translate into significant energy savings and extended equipment lifespan. Concerns often revolve around the initial investment required for AI integration, the complexity of data management, and the need for specialized skills to deploy and maintain AI-powered systems. Expectations are high for AI to usher in a new era of smart, self-optimizing filtration plants, providing unprecedented levels of operational intelligence and environmental stewardship.

- AI-driven predictive maintenance optimizes equipment uptime by forecasting failures.

- Real-time process optimization through AI algorithms enhances filtration efficiency and product purity.

- AI enables autonomous control systems, reducing manual intervention and operational errors.

- Advanced data analytics powered by AI identifies patterns for improved system design and operation.

- AI assists in developing novel filtration materials by simulating performance characteristics.

- Enhanced energy consumption management through AI-based workload scheduling.

- Improved anomaly detection in filtration processes, preventing costly system failures.

- Smart sensor integration with AI for comprehensive remote monitoring and diagnostics.

DRO & Impact Forces Of Filtration and Separation Equipment Market

The Filtration and Separation Equipment Market is significantly influenced by a complex interplay of driving forces, inherent restraints, and compelling opportunities that together shape its growth trajectory and competitive landscape. Key drivers include the global surge in industrialization and manufacturing activities, which inherently increases the demand for process and effluent treatment solutions. Stricter environmental regulations worldwide, particularly concerning water quality, air emissions, and waste management, compel industries to adopt advanced filtration and separation technologies to ensure compliance. Furthermore, the escalating global water scarcity crisis is spurring investments in water recycling, reuse, and desalination projects, all of which heavily rely on sophisticated filtration systems. The rising demand for product purity in sensitive sectors such as pharmaceuticals, food and beverage, and biotechnology also acts as a powerful catalyst for market expansion, pushing for more efficient and reliable separation solutions.

However, the market also faces notable restraints. The high initial capital investment required for advanced filtration and separation equipment can be a significant barrier for small and medium-sized enterprises (SMEs), particularly in developing regions. The operational complexities associated with maintaining these sophisticated systems, coupled with the need for specialized technical expertise, can also deter adoption. Additionally, the periodic replacement of consumable components like filter cartridges and membranes contributes to ongoing operational costs, impacting the total cost of ownership. The intense competition from local manufacturers offering lower-cost alternatives, especially in price-sensitive markets, further adds pressure on established global players, necessitating continuous innovation and differentiation.

Despite these challenges, the market is rich with opportunities for growth and innovation. The increasing focus on sustainable industrial practices and circular economy principles is opening avenues for technologies that support resource recovery and waste valorization, such as advanced membrane bioreactors and selective separation techniques. The integration of Industry 4.0 technologies, including IoT, AI, and big data analytics, is creating smart filtration systems capable of predictive maintenance, real-time optimization, and remote monitoring, offering significant efficiency gains. Emerging economies in Asia Pacific and Latin America present vast untapped potential due to rapid infrastructure development and growing industrial bases. Moreover, the continuous development of novel materials and hybrid technologies promises to deliver more efficient, durable, and cost-effective filtration solutions, addressing a broader spectrum of separation challenges across various end-user industries.

Segmentation Analysis

The Filtration and Separation Equipment Market is comprehensively segmented based on various critical parameters, including type, end-user industry, and technology, providing a granular view of market dynamics and identifying key growth areas. This detailed segmentation allows for a precise understanding of specific product demands, technological preferences, and regional consumption patterns, enabling stakeholders to tailor strategies effectively. The diverse range of equipment available reflects the multifaceted requirements across industries, from removing macro particulates to achieving molecular-level separation for ultra-pure applications.

- By Type:

- Liquid Filtration

- Bag Filters

- Cartridge Filters

- Sand Filters

- Strainers

- Nutsche Filters

- Automatic Filters

- Self-Cleaning Filters

- Pressure Filters

- Vacuum Filters

- Air Filtration

- HEPA Filters

- ULPA Filters

- Dust Collectors

- Mist Collectors

- Activated Carbon Filters

- Cabin Air Filters

- HVAC Filters

- Separator Technologies

- Centrifugal Separators

- Magnetic Separators

- Electrostatic Separators

- Oil Water Separators

- Cyclones

- Hydrocyclones

- Sifters

- Liquid Filtration

- By Technology:

- Membrane Separation

- Microfiltration (MF)

- Ultrafiltration (UF)

- Nanofiltration (NF)

- Reverse Osmosis (RO)

- Forward Osmosis (FO)

- Electrodialysis (ED)

- Physical Separation

- Gravity Settling

- Flotation

- Screening

- Centrifugation

- Chemical Separation

- Ion Exchange

- Adsorption

- Coagulation/Flocculation

- Mechanical Separation

- Depth Filtration

- Surface Filtration

- Filter Presses

- Leaf Filters

- Membrane Separation

- By End-User Industry:

- Water and Wastewater Treatment

- Food and Beverage

- Pharmaceutical and Biotechnology

- Chemical and Petrochemical

- Oil and Gas

- Mining and Metals

- Power Generation

- Automotive

- HVAC

- Manufacturing

- Agriculture

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Value Chain Analysis For Filtration and Separation Equipment Market

The value chain for the Filtration and Separation Equipment Market is a complex network involving several stages, beginning with the sourcing of raw materials and culminating in the end-user application and after-sales services. Upstream activities involve the extraction and processing of essential raw materials such as various polymers for membranes, metals for casings and structural components, and specialized filter media materials like cellulose, ceramics, and activated carbon. This stage also includes component manufacturing, where specialized parts like pumps, valves, sensors, and control systems are produced, forming the foundational elements of the filtration equipment. Manufacturers often rely on a global network of suppliers for these critical inputs, emphasizing quality and cost-effectiveness.

Midstream activities primarily encompass the design, engineering, and manufacturing of the filtration and separation equipment itself. This involves research and development to innovate new technologies, material science advancements, and the assembly of various components into finished products. Equipment manufacturers leverage their technical expertise to produce a wide array of systems, from standard industrial filters to highly customized solutions for specific applications. The efficiency and quality of manufacturing processes at this stage are crucial for the performance and durability of the final products. Distribution channels play a pivotal role, connecting manufacturers with end-users through a mix of direct and indirect approaches. Direct sales involve manufacturers selling directly to large industrial clients or through their own sales force, allowing for direct engagement and tailored solutions. Indirect channels include distributors, resellers, system integrators, and engineering, procurement, and construction (EPC) firms, who often provide regional access, logistical support, and installation services, reaching a broader customer base.

Downstream activities focus on the installation, operation, maintenance, and after-sales support of the filtration and separation equipment at the end-user sites. This stage is critical for ensuring the optimal performance and longevity of the systems. End-users require ongoing technical support, spare parts, and regular servicing to maximize their investment and comply with operational standards. Service providers, often working in conjunction with equipment manufacturers or as independent entities, offer maintenance contracts, troubleshooting, and training services. This robust after-sales ecosystem ensures continued functionality and customer satisfaction, often generating significant recurring revenue for market participants. The efficiency of the entire value chain, from raw material procurement to post-sales support, directly impacts the market competitiveness and overall customer value proposition.

Filtration and Separation Equipment Market Potential Customers

The potential customers for Filtration and Separation Equipment span a vast array of industries and sectors globally, each with distinct needs for purification, separation, and environmental compliance. These end-users, or buyers, are organizations and entities that rely on these technologies to optimize their processes, ensure product quality, protect their assets, and meet regulatory requirements. The diversity in applications means that market players must often tailor their offerings to address specific industrial challenges, such as high-temperature environments, corrosive chemicals, sterile processing, or large-volume treatment requirements. Understanding the specific pain points and operational objectives of each customer segment is crucial for effective market penetration and solution delivery.

Key segments of potential customers include municipalities and industrial facilities engaged in water and wastewater treatment, where the equipment is vital for potable water production, industrial effluent purification, and sludge dewatering. The food and beverage industry represents a significant customer base, requiring filtration for product clarity, shelf-life extension, microbial control, and ingredient purification in processes ranging from brewing and dairy production to juice processing. Pharmaceutical and biotechnology companies are high-value customers, demanding ultra-pure and sterile filtration solutions for drug manufacturing, vaccine production, and sterile air handling, where product integrity and compliance with Good Manufacturing Practices (GMP) are paramount. The chemical and petrochemical sectors utilize separation equipment for catalysts recovery, product purification, solvent recovery, and gas processing, often under challenging operating conditions.

Furthermore, the oil and gas industry is a major consumer, employing filtration and separation equipment for crude oil refinement, natural gas processing, produced water treatment, and pipeline protection. Mining and metals companies use these systems for dewatering concentrates, tailings management, and process water clarification. Power generation plants, particularly those relying on coal or biomass, utilize air filtration for emissions control and water treatment for boiler feed and cooling tower makeup. Other significant customer groups include the automotive industry (e.g., paint booths, engine manufacturing), HVAC systems in commercial and residential buildings (for indoor air quality), and various manufacturing industries that require clean processes and waste stream management. The pervasive need for purity and efficiency across nearly all industrial operations ensures a broad and continually expanding customer base for filtration and separation equipment providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 56.5 Billion |

| Market Forecast in 2032 | USD 89.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation, Parker Hannifin Corporation, GEA Group Aktiengesellschaft, Alfa Laval AB, DuPont de Nemours Inc, Suez SA, Donaldson Company Inc, Mann+Hummel International GmbH & Co KG, Pall Corporation (Danaher Corporation), Pentair plc, Evoqua Water Technologies LLC, Veolia Environnement SA, Camfil AB, SPX Flow Inc, Thermax Limited, Lenntech B V, Cummins Inc, W L Gore & Associates Inc, ANDRITZ AG, Koch Separation Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Filtration and Separation Equipment Market Key Technology Landscape

The Filtration and Separation Equipment Market is characterized by a dynamic and evolving technology landscape, driven by continuous innovation aimed at improving efficiency, reducing operational costs, and addressing increasingly complex separation challenges. Central to this landscape are advancements in membrane technologies, which continue to expand their applications across various sectors. Microfiltration (MF), Ultrafiltration (UF), Nanofiltration (NF), and Reverse Osmosis (RO) membranes are becoming more sophisticated, offering enhanced selectivity, flux rates, and fouling resistance through the development of novel materials like graphene, carbon nanotubes, and advanced polymers. Hybrid membrane processes, combining different membrane types or integrating membranes with other separation techniques, are also gaining traction to achieve multi-stage purification and optimize overall system performance. These innovations are critical for applications demanding high purity levels, such as desalination, pharmaceutical manufacturing, and ultrapure water production for electronics.

Beyond membrane technology, significant technological advancements are also evident in physical and mechanical separation methods. Centrifugal separators, including decanters, disc stack centrifuges, and tubular centrifuges, are being engineered for higher G-forces and improved solids handling capabilities, making them indispensable in industries like food and beverage, chemicals, and wastewater treatment. Filter presses, a traditional yet highly effective technology, are evolving with automated controls, faster cycle times, and enhanced plate designs to improve dewatering efficiency and reduce manual labor. Depth and surface filtration techniques are benefiting from new filter media compositions that offer higher dirt holding capacities, longer service life, and greater chemical compatibility, leading to more robust and versatile cartridge and bag filters. Furthermore, self-cleaning filter technologies, incorporating automated backwash or scraping mechanisms, are minimizing maintenance downtime and extending filter lifespan across a range of industrial applications.

The advent of Industry 4.0 and digital transformation is profoundly impacting the filtration and separation market, with the integration of smart technologies becoming a key differentiator. The Internet of Things (IoT) enables real-time monitoring of filter performance, pressure differentials, flow rates, and contamination levels, allowing for proactive maintenance and operational adjustments. Artificial Intelligence (AI) and machine learning algorithms are being employed for predictive analytics, identifying potential failures before they occur and optimizing operating parameters to maximize efficiency and minimize energy consumption. Advanced sensors, control systems, and data analytics platforms are transforming traditional equipment into intelligent, interconnected systems capable of autonomous operation and remote diagnostics. This shift towards smart filtration solutions not only enhances operational reliability and cost-effectiveness but also provides valuable insights for process optimization and regulatory compliance, ensuring the market remains at the forefront of industrial innovation.

Regional Highlights

- North America: This region represents a mature yet robust market for filtration and separation equipment, driven by stringent environmental regulations, particularly regarding water and wastewater treatment, and air quality standards. The presence of well-established industries like oil and gas, pharmaceuticals, and food and beverage fuels consistent demand for advanced separation solutions. Investments in upgrading aging infrastructure and a strong focus on industrial automation and digitalization also contribute to market growth. The region is a hub for technological innovation, with continuous R&D activities leading to the introduction of high-performance and energy-efficient equipment.

- Europe: Europe is a key market characterized by high environmental awareness, strict regulatory frameworks (such as REACH and various EU directives on water quality and industrial emissions), and a strong emphasis on sustainability and circular economy principles. This drives demand for innovative and eco-friendly filtration and separation technologies, including advanced membrane systems for water reuse and resource recovery. Germany, the UK, France, and Italy are significant contributors, with robust chemical, pharmaceutical, and food and beverage industries. The region also benefits from government initiatives supporting green technologies and industrial decarbonization efforts.

- Asia Pacific (APAC): This region is projected to be the fastest-growing market, primarily due to rapid industrialization, urbanization, and significant investments in infrastructure development across countries like China, India, and Southeast Asian nations. The escalating demand for clean water, coupled with increasing air pollution concerns in metropolitan areas, is a major driver. Expansion of manufacturing, chemical, pharmaceutical, and power generation sectors creates substantial opportunities for all types of filtration and separation equipment. Government policies aimed at environmental protection and industrial modernization further boost market expansion, although competitive pricing remains a significant factor.

- Latin America: The market in Latin America is witnessing steady growth, fueled by increasing industrial activities, particularly in mining, oil and gas, and food processing sectors. Countries like Brazil, Mexico, and Argentina are key markets, with rising investments in water and wastewater infrastructure. The region faces challenges related to water scarcity and pollution, driving the adoption of filtration technologies. Economic stability and foreign investments are crucial for sustained market development, encouraging industries to adopt more efficient and compliant separation solutions.

- Middle East and Africa (MEA): The MEA region presents considerable growth opportunities, predominantly driven by extensive investments in the oil and gas industry, which requires sophisticated separation solutions for exploration, production, and refining. Water scarcity is a critical issue in the Middle East, leading to significant investments in desalination plants and industrial wastewater treatment, making it a key market for membrane technologies. Africa's developing industrial base and expanding urban populations are increasing the demand for basic and advanced filtration systems across various sectors, including power generation, mining, and municipal water treatment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Filtration and Separation Equipment Market.- Eaton Corporation

- Parker Hannifin Corporation

- GEA Group Aktiengesellschaft

- Alfa Laval AB

- DuPont de Nemours Inc

- Suez SA

- Donaldson Company Inc

- Mann+Hummel International GmbH & Co KG

- Pall Corporation (Danaher Corporation)

- Pentair plc

- Evoqua Water Technologies LLC

- Veolia Environnement SA

- Camfil AB

- SPX Flow Inc

- Thermax Limited

- Lenntech B V

- Cummins Inc

- W L Gore & Associates Inc

- ANDRITZ AG

- Koch Separation Solutions

Frequently Asked Questions

What is the projected growth rate of the Filtration and Separation Equipment Market?

The Filtration and Separation Equipment Market is projected to grow at a Compo

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager