Financial Advisory Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429918 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Financial Advisory Services Market Size

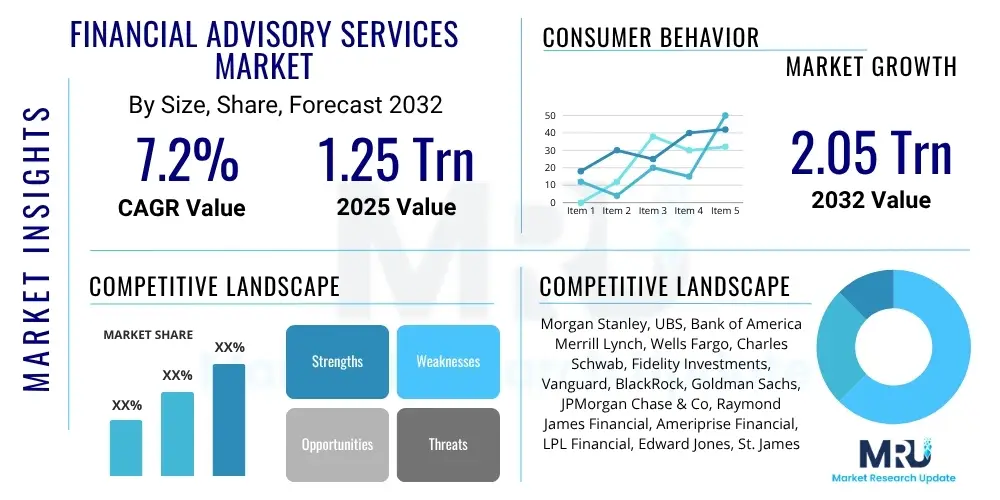

The Financial Advisory Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. The market is estimated at $1.25 Trillion in 2025 and is projected to reach $2.05 Trillion by the end of the forecast period in 2032.

Financial Advisory Services Market introduction

The Financial Advisory Services Market encompasses a broad spectrum of professional services designed to help individuals, families, and organizations manage their financial assets, plan for future goals, and navigate complex financial landscapes. These services range from wealth management and investment advice to retirement planning, tax planning, and estate planning, delivered by qualified professionals. The core product offering involves providing personalized financial strategies and recommendations tailored to client-specific objectives, risk tolerance, and time horizons, aiming to optimize financial outcomes.

Major applications of financial advisory services span across high-net-worth individuals seeking sophisticated portfolio management, mass affluent clients requiring holistic financial planning, and corporate entities needing advice on asset allocation, employee benefits, or merger and acquisition strategies. The primary benefits derived by clients include enhanced wealth creation and preservation, effective risk management, tax efficiency, and the disciplined pursuit of long-term financial objectives, ultimately leading to greater financial security and peace of mind. The market is significantly driven by factors such as increasing global wealth, the complexity of financial instruments, an aging global population necessitating retirement and estate planning, and a heightened awareness among consumers regarding the importance of professional financial guidance.

Financial Advisory Services Market Executive Summary

The Financial Advisory Services Market is currently experiencing transformative business trends characterized by rapid digitalization, the proliferation of fee-based advisory models, and a growing emphasis on personalized and holistic financial planning. Firms are increasingly leveraging technology to enhance client engagement, streamline operational efficiencies, and deliver tailored advice at scale, moving away from traditional commission-based structures towards more transparent and client-aligned compensation models. Environmental, Social, and Governance (ESG) investing has emerged as a significant trend, driving demand for advisors who can integrate sustainable investment principles into client portfolios, reflecting a broader societal shift towards responsible wealth management.

Regionally, developed markets such as North America and Europe continue to dominate the market share, driven by a mature financial ecosystem, high disposable incomes, and robust regulatory frameworks. However, Asia Pacific is rapidly emerging as the fastest-growing region, fueled by expanding middle classes, rising affluence, and increasing financial literacy in economies like China and India. Latin America, the Middle East, and Africa are also presenting significant growth opportunities, albeit from a lower base, as their economies develop and financial services infrastructure improves. Within segments, robo-advisors are gaining considerable traction among younger demographics and mass affluent clients due to their cost-effectiveness and accessibility, while hybrid models combining digital tools with human expertise are appealing to a broader client base seeking the best of both worlds. The demand for comprehensive wealth management, encompassing not just investments but also tax, estate, and retirement planning, is consistently strong across all client segments.

AI Impact Analysis on Financial Advisory Services Market

User inquiries about AI's impact on financial advisory services frequently revolve around its potential to revolutionize efficiency, enhance personalization, and address accessibility issues within the industry. Common questions explore how AI will automate routine tasks, provide deeper insights for investment decisions, and enable advisors to serve more clients with tailored advice. Concerns often focus on the potential for job displacement, the ethical implications of algorithmic decision-making, the security of sensitive financial data, and the importance of maintaining a human touch in a relationship-driven service. Users also inquire about the reliability and transparency of AI-driven recommendations, anticipating both significant benefits in predictive analytics and potential risks associated with data bias or system failures, all while expecting increased convenience and improved financial outcomes.

- Enhanced Data Analysis and Predictive Capabilities: AI algorithms can process vast amounts of financial data, identifying trends, predicting market movements, and assessing risks with greater accuracy and speed than human advisors.

- Automated Portfolio Management and Rebalancing: Robo-advisors powered by AI can autonomously manage and rebalance investment portfolios based on predefined risk profiles and market conditions, offering cost-effective solutions.

- Personalized Financial Planning: AI tools analyze individual financial situations, goals, and behaviors to provide highly customized advice, from savings strategies to retirement planning, at scale.

- Improved Customer Service and Engagement: AI-driven chatbots and virtual assistants offer 24/7 client support, answering common questions, providing market updates, and guiding clients through basic financial processes.

- Operational Efficiency and Cost Reduction: AI automates repetitive administrative tasks, such as data entry, compliance checks, and report generation, allowing human advisors to focus on high-value client interactions.

- Fraud Detection and Risk Management: Advanced AI systems can detect anomalous patterns in transactions and client behavior, significantly improving fraud prevention and overall risk management.

- Augmented Human Advisor Capabilities: AI serves as a powerful tool for human advisors, providing them with advanced analytics, research support, and client insights to enhance their advisory capacity and decision-making.

- Expansion of Services to Underserved Markets: The scalability and lower cost of AI-driven solutions can make professional financial advice accessible to a broader demographic, including mass affluent and retail investors.

DRO & Impact Forces Of Financial Advisory Services Market

The Financial Advisory Services Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, all shaped by overarching impact forces. Key drivers include sustained global economic growth, which increases disposable incomes and wealth creation, leading to higher demand for professional financial management. The increasing complexity of financial products and markets, coupled with an aging global population requiring specialized retirement and estate planning, further propels market expansion. Technological advancements, particularly in AI, machine learning, and data analytics, act as powerful enablers, allowing advisors to offer more personalized, efficient, and accessible services. Additionally, supportive regulatory environments in many jurisdictions that prioritize investor protection and financial literacy also stimulate market growth by building trust and expanding the client base.

Conversely, the market faces several notable restraints. The escalating costs of regulatory compliance, including stringent data privacy and anti-money laundering regulations, impose significant operational burdens on firms. Concerns regarding data security and privacy breaches in an increasingly digital landscape deter some potential clients, necessitating substantial investments in cybersecurity infrastructure. Market volatility, influenced by geopolitical events and economic downturns, can lead to reduced investor confidence and lower demand for advisory services. Furthermore, a persistent lack of financial literacy among certain demographics and deeply ingrained trust issues stemming from past financial crises continue to hinder market penetration. These restraints collectively challenge the industry's growth trajectory and necessitate strategic adaptation.

Opportunities within the Financial Advisory Services Market are abundant, primarily driven by the ongoing integration of robo-advisory platforms and the development of hybrid advisory models that combine technological efficiency with human expertise. The burgeoning demand for personalized digital platforms that offer seamless client experiences and real-time insights presents a significant avenue for innovation. Niche markets, such as ESG investing, cryptocurrency advisory, and specialized planning for diverse demographics (e.g., Gen Z, expatriates), offer fertile ground for differentiation and growth. Moreover, the vast untapped potential in emerging economies, where wealth is accumulating rapidly but professional financial guidance is less prevalent, represents a substantial long-term opportunity for market expansion and new client acquisition. These opportunities, when strategically leveraged, can reshape the market landscape and foster sustainable growth.

Segmentation Analysis

The Financial Advisory Services Market is extensively segmented to reflect the diverse needs of its client base and the varied delivery models available. These segments categorize the market by the nature of the advisory service, the type of client served, the mode of interaction, and the underlying technology utilized. This granular segmentation allows for a detailed analysis of market dynamics, competitive landscapes, and growth opportunities within specific niches, enabling providers to tailor their offerings more effectively and target their marketing efforts with precision. Understanding these segments is crucial for stakeholders to identify key growth areas and adapt to evolving consumer preferences and technological advancements.

- By Type:

- Robo-advisors

- Human-advisors

- Hybrid Advisory Models

- By Service:

- Wealth Management

- Financial Planning (Retirement Planning, Education Planning, Debt Management)

- Investment Advisory

- Tax Planning

- Estate Planning

- Risk Management and Insurance Planning

- By End-User:

- Individuals

- High-Net-Worth Individuals (HNWI)

- Ultra-High-Net-Worth Individuals (UHNWI)

- Mass Affluent

- Retail Investors

- Corporates (SMEs, Large Enterprises)

- Institutions (Pension Funds, Endowments, Foundations)

- Individuals

- By Mode of Interaction:

- Online/Digital Platforms

- Offline/In-person Consultation

Value Chain Analysis For Financial Advisory Services Market

The value chain for the Financial Advisory Services Market begins with upstream activities involving foundational technology and data providers. This segment includes financial technology (FinTech) companies developing specialized software for portfolio management, customer relationship management (CRM), and regulatory compliance, as well as analytics firms supplying critical market data, research, and economic forecasts. These upstream partners are essential for equipping financial advisors with the tools and information necessary to deliver sophisticated and informed advice to their clients. The quality and reliability of these upstream services directly impact the efficiency and effectiveness of the entire advisory process, forming the bedrock upon which advisory firms build their service offerings.

Moving downstream, the value chain encompasses the advisory firms themselves, who package these tools and insights into actionable financial strategies for end-users. Distribution channels are varied, including direct models where clients engage directly with independent financial advisors or large advisory firms. Indirect channels involve referrals from banks, brokerage houses, accounting firms, and even insurance companies, which may offer advisory services as part of a broader suite of financial products. Both direct and indirect models leverage robust client acquisition strategies, sophisticated advisory processes, and continuous client engagement to deliver value. The efficiency of these distribution channels, coupled with the quality of direct client interaction, is paramount for securing market share and fostering long-term client relationships within the highly competitive financial advisory landscape.

Financial Advisory Services Market Potential Customers

The primary potential customers and end-users of Financial Advisory Services are broadly categorized by their wealth levels, organizational structure, and specific financial needs. High-Net-Worth Individuals (HNWI) and Ultra-High-Net-Worth Individuals (UHNWI) represent a significant segment, seeking comprehensive wealth management, sophisticated investment strategies, tax optimization, and complex estate planning solutions due to their substantial assets and intricate financial portfolios. The Mass Affluent segment, while having lower asset bases, also increasingly seeks guidance on investment planning, retirement savings, and general financial education to grow and protect their wealth. These individual clients are driven by a desire for financial security, wealth growth, and the achievement of specific life goals.

Beyond individuals, corporate entities and institutions form another crucial customer base. Small and Medium-sized Enterprises (SMEs) often require advisory services for business growth strategies, employee benefits planning, succession planning, and corporate finance. Large corporations may seek expertise in treasury management, risk assessment, and capital market strategies. Institutional investors, such as pension funds, endowments, and foundations, utilize financial advisors for asset allocation, performance monitoring, regulatory compliance, and responsible investment strategies to ensure the longevity and growth of their funds. Each of these customer groups exhibits unique financial challenges and objectives, necessitating tailored advisory approaches that address their distinct requirements for wealth creation, preservation, and strategic financial management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $1.25 Trillion |

| Market Forecast in 2032 | $2.05 Trillion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Morgan Stanley, UBS, Bank of America Merrill Lynch, Wells Fargo, Charles Schwab, Fidelity Investments, Vanguard, BlackRock, Goldman Sachs, JPMorgan Chase & Co, Raymond James Financial, Ameriprise Financial, LPL Financial, Edward Jones, St. James's Place Wealth Management, Capgemini, Deloitte, Ernst & Young, PwC, KPMG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Financial Advisory Services Market Key Technology Landscape

The Financial Advisory Services market is undergoing a significant technological transformation, driven by innovations designed to enhance efficiency, personalization, and accessibility. Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront, powering advanced analytics for predictive modeling, risk assessment, and personalized investment recommendations. These technologies enable sophisticated robo-advisors to automate portfolio management and rebalancing, making financial advice more scalable and cost-effective. Big Data Analytics complements AI and ML by allowing advisors to process and derive insights from vast datasets, leading to more informed decision-making and tailored client strategies. Cloud Computing provides the scalable infrastructure necessary to host these complex applications, facilitating secure data storage, remote accessibility, and seamless integration of various FinTech solutions.

Further enhancing the technological landscape are robust Customer Relationship Management (CRM) systems specifically adapted for financial advisors, which centralize client data, track interactions, and streamline communication, fostering deeper client relationships. Blockchain technology is emerging as a critical enabler for enhanced security, transparency, and efficiency in transaction processing, record-keeping, and smart contract execution, potentially reducing fraud and operational costs. Specialized Portfolio Management Software offers comprehensive tools for asset allocation, performance tracking, and compliance reporting. Digital client portals and mobile applications are becoming standard, providing clients with convenient access to their portfolios, financial plans, and communication with their advisors, ultimately enhancing the overall client experience and driving digital engagement across the advisory ecosystem.

Regional Highlights

- North America: This region holds a dominant share in the Financial Advisory Services Market, primarily driven by a mature financial sector, high per capita wealth, and a strong culture of personal financial planning. The United States, in particular, leads in adopting advanced FinTech solutions, including robo-advisors and hybrid models. Strict regulatory frameworks also contribute to market stability and investor confidence.

- Europe: The European market is characterized by diverse regulatory environments and varying levels of financial literacy across countries. Western European nations, such as the UK, Germany, and Switzerland, are significant contributors due to their robust wealth management sectors and increasing demand for personalized investment advice, particularly in ESG investing. Digital transformation and cross-border advisory services are key trends.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapidly expanding economies like China and India, burgeoning middle classes, and a significant rise in high-net-worth individuals. Increased financial awareness, coupled with a growing adoption of digital platforms and innovative advisory models, is propelling market expansion across Southeast Asia and Australia.

- Latin America: This region presents considerable growth potential, driven by economic development, increasing disposable incomes, and a growing demand for structured financial planning. Brazil and Mexico are leading markets, with a rising adoption of digital advisory services. However, market volatility and regulatory complexities remain factors influencing growth.

- Middle East and Africa (MEA): The MEA market is witnessing steady growth, particularly in the GCC countries, owing to wealth accumulation from oil revenues, favorable government initiatives promoting financial sector development, and a growing expatriate population seeking international financial advice. Digitalization and the establishment of FinTech hubs are enhancing market accessibility and service offerings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Financial Advisory Services Market.- Morgan Stanley

- UBS

- Bank of America Merrill Lynch

- Wells Fargo

- Charles Schwab

- Fidelity Investments

- Vanguard

- BlackRock

- Goldman Sachs

- JPMorgan Chase & Co

- Raymond James Financial

- Ameriprise Financial

- LPL Financial

- Edward Jones

- St. James's Place Wealth Management

- Capgemini

- Deloitte

- Ernst & Young

- PwC

- KPMG

Frequently Asked Questions

What are the primary types of financial advisory services available?

Financial advisory services typically encompass wealth management, financial planning (including retirement and education planning), investment advisory, tax planning, and estate planning, tailored to individual or corporate needs.

How do robo-advisors differ from traditional human financial advisors?

Robo-advisors utilize algorithms and AI to provide automated, low-cost investment management and basic financial advice, typically online. Traditional human advisors offer personalized, comprehensive financial planning and complex advice through direct, in-person consultations.

What is the projected growth rate for the Financial Advisory Services Market?

The Financial Advisory Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032, driven by increasing wealth and technological advancements.

What impact does AI have on the financial advisory industry?

AI significantly impacts the industry by enabling enhanced data analysis, personalized advice, automated portfolio management, improved customer service, and increased operational efficiency, transforming how services are delivered.

Which regions are leading the growth in financial advisory services?

North America currently holds the largest market share, while Asia Pacific is anticipated to be the fastest-growing region, fueled by rising affluence and digital adoption in emerging economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager