Financial Analytics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427960 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Financial Analytics Market Size

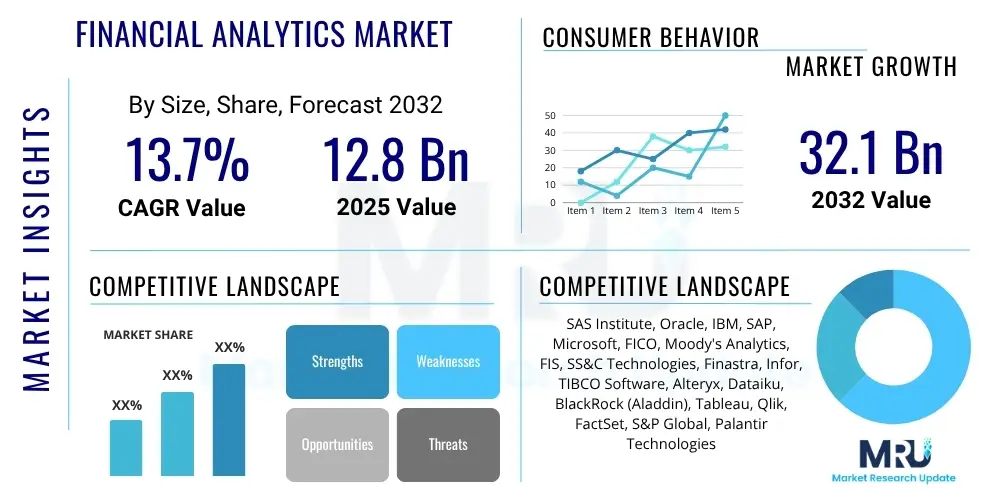

The Financial Analytics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.7% between 2025 and 2032. The market is estimated at $12.8 Billion in 2025 and is projected to reach $32.1 Billion by the end of the forecast period in 2032.

Financial Analytics Market introduction

The Financial Analytics Market encompasses a sophisticated array of software solutions and services designed to empower financial institutions and corporate finance departments with advanced data analysis capabilities. These tools leverage extensive datasets, including transactional records, market data, economic indicators, and customer behavior patterns, to extract actionable insights. The primary objective is to enhance decision-making across various financial operations, ranging from strategic planning and investment analysis to risk management and fraud detection. Product offerings within this market are diverse, including platforms for predictive modeling, real-time reporting, regulatory compliance, and performance optimization. Major applications span critical areas such as asset and wealth management, banking, insurance, corporate finance, and capital markets, enabling organizations to gain a competitive edge and navigate complex financial landscapes more effectively. Key benefits derived from the adoption of financial analytics solutions include improved accuracy in forecasting, enhanced operational efficiency through automation of analytical processes, better identification and mitigation of financial risks, stronger adherence to evolving regulatory requirements, and the ability to personalize financial products and services. The market's robust growth is primarily driven by the exponential increase in financial data volumes, the urgent need for digital transformation within the finance sector, the escalating complexity of global regulations, and the relentless pressure on organizations to optimize financial performance and minimize losses. Furthermore, the pervasive adoption of cloud computing, the integration of artificial intelligence and machine learning, and the demand for real-time insights are continually reshaping the capabilities and value proposition of financial analytics solutions, making them indispensable for modern financial operations.

Financial Analytics Market Executive Summary

The Financial Analytics Market is undergoing significant transformation, driven by a confluence of evolving business trends, distinct regional dynamics, and advancements across its various segments. A paramount business trend is the accelerating embrace of cloud-based financial analytics solutions, which offer unparalleled scalability, flexibility, and cost-efficiency, enabling even small and medium-sized enterprises (SMEs) to access sophisticated analytical capabilities previously reserved for larger corporations. Alongside this, the integration of artificial intelligence (AI) and machine learning (ML) is fundamentally reshaping the market, moving financial analysis beyond descriptive and diagnostic insights to predictive and prescriptive intelligence, thereby enabling more proactive and strategic decision-making. Furthermore, there is a growing emphasis on real-time data processing and analytics, as financial markets and customer expectations demand immediate insights to respond swiftly to opportunities and threats. From a regional perspective, North America and Europe continue to dominate the market due to early adoption of advanced technologies, stringent regulatory frameworks necessitating robust analytical tools, and the presence of numerous key market players and innovation hubs. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapid economic growth, increasing digitization of financial services, and a burgeoning FinTech ecosystem, particularly in countries like China, India, and Japan. Latin America, the Middle East, and Africa (MEA) are also showing promising growth, albeit from a lower base, as financial inclusion initiatives and digital transformation efforts gain momentum. Segment-wise, the demand for predictive analytics tools is experiencing substantial growth, driven by the need for more accurate financial forecasting, risk modeling, and customer behavior predictions. The governance, risk, and compliance (GRC) segment remains a critical area, with financial institutions heavily investing in analytics to navigate increasingly complex regulatory landscapes and avoid costly penalties. Concurrently, customer analytics and fraud detection segments are also expanding rapidly, as organizations seek to enhance customer experience, personalize offerings, and protect against financial crime in an increasingly digital and interconnected world. The interplay of these trends highlights a market characterized by continuous innovation and increasing strategic importance for financial entities globally.

AI Impact Analysis on Financial Analytics Market

The integration of Artificial Intelligence (AI) into the Financial Analytics Market is profoundly altering its capabilities and strategic importance, addressing numerous common user questions and concerns regarding efficiency, accuracy, and future potential. Users frequently inquire about how AI can enhance the precision of financial forecasting, automate repetitive analytical tasks, and improve the speed and effectiveness of fraud detection. There is also significant interest in AI's role in developing more sophisticated risk management models, personalizing financial advice, and ensuring regulatory compliance in an increasingly complex environment. Concerns often revolve around the ethical implications of AI, data privacy, the potential for job displacement, and the need for explainable AI models (XAI) to ensure transparency and trust in automated financial decisions. The overarching theme from user questions indicates a strong expectation that AI will unlock new levels of insight and operational efficiency, but also a desire for robust frameworks to manage its associated risks.

Based on this analysis, AI's influence in financial analytics centers on its capacity to process vast volumes of unstructured and structured data at speeds and scales unattainable by human analysts, identifying patterns and anomalies that might otherwise be missed. This capability is critical for optimizing investment strategies, predicting market movements, and proactively managing credit risk. AI-powered systems can learn from historical data to adapt to new market conditions, making financial models more resilient and responsive. Furthermore, the automation provided by AI reduces manual errors, frees up human capital for more strategic tasks, and significantly lowers operational costs, directly addressing core concerns about efficiency and resource allocation within financial institutions. The widespread adoption of AI is not merely an enhancement but a fundamental shift towards more intelligent, adaptive, and predictive financial operations.

However, the ethical deployment of AI and the safeguarding of sensitive financial data remain paramount considerations. Users expect AI solutions to be not only powerful but also secure, transparent, and fair. The development of AI in financial analytics is therefore increasingly focused on incorporating explainability features that allow financial professionals to understand the rationale behind AI-driven recommendations, fostering greater trust and enabling regulatory scrutiny. Addressing these concerns is crucial for widespread adoption and for harnessing AI's full potential to deliver transformative value across the financial sector, moving beyond basic automation to truly intelligent decision support systems that enhance both operational effectiveness and strategic foresight.

- Enhanced Predictive Modeling: AI algorithms, particularly machine learning, significantly improve the accuracy of financial forecasting, market trend prediction, and credit risk assessment by identifying complex, non-linear patterns in vast datasets.

- Advanced Fraud Detection: AI systems can detect anomalous transactions and behavioral patterns in real-time with higher precision, drastically reducing financial losses due to fraud and strengthening security protocols.

- Automated Algorithmic Trading: AI drives sophisticated algorithmic trading strategies, optimizing trade execution, managing portfolios, and exploiting fleeting market opportunities with minimal human intervention.

- Personalized Financial Advisory: AI-powered platforms analyze individual financial data, risk tolerance, and goals to offer tailored investment advice, wealth management strategies, and product recommendations to clients.

- Optimized Risk Management: AI models provide dynamic risk assessment, scenario analysis, and stress testing capabilities, enabling financial institutions to better understand, quantify, and mitigate various financial risks, including market, credit, and operational risks.

- Streamlined Regulatory Compliance: AI automates the monitoring of regulatory changes, identifies potential compliance breaches, and assists in generating audit trails and reports, ensuring adherence to complex financial regulations like AML and KYC.

- Operational Efficiency & Cost Reduction: AI automates routine analytical tasks, data processing, and report generation, reducing operational costs, improving efficiency, and allowing human analysts to focus on higher-value strategic initiatives.

- Customer Experience Enhancement: AI-driven analytics help understand customer behavior deeply, leading to personalized product offerings, proactive service, and improved customer engagement and retention.

DRO & Impact Forces Of Financial Analytics Market

The Financial Analytics Market is profoundly shaped by a dynamic interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate its growth trajectory and competitive landscape. A primary driver is the explosive growth of digital financial data, generated from an increasing number of online transactions, digital banking platforms, and interconnected financial systems, which creates an imperative for advanced analytics to extract meaningful insights. Complementing this is the accelerating pace of digital transformation across the financial sector, where traditional institutions are investing heavily in modernizing their IT infrastructure to leverage data for competitive advantage. The escalating complexity of global financial regulations, such as Basel III, IFRS 9, Solvency II, and various anti-money laundering (AML) directives, also acts as a significant driver, compelling institutions to adopt sophisticated analytics for robust compliance and risk reporting. Furthermore, the relentless demand for real-time insights to navigate volatile markets, make agile investment decisions, and detect fraud instantly, along with intense competitive pressures from FinTech disruptors and incumbent players, pushes financial entities towards advanced analytics solutions to optimize performance and reduce losses. These drivers collectively create a compelling need for solutions that can transform raw data into actionable intelligence, underpinning strategic and operational decision-making across the financial spectrum.

Despite these powerful drivers, several significant restraints challenge the market's full potential. Paramount among these are growing concerns regarding data security and privacy, especially with the sensitive nature of financial information, where breaches can lead to severe reputational damage and regulatory penalties. The integration of new financial analytics platforms with legacy IT systems presents substantial technical and operational challenges, often leading to protracted implementation cycles and high upfront costs. Furthermore, the high initial investment required for sophisticated analytics software, hardware infrastructure, and specialized talent can be prohibitive for smaller institutions or those with limited budgets. A critical restraint is the persistent shortage of skilled data scientists, financial analysts with advanced analytical expertise, and AI specialists, making it difficult for organizations to effectively deploy and manage complex analytics solutions. These restraints highlight the need for vendors to offer more secure, easily integrable, cost-effective, and user-friendly solutions, while also addressing the talent gap through partnerships and training initiatives to overcome barriers to adoption.

Opportunities abound for innovation and expansion within the Financial Analytics Market. The continuous advancements in Artificial Intelligence and Machine Learning (AI/ML) present immense potential for developing more predictive, prescriptive, and automated analytical capabilities, opening avenues for new product development in areas like hyper-personalized financial advice and advanced fraud prevention. The increasing adoption of cloud-based solutions represents a significant opportunity, offering scalability, accessibility, and reduced infrastructure burden for financial institutions of all sizes. Emerging markets in Asia Pacific, Latin America, and Africa represent vast untapped potential, as these regions undergo rapid economic development and digitization of their financial services, driving demand for modern analytical tools. Furthermore, the growing focus on Environmental, Social, and Governance (ESG) criteria is creating a new segment for ESG analytics, allowing investors and institutions to assess and manage sustainability-related financial risks and opportunities. The competitive landscape is also shaped by several impact forces: the bargaining power of buyers is high, as financial institutions demand highly customized, secure, and cost-effective solutions; the bargaining power of suppliers, particularly for specialized data and AI technologies, can be moderate to high; the threat of new entrants, often FinTechs with innovative niche solutions, is moderate; the threat of substitute products, such as traditional BI tools or in-house developed solutions, is present but diminishing as specialized analytics offer superior capabilities; and finally, intense competitive rivalry among established vendors and emerging players drives continuous innovation and pricing strategies.

- Drivers:

- Explosive Growth of Financial Data: The sheer volume and velocity of data generated from digital transactions and interconnected systems necessitate advanced analytical tools.

- Accelerated Digital Transformation: Financial institutions are heavily investing in modernizing infrastructure and adopting digital strategies, with analytics at the core.

- Increasing Regulatory Complexities: Stringent and evolving global financial regulations (e.g., Basel III, IFRS 9, AML/KYC) mandate sophisticated analytics for compliance and risk reporting.

- Demand for Real-time Insights: The need for immediate data analysis to support agile decision-making, optimize trading strategies, and detect fraudulent activities instantly.

- Intense Competitive Pressure: Financial organizations seek analytics to gain competitive advantage, personalize customer experiences, and optimize operational efficiency against FinTechs and incumbents.

- Restraints:

- Data Security and Privacy Concerns: The sensitive nature of financial data raises significant concerns about breaches, compliance with privacy laws (e.g., GDPR), and cyber threats.

- Integration Challenges with Legacy Systems: Difficulty in integrating modern analytics platforms with existing, often outdated, IT infrastructures within financial institutions.

- High Implementation and Maintenance Costs: Substantial initial investment for software licenses, hardware, and ongoing maintenance, alongside the need for specialized IT personnel.

- Shortage of Skilled Professionals: A global scarcity of data scientists, AI experts, and financial analysts proficient in advanced analytical tools hinders effective deployment and utilization.

- Opportunities:

- Advancements in AI and Machine Learning: Continuous innovation in AI/ML technologies promises more predictive, prescriptive, and automated analytical capabilities.

- Growing Adoption of Cloud-based Solutions: Cloud platforms offer scalability, flexibility, and reduced infrastructure costs, making advanced analytics accessible to a broader range of institutions.

- Expansion into Emerging Markets: Rapid digitization of financial services and economic growth in regions like APAC, Latin America, and MEA present significant untapped potential.

- Development of ESG Analytics: Increasing focus on Environmental, Social, and Governance (ESG) criteria creates a new segment for specialized analytical tools to assess sustainability risks and opportunities.

- Impact Forces:

- High Bargaining Power of Buyers: Financial institutions demand highly customized, secure, and cost-effective solutions tailored to their specific needs.

- Moderate to High Bargaining Power of Suppliers: Specialized technology providers and data vendors hold significant influence due to unique offerings.

- Moderate Threat of New Entrants: FinTech startups, often leveraging innovative technologies, pose a continuous threat by introducing disruptive niche solutions.

- Low to Moderate Threat of Substitute Products: While traditional BI tools exist, specialized financial analytics offer superior capabilities, limiting substitution risk.

- Intense Competitive Rivalry: Numerous established vendors and emerging players compete aggressively through innovation, strategic partnerships, and pricing.

Segmentation Analysis

The Financial Analytics Market is meticulously segmented to provide a granular understanding of its diverse components and target audiences, reflecting the varied needs and operational scales of financial entities. This segmentation allows market players to tailor their offerings more effectively, identify niche opportunities, and develop precise go-to-market strategies. Key segmentation dimensions typically include the component of the solution (software versus services), the deployment model (on-premise or various cloud configurations), the specific application areas within finance, the size of the organization adopting the solutions, and the industry vertical served. Each segment presents unique growth drivers, challenges, and competitive dynamics, contributing to the overall complexity and richness of the market landscape. Understanding these delineations is crucial for stakeholders aiming to capture market share and innovate within specific domains, ensuring that financial analytics solutions are precisely aligned with user requirements and operational contexts. This detailed breakdown ensures that the market's diverse functionalities and delivery methods are comprehensively addressed, facilitating both strategic planning and product development.

- By Component:

- Software: Includes various platforms, tools, and applications for data analysis, reporting, and visualization.

- Services: Comprises consulting, integration & implementation, and support & maintenance services essential for deploying and optimizing analytics solutions.

- By Deployment Model:

- On-Premise: Solutions hosted and managed within the financial institution's own IT infrastructure, offering higher control and customization.

- Cloud-based:

- Public Cloud: Solutions hosted on third-party cloud provider infrastructure, offering scalability and reduced maintenance.

- Private Cloud: Dedicated cloud environment for a single organization, balancing scalability with enhanced security.

- Hybrid Cloud: A combination of on-premise, public, and private cloud deployments, providing flexibility and optimized resource utilization.

- By Application:

- Risk Management: Tools for credit risk, market risk, operational risk, and liquidity risk assessment, modeling, and mitigation.

- Fraud Detection & Prevention: Solutions for identifying and preventing fraudulent activities across various financial transactions and accounts.

- Customer Analytics: Analyzing customer behavior, preferences, and segmentation to enhance personalization, loyalty, and marketing strategies.

- Financial Forecasting & Budgeting: Tools for predicting financial performance, managing budgets, and planning future financial activities.

- Portfolio Management: Analytics for optimizing investment portfolios, assessing asset performance, and managing investment risks.

- Governance, Risk, & Compliance (GRC): Solutions aiding adherence to regulatory requirements, internal policies, and enterprise risk management frameworks.

- Financial Reporting & Analysis: Generating comprehensive financial statements, performance reports, and ad-hoc analysis.

- By Organization Size:

- Large Enterprises: Organizations with extensive financial operations and complex data environments requiring robust, scalable analytics.

- Small and Medium-sized Enterprises (SMEs): Businesses seeking cost-effective, easy-to-deploy analytics solutions to gain competitive insights.

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI): Encompasses retail banks, investment banks, asset management firms, credit unions, and insurance providers.

- Retail & E-commerce: For financial planning, inventory optimization, and customer purchasing behavior analysis within retail.

- Healthcare: For financial management of healthcare operations, revenue cycle management, and fraud detection in claims.

- IT & Telecommunication: For financial performance analysis, billing optimization, and service profitability assessment.

- Manufacturing: For managing production costs, supply chain finance, and financial forecasting related to operations.

- Government & Public Sector: For budget management, public finance analysis, and fraud detection in public programs.

- Others: Includes transportation, energy & utilities, education, and various other sectors leveraging financial analytics for their specific needs.

Value Chain Analysis For Financial Analytics Market

The value chain of the Financial Analytics Market illustrates the sequential activities involved in delivering advanced analytical capabilities to end-users, highlighting the interconnectedness of various stakeholders from data origination to final application. At the upstream end of the value chain are the foundational elements, primarily focused on data provision and core technology development. This involves a diverse ecosystem of data providers, including financial market data vendors, credit bureaus, economic data aggregators, and alternative data sources that supply the raw material for analysis. Simultaneously, technology vendors specializing in database management systems, big data platforms, AI/ML libraries, cloud infrastructure, and core analytical engines form a critical part of this upstream segment. These entities develop the fundamental tools and infrastructure that allow financial analytics solutions to process, store, and analyze vast and complex datasets. The quality and accessibility of these upstream components directly influence the sophistication and performance of the downstream analytics applications. Collaborative partnerships between data providers and technology developers are increasingly common, aimed at creating integrated solutions that can handle the volume, velocity, and variety of modern financial data.

Moving downstream, the value chain progresses to the development and integration of specific financial analytics applications, followed by their distribution to end-users. This mid-stream segment involves software developers and specialized financial analytics solution providers who build platforms for risk management, fraud detection, portfolio optimization, and other critical functions. These providers take the foundational technologies and data from the upstream segment and transform them into tailored, user-friendly applications that address specific financial challenges. Further downstream, system integrators and consulting firms play a pivotal role. They assist financial institutions in customizing, implementing, and integrating these complex analytics solutions into their existing IT infrastructure, ensuring seamless operation and maximizing value. These service providers also offer ongoing support, training, and strategic advisory to help clients optimize their use of financial analytics and adapt to evolving business needs. The effectiveness of this downstream segment is crucial for successful adoption and return on investment for the end-users.

The distribution channels for financial analytics solutions are multifaceted, encompassing both direct and indirect approaches. Direct channels typically involve vendors selling their proprietary software and services directly to financial institutions through their sales teams, often for large enterprise clients with complex requirements. This approach allows for deep engagement, customization, and direct relationship management. Indirect channels, on the other hand, leverage a network of partners, resellers, value-added resellers (VARs), and strategic alliances. These partners often have specialized industry knowledge or regional presence, enabling vendors to reach a broader customer base and offer localized support. The interplay between direct and indirect channels is often strategic, with vendors utilizing direct sales for key accounts and complex implementations, while relying on indirect partners for market penetration, particularly within SMEs or specific geographical regions. Furthermore, the rise of cloud-based platforms has facilitated new distribution models, including marketplace listings and subscription-based services, making financial analytics more accessible and expanding the overall market reach. Optimizing these distribution channels is vital for vendors to ensure their solutions reach the right customers efficiently and effectively, ultimately strengthening their position in the competitive market.

Financial Analytics Market Potential Customers

The Financial Analytics Market serves a broad and diverse spectrum of end-users and buyers, spanning the entire financial services ecosystem and extending into corporate finance departments across various industries. These potential customers are united by a common need to leverage data for improved decision-making, risk mitigation, operational efficiency, and strategic planning. Banks, including retail banks, commercial banks, and investment banks, represent a cornerstone of the customer base. They utilize financial analytics for everything from credit scoring, fraud detection, and customer segmentation to liquidity management, regulatory reporting, and algorithmic trading. The sheer volume and complexity of transactions in banking necessitate advanced analytical capabilities to maintain profitability, manage risk exposures, and comply with stringent global regulations. Moreover, with the increasing competition from FinTechs, banks are compelled to adopt analytics to personalize customer experiences and offer innovative digital services, making these solutions indispensable for their continued relevance and growth.

Beyond traditional banking, the insurance sector forms another critical segment of potential customers. Insurance companies employ financial analytics for actuarial modeling, risk assessment, fraud detection in claims processing, policy pricing optimization, and customer lifetime value analysis. Analytics enable insurers to better understand policyholder behavior, personalize product offerings, and accurately predict future liabilities and claims, thereby enhancing underwriting profitability and operational efficiency. Asset and wealth management firms, including hedge funds, private equity firms, and mutual funds, are also significant buyers. They rely on financial analytics for portfolio optimization, performance attribution, market trend analysis, risk management of investment portfolios, and strategic asset allocation. These firms require sophisticated tools to navigate volatile markets, generate alpha, and provide superior returns for their clients, making advanced analytics a core component of their investment strategies. The ability to quickly process and interpret vast amounts of market data is crucial for gaining a competitive edge in this highly dynamic sector.

Furthermore, corporate finance departments across virtually all industry verticals, from manufacturing and retail to healthcare and technology, constitute a substantial and growing customer segment. These departments utilize financial analytics for budgeting, forecasting, cash flow management, capital expenditure analysis, profitability analysis, and treasury management. They seek to optimize financial performance, identify cost-saving opportunities, and support strategic business decisions with data-driven insights. Regulatory bodies and government agencies also represent potential customers, as they use financial analytics for market surveillance, economic forecasting, financial stability assessment, and detecting illicit financial activities. The rising prominence of FinTech companies, challenger banks, and financial technology startups also creates a vibrant customer segment. These innovative players often build their entire business models around advanced analytics, leveraging AI and machine learning to offer disruptive services, and thus are heavy consumers of specialized financial analytics platforms and services. This broad appeal underscores the fundamental value that financial analytics brings to any organization dealing with monetary data and strategic financial decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $12.8 Billion |

| Market Forecast in 2032 | $32.1 Billion |

| Growth Rate | 13.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAS Institute, Oracle, IBM, SAP, Microsoft, FICO, Moody's Analytics, FIS, SS&C Technologies, Finastra, Infor, TIBCO Software, Alteryx, Dataiku, BlackRock (Aladdin), Tableau, Qlik, FactSet, S&P Global, Palantir Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Financial Analytics Market Key Technology Landscape

The technological landscape underpinning the Financial Analytics Market is characterized by rapid innovation and the integration of cutting-edge solutions designed to handle the increasing volume, velocity, and variety of financial data. At its core, the market heavily relies on robust big data platforms and architectures, including distributed processing frameworks like Apache Hadoop and Spark, as well as NoSQL databases, which are essential for storing and processing petabytes of structured and unstructured financial data from diverse sources. These platforms provide the scalable infrastructure necessary to perform complex analytical operations and manage vast datasets generated from transactions, market feeds, social media, and more. Data warehousing and data lakes also play a crucial role in consolidating information, providing a unified view for comprehensive analysis, and ensuring data quality and governance, which are paramount in the heavily regulated financial sector. The ability to efficiently manage and query these immense data reservoirs is a fundamental technological requirement for any effective financial analytics solution, directly influencing the speed and depth of insights achievable.

Artificial Intelligence (AI) and Machine Learning (ML) are transformative technologies within this landscape, evolving beyond statistical modeling to power predictive, prescriptive, and cognitive analytics. Specific AI/ML techniques such as natural language processing (NLP) are used to analyze unstructured data like news articles, analyst reports, and customer feedback for sentiment analysis and market intelligence. Deep learning algorithms are employed for advanced pattern recognition in fraud detection, algorithmic trading, and complex risk modeling. Furthermore, machine learning models are continuously learning from new data, improving forecasting accuracy and adapting to dynamic market conditions, making them indispensable for real-time decision support. Cloud computing is another pivotal technology, offering unparalleled scalability, flexibility, and cost-efficiency. Public, private, and hybrid cloud environments enable financial institutions to deploy and manage analytics solutions without significant upfront infrastructure investments, facilitating access to high-performance computing resources on demand. This shift to the cloud accelerates deployment, enables global collaboration, and supports the elastic demand for computational power required by intensive analytical workloads.

Beyond these core technologies, various other tools and platforms contribute significantly to the comprehensive financial analytics ecosystem. Business Intelligence (BI) and data visualization tools, such as Tableau, Qlik, and Power BI, are crucial for transforming complex analytical outputs into intuitive dashboards and reports, enabling non-technical users to grasp insights quickly and make informed decisions. Predictive analytics engines, often powered by advanced statistical algorithms and machine learning, are essential for forecasting market trends, customer behavior, and potential financial risks. Application Programming Interfaces (APIs) are vital for seamless integration between disparate financial systems, data sources, and analytics platforms, fostering interoperability and allowing for the creation of composite solutions. While still nascent in some areas, blockchain technology holds potential for enhancing data security, transparency, and traceability in specific financial applications, such as trade finance and cross-border payments, potentially impacting future financial analytics infrastructure. The continuous evolution and convergence of these technologies are driving the next generation of financial analytics, offering increasingly sophisticated capabilities for navigating the complexities of the global financial market.

Regional Highlights

The global Financial Analytics Market exhibits distinct regional dynamics, influenced by varying levels of digital adoption, regulatory environments, economic development, and technological infrastructure. North America stands as a dominant force in the market, primarily driven by the early adoption of advanced financial technologies, the presence of a mature and highly competitive financial services industry, and significant investments in research and development by key market players. The region benefits from a robust regulatory framework that often mandates sophisticated risk management and compliance analytics, further fueling demand. Furthermore, the high concentration of technological innovation hubs, coupled with a strong emphasis on data-driven decision-making, ensures North America remains at the forefront of financial analytics solution development and deployment. The United States, in particular, leads in terms of market size and innovation, with substantial spending on AI/ML-driven analytics and cloud-based solutions across its banking, insurance, and asset management sectors.

Europe represents another significant market for financial analytics, characterized by stringent data protection regulations such as GDPR and a complex financial landscape with numerous national and supranational regulatory bodies. This regulatory environment necessitates advanced analytics for compliance, fraud detection, and risk management, driving consistent demand across the region. Countries like the United Kingdom, Germany, France, and Switzerland are key contributors, with a strong focus on enhancing operational efficiency, managing market volatility, and ensuring financial stability. The European market is also seeing a surge in cloud adoption and AI integration, as financial institutions strive to modernize their legacy systems and compete with agile FinTech startups. While growth rates might be more moderate compared to emerging markets, the sheer volume of financial transactions and the emphasis on regulatory adherence ensure a stable and substantial market for financial analytics solutions.

The Asia Pacific (APAC) region is projected to be the fastest-growing market for financial analytics, fueled by rapid economic expansion, increasing disposable incomes, and widespread digital transformation across its diverse economies. Countries like China, India, Japan, Australia, and Singapore are witnessing a burgeoning FinTech ecosystem and a massive shift towards digital banking and online payments, generating unprecedented volumes of financial data. This digital surge necessitates sophisticated analytics for customer segmentation, fraud prevention, and real-time transaction processing. Government initiatives promoting financial inclusion and digital infrastructure development further accelerate the adoption of financial analytics solutions. Latin America, the Middle East, and Africa (MEA) are also emerging as promising markets, albeit from a smaller base. These regions are experiencing increased financial digitization, urbanization, and a growing middle class, leading to a greater demand for modern financial services. While challenges related to infrastructure and regulatory maturity exist, the opportunity for greenfield deployments and the strong impetus for economic diversification, particularly in the Middle East, are driving significant investments in financial analytics to support growth, manage risks, and ensure regulatory compliance.

- North America: Dominant market due to early technology adoption, mature financial services sector, stringent regulations (e.g., Dodd-Frank), high R&D investments, and strong presence of key market players and innovation hubs.

- Europe: Significant market driven by complex regulatory frameworks (e.g., GDPR, MiFID II, PSD2), focus on operational efficiency, risk management, and digital transformation initiatives in countries like the UK, Germany, and France.

- Asia Pacific (APAC): Fastest-growing market propelled by rapid economic growth, extensive digitization of financial services, burgeoning FinTech ecosystem, increasing financial inclusion, and rising data volumes in countries like China, India, and Japan.

- Latin America: Emerging market experiencing growth due to increasing financial digitization, urbanization, demand for modern banking services, and efforts to combat financial crime and enhance regulatory oversight.

- Middle East and Africa (MEA): Growing market driven by infrastructure development, economic diversification efforts, increasing digital adoption, and a rising need for robust risk management and fraud detection solutions in the expanding financial sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Financial Analytics Market.- SAS Institute

- Oracle

- IBM

- SAP

- Microsoft

- FICO

- Moody's Analytics

- FIS

- SS&C Technologies

- Finastra

- Infor

- TIBCO Software

- Alteryx

- Dataiku

- BlackRock (Aladdin)

- Tableau

- Qlik

- FactSet

- S&P Global

- Palantir Technologies

Frequently Asked Questions

What is financial analytics and why is it crucial for modern businesses?

Financial analytics refers to the process of collecting, analyzing, and interpreting financial data to gain actionable insights, predict future trends, and support strategic decision-making. It encompasses a range of techniques and tools, from statistical modeling to artificial intelligence, applied to financial datasets. Its crucial importance for modern businesses stems from the exponential growth of financial data, the increasing complexity of global markets, and stringent regulatory requirements. By leveraging financial analytics, organizations can optimize financial performance, enhance risk management, detect fraud more effectively, personalize customer experiences, and achieve greater operational efficiency. This data-driven approach empowers businesses to navigate economic uncertainties, gain a competitive edge, and ensure sustainable growth by transforming raw financial information into valuable intelligence.

How do AI and Machine Learning (ML) impact the Financial Analytics Market?

AI and Machine Learning (ML) are profoundly transforming the Financial Analytics Market by elevating its capabilities beyond traditional methods. These technologies enable advanced predictive modeling, allowing financial institutions to forecast market movements, credit risks, and customer behavior with significantly higher accuracy and speed. AI-powered systems automate complex analytical tasks, reducing manual errors and freeing up human analysts for more strategic initiatives. Furthermore, AI excels at real-time fraud detection by identifying subtle anomalies in vast transaction datasets, and it facilitates personalized financial advisory services by analyzing individual client profiles and risk tolerances. The impact extends to enhancing regulatory compliance through automated monitoring and reporting, and optimizing investment strategies through sophisticated algorithmic trading. Ultimately, AI and ML make financial analytics more intelligent, adaptive, and proactive, driving greater efficiency, profitability, and security across the financial sector.

What are the key challenges in implementing financial analytics solutions?

Implementing financial analytics solutions often presents several significant challenges that organizations must carefully address. A primary hurdle is data integration and quality; financial data often resides in disparate legacy systems, leading to inconsistencies, silos, and poor data quality, which can undermine the accuracy of analytical insights. Another major challenge involves data security and privacy concerns, given the highly sensitive nature of financial information and the strict regulatory frameworks (like GDPR) governing its handling. The high upfront costs associated with purchasing software, infrastructure, and hiring specialized talent can also be a barrier, particularly for smaller institutions. Furthermore, there is a persistent shortage of skilled professionals, such as data scientists and financial analysts with advanced analytical expertise, making it difficult to effectively deploy, manage, and interpret complex analytics platforms. Finally, resistance to change within organizations and the need for explainable AI models to ensure transparency and trust in automated decisions can also impede successful implementation and adoption.

What are the main applications of financial analytics across industries?

Financial analytics finds extensive applications across a multitude of industries, with its core purpose being to optimize financial health and strategic decision-making. In the Banking, Financial Services, and Insurance (BFSI) sector, key applications include risk management (credit, market, operational risk), fraud detection and prevention, customer segmentation and personalization, regulatory compliance, and portfolio management. Corporate finance departments across industries like manufacturing, retail, and healthcare utilize financial analytics for budgeting, forecasting, cash flow management, profitability analysis, and capital expenditure planning. In e-commerce and retail, it's applied to optimize pricing strategies, analyze customer purchasing behavior, and manage inventory finances. Healthcare organizations leverage it for revenue cycle management, claims processing fraud detection, and operational cost analysis. Even government entities use financial analytics for budget allocation, public finance analysis, and detecting financial irregularities. The versatility of financial analytics means it is increasingly indispensable for any organization seeking to transform its financial data into actionable intelligence for growth and stability.

Which deployment model is more prevalent for financial analytics: on-premise or cloud-based?

While traditional on-premise deployments have historically been dominant due to security concerns and regulatory requirements, cloud-based solutions are rapidly gaining prevalence in the Financial Analytics Market. Cloud deployment models, including public, private, and hybrid clouds, offer significant advantages such as enhanced scalability, greater flexibility, and reduced infrastructure and maintenance costs. Financial institutions can access powerful computing resources on-demand, enabling them to process vast datasets and run complex analytical models without substantial upfront capital investment. This accessibility makes advanced analytics more viable for Small and Medium-sized Enterprises (SMEs) and accelerates time-to-market for new analytical applications. While concerns about data security and regulatory compliance in the cloud persist, cloud providers are continuously enhancing their security protocols and obtaining industry-specific certifications, making cloud-based financial analytics an increasingly secure and attractive option for a growing number of financial institutions globally. Hybrid cloud models are particularly favored by larger institutions seeking a balance between the control of on-premise systems and the agility of the cloud.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager