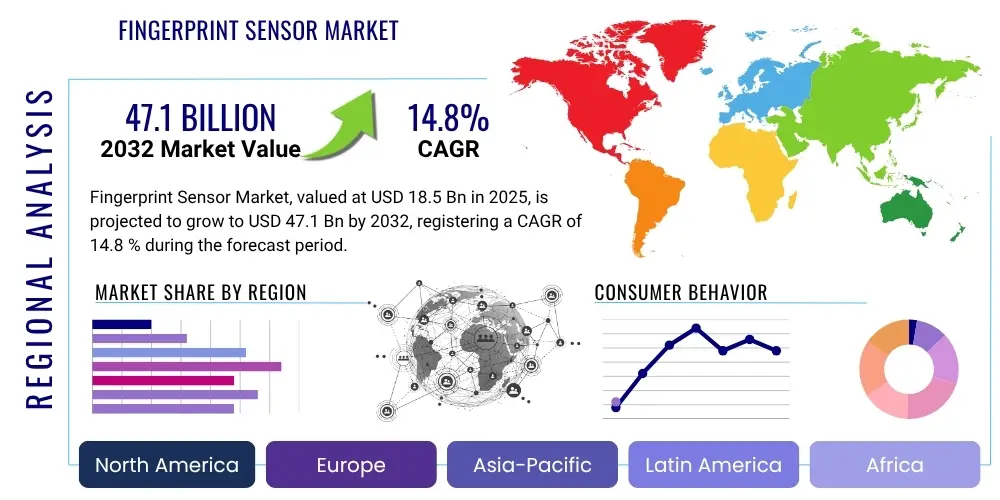

Fingerprint Sensor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427979 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Fingerprint Sensor Market Size

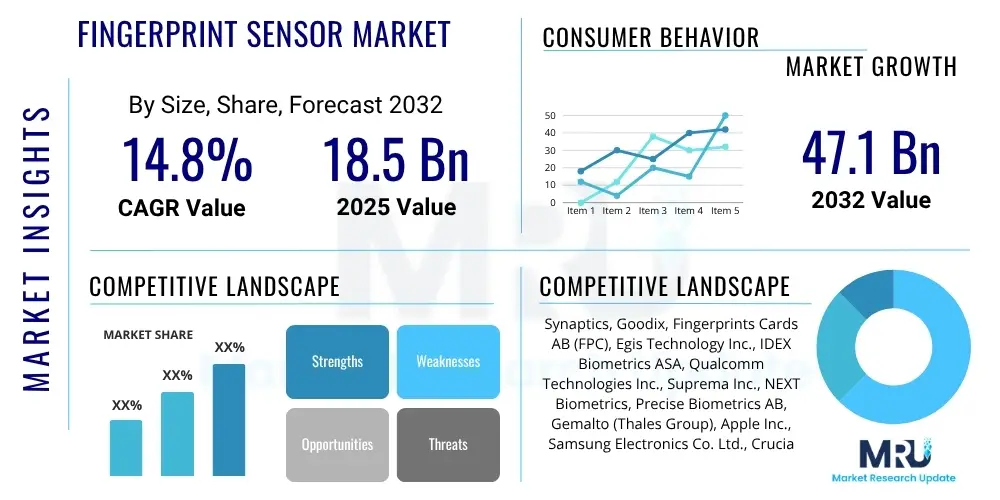

The Fingerprint Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2025 and 2032. The market is estimated at USD 18.5 Billion in 2025 and is projected to reach USD 47.1 Billion by the end of the forecast period in 2032. This significant expansion is driven by the escalating demand for enhanced security and convenience across various sectors, including consumer electronics, automotive, government, and healthcare. The continuous integration of biometric technologies into everyday devices and systems is a primary catalyst for this robust growth trajectory, underscoring the indispensable role of fingerprint recognition in modern authentication processes. The market's upward trend reflects not only the increasing adoption in traditional segments but also the emergence of new applications that leverage the reliability and user-friendliness of fingerprint biometrics.

Fingerprint Sensor Market introduction

The Fingerprint Sensor Market encompasses the global industry involved in the development, manufacturing, and deployment of devices capable of capturing and processing fingerprint images for identification and verification purposes. These sophisticated sensors translate the unique patterns of human fingertips into digital data, which is then used to grant access, authenticate transactions, or verify identity. The evolution of fingerprint sensor technology has been rapid, moving from bulky, less reliable optical scanners to highly compact, accurate, and secure capacitive, ultrasonic, and thermal sensors. This technological advancement has significantly broadened the applicability of these sensors, transforming them from niche security solutions into mainstream components in a vast array of devices and systems. The market is characterized by intense innovation, with companies continually striving to improve sensor performance, reduce form factors, enhance security features, and lower manufacturing costs to capture a larger share of the expanding global demand.

Fingerprint sensors operate on various principles, each offering distinct advantages. Capacitive sensors, prevalent in smartphones, measure capacitance variations between the finger's ridges and valleys and an array of electrodes. Optical sensors, often found in traditional security systems, capture a visual image of the fingerprint. Ultrasonic sensors, a newer innovation, use sound waves to create a 3D map of the fingerprint, offering enhanced security and the ability to work through materials like glass. Thermal sensors detect temperature differences between ridges and valleys. Major applications of these sensors span across consumer electronics, including smartphones, tablets, laptops, and wearables, providing a seamless and secure method for device unlocking and mobile payments. Beyond consumer electronics, they are crucial in commercial security for access control, government applications like national ID programs and border control, automotive systems for personalized car access, and healthcare for patient identification and data access, demonstrating their versatile utility.

The primary benefits driving the widespread adoption of fingerprint sensors include unparalleled security, offering a significantly higher level of protection compared to traditional PINs or passwords due to the uniqueness of each fingerprint. They also provide immense convenience, allowing users to unlock devices or authenticate transactions with a simple touch, eliminating the need to remember complex credentials. This convenience translates into faster, more efficient user experiences in various scenarios. Key driving factors propelling market growth include the surging demand for biometric authentication in mobile devices, the growing implementation of these sensors in smart home and IoT devices, the increasing focus on cybersecurity and data privacy necessitating robust authentication methods, and the expanding use in government and enterprise sectors for secure access control and workforce management. The continuous push for contactless and seamless authentication further fuels the market's expansion, solidifying fingerprint sensors as a cornerstone of modern digital security infrastructure.

Fingerprint Sensor Market Executive Summary

The Fingerprint Sensor Market is experiencing robust growth fueled by several dynamic business trends. A significant trend is the relentless pursuit of integration into an ever-expanding array of devices, moving beyond smartphones to include wearables, automotive systems, smart cards, and IoT devices. This widespread integration is driven by consumer demand for secure, convenient, and seamless authentication experiences. Furthermore, there is an increasing shift towards under-display and in-display fingerprint sensor technologies, particularly ultrasonic and optical variants, which allows for larger screen-to-body ratios and more innovative device designs. Manufacturers are also focusing on improving the accuracy, speed, and robustness of sensors, alongside enhancing anti-spoofing capabilities through advanced algorithms and liveness detection. Strategic partnerships between sensor manufacturers, device OEMs, and software providers are becoming more common to deliver comprehensive and integrated biometric solutions, facilitating faster market penetration and broader application development. The miniaturization of sensors coupled with enhanced processing capabilities is another key business trend, enabling their incorporation into smaller and more diverse form factors without compromising performance.

Regional trends significantly influence the market's trajectory, with Asia Pacific emerging as the dominant region and the fastest-growing market. This growth is primarily attributed to the massive production and consumption of consumer electronics, particularly smartphones, in countries like China, India, and South Korea, which are early adopters of advanced mobile technologies. Government initiatives in these regions for digital identification programs and smart city developments also play a crucial role. North America and Europe demonstrate mature markets, driven by stringent security regulations, high adoption rates in enterprise and banking sectors, and the growing demand for secure mobile payment solutions. These regions are also hubs for R&D in advanced biometric technologies, fostering innovation. Latin America, the Middle East, and Africa are experiencing steady growth, propelled by increasing smartphone penetration, digital transformation initiatives, and the need for enhanced security in financial services, although the pace of adoption may vary due to economic and infrastructural factors. These regional disparities highlight diverse market dynamics and opportunities for growth tailored to local demands and regulatory landscapes.

Segmentation trends reveal significant insights into the market's evolution. By type, capacitive sensors currently hold the largest market share due to their cost-effectiveness and widespread adoption in smartphones, but ultrasonic and optical under-display sensors are rapidly gaining traction, especially in premium smartphone segments, offering superior security and design flexibility. In terms of technology, area and touch sensors dominate, providing quick and intuitive authentication. Application-wise, the consumer electronics segment, particularly smartphones and tablets, remains the largest revenue generator, driven by the sheer volume of devices and the necessity for secure personal access. However, rapid growth is anticipated in emerging applications such as automotive for personalized driver profiles and access, smart home devices for enhanced security and automation, and healthcare for secure patient record access and medical device authentication. The increasing demand for biometric smart cards for payment and access control is also a noteworthy segment trend, promising substantial growth. These shifts underscore a broad diversification of sensor applications beyond traditional security, embedding biometric authentication into the fabric of daily life and commerce.

AI Impact Analysis on Fingerprint Sensor Market

Common user questions regarding AI's impact on the Fingerprint Sensor Market often revolve around concerns about data privacy, security vulnerabilities like deepfake biometric attacks, the accuracy of recognition in diverse conditions, and the potential for AI to render current sensor technologies obsolete. Users are particularly interested in how AI can enhance the reliability of fingerprint recognition, minimize false positives and negatives, and provide more sophisticated liveness detection to counter spoofing attempts. There is also considerable curiosity about AI's role in processing complex biometric data patterns, adapting to variations in fingerprints due to age or damage, and integrating seamlessly with other authentication factors for multi-modal biometrics. Expectations are high for AI to deliver predictive analytics for maintenance, optimize sensor performance in real-time, and personalize user experiences, suggesting a desire for more intelligent and adaptable security solutions that anticipate threats and user needs.

The integration of Artificial Intelligence (AI) is profoundly transforming the Fingerprint Sensor Market, elevating capabilities beyond traditional pattern matching. AI algorithms, particularly those based on machine learning and deep learning, are being deployed to significantly enhance the accuracy and reliability of fingerprint recognition systems. By analyzing vast datasets of fingerprint images, AI can learn to discern subtle features, compensate for variations in pressure, angle, and skin condition, and effectively handle partial or degraded prints. This leads to a substantial reduction in False Acceptance Rates (FAR) and False Rejection Rates (FRR), making biometric authentication more robust and user-friendly. Furthermore, AI plays a critical role in improving the speed of recognition, optimizing the processing power required for complex algorithms, which is vital for real-time authentication in high-volume applications like mobile payments and access control systems. The ability of AI to rapidly compare and match fingerprints against large databases without compromising speed is a key differentiator in contemporary biometric solutions, ensuring both efficiency and security for end-users and service providers.

Beyond basic recognition, AI's most significant contribution to fingerprint sensor technology lies in advanced security and anti-spoofing measures. AI-powered liveness detection algorithms can distinguish between a real human finger and a sophisticated fake, such as a silicone mold or a 3D-printed replica, by analyzing subtle physiological signs like blood flow, pulse, or skin texture. This capability is crucial in preventing fraudulent access and enhancing the overall integrity of biometric systems, addressing one of the most critical vulnerabilities of traditional sensors. Moreover, AI is instrumental in adaptive learning, allowing fingerprint systems to improve their performance over time by continuously learning from new data and user interactions. This means the system can adapt to changes in a user's fingerprint due to minor injuries, wear, or aging, maintaining high accuracy throughout the device's lifespan. AI also facilitates the integration of multi-modal biometrics, where fingerprint data can be fused with other biometric modalities like facial recognition or iris scans, creating a more comprehensive and resilient authentication framework. This holistic approach, driven by AI, sets a new standard for biometric security, moving towards truly intelligent and impenetrable identity verification.

- Enhanced Accuracy and Reliability: AI algorithms significantly improve the precision of fingerprint recognition, reducing false positives and negatives by learning from diverse data.

- Advanced Anti-Spoofing Capabilities: Machine learning models detect subtle liveness indicators (e.g., blood flow, skin texture) to differentiate real fingers from sophisticated fakes, countering fraudulent attempts.

- Adaptive Learning for Performance Improvement: AI enables sensors to adapt to changes in user fingerprints over time (due to age, injury, wear), maintaining high recognition accuracy.

- Faster Processing and Authentication: AI optimizes algorithms for quicker matching against large databases, crucial for real-time applications like mobile payments and access control.

- Integration with Multi-Modal Biometrics: AI facilitates the fusion of fingerprint data with other biometrics (e.g., facial, iris) to create more robust and secure authentication systems.

- Predictive Maintenance and Performance Optimization: AI can analyze sensor performance data to predict potential issues and optimize operational efficiency proactively.

- Personalized User Experience: AI can tailor authentication thresholds and methods based on user behavior and context, enhancing convenience without compromising security.

DRO & Impact Forces Of Fingerprint Sensor Market

The Fingerprint Sensor Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, collectively shaping its trajectory and impact forces. Among the key drivers is the escalating global demand for enhanced security and robust authentication methods, spurred by the increasing sophistication of cyber threats and the imperative to protect personal and financial data. The widespread adoption of smartphones and other smart devices, coupled with the proliferation of mobile payment solutions, has created a massive addressable market for integrated biometric sensors, making secure, convenient unlocking and transaction verification a standard expectation. Government initiatives globally, focusing on digital identity programs, border control, and national security, further boost the demand for reliable fingerprint biometrics. Moreover, the integration of fingerprint sensors into emerging applications like the Internet of Things (IoT), smart home devices, and automotive systems is opening new avenues for growth, as these sectors increasingly prioritize personalized and secure access, propelling technological advancements and mass production to meet evolving consumer and industry needs.

Despite the strong growth drivers, the market faces several notable restraints. Concerns regarding data privacy and the potential for misuse of biometric data remain a significant impediment, prompting stricter regulations such as GDPR and CCPA, which can increase compliance costs and complexity for sensor manufacturers and integrators. The inherent vulnerability of any biometric system to spoofing attacks, though constantly mitigated by advanced liveness detection, represents a persistent security challenge that requires continuous innovation and investment. High manufacturing costs for advanced sensor technologies, particularly for in-display ultrasonic sensors, can limit their adoption in budget-sensitive segments. Furthermore, the perceived inconvenience or reliability issues in certain environmental conditions (e.g., wet or dirty fingers) can occasionally lead to user dissatisfaction, potentially slowing widespread adoption in specific use cases. The ongoing debate around standardization of biometric data formats and interoperability across different systems also poses a challenge for seamless integration and broad market expansion.

Opportunities within the Fingerprint Sensor Market are abundant and diverse. The burgeoning market for biometric smart cards, offering secure and convenient payment and access control solutions, presents a substantial growth opportunity, particularly in banking and government sectors. The expansion of biometric identification into new verticals such as healthcare for patient identification and secure access to medical records, and the automotive industry for personalized driver profiles and vehicle access, promises significant future revenue streams. Furthermore, advancements in sensor miniaturization and integration capabilities are enabling the development of next-generation devices with invisible or under-screen fingerprint scanning, enhancing user experience and device aesthetics. The increasing focus on multi-modal biometrics, combining fingerprint recognition with other modalities like facial or iris scans, offers opportunities for developing more robust and resilient security solutions. The continuous evolution of AI and machine learning also presents opportunities to further enhance sensor accuracy, anti-spoofing capabilities, and adaptive learning, ensuring the market remains at the forefront of identity verification technologies and continues to innovate in response to emerging security demands.

Segmentation Analysis

The Fingerprint Sensor Market is extensively segmented to provide a granular understanding of its diverse components and growth dynamics. These segmentations are crucial for identifying specific market trends, competitive landscapes, and untapped opportunities across various technologies, types, applications, and end-users. The comprehensive analysis allows stakeholders to tailor their product offerings and market strategies to specific niches within the broader biometric security ecosystem, ensuring targeted development and successful market penetration. Understanding these segments is key to forecasting future growth areas and adapting to the rapid technological advancements characterizing this vital industry.

- By Type

- Capacitive Fingerprint Sensors: Dominate the market due to cost-effectiveness and high integration in smartphones.

- Optical Fingerprint Sensors: Traditional sensors, increasingly used in under-display solutions for smartphones and larger access control systems.

- Ultrasonic Fingerprint Sensors: Advanced technology offering enhanced security and ability to scan through materials, gaining traction in premium smartphones.

- Thermal Fingerprint Sensors: Less common but used in specific niche applications, leveraging heat differentiation.

- Other Types: Emerging and specialized sensor technologies.

- By Technology

- Area & Touch Sensors: Widely adopted for their convenience and speed, allowing full fingerprint capture with a single touch.

- Swipe Sensors: Smaller and more cost-effective, requiring a finger swipe for capture, typically used in niche or older applications.

- By Application

- Smartphones & Tablets: Largest application segment, driven by mobile security and payment integration.

- PCs & Laptops: Used for secure login and data protection.

- Wearable Devices: Including smartwatches and fitness trackers for secure access and personal data.

- Smart Home Devices: For home access control and smart appliance authentication.

- Automotive: For personalized driver profiles, vehicle access, and infotainment security.

- Government & Law Enforcement: For national ID programs, border control, criminal identification, and secure facility access.

- Commercial Security: For corporate access control, time & attendance, and data center security.

- Healthcare: For patient identification, secure access to medical records, and drug dispensing.

- Banking & Financial Services: For secure mobile banking, transaction authentication, and biometric smart cards.

- Travel & Immigration: For passport control, visa processing, and airport security.

- Industrial: For secure access to machinery and operational areas.

- Others: Including point-of-sale terminals, IoT devices, and various custom solutions.

- By End-User Industry

- Consumer Electronics: Dominant segment, encompassing smartphones, laptops, and wearables.

- Commercial: Includes retail, corporate offices, and data centers.

- Government: Public sector applications for national security and digital identification.

- Healthcare: Hospitals, clinics, and pharmaceutical companies.

- Automotive: Car manufacturers and aftermarket solutions.

- Others: Emerging sectors and specialized applications.

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Fingerprint Sensor Market

The value chain of the Fingerprint Sensor Market is a complex ecosystem involving multiple stages, starting from raw material suppliers and extending to end-users, with distinct upstream and downstream activities that contribute to the final product's delivery and adoption. Upstream analysis begins with the suppliers of crucial raw materials and components, such as semiconductor wafers (silicon, gallium nitride), integrated circuits (ICs), optical components, microcontrollers, and specialized polymers for protective coatings. These suppliers form the foundational layer, providing the basic building blocks necessary for sensor manufacturing. Research and Development (R&D) firms and intellectual property (IP) providers also play a vital upstream role, innovating new sensor technologies, algorithms for image processing and matching, and enhanced security features like liveness detection. These R&D efforts are critical for driving technological advancements, improving sensor accuracy, reducing costs, and enabling the integration of sensors into novel applications, shaping the core capabilities and competitive differentiation of the finished products in the market.

Midstream activities primarily involve the design, manufacturing, and assembly of fingerprint sensor modules. This stage includes specialized sensor manufacturers (e.g., FPC, Synaptics, Goodix) who focus on developing proprietary sensor architectures and production processes. These manufacturers procure components from upstream suppliers, conduct intricate fabrication processes, and integrate various elements like sensor arrays, signal processing units, and secure storage modules into a compact, functional unit. Quality control and testing are paramount at this stage to ensure the reliability, accuracy, and security of the sensors. Furthermore, software development, including biometric algorithms, drivers, and SDKs (Software Development Kits), is a critical midstream activity, enabling seamless integration of the hardware into various platforms and applications. The efficiency and precision of this manufacturing and integration stage directly impact the cost-effectiveness, performance, and scalability of fingerprint sensor solutions globally.

Downstream analysis focuses on the distribution, integration, and end-use of fingerprint sensors. Distribution channels can be direct or indirect. Direct channels involve sensor manufacturers selling directly to large Original Equipment Manufacturers (OEMs) such as smartphone manufacturers (e.g., Apple, Samsung), laptop makers, or automotive companies, often through long-term contracts and tailored solutions. Indirect channels involve distributors and value-added resellers (VARs) who aggregate products from multiple manufacturers and supply them to system integrators, security solution providers, and smaller device makers. System integrators play a crucial downstream role by embedding fingerprint sensors into larger security systems, access control solutions, smart cards, and IoT devices. The final stage involves the end-users, who are the ultimate consumers of devices and systems incorporating fingerprint sensors, spanning individual consumers, government agencies, commercial enterprises, and healthcare providers. Effective after-sales support, maintenance, and regular software updates are also essential downstream services to ensure sustained performance and user satisfaction, completing the comprehensive value delivery process.

Fingerprint Sensor Market Potential Customers

Potential customers for fingerprint sensors span a remarkably broad spectrum of industries and end-users, reflecting the ubiquitous need for robust, convenient, and personalized identity verification. In the consumer electronics sector, virtually every smartphone manufacturer, tablet producer, laptop vendor, and increasingly, wearable device company represents a primary customer segment. These companies integrate fingerprint sensors into their products to offer secure device unlocking, mobile payment authentication, and protected access to applications and personal data, meeting the critical demands of modern digital lifestyles. As smart home technology continues to proliferate, manufacturers of smart locks, security systems, and connected appliances also emerge as significant potential customers, seeking to provide convenient and secure access control and user authentication within residential environments. The widespread adoption in these consumer-facing segments is largely driven by the expectation of seamless user experience combined with enhanced personal security, making fingerprint sensors an essential feature for competitive products.

Beyond consumer goods, the commercial and enterprise sectors constitute a substantial market for fingerprint sensors. Businesses across various verticals, including finance, retail, and corporate offices, are increasingly adopting biometric solutions for physical access control to facilities, logical access to computer systems and sensitive data, and for time & attendance tracking. This is driven by the need to enhance operational security, comply with regulatory requirements, and improve workforce management efficiency. The banking and financial services industry, in particular, relies heavily on fingerprint biometrics for secure online and mobile banking transactions, ATM access, and the emerging market of biometric payment cards, where the sensor is embedded directly into the card. These commercial customers prioritize reliability, scalability, and integration capabilities, often requiring robust SDKs and comprehensive support for deployment across large organizations, highlighting a focus on both security and practical implementation in complex enterprise IT infrastructures.

Government agencies and public sector organizations represent another critical segment of potential customers. This includes national identification programs, border control and immigration services, law enforcement agencies, and defense sectors that utilize fingerprint sensors for citizen identity verification, criminal identification, secure facility access, and background checks. The automotive industry is also rapidly becoming a key customer, integrating fingerprint sensors into vehicles for personalized driver profiles, keyless entry and ignition, and enhanced infotainment security, catering to the growing demand for customization and theft prevention. Furthermore, the healthcare sector is increasingly adopting fingerprint biometrics for secure patient identification, access to electronic health records (EHR), and controlled dispensing of medication, ensuring patient safety and data privacy. These diverse end-users underscore the fundamental value proposition of fingerprint sensors: providing an unparalleled blend of security, convenience, and efficiency across nearly every facet of modern life and industry, continuously expanding their market reach.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 18.5 Billion |

| Market Forecast in 2032 | USD 47.1 Billion |

| Growth Rate | 14.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Synaptics, Goodix, Fingerprints Cards AB (FPC), Egis Technology Inc., IDEX Biometrics ASA, Qualcomm Technologies Inc., Suprema Inc., NEXT Biometrics, Precise Biometrics AB, Gemalto (Thales Group), Apple Inc., Samsung Electronics Co. Ltd., CrucialTec, ELAN Microelectronics Corporation, HID Global, VFS Global, NXP Semiconductors N.V., AU Optronics Corp., Crossmatch (HID Global), Vision-Box |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fingerprint Sensor Market Key Technology Landscape

The key technology landscape of the Fingerprint Sensor Market is characterized by continuous innovation and diversification, driven by the persistent demand for enhanced accuracy, speed, security, and integration capabilities. At the forefront are capacitive sensors, which utilize electrical capacitance to map the unique ridge and valley patterns of a fingerprint. These sensors are highly prevalent in smartphones due to their compact size, cost-effectiveness, and robust performance, providing a balance of security and convenience. Advances in capacitive technology focus on improving the signal-to-noise ratio, enhancing the detection of subtle features, and integrating features like active sensing for improved liveness detection. The miniaturization of capacitive arrays allows for seamless integration into various device form factors, making them a staple in consumer electronics and embedded security solutions. This technology continues to evolve, with research aimed at developing more power-efficient designs and expanding their use in ultra-thin devices without compromising reliability or user experience.

Optical fingerprint sensors, once a staple in larger access control systems, have undergone a significant transformation with the advent of under-display optical sensing. This technology uses light to illuminate the finger and a camera or optical sensor to capture an image of the fingerprint pattern, often through the device's screen. Recent innovations have focused on increasing the effective sensing area, improving image clarity, and developing advanced algorithms to process the captured images more efficiently. Under-display optical sensors offer significant design advantages for smartphone manufacturers, enabling full-screen displays without requiring a physical sensor button. Furthermore, ultrasonic fingerprint sensors represent a cutting-edge advancement, utilizing high-frequency sound waves to create a detailed 3D map of the finger's ridges, pores, and sub-dermal structures. This technology boasts superior security, capable of scanning through various materials like glass and metal, and offering enhanced resistance to spoofing due to its ability to detect liveness and deeper biometric features. The precision and depth of detail captured by ultrasonic sensors position them as a premium solution, particularly in high-security applications and flagship consumer devices, pushing the boundaries of biometric performance.

Beyond the primary sensor types, the broader technology landscape includes crucial advancements in algorithm development, secure element integration, and multi-modal biometrics. Sophisticated algorithms, often powered by Artificial Intelligence and machine learning, are essential for efficient fingerprint matching, noise reduction, image reconstruction, and liveness detection. These algorithms are continuously refined to improve accuracy, reduce false acceptance rates (FAR) and false rejection rates (FRR), and adapt to variations in fingerprints. Secure element technology, involving dedicated hardware security modules (HSMs) or trusted execution environments (TEEs), is increasingly integrated with fingerprint sensors to protect biometric data from unauthorized access and attacks. This ensures that the fingerprint templates are stored and processed in an isolated and highly secure environment. Moreover, the trend towards multi-modal biometrics, combining fingerprint recognition with other modalities like facial recognition, iris scanning, or voice biometrics, is gaining traction. This approach leverages the strengths of multiple biometric technologies to create more robust, redundant, and adaptable authentication systems, providing a layered security architecture that significantly enhances overall protection and user convenience in a wide array of applications, from mobile devices to high-security enterprise solutions.

Regional Highlights

- Asia Pacific: Dominates the global market due to the massive presence of smartphone manufacturing hubs (China, South Korea, India), high consumer electronics adoption, and increasing government investments in digital identification and smart cities. The region is a key innovator and consumer, driving rapid market growth.

- North America: A mature market characterized by early adoption of advanced biometric solutions, strong demand from the enterprise and government sectors for enhanced security, and a high concentration of R&D activities in biometric technology. Stringent data protection regulations also push for robust authentication.

- Europe: Exhibits steady growth, driven by increasing awareness of cybersecurity, growing adoption of biometric authentication in banking and financial services, and supportive government initiatives for digital transformation. Regulations like GDPR influence security standards and innovation.

- Latin America: Emerging market with growing smartphone penetration, increasing focus on digital banking and mobile payments, and a rising need for secure identity verification solutions in various public and private sectors. Brazil and Mexico are leading the adoption curve.

- Middle East & Africa (MEA): Demonstrates significant growth potential, fueled by increasing investment in smart infrastructure projects, growing smartphone usage, and the implementation of national ID programs and secure financial services. Countries like UAE and Saudi Arabia are investing heavily in biometric technologies.

- China: A powerhouse within APAC, driven by its vast consumer electronics market, domestic manufacturing capabilities, and extensive use of biometrics for mobile payments, social security, and public surveillance, making it a critical market for innovation and consumption.

- India: Rapidly growing market propelled by the "Digital India" initiative, which promotes Aadhaar (national ID) and digital payment platforms, creating immense opportunities for integrated biometric solutions in both government and private sectors.

- Germany: A leading European market, characterized by strong industrial automation, high-security standards in automotive and industrial sectors, and a focus on enterprise-grade biometric solutions for access control and data protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fingerprint Sensor Market.- Synaptics Inc.

- Goodix Technology Inc.

- Fingerprints Cards AB (FPC)

- Egis Technology Inc.

- IDEX Biometrics ASA

- Qualcomm Technologies Inc.

- Suprema Inc.

- NEXT Biometrics ASA

- Precise Biometrics AB

- Gemalto (Thales Group)

- Apple Inc.

- Samsung Electronics Co. Ltd.

- CrucialTec

- ELAN Microelectronics Corporation

- HID Global

- VFS Global

- NXP Semiconductors N.V.

- AU Optronics Corp.

- Crossmatch (now part of HID Global)

- Vision-Box S.A.

Frequently Asked Questions

What are the primary types of fingerprint sensors and their key applications?

The primary types of fingerprint sensors include capacitive, optical, and ultrasonic. Capacitive sensors are most common in smartphones and laptops for secure device unlocking and mobile payments, owing to their cost-effectiveness and compact size. Optical sensors, traditionally used in larger security systems, are now seeing renewed use in under-display configurations for high-end smartphones, offering seamless integration with full-screen designs. Ultrasonic sensors, representing the cutting edge, utilize sound waves to create a 3D map of the fingerprint, providing superior security and anti-spoofing capabilities, particularly in premium mobile devices and secure access applications, as they can scan through materials like glass. Each type offers a unique balance of cost, performance, and integration flexibility, catering to a diverse range of security and convenience needs across consumer electronics, commercial access control, and government identification programs.

How is Artificial Intelligence (AI) impacting the security and performance of fingerprint sensors?

Artificial Intelligence (AI) is revolutionizing the security and performance of fingerprint sensors by significantly enhancing their accuracy, speed, and anti-spoofing capabilities. AI-powered algorithms, leveraging machine learning and deep learning, can analyze intricate fingerprint patterns more effectively, reducing false acceptance and rejection rates even with partial or degraded prints. Crucially, AI enables advanced liveness detection, allowing sensors to distinguish between a real human finger and sophisticated fake replicas by analyzing subtle physiological characteristics like blood flow or skin texture, thereby preventing fraudulent access. Furthermore, AI contributes to adaptive learning, where the sensor system improves its recognition capabilities over time by learning from user interactions and adapting to changes in fingerprints due to age or minor injuries. This intelligent augmentation makes fingerprint authentication more robust, resilient, and user-friendly, setting new benchmarks for biometric security in various applications.

What are the major driving factors for the growth of the Fingerprint Sensor Market?

The Fingerprint Sensor Market's growth is primarily driven by several compelling factors. Firstly, the escalating global demand for enhanced security and robust authentication methods across both personal and enterprise domains is a major catalyst, spurred by the increasing volume and sophistication of cyber threats. Secondly, the widespread adoption of smartphones and other smart devices, coupled with the rapid proliferation of mobile payment solutions, has made secure and convenient authentication a standard expectation, creating a massive addressable market. Thirdly, government initiatives worldwide, focusing on digital identity programs, border control, and national security, necessitate highly reliable biometric solutions. Lastly, the increasing integration of fingerprint sensors into emerging applications such as the Internet of Things (IoT), smart home devices, and automotive systems is opening new avenues for growth, as these sectors prioritize personalized and secure access, demonstrating a broad and diversified demand landscape.

What challenges and restraints does the Fingerprint Sensor Market face?

Despite its robust growth, the Fingerprint Sensor Market confronts several challenges and restraints. One significant concern is data privacy, as the collection and storage of unique biometric data raise questions about potential misuse and unauthorized access, leading to stringent regulations like GDPR and CCPA that increase compliance burdens. Another key restraint is the inherent vulnerability to spoofing attacks, where sophisticated fake fingerprints can potentially bypass security, necessitating continuous investment in advanced liveness detection technologies. High manufacturing costs for cutting-edge sensor technologies, particularly ultrasonic under-display sensors, can limit their widespread adoption in price-sensitive market segments. Additionally, perceived reliability issues in certain environmental conditions, such as wet or oily fingers, can occasionally impact user experience. The lack of universal standardization for biometric data formats and interoperability across different systems also poses integration challenges, hindering seamless cross-platform usage and broader market expansion.

Which regions are leading the adoption and innovation in the Fingerprint Sensor Market?

The Asia Pacific (APAC) region currently dominates the Fingerprint Sensor Market in terms of both adoption and innovation, driven by its massive consumer electronics manufacturing base, particularly in countries like China, South Korea, and India. This region benefits from a huge market for smartphones and other smart devices, where fingerprint sensors are standard. Additionally, governmental digital transformation initiatives and smart city projects in these countries further accelerate biometric integration. North America and Europe are also significant players, known for their mature markets, stringent security regulations, and high adoption rates in enterprise, banking, and government sectors. These regions are hubs for research and development in advanced biometric technologies, fostering continuous innovation. While APAC leads in volume and rapid integration, North America and Europe often drive the development of high-security and sophisticated enterprise-grade biometric solutions, creating a dynamic global landscape for fingerprint sensor technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Under Display Fingerprint Sensor Market Statistics 2025 Analysis By Application (Smart Phone, Tablet), By Type (Optical Fingerprint Module, Ultrasonic Fingerprint Module), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- In-display Fingerprint Sensor Modules Market Statistics 2025 Analysis By Application (Smart Phone, Tablet), By Type (Optical Fingerprint Module, Ultrasonic Fingerprint Module), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager