Finished Vehicle Logistics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428202 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Finished Vehicle Logistics Market Size

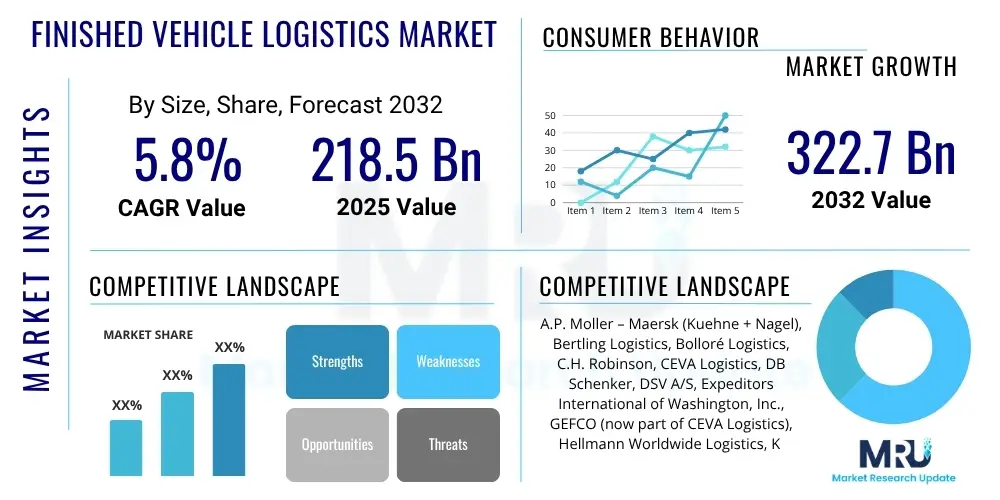

The Finished Vehicle Logistics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 218.5 Billion in 2025 and is projected to reach USD 322.7 Billion by the end of the forecast period in 2032.

Finished Vehicle Logistics Market introduction

The Finished Vehicle Logistics (FVL) market encompasses the entire process of transporting newly manufactured or imported vehicles from production plants or ports to dealerships, rental agencies, or direct customers. This intricate supply chain involves a series of complex operations, including inbound transport of components to manufacturing, assembly, pre-delivery inspection, storage, and outbound distribution using various modes such as road, rail, sea, and air. The primary objective is to deliver vehicles efficiently, safely, and cost-effectively, maintaining their quality and integrity throughout the journey. Given the high value and sensitive nature of automobiles, FVL demands specialized handling, robust tracking systems, and precise scheduling to ensure timely delivery and minimize transit damage.

Major applications of finished vehicle logistics span across the entire automotive ecosystem. Original Equipment Manufacturers (OEMs) rely heavily on FVL for distributing their newly produced cars, trucks, motorcycles, and other vehicles to an extensive global network of dealerships and distribution centers. Automotive importers and exporters utilize these services to manage cross-border movements, often involving complex customs procedures and multimodal transportation. Additionally, car rental companies, fleet operators, and even some large-scale direct-to-consumer automotive brands are increasingly leveraging advanced FVL solutions to streamline their acquisition and distribution processes, emphasizing speed and efficiency in a competitive market.

The benefits derived from an optimized FVL system are multifaceted and crucial for automotive stakeholders. Efficient logistics lead to reduced lead times, enabling quicker market penetration for new models and enhancing customer satisfaction. Minimized damage during transit safeguards vehicle value and reduces claims and rework costs. Furthermore, streamlined FVL operations contribute to lower inventory holding costs for manufacturers and dealerships by facilitating just-in-time delivery. Driving factors for this market's growth include the steady rise in global vehicle production and sales, the burgeoning demand for electric vehicles (EVs) necessitating new logistics infrastructure, the expansion of e-commerce platforms for vehicle sales, increasing globalization of automotive supply chains, and the continuous push for operational efficiencies and cost reduction across the automotive industry.

Finished Vehicle Logistics Market Executive Summary

The Finished Vehicle Logistics market is experiencing dynamic shifts, driven by evolving business trends across the automotive sector. Globally, manufacturers are navigating increased production complexities, a diversified product portfolio including a rapid rise in electric vehicles, and a growing emphasis on sustainability. Business trends highlight a strong move towards digitalization and automation within logistics operations to enhance visibility, optimize routes, and reduce human error. The shift to direct-to-consumer sales models by some automotive brands is also reshaping traditional distribution networks, demanding more flexible and customer-centric delivery solutions. Additionally, consolidation among logistics providers is creating larger, more integrated service offerings aimed at end-to-end supply chain management for vehicles.

Regional trends significantly influence the FVL market's trajectory. Asia Pacific, particularly China and India, remains a dominant force due to high vehicle production volumes and a rapidly expanding consumer base, fostering substantial growth in regional and intra-regional vehicle movements. North America and Europe, characterized by mature automotive markets, are focusing on optimizing existing infrastructure, investing in advanced logistics technologies, and addressing challenges related to emission regulations and labor shortages. Emerging markets in Latin America and the Middle East and Africa are witnessing infrastructural development and increasing local manufacturing capabilities, presenting new opportunities for FVL providers as vehicle sales continue to climb, albeit with unique geographical and logistical challenges.

Segmentation trends reveal distinct growth patterns across various service types, modes of transport, and vehicle categories. The transportation segment, encompassing road, rail, sea, and air, continues to hold the largest share, with rail and sea gaining traction for long-haul and intercontinental movements due to cost-effectiveness and environmental benefits. The warehousing and storage segment is expanding, driven by the need for strategic buffer stocks and efficient pre-delivery inspection services. In terms of vehicle types, the growth of electric vehicles is a significant trend, requiring specialized handling equipment and charging infrastructure at logistics hubs. Commercial vehicles also represent a steady segment, necessitating robust and scalable logistics solutions tailored to their diverse dimensions and weight characteristics.

AI Impact Analysis on Finished Vehicle Logistics Market

Users frequently inquire about AI's transformative potential in Finished Vehicle Logistics, specifically how it can address current operational inefficiencies, enhance real-time decision-making, and contribute to future-proofing supply chains. Common questions revolve around AI's ability to optimize complex routing, predict demand fluctuations, improve inventory management, and automate various stages of vehicle handling. There is also significant interest in AI's role in predictive maintenance for logistics assets, enhancing security measures during transit, and ensuring compliance with evolving regulations. Users generally expect AI to deliver substantial cost reductions, increase operational speed and accuracy, and provide greater visibility across the entire FVL ecosystem, ultimately leading to a more resilient and responsive logistics network capable of adapting to market volatility and increasing customer expectations.

- AI-driven route optimization algorithms significantly reduce transit times and fuel consumption by analyzing real-time traffic, weather, and road conditions, thus improving delivery efficiency.

- Predictive analytics powered by AI enables more accurate demand forecasting for specific vehicle models and regional markets, optimizing inventory levels and reducing unnecessary storage costs.

- AI-enhanced warehouse management systems automate vehicle tracking, placement, and retrieval within large storage facilities, minimizing human error and accelerating handling processes.

- Computer vision and machine learning contribute to automated damage detection during inspections, providing objective assessments and streamlining claims processes.

- AI assists in optimizing capacity utilization across various transport modes, ensuring that car carriers, rail wagons, and ships are loaded efficiently to maximize payload and minimize empty runs.

- Intelligent automation, including robotic process automation (RPA), is being deployed for administrative tasks, documentation, and even some aspects of vehicle preparation, enhancing operational speed.

- AI models analyze historical data to predict potential disruptions, such as port congestions or weather delays, allowing FVL providers to proactively reroute or adjust schedules.

- Enhanced security through AI-powered surveillance systems monitors vehicle movements and identifies anomalies, protecting high-value assets during transit and storage.

- AI facilitates better supplier and partner management by analyzing performance data, identifying reliable service providers, and optimizing collaborative efforts within the FVL value chain.

DRO & Impact Forces Of Finished Vehicle Logistics Market

The Finished Vehicle Logistics market is propelled by several significant drivers. A primary impetus is the consistent growth in global vehicle production and sales, particularly fueled by emerging economies and the expanding middle class, which creates a continuous demand for efficient vehicle distribution. The rapid proliferation of electric vehicles (EVs) is another crucial driver, necessitating specialized logistics solutions for charging infrastructure at terminals, unique handling requirements, and a different geographic distribution strategy compared to traditional internal combustion engine (ICE) vehicles. Furthermore, the increasing complexity of global automotive supply chains, coupled with the rising adoption of e-commerce platforms for vehicle sales, necessitates more sophisticated, agile, and transparent FVL services that can handle direct-to-consumer deliveries and diverse customer expectations efficiently.

However, the market also faces considerable restraints that challenge its growth trajectory and operational efficiency. High operational costs associated with specialized equipment, fuel price volatility, labor shortages (especially for skilled drivers and logistics personnel), and infrastructure limitations in certain regions impede seamless FVL operations. Geopolitical uncertainties, trade disputes, and the imposition of tariffs can disrupt global supply chains, leading to increased transit times and costs. Moreover, stringent environmental regulations aimed at reducing carbon emissions necessitate investments in eco-friendly transportation modes and technologies, adding another layer of cost and complexity for FVL providers seeking compliance.

Despite these restraints, numerous opportunities abound within the FVL landscape. The widespread adoption of advanced logistics technologies such as Artificial intelligence (AI), Internet of Things (IoT), blockchain, and telematics offers immense potential for optimizing routes, enhancing real-time tracking, improving inventory management, and increasing overall supply chain visibility and security. The expansion into untapped and emerging markets, coupled with the development of multimodal transportation hubs, provides avenues for market players to diversify their operations and reach new customer segments. The growing focus on sustainability also presents an opportunity for FVL providers to differentiate themselves through green logistics solutions, including the use of alternative fuels, electric truck fleets, and optimized capacity utilization, catering to environmentally conscious OEMs and consumers.

Segmentation Analysis

The Finished Vehicle Logistics market is meticulously segmented to provide a granular understanding of its diverse components and evolving dynamics. This comprehensive segmentation allows market participants to identify specific growth areas, understand competitive landscapes, and tailor their service offerings to meet specialized industry requirements. The market can be categorized based on various crucial factors, including the mode of transport utilized, the specific type of vehicle being transported, the nature of the services provided, and the end-use applications of these logistics solutions across the automotive value chain.

- By Mode of Transport:

- Road: Dominant for short-to-medium distances, flexible door-to-door delivery, including specialized car carriers.

- Rail: Cost-effective and environmentally friendly for long-haul, high-volume domestic movements, utilizes specialized rail wagons.

- Sea: Essential for intercontinental and international shipments, utilizes Roll-on/Roll-off (RoRo) vessels and container ships for large volumes.

- Air: Used for expedited, high-value, or urgent deliveries, typically for luxury or limited-edition vehicles, though cost-intensive.

- By Vehicle Type:

- Passenger Cars: Includes sedans, SUVs, hatchbacks, and sports cars, representing the largest volume.

- Commercial Vehicles: Encompasses Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs) such as trucks and buses, and specialized vehicles.

- Two-Wheelers: Motorcycles, scooters, and mopeds, often requiring specific handling and securing methods.

- Electric Vehicles (EVs): Growing segment with unique logistics needs related to battery safety, charging, and weight distribution.

- By Service Type:

- Transportation: Core service, encompassing the physical movement of vehicles from origin to destination.

- Warehousing and Storage: Temporary holding of vehicles at various points in the supply chain, including pre-delivery inspection (PDI) centers.

- Inventory Management: Systems and processes for tracking and optimizing vehicle stock levels throughout the logistics pipeline.

- Customs and Documentation: Handling import/export regulations, tariffs, and paperwork for international shipments.

- Value-Added Services: Includes vehicle accessorizing, minor repairs, cleaning, and final preparation before delivery.

- By End-Use:

- Original Equipment Manufacturers (OEMs): Primary clients for moving vehicles from factories to distribution networks.

- Dealerships: Receiving finished vehicles from OEMs or central hubs for local sales.

- Rental Companies: Logistics for acquiring and repositioning fleet vehicles.

- Fleet Owners: Companies managing large vehicle fleets for business purposes.

- Individuals: Direct-to-consumer delivery services, particularly for online vehicle purchases or specialty vehicles.

Value Chain Analysis For Finished Vehicle Logistics Market

The Finished Vehicle Logistics value chain is a complex ecosystem that begins long before a vehicle rolls off the assembly line and extends well beyond its arrival at a dealership. It starts with upstream activities primarily involving the procurement and management of raw materials and components that feed into automotive manufacturing. While FVL directly handles finished products, the efficiency of upstream logistics heavily influences production schedules, which in turn dictate FVL demand. Key stakeholders here include component suppliers, raw material providers, and freight forwarding companies specializing in industrial goods. Optimizing these early stages through synchronized deliveries and efficient material handling directly impacts the final production output and the subsequent FVL requirements, creating a ripple effect across the entire automotive supply chain.

Midstream activities are centered around vehicle manufacturing and the immediate post-production phases. This includes the assembly plants where vehicles are built, followed by initial quality checks and temporary storage before dispatch. At this stage, coordination between manufacturing schedules and logistics planning is paramount to avoid bottlenecks and ensure a smooth transition of vehicles into the FVL network. The integration of advanced manufacturing execution systems (MES) with logistics planning tools allows for real-time data exchange, enabling FVL providers to prepare for upcoming shipments, allocate resources, and optimize carrier capacity. This seamless handover from production to logistics is critical for maintaining delivery timelines and reducing holding costs at the factory gate.

Downstream analysis focuses on the distribution and delivery of finished vehicles to their final destinations, which typically involves a blend of direct and indirect channels. Direct distribution often refers to vehicle movements from manufacturing plants or major import hubs straight to large dealerships, regional distribution centers, or even directly to end-consumers in some cases. Indirect channels involve intermediate logistics hubs, transshipment points, or smaller regional depots where vehicles might be consolidated, undergo further inspections, or receive value-added services like accessory installation before being dispatched to individual dealerships or rental agencies. The distribution channel encompasses the entire journey, utilizing a mix of road, rail, sea, and air transport to ensure wide geographical reach and timely market penetration. The efficiency of these downstream operations directly impacts customer satisfaction and the overall market responsiveness of automotive brands.

Finished Vehicle Logistics Market Potential Customers

The primary potential customers and end-users of Finished Vehicle Logistics services are unequivocally the Original Equipment Manufacturers (OEMs). Global automotive manufacturers, encompassing major players from Europe, North America, Asia, and other regions, consistently produce millions of vehicles annually that require sophisticated and reliable transportation from assembly plants to their extensive global dealership networks. This includes a diverse range of vehicles, from conventional gasoline and diesel cars to an ever-increasing fleet of electric vehicles (EVs), luxury automobiles, and heavy-duty commercial vehicles. OEMs demand FVL providers who can offer economies of scale, global reach, advanced tracking capabilities, damage prevention protocols, and the flexibility to adapt to dynamic production schedules and market demands.

Beyond OEMs, a significant segment of potential customers includes large multi-brand dealership groups and independent dealerships. These entities are at the front lines of vehicle sales and rely on efficient FVL services to ensure a steady supply of new inventory, enabling them to meet consumer demand and sales targets. Dealerships often require just-in-time deliveries to optimize their showroom inventory and minimize holding costs. Furthermore, their needs extend to specialized services such as pre-delivery inspection (PDI), localized accessory installation, and sometimes even vehicle transfers between their own multiple locations or to individual customers who have purchased vehicles online, highlighting a demand for highly flexible and responsive logistics partners.

Other crucial end-users include car rental companies, fleet operators, and, increasingly, individual buyers through direct-to-consumer channels. Car rental agencies frequently update their fleets and require efficient logistics for acquiring new vehicles and repositioning existing ones across their widespread branches. Similarly, large corporations and governmental bodies managing extensive vehicle fleets for operational purposes depend on FVL providers for the delivery and sometimes the collection of vehicles. The emerging trend of online vehicle sales further expands the customer base to individual consumers who expect seamless, timely, and often personalized home delivery of their newly purchased automobiles, pushing FVL providers to enhance their last-mile delivery capabilities and customer service interface.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 218.5 Billion |

| Market Forecast in 2032 | USD 322.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | A.P. Moller – Maersk (Kuehne + Nagel), Bertling Logistics, Bolloré Logistics, C.H. Robinson, CEVA Logistics, DB Schenker, DSV A/S, Expeditors International of Washington, Inc., GEFCO (now part of CEVA Logistics), Hellmann Worldwide Logistics, K Line Logistics, Kuehne + Nagel International AG, Nippon Express Holdings, Penske Logistics, Ryder System, Inc., Savino Del Bene, STVA (Groupe Charles André), United Parcel Service (UPS), Wallenius Wilhelmsen, XPO Logistics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Finished Vehicle Logistics Market Key Technology Landscape

The Finished Vehicle Logistics market is undergoing a significant technological transformation, driven by the imperative for greater efficiency, transparency, and resilience across complex supply chains. One of the most prominent technological advancements is the widespread adoption of sophisticated Logistics Management Systems (LMS) and Transportation Management Systems (TMS). These platforms integrate various functions such as order processing, load planning, route optimization, carrier selection, and freight auditing into a centralized system. Modern LMS/TMS solutions leverage cloud computing for scalability and accessibility, providing real-time data on vehicle movements, inventory levels, and delivery statuses, which is crucial for dynamic decision-making and proactive problem-solving in a fast-paced environment.

Furthermore, the Internet of Things (IoT) and telematics play a pivotal role in enhancing visibility and control within FVL operations. IoT sensors embedded in vehicles, carriers, or warehouse infrastructure provide continuous data streams on location, temperature, humidity, and even potential impact events during transit. Telematics systems, especially in road transport, offer detailed insights into driver behavior, fuel consumption, and vehicle diagnostics, enabling predictive maintenance and improving operational safety. This real-time data empowers logistics managers to monitor conditions proactively, address unforeseen delays, and ensure the integrity of high-value vehicle shipments, thereby reducing risks and enhancing customer satisfaction through greater transparency and accountability.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is also revolutionizing FVL by enabling advanced predictive analytics and automation. AI algorithms are used for highly accurate demand forecasting, optimizing warehouse space utilization, and dynamically adjusting delivery routes based on live traffic and weather conditions. Machine learning models analyze historical data to identify patterns, predict potential bottlenecks, and suggest optimal strategies for resource allocation and capacity planning. Moreover, technologies like blockchain are being explored to create immutable and transparent records of vehicle ownership and transit, enhancing security and streamlining documentation processes, while robotics and automation are increasingly being deployed in vehicle yards and port operations for efficient handling and sorting, significantly boosting throughput and reducing manual labor requirements.

Regional Highlights

- North America: A mature market characterized by significant automotive production and sales, particularly in the US and Canada. Focus on advanced logistics technologies, intermodal transport (road and rail), and addressing labor challenges. Growing demand for EV logistics and direct-to-consumer delivery models.

- Europe: Highly competitive market with stringent environmental regulations and a strong emphasis on sustainability. Germany, France, and the UK are key players, leveraging advanced multimodal networks (road, rail, short-sea shipping). Significant investment in digital logistics and green solutions.

- Asia Pacific (APAC): The largest and fastest-growing market, driven by robust vehicle production and sales in China, India, Japan, and South Korea. Characterized by increasing domestic demand, expanding export markets, and rapid infrastructure development, leading to substantial FVL growth and technological adoption.

- Latin America: Emerging market with increasing vehicle production, especially in Brazil and Mexico. Faces challenges related to infrastructure, but offers significant growth potential as automotive industries expand and trade agreements foster regional vehicle movements. Focus on cost-effective and resilient solutions.

- Middle East and Africa (MEA): A developing market with growing automotive assembly capabilities and increasing vehicle imports, particularly in Saudi Arabia, UAE, and South Africa. Investments in port infrastructure and logistics hubs are creating new opportunities, with a rising demand for both conventional and luxury vehicle logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Finished Vehicle Logistics Market.- A.P. Moller – Maersk (Kuehne + Nagel)

- Bertling Logistics

- Bolloré Logistics

- C.H. Robinson Worldwide, Inc.

- CEVA Logistics (a CMA CGM Company)

- DB Schenker

- DSV A/S

- Expeditors International of Washington, Inc.

- Hellmann Worldwide Logistics

- K Line Logistics, Ltd.

- Kuehne + Nagel International AG

- Nippon Express Holdings, Inc.

- Penske Logistics

- Ryder System, Inc.

- Savino Del Bene S.p.A.

- STVA (Groupe Charles André)

- United Parcel Service (UPS)

- Wallenius Wilhelmsen ASA

- XPO Logistics, Inc.

Frequently Asked Questions

Analyze common user questions about the Finished Vehicle Logistics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary modes of transport used in Finished Vehicle Logistics?

The primary modes include road transport (car carriers) for flexible short-to-medium distance delivery, rail for cost-effective long-haul domestic movements, sea (RoRo vessels) for intercontinental shipments, and air cargo for urgent or high-value deliveries, often used in combination for multimodal solutions.

How is the growth of Electric Vehicles (EVs) impacting the FVL market?

EV growth is significantly impacting FVL by necessitating specialized handling equipment due to battery weight and safety concerns, requiring new logistics infrastructure with charging capabilities at depots, and driving demand for different geographical distribution strategies, thus fostering innovation in logistics solutions.

What technological advancements are most crucial for enhancing FVL efficiency?

Key technological advancements include Logistics Management Systems (LMS) and Transportation Management Systems (TMS) for overall process optimization, IoT and telematics for real-time tracking and monitoring, AI/Machine Learning for predictive analytics and route optimization, and blockchain for enhanced transparency and security.

What are the main challenges faced by the Finished Vehicle Logistics market?

Major challenges include high operational costs, infrastructure limitations in certain regions, persistent labor shortages (especially for drivers), geopolitical uncertainties impacting global supply chains, and stringent environmental regulations demanding investments in sustainable transport options.

Who are the typical clients for Finished Vehicle Logistics services?

The typical clients are Original Equipment Manufacturers (OEMs) for factory-to-dealership distribution, large and independent dealerships for inventory management, car rental companies for fleet acquisition and repositioning, fleet operators, and increasingly, individual consumers through direct-to-consumer online sales channels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager