Finished Vehicles Logistics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427757 | Date : Oct, 2025 | Pages : 244 | Region : Global | Publisher : MRU

Finished Vehicles Logistics Market Size

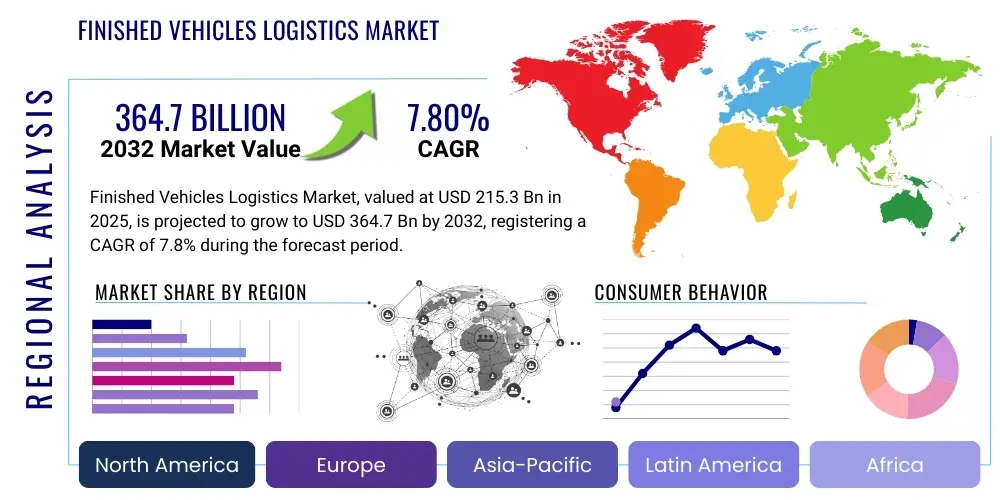

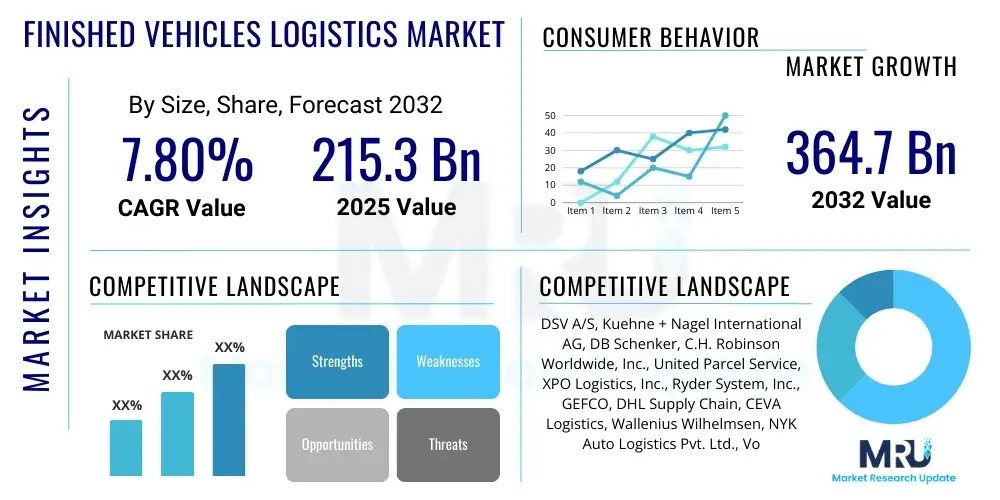

The Finished Vehicles Logistics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 215.3 billion in 2025 and is projected to reach USD 364.7 billion by the end of the forecast period in 2032.

Finished Vehicles Logistics Market introduction

The Finished Vehicles Logistics (FVL) market encompasses the entire process of transporting new and used vehicles from manufacturing plants or ports of entry to dealerships, distribution centers, or end-customers. This intricate supply chain involves a multitude of specialized services designed to ensure the safe, efficient, and timely delivery of vehicles. It is a critical component of the automotive industry, directly impacting inventory management, customer satisfaction, and the overall economic viability of vehicle manufacturers and distributors globally. The complexity of FVL is amplified by the varying types of vehicles, geographical distances, and regulatory landscapes involved in international and domestic transport.

The core "product" within the FVL market extends beyond mere transportation, integrating a suite of value-added services essential for vehicle delivery and presentation. These services include pre-delivery inspection (PDI), which ensures vehicles are in optimal condition before reaching the customer; warehousing and storage solutions that manage inventory fluctuations; customs clearance for international shipments; and various post-production modification services. The precise handling, specialized equipment, and advanced technological solutions employed in FVL differentiate it from general logistics, highlighting its expertise in safeguarding high-value, sensitive cargo throughout its journey.

Major applications of FVL span the entire automotive spectrum, from passenger cars and commercial vehicles to motorcycles, heavy machinery, and the rapidly expanding segment of electric vehicles (EVs). The primary benefits derived from efficient FVL operations include significant cost reductions through optimized routes and consolidated shipments, enhanced operational efficiency, reduced damage rates, and improved inventory turnover for automotive stakeholders. Driving factors for market growth include the steady increase in global vehicle production and sales, the globalization of automotive supply chains, the burgeoning e-commerce sector for vehicle sales, and the escalating demand for specialized logistics solutions for electric and autonomous vehicles, which often require unique handling and charging infrastructure during transit.

Finished Vehicles Logistics Market Executive Summary

The Finished Vehicles Logistics (FVL) market is currently undergoing a transformative period, driven by dynamic shifts in business models, technological advancements, and evolving consumer expectations. Key business trends indicate a strong move towards digitalization, with logistics providers investing heavily in real-time tracking, predictive analytics, and automated systems to enhance visibility and operational efficiency. Furthermore, there is an increasing emphasis on sustainability, prompting the adoption of eco-friendly transport modes and optimized route planning to reduce carbon footprints. The automotive industrys push for leaner supply chains and resilient logistics networks, particularly in the aftermath of global disruptions, is also a predominant theme, fostering strategic partnerships and the outsourcing of complex logistics functions to third-party logistics (3PL) providers.

Regional trends reveal a diverse landscape of growth and maturity. The Asia-Pacific region, led by economic powerhouses like China and India, continues to be the dominant market, propelled by robust vehicle production capacities and a rapidly expanding consumer base. North America and Europe, while representing more mature markets, are characterized by significant investment in advanced logistics technologies, stringent environmental regulations, and a growing demand for premium, high-value-added FVL services. Emerging markets in Latin America and Africa are exhibiting substantial growth potential, driven by increasing disposable incomes, urbanization, and improving infrastructure, which are stimulating both local manufacturing and vehicle imports, thereby fueling FVL demand.

Segmentation trends within the FVL market highlight the increasing dominance of road transport due to its flexibility and last-mile connectivity, although rail and sea transport remain crucial for long-haul and intercontinental shipments, respectively. The electric vehicle (EV) segment is emerging as a critical growth area, demanding specialized logistics solutions for charging, battery handling, and specific transportation requirements, which are often different from conventional internal combustion engine (ICE) vehicles. Moreover, the demand for value-added services such as pre-delivery inspection (PDI), inventory management, and aftermarket parts logistics is expanding, indicating a shift towards more integrated and comprehensive service offerings from FVL providers beyond basic transportation.

AI Impact Analysis on Finished Vehicles Logistics Market

The integration of Artificial Intelligence (AI) is fundamentally reshaping the Finished Vehicles Logistics market, addressing critical challenges and unlocking new efficiencies. Users frequently inquire about how AI can mitigate rising operational costs, enhance supply chain visibility, and improve delivery timeliness in a complex global network. Common themes include the application of AI in optimizing routes to reduce fuel consumption and transit times, its role in predictive maintenance for transport fleets, and the potential for autonomous vehicles in future logistics. Concerns often revolve around the initial investment required for AI infrastructure, data privacy and security, and the impact on the existing workforce, prompting a need for clear insights into tangible benefits and implementation strategies. Overall, stakeholders are seeking to understand how AI can drive greater precision, agility, and cost-effectiveness across the entire FVL value chain, from inventory management to final delivery, while managing the associated risks and ensuring a smooth transition.

- Predictive analytics for demand forecasting and inventory optimization, reducing holding costs.

- Dynamic route optimization algorithms that minimize transit times, fuel consumption, and labor costs.

- Automated scheduling and dispatch systems, enhancing operational efficiency and resource allocation.

- Autonomous vehicle technologies for intra-facility transport and potential long-haul applications.

- Enhanced security and damage detection through AI-powered vision systems during loading and transit.

- Real-time visibility and tracking capabilities, providing accurate ETAs and proactive issue resolution.

- Optimized warehouse management, leveraging robotics and AI for faster processing and storage.

- Data-driven decision making for strategic network planning and risk management.

- Improved customer experience through highly accurate delivery predictions and transparency.

- Simulation and digital twin technologies for testing logistics scenarios and optimizing workflows.

DRO & Impact Forces Of Finished Vehicles Logistics Market

The Finished Vehicles Logistics (FVL) market is influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces. Key drivers include the consistent growth in global vehicle production and sales, particularly in emerging economies, which necessitates robust and expanded logistics capabilities. The increasing complexity of automotive supply chains, driven by globalization and the diversification of vehicle models, further fuels demand for specialized FVL services. Additionally, the rapid advancements in logistics technology, such as IoT, AI, and telematics, are creating more efficient and transparent operations, compelling logistics providers to adopt these innovations to stay competitive and cater to evolving client needs. The rise of e-commerce platforms for vehicle sales also mandates sophisticated last-mile delivery solutions, pushing the FVL market towards greater flexibility and consumer-centric services.

Despite significant growth prospects, several restraints challenge the FVL market. Infrastructure limitations, including inadequate road networks, port congestion, and insufficient rail capacity in various regions, often impede efficient vehicle movement. High operational costs, encompassing fuel prices, labor wages, and maintenance of specialized transport fleets, can significantly impact profitability. Regulatory complexities and varying trade policies across different countries impose compliance burdens and can create delays in cross-border vehicle transport. Furthermore, geopolitical instability, trade disputes, and natural disasters introduce significant supply chain risks and can disrupt established logistics routes, requiring agile and adaptive solutions. The ongoing shortage of skilled labor, particularly drivers and logistics professionals, also remains a persistent challenge affecting service capacity and efficiency.

Opportunities for growth in the FVL market are abundant, particularly with the surging demand for electric vehicles (EVs), which require specialized charging infrastructure and handling protocols during logistics. The expansion of last-mile delivery services for direct-to-consumer vehicle sales presents a substantial opportunity for innovation in urban logistics. Moreover, the increasing focus on sustainable logistics solutions, including the adoption of cleaner fuel vehicles and multimodal transport strategies, aligns with global environmental goals and can attract environmentally conscious clients. Digitalization continues to offer a fertile ground for developing advanced visibility platforms, predictive analytics, and automated systems that can revolutionize operational efficiency and customer service. Emerging markets, with their burgeoning middle classes and developing automotive industries, represent untapped potential for market expansion and new service offerings.

Segmentation Analysis

The Finished Vehicles Logistics (FVL) market is comprehensively segmented to address the diverse needs of the automotive industry, ensuring specialized and efficient delivery across various parameters. This segmentation allows logistics providers to tailor their services to specific transport modes, vehicle types, and the required scope of services, thereby optimizing cost, speed, and safety. Understanding these segments is crucial for market participants to identify niche opportunities, allocate resources effectively, and develop targeted strategies that cater to the unique demands of each automotive supply chain component, from initial manufacturing outflow to final consumer delivery, while navigating regulatory and technological landscapes. The complex interaction of these segmentation layers defines the competitive dynamics and growth trajectories within the FVL industry.

- By Transport Mode:

- Road: Dominant for flexibility and last-mile delivery.

- Rail: Cost-effective for long-distance, high-volume domestic transport.

- Sea: Essential for intercontinental and international shipments.

- Air: Used for urgent or high-value vehicle deliveries, though less common.

- By Vehicle Type:

- Passenger Vehicles: Including sedans, SUVs, hatchbacks, and luxury cars.

- Commercial Vehicles: Encompassing trucks, vans, and buses.

- Two-Wheelers: Motorcycles, scooters, and mopeds.

- Electric Vehicles (EVs): Requiring specialized handling and charging considerations.

- By Service Type:

- Transportation: Core movement of vehicles.

- Warehousing and Storage: Inventory management and safe keeping.

- Inventory Management: Tracking, rotation, and distribution planning.

- Pre-Delivery Inspection (PDI): Quality checks and minor preparations before delivery.

- Aftermarket Logistics: Handling of spare parts and components for maintenance.

- Value-Added Services: Including customs clearance, vehicle re-branding, and accessory installation.

Finished Vehicles Logistics Market Value Chain Analysis

The Finished Vehicles Logistics (FVL) value chain begins significantly upstream, rooted deeply within the automotive manufacturing ecosystem. This segment involves the procurement of raw materials and components by various suppliers, followed by their assembly into complete vehicles by Original Equipment Manufacturers (OEMs). The efficiency and scheduling of these upstream activities directly dictate the volume and timing of finished vehicles ready for transport, making seamless integration between manufacturing schedules and logistics planning paramount. Any disruptions or delays at this stage can cascade throughout the entire value chain, highlighting the critical need for robust communication and synchronized operations between vehicle producers and their logistics partners to ensure a steady flow of production output into the distribution channels.

Midstream, the value chain focuses on the transportation and interim handling of vehicles post-production. This phase involves the primary movement of vehicles from the factory gate to various distribution hubs, ports, rail yards, or large storage facilities. Third-Party Logistics (3PL) providers often play a pivotal role here, offering specialized vehicle carriers (car haulers), rail transport, or ocean freight services. During this stage, services such as secure warehousing, inventory management, and initial quality checks (though comprehensive PDI is usually downstream) are crucial to maintain vehicle integrity and manage inventory levels effectively before final distribution. These services ensure that vehicles are strategically positioned for subsequent movements, minimizing transit times and reducing the risk of damage or loss.

Downstream, the FVL value chain culminates in the direct delivery to various end-points, primarily dealerships, rental fleets, or, increasingly, directly to consumers for online vehicle purchases. This final leg often involves detailed pre-delivery inspection (PDI) services, where vehicles are thoroughly checked, cleaned, and prepared for customer handover. The distribution channel can be direct, with OEMs managing their own logistics for high-volume markets or specific premium brands, or more commonly, indirect, through a network of 3PLs that handle the intricate last-mile deliveries to geographically dispersed dealerships. Both direct and indirect channels rely on efficient communication, sophisticated tracking systems, and a commitment to meticulous handling to ensure that the vehicle arrives in pristine condition, ready for the customer, thereby concluding the FVL value chain cycle with customer satisfaction.

Finished Vehicles Logistics Market Potential Customers

The Finished Vehicles Logistics (FVL) market serves a diverse array of potential customers, all fundamentally connected to the automotive industrys distribution and sales networks. The primary end-users and buyers of FVL services are Original Equipment Manufacturers (OEMs), who require the efficient and reliable transport of newly manufactured vehicles from production facilities to various global markets and regional distribution centers. These manufacturers seek comprehensive logistics solutions that can handle large volumes, diverse vehicle types, and complex international shipping requirements, including customs clearance and port management. The quality and efficiency of FVL directly impact an OEMs ability to meet market demand and maintain brand reputation for timely delivery.

Beyond the OEMs, automotive dealerships represent a significant customer segment. Dealerships rely on FVL providers to deliver vehicles from central distribution hubs or direct from manufacturers to their sales lots in ready-to-sell condition. This includes managing smaller, more frequent shipments and often involves specialized services like pre-delivery inspection (PDI) and immediate preparation for customer handover. Additionally, large fleet operators, such as car rental companies, corporate fleets, and ride-sharing services, are major consumers of FVL, requiring bulk transport of vehicles to various operational hubs. Vehicle importers and exporters also frequently utilize FVL services for cross-border movements, navigating international trade regulations and requiring expertise in multimodal transport to ensure seamless global distribution. Furthermore, the growing online used car market and auction houses are increasingly engaging FVL providers for vehicle collection, transport, and delivery, expanding the customer base beyond traditional new vehicle sales.

Finished Vehicles Logistics Market Key Technology Landscape

The Finished Vehicles Logistics (FVL) market is increasingly reliant on a sophisticated technology landscape to enhance efficiency, visibility, and security across the entire supply chain. Core to this evolution are telematics and Global Positioning System (GPS) tracking systems, which provide real-time location data for vehicles in transit, enabling precise monitoring of delivery schedules and asset utilization. These systems are often integrated with advanced analytics platforms that can identify bottlenecks, predict potential delays, and optimize routes on the fly, reducing fuel consumption and operational costs. The deployment of Internet of Things (IoT) sensors on vehicles and in storage facilities further augments this visibility, allowing for continuous monitoring of conditions such as temperature, humidity, and vibration, which is particularly critical for sensitive vehicle components and electric vehicle batteries.

Artificial Intelligence (AI) and Machine Learning (ML) algorithms are transforming FVL by enabling predictive capabilities and automation. AI is utilized for demand forecasting, optimizing inventory levels at various distribution points, and dynamically scheduling transportation routes based on traffic, weather, and historical data. ML-driven insights contribute to predictive maintenance for transport fleets, minimizing unexpected breakdowns and ensuring vehicle carrier reliability. Furthermore, the adoption of robotic process automation (RPA) in warehouses for tasks like vehicle identification and movement, alongside the gradual integration of autonomous vehicles for yard management and potentially long-haul segments, is poised to significantly reduce human error and improve operational throughput, driving a new era of efficiency and reduced labor dependency within the FVL sector.

Blockchain technology is gaining traction for its potential to create an immutable and transparent record of vehicle movements and transactions throughout the FVL journey, enhancing trust and reducing fraud, especially in multi-party international logistics. Real-time visibility platforms, often cloud-based, aggregate data from various sources (telematics, IoT, ERP systems) to provide a single, comprehensive view of the entire logistics operation, empowering stakeholders with actionable insights. Digital twins, virtual models of physical logistics systems, are also emerging as a valuable tool for simulating different scenarios, optimizing network designs, and testing new operational strategies without impacting live operations. These technological advancements collectively contribute to a more resilient, responsive, and cost-effective FVL market, addressing the growing complexities of automotive distribution in a globalized world.

Regional Highlights

- North America: Characterized by a mature automotive market, significant focus on technological adoption (telematics, AI for route optimization), and a growing demand for robust, integrated logistics solutions. The United States and Canada are leading in infrastructure development for advanced FVL.

- Europe: A highly competitive market with stringent environmental regulations driving sustainability in logistics (e.g., multimodal transport, low-emission fleets). Germany, the UK, and France are key contributors, emphasizing efficiency and advanced tracking systems.

- Asia Pacific: The largest and fastest-growing region, fueled by high vehicle production volumes in China, India, Japan, and South Korea. Rapid urbanization, increasing disposable incomes, and expanding automotive manufacturing bases are propelling demand for FVL services, with a strong emphasis on capacity and cost-effectiveness.

- Latin America: An emerging market with significant growth potential, particularly in Brazil and Mexico. The region is investing in infrastructure improvements and adopting modern logistics practices, though challenges like geographical complexities and varying regulations persist.

- Middle East & Africa: Experiencing growth driven by economic diversification, increasing vehicle ownership, and developing automotive assembly operations, especially in the UAE, Saudi Arabia, and South Africa. This region focuses on establishing robust trade routes and port logistics for vehicle imports and distribution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Finished Vehicles Logistics Market.- DSV A/S

- Kuehne + Nagel International AG

- DB Schenker

- C.H. Robinson Worldwide, Inc.

- United Parcel Service (UPS)

- XPO Logistics, Inc.

- Ryder System, Inc.

- GEFCO

- DHL Supply Chain

- CEVA Logistics

- Wallenius Wilhelmsen

- NYK Auto Logistics (India) Pvt. Ltd.

- Volkswagen Konzernlogistik GmbH & Co. KG

- BDP International

- Jack Cooper Transport

- Eurogate Logistics GmbH

- Logistics Group International (LGI)

- Grupo Sesé

- Penske Logistics

- Rhenus Group

Frequently Asked Questions

What is Finished Vehicles Logistics (FVL)?

Finished Vehicles Logistics (FVL) encompasses the specialized processes involved in transporting new and used vehicles from manufacturing plants or ports to dealerships, distribution centers, or directly to consumers. It includes a comprehensive range of services such as transportation by road, rail, sea, and sometimes air, along with warehousing, inventory management, pre-delivery inspection (PDI), and various value-added services necessary to ensure vehicles arrive safely and in ready-to-sell condition. FVL is a critical, complex, and high-value segment within the broader logistics industry, essential for the efficient operation of the global automotive supply chain, directly impacting delivery times, customer satisfaction, and the overall cost structure for vehicle manufacturers and distributors.

What are the key challenges facing the Finished Vehicles Logistics market?

The Finished Vehicles Logistics market faces several significant challenges, including volatile fuel prices, which directly impact operational costs for transporters. Infrastructure limitations, such as road congestion, port delays, and insufficient rail capacity in various regions, often lead to bottlenecks and extended transit times. Regulatory complexities, differing trade policies, and customs procedures across international borders add layers of difficulty, increasing compliance burdens and potential for delays. Furthermore, a persistent shortage of skilled labor, particularly qualified drivers and logistics professionals, poses a substantial constraint on service capacity and efficiency. Geopolitical instabilities and global supply chain disruptions, as recently experienced, also present ongoing risks, demanding greater resilience and adaptability from FVL providers to maintain smooth operations and minimize financial impact.

How is technology transforming Finished Vehicles Logistics?

Technology is fundamentally transforming Finished Vehicles Logistics by enhancing efficiency, visibility, and security across the entire supply chain. Real-time GPS tracking and telematics provide precise location data and performance metrics, enabling dynamic route optimization, reducing transit times, and improving fuel efficiency. Artificial Intelligence (AI) and Machine Learning (ML) are deployed for predictive analytics, optimizing demand forecasting, inventory management, and maintenance schedules, thereby minimizing costs and maximizing asset utilization. Automated systems, including robotics in warehouses and the development of autonomous vehicles for yard management, are increasing operational throughput and reducing human error. Furthermore, advanced data analytics platforms offer comprehensive insights into logistics operations, allowing for data-driven decision-making, while blockchain technology is emerging to enhance transparency and security in multi-party transactions, collectively making FVL operations smarter, faster, and more reliable.

What role do Third-Party Logistics (3PL) providers play in FVL?

Third-Party Logistics (3PL) providers play a pivotal and expanding role in the Finished Vehicles Logistics market by offering specialized, outsourced solutions that automotive manufacturers and dealerships might not possess in-house. These providers bring expertise in managing complex logistics networks, offering services ranging from multimodal transportation (road, rail, sea) and secure warehousing to inventory management, customs clearance, and pre-delivery inspections. By partnering with 3PLs, automotive companies can leverage economies of scale, reduce operational costs, and access advanced technological solutions without significant capital investment. This allows OEMs and dealers to focus on their core competencies of vehicle manufacturing and sales, while the 3PL ensures efficient, reliable, and compliant vehicle movement, adapting to market fluctuations and mitigating supply chain risks effectively. The strategic use of 3PLs is therefore crucial for optimizing the entire FVL value chain and enhancing market responsiveness.

What are the future trends shaping the Finished Vehicles Logistics market?

The Finished Vehicles Logistics market is being shaped by several prominent future trends. The rapid growth of Electric Vehicles (EVs) is a major driver, necessitating specialized logistics for battery handling, charging infrastructure, and unique transportation requirements. Sustainability is becoming paramount, leading to increased adoption of eco-friendly transport modes, such as rail and short-sea shipping, and investment in greener fleet technologies to reduce carbon emissions. Further digitalization, including advanced AI-driven analytics, real-time visibility platforms, and the potential for blockchain for enhanced transparency, will continue to optimize operational efficiency and predictive capabilities. The evolution of direct-to-consumer sales models for vehicles will drive innovation in last-mile delivery solutions, requiring more agile and personalized logistics services. Finally, the development and integration of autonomous vehicles, initially for yard management and potentially for long-haul routes, promise to revolutionize FVL operations by increasing safety, efficiency, and reducing labor costs, fundamentally altering the operational landscape.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager