Fire Control System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430605 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Fire Control System Market Size

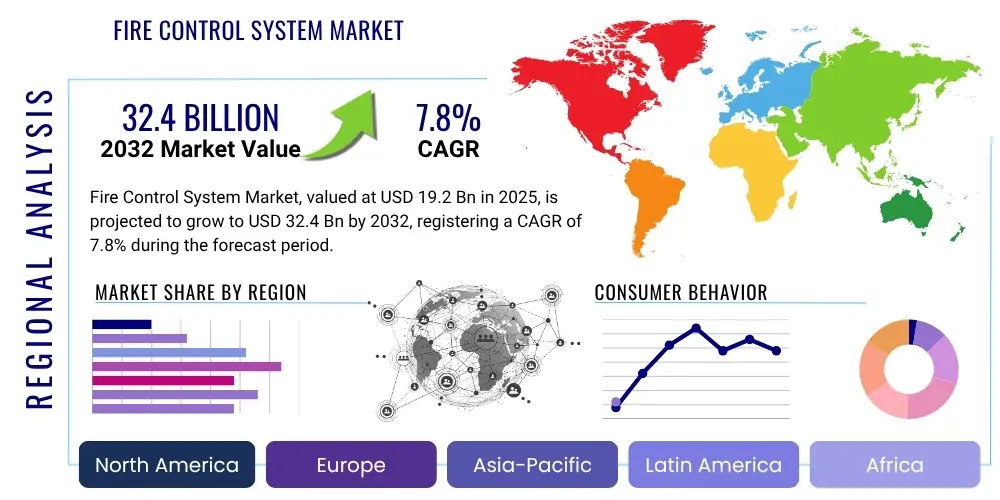

The Fire Control System Market is projected to grow at a Compound Annual Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 19.2 Billion in 2025 and is projected to reach USD 32.4 Billion by the end of the forecast period in 2032.

Fire Control System Market introduction

A Fire Control System (FCS) is a critical integration of hardware and software components, precisely engineered to enhance weapon system accuracy and effectiveness across military and security platforms. These systems process real-time data on target motion, environmental conditions, and weapon ballistics to generate precise aiming solutions for ordnance delivery. The core objective of an FCS is to significantly improve hit probability, minimize ammunition use, reduce collateral damage, and optimize operational resources in complex combat scenarios, becoming increasingly vital for precision and efficiency in modern defense.

Modern FCS products typically include advanced sensor suites such as thermal imagers, high-definition optical cameras, laser rangefinders, and multi-mode radar systems, providing comprehensive situational awareness and target data. These sensors are coupled with high-speed ballistic computers for rapid calculations and robust weapon interfaces for mechanical adjustments. Major applications span land-based platforms like main battle tanks and artillery, naval vessels from frigates to aircraft carriers, and airborne platforms including fighter jets, bombers, and unmanned aerial vehicles (UAVs). FCS ensures optimized performance in diverse combat domains, from air-to-air engagements to naval surface warfare and ground combat operations.

Benefits from deploying cutting-edge FCS are substantial. These include significantly enhanced target acquisition and tracking, leading to superior accuracy and increased lethality. FCS drastically reduces engagement time, allowing quicker reactions to threats. By providing precise firing solutions, these systems lessen operator workload and fatigue, freeing personnel for tactical decision-making. The ability to network and share target data among multiple platforms further amplifies collective combat power and situational awareness across an operational theater.

Market driving factors are primarily global geopolitical instability, compelling nations to upgrade defense capabilities and fueling demand for advanced FCS. Increased global defense budgets from major military powers and emerging economies directly support FCS procurement. The imperative for precision-strike capabilities, aimed at minimizing civilian casualties, is a critical driver. Continuous technological advancements in sensor technology, artificial intelligence, and data processing are also pivotal, enabling more capable, integrated, and autonomous fire control solutions, fostering market growth and innovation.

Fire Control System Market Executive Summary

The Fire Control System (FCS) market is experiencing dynamic shifts, reflecting global defense landscape evolution. Business trends show a strong push towards integrating artificial intelligence (AI) and machine learning (ML) for advanced target recognition, predictive analytics, and enhanced decision-making autonomy. There is a growing emphasis on modular, open-architecture systems for easier integration, upgrades, and interoperability across platforms and alliances. Cybersecurity is a critical design consideration, with significant investments in robust protection mechanisms to safeguard systems from cyber threats and ensure data integrity. Strategic partnerships among defense contractors and technology firms are also shaping the competitive landscape, fostering innovation.

Regionally, North America and Europe continue to dominate, driven by substantial defense budgets, advanced technological infrastructures, and ongoing military modernization by nations like the United States, United Kingdom, France, and Germany. The Asia Pacific region is rapidly emerging as the fastest-growing market, fueled by increasing defense spending from nations such as China, India, South Korea, and Japan, addressing regional security challenges. Latin America, the Middle East, and Africa also show sustained demand, primarily for upgrading existing defense inventories and enhancing border security, often through technology transfers and imports.

Segment-wise, the FCS market sees notable advancements. Demand for advanced naval FCS is propelled by increasing maritime security threats and fleet expansion, focusing on anti-ship and anti-missile defense. Land-based systems integrate sophisticated FCS into armored vehicles and artillery for improved precision and mobility. Airborne FCS is crucial for next-generation fighter aircraft and UAVs, focusing on beyond-visual-range engagement. A significant trend is the development of software-defined FCS, offering flexibility and seamless integration with emerging technologies. Ongoing demand for highly sensitive sensor technologies, including electro-optical/infrared (EO/IR) and active electronically scanned array (AESA) radar, remains a core driver, ensuring superior situational awareness.

AI Impact Analysis on Fire Control System Market

User questions about Artificial Intelligence's impact on Fire Control Systems frequently focus on how AI can enhance precision, automate complex tasks, improve situational awareness, and potentially lead to more autonomous weapon systems. Common concerns highlight ethical implications of AI-driven lethal force, cybersecurity vulnerabilities, and the need for explainable AI in combat. Users also inquire about integration challenges, cost-effectiveness, and AI's potential to transform operational doctrines. The overarching theme is a strong expectation for AI to revolutionize FCS capabilities, tempered by significant ethical and operational considerations requiring careful governance and development.

AI integration into Fire Control Systems promises to usher in a new era of capabilities, moving beyond traditional computational assistance to intelligent battlefield support. This transformation extends to every facet of FCS operation, from data acquisition and processing to target engagement. AI's ability to learn from vast datasets and adapt to dynamic combat environments offers unparalleled precision and responsiveness. However, system complexity necessitates significant investment in development, testing, and validation to ensure reliability and minimize unintended consequences. Addressing ethical dilemmas and ensuring secure implementation will be paramount for widespread adoption and acceptance of AI-enhanced FCS technologies.

- Enhanced target recognition and classification via deep learning, for faster, accurate identification of entities.

- Predictive analytics for ballistic calculations, dynamically adjusting for environmental factors with precision, boosting hit probability.

- Autonomous decision-making support systems that recommend optimal engagement solutions, reducing operator cognitive load and accelerating response.

- Adaptive weapon control mechanisms that learn from engagements, refining firing parameters for superior performance.

- Improved sensor fusion, synthesizing data from multiple sensors (radar, thermal, acoustic) into a comprehensive tactical picture.

- Facilitation of human-machine teaming, with AI handling data processing, keeping human operators in supervisory roles.

- Development of advanced counter-drone and anti-missile systems, with AI-driven FCS rapidly identifying and neutralizing multiple threats.

- Automated threat assessment and prioritization, ranking multiple threats based on intelligence and rules.

- Self-healing and adaptive cybersecurity protocols, with AI constantly monitoring for anomalies against cyberattacks.

- Real-time battle damage assessment and feedback loops, utilizing AI to evaluate engagement effectiveness and recommend actions.

DRO & Impact Forces Of Fire Control System Market

The Fire Control System (FCS) market is significantly shaped by a complex interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers include escalating global geopolitical instability, compelling nations to continuously upgrade defense capabilities, fueling demand for advanced FCS. The universal quest for precision-strike capabilities across all military domains—land, naval, and air—is another powerful impetus, as modern warfare emphasizes minimizing collateral damage. Furthermore, relentless technological innovation in advanced sensors, AI, and data processing pushes FCS capabilities, fostering continuous upgrades. Modernization programs by armed forces worldwide, replacing aging equipment with state-of-the-art solutions, also serve as a crucial market impetus.

Despite robust drivers, the FCS market faces notable restraints. High development, procurement, and maintenance costs pose a significant barrier, especially for smaller defense budgets. Stringent regulatory frameworks and export controls complicate market access and technology transfer, limiting advanced FCS proliferation. Ethical concerns surrounding increasing autonomy of AI-augmented weapon systems present moral and political dilemmas, influencing R&D. Additionally, the complexity of integrating advanced FCS into legacy platforms and ensuring interoperability introduces substantial technical and logistical challenges.

Opportunities within the FCS market are plentiful, particularly in advanced technological integration. The burgeoning potential of AI and machine learning to revolutionize target acquisition, ballistic computation, and autonomous decision support offers fertile ground for innovation and expansion. Growing demand for networked warfare and integrated battle management systems presents opportunities for highly interconnected solutions. Furthermore, the rising threat from unmanned aerial vehicles (UAVs) drives specialized counter-drone FCS solutions. Opportunities also exist in upgrading existing military inventories with modern FCS components, extending platform life, and exploring dual-use applications in civilian security.

Impact forces on the FCS market are broadly categorized by technological advancements, geopolitical instability, defense spending trends, and international arms trade regulations. Rapid advancements in computing power, sensor miniaturization, and communication directly enable more capable and compact FCS. The fluctuating international relations landscape, including regional conflicts and arms races, influences defense budgets and procurement. Global defense spending trends, whether increasing or decreasing, directly impact market trajectory. Finally, international arms trade agreements and export control regimes significantly shape where and how FCS technologies are developed, sold, and deployed, creating both barriers and strategic market advantages.

Segmentation Analysis

The Fire Control System (FCS) market is extensively segmented to reflect diverse applications, technological complexities, and operational requirements in modern defense and security. This detailed segmentation allows for granular understanding of market dynamics, identifying specific growth areas, technological preferences, and varying end-user demands. Primary segmentation categories encompass platform type, component type, system type, and end-user, each providing critical insights into market structure and competitive landscape, crucial for strategic planning, product development, and market entry decisions for stakeholders.

Each segment within the FCS market exhibits unique characteristics and growth trajectories, driven by specific military doctrines, technological advancements, and regional security priorities. Naval FCS demand links to maritime security and fleet modernization; airborne FCS growth connects to combat aircraft and UAV capabilities. Similarly, sensor technologies and AI algorithms directly influence the component segment, pushing for sophisticated, integrated solutions. This multi-layered segmentation highlights the intricate nature of the FCS market, demonstrating how different elements contribute to market valuation and future growth, while striving for greater precision, automation, and interoperability across all defense domains.

- By Platform

- Land-Based Fire Control Systems

- Main Battle Tanks (MBTs): For primary weapon accuracy, including thermal sights, laser rangefinders.

- Armored Personnel Carriers (APCs) & Infantry Fighting Vehicles (IFVs): Enhancing target engagement for vehicle-mounted weapons.

- Self-Propelled Howitzers (SPH) & Artillery: Crucial for indirect fire precision, integrating GPS, INS, meteorological data.

- Mortar Systems: Advanced aiming devices for close-support fire missions.

- Anti-Aircraft Artillery (AAA): For short-range air defense, integrated with radar tracking.

- Naval Fire Control Systems

- Destroyers and Frigates: For anti-ship/air warfare, gunnery, with ship motion compensation.

- Aircraft Carriers: Primarily for self-defense, close-in weapon systems (CIWS).

- Submarines: For torpedo and missile launch, integrated with sonar.

- Patrol Vessels & Littoral Combat Ships: For small to medium caliber guns, vital for coastal security.

- Coastal Defense Systems: Land-based systems protecting maritime approaches, with shore-based radars.

- Airborne Fire Control Systems

- Fighter Aircraft: For air-to-air/ground missiles, cannons; includes helmet-mounted displays.

- Bombers: For precision-guided munitions, involving complex navigation and targeting pods.

- Unmanned Aerial Vehicles (UAVs) & Drones: For surveillance, reconnaissance, precision strike payloads, often AI-controlled.

- Attack Helicopters: For rockets, missiles, cannons; integrating advanced optics.

- Transport Aircraft (for defensive systems): For flare/chaff dispensers, DIRCM systems.

- Land-Based Fire Control Systems

- By Component

- Sensors

- Electro-Optical/Infrared (EO/IR) Systems: For day/night surveillance, target identification.

- Radar Systems: AESA for long-range detection, tracking, target illumination.

- Laser Rangefinders: For accurate distance measurement.

- GPS/Inertial Navigation Systems (INS): For precise platform positioning.

- Acoustic & Meteorological Sensors: For environmental and indirect fire data.

- Targeting Systems

- Ballistic Computers: High-speed processors for trajectory calculations.

- Weapon Sights: Optical/electronic displays for aiming.

- Stabilization & Target Trackers: For maintaining aim and following targets.

- Mission Computers: Central processing units integrating functions.

- Weapon Interface Systems

- Gun Control, Missile Launchers, Torpedo Tubes, Rocket Launchers: Control systems for weapon deployment.

- Command & Control (C2) Units: Centralized systems for managing and coordinating engagement.

- Display Systems

- Multi-Function Displays (MFD), Head-Up Displays (HUD), Helmet-Mounted Displays (HMD): For presenting tactical data and enhanced situational awareness.

- Sensors

- By System Type

- Weapon Control Systems (WCS)

- Target Acquisition Systems (TAS)

- Fire Control Radars (FCR)

- By End User

- Defense Sector: Army, Navy, Air Force, Special Forces.

- Homeland Security/Border Control: For surveillance, coastal defense, critical infrastructure protection.

Value Chain Analysis For Fire Control System Market

The value chain for the Fire Control System (FCS) market is highly specialized and complex, involving a multi-tiered network of suppliers, manufacturers, integrators, and end-users. Upstream, it begins with raw material suppliers providing specialized metals, alloys, optical components, and electronic substrates for high-performance defense systems. These feed into component manufacturers producing advanced sensors (e.g., thermal imagers, radar), microprocessors, communication modules, and precision mechanical parts. R&D institutions play a crucial upstream role, developing innovative technologies and intellectual property foundational to next-generation FCS, characterized by intense investment in R&D.

Downstream, sophisticated components are assembled and integrated by specialized defense contractors and system integrators. These entities combine sensors, ballistic computers, weapon interfaces, and command and control units into cohesive FCS. This phase involves extensive testing, calibration, and software development for optimal performance and compatibility. Distribution channels are primarily direct, through long-term contracts with national defense ministries and government agencies. Indirect channels involve large defense primes integrating FCS as sub-systems within larger platforms (tanks, ships, aircraft). Post-deployment, the value chain extends to MRO services, support, and upgrades, ensuring operational readiness and longevity of these critical systems.

Fire Control System Market Potential Customers

The primary potential customers for Fire Control Systems are national defense ministries and armed forces globally, including army, navy, air force, and marine corps. These entities consistently seek advanced FCS solutions to enhance the lethality, accuracy, and operational efficiency of their military assets, from individual soldier systems to large naval vessels and aerial platforms. Continuous military modernization, replacement of aging equipment, and acquisition of new weapon systems to maintain a strategic advantage drive sustained demand. National defense budgets, security doctrines, and threat perceptions directly influence their procurement decisions, making them the most significant segment of buyers.

Beyond traditional military branches, other governmental security agencies represent significant potential customers. This includes homeland security departments, border patrol units, and specialized counter-terrorism forces requiring sophisticated targeting and observation systems for surveillance, threat neutralization, and critical infrastructure protection. For instance, FCS components might be integrated into perimeter defense systems or vehicles for border monitoring. International peacekeeping organizations or multi-national defense alliances may also procure FCS to standardize capabilities among member states or for specific joint operational requirements. The increasing complexity of global security challenges, encompassing conventional and asymmetric threats, expands the spectrum of potential buyers seeking robust and reliable fire control solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 19.2 Billion |

| Market Forecast in 2032 | USD 32.4 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin Corporation, Raytheon Technologies Corporation, BAE Systems plc, Northrop Grumman Corporation, General Dynamics Corporation, L3Harris Technologies Inc., Saab AB, Thales Group, Elbit Systems Ltd., Leonardo S.p.A., Aselsan A.S., Rheinmetall AG, Rafael Advanced Defense Systems Ltd., Boeing Company, Israel Aerospace Industries Ltd., Hanwha Defense, Kongsberg Gruppen, MBDA, Textron Inc., RUAG Holding AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fire Control System Market Key Technology Landscape

The Fire Control System (FCS) market is shaped by a dynamic and rapidly evolving technological landscape, with advancements continuously enhancing precision, autonomy, and integration. A pivotal element is advanced sensor fusion, integrating data from multiple disparate sensors (EO/IR, radar, laser rangefinders, acoustic) into a single, coherent combat picture. This fusion significantly enhances target detection, identification, and tracking, even in challenging conditions or against stealthy threats. Sensor miniaturization and increased processing power allow integration into a broader range of platforms, from individual soldier systems to small UAVs.

Artificial Intelligence (AI) and Machine Learning (ML) are transformative forces. These technologies are leveraged for highly accurate target recognition and classification, reducing operator cognitive load. AI-powered predictive ballistic calculations dynamically account for complex environmental variables and target motion, leading to unprecedented precision and higher hit probabilities. AI enables autonomous decision support systems for optimal engagement parameters, accelerating response. ML algorithms facilitate adaptive weapon control, learning from engagements and adjusting parameters. Networked warfare capabilities are critical, with FCS designed for seamless integration into C4ISR networks, enabling real-time data exchange and collaborative engagement.

Other significant advancements include robust cybersecurity measures, with encryption and intrusion detection systems protecting system integrity. Augmented Reality (AR) and Virtual Reality (VR) interfaces enhance operator situational awareness and training. The integration of directed energy weapon (DEW) systems requires new precise targeting solutions. Stealth technologies for adversary platforms necessitate sensitive FCS for low-observable target detection. Modular, open-architecture FCS designs offer greater flexibility, easier upgrades, and interoperability, reducing lifecycle costs. These shifts point towards more intelligent, connected, resilient, and highly autonomous fire control capabilities.

Regional Highlights

- North America: Dominant in the FCS market, driven by the substantial U.S. defense budget and commitment to military modernization. Robust ecosystem of leading defense contractors and R&D. Focus on integrating AI, advanced sensors, and networked capabilities across all military domains. Canada also contributes through defense spending and NATO participation.

- Europe: A significant market with advanced defense industries in the UK, France, Germany. Driven by geopolitical tensions, NATO commitments, and collective security. Heavy investment in upgrading existing assets and indigenous FCS development. Strong emphasis on interoperability, standardization, cyber resilience, and ethical AI in defense.

- Asia Pacific (APAC): Projected fastest-growing market. Propelled by escalating defense expenditures from China, India, South Korea, Japan, and Australia, in response to regional disputes and maritime concerns. High demand for naval and airborne FCS, land-based artillery, and air defense. Rapid development of local manufacturing capabilities.

- Middle East & Africa (MEA): Exhibits steady demand for FCS, influenced by regional conflicts, internal security challenges, and counter-terrorism. Countries like Saudi Arabia, UAE, and Turkey are key importers enhancing military capabilities. African nations invest in FCS for border security and stability, often via international aid or arms imports.

- Latin America: Smaller market share but experiencing gradual growth. Countries like Brazil, Mexico, and Argentina undertake military modernization, constrained by budgets. Focus on cost-effective upgrades, acquiring equipment for border control, anti-narcotics, and internal security, often through international suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fire Control System Market.- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- BAE Systems plc

- Northrop Grumman Corporation

- General Dynamics Corporation

- L3Harris Technologies Inc.

- Saab AB

- Thales Group

- Elbit Systems Ltd.

- Leonardo S.p.A.

- Aselsan A.S.

- Rheinmetall AG

- Rafael Advanced Defense Systems Ltd.

- Boeing Company

- Israel Aerospace Industries Ltd.

- Hanwha Defense

- Kongsberg Gruppen

- MBDA

- Textron Inc.

- RUAG Holding AG

Frequently Asked Questions

What is a Fire Control System?

A Fire Control System (FCS) is an integrated suite of hardware and software, including sensors, ballistic computers, and weapon interfaces, designed to precisely aim and fire weapons, enhancing accuracy, effectiveness, and safety in military and security operations.

How does AI significantly impact the Fire Control System market?

AI profoundly impacts the FCS market by improving target recognition, enabling predictive analytics for enhanced precision, supporting autonomous decision-making, and facilitating advanced sensor fusion, leading to more intelligent and precise weapon engagement capabilities.

What are the primary applications of Fire Control Systems?

Primary applications of FCS span defense platforms, including land-based systems (tanks, artillery), naval vessels (destroyers, submarines), and airborne platforms (fighter jets, attack helicopters), aimed at bolstering combat precision and operational readiness.

What are the key drivers for the Fire Control System market growth?

Key drivers include escalating global geopolitical tensions, increasing defense budgets, the persistent demand for precision-strike capabilities to minimize collateral damage, and continuous technological advancements in sensor and computing technologies.

Which regions are leading the Fire Control System market, and what are their growth drivers?

North America and Europe currently lead the FCS market due to substantial defense spending and advanced tech infrastructure. The Asia Pacific region is rapidly emerging as a significant growth area, driven by increasing defense budgets and heightened security concerns.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager