Firefighting Aircraft Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428188 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Firefighting Aircraft Market Size

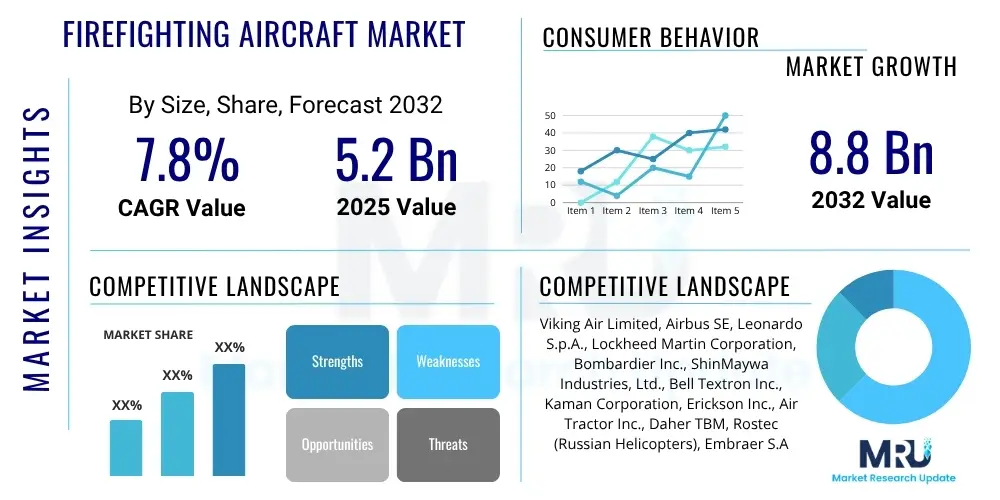

The Firefighting Aircraft Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 5.2 Billion in 2025 and is projected to reach USD 8.8 Billion by the end of the forecast period in 2032. This substantial growth is primarily driven by an escalating global incidence of wildfires, increased focus on aerial firefighting capabilities, and continuous technological advancements in aircraft design and operational efficiency. The rising awareness among governments and private entities regarding the critical role of rapid aerial response in mitigating catastrophic fire events further propels market expansion.

Firefighting Aircraft Market introduction

The Firefighting Aircraft Market encompasses the global industry dedicated to the design, manufacturing, sale, and operation of specialized aircraft used for combating wildfires and other large-scale infernos. These aircraft, ranging from fixed-wing air tankers and water bombers to rotary-wing helicopters, are engineered to deliver water, fire retardants, or foam directly onto active fire zones, often in remote or difficult-to-access terrains. The primary objective is to suppress fires, create containment lines, and support ground firefighting crews, thereby protecting lives, property, and natural ecosystems. The market is characterized by a high degree of specialization, stringent regulatory requirements, and significant capital investment in both procurement and operational maintenance.

Products within this market include purpose-built airframes designed specifically for firefighting missions, as well as modified versions of existing transport or utility aircraft. Major applications span across governmental forestry services, national defense agencies, emergency response units, and increasingly, private firefighting contractors operating globally. The benefits derived from these aerial assets are manifold: they provide rapid initial attack capabilities, deliver large volumes of suppressants over vast areas, can access terrain inaccessible to ground crews, and offer strategic aerial surveillance for fire mapping and command coordination. These advantages are crucial in containing fires before they escalate into uncontrollable disasters, minimizing environmental damage, and safeguarding critical infrastructure.

Driving factors for the Firefighting Aircraft Market include the undeniable impact of climate change leading to longer, hotter, and drier fire seasons globally, particularly in regions like North America, Europe, Australia, and parts of Asia. Concurrently, there is an increasing urbanization and expansion into wildland-urban interface (WUI) areas, elevating the risk of property loss and human casualties from wildfires. Governments worldwide are responding with heightened investments in fire prevention and suppression infrastructure, including modernizing and expanding their aerial firefighting fleets. Furthermore, technological innovations such as enhanced navigation systems, more efficient water/retardant delivery mechanisms, and improved aircraft performance capabilities are making these assets more effective and appealing to operators, fueling continuous demand and market growth.

Firefighting Aircraft Market Executive Summary

The Firefighting Aircraft Market is currently undergoing significant transformation, driven by a confluence of evolving business trends, distinct regional dynamics, and specialized segment growth. Business trends indicate a strong move towards fleet modernization and expansion, particularly among government agencies and an expanding pool of private operators who contract services. There is a discernible shift towards multi-role aircraft capable of performing various missions beyond just water bombing, such as reconnaissance, logistics, and personnel transport, enhancing their cost-effectiveness and utility. Furthermore, partnerships between public sector entities and private companies for aircraft maintenance, operational support, and even acquisition models are becoming more prevalent, reflecting a trend towards optimizing resource utilization and leveraging specialized expertise within the private aerospace industry.

Regional trends are highly pronounced, with North America and Europe consistently representing the largest markets due to their advanced infrastructure, established aerial firefighting programs, and high frequency of severe wildfires. These regions are characterized by ongoing investments in new generation aircraft and sophisticated command and control systems. The Asia Pacific region is emerging as a significant growth hotspot, propelled by increasing awareness, growing wildfire incidents, and government initiatives to build robust disaster response capabilities, particularly in countries like Australia, India, and China. Latin America and the Middle East & Africa also show nascent but growing demand, influenced by similar environmental challenges and increasing governmental focus on national security and disaster preparedness, albeit often constrained by budget limitations and reliance on international aid or leasing agreements.

Segmentation trends reveal robust demand across both fixed-wing and rotary-wing aircraft types, each serving distinct tactical roles. Fixed-wing aircraft, especially large air tankers, are favored for their capacity to deliver massive loads of suppressants over wide areas, critical for initial attacks and containing large-scale fires. Rotary-wing aircraft (helicopters) are indispensable for precision drops, personnel insertion, and reconnaissance in challenging terrains. There is also a notable trend towards medium and large-capacity aircraft for enhanced efficiency and effectiveness in combating larger and more intense fires. The end-user segment is dominated by government and defense agencies, but the role of commercial and private operators is steadily increasing, driven by contract-based services and specialized operational needs. Technology advancements in avionics, sensor systems, and retardant delivery mechanisms are continuously shaping sub-segments, offering improved situational awareness and operational safety for aerial firefighting crews.

AI Impact Analysis on Firefighting Aircraft Market

Common user questions regarding the impact of AI on the Firefighting Aircraft Market frequently revolve around how artificial intelligence can enhance detection capabilities, improve operational efficiency, and mitigate risks for aircrews. Users often inquire about the potential for autonomous or semi-autonomous flight systems in dangerous fire zones, the role of AI in optimizing flight paths for suppressant drops, and its application in predictive analytics for wildfire behavior. There is significant interest in how AI can integrate with existing firefighting protocols to provide real-time situational awareness and aid decision-making for commanders. Key themes that emerge include the desire for increased safety for personnel, more precise and effective fire suppression, and the potential for cost reduction through optimized operations and reduced human error, alongside concerns about job displacement and the reliability of AI in critical, unpredictable environments.

- AI-powered predictive analytics for wildfire spread and intensity, enabling proactive deployment of aerial assets.

- Enhanced sensor fusion and image recognition on surveillance aircraft for rapid and accurate fire detection and mapping.

- Optimized flight path planning for water/retardant drops, considering wind, terrain, and fire dynamics for maximum effectiveness.

- Integration of AI in autonomous or semi-autonomous drones for reconnaissance, hot-spot detection, and small-scale suppression in high-risk areas.

- AI-driven maintenance predictive systems to improve aircraft readiness and reduce downtime.

- Real-time decision support systems for aircrews and ground commanders, improving coordination and tactical response.

- Development of AI-powered simulation and training platforms for pilots and operators, enhancing skill development and emergency preparedness.

- Automated analysis of historical firefighting data to refine strategies and improve resource allocation.

- Smart payload management systems that adjust suppressant release based on real-time fire conditions and aircraft performance.

DRO & Impact Forces Of Firefighting Aircraft Market

The Firefighting Aircraft Market is profoundly influenced by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that shape its trajectory. A primary driver is the accelerating frequency and intensity of global wildfires, fueled by climate change, drought conditions, and human activity. This environmental imperative places increasing pressure on governments and emergency services worldwide to enhance their aerial firefighting capabilities, leading to greater demand for specialized aircraft. Technological advancements in aircraft performance, avionics, and fire retardant delivery systems also act as significant drivers, offering more effective, safer, and efficient tools for fire suppression. Furthermore, rising public awareness and political will to mitigate the devastating consequences of wildfires translate into increased budgetary allocations for aerial firefighting assets, driving fleet modernization and expansion.

However, several restraints temper the market's growth. The extremely high acquisition and operational costs of firefighting aircraft represent a significant barrier, particularly for developing nations or regions with limited budgets. These costs encompass not only the purchase price but also substantial expenses related to maintenance, specialized training for pilots and crews, and extensive logistical support. Stringent regulatory certifications and airworthiness standards imposed by aviation authorities, while crucial for safety, can lengthen development cycles and increase compliance costs. Environmental concerns surrounding the use of certain fire retardants and their potential impact on ecosystems also present a restraint, necessitating ongoing research into more eco-friendly alternatives and influencing operational protocols. The limited operational windows due to weather conditions like high winds, smoke, or poor visibility further restrict the effective deployment of these aircraft, impacting their overall utility and perceived value in certain scenarios.

Opportunities within the market are numerous and promising. The integration of unmanned aerial vehicles (UAVs) and drones, particularly for reconnaissance, hot-spot detection, and initial attack on smaller fires, presents a significant growth avenue, complementing traditional manned aircraft. The development of advanced materials, such as lighter composites, can lead to more fuel-efficient and higher-capacity aircraft, while innovations in propulsion, including hybrid-electric or electric aircraft, could reduce operational costs and environmental footprints in the long term. Moreover, emerging markets in regions with increasing wildfire risks but currently limited aerial firefighting infrastructure offer substantial growth potential for new sales and service contracts. The growing trend of public-private partnerships for aircraft procurement, maintenance, and operation also creates opportunities for private sector involvement and innovation. Impact forces, beyond the immediate DROs, include the escalating severity of climate change and its direct correlation with wildfire risk, dictating long-term demand. Government spending policies on disaster management and forestry, along with evolving international collaborations for resource sharing, significantly influence market dynamics. The insurance industry's growing interest in wildfire risk mitigation further encourages investment in preventative and suppressive technologies, including aerial assets. Finally, continuous technological innovation in aerospace and defense sectors, particularly in areas like sensor technology, automation, and communication systems, will inevitably spill over into and redefine the capabilities of firefighting aircraft, maintaining a cycle of development and adoption.

Segmentation Analysis

The Firefighting Aircraft Market is comprehensively segmented to provide a granular understanding of its diverse components and dynamics. This segmentation facilitates targeted market analysis, allowing stakeholders to identify specific growth areas, understand competitive landscapes, and formulate strategic decisions. The market is primarily categorized based on the type of aircraft, tank capacity for suppressant delivery, the end-user operating the aircraft, and the various systems comprising these complex aerial platforms. Each segment reflects unique operational requirements, technological advancements, and demand drivers, collectively painting a detailed picture of the global aerial firefighting industry.

- By Type

- Fixed-Wing Aircraft

- Water Bombers (e.g., Bombardier 415, CL-215, ShinMaywa US-2)

- Air Tankers (e.g., C-130 Hercules, DC-10, Boeing 747, MD-87, Dash 8 Q400AT)

- Observation & Reconnaissance Aircraft

- Rotary-Wing Aircraft (Helicopters)

- Light Helicopters (e.g., Bell 206, Airbus H125)

- Medium Helicopters (e.g., Bell 412, Sikorsky S-70/UH-60 Black Hawk, Airbus H225)

- Heavy-Lift Helicopters (e.g., Erickson S-64 Aircrane, CH-47 Chinook)

- Fixed-Wing Aircraft

- By Tank Capacity

- Small (Up to 1,000 Gallons)

- Medium (1,001 - 3,000 Gallons)

- Large (Above 3,000 Gallons)

- By End-User

- Government & Defense Agencies

- Forestry Services

- Emergency Services

- Military

- Commercial & Private Operators

- Contractors

- Private Fire Departments

- Research & Development

- Government & Defense Agencies

- By System

- Aerial Platforms (Airframe, Engines)

- Water/Retardant Delivery Systems (Tanks, Doors, Pumps, Discharge Systems)

- Avionics & Navigation Systems (GPS, FMS, Autopilots, Communication)

- Surveillance & Sensing Equipment (Thermal Cameras, LIDAR, IR Sensors)

- Ground Support Systems (Refueling, Maintenance, Command & Control)

Value Chain Analysis For Firefighting Aircraft Market

The value chain for the Firefighting Aircraft Market is intricate, involving multiple specialized stages from raw material sourcing to end-user operation and support. This complex structure ensures the development, production, and deployment of highly sophisticated aircraft capable of performing critical, life-saving missions. The upstream segment primarily involves the procurement of advanced materials such as aerospace-grade alloys, composites, and specialized electronics, along with the manufacturing of critical components like engines, landing gear, and avionics systems by a specialized network of suppliers. These suppliers, often large multinational aerospace component manufacturers, provide the fundamental building blocks necessary for aircraft construction. Rigorous quality control and adherence to aviation standards are paramount at this stage, setting the foundation for the aircraft's performance and safety characteristics. Relationships at this level are often long-term and strategic, involving significant research and development investments to meet evolving technological requirements.

Moving downstream, the value chain encompasses the original equipment manufacturers (OEMs) who design, assemble, and integrate these components into complete firefighting aircraft. This stage involves complex engineering, system integration, and extensive testing to ensure the aircraft meets stringent operational and safety specifications for aerial firefighting. Once manufactured, the distribution channel plays a crucial role. This often involves direct sales from OEMs to large government entities, national forestry services, or defense departments. Given the high value and specialized nature of these assets, indirect channels are less common for new aircraft sales but can include brokers or leasing companies for pre-owned or specialized fleet expansions. Furthermore, aftermarket services, including maintenance, repair, and overhaul (MRO), spare parts supply, and pilot training, form a significant part of the downstream value chain. These services are often provided by the OEMs themselves, authorized service centers, or specialized third-party MRO providers, ensuring the continued airworthiness and operational readiness of the fleet throughout its lifecycle.

The distinction between direct and indirect distribution in this market is largely dependent on the scale and nature of the transaction. Direct sales channels are predominant for large, new aircraft acquisitions by national governments, which involve direct negotiations, customization, and long-term support contracts with the OEM. This direct relationship allows for tailored solutions and ensures comprehensive technical support. Indirect channels, while less frequent for new full aircraft purchases, become more relevant for smaller operators, specific component procurement, or when engaging with leasing companies that act as intermediaries. These leasing companies may purchase aircraft directly from OEMs and then lease them to various end-users, providing a more flexible acquisition model for smaller entities or those needing temporary fleet expansion. The entire value chain is characterized by a high degree of technical expertise, regulatory oversight, and a strong emphasis on reliability and safety, given the critical role these aircraft play in disaster management.

Firefighting Aircraft Market Potential Customers

The potential customers for the Firefighting Aircraft Market are primarily governmental and quasi-governmental entities, alongside a growing segment of commercial and private operators. These buyers are typically organizations with mandates for public safety, environmental protection, and national security, recognizing the indispensable role of aerial assets in managing and suppressing large-scale wildfires. National and provincial forestry departments constitute a significant segment of end-users, as they are directly responsible for wildland fire management and often operate extensive aerial fleets. Emergency services, including civil defense organizations and national disaster response agencies, also represent a core customer base, deploying these aircraft as part of broader disaster mitigation strategies. Furthermore, military branches, particularly air forces, in many countries are equipped with or can rapidly deploy firefighting aircraft, often utilizing multi-role platforms for both defense and civil assistance missions, making them key strategic purchasers.

Beyond traditional governmental buyers, the commercial and private sector is emerging as a critical customer segment. This includes specialized aerial firefighting contractors who are hired by governments or private landowners to provide fire suppression services on a contract basis. These private operators often manage and maintain their own fleets, requiring purchases of new or used aircraft to meet contractual demands and expand their service offerings. Large private landowners, such as timber companies or agricultural conglomerates with significant landholdings susceptible to fire, may also invest in smaller firefighting aircraft or specialized services. The insurance industry, while not direct buyers of aircraft, significantly influences market demand by encouraging investments in fire prevention and suppression technologies to mitigate potential losses, indirectly supporting the market through policy and risk management incentives. The growing complexity and scale of wildfires necessitate a diverse range of customers, all seeking effective aerial solutions to protect assets and lives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.2 Billion |

| Market Forecast in 2032 | USD 8.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Viking Air Limited, Airbus SE, Leonardo S.p.A., Lockheed Martin Corporation, Bombardier Inc., ShinMaywa Industries, Ltd., Bell Textron Inc., Kaman Corporation, Erickson Inc., Air Tractor Inc., Daher TBM, Rostec (Russian Helicopters), Embraer S.A., Boeing (for defense applications), United Aircraft Corporation (UAC), Kawasaki Heavy Industries, Inc., Textron Aviation, Collins Aerospace (Raytheon Technologies), GE Aviation, Honeywell International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Firefighting Aircraft Market Key Technology Landscape

The Firefighting Aircraft Market is increasingly shaped by a dynamic and evolving technology landscape, with continuous innovations aimed at enhancing aircraft performance, operational efficiency, and crew safety. One of the most significant technological advancements lies in the realm of advanced avionics and navigation systems. Modern firefighting aircraft are equipped with sophisticated GPS-guided flight management systems, multi-function displays (MFDs), and enhanced ground proximity warning systems (EGPWS). These technologies enable pilots to execute precise water and retardant drops, navigate challenging terrains under adverse conditions, and maintain situational awareness, which is crucial for operations in smoky environments or at low altitudes. Integration of satellite communication systems ensures seamless coordination between air and ground crews, improving overall command and control during complex firefighting missions. The shift towards glass cockpits with intuitive human-machine interfaces also reduces pilot workload and increases operational safety, making these advanced aircraft more appealing to operators.

Another pivotal area of technological development is in the water and retardant delivery systems. Traditional gravity-fed tanks are being replaced or supplemented by pressure-fed systems that allow for more controlled and precise dispersal patterns, optimizing the coverage area and minimizing waste. Innovations include computer-controlled doors and flow rates that can be adjusted in real-time based on fire intensity and terrain, as well as the development of more effective and environmentally friendly fire retardants. Furthermore, the incorporation of advanced surveillance and sensing equipment is transforming reconnaissance capabilities. Aircraft are now outfitted with high-resolution electro-optical/infrared (EO/IR) cameras, LIDAR systems, and thermal imaging sensors that can detect hotspots through dense smoke, map fire perimeters, and identify ignition points with unprecedented accuracy. These real-time data streams are critical for strategic decision-making and for directing ground crews effectively, providing a comprehensive understanding of the fire's behavior and potential spread.

The future technology landscape for firefighting aircraft is also heavily influenced by the emergence of unmanned aerial vehicles (UAVs) and the potential for autonomous operations. While fully autonomous firefighting aircraft are still in early stages of development, UAVs are increasingly being deployed for reconnaissance, surveillance, and even targeted small-scale suppressant drops, especially in areas too dangerous for manned aircraft. Research into hybrid-electric and all-electric propulsion systems aims to reduce the environmental footprint and operational costs of these aircraft, although significant challenges remain for large-scale application. Advanced materials, such as lightweight composites, are being utilized to construct more durable, fuel-efficient airframes with increased payload capacities. Artificial intelligence and machine learning are also poised to play a crucial role, enhancing predictive analytics for fire behavior, optimizing flight plans, and improving decision support systems for aircrews. These technological strides collectively contribute to making firefighting aircraft more effective, safer, and adaptable to the evolving challenges of global wildfire management, driving the long-term growth and innovation within this critical market segment.

Regional Highlights

- North America: This region consistently represents the largest market share for firefighting aircraft, driven by extensive wildland-urban interface (WUI) areas, prevalent dry conditions, and a proactive approach to wildfire management. Countries like the United States and Canada experience severe wildfire seasons annually, leading to significant government investments in fleet modernization and expansion. Both nations operate large and diverse fleets of fixed-wing air tankers and rotary-wing helicopters, with a strong focus on advanced avionics, satellite communications, and precision delivery systems. The presence of major aerospace manufacturers and robust private contracting services further strengthens the market here.

- Europe: The European market is robust, particularly in Southern European countries such as Spain, Portugal, France, Italy, and Greece, which are highly susceptible to wildfires. The region benefits from strong cross-border cooperation initiatives, like the rescEU program, which pools aerial firefighting assets among member states. There is a continuous demand for amphibious aircraft (water bombers) and heavy-lift helicopters. Investments are focused on enhancing rapid response capabilities, integrating advanced surveillance technologies, and developing more sustainable operational practices.

- Asia Pacific (APAC): The APAC region is projected to exhibit significant growth, driven by increasing awareness, urbanization into wildland areas, and the escalating frequency of wildfires in countries like Australia, India, and China. Australia, in particular, possesses a highly developed aerial firefighting capability due to its severe bushfire seasons. Other nations are rapidly developing their fleets, often through direct procurement or leasing agreements from international suppliers. The market here is characterized by a growing demand for a mix of fixed-wing and rotary-wing aircraft to suit diverse geographical and climatic conditions.

- Latin America: This region presents an emerging market with growing demand, particularly in countries with large forested areas like Brazil, Argentina, and Chile. Deforestation and climate change contribute to increased wildfire risks. While historically reliant on smaller, less specialized aircraft or international assistance, there is a growing trend towards investing in dedicated firefighting aircraft as governments recognize the escalating threat. Market growth is influenced by economic stability and governmental priorities in disaster preparedness.

- Middle East and Africa (MEA): The MEA region is experiencing nascent but growing demand for firefighting aircraft. While some countries in the Middle East have advanced capabilities for defense, the specific application of aerial firefighting is developing. In Africa, increasing instances of wildfires in various ecosystems and growing investments in environmental protection and disaster management are driving modest market expansion. Demand is often met through international aid, leasing, or direct purchases of versatile aircraft suitable for multi-role operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Firefighting Aircraft Market.- Viking Air Limited

- Airbus SE

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Bombardier Inc.

- ShinMaywa Industries, Ltd.

- Bell Textron Inc.

- Kaman Corporation

- Erickson Inc.

- Air Tractor Inc.

- Daher TBM

- Rostec (Russian Helicopters)

- Embraer S.A.

- Boeing (defense & derivative aircraft)

- United Aircraft Corporation (UAC)

- Kawasaki Heavy Industries, Inc.

- Textron Aviation

- Collins Aerospace (Raytheon Technologies)

- GE Aviation

- Honeywell International Inc.

Frequently Asked Questions

What types of aircraft are predominantly used in aerial firefighting operations?

Aerial firefighting primarily utilizes two main types of aircraft: fixed-wing aircraft and rotary-wing aircraft (helicopters). Fixed-wing aircraft, such as large air tankers and water bombers, are designed for delivering substantial volumes of water or retardant over wide areas, often for initial attack or containment lines. Rotary-wing aircraft, including light, medium, and heavy-lift helicopters, offer greater maneuverability for precision drops, personnel transport, and reconnaissance in challenging terrains and closer to fire lines. Both types are crucial for effective wildfire suppression strategies globally, often deployed in coordinated efforts to maximize their impact.

How is climate change impacting the demand for firefighting aircraft?

Climate change is a primary driver of increasing demand for firefighting aircraft by contributing to longer, hotter, and drier wildfire seasons globally. This leads to a higher frequency, intensity, and geographical spread of wildfires, necessitating more robust and extensive aerial firefighting capabilities. Governments and emergency services are compelled to invest in modernizing and expanding their fleets to combat these escalating threats, directly correlating climate change impacts with market growth for specialized aerial firefighting assets. The need for rapid response and sustained suppression efforts is amplified, driving continuous innovation and procurement in this sector.

What are the key technological advancements shaping the firefighting aircraft market?

Key technological advancements include sophisticated avionics and navigation systems, such as GPS-guided flight management and enhanced ground proximity warning systems, improving precision and safety. Innovations in water/retardant delivery systems, like pressure-fed tanks and computer-controlled dispersal, optimize suppressant effectiveness. Furthermore, advanced surveillance and sensing equipment, including EO/IR cameras and thermal imaging, enhance real-time fire detection and mapping. The integration of AI for predictive analytics and the increasing use of unmanned aerial vehicles (UAVs) for reconnaissance and small-scale drops are also critical developments, transforming operational efficiency and crew safety.

What are the primary challenges faced by the firefighting aircraft market?

The primary challenges faced by the firefighting aircraft market include the extremely high acquisition and operational costs associated with these specialized aircraft, encompassing purchase price, maintenance, and extensive crew training. Stringent regulatory certifications and airworthiness standards add to development timelines and compliance expenses. Additionally, environmental concerns regarding the long-term impact of fire retardants necessitate ongoing research into greener alternatives. Limited operational windows due to adverse weather conditions like high winds, dense smoke, or poor visibility further restrict effective deployment, impacting the overall utility and efficiency of aerial firefighting assets.

Which regions are leading in the adoption and investment in firefighting aircraft?

North America and Europe are currently leading regions in the adoption and investment in firefighting aircraft. North America, particularly the United States and Canada, faces extensive wildfires annually and maintains large, advanced fleets with significant government funding. European countries, especially those in the Mediterranean basin, also heavily invest in aerial firefighting assets, often through national programs and collaborative initiatives like rescEU. The Asia Pacific region, notably Australia, is rapidly increasing its capabilities due to severe bushfire seasons, positioning it as a significant growth area for future investments and technological adoption in the firefighting aircraft market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager