Fixed Income Asset Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429522 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Fixed Income Asset Management Market Size

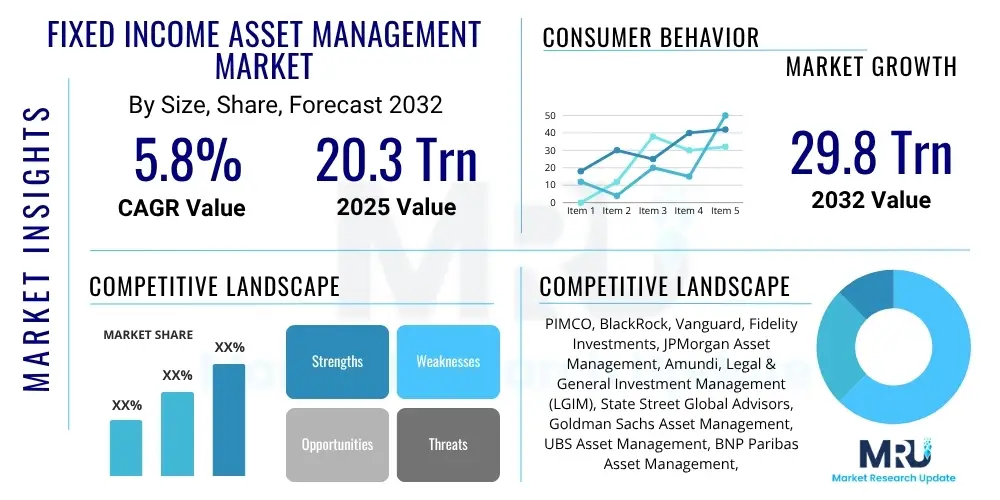

The Fixed Income Asset Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 20.3 Trillion in 2025 and is projected to reach USD 29.8 Trillion by the end of the forecast period in 2032.

Fixed Income Asset Management Market introduction

Fixed income asset management encompasses the highly specialized professional oversight and strategic deployment of portfolios primarily composed of diverse debt securities. These include a wide spectrum of instruments such as sovereign government treasuries, municipal bonds issued by local authorities, various corporate debt instruments spanning different credit ratings, and other interest-bearing financial products like asset-backed and mortgage-backed securities. The fundamental objective of this critical financial service is multi-faceted: it aims for stringent capital preservation to protect investor principal, to consistently generate predictable income streams through regular coupon payments or interest accruals, and to effectively mitigate inherent investment risks through meticulous credit analysis, duration management, and broad diversification for a diverse clientele. These debt assets are typically characterized by a defined maturity date and offer either fixed or floating interest payments, thereby serving as indispensable cornerstones for stable financial planning, robust liability matching, and sophisticated wealth management strategies across global financial markets. The disciplined approach to managing these assets is crucial for achieving long-term financial stability and fulfilling specific return mandates while navigating market complexities.

The major applications of fixed income asset management extend across an expansive array of institutional and individual investor profiles, each presenting unique financial requirements and strategic objectives. Large public and corporate pension funds, for instance, are critically reliant on these assets to secure stable, long-term returns that are indispensable for meeting their extensive future retiree liabilities and ensuring intergenerational financial security. Similarly, insurance companies, which manage vast pools of capital to cover policyholder claims and long-term annuities, utilize robust fixed income portfolios to precisely match their long-duration policy obligations, thereby ensuring solvency, regulatory compliance, and consistent profitability. Sovereign wealth funds, tasked with preserving and growing national wealth for future generations, strategically incorporate fixed income for comprehensive portfolio diversification, macroeconomic stabilization, and consistent wealth accumulation within prudent risk parameters. On the individual investor side, high-net-worth individuals and family offices frequently employ sophisticated fixed income strategies for reliable income generation, meticulous wealth preservation against inflation, and as a strategic component for efficient intergenerational wealth transfer, often prioritizing stability and downside protection over aggressive capital appreciation. This broad utility underscores the indispensable and foundational role of fixed income in modern finance.

The principal benefits derived from strategic fixed income investments are manifold and critical for balanced portfolio construction and risk management. These assets inherently provide predictable cash flows, which are invaluable for budgeting, financial planning, and meeting regular expenditure commitments for both individuals and institutions, fostering financial discipline. Furthermore, they offer significant portfolio diversification, acting as a powerful counterbalance against the typically higher volatility and cyclicality of equity markets, especially during periods of market stress. Fixed income assets often serve as a robust hedge against economic downturns and deflationary pressures, proving particularly valuable in uncertain market conditions by providing a crucial element of stability and capital safety. Key driving factors propelling the continuous growth of this market include the increasing and systemic demand from an aging global population, particularly for secure and reliable retirement income solutions that can withstand market fluctuations and preserve purchasing power. There is also an ongoing and critical need for institutional investors to precisely match their long-term liabilities with stable, income-generating assets, a mandate often imposed by regulatory bodies. Historically, periods of low-to-moderate interest rates have made fixed income securities particularly attractive for yield-seeking investors globally, while persistent geopolitical uncertainties frequently drive increased allocations towards perceived safe-haven assets, such as highly-rated government bonds, further bolstering market demand and capital inflows into the sector.

Fixed Income Asset Management Market Executive Summary

The Fixed Income Asset Management market is currently undergoing a significant and dynamic transformation, profoundly shaped by several overarching business trends that redefine strategic priorities. A notable shift includes the increased adoption of both passive investment strategies, primarily driven by their lower expense ratios, greater transparency, and efficiency in tracking broad market indices, alongside highly specialized active management approaches focused on generating idiosyncratic alpha within less efficient or specialized fixed income segments. Furthermore, the systematic integration of Environmental, Social, and Governance (ESG) criteria into core investment frameworks is rapidly gaining paramount traction, compelling asset managers to develop robust analytical tools, integrate sophisticated data sets, and establish transparent reporting structures for a burgeoning array of sustainable fixed income products. Technological advancements, particularly in advanced data analytics, artificial intelligence, machine learning, and automation, are profoundly enhancing operational efficiency, elevating risk management capabilities, and enabling the construction of increasingly sophisticated and adaptive portfolios across the entire industry, fundamentally altering traditional workflows and decision-making processes.

Regionally, the Fixed Income Asset Management market exhibits highly varied and complex dynamics, reflecting distinct economic conditions, regulatory landscapes, and investor preferences across different geographies. North America and Europe continue to represent dominant and mature markets, characterized by their extensive institutional investor bases, highly sophisticated regulatory frameworks, and a strong emphasis on innovative financial products, including cutting-edge sustainable and impact-focused fixed income offerings. These regions are also witnessing intense competitive pressures and ongoing industry consolidation among asset managers, driving the pursuit of scale and specialized expertise. In stark contrast, the Asia Pacific (APAC) region is experiencing accelerated and robust growth, propelled by burgeoning middle-class populations, rapidly expanding national pension systems, and significant accumulation of sovereign wealth, particularly within economic powerhouses like China, Japan, and India. Emerging markets, while consistently offering potentially higher yields due to greater risk premiums, also present greater inherent volatility and necessitate specialized expertise in navigating their unique economic, political, and regulatory landscapes, attracting capital with a higher risk appetite and advanced due diligence capabilities.

In terms of segment trends, institutional investors, such as colossal public and corporate pension funds, major insurance companies, and sovereign wealth funds, maintain their unwavering dominance as the primary and most significant clients within the fixed income asset management sector, driven by their substantial asset bases, extensive long-term liabilities, and complex liability matching requirements. Concurrently, the influence and participation of retail investors are steadily rising, as improved accessibility through exchange-traded funds (ETFs), traditional mutual funds, and innovative robo-advisory platforms allows for broader and more convenient participation in fixed income markets. Within specific product types, while traditional government and corporate bonds remain foundational pillars of fixed income portfolios, there is a discernible and increasing appetite for strategic diversification into high-yield bonds, alternative fixed income assets including private credit, direct lending, and highly structured finance products, as investors relentlessly seek enhanced returns in an environment characterized by persistently challenging yields. This dynamic interplay of macroeconomic trends, technological disruption, evolving investor preferences, and regulatory shifts underscores a market that is simultaneously resilient and highly adaptable, continuously evolving to meet diverse investor needs and respond proactively to global economic transformations.

AI Impact Analysis on Fixed Income Asset Management Market

Users frequently inquire about the transformative capabilities of Artificial Intelligence (AI) in fundamentally altering portfolio construction methodologies, significantly refining risk assessment frameworks, and revolutionizing traditional trading strategies within the complex fixed income domain. Common user questions often focus on AI's unprecedented ability to efficiently process and interpret vast, disparate datasets for superior predictive analytics, the extensive automation of numerous repetitive and labor-intensive operational tasks, and its profound potential to either generate significant idiosyncratic alpha or dramatically enhance existing risk management frameworks far beyond the capabilities of conventional human analysis. Furthermore, there is considerable and growing interest in meticulously exploring the ethical dimensions of AI deployment, particularly the critical imperative of data privacy in highly sensitive financial contexts, and the evolving role of human financial analysts as automation becomes increasingly pervasive across all aspects of the investment lifecycle. Concerns regarding algorithmic bias, the potential for systemic risk amplification, and the necessity for robust transparency and explainability in complex AI models also consistently emerge as central themes in user inquiries, reflecting a cautious yet largely optimistic outlook on AI's pervasive and unavoidable influence.

Artificial Intelligence is profoundly transforming the operational efficiency of fixed income asset management firms, largely by automating critical functions such as real-time market data aggregation, intelligent trade execution across multiple venues, and streamlined, audit-ready compliance reporting. This advanced automation significantly contributes to faster transaction processing speeds, substantially reduces the incidence of human error across complex workflows, and ultimately lowers overall operational costs, thereby enhancing profitability and competitiveness within the investment lifecycle. Beyond mere task automation, AI-powered analytics are exceptionally adept at discerning intricate patterns, subtle anomalies, and complex correlations within vast and often unstructured market datasets, frequently identifying insights that might elude even highly experienced human analysts due to cognitive limitations or data overload. This enhanced analytical capability informs more sophisticated investment decisions, optimizes portfolio allocations across various debt instruments, and allows for more precise scenario simulations, enabling the prediction of yield curve movements, spread changes, and credit migration probabilities with significantly improved accuracy. Such elevated predictive power provides a distinct and sustainable competitive advantage in rapidly evolving and increasingly data-intensive financial markets.

In the crucial realm of risk management, AI demonstrates exceptional prowess in real-time monitoring and proactive assessment of crucial factors like credit risk across diverse issuers, interest rate risk (including duration and convexity management), and liquidity risk across various market segments, delivering advanced warnings and facilitating the implementation of highly dynamic hedging strategies. Machine learning models can meticulously analyze issuer fundamentals, interpret a broad spectrum of macroeconomic indicators, gauge nuanced market sentiment from diverse sources, and assess geopolitical developments to forecast credit default probabilities and rating changes with unprecedented precision. For the generation of alpha, sophisticated AI algorithms are adept at uncovering subtle mispricings in bond markets, optimizing the intricate process of bond selection within specific credit sectors, and executing complex relative value trades across various fixed income instruments and derivatives. These capabilities collectively contribute to enhancing returns significantly beyond traditional benchmarks and passive strategies, marking a new and highly sophisticated era of data-driven investment performance and risk mitigation in fixed income. The ability of AI to rapidly adapt to new market information and iterate on strategies provides a continuous edge.

- Enhanced Predictive Analytics: AI models analyze extensive and disparate datasets, including economic indicators, news sentiment, and trading volumes, to forecast interest rate fluctuations, credit default probabilities, and market liquidity dynamics with superior accuracy and foresight, moving beyond traditional econometric models.

- Automated Trading and Execution: Sophisticated algorithms automate trade placement, optimize order routing across multiple electronic venues, and streamline execution, thereby minimizing slippage, reducing transaction costs, and improving market timing by capitalizing on fleeting opportunities.

- Improved Portfolio Optimization: AI-driven tools facilitate the construction of highly diversified, robust, and dynamically rebalancing fixed income portfolios, meticulously aligning with specific client risk appetites, liquidity requirements, and precise return objectives through advanced multi-factor asset allocation models and scenario-based stress testing.

- Advanced Risk Management: Real-time monitoring and in-depth analysis of a multitude of risks, including credit risk, interest rate sensitivity, currency risk, and liquidity stress, enable proactive identification, quantification, and granular mitigation of potential vulnerabilities across complex portfolios, enhancing overall resilience.

- Operational Efficiency Gains: The automation of labor-intensive, rule-based processes such as data ingestion, reconciliation across systems, compliance checks, and regulatory reporting significantly reduces manual effort, improves data integrity, accelerates operational workflows, and frees human capital for higher-value analytical tasks.

- Sentiment Analysis and Market Intelligence: AI interprets vast volumes of qualitative data from financial news feeds, social media platforms, research reports, and analyst commentaries to gauge real-time market sentiment, uncover emerging themes, and inform strategic trading and investment decisions with greater nuance.

- Customized Investment Product Development: AI facilitates the rapid creation and tailoring of highly personalized fixed income solutions, allowing asset managers to cater precisely to the unique needs, specific preferences, and precise risk-return profiles of individual clients, bespoke institutional mandates, and niche market segments.

- Fraud Detection and Cybersecurity Enhancement: Machine learning algorithms excel at identifying anomalous patterns in transactional data and market behavior, bolstering cybersecurity measures and providing robust, proactive defenses against financial fraud, unauthorized access, and sophisticated cyber threats, ensuring data integrity and client trust.

- Regulatory Compliance Assistance: AI tools aid in continuously monitoring market activities and internal processes, ensuring strict adherence to the ever-evolving and increasingly complex regulatory requirements (e.g., MiFID II, Dodd-Frank, EMIR), significantly alleviating the compliance burden on financial institutions and reducing potential penalties.

- Enhanced Research and Idea Generation: AI systems efficiently sift through vast volumes of financial literature, economic reports, company filings, and earnings transcripts, identifying obscure yet significant trends, uncovering novel investment opportunities, and generating actionable research insights with unparalleled speed and analytical depth.

DRO & Impact Forces Of Fixed Income Asset Management Market

The Fixed Income Asset Management market is fundamentally driven by a consistent and pervasive demand for stable income streams, which is particularly pronounced among an aging global demographic reliant on secure retirement savings and predictable payouts to maintain their standard of living. Concurrently, the continuous and substantial growth in capital allocated to major institutional investors, such as colossal pension funds and sophisticated insurance companies, creates an imperative for robust fixed income portfolios to meet their extensive long-term liabilities, comply with stringent regulatory capital adequacy requirements, and minimize duration gaps. Furthermore, rapid technological advancements, encompassing sophisticated analytical platforms, advanced algorithmic trading systems, and enhanced big data processing capabilities, significantly augment market efficiency, reduce transaction costs, and enhance accessibility, thereby stimulating broader market participation and fostering continuous innovation within product design and execution. The intrinsic desire for portfolio diversification, serving as a critical hedge against the inherent volatility and cyclicality of equity markets, also consistently underpins substantial and strategic allocations to fixed income assets, particularly during periods of economic uncertainty or market corrections.

Conversely, significant restraints persistently impede the market's unbridled expansion and introduce substantial challenges for asset managers. Paramount among these is interest rate volatility, particularly the prospect of a sustained period of rising rates, which can exert considerable downward pressure on existing bond valuations and lead to capital losses, thereby diminishing the attractiveness of traditional fixed income investments for those primarily focused on capital appreciation. Pervasive geopolitical uncertainties, escalating global trade tensions, and the persistent threat of regional or global economic slowdowns introduce systemic risks that have the potential to adversely affect both sovereign and corporate credit quality across jurisdictions, leading to downgrades and increased default probabilities. Additionally, the increasingly complex and dynamic global regulatory landscape, which mandates stringent compliance measures, elaborate reporting requirements (e.g., Solvency II, Basel III), and enhanced transparency, imposes substantial operational burdens, considerable cost overheads, and heightened legal risks on asset management firms. Periods characterized by a low-yield environment, while paradoxically driving some investors to seek higher-yielding alternatives in riskier assets, can simultaneously limit the availability of attractive conventional fixed income opportunities and compress profitability margins for traditional, conservative fixed income strategies, making it harder to generate sufficient returns.

Amidst these complex dynamics, compelling opportunities are rapidly emerging and fundamentally reshaping the fixed income landscape, demanding agile adaptation from market participants. The burgeoning sustainable fixed income sector, prominently featuring green bonds, social bonds, sustainability bonds, and sustainability-linked bonds, is experiencing exponential growth as Environmental, Social, and Governance (ESG) principles ascend in importance among a global investor base that increasingly seeks to align investments with ethical values and impact objectives. Strategic expansion into nascent and underserved emerging markets offers considerable potential for enhanced yield and diversification, albeit accompanied by a correspondingly elevated risk profile requiring specialized expertise in macroeconomics and local political dynamics. Furthermore, the advent of sophisticated data analytics, Artificial Intelligence, and machine learning is facilitating the hyper-personalization of fixed income solutions, allowing for products precisely tailored to individual client needs, liability structures, and precise risk tolerances. The development and increasing adoption of alternative fixed income products, such as private debt, direct lending, peer-to-peer lending, and highly structured credit, are providing diversified avenues for return enhancement and capital deployment beyond traditional public markets. These powerful drivers, formidable restraints, and compelling opportunities collectively act as potent impact forces, profoundly influencing strategic asset allocation decisions, catalyzing innovation in product development and distribution, dictating evolving regulatory responses, and ultimately determining the risk-return characteristics and the overarching growth trajectory of the global fixed income asset management market for the foreseeable future, demanding continuous adaptation and strategic foresight from all stakeholders.

Segmentation Analysis

The Fixed Income Asset Management market is characterized by a sophisticated and highly granular segmentation, meticulously reflecting the diverse nature of debt instruments available, the varied profiles of investor types, and critical geographical considerations that inherently influence investment behavior and asset allocation decisions. This multi-faceted approach to market analysis is absolutely essential for enabling asset managers to deploy highly targeted and efficient investment strategies, and to develop bespoke product offerings that precisely cater to distinct risk appetites, specific liquidity requirements, and the unique regulatory environments prevalent across different global jurisdictions. A comprehensive and insightful understanding of these intricate market segments is paramount for all market participants, allowing them to accurately identify nuanced niche opportunities, construct and manage highly specialized portfolios that meet stringent mandates, and proactively adapt to the continuously evolving demands, macroeconomic shifts, and technological complexities of the fixed income landscape, ensuring sustained competitiveness and growth. This deep segmentation supports precise competitive positioning and strategic resource allocation.

The market's segmentation by product type, end-user, and distribution channel provides an exceptionally granular and insightful view into its structural nuances and operational dynamics, highlighting key areas of growth and specialization. For example, large institutional investors, owing to their immense scale, extensive long-term liabilities, and conservative mandates, predominantly concentrate their investments in specific, often highly liquid, bond categories such as government treasuries, agency bonds, and high-grade corporate debt. In contrast, retail investors are increasingly gaining accessible exposure to the fixed income market through user-friendly pooled investment vehicles like traditional mutual funds and liquid exchange-traded funds (ETFs), which offer inherent diversification, professional management, and lower entry barriers. Moreover, the emergence of innovative new asset classes, such as private debt, infrastructure debt, and highly structured credit products, alongside the rapid proliferation of digital distribution channels and algorithm-driven robo-advisory platforms, further diversifies the market landscape. This dynamic evolution creates substantial opportunities for both well-established incumbent players seeking to innovate their offerings and agile new entrants capable of leveraging technological disruption, underscoring the strategic complexity and continuous evolution within the dynamic fixed income asset management sector, demanding constant innovation and adaptation from all participants.

- By Product Type

- Government Bonds: Comprising highly liquid and low-risk instruments such as sovereign treasuries (e.g., U.S. Treasuries, German Bunds), agency bonds (issued by government-sponsored enterprises), and municipal bonds issued by state and local government entities, often offering tax-exempt interest income.

- Corporate Bonds: Debt securities issued by corporations, segmented into investment-grade bonds (higher credit quality, lower default risk) and high-yield or junk bonds (lower credit quality, higher return potential, greater default risk), as well as convertible bonds offering equity upside potential.

- Securitized Products: Complex instruments backed by pools of underlying assets, including Mortgage-Backed Securities (MBS) collateralized by residential or commercial mortgages, Asset-Backed Securities (ABS) collateralized by diverse consumer loans (e.g., auto loans, credit card receivables), and Collateralized Loan Obligations (CLOs) backed by syndicated bank loans.

- Emerging Market Debt: Debt instruments issued by governments or corporations in developing economies, categorized into local currency debt (higher currency risk) and hard currency debt (USD or EUR denominated, lower currency risk but still credit sensitive), offering higher yields.

- Inflation-Protected Securities (IPS): Such as Treasury Inflation-Protected Securities (TIPS), designed to shield investors from inflation by adjusting principal value based on official inflation indices, providing real return protection.

- Money Market Instruments: Short-term, highly liquid and low-risk debt instruments including commercial paper, certificates of deposit, and repurchase agreements, primarily used for short-term financing and liquidity management for corporations and financial institutions.

- Municipal Bonds: Debt issued by state and local governments and their agencies to finance public projects, offering interest income that is often exempt from federal, state, and local taxes, making them attractive to high-income investors.

- By End-User

- Institutional Investors: Large, sophisticated entities such as public and corporate pension funds, insurance companies (life and property/casualty), sovereign wealth funds, university endowments, and charitable foundations with long-term investment horizons and specific liability matching requirements.

- Retail Investors: Including high-net-worth individuals (HNWIs), ultra-high-net-worth individuals (UHNWIs), and mass affluent clients seeking diversified income and capital preservation solutions for personal wealth management, often accessed through wealth advisors or direct platforms.

- Corporations: Investing surplus cash for short-term liquidity management, capital preservation, or long-term strategic investments, often utilizing money market instruments or short-duration corporate bonds.

- Government Entities: Including central banks and other governmental bodies managing foreign exchange reserves, public funds, and intergovernmental financial operations, with a strong focus on safety and liquidity.

- By Distribution Channel

- Direct Sales: Asset managers engaging directly with large institutional clients for customized mandates, segregated accounts, and proprietary product offerings, involving extensive relationship management.

- Independent Financial Advisors (IFAs): Providing personalized investment advice and facilitating access to various fixed income products, including mutual funds and ETFs, for individual and family clients, often acting as fiduciaries.

- Wealth Managers: Offering comprehensive financial planning and holistic investment management services, including strategic fixed income allocations, to high-net-worth individuals and family offices.

- Online Platforms/Robo-Advisors: Digital platforms providing automated, algorithm-driven investment advice and seamless access to diversified fixed income ETFs or expertly managed funds, democratizing access for retail investors.

- Broker-Dealers: Facilitating the buying and selling of individual bonds, fixed income funds, and other debt products for both institutional and retail clients, providing market access and execution services.

- By Investment Strategy

- Active Management: Portfolio managers actively selecting securities, adjusting allocations, and timing trades to outperform a predefined benchmark, leveraging deep credit research, macroeconomic analysis, and proprietary models.

- Passive Management: Strategies aiming to replicate the performance of a specific fixed income index (e.g., Bloomberg Global Aggregate Index) through low-cost exchange-traded funds (ETFs) or index funds, focusing on broad market exposure.

- Core Fixed Income: A foundational strategy focusing on broad market exposure to investment-grade bonds, aiming for consistent income, moderate capital appreciation, and robust capital preservation, forming the backbone of many portfolios.

- Core Plus Fixed Income: Expands beyond traditional core fixed income by strategically including tactical allocations to higher-yielding, less traditional sectors such as high-yield bonds, emerging market debt, securitized credit, or even modest allocations to alternative debt, seeking enhanced returns.

- Absolute Return Fixed Income: Strategies designed to generate positive returns irrespective of market direction, often employing derivatives, leverage, and complex trading techniques across various fixed income segments with a focus on risk-adjusted returns.

- Unconstrained Fixed Income: Flexible mandates allowing managers broad discretion to invest across various fixed income sectors, geographies, and credit qualities globally, without strict benchmark constraints, emphasizing total return and active risk management.

- By Asset Class

- Investment Grade Fixed Income: Bonds rated highly by recognized credit rating agencies (e.g., AAA to BBB- by S&P/Fitch, Aaa to Baa3 by Moody's), indicating lower default risk and higher credit quality.

- High Yield Fixed Income: Bonds rated below investment grade (e.g., BB+ or lower), commonly known as "junk bonds," offering higher potential returns in exchange for greater credit risk and volatility.

- Convertible Fixed Income: Hybrid securities that combine features of bonds and equities, offering a fixed interest payment while providing the option to convert into a predetermined number of common stock shares under certain conditions.

- Sustainable Fixed Income: Bonds specifically designated to finance environmental or social projects (green bonds, social bonds), or those issued by entities demonstrating strong Environmental, Social, and Governance (ESG) practices, appealing to socially conscious investors.

Value Chain Analysis For Fixed Income Asset Management Market

The value chain of the Fixed Income Asset Management market represents a complex and highly integrated series of interconnected activities, commencing with the indispensable upstream provision of raw data and specialized technology, meticulously progressing through the core functions performed by expert asset managers, and ultimately culminating with the crucial downstream delivery of tai

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 20.3 Trillion |

| Market Forecast in 2032 | USD 29.8 Trillion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PIMCO, BlackRock, Vanguard, Fidelity Investments, JPMorgan Asset Management, Amundi, Legal & General Investment Management (LGIM), State Street Global Advisors, Goldman Sachs Asset Management, UBS Asset Management, BNP Paribas Asset Management, Capital Group, Invesco, T. Rowe Price, Franklin Templeton, Schroders, AXA Investment Managers, Bridgewater Associates, Nuveen, Dodge & Cox |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fixed Income Asset Management Market Key Technology Landscape

The Fixed Income Asset Management market is currently experiencing a profound and rapid technological transformation, fundamentally driven by an escalating imperative for augmented operational efficiency, superior analytical capabilities, and exceptionally robust risk management frameworks that can adapt to increasingly volatile global markets. Modern asset management firms are increasingly deploying a sophisticated and integrated array of cutting-edge technologies to adeptly navigate the complexities of dynamic market environments, meticulously optimize portfolio performance against defined benchmarks, and consistently meet the ever-evolving and increasingly stringent demands of their diverse client base. This pervasive technological shift is impacting virtually every facet of the investment lifecycle, encompassing everything from advanced data acquisition and intricate analysis to streamlined trading execution, rigorous regulatory compliance, and personalized client reporting, thereby fostering a more data-driven, highly automated, and resilient operational ecosystem across the entire industry. The strategic adoption of these technologies is not merely an option but a competitive necessity for sustained success and growth.

Regional Highlights

- North America: Representing a dominant and highly mature market, North America is characterized by its exceptionally sophisticated institutional investor base, an extensive array of diverse product offerings, and a robust, highly developed regulatory environment. The region commands a significant proportion of global assets under management, largely driven by its colossal public and corporate pension funds, major insurance companies, and a deeply ingrained culture of both active and passive investment management strategies. The United States and Canada are at the forefront of innovation in financial technology (FinTech), advanced quantitative analysis, and the accelerated integration of Environmental, Social, and Governance (ESG) criteria into fixed income investment mandates, setting global industry benchmarks for best practices and product development.

- Europe: A profoundly diverse market, Europe exhibits considerable variations in economic conditions, sovereign debt profiles, and regulatory frameworks across its numerous constituent countries, presenting both challenges and opportunities. The region is distinctly marked by a strong and growing emphasis on sustainable finance, particularly evident in the rapid proliferation of green bonds, social bonds, and sustainability-linked bonds, and an increasing investor appetite for fully ESG-compliant fixed income strategies. European asset managers frequently contend with challenges stemming from persistently negative or exceptionally low-yield environments, fragmentation across national markets, and complex geopolitical uncertainties, which collectively drive a strong demand for advanced diversification strategies and innovative solutions for yield enhancement, often involving cross-border investments and alternative credit.

- Asia Pacific (APAC): Recognized as the fastest-growing region globally for fixed income asset management, APAC is vigorously fueled by its burgeoning middle-class populations, rapidly expanding national pension systems, and significant accumulation of sovereign wealth in key economic powerhouses such as China, Japan, Australia, and India. The demand for stable returns, robust capital preservation, and strategic portfolio diversification is on a steep upward trajectory, consistently attracting substantial capital and expertise from global asset managers seeking growth opportunities. Key developmental trends include the deepening and increasing sophistication of local bond markets, the ongoing liberalization of capital accounts, and the accelerated adoption of international investment standards and best practices, enhancing transparency and investor confidence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fixed Income Asset Management Market.- PIMCO

- BlackRock

- Vanguard

- Fidelity Investments

- JPMorgan Asset Management

- Amundi

- Legal & General Investment Management (LGIM)

- State Street Global Advisors

- Goldman Sachs Asset Management

- UBS Asset Management

- BNP Paribas Asset Management

- Capital Group

- Invesco

- T. Rowe Price

- Franklin Templeton

- Schroders

- AXA Investment Managers

- Bridgewater Associates

- Nuveen

- Dodge & Cox

Frequently Asked Questions

What is fixed income asset management?

Fixed income asset management involves the professional oversight and strategic deployment of portfolios primarily composed of diverse debt securities, such as government and corporate bonds, and other interest-bearing instruments. The core objectives are to ensure stringent capital preservation, generate predictable and consistent income streams through coupon payments, and provide essential portfolio diversification to mitigate the inherent volatility commonly associated with equity markets. It caters to a broad spectrum of investors, from large institutions to individuals, who are seeking stability, regular cash flow, and a reliable component for long-term financial planning and liability matching. This specialized service is crucial for managing financial risks and achieving specific return mandates within defined parameters.

How do interest rate changes impact fixed income investments?

Interest rate changes bear a fundamental and inverse relationship with the market prices of existing fixed income bonds. When prevailing interest rates rise in the broader economy, the market value of older bonds, which offer comparatively lower fixed coupon rates, typically declines. This is because newly issued bonds become more attractive by offering higher current yields, diminishing the appeal of existing lower-yielding instruments. Conversely, if interest rates fall, the value of existing bonds with their relatively higher fixed coupon payments tends to increase, rendering them more appealing to investors. This inherent sensitivity to interest rate fluctuations, known as duration risk, is a critical factor that fixed income asset managers meticulously analyze and manage within their portfolios to optimize returns and control risk exposure. Effective duration management is paramount for navigating dynamic market environments.

What are the main types of fixed income securities?

The main categories of fixed income securities encompass a diverse range of debt instruments, each with unique characteristics, risk profiles, and return potential. These include government bonds, such as highly liquid U.S. Treasuries, agency bonds, and municipal bonds issued by state and local governments, often offering tax-exempt interest income. Corporate bonds, debt issued by companies, are segmented into investment-grade (higher credit quality) and high-yield (lower credit quality, higher return potential) categories. Securitized products, such as mortgage-backed securities (MBS) and asset-backed securities (ABS), are complex instruments backed by pools of underlying assets like mortgages or consumer loans. Emerging market debt, inflation-protected securities (TIPS), and money market instruments also represent significant segments, providing various tools for portfolio construction and diversification depending on an investor's objectives and risk tolerance.

Why do investors choose fixed income assets for their portfolios?

Investors strategically choose fixed income assets for their portfolios for several compelling and fundamental reasons. Primarily, these assets provide a consistent and predictable stream of income through regular coupon payments, which is particularly attractive for retirees, institutional investors with liability matching needs, or those dependent on regular cash flows for operational expenses. They also offer a comparatively lower risk profile than equities, contributing significantly to overall portfolio diversification and acting as a crucial hedge against market volatility, economic downturns, or deflationary periods, thereby enhancing portfolio stability. Fixed income is vital for capital preservation, safeguarding principal against market fluctuations, and meeting long-term financial liabilities and specific investment mandates. The inclusion of fixed income helps to balance risk and return across a diversified asset allocation strategy, providing a foundational element of financial security and stability.

What role does ESG play in modern fixed income asset management?

Environmental, Social, and Governance (ESG) principles are playing an increasingly vital and transformative role in modern fixed income asset management, influencing both investment processes and product development. Investors are actively integrating ESG factors into their credit analysis and bond selection processes to identify issuers with robust sustainable practices, effectively mitigate non-financial risks (e.g., environmental liabilities, social controversies, governance failures), and align their investments with ethical values and specific impact objectives. This integration is driving significant demand for specialized instruments such as green bonds (financing environmental projects), social bonds (funding social initiatives), and sustainability-linked bonds (where coupon payments are tied to sustainability performance targets). ESG considerations are fundamentally reshaping investment criteria, encouraging greater corporate responsibility, and promoting more sustainable capital allocation within the fixed income market, enhancing both long-term financial returns and positive societal impact.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager