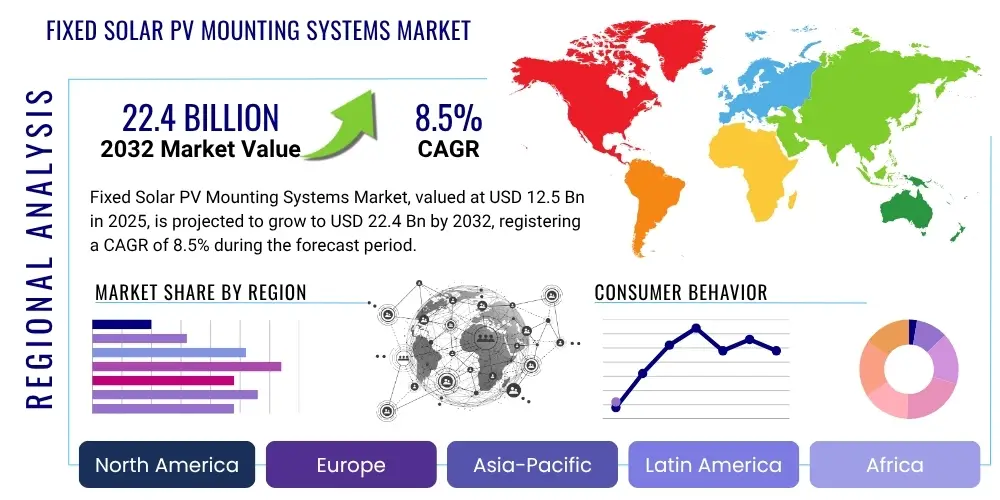

Fixed Solar PV Mounting Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429809 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Fixed Solar PV Mounting Systems Market Size

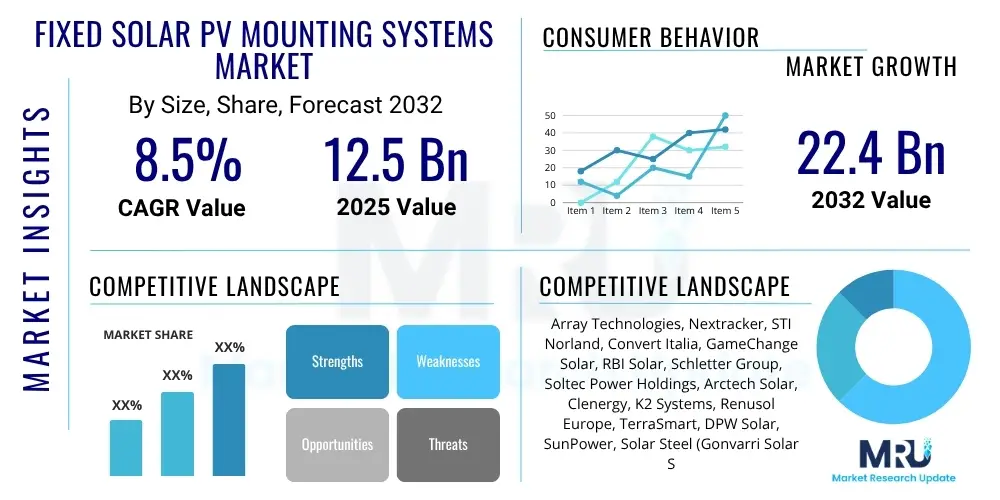

The Fixed Solar PV Mounting Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at $12.5 Billion in 2025 and is projected to reach $22.4 Billion by the end of the forecast period in 2032.

Fixed Solar PV Mounting Systems Market introduction

The Fixed Solar PV Mounting Systems Market comprises structures designed to securely hold solar photovoltaic panels in a stationary position, typically optimized for maximum solar energy capture at a specific location. These systems are fundamental components in any solar energy installation, providing the necessary support, tilt, and orientation for PV modules. Unlike tracking systems that adjust their position to follow the sun, fixed systems offer a cost-effective and robust solution, suitable for a wide range of installations from small residential rooftops to vast utility-scale solar farms.

Products within this market include various types of mounting structures, such as ground-mounted systems, rooftop-mounted systems, and specialized carports or building integrated photovoltaics (BIPV) solutions. Ground-mounted systems are prevalent in large-scale utility projects due to their scalability and ease of installation on open land, while rooftop systems are widely adopted in residential and commercial sectors. Major applications span across utility-scale power generation, commercial and industrial establishments, and residential dwellings, each demanding specific design considerations for structural integrity, wind load resistance, and ease of maintenance.

The primary benefits of fixed solar PV mounting systems include their durability, low maintenance requirements, and cost-effectiveness compared to their tracking counterparts. They offer reliable support for PV panels, ensuring long-term operational stability and power output. Key driving factors for market growth include the global impetus for renewable energy adoption, decreasing costs of solar PV technology, supportive government policies and incentives for solar installations, and increasing electricity demand worldwide. These factors collectively contribute to the sustained expansion and innovation within the fixed solar PV mounting systems sector.

Fixed Solar PV Mounting Systems Market Executive Summary

The Fixed Solar PV Mounting Systems Market is experiencing robust growth, driven by escalating global demand for renewable energy and favorable regulatory landscapes. Business trends indicate a strong focus on material innovation, such as the increasing use of lightweight and corrosion-resistant alloys, alongside advancements in modular design to simplify installation and reduce overall project timelines. There is also a notable shift towards integrated solutions that combine mounting with other components like inverters or optimizers, streamlining procurement and deployment processes for solar developers and EPC contractors. The competitive landscape is characterized by both established global players and agile regional manufacturers, all vying for market share through product differentiation and strategic partnerships.

Regional trends highlight the Asia Pacific region as a dominant force, particularly China and India, owing to massive government investments in solar infrastructure and rapid industrialization. North America and Europe also present significant growth opportunities, spurred by ambitious decarbonization targets and robust consumer adoption of rooftop solar. Latin America and the Middle East and Africa (MEA) are emerging as high-potential markets, benefiting from abundant solar resources and increasing energy independence initiatives. These regions are witnessing increased foreign direct investment and local manufacturing capabilities, signaling a diversification of the global supply chain for mounting systems.

Segmentation trends reveal a continued dominance of ground-mounted systems in the utility-scale segment due to their economic viability for large projects, while rooftop-mounted systems are pivotal for distributed generation across residential and commercial sectors. Material-wise, steel remains a foundational choice for its strength and cost-effectiveness, though aluminum is gaining traction for its lightweight properties and corrosion resistance, especially in coastal or humid environments. The market is also seeing specialized fixed-tilt solutions for various terrains and climatic conditions, enhancing adaptability and optimizing energy yield even in challenging sites. These trends collectively underscore a dynamic market evolving to meet diverse installation requirements and sustainability goals.

AI Impact Analysis on Fixed Solar PV Mounting Systems Market

Users frequently inquire about how artificial intelligence can optimize the design, deployment, and operational efficiency of fixed solar PV mounting systems. Key themes revolve around leveraging AI for site assessment, structural integrity analysis, and predictive maintenance. There is significant interest in AI's potential to reduce design errors, accelerate engineering processes, and enhance the resilience of mounting structures against environmental stressors. Users also express expectations regarding AI's role in improving supply chain logistics and project management, ultimately driving down costs and increasing the overall return on investment for solar projects incorporating fixed mounting solutions. The general sentiment is one of anticipation for AI to transform traditional engineering practices into more data-driven and intelligent approaches.

- AI-driven site assessment for optimal system placement and tilt angles, maximizing energy harvest.

- Predictive analytics for maintenance schedules, identifying potential structural weaknesses or material degradation before failure.

- Automated design and engineering tools reducing human error and accelerating the design phase of mounting structures.

- Real-time monitoring and anomaly detection to ensure structural integrity and prevent damage from extreme weather.

- Optimization of material usage and logistics, leading to cost reductions and more sustainable manufacturing processes.

- Enhanced quality control during manufacturing and assembly through AI-powered visual inspection systems.

- Integration with broader energy management systems for grid stability and demand-side response in large-scale installations.

DRO & Impact Forces Of Fixed Solar PV Mounting Systems Market

The Fixed Solar PV Mounting Systems Market is significantly influenced by a confluence of driving factors, restraints, and opportunities, all shaped by various impact forces. The primary drivers include the global push for renewable energy generation, catalyzed by increasing environmental concerns and international climate agreements, leading to widespread adoption of solar power. Furthermore, the continuous reduction in the overall cost of solar PV technology, including panels and inverters, makes solar energy more economically competitive, thereby stimulating demand for robust and affordable mounting systems. Supportive government policies, such as subsidies, tax incentives, and renewable portfolio standards, play a crucial role in fostering market growth by making solar investments more attractive for utility companies, businesses, and residential consumers.

However, the market faces several notable restraints. Land availability and acquisition can be a significant challenge for large-scale ground-mounted projects, especially in densely populated regions. The initial capital investment required for solar installations, even for fixed systems which are more cost-effective than trackers, can still be substantial, posing a barrier for some potential investors or end-users. Aesthetic concerns, particularly for rooftop installations in residential areas or historic districts, can sometimes limit the adoption of solar PV. Additionally, variability in raw material prices, such as steel and aluminum, can impact manufacturing costs and, consequently, the final price of mounting systems, introducing market volatility.

Opportunities for growth are abundant within the market. Emerging markets in Latin America, Africa, and Southeast Asia present untapped potential for solar development, driven by increasing energy demand and improving economic conditions. Technological innovations, including lighter yet stronger materials, advanced coating techniques for enhanced durability, and modular designs that simplify installation, offer avenues for product differentiation and market expansion. The development of hybrid systems that combine solar with other renewables or energy storage solutions also presents new application areas for fixed mounting systems. Impact forces, such as the bargaining power of buyers (large utility companies or EPCs demanding competitive pricing) and suppliers (raw material providers), competitive rivalry among mounting system manufacturers, and the threat of substitutes (e.g., advanced thin-film PV that might integrate differently) or new entrants, continuously shape market dynamics and encourage innovation and efficiency improvements across the value chain.

Segmentation Analysis

The Fixed Solar PV Mounting Systems market is segmented based on several critical parameters, offering a comprehensive view of its structure and dynamics. These segments enable a detailed analysis of market trends, consumer preferences, and technological advancements across different applications and product types. Understanding these segmentations is vital for stakeholders to identify growth areas, tailor product offerings, and formulate effective market penetration strategies. The market is primarily bifurcated by system type, material used, and application, with further sub-segmentations providing granular insights into specific market niches and emerging trends.

- By Type

- Ground Mounted Systems: Large-scale installations on open land, typically for utility and commercial use.

- Rooftop Mounted Systems: Installations on building rooftops, common in residential and commercial sectors.

- Pitched Roof

- Flat Roof

- By Material

- Steel: Known for strength, durability, and cost-effectiveness, widely used in ground-mounted systems.

- Aluminum: Lightweight, corrosion-resistant, often preferred for rooftop applications and areas with high humidity.

- Other Materials: Includes composites, concrete, and specialized alloys for niche applications.

- By Application

- Utility Scale: Large installations generating power for the grid, often ground-mounted.

- Commercial: Solar systems for businesses, offices, and industrial facilities, typically rooftop or smaller ground-mounted.

- Residential: Solar installations on individual homes, predominantly rooftop-mounted.

- By Installation Method

- Ballasted: Uses weights to secure mounts without roof penetration, common on flat roofs.

- Penetrative: Directly attaches to the roof or ground structure, ensuring high stability.

- Non-penetrative: Often clamped or adhered, used in specific rooftop scenarios.

Value Chain Analysis For Fixed Solar PV Mounting Systems Market

The value chain for the Fixed Solar PV Mounting Systems market is complex and involves several key stages, beginning from raw material sourcing to final installation and after-sales support. Upstream analysis focuses on the procurement of primary materials essential for manufacturing the mounting structures. This primarily includes suppliers of steel (galvanized, stainless) and aluminum (extruded profiles, sheets), which are critical for providing the structural integrity and durability required for these systems. Other upstream suppliers provide fasteners, coatings, and specialized components like clamps and rails. The efficiency and cost-effectiveness at this stage are crucial, as raw material prices directly impact the final product cost and market competitiveness.

Midstream activities involve the design, engineering, and manufacturing of the mounting systems. Manufacturers utilize CAD/CAM software for design optimization, ensuring structural integrity, ease of assembly, and adherence to various load specifications (wind, snow). Fabrication processes include cutting, bending, welding, and surface treatments to produce the final components. Quality control and adherence to international standards are paramount at this stage to ensure product reliability and longevity. Innovation in modular design and assembly techniques is a key competitive differentiator, aiming to reduce installation time and labor costs.

Downstream analysis encompasses distribution, installation, and end-user engagement. Mounting systems are distributed through a mix of direct sales channels, where manufacturers sell directly to large utility-scale project developers or major EPC contractors, and indirect channels, which involve a network of distributors, wholesalers, and specialized solar installers. These indirect channels cater primarily to commercial and residential markets, providing localized service and support. Installers and EPC firms are critical in the final assembly and commissioning of solar projects, ensuring proper integration of the mounting systems with PV panels and other electrical components. After-sales support, including warranty services and technical assistance, completes the value chain, ensuring customer satisfaction and fostering long-term relationships.

Fixed Solar PV Mounting Systems Market Potential Customers

The potential customers for Fixed Solar PV Mounting Systems are diverse, spanning across various sectors that are increasingly adopting solar energy solutions. These end-users are primarily categorized by the scale and nature of their energy consumption and their investment capabilities in renewable infrastructure. Identifying and understanding these distinct customer segments is crucial for manufacturers and distributors to tailor their product offerings, marketing strategies, and sales approaches effectively. The broad shift towards sustainability and energy independence across the globe continues to expand this customer base.

A significant portion of the customer base consists of large-scale utility companies and independent power producers (IPPs) who develop and operate vast solar farms. These entities require robust, scalable, and cost-effective ground-mounted systems capable of withstanding various environmental conditions over long operational lifespans. Their purchasing decisions are heavily influenced by total cost of ownership, installation efficiency, and compliance with stringent performance and safety standards. They often engage in direct procurement from manufacturers or through large engineering, procurement, and construction (EPC) contractors.

Another key segment includes commercial and industrial (C&I) businesses. These customers range from small businesses installing solar on their premises to large corporations seeking to offset significant energy consumption and enhance their corporate social responsibility profile. For C&I customers, both rooftop and ground-mounted solutions are relevant, depending on available space and energy needs. Their decisions are driven by potential energy bill savings, return on investment, and the ability to demonstrate environmental stewardship. The residential sector forms the third major customer group, comprising individual homeowners seeking to reduce electricity costs, increase energy independence, and contribute to environmental sustainability, typically opting for rooftop-mounted systems. Furthermore, governmental agencies and educational institutions also represent potential customers, driven by public mandates for renewable energy and long-term cost savings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $12.5 Billion |

| Market Forecast in 2032 | $22.4 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Array Technologies, Nextracker, STI Norland, Convert Italia, GameChange Solar, RBI Solar, Schletter Group, Soltec Power Holdings, Arctech Solar, Clenergy, K2 Systems, Renusol Europe, TerraSmart, DPW Solar, SunPower, Solar Steel (Gonvarri Solar Steel), Mounting Systems GmbH, PV Racking, OMCO Solar, Unirac, IronRidge, Valmont Solar |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fixed Solar PV Mounting Systems Market Key Technology Landscape

The technological landscape of the Fixed Solar PV Mounting Systems market is characterized by continuous innovation aimed at enhancing durability, reducing installation costs, and improving system adaptability to diverse environmental conditions. Material science plays a pivotal role, with ongoing research into advanced alloys of steel and aluminum that offer superior strength-to-weight ratios and enhanced corrosion resistance. Developments in surface coatings and finishes are also critical, providing better protection against harsh weather, UV degradation, and abrasive elements, thereby extending the lifespan of the mounting structures and reducing maintenance needs over the solar installation's operational period.

Design and engineering software represent another core technological advancement. Advanced Computer-Aided Design (CAD) and Finite Element Analysis (FEA) tools enable precise modeling of mounting structures, allowing engineers to optimize designs for specific wind, snow, and seismic loads, ensuring structural integrity under extreme conditions. These tools also facilitate the development of modular and pre-assembled components, which significantly reduce on-site labor requirements and accelerate installation timelines. The integration of Building Information Modeling (BIM) is also becoming more prevalent, especially for complex commercial and industrial rooftop projects, enabling better coordination and clash detection with other building systems.

Furthermore, automation and prefabrication techniques in manufacturing are transforming the production of fixed mounting systems. Automated welding, cutting, and assembly lines ensure high precision and consistency in component quality while driving down manufacturing costs. Innovations in fastening systems, such as tool-less clamps and quick-connect mechanisms, simplify the mounting of PV modules to the structures, further contributing to faster and more efficient installations. The overarching technological trend is towards creating more resilient, easy-to-install, and cost-effective mounting solutions that can support the rapid global deployment of solar photovoltaic energy, continually evolving to meet new challenges and demands in the renewable energy sector.

Regional Highlights

- North America: A mature market with strong governmental support for renewable energy, particularly in the United States and Canada. High adoption of rooftop solar in residential and commercial sectors, coupled with significant utility-scale projects.

- Europe: Driven by ambitious climate targets and feed-in tariffs, countries like Germany, Spain, and Italy are leading the adoption. Emphasis on innovative installation methods and aesthetically integrated solutions for urban environments.

- Asia Pacific (APAC): The largest and fastest-growing market, primarily led by China, India, and Australia. Massive investments in utility-scale solar farms and a rapidly expanding distributed generation sector due to increasing energy demand and favorable policies.

- Latin America: Emerging market with abundant solar resources and increasing investments, particularly in Brazil, Mexico, and Chile. Focus on large ground-mounted projects for industrial and utility sectors.

- Middle East and Africa (MEA): High growth potential due to vast untapped solar resources and national diversification strategies away from fossil fuels. Saudi Arabia, UAE, and South Africa are key players with significant planned projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fixed Solar PV Mounting Systems Market.- Array Technologies

- Nextracker

- STI Norland

- Convert Italia

- GameChange Solar

- RBI Solar

- Schletter Group

- Soltec Power Holdings

- Arctech Solar

- Clenergy

- K2 Systems

- Renusol Europe

- TerraSmart

- DPW Solar

- SunPower

- Solar Steel (Gonvarri Solar Steel)

- Mounting Systems GmbH

- PV Racking

- OMCO Solar

- Unirac

- IronRidge

- Valmont Solar

Frequently Asked Questions

What are the primary types of fixed solar PV mounting systems?

The primary types include ground-mounted systems, which are ideal for large utility-scale projects on open land, and rooftop-mounted systems, commonly used for residential and commercial buildings. Rooftop systems further segment into pitched and flat roof applications, each requiring specific design considerations.

How do fixed mounting systems differ from solar trackers?

Fixed mounting systems hold solar panels in a stationary, optimized position, offering cost-effectiveness and durability. Solar trackers, conversely, dynamically adjust panel orientation to follow the sun's path, maximizing energy capture but involving higher initial costs and maintenance requirements.

What materials are commonly used in fixed solar PV mounting systems?

Steel and aluminum are the most common materials. Steel is valued for its strength and cost-effectiveness, especially in ground-mounted applications, while aluminum is favored for its lightweight and corrosion-resistant properties, making it suitable for rooftop installations and humid environments.

What are the main drivers of growth in the fixed solar PV mounting systems market?

Key drivers include increasing global demand for renewable energy, supportive government policies and incentives for solar adoption, and the continuous reduction in the overall cost of solar PV technology, making installations more economically viable for a wider range of customers.

How does AI impact the development and deployment of fixed solar mounting systems?

AI impacts the market by optimizing system design and placement through advanced site assessment, enabling predictive maintenance for structural integrity, and streamlining manufacturing and installation processes through automation. It also enhances logistics and overall project management efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager