Fixed Wireless Access Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431155 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Fixed Wireless Access Market Size

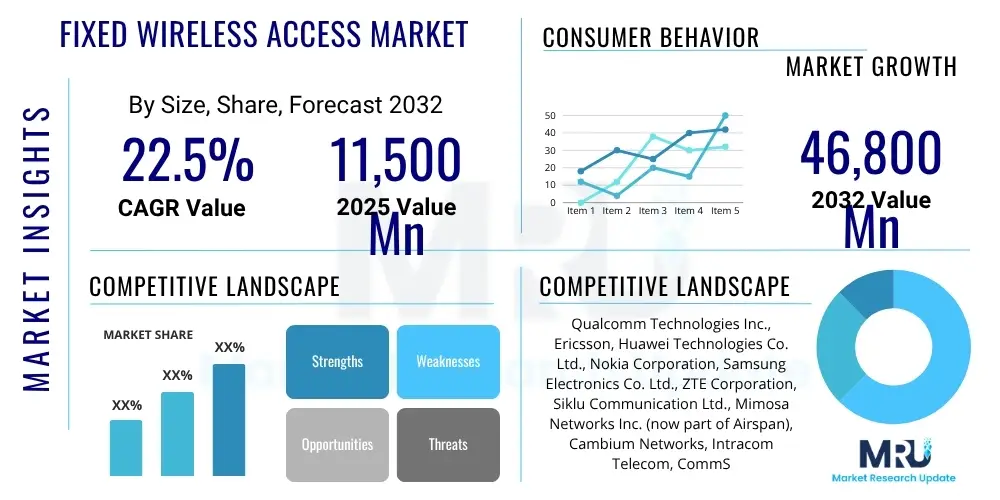

The Fixed Wireless Access Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.5% between 2025 and 2032. The market is estimated at USD 11,500 Million in 2025 and is projected to reach USD 46,800 Million by the end of the forecast period in 2032.

Fixed Wireless Access Market introduction

The Fixed Wireless Access (FWA) market represents a rapidly expanding segment within the telecommunications industry, offering an alternative to traditional wired broadband connections. FWA utilizes wireless cellular technology, primarily 4G LTE and increasingly 5G, to provide high-speed internet access to homes and businesses without the need for physical fiber or copper lines extending directly to the premise. This innovative approach involves installing an outdoor or indoor receiver at the customer location, which connects wirelessly to a nearby cellular tower, delivering robust and reliable broadband services.

Major applications of FWA span across various sectors, including residential broadband for urban, suburban, and especially rural areas where wired infrastructure is costly or unavailable, enterprise connectivity for small and medium businesses, and specialized industrial uses like smart factories and remote monitoring for IoT. The core benefits of FWA include faster deployment times, significant cost savings compared to trenching for fiber, increased flexibility in service delivery, and its crucial role in bridging the global digital divide by extending high-speed internet to underserved populations. These advantages are amplified by the accelerating global rollout of 5G networks, which provide the necessary bandwidth and low latency to make FWA a competitive and compelling broadband solution.

The primary driving factors behind the FWA market's robust growth include the pervasive demand for high-speed, low-latency internet connectivity for diverse applications from streaming to cloud computing, coupled with the inherent advantages of wireless deployment. The expansion of 5G infrastructure, characterized by its massive capacity and efficiency, is perhaps the most significant catalyst, transforming FWA into a legitimate alternative to fiber. Furthermore, supportive government initiatives and funding programs aimed at enhancing digital inclusion and universal broadband access, particularly in rural and remote regions, are actively stimulating market adoption and investment. The cost-effectiveness of FWA deployment, especially when compared to the capital-intensive rollout of fiber-to-the-home (FTTH), makes it an attractive proposition for telecommunication operators seeking to expand their subscriber base efficiently.

Fixed Wireless Access Market Executive Summary

The Fixed Wireless Access (FWA) market is experiencing dynamic business trends, marked by increasing investment from major telecom operators who are leveraging their existing cellular infrastructure to offer broadband services. A significant trend involves strategic partnerships between technology providers and network operators to accelerate 5G FWA deployments, alongside a growing focus on customer premises equipment (CPE) innovation to enhance installation ease and performance. Consolidation activities and mergers within the wireless technology sector are also shaping the competitive landscape, aiming to create more integrated and efficient FWA ecosystems. Service providers are increasingly diversifying their offerings, bundling FWA with mobile services to attract and retain subscribers, while also exploring new business models such as providing FWA as a primary or backup solution for enterprises.

Regionally, the market exhibits diverse growth patterns. North America and parts of Europe are leading in 5G FWA adoption, driven by strong consumer demand for high-speed internet and aggressive operator strategies. Asia Pacific, particularly countries like India and China, is projected to be a powerhouse for FWA growth, fueled by vast populations, significant digital divide challenges, and proactive government investments in digital infrastructure. Latin America, the Middle East, and Africa are also emerging as key growth regions, where FWA presents a viable and often superior alternative to underdeveloped or non-existent wired networks, facilitating rapid expansion of internet access in underserved communities. Regulatory frameworks and spectrum availability play a crucial role in determining the pace and scale of FWA deployment across these diverse geographies.

Segment-wise, the 5G FWA segment is poised for exponential growth, becoming the dominant technology due to its superior speed, capacity, and low latency capabilities compared to 4G LTE FWA. The residential application segment continues to be the largest consumer of FWA services, driven by the increasing demand for reliable home broadband and the work-from-home trend. However, the commercial and industrial segments are witnessing accelerated adoption as businesses seek flexible, rapidly deployable, and scalable connectivity solutions for offices, retail locations, and IoT deployments. Rural areas remain a critical demographic focus for FWA, offering significant untapped potential for operators. Furthermore, advancements in millimeter-wave (mmWave) technology are enabling ultra-high-speed FWA in dense urban environments, while sub-6 GHz spectrum remains vital for broader coverage and penetration.

AI Impact Analysis on Fixed Wireless Access Market

Common user questions about AI's impact on Fixed Wireless Access primarily revolve around how artificial intelligence can enhance network performance, reliability, and customer experience. Users often inquire about AI's role in optimizing network resource allocation, predicting and preventing outages, and automating complex operational tasks. There is also significant interest in how AI contributes to personalized service delivery and dynamic spectrum management in FWA deployments. Key themes consistently emerging include the expectation that AI will make FWA networks smarter, more efficient, and more resilient, addressing potential challenges like signal interference and fluctuating bandwidth demands. Concerns often touch upon the data security implications of AI integration and the expertise required for effective implementation.

- AI-driven network optimization: Enhances spectral efficiency, optimizes cell tower resource allocation, and manages traffic flow dynamically for improved performance and reduced congestion.

- Predictive maintenance: Utilizes machine learning algorithms to analyze network data, anticipate equipment failures, and enable proactive maintenance, minimizing downtime and improving network reliability.

- Automated fault detection and resolution: AI systems can quickly identify and diagnose network issues, often resolving them automatically or guiding technicians, leading to faster restoration of services.

- Enhanced customer experience: AI chatbots and virtual assistants provide immediate support, while AI-powered analytics enable personalized service offerings and proactive troubleshooting based on user behavior and network conditions.

- Dynamic spectrum management: AI algorithms can dynamically allocate spectrum resources based on real-time demand, ensuring efficient use of limited spectrum and optimizing signal quality.

- Security and fraud detection: AI enhances network security by identifying unusual patterns indicative of cyber threats or fraudulent activities, bolstering the overall integrity of FWA networks.

- Network planning and deployment: AI tools assist operators in optimizing site selection for FWA base stations, predicting coverage areas, and managing interference, streamlining deployment processes.

DRO & Impact Forces Of Fixed Wireless Access Market

The Fixed Wireless Access (FWA) market is propelled by a confluence of powerful drivers, notably the global surge in demand for high-speed internet connectivity for both residential and commercial users, exacerbated by the shift towards remote work and digital entertainment. The accelerated deployment of 5G networks worldwide provides the foundational infrastructure for robust FWA services, offering fiber-like speeds and lower latency. FWA's inherent cost-effectiveness and significantly faster deployment times compared to traditional fiber optic installations make it an attractive alternative, especially in challenging terrains or underserved rural areas. Furthermore, substantial government initiatives and funding programs aimed at bridging the digital divide and promoting universal broadband access are actively catalyzing market expansion and encouraging operator investment in FWA technologies.

Despite the strong growth trajectory, the FWA market faces notable restraints. The availability and cost of suitable spectrum remain a significant challenge, as access to licensed frequencies is crucial for reliable and high-capacity FWA services. Signal interference, particularly in dense urban environments or areas with diverse topographical features, can impact service quality and consistency. Regulatory hurdles and complex licensing procedures in some regions can slow down deployment and innovation. Additionally, while 5G FWA performance is impressive, potential latency concerns for highly sensitive applications and intense competition from established fiber optic and cable broadband providers in urban and suburban markets present ongoing challenges for market penetration and differentiation. Technological limitations in overcoming obstacles like heavy foliage or building penetration also pose design and deployment complexities.

Opportunities for the FWA market are abundant and varied. The vast segments of underserved rural and remote populations globally present a substantial untapped market for affordable and high-speed internet access. The proliferation of smart city initiatives and the expanding ecosystem of IoT devices create new demands for ubiquitous and reliable wireless connectivity, where FWA can play a pivotal role. Offering FWA as a primary or secondary broadband solution for enterprises, particularly for business continuity and rapid branch office deployments, represents a growing niche. Continued innovation in antenna technologies, such as Massive MIMO and beamforming, coupled with advancements in customer premises equipment, will enhance network performance and expand market reach. Furthermore, the development of new frequency bands and more flexible spectrum sharing models could alleviate current spectrum constraints and unlock further growth potential for FWA providers, solidifying its position as a critical component of the global connectivity landscape.

Segmentation Analysis

The Fixed Wireless Access market is comprehensively segmented to provide a detailed understanding of its diverse components and target audiences. This segmentation is crucial for market participants to identify niche opportunities, tailor service offerings, and develop targeted strategies. The market is primarily analyzed across various dimensions including the underlying technology, the specific application areas it serves, the demographics of its end-users, the operating environment of its deployment, and the frequency bands utilized for transmission. Each segment offers distinct characteristics and growth potential, influenced by technological advancements, regulatory frameworks, and evolving consumer and business needs.

Understanding these segments allows for a granular view of market dynamics. For instance, the transition from 4G LTE to 5G FWA marks a significant technological shift, offering superior performance and enabling new applications. The residential segment, while dominant, is experiencing shifts in demand for higher speeds, while commercial and industrial applications are increasingly seeking reliable FWA for critical operations. Geographical and demographic factors, such as the prevalence of rural populations, heavily influence deployment strategies and market penetration. Similarly, the choice of frequency band directly impacts coverage, capacity, and overall service quality, driving innovation in equipment and network architecture to optimize performance across different operational contexts. This multifaceted segmentation helps in dissecting the complex FWA ecosystem and projecting future growth trajectories across its various components.

- By Technology

- 4G LTE FWA

- 5G FWA

- Other (e.g., 3G, WiMAX)

- By Application

- Residential

- Commercial

- Industrial

- Government

- By Demographics

- Urban

- Suburban

- Rural

- By Operating Environment

- Outdoor (Customer Premises Equipment)

- Indoor (Customer Premises Equipment)

- By Frequency Band

- Sub-6 GHz

- mmWave (e.g., 24 GHz, 28 GHz, 39 GHz)

Value Chain Analysis For Fixed Wireless Access Market

The Fixed Wireless Access market's value chain is a complex ecosystem involving multiple stages, from foundational technology development to end-user service delivery. At the upstream end, the value chain begins with component manufacturers responsible for producing crucial hardware such as chipsets, modems, antennas, and radio frequency (RF) modules that enable wireless communication. This also includes infrastructure providers specializing in base station equipment, network hardware, and software solutions for network management. Research and development activities at this stage are critical for driving innovation in wireless standards (like 5G NR), optimizing performance, and reducing costs. These foundational elements are then supplied to network equipment vendors who integrate these components into complete FWA solutions.

Moving downstream, the value chain progresses through the deployment and operational phases. Network equipment vendors supply comprehensive FWA systems, including base stations and customer premises equipment (CPE), to telecommunication operators and internet service providers (ISPs). These operators are responsible for network planning, spectrum acquisition, infrastructure deployment, and managing the core network elements. They then package and market FWA services to end-users. The distribution channels for FWA services are predominantly direct, where telecom operators sell directly to residential and business customers through their sales forces, online platforms, and retail stores. However, indirect channels also play a role, involving partnerships with resellers, system integrators, and local service providers, especially in reaching specific enterprise segments or remote communities.

The final stage of the value chain focuses on customer engagement and service delivery. This includes installation, customer support, billing, and ongoing maintenance of FWA connections. End-users, who are the ultimate buyers of the product, encompass a broad range from individual households requiring residential broadband to large enterprises seeking reliable connectivity, and even government agencies or industrial entities deploying IoT solutions. The efficiency and effectiveness of the entire value chain are critical for the successful adoption and sustained growth of the FWA market. Optimizing collaboration between component suppliers, equipment manufacturers, network operators, and distribution partners is paramount to delivering high-quality, affordable FWA services that meet the evolving demands of a connected world.

Fixed Wireless Access Market Potential Customers

The Fixed Wireless Access market targets a broad and diverse range of potential customers, spanning both consumer and enterprise segments, largely driven by the universal demand for reliable, high-speed internet connectivity. At the forefront are residential customers, particularly those residing in rural and suburban areas where traditional wired broadband infrastructure is either unavailable, economically unfeasible to deploy, or offers suboptimal performance. FWA presents an attractive alternative for households seeking faster internet speeds for streaming, online gaming, remote work, and smart home applications, without the complexities and costs associated with fiber installation. Urban residents also represent potential customers, especially in areas where incumbent wired providers offer limited choice or face capacity constraints, with FWA serving as a competitive option or backup connection.

Beyond individual households, Small and Medium Businesses (SMBs) constitute a significant and growing customer base for FWA. These businesses often require reliable internet for their daily operations, cloud-based applications, and point-of-sale systems but may lack access to enterprise-grade wired connections or seek more flexible and rapidly deployable solutions. FWA offers SMBs a cost-effective and scalable broadband option, supporting their digital transformation initiatives. Furthermore, larger enterprises, while typically having access to fiber, increasingly utilize FWA for business continuity as a redundant connection, for temporary deployments at new sites, or to provide connectivity to remote branch offices where wired infrastructure is impractical. The rapid deployment capability of FWA makes it ideal for pop-up events, construction sites, and emergency services.

Other key end-users include educational institutions, healthcare providers, and various government agencies. Schools and universities can leverage FWA to provide connectivity to students and staff, particularly in remote campuses or for e-learning initiatives. Healthcare facilities, especially those in rural settings, benefit from FWA for telemedicine, electronic health records, and remote monitoring systems. Government bodies may utilize FWA for smart city projects, public safety networks, and providing internet access to underserved communities as part of digital inclusion programs. Lastly, the burgeoning Internet of Things (IoT) sector represents a critical growth area, with FWA providing the necessary backbone for connecting a vast array of sensors, devices, and industrial equipment in smart factories, agricultural settings, and logistics operations, demonstrating the broad applicability and enduring value proposition of Fixed Wireless Access solutions across numerous sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 11,500 Million |

| Market Forecast in 2032 | USD 46,800 Million |

| Growth Rate | 22.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Qualcomm Technologies Inc., Ericsson, Huawei Technologies Co. Ltd., Nokia Corporation, Samsung Electronics Co. Ltd., ZTE Corporation, Siklu Communication Ltd., Mimosa Networks Inc. (now part of Airspan), Cambium Networks, Intracom Telecom, CommScope Inc., Cradlepoint Inc. (now part of Ericsson), T-Mobile US Inc., Verizon Communications Inc., ATandT Inc., Orange S.A., Vodafone Group Plc, Deutsche Telekom AG, Cisco Systems Inc., Inseego Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fixed Wireless Access Market Key Technology Landscape

The technological landscape of the Fixed Wireless Access market is rapidly evolving, driven primarily by advancements in cellular communication standards and associated hardware and software innovations. At its core, the current FWA market is heavily reliant on 4G LTE and, increasingly, 5G New Radio (NR) technologies. 5G NR is a game-changer for FWA, offering significantly higher bandwidth, lower latency, and greater capacity compared to its predecessors, making it a viable alternative to fiber. Key technologies underpinning 5G FWA include Massive Multiple-Input Multiple-Output (Massive MIMO), which employs a large number of antennas at the base station to concurrently serve multiple users and improve spectral efficiency, and sophisticated beamforming techniques that direct wireless signals precisely towards individual user devices, enhancing signal strength and reducing interference.

Further technological developments contributing to the FWA market include advanced antenna systems, such as phased arrays and integrated antenna solutions, which are crucial for effective operation in higher frequency bands like millimeter-wave (mmWave). mmWave FWA leverages abundant spectrum in the 24 GHz to 40 GHz range to deliver ultra-high speeds, although it typically requires line-of-sight and has a shorter range. Complementary technologies like dynamic spectrum sharing (DSS) allow operators to flexibly deploy 4G and 5G services on the same spectrum, optimizing resource utilization. Software-Defined Networking (SDN) and Network Function Virtualization (NFV) are also pivotal, enabling greater network agility, automation, and the efficient deployment and management of FWA services, allowing operators to scale resources on demand and introduce new services more rapidly.

The continued innovation in Customer Premises Equipment (CPE) is another critical aspect of the FWA technology landscape. Modern FWA CPEs are becoming more sophisticated, incorporating advanced modems, high-gain antennas, and robust Wi-Fi capabilities to ensure optimal signal reception and efficient distribution of broadband within homes and businesses. These devices often include intelligent features like self-installation guides, remote management capabilities, and integration with home networking ecosystems. Furthermore, the development of secure and efficient network slicing capabilities within 5G allows FWA providers to offer tailored connectivity solutions with guaranteed Quality of Service (QoS) for specific applications or enterprise clients, differentiating their offerings and unlocking new revenue streams. The synergy of these technologies ensures that FWA remains at the forefront of delivering next-generation wireless broadband experiences.

Regional Highlights

- North America: This region is a leading adopter of Fixed Wireless Access, driven by major telecom operators like Verizon and T-Mobile aggressively rolling out 5G FWA services. The strong demand for high-speed internet, coupled with robust infrastructure investments and a competitive market, positions North America at the forefront of FWA growth. Significant government initiatives aimed at closing the digital divide in rural areas further stimulate market expansion.

- Europe: Europe exhibits substantial growth potential for FWA, particularly as countries focus on expanding broadband coverage to rural and underserved communities. Regulatory support for 5G deployment and strategic investments by operators are key drivers. However, diverse spectrum policies and competition from established fiber networks influence the pace and nature of FWA adoption across the continent.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing market for FWA, fueled by massive population sizes, rapid urbanization, and significant government backing for digital infrastructure development in countries like India, China, and Southeast Asian nations. FWA serves as a crucial technology for providing affordable internet access to vast, unserved populations and supporting smart city initiatives.

- Latin America: The FWA market in Latin America is characterized by its role in addressing the significant digital divide, especially in remote and rural areas where wired infrastructure is scarce. Expanding mobile broadband penetration and government efforts to improve connectivity are propelling FWA adoption, offering a cost-effective and rapid deployment solution for internet access.

- Middle East and Africa (MEA): MEA presents considerable opportunities for FWA due to underdeveloped wired infrastructure and a high demand for internet services. Governments and operators are investing in FWA to bring connectivity to remote regions and rapidly urbanizing areas. The focus on affordable and quickly deployable solutions makes FWA a vital technology for digital inclusion and economic growth in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fixed Wireless Access Market.- Qualcomm Technologies Inc.

- Ericsson

- Huawei Technologies Co. Ltd.

- Nokia Corporation

- Samsung Electronics Co. Ltd.

- ZTE Corporation

- Siklu Communication Ltd.

- Mimosa Networks Inc. (now part of Airspan)

- Cambium Networks

- Intracom Telecom

- CommScope Inc.

- Cradlepoint Inc. (now part of Ericsson)

- T-Mobile US Inc.

- Verizon Communications Inc.

- ATandT Inc.

- Orange S.A.

- Vodafone Group Plc

- Deutsche Telekom AG

- Cisco Systems Inc.

- Inseego Corp.

Frequently Asked Questions

What is Fixed Wireless Access FWA?

Fixed Wireless Access (FWA) is a method of providing broadband internet access to homes and businesses using wireless cellular technology, typically 4G LTE or 5G, instead of traditional wired connections like fiber or cable. It employs an outdoor or indoor receiver at the customer's premises to connect wirelessly to a nearby cell tower.

How fast is Fixed Wireless Access?

FWA speeds vary significantly depending on the technology used (4G LTE vs. 5G), network congestion, and signal quality. 4G LTE FWA can offer speeds comparable to DSL or basic cable, while 5G FWA, especially utilizing millimeter-wave spectrum, can deliver fiber-like speeds ranging from 100 Mbps to over 1 Gbps, providing robust performance for demanding applications.

What are the primary benefits of FWA?

The main benefits of FWA include rapid deployment without extensive civil works, cost-effectiveness compared to trenching for fiber, greater flexibility in service provision, and its crucial role in bridging the digital divide by extending high-speed internet to underserved and rural areas where wired infrastructure is economically impractical.

Is FWA a viable alternative to fiber optic internet?

For many applications and locations, especially with 5G technology, FWA is indeed a viable alternative to fiber. It offers competitive speeds and lower latency, making it suitable for residential broadband, remote work, and many business applications. While fiber might offer ultimate capacity and the lowest latency, FWA provides a compelling and often more accessible solution, particularly in areas lacking fiber infrastructure.

Which regions are leading in FWA adoption?

North America, particularly the United States, is a leader in FWA adoption due to aggressive 5G deployments by major carriers. Asia Pacific, driven by countries like India and China, is experiencing rapid growth due to vast populations and government initiatives. Europe is also seeing increasing FWA deployments, especially in rural areas.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager