Flavoring Agents Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430663 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Flavoring Agents Market Size

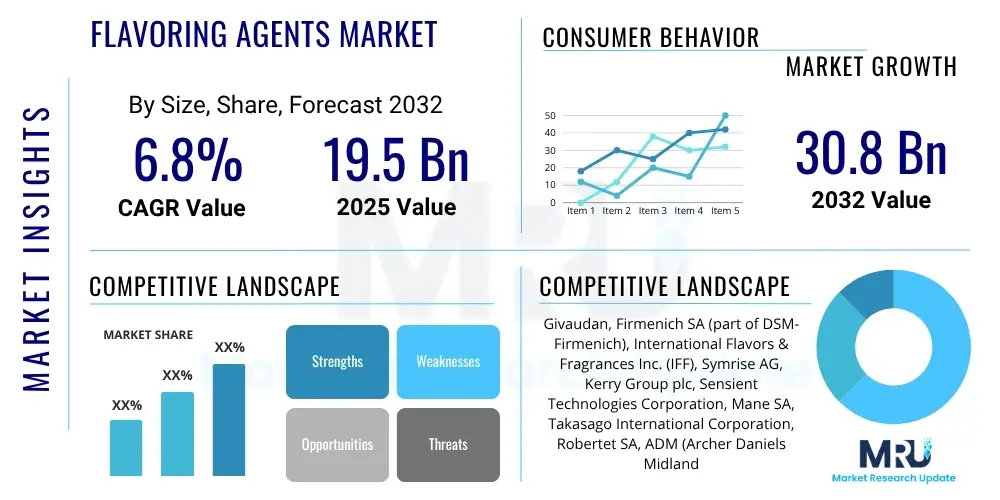

The Flavoring Agents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 19.5 Billion in 2025 and is projected to reach USD 30.8 Billion by the end of the forecast period in 2032.

Flavoring Agents Market introduction

The global flavoring agents market encompasses a diverse and dynamic sector dedicated to enhancing the taste and aroma of a wide array of products. These agents are essential components in modern food and beverage manufacturing, playing a critical role in creating distinct product identities, masking undesirable inherent tastes, and ensuring consistent flavor profiles across different production batches and geographical markets. The market spans both natural and artificial compounds, catering to a broad spectrum of consumer preferences, technological requirements, and evolving regulatory landscapes. Products range from classic sweet and savory notes to complex blends mimicking exotic fruits, traditional spices, and sophisticated culinary experiences, finding widespread application across numerous industries.

Flavoring agents are generally categorized by their origin and chemical structure. Natural flavoring agents are derived through physical, enzymatic, or microbiological processes from natural sources such as plants (fruits, vegetables, herbs, spices), animals, or microbial fermentation, often involving sophisticated extraction and purification techniques to capture their authentic essence. Conversely, artificial (or synthetic) flavoring agents are chemically produced compounds designed to mimic natural flavors or to create entirely novel taste sensations not found in nature. Major applications of these agents are predominantly found within the expansive food and beverage industry, including the production of confectionery, bakery goods, dairy products, snacks, processed meats, soups, sauces, and a vast array of alcoholic and non-alcoholic beverages. Beyond food, their utility extends to pharmaceuticals for masking bitter active ingredients, oral care products to improve palatability, and even animal feed to enhance intake.

The benefits derived from the use of flavoring agents are multifaceted and crucial for market success. They significantly improve product palatability and consumer acceptance, which is vital for brand loyalty and repeat purchases. Flavorings enable product innovation, allowing manufacturers to launch new and exciting taste experiences that capture consumer interest and drive market growth. Furthermore, they contribute to extended product shelf-life by masking off-notes that might develop over time and ensure a consistent consumer experience, irrespective of raw material variability. Key driving factors propelling this market include the escalating global demand for convenience foods due to busy lifestyles, increasing consumer curiosity and preference for diverse, international, and exotic flavors, the steady expansion of the global population, and profound shifts in dietary patterns towards plant-based, functional, and health-conscious food options. Continuous advancements in flavor technology, including more efficient extraction methods and stable delivery systems, further accelerate market expansion by enabling the creation of more authentic, versatile, and cost-effective flavor solutions.

Flavoring Agents Market Executive Summary

The global flavoring agents market is currently experiencing robust expansion, fundamentally propelled by dynamic shifts in consumer preferences and an accelerated pace of product innovation within the global food and beverage sector. Strategic business trends indicate a pronounced industry-wide pivot towards natural and clean-label ingredient solutions, compelling manufacturers to substantially increase their investments in advanced research and development for naturally derived flavor compounds, alongside establishing more sustainable and ethical sourcing practices. A significant emphasis is also placed on the development of highly customized flavor profiles, leveraging sophisticated data analytics and real-time consumer insights to meticulously cater to distinct regional tastes, evolving dietary restrictions, and specific demographic preferences. The landscape is also characterized by frequent strategic mergers, acquisitions, and partnerships, as key players actively pursue opportunities to consolidate market share, diversify their product portfolios, and integrate cutting-edge technological capabilities, fostering an environment of intense competition and continuous innovation.

An analysis of regional trends reveals that Asia Pacific stands out as a paramount growth hub, exhibiting the most rapid expansion rate within the global flavoring agents market. This impressive growth is largely attributed to its expansive and burgeoning population, consistently rising disposable incomes that fuel consumer spending, and the progressive Westernization of diets which translates into a heightened consumption of processed and convenience foods. Conversely, North America and Europe, while representing mature market landscapes, continue to be significant centers of innovation. These regions are primarily focused on the development and marketing of premium, functional, and health-oriented flavor offerings, including low-sugar, low-sodium, and an extensive array of plant-based flavor alternatives that resonate with health-conscious consumer segments. Emerging markets across Latin America and the Middle East & Africa are demonstrating substantial untapped potential, driven by accelerating urbanization, rapidly evolving retail infrastructures, and an increasing consumer appetite for diverse food and beverage products, consequently attracting significant investments in localized flavor production capacities and optimized distribution networks.

Segment-specific trends underscore the enduring dominance of savory and sweet flavors, although these traditional categories are now experiencing a notable surge in demand for more exotic, authentically ethnic, and intricate flavor blends that promise unique and highly differentiated taste experiences. The beverage sector, particularly the non-alcoholic segment, emerges as a critical growth area for flavoring agents, underpinned by relentless innovation in functional beverages, a burgeoning market for flavored waters, and novel soft drink formulations designed to meet diverse consumer needs. Within the broader market, specific flavor types such as classic vanilla, rich chocolate, various fruit essences, and complex spice blends maintain consistently high demand, alongside a rapidly growing interest in nuanced umami and botanical notes, reflecting a sophisticated evolution in consumer palatability. Furthermore, the pervasive industry push for healthier food options is actively stimulating the development of advanced flavor enhancers capable of reducing sugar and salt content without compromising on taste, signaling a crucial strategic direction for future segment growth and technological breakthroughs.

AI Impact Analysis on Flavoring Agents Market

User inquiries concerning the influence of Artificial Intelligence on the flavoring agents market predominantly focus on how AI can fundamentally transform and optimize various stages of flavor creation, accurately predict consumer preferences, and significantly enhance overall production efficiency. There is keen interest in AI's potential to dramatically accelerate the discovery and synthesis of novel flavor molecules, allowing for a much faster ideation-to-market cycle for new products. Users also question AI's capability to personalize taste profiles to an unprecedented degree and to automate traditionally labor-intensive aspects of the flavor development process, thereby fostering innovation at an accelerated pace. Common concerns frequently raised include the potential for job displacement among traditional flavorists and sensory scientists, the ethical ramifications of AI-generated flavors regarding authenticity and naturalness, and the reliability and nuance of AI in truly capturing the intricate complexities of human taste perception. Despite these concerns, there is a widespread expectation that AI is poised to play a profoundly transformative role in the future of flavor innovation, presenting both immense opportunities for heightened creativity and significant challenges related to intellectual property, regulatory compliance, and consumer acceptance of synthetic, AI-derived tastes.

- AI-driven predictive analytics for identifying and forecasting emerging consumer taste trends and preferences across diverse demographics and regions.

- Accelerated discovery and synthesis of novel flavor compounds and molecules through machine learning algorithms and computational chemistry, reducing R&D timelines.

- Optimization of complex flavor formulations to achieve precise desired taste profiles, sensory attributes, and textural interactions more efficiently than traditional methods.

- Enhanced quality control and consistency in large-scale flavor production through AI-powered real-time monitoring and anomaly detection in manufacturing processes.

- Personalized flavor recommendations and bespoke product development based on granular individual consumer data analysis and preference mapping.

- Automation of routine and repetitive tasks in flavor development, testing, and sensory evaluation, thereby improving laboratory efficiency and reducing human error.

- Development of entirely new, synthetic, or bio-identical flavor profiles that are challenging or impossible to create using conventional flavor chemistry techniques.

- Supply chain optimization for sourcing rare or seasonal natural flavor ingredients, leveraging AI for logistics, demand forecasting, and risk management.

- Improved understanding of intricate flavor-ingredient interactions, stability under various processing conditions, and shelf-life characteristics through advanced data modeling.

DRO & Impact Forces Of Flavoring Agents Market

The flavoring agents market is profoundly influenced by a complex interplay of driving forces, inherent restraints, and emerging opportunities, alongside various external impact forces that collectively dictate its trajectory and future landscape. A primary and persistent driver is the unrelenting growth of the global population coupled with increasing urbanization, which inevitably escalates the demand for processed, packaged, and ready-to-eat foods. These convenience-oriented products are heavily reliant on diverse and sophisticated flavoring agents to ensure their appeal, palatability, and consistent taste profile across mass production. Furthermore, the relentless pace of innovation within the food and beverage industry, fueled by increasingly sophisticated consumer tastes and an insatiable quest for novel culinary experiences, necessitates a continuous supply of new, authentic, and improved flavor profiles. Rising disposable incomes, particularly within rapidly developing economies, empower consumers to explore a wider variety of premium and specialty flavored food and beverage items, significantly contributing to the overall market expansion. The growing awareness and demand for functional foods and beverages, often enhanced with specific flavorings to mask undesirable notes or improve palatability of health-promoting ingredients, also serve as a strong market impetus, pushing for specialized flavor solutions.

However, the market navigates several substantial restraints that pose significant challenges and could potentially impede its growth trajectory. Stringent and evolving regulatory frameworks, coupled with rigorous food safety standards imposed by various governmental and international bodies such as the FDA, EFSA, and regional authorities, present considerable hurdles. These regulations often pertain to the approval, permissible usage limits, and labeling requirements of both natural and artificial flavoring agents, necessitating costly and time-consuming compliance efforts. There is a perceptible and accelerating shift in consumer preference towards natural, clean-label, and organic ingredients, which redirects demand away from synthetic flavors. This shift often translates into higher production costs, greater supply chain complexities, and more demanding sourcing logistics for manufacturers aiming to meet these "natural" criteria. Persistent price volatility of key raw materials, particularly for natural extracts, essential oils, and botanicals, can significantly impact profitability and disrupt the stability of the supply chain. Moreover, the increasing complexity of consumer dietary restrictions, allergen concerns, and lifestyle choices necessitates substantial investment from flavor companies in developing allergen-free, vegan, and other specialty flavor solutions, further adding to operational intricacies and development costs.

Despite these challenges, numerous opportunities within the flavoring agents market are abundant and highly promising, poised to drive significant future growth. The burgeoning demand for plant-based and vegan food products presents a vast and largely untapped avenue for developing innovative savory and sweet flavorings that can authentically mimic traditional animal-derived tastes or significantly enhance the palatability of plant-based ingredients. The escalating trend towards personalization in food and beverages, driven by individual health consciousness, specific dietary needs, and unique taste preferences, offers fertile ground for bespoke flavor solutions and customized product development. Continuous technological advancements in extraction methodologies (e.g., precision fermentation, supercritical fluid extraction), encapsulation techniques (e.g., microencapsulation for controlled release), and biotechnology are enabling the creation of more stable, authentic, cost-effective, and sustainably produced natural flavors. Furthermore, the rapid expansion of e-commerce platforms and direct-to-consumer models is opening up novel and efficient distribution channels for specialty flavor ingredients, allowing wider market reach. Overall, the market's impact forces are dynamically steered by evolving consumer health trends, relentless technological innovation, increasing regulatory scrutiny, and a growing emphasis on sustainability and ethical sourcing, compelling continuous adaptation and strategic development from market players to sustain competitiveness and achieve robust growth in this highly intricate and dynamic sector.

Segmentation Analysis

The flavoring agents market is meticulously segmented across various crucial parameters, including but not limited to type, origin, application, and form, thereby providing a highly granular and comprehensive view of the intricate market dynamics and diverse consumer preferences. This exhaustive segmentation is instrumental in precisely identifying specific growth drivers and existing challenges within each distinct sub-market, consequently enabling companies to strategically tailor their product development initiatives, refine their marketing approaches, and optimize their distribution channels. The inherent diversity within these segmentation categories clearly reflects the complex and multidisciplinary nature of flavor creation, spanning from basic chemical synthesis to advanced biological fermentation, and highlights its widespread and indispensable integration across a multitude of industries, ranging from foundational processed foods to highly specialized pharmaceuticals.

- By Type

- Artificial Flavoring Agents: Chemically synthesized compounds mimicking natural or creating novel flavors.

- Natural Flavoring Agents: Derived from natural sources like plants, animals, or microbes through physical, enzymatic, or fermentation processes.

- By Origin

- Plant-based: Flavors derived from fruits, vegetables, herbs, spices, and other botanical sources.

- Animal-based: Flavors derived from meat, dairy, or other animal products.

- Synthetic: Flavors created through chemical synthesis in laboratories.

- Microbial: Flavors produced via fermentation using microorganisms.

- By Application

- Food and Beverages

- Bakery and Confectionery: Cakes, cookies, chocolates, candies, pastries.

- Dairy and Frozen Desserts: Yogurts, ice creams, flavored milks, cheese.

- Snacks and Savory: Potato chips, extruded snacks, seasonings, processed meats.

- Beverages (Alcoholic and Non-Alcoholic): Soft drinks, juices, functional drinks, spirits, beer.

- Meat, Poultry, and Seafood: Processed meats, marinades, seafood preparations.

- Soups, Sauces, and Dressings: Ready-to-use sauces, gravies, salad dressings.

- Ready-to-Eat Meals: Instant meals, frozen dinners, convenience foods.

- Pharmaceuticals: Medications, syrups, chewable tablets requiring taste masking.

- Oral Care Products: Toothpastes, mouthwashes, breath fresheners.

- Animal Feed: Pet food, livestock feed to enhance palatability.

- Tobacco and E-cigarettes: Flavorings for smoking alternatives.

- Food and Beverages

- By Form

- Liquid: Flavor extracts, essences, emulsions.

- Powder: Encapsulated flavors, spray-dried flavors, seasoning blends.

- Paste: Concentrated flavor pastes, often used in bakery and confectionery.

- Emulsion: Oil-in-water or water-in-oil emulsions for beverages and dairy.

- By Flavor Profile

- Sweet: Vanilla, Chocolate, Caramel, Fruit (strawberry, apple, orange), Berry, Honey.

- Savory: Umami (mushroom, soy), Meat (beef, chicken), Cheese, Vegetable.

- Spicy: Chili, Pepper, Ginger, Cinnamon, Clove.

- Mint and Menthol: Peppermint, Spearmint, Menthol.

- Floral: Rose, Lavender, Jasmine.

- Herbal: Rosemary, Thyme, Basil, Oregano.

- By End-Use Industry

- Food Manufacturing: All aspects of food product creation.

- Beverage Manufacturing: All aspects of drink product creation.

- Nutraceuticals: Dietary supplements, functional food ingredients.

- Personal Care and Cosmetics: Lip balms, flavored cosmetics.

- Animal Feed Industry: Feed additives for palatability.

- Pharmaceutical Industry: Drug formulation and compliance.

Value Chain Analysis For Flavoring Agents Market

The value chain for the flavoring agents market is inherently complex and spans multiple distinct stages, commencing from the meticulous sourcing of diverse raw materials and extending all the way to the final consumption of end-products by consumers. The upstream analysis primarily involves the intensive cultivation and strategic harvesting of a wide array of natural ingredients, encompassing fruits, vegetables, herbs, and spices, which serve as foundational components for natural flavors. Concurrently, it includes the intricate production of basic chemical precursors essential for the synthesis of artificial flavors. This initial stage also encompasses the crucial processing of these raw materials through various sophisticated techniques such as advanced extraction, precise distillation, controlled fermentation, and complex chemical synthesis to yield crude flavor compounds. Key participants at this foundational stage include specialized agricultural suppliers, major chemical manufacturers, and innovative biotech firms with a focus on microbial fermentation for high-value flavor production. Paramount importance is placed on stringent quality control measures and the implementation of sustainable sourcing practices at this juncture, as these factors directly and profoundly influence the final flavor quality, cost structure, and overall market acceptance of the end-product.

Midstream activities within the value chain are centered around the operations of specialized flavor houses, which represent a critical hub where crude flavor compounds undergo sophisticated refinement, precise blending, and meticulous formulation into specific, marketable flavoring agents. This stage demands extensive and highly specialized expertise in flavor chemistry, advanced sensory science, and cutting-edge application technology to ensure optimal results. Flavor houses are responsible for developing proprietary flavor blends, employing advanced encapsulation techniques to protect volatile flavor components, and conducting rigorous testing to guarantee the achievement of desired taste profiles, stability characteristics, and strict adherence to global regulatory standards. Research and development forms a cornerstone of this stage, with continuous efforts focused on pioneering novel flavor concepts, enhancing the performance and authenticity of existing ones, and developing innovative clean-label and natural flavor solutions to meet evolving consumer demands. Strategic collaborations with technology providers for advanced processing equipment, analytical instrumentation, and digital sensory evaluation tools are also a significant and increasingly vital aspect of midstream operations, contributing to efficiency and innovation.

Downstream activities encompass the critical stages of distribution and the subsequent application of flavoring agents across a multitude of end-use industries. Distribution channels for flavoring agents can be both direct and indirect. Direct channels typically involve large flavor houses supplying directly to major food and beverage manufacturers, facilitating close collaboration on product development. Indirect channels, conversely, involve a network of specialized distributors, agents, and ingredient suppliers who cater to smaller manufacturers, niche markets, and diverse industrial clients, providing broader market access. The application stage is where end-product manufacturers meticulously incorporate these flavoring agents into their final products. This requires deep technical knowledge of ingredient interactions, processing conditions (e.g., heat, pH), and optimal dosage to achieve the desired sensory impact without compromising product integrity. Marketing and sales efforts at this stage are intensely focused on demonstrating the functional, sensory, and economic benefits of specific flavors to potential buyers, often involving customized sample development. The entire value chain ultimately culminates with the consumption of flavored products by end-users, whose continuous feedback, evolving preferences, and emerging health trends serve as powerful drivers for perpetual innovation and strategic adjustments throughout every stage of the supply network, reinforcing the critical importance of a highly integrated, agile, and responsive value chain.

Flavoring Agents Market Potential Customers

The potential customer base for flavoring agents is exceptionally broad and diverse, primarily anchored within the expansive food and beverage sector but extending significantly into the pharmaceutical, nutraceutical, and personal care industries. Within the food industry, major customers include large-scale manufacturers responsible for the production of a vast range of processed foods such as confectionery items, bakery products, dairy articles, snack foods, and an ever-growing category of ready-to-eat meals. These corporations are heavily reliant on high-quality flavoring agents to create and maintain distinct product identities, ensure unparalleled consistency across massive production batches, and effectively cater to the highly diverse and often rapidly evolving taste preferences of global consumers. The relentless pursuit of product innovation and market differentiation, driven by competitive pressures, consistently fuels their demand for novel, specialty, and authentic flavors. Additionally, a substantial and growing segment of small and medium-sized food enterprises also constitutes a significant customer base, often procuring their flavor requirements through specialized distributors and ingredient suppliers.

The beverage industry represents another fundamentally substantial segment of potential customers, encompassing both alcoholic and non-alcoholic drinks manufacturers. This includes producers of mainstream soft drinks, fruit juices, innovative functional beverages, flavored waters, and a wide array of alcoholic beverages such as beers, spirits, and wines. These companies strategically utilize flavoring agents to develop compelling new drink formulations, enhance the sensory profiles of existing product lines, and offer an extensive range of flavored options specifically designed to appeal to varied consumer demographics and lifestyle choices. The pervasive global trend towards healthier beverage options, exemplified by the demand for low-sugar, naturally sweetened, or natural ingredient-based drinks, generates specific and complex demands for appropriate flavoring solutions that can maintain optimal palatability and mouthfeel while meeting stringent health criteria, often requiring innovative masking and enhancement technologies.

Beyond the conventional food and beverage sectors, the pharmaceutical and nutraceutical industries are rapidly expanding as significant customers for advanced flavoring agents. These sectors strategically employ flavors to effectively mask the often unpleasant or bitter taste of active pharmaceutical ingredients in medications, a diverse range of dietary supplements, and health-enhancing drinks, thereby profoundly improving patient compliance and overall consumer acceptance. Similarly, the oral care sector is a consistent user of flavors in products such as toothpastes, mouthwashes, and breath mints, primarily for sensory appeal and a refreshing user experience. Furthermore, the animal feed industry is increasingly incorporating specialized flavors to significantly improve the palatability and encourage consistent feed intake for various livestock and companion animals, thereby optimizing nutritional delivery. These extensive and diverse applications unequivocally underscore the critical and versatile role that flavoring agents play in making a multitude of products more desirable, acceptable, and effective for their intended end-users, highlighting a broad, expanding, and technologically demanding customer base that consistently seeks innovative, safe, and effective flavor solutions across numerous industrial verticals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 19.5 Billion |

| Market Forecast in 2032 | USD 30.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Givaudan, Firmenich SA (part of DSM-Firmenich), International Flavors & Fragrances Inc. (IFF), Symrise AG, Kerry Group plc, Sensient Technologies Corporation, Mane SA, Takasago International Corporation, Robertet SA, ADM (Archer Daniels Midland Company), Döhler GmbH, T. Hasegawa Co., Ltd., Synergy Flavors, Flavorchem Corporation, Frutarom (now part of IFF), GNT Group B.V., Koninklijke DSM N.V., Ingredion Incorporated, Kalsec Inc., Ajinomoto Co., Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flavoring Agents Market Key Technology Landscape

The flavoring agents market is undergoing continuous transformation driven by cutting-edge technological advancements, which are fundamentally revolutionizing flavor creation, extraction methodologies, and efficient delivery systems. A particularly prominent technological domain is represented by advanced extraction techniques. These include supercritical fluid extraction (SFE), microwave-assisted extraction (MAE), and ultrasound-assisted extraction (UAE), which offer significant advantages over conventional solvent-based methods. These modern approaches consistently yield higher purities, improved extraction efficiencies, and notably reduced environmental footprints, aligning with sustainability goals. They are instrumental in the precise isolation of delicate aroma compounds and complex bioactive molecules from diverse natural sources, a capability that is absolutely crucial for developing authentic, clean-label natural flavors with superior sensory profiles. The enhanced precision, selectivity, and operational efficiency afforded by these techniques are vital for meeting the escalating consumer demand for natural and sustainably sourced ingredients, while simultaneously maintaining cost-effectiveness for flavor manufacturers operating in a highly competitive market.

Encapsulation technologies constitute another critically important area of innovation within the dynamic flavor landscape, offering robust solutions for flavor stability and controlled release. Advanced techniques such as spray drying, coacervation, emulsion polymerization, and extrusion are extensively employed to meticulously encapsulate volatile flavor compounds within protective matrices. This sophisticated process serves multiple vital functions: it effectively shields delicate flavor components from various forms of degradation caused by external factors like heat, light, oxygen, and moisture, thereby preserving their integrity. Furthermore, encapsulation enables precisely controlled release mechanisms, extending the product's shelf life, improving flavor stability during storage and processing, and ensuring consistent flavor perception throughout the product's lifespan. Microencapsulation and nanoencapsulation, in particular, are gaining traction for highly sensitive or potent flavors, facilitating their seamless incorporation into complex food matrices without any loss of intensity or undesirable alteration of their original profile, and enabling their effective utilization in challenging processing environments, such as high-temperature baking, pasteurization, or acidic beverage formulations where flavor integrity is typically difficult to maintain.

Moreover, the confluence of biotechnology, bioinformatics, and artificial intelligence (AI) is playing an increasingly transformative role in shaping the future of flavoring agents. Fermentation technology, specifically precision fermentation, which harnesses microorganisms to produce specific flavor compounds, offers highly sustainable, scalable, and environmentally friendly solutions for natural flavor production. This approach is capable of creating complex and novel flavor notes that are often difficult or economically unfeasible to obtain through traditional synthetic or plant-based extraction methods. Enzyme technology is also strategically employed for the biotransformation of precursor molecules into highly desirable flavor compounds, enabling clean-label solutions. In conjunction with these biotechnological advancements, sophisticated analytical technologies like Gas Chromatography-Mass Spectrometry (GC-MS), High-Performance Liquid Chromatography (HPLC), and Nuclear Magnetic Resonance (NMR) spectroscopy are absolutely essential. These tools enable the accurate identification, precise quantification, and rigorous quality control of flavor ingredients, ensuring consistency, authenticity, and strict adherence to global regulatory standards. The emerging integration of artificial intelligence and machine learning, particularly for predicting optimal flavor combinations, analyzing sensory data, and understanding consumer preferences at an unprecedented level of detail, is rapidly establishing itself as a truly transformative technology, empowering faster, more targeted, and highly personalized flavor development, thereby providing a significant and sustainable competitive edge in this constantly evolving and highly dynamic market sector.

Regional Highlights

- North America: This is a highly mature and innovative market characterized by a substantial consumer base with elevated awareness regarding health and wellness. There is a robust and growing demand for natural, organic, and functional flavors, largely driven by pervasive clean-label trends, increasing prevalence of specific dietary preferences (e.g., keto, paleo, vegan), and a strong preference for authentic, traceable ingredients. The region demonstrates significant leadership in developing advanced plant-based and low-sugar flavor solutions, particularly in the beverage and snack categories.

- Europe: Similar to North America, Europe represents a highly sophisticated market with exceptionally stringent food safety regulations and a strong, deeply ingrained emphasis on naturalness, sustainability, and ethical sourcing across the entire supply chain. The demand profile is dominated by a preference for authentic, regional, and gourmet flavors that resonate with local culinary traditions. There is a persistent and strong focus on dramatically reducing or eliminating artificial ingredients, flavor enhancers, and preservatives, pushing manufacturers towards advanced natural alternatives and transparent ingredient lists.

- Asia Pacific (APAC): This region is unequivocally the fastest-growing market globally for flavoring agents, experiencing unprecedented growth propelled by rapid and extensive urbanization, steadily increasing disposable incomes, and significantly evolving dietary patterns that often incorporate elements of Western cuisine alongside traditional fare. APAC presents immense potential for both the rapid expansion of traditional ethnic and regional flavors, as well as the surging adoption of Western-style flavor profiles in convenience foods. Emerging economic powerhouses like China, India, and Southeast Asian nations are acting as primary engines for this exponential market growth.

- Latin America: The Latin American market is currently experiencing robust and consistent growth, significantly driven by an increasing demand for diverse processed foods and beverages, coupled with the expansion of a burgeoning middle-class population that has greater purchasing power and exposure to global food trends. There is a pronounced preference for vibrant tropical fruit flavors, savory snack seasonings, and authentic local culinary profiles. This market is dynamically influenced by a synergistic blend of global food trends and deeply embedded local culinary traditions, leading to unique flavor innovation opportunities.

- Middle East and Africa (MEA): As an emerging market with substantial untapped growth potential, particularly within the affluent Gulf Cooperation Council (GCC) countries, the MEA region is witnessing a rapid increase in demand for convenience foods, dairy products, and a wide variety of flavored beverages. Key considerations for market players include developing flavors that cater specifically to distinct regional tastes, aligning with Islamic dietary laws (halal certification), and accommodating diverse cultural preferences, making localized flavor development and marketing strategies crucial for success.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flavoring Agents Market.- Givaudan

- Firmenich SA (part of DSM-Firmenich)

- International Flavors & Fragrances Inc. (IFF)

- Symrise AG

- Kerry Group plc

- Sensient Technologies Corporation

- Mane SA

- Takasago International Corporation

- Robertet SA

- ADM (Archer Daniels Midland Company)

- Döhler GmbH

- T. Hasegawa Co., Ltd.

- Synergy Flavors

- Flavorchem Corporation

- GNT Group B.V.

- Koninklijke DSM N.V. (now part of DSM-Firmenich)

- Ingredion Incorporated

- Kalsec Inc.

- Ajinomoto Co., Inc.

- Bell Flavors & Fragrances

Frequently Asked Questions

What are flavoring agents and their primary role in the food industry?

Flavoring agents are specialized chemical compounds or natural extracts added to food and beverages to enhance, modify, or impart specific tastes and aromas. Their primary role in the food industry is multifaceted: they are crucial for creating distinct product identities, masking any undesirable inherent tastes of raw ingredients, ensuring consistent flavor profiles across large-scale production batches, and ultimately improving overall consumer appeal and extending product desirability. They enable manufacturers to innovate and differentiate their offerings in a competitive market.

What are the key drivers for the sustained growth of the flavoring agents market?

The sustained growth of the flavoring agents market is primarily driven by several powerful factors. These include the escalating global demand for convenience foods and ready-to-eat meals due to changing lifestyles, the increasing consumer interest in diverse, exotic, and authentic flavor profiles from around the world, the continuous wave of product innovation within the food and beverage industry, and the rising disposable incomes in emerging economies. Additionally, the growing consumer preference for functional and plant-based foods, which often require flavor enhancement, is a significant catalyst.

How do natural and artificial flavoring agents fundamentally differ in their composition and use?

Natural flavoring agents are substances derived exclusively from natural sources such as plants, animals, or microorganisms through physical, enzymatic, or microbiological processes. They aim to replicate flavors found in nature. Artificial flavoring agents, conversely, are entirely synthetically produced compounds that either mimic natural flavors or create novel taste sensations that do not exist naturally. While natural flavors often appeal to clean-label trends, artificial flavors can offer greater stability, cost-effectiveness, and availability, and are widely used in mass-produced products.

What significant impact do global regulatory frameworks have on the flavoring agents market?

Global regulatory frameworks, such as those established by the FDA (U.S.) or EFSA (Europe), exert a profound impact on the flavoring agents market. These regulations set rigorous standards for the safety assessment, approval, permissible usage limits, and mandatory labeling requirements for both natural and artificial flavors. Compliance with these diverse and often complex regulations necessitates extensive research, development, and testing by manufacturers. This regulatory pressure often drives innovation towards safer, more transparent, and natural ingredient solutions, while also influencing market access and product formulation strategies across different geographic regions.

Which geographical regions are currently leading in the consumption and innovative production of flavoring agents?

The Asia Pacific (APAC) region is currently leading as the fastest-growing market for both the consumption and innovative production of flavoring agents, primarily fueled by its massive population, rapid urbanization, and increasing economic prosperity. North America and Europe, while representing mature markets, continue to be significant global players, characterized by high levels of innovation, strong demand for premium and natural flavors, and well-established production capabilities. These regions also lead in the development of sophisticated flavor solutions for health-conscious and specialized dietary segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager