Flexible AC Transmission Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427978 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Flexible AC Transmission Systems Market Size

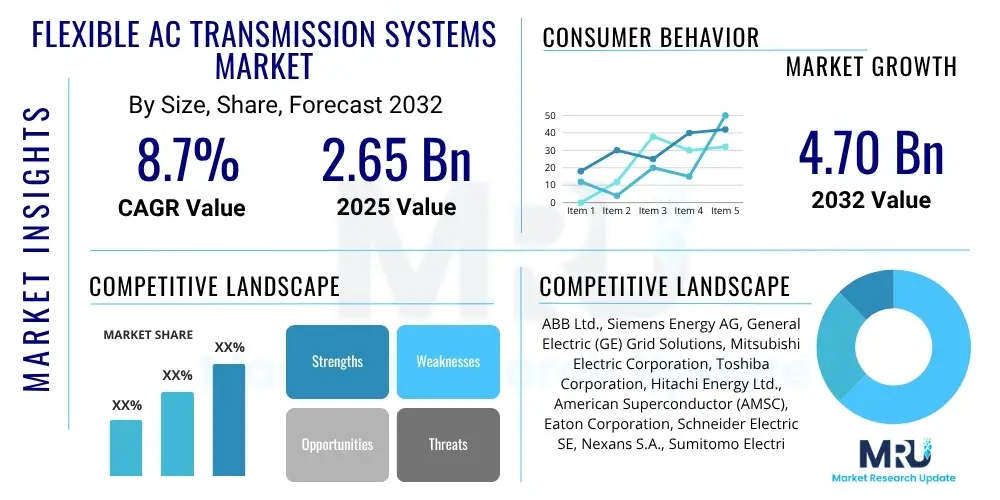

The Flexible AC Transmission Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2032. The market is estimated at USD 2.65 billion in 2025 and is projected to reach USD 4.70 billion by the end of the forecast period in 2032. This substantial growth is primarily driven by the escalating global demand for electricity, the imperative to integrate a growing share of renewable energy sources into existing grids, and the urgent need for grid modernization and stability enhancements across various geographies. The increasing complexity of modern power grids, coupled with the need to transmit power efficiently over long distances while maintaining voltage stability and power quality, positions FACTS technologies as critical enablers for future energy infrastructure.

The market expansion is further supported by significant investments in transmission infrastructure, particularly in developing economies, and the ongoing global push towards sustainable energy solutions. Governments and utility companies worldwide are recognizing the economic and environmental benefits of FACTS devices in optimizing power flow, reducing transmission losses, and enhancing the overall reliability and resilience of power networks. As the energy landscape continues to evolve, characterized by distributed generation and smart grid initiatives, the demand for advanced control and management solutions offered by FACTS will only intensify, solidifying its trajectory towards significant market valuation by the end of the forecast period.

Flexible AC Transmission Systems Market introduction

The Flexible AC Transmission Systems (FACTS) market encompasses a range of power electronics-based devices designed to enhance the controllability and increase the power transfer capability of AC transmission networks. These advanced technologies play a pivotal role in modernizing power grids by addressing issues such as voltage instability, power oscillations, and thermal limits, thereby improving the efficiency, reliability, and security of electricity transmission. FACTS devices leverage sophisticated semiconductor technology to inject or absorb reactive power, or to control impedance and phase angle, offering dynamic control over power flow in real-time. This capability is crucial in today's increasingly complex grid architectures, which must accommodate diverse generation sources, including intermittent renewables, and handle fluctuating load demands.

Major applications of FACTS technologies include the integration of large-scale renewable energy projects such as wind and solar farms into the main grid, where they help mitigate variability and ensure grid stability. They are also widely utilized for enhancing the capacity of existing transmission lines, avoiding the costly and time-consuming process of building new lines, and for improving voltage profiles and power quality in urban and industrial areas. Furthermore, FACTS systems contribute significantly to damping power oscillations, preventing blackouts, and enabling optimal power dispatch, thus making the grid more robust and adaptive to dynamic operating conditions. Their ability to rapidly respond to grid disturbances makes them indispensable for maintaining system integrity and preventing cascading failures, offering a strategic advantage in grid management.

The core benefits of deploying FACTS devices include improved grid stability and reliability, enhanced transmission capacity utilization, reduced transmission losses, and better voltage control, leading to higher overall operational efficiency. Key driving factors for this market include the global surge in electricity consumption, driven by industrialization and urbanization, the escalating imperative to integrate an ever-increasing share of renewable energy into the grid, which demands more dynamic and flexible transmission solutions, and the ongoing initiatives for grid modernization and smart grid development across both developed and emerging economies. These factors collectively underscore the critical role of FACTS in enabling a resilient, efficient, and sustainable global power infrastructure.

Flexible AC Transmission Systems Market Executive Summary

The Flexible AC Transmission Systems (FACTS) market is currently undergoing a transformative period, marked by significant business trends that underscore its strategic importance in the evolving energy landscape. A key trend involves substantial capital investments from utility companies worldwide, focused on upgrading aging transmission infrastructure and integrating advanced digital technologies to create smarter, more resilient grids. There is also a pronounced shift towards modular and scalable FACTS solutions, enabling utilities to deploy systems that can be easily expanded or reconfigured to meet changing grid demands, thus optimizing resource allocation and reducing long-term costs. Furthermore, strategic partnerships and collaborations between technology providers, research institutions, and utility operators are becoming more prevalent, aiming to accelerate innovation and develop customized solutions for specific regional grid challenges. The emphasis on lifecycle cost optimization and predictive maintenance, facilitated by digital integration, is also a growing business trend, ensuring long-term operational efficiency and asset longevity for FACTS installations.

Regional trends reveal varying paces and drivers for FACTS market adoption. North America and Europe are leading the market, propelled by ambitious renewable energy targets, extensive grid modernization programs, and a strong regulatory push for enhanced grid reliability and efficiency. These regions are actively replacing or augmenting their conventional grid components with advanced FACTS technologies to support cross-border power flows and integrate distributed energy resources. The Asia Pacific region is experiencing the fastest growth, primarily driven by rapid industrialization, urbanization, and massive investments in new power generation and transmission infrastructure, particularly in countries like China and India. Latin America, the Middle East, and Africa are also showing promising growth, albeit from a smaller base, as these regions address their burgeoning electricity demands and strive to improve access to reliable power, often leveraging FACTS to overcome limitations in existing grid capacity and stability.

Segmentation trends within the FACTS market highlight the increasing demand for advanced controller types and applications. The Static Synchronous Compensator (STATCOM) segment is exhibiting robust growth, attributed to its superior dynamic response and precise voltage control capabilities compared to traditional devices. Similarly, the Thyristor-Controlled Series Capacitor (TCSC) continues to be a vital component for enhancing power transfer capability over long transmission lines. In terms of application, the integration of renewable energy sources remains a dominant driver, as FACTS devices are indispensable for managing the intermittency and variability associated with wind and solar power. Grid interconnection and transmission capacity enhancement also represent significant and continuously growing segments, reflecting the global need for more flexible and robust power delivery systems. The convergence of these business, regional, and segmentation trends points towards a dynamic and expanding market for FACTS technologies.

AI Impact Analysis on Flexible AC Transmission Systems Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Flexible AC Transmission Systems (FACTS) market frequently center on how AI can enhance the performance, reliability, and cost-effectiveness of these critical grid components. Common questions explore AI's role in optimizing FACTS device control, improving predictive maintenance, and facilitating more intelligent grid integration. Users are keen to understand if AI can make FACTS devices more adaptive to dynamic grid conditions, reduce operational complexities, and extend asset lifespan. There is also significant interest in AI's potential to enable more sophisticated anomaly detection, fault identification, and real-time decision-making within FACTS-enabled grids, ultimately contributing to a more resilient and efficient power system. The overarching theme of user expectations revolves around AI serving as a transformative force, moving FACTS technology beyond its current capabilities to unlock new levels of grid intelligence and autonomy.

The key themes emerging from this analysis indicate a strong desire for AI-driven solutions that can address the inherent complexities of power grid management and the operational challenges of FACTS devices. Concerns often include the computational demands of AI algorithms in real-time applications, data security and privacy implications when integrating AI into critical infrastructure, and the necessity for robust, explainable AI models that can be trusted by grid operators. Users also anticipate AI to provide significant advancements in demand-side management, allowing FACTS systems to respond proactively to anticipated load fluctuations and renewable energy generation profiles. The expectation is that AI will move FACTS from reactive control to predictive and proactive optimization, minimizing human intervention and maximizing system performance under various operating scenarios.

Ultimately, the consensus among user queries suggests that AI is viewed as a crucial next step in the evolution of FACTS technology, offering the potential to unlock greater value from existing infrastructure and pave the way for future grid innovations. The focus is on leveraging AI for enhanced analytical capabilities, automated decision support, and improved overall grid situational awareness. This includes optimizing the dispatch of reactive power, preventing cascading failures through intelligent anomaly detection, and providing deeper insights into the health and performance of FACTS assets, thereby ensuring the grid operates closer to its optimal limits with higher levels of reliability and security.

- Predictive Maintenance: AI algorithms analyze sensor data from FACTS devices to predict potential failures, enabling proactive maintenance and reducing downtime.

- Optimized Control Strategies: AI can develop and implement advanced control algorithms for FACTS devices, dynamically adjusting parameters in real-time to optimize power flow, voltage stability, and reduce losses across the grid.

- Enhanced Grid Stability: AI models can rapidly detect and respond to grid disturbances, using FACTS devices to stabilize voltage and frequency, preventing blackouts and improving resilience.

- Renewable Energy Integration: AI facilitates the seamless integration of intermittent renewable energy sources by intelligently controlling FACTS devices to compensate for fluctuations and maintain grid balance.

- Anomaly Detection: Machine learning identifies unusual patterns in grid operations or FACTS device performance, signaling potential issues before they escalate into major faults.

- Improved Operational Efficiency: AI-driven insights help grid operators make data-backed decisions, leading to more efficient asset utilization and reduced operational costs for FACTS installations.

DRO & Impact Forces Of Flexible AC Transmission Systems Market

The Flexible AC Transmission Systems (FACTS) market is profoundly shaped by a complex interplay of drivers, restraints, and opportunities, collectively forming the impact forces that dictate its growth trajectory. A primary driver is the accelerating global demand for electricity, fueled by population growth, rapid urbanization, and industrial expansion, particularly in emerging economies. This increasing demand necessitates more robust and efficient transmission infrastructure capable of handling higher power loads. Concurrently, the imperative to integrate an ever-growing share of renewable energy sources, such as wind and solar, into national grids acts as a significant catalyst. FACTS devices are essential for managing the inherent intermittency and variability of these sources, ensuring grid stability and power quality. Furthermore, the global trend of grid modernization, driven by aging infrastructure in developed nations and the need for enhanced resilience against extreme weather events and cyber threats, provides a strong impetus for the adoption of advanced FACTS technologies. Investments in smart grid initiatives and the need to optimize the utilization of existing transmission assets also contribute significantly to market expansion, as FACTS can increase capacity without costly new construction.

However, the market faces notable restraints that could temper its growth. The high initial capital investment required for the procurement and installation of FACTS devices represents a significant barrier, especially for utilities in developing regions with limited financial resources. The complexity of these advanced power electronics systems also poses challenges, requiring specialized technical expertise for installation, operation, and maintenance, which can be scarce. Regulatory hurdles, including stringent approval processes and varying technical standards across different regions, can delay project implementation and increase costs. Moreover, the long project lead times associated with large-scale transmission infrastructure upgrades, coupled with environmental concerns and land acquisition issues for new installations, can slow down the deployment of FACTS solutions. These factors necessitate careful planning and substantial long-term commitment from stakeholders.

Despite these restraints, ample opportunities exist for market players to capitalize on. The ongoing development of smart grid technologies, which inherently require the dynamic control capabilities offered by FACTS, presents a vast potential for market growth. Advancements in power electronics, materials science, and control algorithms are continuously making FACTS devices more cost-effective, efficient, and versatile, opening up new application areas. The expansion into developing economies, particularly in Asia Pacific and Latin America, where rapid industrialization and electrification efforts are underway, offers lucrative market prospects. Moreover, the increasing focus on energy efficiency, carbon emission reduction, and grid reliability globally reinforces the strategic importance of FACTS in achieving sustainable energy goals. Collaborative initiatives between public and private sectors to fund and implement grid modernization projects, coupled with a push for standardized, interoperable solutions, are expected to unlock further growth opportunities. The convergence of these forces suggests a future where FACTS plays an increasingly central role in global power transmission.

Segmentation Analysis

The Flexible AC Transmission Systems (FACTS) market is comprehensively segmented to provide a detailed understanding of its diverse components and their varying applications across the global power landscape. This segmentation allows for a granular analysis of market trends, technological preferences, and end-user adoption patterns, offering crucial insights for stakeholders. The market is primarily broken down by compensation type, delineating between systems that offer reactive power support in parallel (shunt), in series with the transmission line, or a combination of both. Each type serves distinct purposes in optimizing power flow and enhancing grid stability, addressing specific challenges within the transmission network. Furthermore, the market is categorized by the specific controller types, which represent the core power electronic devices employed in FACTS installations. These controllers vary significantly in their operational principles, response times, and application suitability, reflecting the technological diversity within the market.

Beyond the technical classification, the market is also segmented by its myriad applications, illustrating how FACTS devices are deployed to solve critical problems in power transmission. This includes their vital role in integrating renewable energy sources, enhancing the overall capacity of existing transmission lines, ensuring voltage stability across the grid, and improving general power quality. Understanding these applications is essential for identifying key demand drivers and emerging areas of growth. Finally, the end-use segmentation highlights the primary sectors that benefit from and implement FACTS technologies. This typically includes large utility companies responsible for national and regional grids, various industrial sectors with significant power demands, and specialized applications such as railway systems. Analyzing these segments provides a holistic view of the market's structure and the underlying dynamics that propel its expansion.

The intricate interplay between these segmentation categories reveals that the demand for specific FACTS solutions is often dictated by regional grid characteristics, regulatory frameworks, and the prevailing energy generation mix. For instance, regions heavily investing in wind or solar power will likely prioritize controller types and compensation methods optimized for renewable energy integration and voltage stability. Similarly, areas with congested transmission corridors will focus on solutions for capacity enhancement. This layered segmentation approach not only clarifies the current market landscape but also aids in forecasting future trends and identifying niche opportunities for technological innovation and market penetration, ensuring that research and development efforts are aligned with practical industry needs.

- By Compensation Type:

- Shunt Compensation

- Series Compensation

- Combined Compensation

- By Controller Type:

- Static VAR Compensator (SVC)

- Static Synchronous Compensator (STATCOM)

- Thyristor-Controlled Series Capacitor (TCSC)

- Unified Power Flow Controller (UPFC)

- Fault Current Limiters (FCL)

- Other Advanced Controllers (e.g., SSSC, IPFC)

- By Application:

- Grid Interconnection & Stability

- Renewable Energy Integration

- Transmission Capacity Enhancement

- Voltage Stability & Control

- Power Quality Improvement

- Load Flow Control

- By End-Use:

- Utilities (Transmission System Operators, Distribution System Operators)

- Industrial (Heavy Industries, Data Centers)

- Railways

- Oil & Gas

- Others (e.g., Mining, Marine)

Value Chain Analysis For Flexible AC Transmission Systems Market

The value chain for the Flexible AC Transmission Systems (FACTS) market is a complex ecosystem involving multiple stages, from raw material sourcing to final deployment and maintenance. It begins with upstream activities, primarily focusing on the design and manufacturing of critical components. This involves suppliers of advanced power semiconductors such as IGBTs and thyristors, capacitors, transformers, reactors, and sophisticated control systems. These components are sourced from specialized manufacturers who often invest heavily in research and development to produce high-performance, reliable parts that can withstand the rigorous demands of high-voltage power transmission. Quality assurance and compliance with international standards are paramount at this stage, as the integrity of the final FACTS device hinges on the reliability of its constituent parts. Innovation in power electronics is a continuous driver here, with advancements in material science and semiconductor technology directly impacting the efficiency and cost-effectiveness of FACTS solutions.

Moving downstream, the value chain encompasses the integration, assembly, and testing of these components into complete FACTS devices. This stage is dominated by major electrical equipment manufacturers and specialized FACTS system integrators. These companies possess the engineering expertise to design, configure, and assemble custom FACTS solutions tailored to specific grid requirements. Their activities involve complex project management, rigorous factory acceptance testing, and coordination with grid operators. Once the systems are manufactured, the distribution channels play a crucial role in delivering these highly specialized and often large-scale equipment to end-users. Direct sales and distribution are predominant, given the technical complexity and customized nature of FACTS projects. Major manufacturers typically have their own sales teams and engineering support to engage directly with utilities and industrial clients, offering comprehensive solutions from conceptual design to commissioning.

Post-installation, the value chain extends to services such as installation, commissioning, operation, and ongoing maintenance. This after-sales support is critical for ensuring the long-term performance and reliability of FACTS devices. Direct channels involve manufacturers providing these services themselves, leveraging their deep product knowledge. Indirect channels might include local engineering firms or specialized service providers partnering with manufacturers to offer maintenance and support, particularly in regions where manufacturers do not have a strong direct presence. These services often include software updates, diagnostics, spare parts management, and emergency repairs. The entire value chain emphasizes a high degree of technical expertise, stringent quality control, and strong collaboration among all participants to deliver effective and reliable FACTS solutions that enhance grid stability and efficiency.

Flexible AC Transmission Systems Market Potential Customers

The primary potential customers for Flexible AC Transmission Systems (FACTS) are major power utilities and Transmission System Operators (TSOs) around the globe. These entities are responsible for the generation, transmission, and distribution of electricity across national and regional grids, making them the largest and most critical end-users. Their demand for FACTS devices stems from the continuous need to upgrade aging infrastructure, enhance grid reliability, expand transmission capacity, and seamlessly integrate new, often intermittent, renewable energy sources into their networks. Utilities seek FACTS solutions to manage voltage instability, damp power oscillations, control reactive power flow, and ultimately prevent costly blackouts, ensuring a stable and secure electricity supply to millions of consumers. The strategic investment decisions made by these utilities are heavily influenced by regulatory mandates, energy policy shifts, and the long-term economic benefits associated with improved grid performance and reduced operational losses. Therefore, a deep understanding of their strategic plans and infrastructure development roadmaps is crucial for market players.

Beyond traditional utilities, industrial sectors with significant and critical power demands also represent a growing segment of potential customers. Large industrial complexes, such as steel mills, chemical plants, mining operations, and data centers, require highly reliable and high-quality power supply to maintain continuous operations and protect sensitive equipment. Power quality issues, including voltage sags, swells, and harmonics, can lead to production losses and equipment damage. FACTS devices, particularly those focused on voltage control and power quality improvement like STATCOMs and SVCs, offer tailored solutions to these industries. These industrial end-users prioritize systems that can offer immediate and precise reactive power compensation, minimize power losses, and ensure an uninterrupted, stable power supply, thus enhancing their operational efficiency and reducing energy-related costs. The increasing digitalization and automation within the industrial sector further amplify the need for robust and stable power infrastructure.

Furthermore, specialized sectors such as railway operators constitute another important customer segment. Modern railway systems, especially high-speed and electrified lines, require substantial and stable power to operate efficiently. Fluctuations in power demand from accelerating trains can cause voltage drops and power quality issues in the traction power supply systems. FACTS devices are deployed to stabilize the voltage, reduce harmonic distortions, and improve the power factor, ensuring a reliable and efficient power supply for railway electrification. Other emerging potential customers include organizations involved in large-scale infrastructure projects, such as smart cities and port electrification, where distributed energy resources and complex load profiles necessitate advanced power management solutions. Understanding the unique operational requirements, financial constraints, and strategic objectives of each of these customer segments is paramount for market players seeking to effectively position and deliver FACTS solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.65 Billion |

| Market Forecast in 2032 | USD 4.70 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens Energy AG, General Electric (GE) Grid Solutions, Mitsubishi Electric Corporation, Toshiba Corporation, Hitachi Energy Ltd., American Superconductor (AMSC), Eaton Corporation, Schneider Electric SE, Nexans S.A., Sumitomo Electric Industries, Alstom S.A., NR Electric Co. Ltd., Xian Electric Engineering Co., Ltd., ZTT (Zhongtian Technology) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flexible AC Transmission Systems Market Key Technology Landscape

The technological landscape of the Flexible AC Transmission Systems (FACTS) market is characterized by continuous innovation in power electronics, control systems, and communication technologies, all aimed at enhancing grid performance and reliability. At the core of FACTS devices are advanced semiconductor technologies, primarily based on insulated-gate bipolar transistors (IGBTs) and thyristors. IGBTs, with their high switching speeds and lower power losses, are instrumental in voltage source converter (VSC)-based FACTS devices like STATCOMs and UPFCs, enabling rapid and precise reactive power compensation. Thyristors, known for their robustness and high power handling capabilities, remain crucial for applications in SVCs and TCSCs. Ongoing research in wide-bandgap semiconductors like Silicon Carbide (SiC) and Gallium Nitride (GaN) promises even higher switching frequencies, reduced losses, and more compact designs, which will further improve the efficiency and cost-effectiveness of future FACTS installations.

Beyond the power electronic converters themselves, sophisticated digital control systems are central to the functionality of FACTS devices. These systems employ advanced microprocessors and digital signal processors (DSPs) to implement complex control algorithms that monitor grid conditions in real-time and adjust FACTS parameters accordingly. These control systems are increasingly leveraging real-time data analytics and, as explored previously, AI algorithms to optimize power flow, dampen oscillations, and respond dynamically to grid disturbances. The integration of advanced communication protocols and cybersecurity measures is also a critical technological aspect, ensuring secure and reliable data exchange between FACTS devices, substations, and central control centers. This allows for seamless integration into broader smart grid architectures and enhances the overall situational awareness of grid operators, enabling more informed decision-making during normal and disturbed operating conditions.

Furthermore, the development of modular and scalable FACTS solutions represents another significant technological trend. Manufacturers are designing FACTS devices with standardized modules that can be easily assembled and configured to meet varying power demands and grid specifications. This modularity reduces manufacturing costs, simplifies installation, and enhances flexibility for future upgrades or expansions. Innovations in cooling technologies, such as advanced liquid cooling systems, are also contributing to the miniaturization and improved efficiency of FACTS components. The focus on integrating FACTS with other grid modernization technologies, such as Wide Area Monitoring Systems (WAMS) and Energy Management Systems (EMS), is creating a synergistic effect, enabling a more holistic approach to grid control and optimization. These technological advancements collectively drive the evolution of FACTS, making them indispensable tools for building the smart, resilient, and efficient power grids of tomorrow.

Regional Highlights

- North America: This region is a leading market for FACTS, driven by extensive grid modernization initiatives, the increasing integration of renewable energy sources like wind and solar, and the need to enhance grid resilience against extreme weather events. Countries such as the United States and Canada are making significant investments in upgrading aging transmission infrastructure and implementing smart grid technologies. Regulatory frameworks in these nations strongly support grid stability and reliability, further stimulating the adoption of FACTS devices to manage complex power flows and maintain voltage profiles. The presence of key technology providers and ongoing research and development in advanced power electronics also contribute to the region's strong market position.

- Europe: Europe stands as another dominant market, primarily propelled by ambitious renewable energy targets and the establishment of an interconnected European supergrid. Countries like Germany, the UK, France, and Nordic nations are heavily investing in FACTS to integrate offshore wind farms, manage cross-border power exchanges, and ensure the stability of their highly complex grids. Strict carbon emission reduction policies and the emphasis on energy efficiency incentivize the deployment of FACTS for optimized power transmission and reduced losses. Collaborative research projects and a robust innovation ecosystem also foster the development and adoption of cutting-edge FACTS solutions across the continent.

- Asia Pacific (APAC): The APAC region is projected to exhibit the fastest growth in the FACTS market, driven by rapid industrialization, urbanization, and the immense demand for electricity in developing economies like China, India, and Southeast Asian countries. Massive investments in new power generation and transmission infrastructure, coupled with large-scale renewable energy deployment projects, are fueling the adoption of FACTS to enhance grid capacity and stability. China, in particular, is a major player, leading in both the manufacturing and deployment of advanced FACTS technologies for its vast and expanding grid. The need to provide reliable power to remote areas and support economic growth further accentuates the demand for flexible transmission solutions in this dynamic region.

- Latin America: This region is experiencing steady growth in the FACTS market as countries address increasing electricity demand, improve grid reliability, and integrate renewable energy sources, particularly hydro and solar. Brazil, Mexico, and Chile are key markets, with investments focused on enhancing transmission capacity over long distances and stabilizing grids to support economic development. The need to reduce transmission losses and improve power quality in rapidly expanding urban areas also contributes to the adoption of FACTS technologies.

- Middle East and Africa (MEA): The MEA region is witnessing emerging opportunities in the FACTS market, primarily driven by significant investments in new power infrastructure projects to meet burgeoning electricity demands and support industrial expansion. Gulf Cooperation Council (GCC) countries are investing heavily in grid interconnections and large-scale solar power projects, necessitating FACTS for stable and efficient power transmission. In Africa, efforts to electrify remote areas and enhance grid stability in developing economies are creating demand for flexible transmission solutions, albeit from a relatively smaller base. The focus here is on improving energy access and reducing technical losses across vast geographical areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flexible AC Transmission Systems Market.- ABB Ltd.

- Siemens Energy AG

- General Electric (GE) Grid Solutions

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Hitachi Energy Ltd.

- American Superconductor (AMSC)

- Eaton Corporation

- Schneider Electric SE

- Nexans S.A.

- Sumitomo Electric Industries

- Alstom S.A.

- NR Electric Co. Ltd.

- Xian Electric Engineering Co., Ltd.

- ZTT (Zhongtian Technology)

- Hyundai Electric Co., Ltd.

- Powell Industries, Inc.

- CG Power and Industrial Solutions Ltd.

- Emerson Electric Co.

- Statcom, Inc.

Frequently Asked Questions

What are Flexible AC Transmission Systems (FACTS) and why are they important?

Flexible AC Transmission Systems (FACTS) are power electronics-based devices designed to enhance the controllability and power transfer capability of AC transmission networks. They are crucial for improving grid stability, reliability, and efficiency by dynamically controlling voltage, impedance, and phase angle, which is vital for modern grids integrating renewable energy and managing complex power flows.

How do FACTS devices contribute to renewable energy integration?

FACTS devices play a critical role in renewable energy integration by compensating for the inherent variability and intermittency of sources like wind and solar. They help maintain voltage stability, damp power oscillations, and regulate reactive power, ensuring the smooth and reliable connection of these fluctuating energy sources to the main grid without compromising system stability.

What is the primary difference between a Static VAR Compensator (SVC) and a Static Synchronous Compensator (STATCOM)?

Both SVCs and STATCOMs provide reactive power compensation. The primary difference lies in their operational technology: an SVC uses thyristors to switch reactors and capacitors for reactive power control, offering a relatively slower response. A STATCOM, based on voltage source converters (VSC) with IGBTs, provides faster and more precise reactive power control, with the ability to both generate and absorb reactive power independently of the AC system voltage, offering superior dynamic performance.

What are the main drivers for the growth of the FACTS market?

Key drivers for the FACTS market growth include the escalating global demand for electricity, the urgent need for integrating diverse renewable energy sources into existing grids, ongoing grid modernization efforts to replace aging infrastructure, and increased investments in transmission capacity enhancement to improve power delivery efficiency and reliability.

What are the major challenges or restraints hindering the FACTS market?

Significant restraints for the FACTS market include the high initial capital investment required for these complex systems, the need for specialized technical expertise for installation and maintenance, the complexity of integration with existing grid infrastructure, and potential regulatory hurdles and long project lead times that can delay deployment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager