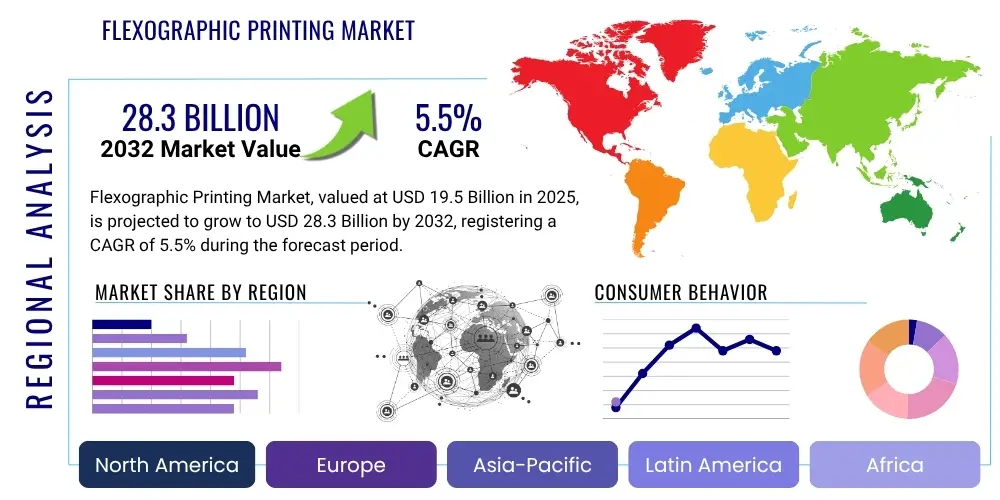

Flexographic Printing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429215 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Flexographic Printing Market Size

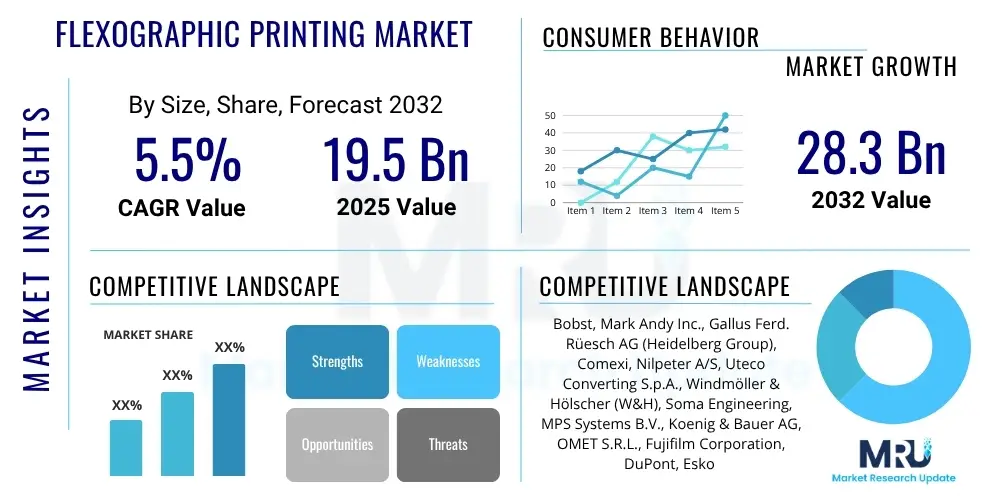

The Flexographic Printing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2025 and 2032. The market is estimated at USD 19.5 Billion in 2025 and is projected to reach USD 28.3 Billion by the end of the forecast period in 2032.

Flexographic Printing Market introduction

The Flexographic Printing Market encompasses the global industry dedicated to flexographic printing technology, which utilizes a flexible relief plate to transfer ink onto various substrates. This versatile printing method is highly regarded for its ability to print on a wide array of materials, from non-porous plastics to paper, paperboard, and corrugated materials, making it indispensable for packaging, labels, and various consumer goods applications. The core components of this market include flexographic presses (stack, common impression, and in-line configurations), photopolymer plates, and a diverse range of inks (water-based, solvent-based, and UV-curable). The consistent evolution of flexographic technology, driven by the demand for higher print quality, faster production speeds, and increased automation, continues to solidify its position as a cornerstone in the global printing landscape.

Flexographic printing's distinct product description highlights its key attributes: high-speed capability, excellent substrate versatility, and cost-effectiveness, particularly for long print runs. Its major applications primarily reside within the packaging sector, including flexible packaging for food and beverages, corrugated boxes for shipping and retail, and an extensive variety of labels for products across numerous industries. Beyond packaging, flexography also finds significant use in printing newspapers, envelopes, and decorative laminates. The inherent benefits of flexography, such as its robust ink transfer, ability to use various ink types to suit different substrate requirements, and its adaptability to both narrow and wide web formats, underscore its pervasive adoption across manufacturing and consumer markets.

The market's sustained growth is propelled by several critical driving factors. Foremost among these is the unceasing expansion of the global packaging industry, fueled by e-commerce proliferation and rising consumer demand for packaged goods, particularly in emerging economies. There is a growing emphasis on sustainable packaging solutions and printing processes, prompting innovation in water-based and UV LED curable inks, which are more environmentally friendly. Furthermore, continuous technological advancements in plate materials, anilox rolls, press automation, and inline finishing capabilities are enhancing print quality, reducing setup times, and improving overall operational efficiency, making flexography an increasingly attractive and competitive choice for brand owners and converters alike. This confluence of factors ensures a dynamic and expansive market outlook for flexographic printing.

Flexographic Printing Market Executive Summary

The Flexographic Printing Market demonstrates robust business trends characterized by increasing automation, digitalization of prepress workflows, and a strong drive towards sustainable practices. Converters are investing in advanced flexo presses that offer quicker job changeovers, enhanced print quality, and improved efficiency to meet the evolving demands for shorter runs and personalized packaging. Regional trends highlight the Asia Pacific as a primary growth engine, propelled by burgeoning manufacturing sectors and a rapidly expanding middle class, driving demand for packaged goods. North America and Europe, while mature, exhibit consistent innovation in hybrid printing technologies and eco-friendly solutions, maintaining steady growth. Segment trends reveal the dominance of flexible packaging and labels, with significant growth in corrugated packaging due to e-commerce expansion. Water-based and UV-curable inks are gaining traction over solvent-based alternatives, reflecting a broader industry shift towards environmental responsibility and regulatory compliance. This dynamic interplay of technological advancement, sustainability initiatives, and market demand underpins the positive trajectory of the flexographic printing industry.

AI Impact Analysis on Flexographic Printing Market

User inquiries concerning the integration of Artificial Intelligence (AI) into the flexographic printing market frequently revolve around its potential to revolutionize operational efficiency, enhance print quality, and streamline the entire production workflow. Common questions explore how AI algorithms can optimize prepress processes, predict maintenance needs for presses, and facilitate real-time quality control to minimize waste and errors. There is significant interest in AI's capacity to automate complex decision-making, such as color matching, substrate optimization, and defect detection, thereby reducing the reliance on skilled human intervention and improving consistency across print runs. Users are keenly interested in understanding the practical applications of AI in areas like predictive analytics for equipment uptime, personalized design generation, and intelligent supply chain management for raw materials and finished products, all of which promise substantial cost savings and faster time-to-market. The overarching expectation is that AI will usher in a new era of smart manufacturing, making flexography more agile, responsive, and ultimately more profitable.

Concerns surrounding AI's influence primarily center on job displacement, the substantial initial investment required for AI integration, and the complexities of adopting new technological paradigms within established operational frameworks. Users question how the existing workforce can be reskilled to leverage AI tools effectively and what the necessary infrastructure upgrades will entail for smaller and medium-sized enterprises (SMEs). Data security and privacy are also recurrent themes, particularly when AI systems handle sensitive client designs or production data. However, these concerns are often balanced by the recognition that AI presents unparalleled opportunities for competitive differentiation and long-term sustainability. The industry is exploring how AI can address the persistent challenge of attracting and retaining skilled labor by automating repetitive tasks, allowing human operators to focus on more strategic and creative aspects of the printing process. This blend of apprehension and optimism underscores a market poised for transformative change, where the careful implementation of AI could redefine operational benchmarks.

Expectations for AI's role in the flexographic printing market are high, anticipating its ability to unlock new levels of precision, speed, and customization. Stakeholders foresee AI enabling highly accurate color reproduction across diverse substrates and improving the consistency of brand colors, which is crucial for brand integrity. AI-powered vision systems are expected to provide real-time, inline defect detection and correction, drastically reducing material waste and improving overall quality assurance. Furthermore, AI is anticipated to play a pivotal role in optimizing production scheduling, managing inventory more intelligently, and even assisting in the design phase by recommending optimal layouts and material usage for specific print jobs. The long-term vision includes fully autonomous flexographic operations, where AI orchestrates everything from job intake and prepress to printing, finishing, and quality inspection, ultimately driving down costs, enhancing responsiveness to market demands, and opening avenues for innovative product offerings such as smart and interactive packaging. These advancements are expected to reshape the competitive landscape and provide significant strategic advantages to early adopters.

- AI optimizes prepress workflows, improving plate calibration and color management accuracy.

- Predictive maintenance driven by AI minimizes press downtime and enhances equipment longevity.

- Real-time quality control systems leverage AI for inline defect detection and automated correction.

- AI-powered analytics provide insights for production planning, inventory management, and waste reduction.

- Automated design and artwork optimization tools integrate AI for faster iteration and consistency.

- Intelligent automation reduces reliance on manual adjustments, boosting overall operational efficiency.

DRO & Impact Forces Of Flexographic Printing Market

The flexographic printing market is significantly shaped by a combination of key drivers, formidable restraints, and promising opportunities, all influenced by various impact forces that dictate its competitive landscape and future trajectory. A primary driver is the relentless growth of the global packaging industry, particularly flexible packaging and labels, fueled by burgeoning e-commerce platforms, shifting consumer preferences for convenience, and rising disposable incomes in emerging markets. This increased demand for packaged goods directly translates into higher requirements for flexographic printing. Furthermore, technological advancements in flexo presses, such as greater automation, faster setup times, and improved print quality, are making the technology more competitive and attractive. The growing focus on sustainability and the demand for eco-friendly printing solutions, including water-based and UV LED inks, also serve as a significant driver, pushing manufacturers towards greener processes that align with global environmental mandates and consumer expectations.

Despite these strong drivers, the market faces several notable restraints. The high initial capital investment required for advanced flexographic presses and associated prepress equipment acts as a significant barrier to entry for new players and limits expansion for smaller businesses. This substantial upfront cost can deter adoption, especially when balanced against the lower initial investment of digital printing solutions. Intense competition from alternative printing technologies, particularly digital printing, poses another challenge. While flexography excels in long runs, digital printing offers unparalleled flexibility for short runs, variable data printing, and rapid prototyping, capturing a segment of the market that flexo traditionally served. Moreover, stringent environmental regulations regarding volatile organic compounds (VOCs) and ink disposal necessitate continuous innovation and compliance, adding operational complexities and costs for manufacturers, particularly those reliant on solvent-based inks.

Opportunities abound for market players willing to innovate and adapt. The expansion into emerging markets, particularly in Asia Pacific, Latin America, and the Middle East and Africa, presents substantial growth avenues as industrialization and urbanization drive demand for packaged goods. The increasing consumer preference for personalized and customized packaging offers a niche where flexography, particularly when integrated with digital capabilities in hybrid presses, can thrive. Innovations in smart packaging, incorporating elements like QR codes, NFC tags, and augmented reality, provide new value propositions that flexographic printing can support through sophisticated printing techniques. The ongoing development of hybrid printing solutions, which combine the efficiency of flexo with the versatility of digital, represents a significant opportunity to offer comprehensive solutions that meet a broader spectrum of customer needs, blending cost-effectiveness for base designs with personalization capabilities. These opportunities, coupled with ongoing research into advanced materials and processes, are expected to fuel the market's long-term expansion.

- Drivers: Escalating global demand for packaging, especially flexible packaging and labels; continuous technological advancements in press design and automation; increasing focus on sustainable printing solutions.

- Restraints: High capital expenditure for advanced flexo equipment; fierce competition from digital printing for short-to-medium runs; skilled labor shortages; stringent environmental regulations impacting ink formulations.

- Opportunities: Untapped potential in emerging economies; growing market for personalized and customized packaging; integration with smart packaging technologies; development of hybrid flexo-digital printing solutions.

- Impact Forces: High competitive intensity due to numerous established players; moderate to high buyer power due to availability of alternative printing methods; increasing supplier power for specialized components like anilox rolls and plates; threat of substitutes from evolving digital and gravure technologies.

Segmentation Analysis

The Flexographic Printing Market is comprehensively segmented to provide a detailed understanding of its diverse operational landscape, technological preferences, and end-user applications. This segmentation allows for precise market analysis, identifying key growth areas and niche opportunities within the broader industry. The market is primarily broken down by press type, reflecting different operational configurations; by ink type, showcasing the chemical compositions utilized; by substrate, highlighting the material versatility; by application, detailing primary end-uses; and by end-use industry, categorizing the sectors that leverage flexographic printing for their products. Understanding these segments is crucial for stakeholders to tailor strategies, optimize investments, and address specific market demands effectively.

- By Type:

- Stack Flexo Press

- Common Impression (CI) Flexo Press

- In-line Flexo Press

- By Ink Type:

- Water-based Inks

- Solvent-based Inks

- UV-curable Inks

- By Substrate:

- Flexible Plastic Films

- Paper & Paperboard

- Corrugated Board

- Labels

- Metalized Films

- Others (e.g., Non-woven Fabrics, Foils)

- By Application:

- Flexible Packaging

- Labels & Tags

- Corrugated Packaging

- Folding Cartons

- Other Printing (e.g., Gift Wrap, Envelopes, Wallpapers)

- By End-Use Industry:

- Food & Beverage

- Personal Care & Cosmetics

- Pharmaceuticals & Healthcare

- Consumer Goods

- Industrial & Automotive

- Publishing & Stationery

- Others

Value Chain Analysis For Flexographic Printing Market

The value chain of the Flexographic Printing Market is a complex and interconnected network, commencing with upstream activities focused on raw material sourcing and manufacturing of essential components. This segment includes suppliers of photopolymer plates, anilox rolls, and various ink ingredients such as pigments, resins, and additives. Key technology providers for prepress software, plate imagers, and press manufacturers also reside upstream, developing and supplying the machinery and digital tools that underpin the flexographic process. The efficiency and innovation within this upstream segment directly impact the quality, speed, and cost-effectiveness of the entire printing process. Strong relationships between raw material suppliers, equipment manufacturers, and printing companies are crucial for ensuring a steady supply of high-quality inputs and the continuous integration of technological advancements, driving overall market competitiveness.

Moving downstream, the value chain encompasses the actual printing operations performed by packaging converters, label manufacturers, and commercial printers. These entities utilize flexographic presses to transform raw substrates and inks into finished printed products, which are then supplied to brand owners and end-user industries. This stage involves intricate processes from artwork design and prepress, through plate mounting and ink formulation, to the actual printing, drying, and finishing steps. The quality of output, turnaround times, and adherence to specific client requirements are paramount in this downstream segment. Post-printing activities, such as lamination, die-cutting, slitting, and quality inspection, add further value before the product reaches the final consumer. The effectiveness of these downstream operations is critical for customer satisfaction and determines the final market uptake of flexographically printed goods.

Distribution channels for flexographic printing products are predominantly direct and indirect, catering to a diverse clientele. Direct sales involve printing companies supplying finished goods directly to brand owners, consumer product manufacturers, and other businesses that require packaging or labels. This direct approach often involves long-term contracts and close collaboration on design and production specifications. Indirect channels, on the other hand, might involve intermediaries such as brokers, distributors, or logistics providers who facilitate the movement of printed materials from the converter to the end-user. For equipment and raw materials, direct sales from manufacturers to printers are common, often complemented by a network of regional distributors or agents who provide local sales support, technical service, and spare parts. Both direct and indirect models are vital for market penetration, ensuring broad accessibility of flexographic products and services across various geographic regions and industry verticals, thereby contributing to the market's overall reach and sustainability.

Flexographic Printing Market Potential Customers

The potential customers for the Flexographic Printing Market are broadly diversified across numerous industries, primarily encompassing a wide array of brand owners and packaging converters who rely on efficient, high-quality, and versatile printing solutions. Food and beverage companies represent a significant end-user segment, consistently requiring flexographically printed flexible packaging for snacks, beverages, dairy products, and frozen foods, as well as labels for bottles, cans, and containers. The need for appealing, informative, and durable packaging to attract consumers and comply with regulatory standards drives their demand for flexographic services. Similarly, personal care and cosmetics brands frequently utilize flexography for their intricate labels, sachets, and flexible tubes, where vibrant colors and fine details are crucial for brand differentiation and consumer appeal.

Beyond consumer goods, pharmaceutical and healthcare industries are also key buyers, seeking highly compliant and precise labels for medicines, medical devices, and sterile packaging. These sectors demand print solutions that can withstand harsh environments, resist tampering, and provide critical information clearly, often in high volumes. Industrial manufacturers, encompassing sectors such as automotive, chemicals, and construction, represent another significant customer base, utilizing flexographic printing for durable labels, warning signs, and packaging for their components and finished products. The versatility of flexography in handling robust substrates and specialized inks makes it an ideal choice for these demanding industrial applications where longevity and readability are paramount.

Furthermore, the burgeoning e-commerce sector has significantly boosted the demand for corrugated packaging, making shipping and logistics companies, along with online retailers, crucial potential customers. Flexographic printing is widely employed for branding and informational graphics on corrugated boxes, offering cost-effective and high-speed solutions for mass production. Label manufacturers, who convert blank label stock into finished product labels for various industries, are also direct customers of flexographic equipment and consumables. Essentially, any business requiring large volumes of printed packaging, labels, or other flexible materials that demand cost-efficiency, speed, and consistent quality across diverse substrates will find significant value in the flexographic printing market's offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 19.5 Billion |

| Market Forecast in 2032 | USD 28.3 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bobst, Mark Andy Inc., Gallus Ferd. Rüesch AG (Heidelberg Group), Comexi, Nilpeter A/S, Uteco Converting S.p.A., Windmöller & Hölscher (W&H), Soma Engineering, MPS Systems B.V., Koenig & Bauer AG, OMET S.R.L., Fujifilm Corporation, DuPont, Esko (Danaher), Flint Group, Sun Chemical (DIC), Harper Corporation of America, Tesa SE, Siegwerk Druckfarben AG & Co. KGaA, XSYS Global. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flexographic Printing Market Key Technology Landscape

The Flexographic Printing Market is continuously evolving, driven by significant advancements in its core technologies aimed at enhancing efficiency, print quality, and sustainability. Digital platemaking, specifically Computer-to-Plate (CtP) technology, stands as a cornerstone innovation, enabling faster and more precise creation of flexographic printing plates, reducing manual errors, and improving image reproduction. Advancements in anilox roll technology, including laser-engraved ceramics and specialized cell geometries, have revolutionized ink transfer consistency and volume control, leading to superior print quality and greater operational stability. Furthermore, automated plate mounting and registration systems on modern presses are significantly reducing setup times and minimizing material waste during job changeovers, addressing the industry's demand for shorter runs and quicker turnarounds.

The development of advanced ink formulations represents another critical technological trend. The increasing adoption of water-based and UV LED-curable inks is driven by both environmental regulations and performance benefits. Water-based inks offer lower VOC emissions, while UV LED curing provides instant drying, reduced energy consumption, and the ability to print on heat-sensitive substrates, opening up new application possibilities. Hybrid printing solutions, which integrate flexographic units with digital inkjet capabilities, are gaining traction, allowing for the cost-effectiveness of flexo for static designs combined with the personalization and variable data capabilities of digital printing in a single pass. This convergence of technologies offers unprecedented flexibility and efficiency for complex print jobs requiring both speed and customization.

Further technological innovations enhancing the flexographic landscape include sophisticated workflow software and inline inspection systems. Integrated workflow management software streamlines prepress, production planning, and color management, ensuring greater consistency and reducing manual intervention. Inline inspection cameras and quality control systems leverage high-resolution imaging and machine vision to detect defects in real-time, preventing costly errors and ensuring consistent print quality throughout the run. These systems often incorporate artificial intelligence (AI) for enhanced defect analysis and predictive maintenance. The cumulative effect of these technological advancements is a flexographic printing process that is not only faster and more reliable but also more environmentally responsible and capable of meeting the increasingly complex and dynamic demands of the global packaging and label markets.

Regional Highlights

- North America: A mature market characterized by early adoption of advanced flexo technologies, a strong focus on high-quality and sustainable packaging solutions, and significant investments in automation and hybrid printing. The region benefits from established consumer packaged goods industries and a growing demand for personalized packaging.

- Europe: Known for stringent environmental regulations driving innovation in eco-friendly inks and sustainable substrates. The European market sees steady growth, especially in flexible packaging and labels, with a strong emphasis on digital integration and industry 4.0 principles in flexographic production.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid industrialization, increasing urbanization, and a burgeoning middle class. Countries like China, India, and Southeast Asian nations are witnessing massive expansion in food, beverage, and consumer goods packaging, leading to substantial investments in new flexographic capacity.

- Latin America: An emerging market with significant growth potential, driven by expanding local manufacturing and rising consumer demand. The region shows increasing adoption of modern flexographic printing equipment to cater to its growing packaging and label industries, albeit with varying levels of technological maturity across countries.

- Middle East and Africa (MEA): Exhibiting steady growth, primarily attributed to increasing industrial development, rising disposable incomes, and diversification away from oil-dependent economies. There is a growing demand for packaged goods and sophisticated label solutions, attracting investments in flexographic printing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flexographic Printing Market.- Bobst Group SA

- Mark Andy Inc.

- Gallus Ferd. Rüesch AG (Heidelberg Group)

- Comexi Group S.A.U.

- Nilpeter A/S

- Uteco Converting S.p.A.

- Windmöller & Hölscher (W&H)

- Soma Engineering

- MPS Systems B.V.

- Koenig & Bauer AG (KBA-Flexotecnica)

- OMET S.R.L.

- Fujifilm Corporation

- DuPont de Nemours, Inc.

- Esko (Danaher Corporation)

- Flint Group

- Sun Chemical Corporation (DIC Corporation)

- Harper Corporation of America

- Tesa SE

- Siegwerk Druckfarben AG & Co. KGaA

- XSYS Global

Frequently Asked Questions

What is flexographic printing?

Flexographic printing is a relief printing method that utilizes a flexible photopolymer plate wrapped around a cylinder to transfer fast-drying ink onto various substrates. It is widely recognized for its speed, versatility, and cost-effectiveness in producing high volumes of consistent quality prints, primarily for packaging and labels.

What are the primary applications of flexographic printing?

The main applications of flexographic printing include flexible packaging for food and beverages, labels and tags for diverse products, corrugated packaging for shipping and retail, and various other materials such as folding cartons, gift wrap, and newspapers. Its adaptability to non-porous surfaces makes it ideal for pla

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Flexographic Printing Machine Market Size Report By Type (Unit-type Machine, Central Impression Type, By Material, Paper, Plastic Films, Metallic Films, Corrugated Cardboard, By Ink Type, Water based, Solvent based, Ultraviolet and electron beam, Oil based), By Application (Flexible packaging, Label Manufacturing, Corrugated, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Flexographic Printing Plate Market Statistics 2025 Analysis By Application (Package Printing, Corrugated Printing, Tag and Labels), By Type (Digital Flexographic Plates, Analog Flexographic Plates), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Flexographic Printing Machine Market Statistics 2025 Analysis By Application (Flexible packaging, Label Manufacturing, Corrugated), By Type (Unit-type Machine, Central Impression Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Chambered Doctor Blade Systems Market Statistics 2025 Analysis By Application (Flexographic Printing Machine, Corrugated Box Printing Slotting Machine), By Type (Single-blade system, Dual-blade system), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager