Flight Data Recording Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428886 | Date : Oct, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Flight Data Recording Market Size

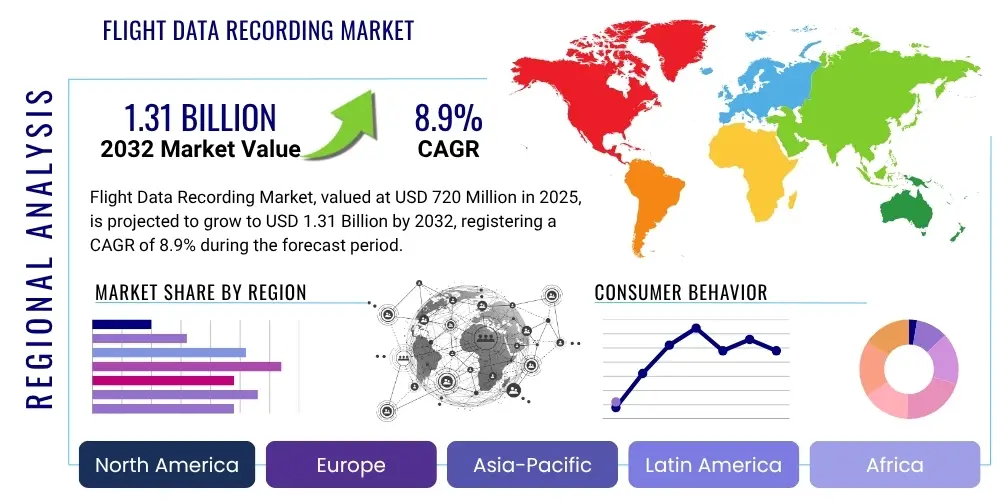

The Flight Data Recording Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2025 and 2032. The market is estimated at $720 Million in 2025 and is projected to reach $1.31 Billion by the end of the forecast period in 2032.

Flight Data Recording Market introduction

The Flight Data Recording Market encompasses the technologies and services associated with the capture and storage of critical aircraft operational parameters and cockpit audio. These indispensable systems, commonly known as "black boxes" despite often being painted bright orange, include Flight Data Recorders (FDRs) and Cockpit Voice Recorders (CVRs). FDRs collect a wide array of flight parameters such as altitude, airspeed, heading, engine performance, and control surface positions, while CVRs record cockpit conversations and ambient sounds. Major applications span commercial aviation, military aircraft, and general aviation, primarily serving accident investigation, flight safety monitoring, and operational efficiency analysis.

The primary benefit of flight data recording is the unparalleled insight it provides into the moments leading up to an aviation incident, crucial for determining root causes and preventing future occurrences. Beyond accident investigation, these systems are increasingly leveraged for routine flight performance monitoring, pilot training, and predictive maintenance, contributing significantly to overall aviation safety and operational integrity. The market's growth is predominantly driven by stringent global aviation safety regulations from bodies like ICAO, FAA, and EASA, which mandate the installation and continuous operation of these devices, alongside the rapid expansion of air travel and the modernization of aircraft fleets globally.

Flight Data Recording Market Executive Summary

The Flight Data Recording Market is experiencing robust expansion driven by an unwavering global commitment to aviation safety and evolving regulatory frameworks. Business trends indicate a shift towards more sophisticated, integrated data recording units capable of capturing a greater number of parameters, coupled with advanced data analytics platforms for real-time insights and predictive maintenance. This includes the development of lightweight, crash-resistant memory modules and the exploration of cloud-based data storage and transmission solutions, moving beyond traditional physical recovery methods. The industry is also seeing a consolidation among key players who are investing heavily in R&D to meet the growing demands for enhanced data integrity and survivability standards, crucial for comprehensive incident analysis.

Regional trends highlight significant growth in the Asia Pacific (APAC) region, fueled by burgeoning commercial aviation sectors and substantial investments in new aircraft procurement, particularly in emerging economies. North America and Europe continue to be dominant markets, characterized by stringent safety regulations, a high density of air traffic, and a strong presence of key technology providers and aircraft manufacturers. These regions are at the forefront of adopting next-generation flight data recording technologies, including those with extended recording durations and enhanced data security features. Latin America, the Middle East, and Africa are also demonstrating steady growth, spurred by fleet modernization initiatives and increasing air travel demand, albeit at a slower pace compared to the more developed markets.

Segment trends underscore the increasing preference for solid-state flight recorders due to their superior durability and data retention capabilities compared to older magnetic tape-based systems. There is a notable emphasis on integrating FDRs and CVRs into single, more robust units, simplifying installation and maintenance. Furthermore, the market for Quick Access Recorders (QARs) is expanding, driven by their utility in providing immediate data for operational performance monitoring and flight quality analysis, distinct from accident investigation. The software and services segment, encompassing data analysis, storage, and maintenance support, is also witnessing substantial growth, reflecting the industry's pivot towards deriving actionable intelligence from vast amounts of recorded flight data.

AI Impact Analysis on Flight Data Recording Market

Common user questions regarding AI's impact on the Flight Data Recording Market frequently revolve around how artificial intelligence can enhance predictive maintenance capabilities, automate anomaly detection in flight data, and improve the efficiency of accident investigation processes. Users are keen to understand whether AI can facilitate real-time data analysis to prevent incidents, ensure data integrity and security, and contribute to the development of more intelligent and autonomous flight systems. There are also queries about the practical implementation challenges, data privacy concerns, and the regulatory implications of integrating AI into safety-critical flight data recording and analysis workflows. Essentially, the core themes are about AI's potential to transform reactive analysis into proactive safety measures and optimize operational efficiencies.

The integration of AI in flight data recording is poised to revolutionize how aviation safety and operational efficiency are managed. AI algorithms can process vast datasets from FDRs much faster and more comprehensively than human analysts, identifying subtle patterns and deviations that might indicate potential mechanical failures or operational irregularities before they escalate into critical incidents. This capability shifts the paradigm from post-event analysis to proactive risk mitigation, significantly enhancing flight safety. For instance, AI can analyze trends in engine performance, hydraulic system pressures, or flap movements to predict component degradation, allowing for timely maintenance interventions and reducing unscheduled downtime.

Beyond predictive maintenance, AI's analytical prowess is invaluable for optimizing flight paths, fuel consumption, and crew performance. By scrutinizing recorded flight parameters, AI can pinpoint inefficiencies in operational procedures, offering data-driven recommendations for improvements. In the context of accident investigation, AI can rapidly correlate data points from multiple sources, reconstruct flight trajectories, and identify causal factors with greater precision, thereby accelerating the investigation process and facilitating quicker implementation of corrective actions. The ongoing development of sophisticated AI models will increasingly enable deeper insights from flight data, extending its utility beyond compliance into a strategic asset for airlines and regulatory bodies.

- Enhanced Predictive Maintenance: AI analyzes flight data to anticipate equipment failures, enabling proactive maintenance.

- Automated Anomaly Detection: Algorithms identify unusual patterns or deviations from normal operating parameters instantly.

- Real-time Operational Insights: AI can process live data streams (from QARs) to provide immediate feedback on flight performance.

- Optimized Flight Operations: AI assists in analyzing data to improve fuel efficiency, flight path planning, and crew performance.

- Accelerated Accident Investigation: AI tools quickly sift through complex data, reconstruct events, and identify causal factors.

- Improved Data Security and Integrity: AI can monitor for unauthorized access or tampering with recorded flight data.

- Facilitates Regulatory Compliance: AI systems can automatically generate compliance reports based on recorded operational data.

DRO & Impact Forces Of Flight Data Recording Market

The Flight Data Recording Market is fundamentally driven by stringent global aviation safety regulations, primarily enforced by organizations such as the International Civil Aviation Organization (ICAO), the Federal Aviation Administration (FAA), and the European Union Aviation Safety Agency (EASA). These mandates necessitate the installation and continuous operation of flight data recorders on nearly all commercial and many general aviation aircraft, ensuring that crucial flight information is always captured for accident investigation and safety enhancement. Complementing these regulatory pressures is the relentless growth in global air traffic, which translates directly into an expanding aircraft fleet and, consequently, a higher demand for flight data recording units. The ongoing modernization of aging aircraft fleets and the introduction of new generation aircraft also fuel market demand, as newer regulations often require more advanced recording capabilities. Furthermore, the increasing emphasis on operational efficiency, predictive maintenance, and data-driven decision-making by airlines significantly contributes to the market's upward trajectory, leveraging recorded data beyond mere accident reconstruction.

However, the market faces several notable restraints. The high upfront cost associated with manufacturing, installing, and maintaining sophisticated flight data recording systems, particularly for older aircraft upgrades, can be a significant barrier for some operators. Furthermore, managing and storing the ever-increasing volume of flight data presents substantial challenges, requiring robust infrastructure and advanced data processing capabilities. Cybersecurity concerns are also paramount, as the integrity and confidentiality of flight data are critical; any breach could have severe implications. The inherent complexity of integrating new recording technologies with existing aircraft avionics systems can also slow down adoption, requiring extensive certification and testing processes. Despite these restraints, considerable opportunities exist for market players. These include the development of innovative, lightweight, and miniaturized flight recorders that are easier to integrate and more cost-effective. The integration of advanced technologies like the Internet of Things (IoT) and artificial intelligence (AI) holds immense potential for real-time data transmission and sophisticated predictive analytics, transforming reactive incident analysis into proactive safety management. Additionally, enhancing data security solutions and developing resilient, cloud-based data storage infrastructure represent significant growth avenues for the market.

The impact forces within the Flight Data Recording Market are shaped by several competitive and structural dynamics. The bargaining power of buyers, primarily large aircraft manufacturers and major airlines, is considerable due to their scale and purchasing volume, often leading to competitive pricing pressures. Conversely, the bargaining power of suppliers for highly specialized components, such as crash-survivable memory modules and advanced sensor technologies, can be moderate to high given the niche expertise required. The threat of new entrants is relatively low due to the substantial capital investment, stringent regulatory barriers, and the necessity for extensive certification processes. However, specialized technology companies offering innovative data analytics or advanced sensor solutions could emerge as disruptive forces. The threat of substitute products is minimal, as flight data recorders are mandated by law, and no viable substitute exists for their primary function of incident investigation. Competitive rivalry among existing players is intense, with companies constantly innovating to offer more robust, feature-rich, and cost-effective solutions to secure market share in this safety-critical industry.

Segmentation Analysis

The Flight Data Recording Market is comprehensively segmented to provide a detailed understanding of its diverse components, end-user applications, and technological advancements. This segmentation allows for precise market analysis, identifying distinct growth drivers, competitive landscapes, and emerging opportunities within each category. The primary segmentation criteria typically include type of recorder, application, and end-user, each revealing unique market dynamics and demand patterns. Understanding these segments is crucial for stakeholders to develop targeted strategies, allocate resources efficiently, and anticipate future market shifts. The rapid evolution of aviation technology and regulatory requirements consistently influences these segments, prompting continuous innovation in recorder capabilities and data management solutions. For instance, the increasing demand for real-time data transfer and enhanced survivability features is driving innovation across specific product types.

Within the type segmentation, the market distinguishes between Flight Data Recorders (FDRs) and Cockpit Voice Recorders (CVRs), as well as Quick Access Recorders (QARs) and potentially the integration of Image Recorders (VIRs). FDRs capture technical flight parameters, CVRs record audio, while QARs provide easily accessible operational data for routine analysis, and VIRs capture visual information. Each type serves a distinct purpose, yet there's a growing trend towards integrated units to streamline installation and data correlation. Application segmentation further delineates the market into commercial aircraft, military aircraft, and general aviation. Commercial aviation, being subject to the most stringent safety regulations and experiencing the highest traffic volumes, represents the largest and most consistently growing application segment. Military aircraft also require robust data recording for training, operational analysis, and incident investigation, often demanding specialized, hardened units. General aviation, while having different regulatory requirements, is increasingly adopting sophisticated recording systems for enhanced safety and insurance purposes, particularly in complex operations. These classifications highlight the varied needs and purchasing behaviors across the aviation spectrum.

- By Type:

- Flight Data Recorders (FDRs)

- Cockpit Voice Recorders (CVRs)

- Quick Access Recorders (QARs)

- Data Acquisition Units (DAUs)

- Combined Voice & Data Recorders (CVDRs)

- Airborne Image Recorders (AIRs)

- By Application:

- Commercial Aircraft

- Military Aircraft

- General Aviation

- Rotorcraft (Helicopters)

- By End-User:

- OEMs (Aircraft Manufacturers)

- MRO (Maintenance, Repair, and Overhaul) Service Providers

- Airlines and Operators

- Leasing Companies

- Government and Defense Organizations

- Air Accident Investigation Boards

- By Component:

- Recording Devices

- Data Storage Units

- Sensors & Transducers

- Power Supplies

- Software & Analytics

- Ground Support Equipment (GSE)

- By Technology:

- Solid-State Recorders

- Digital Flight Data Recorders (DFDRs)

- Wireless Data Offload Systems

- Cloud-Based Data Solutions

Value Chain Analysis For Flight Data Recording Market

The value chain for the Flight Data Recording Market begins with extensive upstream analysis, focusing on the sourcing of critical raw materials and highly specialized components. This stage involves suppliers of high-grade metals for crash-survivable casings, advanced memory chips for data storage (often solid-state NAND flash), precise sensors to capture various flight parameters (e.g., accelerometers, gyroscopes, pressure transducers), and sophisticated microprocessors for data acquisition and processing. These components require rigorous testing and certification to meet aviation safety standards, meaning suppliers in this segment must demonstrate high reliability and quality assurance. Research and development is also a significant upstream activity, driving innovation in data capacity, survivability, and miniaturization of recording units.

Moving downstream, the value chain progresses through the manufacturing and assembly of the flight data recording systems by key industry players. These manufacturers integrate the sourced components, develop proprietary software for data acquisition and management, and perform extensive environmental and crash survivability testing. Once manufactured, these units are supplied directly to aircraft Original Equipment Manufacturers (OEMs) for installation in new aircraft or to Maintenance, Repair, and Overhaul (MRO) service providers and airlines for retrofitting into existing fleets. The distribution channels are predominantly direct for large-volume sales to OEMs and major airlines, ensuring close collaboration for integration and certification. Indirect channels, involving authorized distributors and specialized aviation parts suppliers, serve smaller operators and MROs, providing a wider reach for spare parts and upgrades.

Post-installation, the value chain extends to services, including system integration, certification support, and ongoing maintenance. Data retrieval, analysis, and storage services constitute a significant part of the downstream activities, particularly for accident investigation boards, airlines leveraging data for operational intelligence, and third-party analytics firms. Direct engagement occurs between manufacturers or their certified service centers and end-users for technical support, software updates, and advanced data analysis solutions. This comprehensive value chain underscores the intricate network of specialized suppliers, manufacturers, distributors, and service providers that contribute to the integrity and functionality of flight data recording systems, all operating within a highly regulated environment to ensure aviation safety.

Flight Data Recording Market Potential Customers

The primary end-users and buyers in the Flight Data Recording Market are diverse, reflecting the broad application spectrum of these critical safety systems across the aviation industry. Commercial airlines represent the largest customer segment, driven by strict regulatory mandates to equip their entire fleets with advanced FDRs and CVRs. These operators not only procure new systems for expanding fleets but also invest in upgrades for existing aircraft to comply with evolving standards, such as increased recording parameters or extended recording durations. Their demand extends beyond the physical hardware to include comprehensive data analysis software and ground support equipment necessary for extracting, processing, and interpreting the vast amounts of flight data, essential for safety management systems and operational efficiency improvements. The continuous need for fleet modernization and expansion directly correlates with the demand for flight data recording solutions within this segment.

Another significant customer base is military aviation, encompassing air forces and defense departments globally. Military aircraft, including combat jets, transport planes, and surveillance aircraft, require specialized, often ruggedized flight data recorders capable of withstanding extreme operational conditions and providing critical data for mission analysis, pilot training, and incident investigation. These government entities typically engage directly with manufacturers or through prime defense contractors for custom-built solutions tailored to specific mission requirements and operational environments. The procurement cycles here are often long-term and involve complex contractual agreements. General aviation, including private jets, business aircraft, and smaller charter operators, also constitutes a growing segment of potential customers. While regulatory requirements may be less stringent than for commercial aircraft, an increasing number of general aviation operators are voluntarily installing flight data recorders for enhanced safety, improved insurance rates, and for training purposes, driven by the desire to mitigate risks and improve operational accountability.

Beyond aircraft operators, key players in the maintenance, repair, and overhaul (MRO) sector are vital customers, procuring replacement units, components, and upgrade kits for older aircraft. Aircraft manufacturers (OEMs) are also crucial as they integrate flight data recording systems into new aircraft during the production phase, often partnering directly with key recorder manufacturers. Air accident investigation boards and regulatory authorities, while not direct buyers of the recorders themselves, are significant stakeholders who heavily rely on the output of these systems, indirectly influencing market demand through evolving regulatory requirements and standards for data capture and survivability. Research institutions also act as niche customers for specialized data recording solutions for experimental aircraft and aerospace research projects. The collective demand from these varied customer segments ensures a robust and continuously evolving market for flight data recording technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $720 Million |

| Market Forecast in 2032 | $1.31 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., L3Harris Technologies Inc., Safran S.A., Curtiss-Wright Corporation, Teledyne Controls, Leonardo S.p.A., Collins Aerospace (Raytheon Technologies), GE Aviation, Universal Avionics Systems Corporation, Astronautics Corporation of America, RUAG Group, Parker Hannifin Corporation, Meggitt PLC, BAE Systems, Thales Group, Northrop Grumman Corporation, Lockheed Martin Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flight Data Recording Market Key Technology Landscape

The Flight Data Recording Market is characterized by a dynamic and continuously evolving technology landscape, driven by the imperative for enhanced safety, increased data capacity, and improved data accessibility. At its core are solid-state flight recorders, which have largely replaced older magnetic tape-based systems. These modern recorders leverage non-volatile flash memory, offering superior crash survivability, greater data storage capacity, and significantly improved reliability compared to their predecessors. The development of robust, crash-hardened enclosures designed to withstand extreme temperatures, impacts, and pressures remains a critical area of technological innovation, ensuring data integrity even in severe accident scenarios. Advancements in sensor technology are also pivotal, enabling the capture of an ever-expanding array of flight parameters with higher precision, from engine performance metrics to minute control surface movements, all essential for comprehensive incident analysis.

Beyond the physical recording units, the technology landscape extends to sophisticated data acquisition units (DAUs) that interface with various aircraft systems to gather, digitize, and format the data before it is sent to the recorder. There is a growing trend towards integrated flight data and cockpit voice recorders (CVDRs), consolidating multiple functions into a single, more efficient unit. Furthermore, quick access recorders (QARs) utilize similar technology but are designed for easy data offloading, often wirelessly, to facilitate routine operational analysis and proactive maintenance without physically accessing the primary FDR/CVR. This capability is becoming increasingly important for airlines seeking to optimize operational efficiency and implement data-driven safety management systems. The shift towards wireless data offloading technologies, often employing Wi-Fi or cellular networks when the aircraft is on the ground, significantly streamlines the data retrieval process, reducing turnaround times and manual effort.

Looking ahead, the market is increasingly focused on developing advanced data analytics platforms, often incorporating artificial intelligence (AI) and machine learning (ML) algorithms. These technologies are crucial for processing the vast amounts of recorded flight data, identifying subtle anomalies, predicting potential failures, and extracting actionable insights for safety and operational improvements. Cloud-based data storage and management solutions are also gaining traction, offering scalable, secure, and accessible repositories for flight data, moving beyond traditional on-premise storage. The future also involves exploring potential real-time data streaming capabilities, which, while facing significant technical and regulatory hurdles, could provide immediate insights into critical in-flight situations. Cybersecurity measures are paramount across all these technological advancements, ensuring the integrity, authenticity, and confidentiality of sensitive flight data against unauthorized access or manipulation.

Regional Highlights

North America stands as a dominant force in the Flight Data Recording Market, largely driven by the presence of major aircraft manufacturers, a high volume of commercial air traffic, and stringent aviation safety regulations enforced by the FAA. The region is a hub for technological innovation, with key players investing heavily in R&D for advanced recording systems, including those with enhanced data capacity, survivability, and wireless data offload capabilities. The mature aviation infrastructure and a strong emphasis on proactive safety management systems further bolster demand. Airlines and military organizations in North America are early adopters of new technologies, fueling continuous market growth and innovation, particularly in areas like AI-powered data analytics for predictive maintenance and operational optimization.

Europe represents another significant market, characterized by stringent regulatory oversight from EASA and a robust commercial aviation sector. European airlines are keenly focused on adopting the latest flight data recording technologies to comply with evolving safety standards and improve operational efficiencies. Countries such as France, Germany, and the UK, with their strong aerospace industries and advanced MRO capabilities, contribute substantially to the market. The region also sees a strong drive towards standardized data formats and integrated recording solutions across the diverse national aviation authorities. Investment in upgrading existing fleets with advanced FDRs and CVRs, as well as the procurement of new, technologically advanced aircraft, ensures consistent demand in the European market.

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate in the Flight Data Recording Market. This surge is attributed to the rapid expansion of air travel, significant investments in new airport infrastructure, and the continuous growth of commercial aircraft fleets across countries like China, India, and Southeast Asian nations. As air traffic volumes soar, the emphasis on aviation safety becomes paramount, leading to increased adoption of advanced flight data recording systems. Emerging economies in this region are rapidly modernizing their aviation sectors, often leapfrogging old

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager